Why has the USD failed to strengthen in response to Trump’s tariff plans?

- The USD has failed to strengthen after President Trump put in place more disruptive tariffs on Canada, China and Mexico.

- Building concerns over slowing growth in the US are playing a part in helping to weaken the USD.

- While concerns over growth outside of the US have eased in response to plans for looser fiscal policy in Europe and China.

- Our forecasts for a reversal of USD strength are playing out more quickly than we had anticipated.

Trump’s tariff announcement triggered only modest sell-off for CAD & MXN

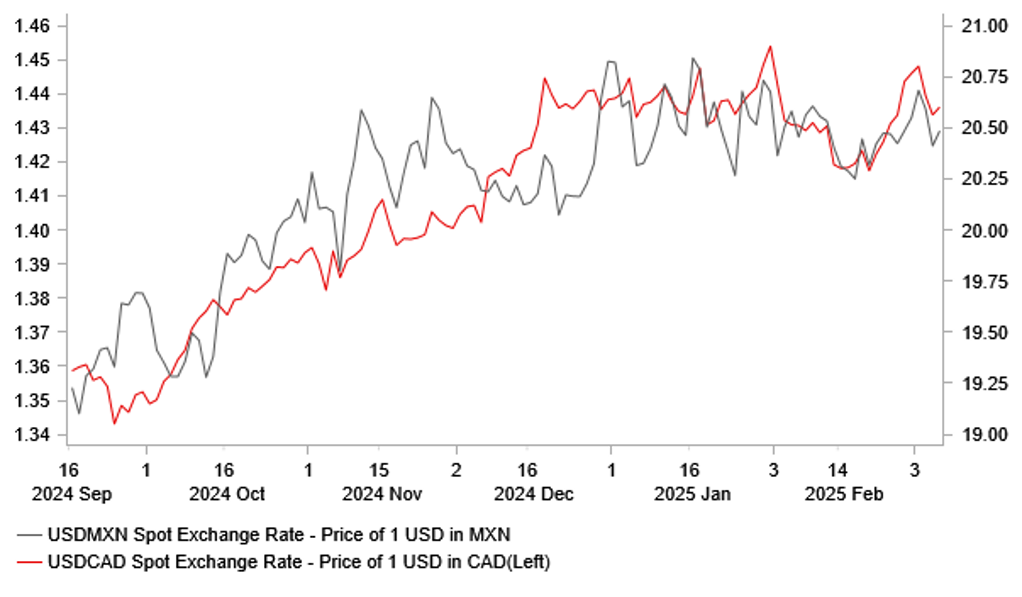

There have been two significant changes in the global macro policy landscape this week. Firstly, President Trump finally took action earlier this week to put in place more disruptive tariffs. He decided to implement 25% tariff hikes on imports from Canada and Mexico with the only exception being a lower 10% tariff rate on imports of energy from Canada. At the same time, President Trump decided to put in place another 10% tariff hike on imports from China. It represented a significant escalation in the global trade war during President Trump’s second term. The tariffs will apply to around USD1.5 trillion of annual imports into the US. Up until this week President Trump had only put in place a 10% tariff hike on imports from China that became effective from 4th February. The Canadian dollar and Mexican peso initially weakened after the tariffs went into effect resulting in USD/CAD and USD/MXN rising to highs of 1.4543 and 20.998 respectively.

However, those initial losses have proven to be short-lived encouraged first by comments since from Commerce Secretary Howard Lutnick who stated that President Trump will “probably” announce a deal to reduce tariff rates on Canada and Mexico. It has since been followed up by confirmation that there will be a one-month exemption from tariffs for “any autos coming through the USMCA including auto parts”. Automakers have been told to make use of the further one-month delay to “start investing, start moving, shift production to the US where there will be no tariff to pay”. By exempting auto and auto parts, the value of imports from Canada and Mexico impacted by higher tariffs will fall to around USD750 billion compared to around USD920 billion. While it will help to ease economic disruption in North America, the remaining tariffs that have been put in place are still significant and will be disruptive for trade and growth in the region.

CAD & MXN CONSOLIDATING AT WEAKER LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

Recent analysis from the BoC in their Monetary Policy Report from January (click here) revealed that these measures could be highly disruptive to the Canadian and US economies. In their quantitative example, the BoC estimated that average annual GDP growth in the first year after tariffs are implemented could be about 2.5 percentage points lower than otherwise, and about 1.5 percentage points lower in the second year. It highlights the heightened risk that Canadian and Mexican economies will slow sharply and fall into recession the longer the tariffs remain in place. We would then expect the BoC and Banxico to deliver deeper rate cuts to support growth even if inflation picks up in the first year driven by the implementation of retaliatory tariffs.

Canada has already implemented the first stage of retaliatory tariffs which involved imposing a 25% tariff on CAD30 billion of US goods. The initial list of US goods includes agricultural products, dairy and food items, iron and steel, machinery, electronics and other consumer goods. If the US tariffs are not withdrawn within 21 days, then Canada will implement a second stage of 25% tariffs on another CAD125 billion of US goods including passenger vehicles and trucks, electric vehicles, steel and aluminium products, fruits and vegetables, and aerospace products. Furthermore, Canada is considering putting in place non-tariff measures such as limiting or shutting out US companies from government contracts. The staggered two stage implementation process for retaliatory tariffs indicates that the Canadian government wants to leave leeway to reach a deal to reverse tariff hikes in the coming weeks. In contrast, Mexican President Sheinbaum has decided to take more time before announcing plans for retaliatory tariffs. She has stated that details of retaliatory tariffs and non-tariff measures will be announced on Sunday. It has been reported previously that Mexico was considering putting in place tariffs on imports from China to march those in the US as part of a deal with the US to avoid tariffs on imports from Mexico. It would help to address one of President Trump’s concerns that China is channelling their exports through Mexico to avoid higher tariffs in the US. Our current forecasts (click here) for the CAD and MXN were made under the assumption that 25% tariff hikes on Canada and Mexico would not be implemented and/or would only be in place for a short period. If we are wrong and the tariffs remain in place for longer, then both currencies could weaken significantly by a further 5-10% against the US dollar.

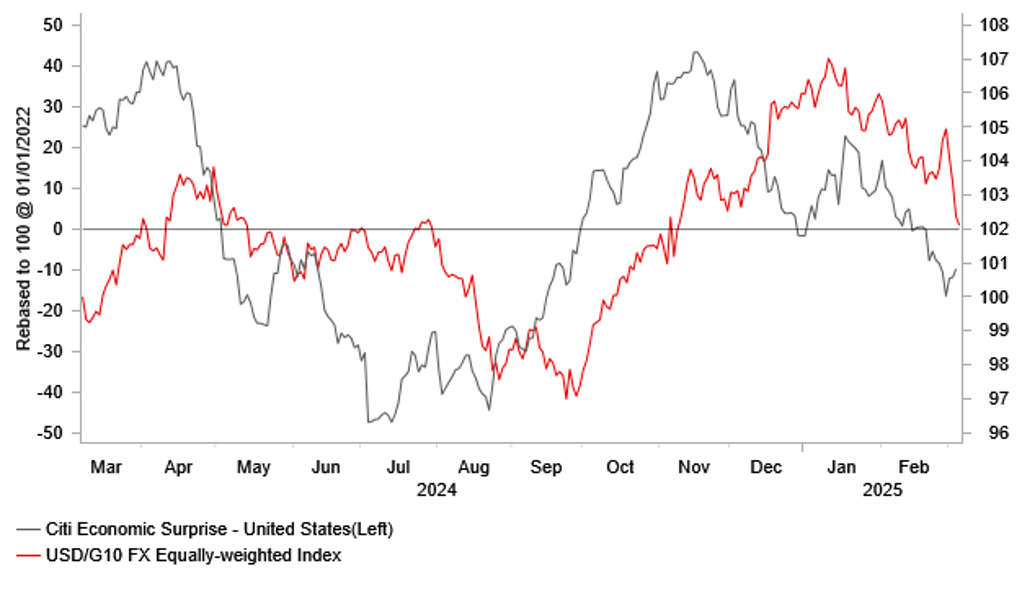

RECENT RUN OF DISAPPOINTING US ECONOMIC DATA WEIGHING ON USD

Source: Bloomberg, Macrobond & MUFG GMR

US growth fears helping to dampen upside for USD from Trump tariffs

The USD’s failure to strengthen more broadly following the latest Trump tariff announcement is also a reflection that market participants have become more concerned over slowing growth in US at the start of this year . Those concerns have contributed to the sharp adjustment lower in US yields. After hitting a high of 4.81% on 14th January, the 10-year US Treasury yield fell back to a low of 4.10% although it has since risen back above support from the 200-day moving average at around 4.25%. Market participants have moved to price back in more active rate cuts from the Fed this year with almost 75bps of cuts almost fully priced in by December compared to the Fed’s current plans for 50bps of further cuts. The recent run of softer than expected US economic data has undershot consensus expectations by the most since September and provided an offset to initial investor optimism that Trump’s plans for deregulation and tax cuts would help to strengthen US growth this year. The recent sharp drop in consumer confidence has indicated concern amongst households over the potential inflationary impact from tariffs on top of the headwinds to growth from heightened policy uncertainty at the start of Trump’s second term and building concerns that DOGE’s efforts to cut back the state will become more evident in the economic data such as payrolls in the coming months. Overall, it has made market participants anticipate that the Fed will put more weight on softer growth than higher inflation when responding to the impact of higher tariffs on the US economy.

Fiscal policy shift underway in Germany helps to ease fears over tariff fallout

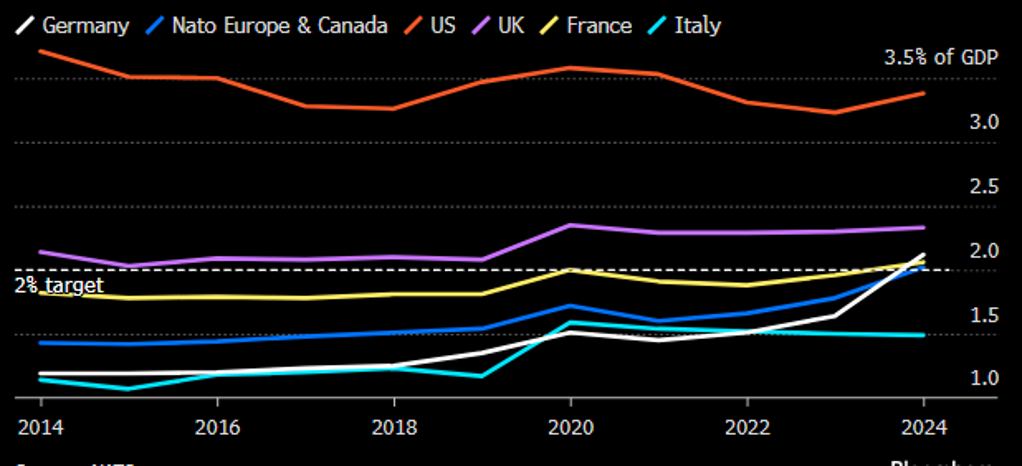

The second significant global macro policy change that is taking place is happening in Europe. European leaders have been jolted into action to step up defence spending in response to President Trump’s plans to scale back US military support for the region. The recent German election result has helped pave the way for a bigger loosening of fiscal policy. Chancellor-in-waiting Friedrich Merz delivered a powerful speech this week echoing comments from former ECB President Mario Draghi at the height of the euro-zone debt crisis when he stated “In view of the threat tour freedom and peace on our continent, our defence must now be based on ‘whatever it takes’ ”.

He has proposed significant changes to Germany’s debt brake that would create open-ended fiscal room for defence. Under the plans, all defence spending above 1% of GDP will be excluded from the borrowing limit under the debt brake and the regions (“Lander”) will be allowed additional borrowing under the debt brake. Defence spending had already started to pick up last year reaching 2.1% of GDP up from 1.6% in 2023. Defence spending is likely to be stepped up further in the coming years. It has been estimated that ramping up defence spending up to 3% to 3.5% of GDP over the next 5-10 years could require additional spending of between EUR700 billion to EUR1.0 trillion. While creating room for additional spending for regional governments could open up additional borrowing of EUR70 billion over ten years.

The plan also includes setting up a EUR500 billion special fund (SPV) for infrastructure spending over the next ten years of which EUR100 billion will be directly channelled to regional governments. No details have been released over how the funds will be allocated for infrastructure investment over the 10 year period but they will cover infrastructure, digitalisation, power grids and education. Furthermore, by creating more room for spending under the debt brake it will free up more room for other policy proposals under the next government such as corporate tax cuts (~6ppt cut by 2029).

GERMANY TO FURTHER STEP UP DEFENCE SPENDING

Source: Bloomberg & NATO

Overall, the plans for extra spending on defence and public investment might plausibly add something in the region of around 20 percentage points or more to debt/GDP over the coming decade. The plans are expected to be put forward for a vote in the Bundestag and Bundesrat next week. The CDU/CSU and the SPD will need the support of the Green party to obtain a two thirds majority in the Bundestag. The Greens have called reform of the debt brake and spending from special funds so they are expected to support the plans. If the plans are passed as expected, a significant loosening of fiscal policy will strengthen the outlook for growth in Germany and should help to bring an end to the period of stagnation that has been in place in recent years. The current consensus forecasts for growth of 0.3% in 2025, and around 1.0% for both 2026 and 2027 are likely to be revised significantly higher especially beyond this year. Our European economist now estimates that growth next year could be closer to 2.0%.

Other European countries are likely to follow Germany’s lead to step up defence spending as well although they have relatively less fiscal room to expand spending as much as Germany in light of higher debt levels. European Commission President Von Der Leyen announced details of a “EUR800 billion” package of defence measures as part of an immediate European response plan called “REARM Europe”. The plans includes setting up a new financial EU instrument to provide member states with loans backed by the EU budget totalling up to EUR150 billion. The Commission will also propose activating in a coordinated manner the national escape clause of the Stability and Growth Pact. It will exempt up to 1.5% of GDP per year of national spending on defence from the EU fiscal rules which would potentially unlock a further EUR650 billion of room for defence spending although it remains to be seen how much of that member states are willing to utilize. To put the figures into perspective EU members spent EUR326 billion on defence last year.

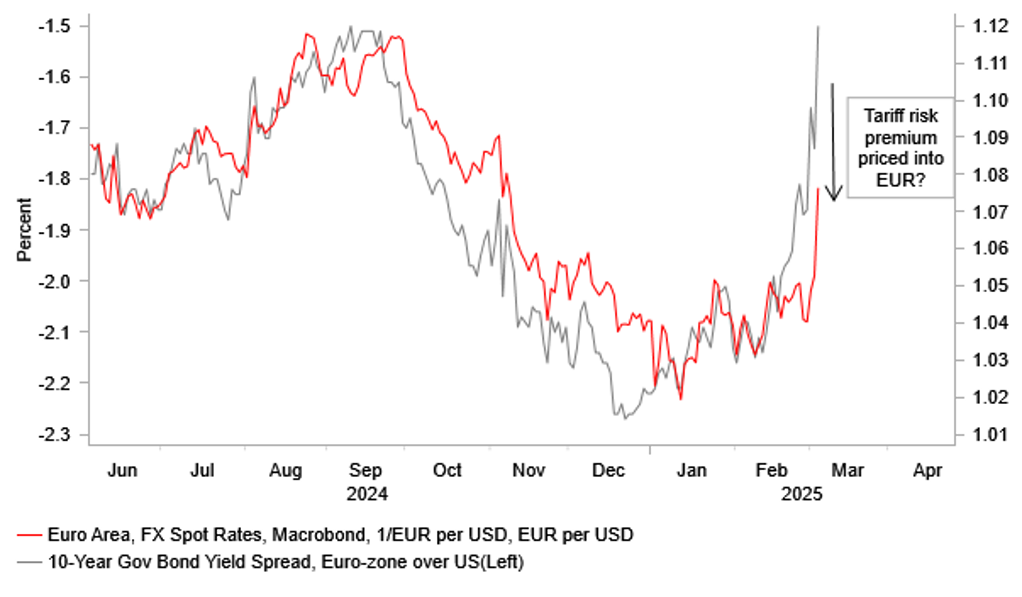

YIELD SPREADS MOVE SHARPLY IN FAVOUR OF EUR

Source: Bloomberg, Macrobond & MUFG GMR

Market implications from European fiscal plans

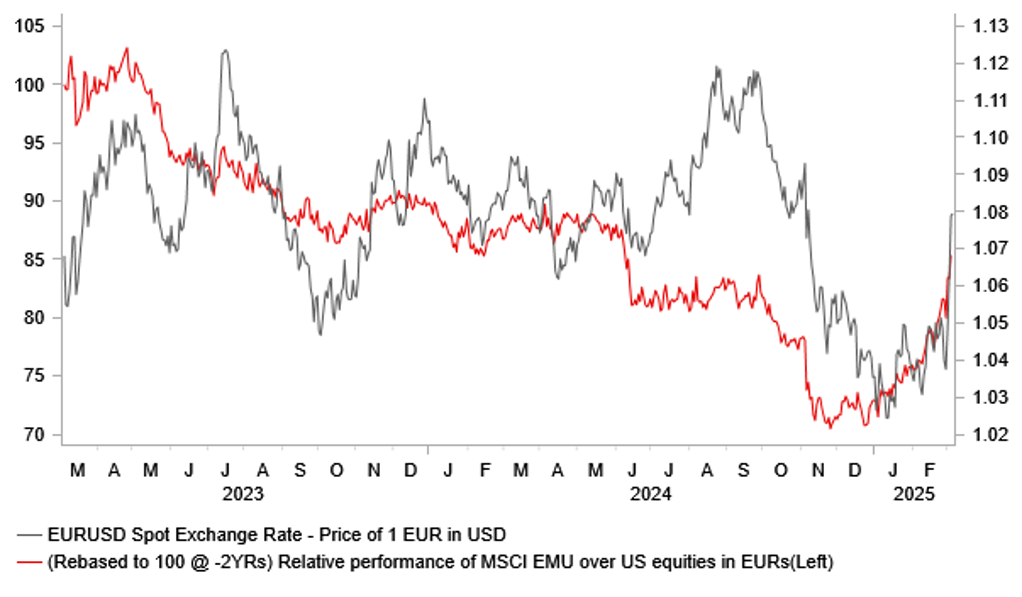

The plans for a significant loosening of fiscal policy in Europe have understandably put upward pressure on yields in the region to reflect the uplift to growth expectations and higher debt levels going forward. The 10-year German government bond yield has risen sharply to the highest level since autumn 2023 at just over 2.90%. It has risen by over 50bps over the past month at a time when the 10-year US Treasury yield has fallen by around 15bps. The abrupt narrowing of the yield differential between the euro-zone and US has been a key driver behind the euro rebounding strongly alongside the outperformance of the European equity markets. The DAX has increased by almost 17% year to date while the S&P500 is down by around -4.5% in euros. It represents a marked reversal of US exceptionalism that has played out in recent years.

The euro has already staged a strong rebound lifting EUR/USD back up above the 1.0800-level. The last time the pair traded at those levels was in early November at the time of the US election. On a DXY-basis the USD has now given back all of its strong gains recorded since President Trump won re-election. While we have been forecasting a euro rebound this year, the timing of the rebound has come much quicker than expected. We had not anticipated the scale of the shift taking place in European

fiscal policy which helps to provide an offset to downside risks from current weak growth momentum and the heightened likelihood of significant trade disruption. The ECB will have to take into consideration plans for significantly looser fiscal policy in the coming years. We still expect the ECB to cut rates further towards 2.00% this year but the need for deeper cuts into stimulative territory has diminished. President Lagarde recently indicated that the neutral rate is between 1.75% and 2.25%. As a result, the policy divergence between the ECB and Fed will be narrower than the market had been anticipating.

REVERSAL OF US EXCEPTIONALISM IN EQUITY MARKETS

Source: Bloomberg, Macrobond & MUFG GMR

Trump’s tariff plans could still deliver a setback for the EUR in Q2

While downside risks for the EUR and euro-zone economy have diminished they have not completely gone away. President Trump’s decision to follow through and implement disruptive tariffs on Canada, Mexico and China has increased the risk that the EU will be hit hard too in the coming months. He has already threatened/is planning to put in place i) 25% tariffs on steel and aluminium imports from 12th March, ii) 25%tariff on imports from the EU from 2nd April, iii) 25% tariffs on imports of autos, pharmaceuticals and semiconductors from 2nd April, iv) unspecified “reciprocal tariffs” against all imports from 2nd April and v) unspecified tariffs on imports of copper from 22nd November. He added to that list this week plans to impose tariffs on “external” agricultural products from 2nd April as well. The plans highlight that President Trump is planning a structural shift in the global trading system. The EU is vulnerable to higher tariffs on autos, agricultural products and pharmaceuticals. President Trump’s decision to take non-tariff barriers into account when setting “reciprocal tariffs” such as VAT which averages around 23% in the EU has heightened the risk that more disruptive tariff hikes will be put in place/announced in the coming months. To reflect these risks, we still expect EUR/USD to drop back in the lower 1.0000-1.0500 range during Q2 before rising back up towards the 1.1000-level in the 2H of this year.

China tariffs, CNY impact & NPC takeaways

China has been the main target again for President Trump’s trade tariffs at the start of his second term. He implemented an additional 10% tariff hike effective from 4th February on all imports from China and has quickly followed that up with another 10% hike from this Tuesday. It is almost double the size of tariffs put in place during his whole first term. Recent press reports have even suggested that the Trump administration is putting pressure on Canada and Mexico to match higher US tariffs on imports from China. In response China has again taken a more targeted approach when putting in place retaliatory tariffs. China will impose a 15% tariff on US chicken, wheat, corn and cotton effective from 10th March. It will also impose a 10% tariff on US sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables, and dairy products. Taken together these moves will raise the average tariff rate on US imports by no more than 2 percentage points. Even when adding on top of the retaliatory measures announced back in February the average tariff rate on US imports has increased by under 3 percentage points which is well below the 20% increase on the US side. It highlights clearly that China has not pushed back hard against action taken by the Trump administration perhaps in an attempt to limit negative spill-overs for their own economy from retaliatory action and potentially to leave the door open to a potential trade deal with the US.

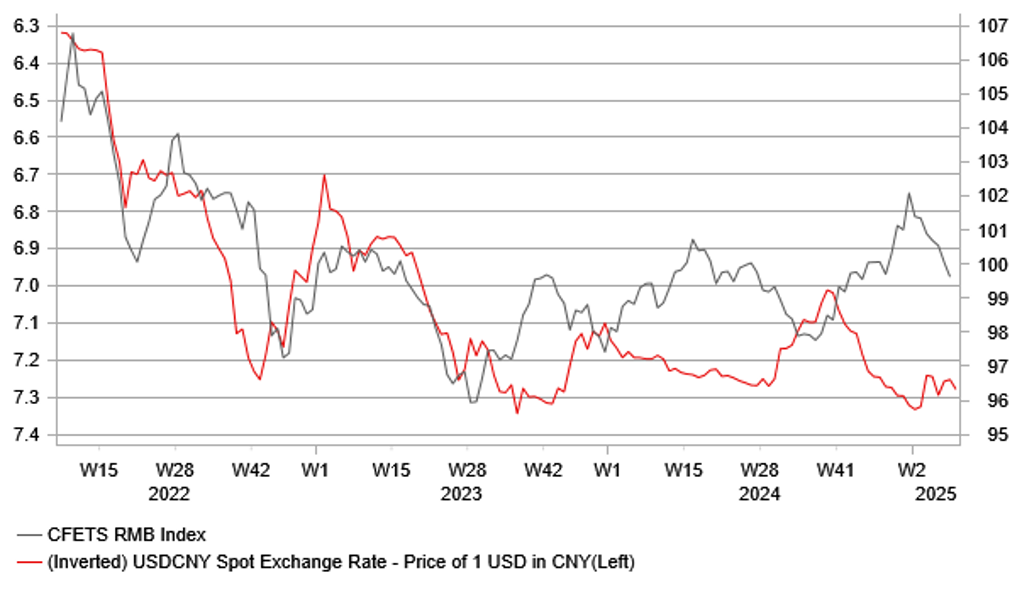

The broad-based weakening of the USD has helped to prevent USD/CNY from adjusting higher in response to Trump’s tariff hikes on China. USD/CNY initially threatened to move back above the 7.3000-level earlier this week but has since dropped back towards the 7.2500-level. Renminbi selling pressure was discouraged by comments from President Trump who criticised the weak currencies of China and Japan as “unfair” and warned that the solution to weak currency policies is tariffs. The comments were intended to act as deterrent for Chinese policymakers to prevent them from allowing their currency to weaken more to offset the negative impact on their economy from the latest trade tariffs. The comments also add to the building view amongst market participants that the yen could be one of the main beneficiaries from a global trade war if President Trump keeps putting pressure on Japan to adjust domestic policies to reverse yen weakness. The yen has continued to outperform at the start of his year resulting in USD/JPY dropping below 148.00 today encouraged by the sharp adjustment higher in Japanese bond yields. The sell-off in the German bond market has spilled over in the JGB market where the 10-year JGB yield hit a high overnight of 1.55%. Narrowing of yield spreads between Japan and other developed economies is making it harder to justify the yen remaining so deeply undervalued.

Finally, this week’s 14th National People’s Congress was an import focus as well for market participants. The government work report set a relatively high growth target, and a series of proactive policies in facing rising external challenges. This year's policies focus more on consumption, people’s livelihood and advancing technological and industrial innovations and etc. These are changes, compared with previous years. The report outlined an array of key development goals for 2025, including an “around 5%” GDP growth target, an “around 5.5%” surveyed urban unemployment rate, over 12 million new urban jobs, and an around 2% CPI inflation, and many more. It has reinforced our expectations that China will implement more proactive fiscal policy and loosen monetary policy to support growth if needed. China is planning an additional CNY2.4 trillion of fiscal funding (1.7% of GDP) for the economy in 2025. It will help to provide an offset to the negative impact from President Trump’s tariff hikes on China’s economy and help dampen downside risks. It is another reason why the USD may not strengthen as much as expected against the CNY although we are still expecting USD/CNY to raise up towards the 7.5000-level this year. Please see our latest FX Focus more details on the NPC (click here).

TWI CNY HAD BEEN STRENTGHENING ALONGSIDE USD

Source: Bloomberg, Macrobond & MUFG GMR