Will BoE continue to stick to gradual easing?

- The BoE cut rates again by 25bps to 4.50%. However, two dissenters voted in favour of a larger 50bps rate cut.

- MPC members have become more pessimistic over the UK economic outlook creating more room to lower rates to less restrictive levels.

- We still expect another gradual 25bps cut at the May MPC meeting but there is a higher risk of faster easing being delivered.

- The GBP has weakened to reflect the dovish shift in thinking amongst MPC members. GBP/JPY to fall further below the 190.00-level.

BoE sticks to gradual cuts but is more negative over UK economic outlook

The BoE decided to lower their policy rate as expected today by 25bps for the third time in the current easing cycle taking it to 4.50%. The voting pattern provided the biggest dovish policy surprise revealing that two MPC members dissented in favour of a bigger 50bps rate cut while the other seven MPC members voted in favour of a 25bps rate cut today. It was a more dovish voting pattern than the last time the BoE voted to cut rates by 25bps in November. On that occasion there was only one dissenter who voted to leave the policy rate unchanged while the eight other MPC members voted for a 25bps rate cut. It clearly highlights that views are shifting in a more dovish direction amongst MPC members.

The two MPC members who voted in favour of a larger 50bps rate cut today were Swati Dhingra and Catherine Mann. Swati Dhingra was already known as one of the biggest doves on the MPC. In contrast, Catherine Mann’s decision to vote for a bigger rate cut was a big surprise given she had previously been one the most hawkish MPC members. At the November MPC meeting she was the single dissenting vote in favour of leaving rates on hold. The accompanying minutes revealed that it was likely Swati Dhingra who favoured a larger rate cut today due to her view that the “subdued outlook for demand remained consistent with CPI inflation staying sustainably at the target in the medium-term despite the expected near-term uptick in regulated prices”. She was believes that the Bank Rate needs to account for the lagged policy transmission of previous policy tightening and supply capacity over the medium-term. It appears like Catherine Mann’s dovish u-turn in her policy thinking by voting for a larger rate cut today reflects her view that “a more activist approach at the meeting would give a clearer signal of financial conditions appropriate for the UK, even as monetary policy would need to remain restrictive for some time to anchor inflation expectations, and the Bank rate would likely stay high given structural persistence and macroeconomic volatility”.

For the majority of MPC members who voted for a smaller 25bps rate cut today, their decision was justified on the basis that there had continued to be sufficient progress on disinflation in domestic prices and wages. They continued to favour an approach to policymaking that was both gradual in continuing to lean against the persistence in inflation and careful in recognising increased uncertainty and that there were two-sided risks to inflation. According to one view, weakening activity and a looser labour market could weigh further on inflation and increased uncertainty around both the UK and global economic outlooks could have a countervailing impact on the inflation outlook. While another view was that weakness in observed activity and employment could continue to reflect constrained supply rather than accumulating economic slack and prove be more inflationary which requires maintaining a cautious approach to further policy easing.

The dovish shift in thinking amongst MPC members was backed up by the downgrade to the BoE’s growth forecasts and upward revisions to the unemployment rate forecasts. The BoE’s forecast for GDP growth this year was cut in half to 0.75% down from 1.5% set in November. GDP is now expected to contract marginally by -0.1% in Q4 and return to growth of just 0.1% in Q1 if this year. At the same time, the unemployment rate forecasts were revised significantly higher by 0.4ppts to 4.5% by the Q4 2025 and by 0.4ppts to 4.7% by Q4 2026. The BoE judges that the labour market is currently “broadly in balance”. Excess supply in the economy is expected to widen over the next couple of years to around 0.75% of potential GDP. As a result the MPC judged that the emerging slack of in the economy acts against some continuing second-round effects in domestic prices and wages so that inflation is likely to fall back to around their 2% target in the medium-term. Inflation is expected to rebound to a higher peak of 3.7% in Q3 before falling to target but remain above 2.0% for longer than previously forecast. In addition, the updated forecasts revealed that the BoE expects private sector wage growth excluding bonuses to slow in the coming years although the forecast for the Q4 2025 has been raised by 0.5ppts to 3.75% and lowered by 0.25ppts to 3.00 by Q4 2026. The BoE cited evidence from their Agents survey showing that pay settlements are expected to slow to 3.7% this year from 5.3% in 2024.

The BoE’s latest Quarterly Inflation Report also included updated analysis on the long-run equilibrium interest rate. Their overall conclusion is that evidence suggests that R* is likely to have “increased modestly” since previous analysis back in the August 2018 QIR. However, they did stress that there is significant uncertainty around the range of estimates at any point and extent of any increase. The macroeconomic models monitored by the Bank staff suggest a modest increase of in R* of around 25 to 75 basis points. In August 2018, the BoE estimated that the equilibrium interest rate in nominal terms was between 2% to 3%. In light of changes since then the equilibrium rate could now be somewhere between 2.25% and 3.75%.

After today’s policy update from the BoE we are more confident in our forecasts for the BoE to cut rates by 100bps in total this year which would lower the policy rate closer to the top of BoE’s estimated range for the neutral policy rate for the UK economy at 3.75%. The BoE’s emphasis still on the need for a gradual and cautious approach to easing amongst the majority of MPC members still suggests that the BoE is likely to stick to quarterly rate cuts at the current juncture. We expect the next 25bps rate cut to be delivered at the May MPC meeting.

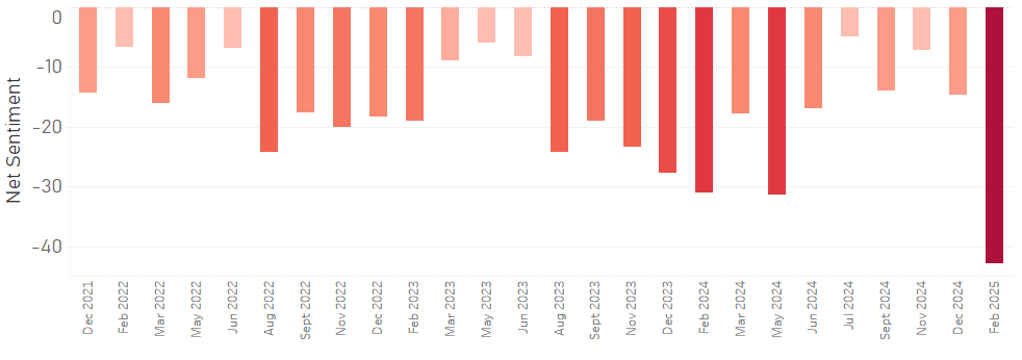

BOE COMMUNICATION TAKES A NEGATIVE TURN

Source: Bloomberg, Macrobond & MUFG GMR

Market Implications

The GBP has weakened sharply in response to today’s MPC meeting resulting in cable falling by around 1% and EUR/GBP rising by around 0.5%. A much larger than normal reaction compared to previous MPC meetings over the past year. The GBP has been undermined by market participants moving to price in more rate cuts from the BoE in response to the dovish shift in policy thinking amongst MPC members today. The SONIA futures curve has moved to price in around 7-8bps of additional rate cuts by the end of this year. It brings market pricing more into line with our own forecasts although we still believe there is room for rates to keep moving lower. The UK rate market is currently pricing in around 68bps of additional rate cuts this year. Another 25bps rate cut is fully priced in by the May MPC meeting and even a small probability of the BoE delivering a larger 50bps rate cut to get rates back to neutral levels more quickly. While two MPC members voted for larger 50bps cut today, there is no clear indication that any other of the seven MPC members considered similar action with the minutes suggesting they all favoured sticking to the gradual approach to easing. As a result, we still consider a larger 50bps cut as unlikely but will be watching upcoming comments from MPC members closely for clarification.

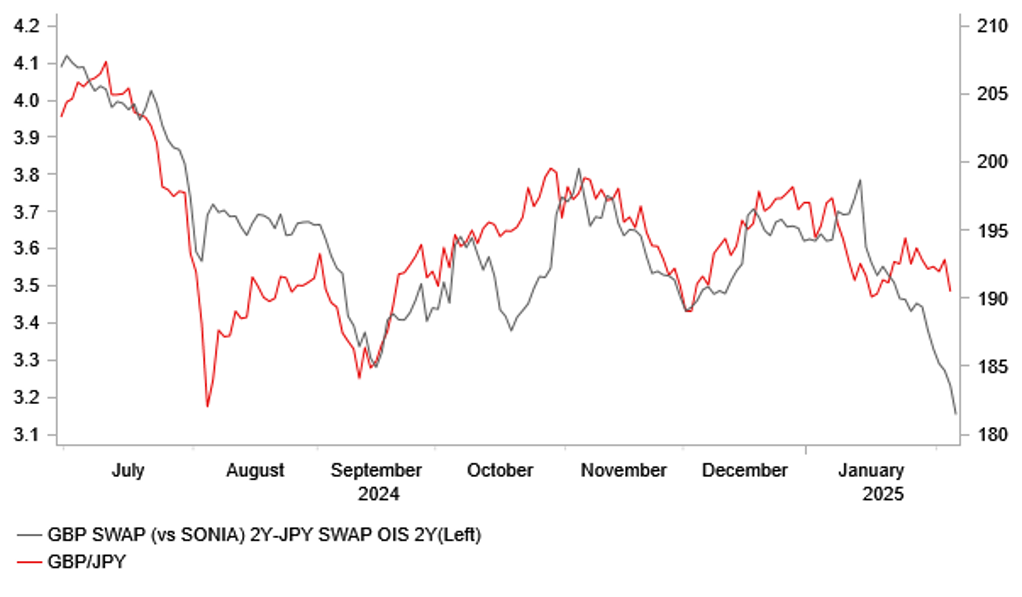

Downside risks for the GBP would increase in the near-term if the BoE adopted a faster pace of easing either by delivering a larger rate cut or by cutting rates sooner than in May. With UK yields moving lower while they have continued to move higher in Japan at the start of this year, the narrowing yield differential is encouraging a lower GBP/JPY. After trading above the 190.00-level since last autumn, GBP/JPY is currently attempting to decisively break back into a lower range. The next important support levels for the pair are provided by the low from 3rd December at 188.09 and then by the 185.00-level.

YIELDS SPREADS MOVING AGAINST GBP AND IN FAVOUR OF JPY

Source: Bloomberg, Macrobond & MUFG GMR