To read the full report, please download PDF.

The stars continue to align for a stronger JPY

FX View:

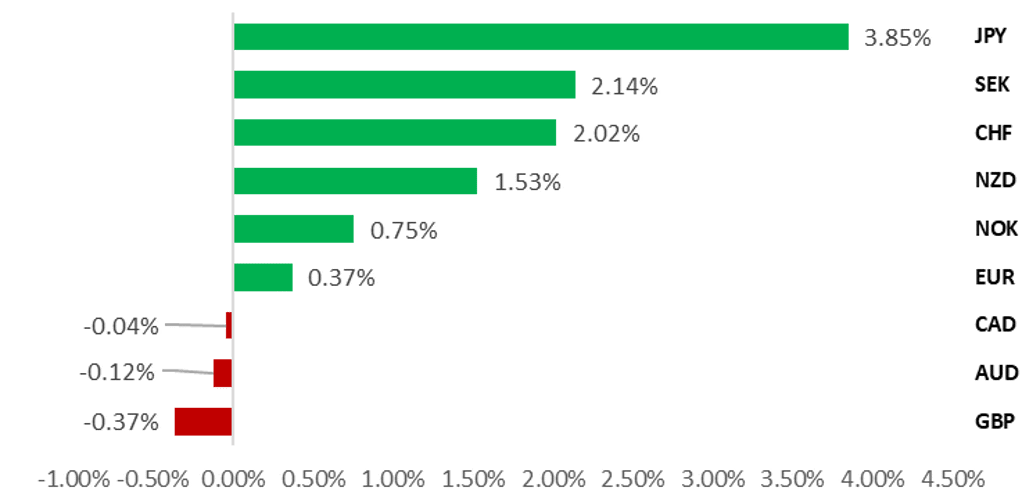

The JPY has continued to surge higher over the past week after the JPY’s upward momentum was reinforced by the BoJ’s hawkish policy update. The BoJ signalled that they are more confident to keep raising rates as long as Japan’s economy evolves in line with their outlook. On the other hand, the Fed signalled that they are moving closer to cutting rates in September. After the release of the much weaker nonfarm payrolls report for July, market participants are becoming more concerned that the Fed has fallen behind the curve and will need to deliver a larger 50bps when they meet in September. Building evidence of slowing global growth alongside heightened geopolitical tensions in the Middle East have boosted demand for safe haven currencies such as the JPY and CHF. It has also contributed to the more mixed performance for the USD alongside the sharp fall in US yields.

USD TAKES A HIT AS FED RATE CUT SPECULATION INTENSIFIES

Source: Bloomberg, 14:170 BST, 2nd August 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new short NZD/CHF trade recommendation.

IMM FX Positioning:

Our two-year rolling z-scores signal revealed that short CHF and CAD positions, and long GBP and NZD positions were the most stretched amongst Leveraged Funds.

JPY Balance of Payments:

The Balance of Payments data released in July by the MoF for the month of May continued to show a continued growth in Japan’s already sizeable external position. JPY depreciation is part of this as incomes earned abroad of FDI and portfolio investments grows in yen terms. As a result of this Japan’s 12mth current account surplus hit another record high in May, totalling JPY 26 trillion, or 4.4% of Japan’s GDP.

FX Views

JPY: Yen surge, the BoJ and risk

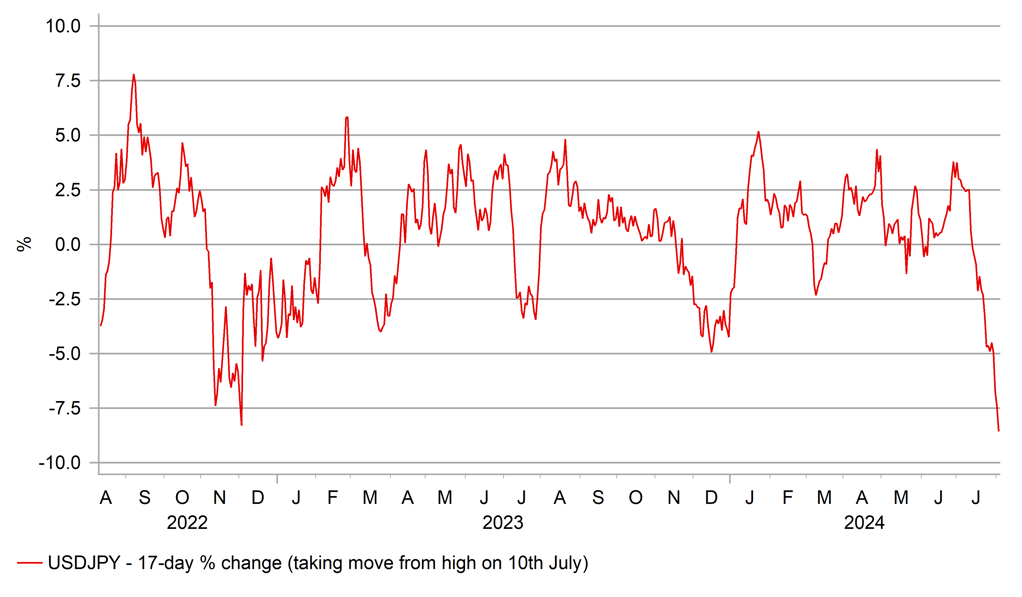

The surge of the yen this week reflects a number of factors that have aligned to prompt a considerable re-think over the outlook for the yen. We for one have stated this week already that there has not been a more compelling moment since the USD/JPY bull-run began in March 2022 to argue the case that the trend of yen depreciation is over. It’s 17 days since USD/JPY hit the last cyclical high and from that close on 10th July (same closing high as 3rd July) USD/JPY has dropped 8.7%. That in fact is not yet unprecedented in this bull-run – in December 2022 over the same number of days we had an 8.3% drop. But we certainly do not see a repeat of the retracement of that drop given the different circumstances today. Back then front-end US yields were not declining like today, the Fed hiked further in 2023 while now are set for a cut. In addition, the BoJ was nowhere near hiking. There are certainly elevated risks over the short-term that JPY strength could over-extend, become detached from fundamentals as positioning liquidation creates a larger than expected ‘pain trade’.

The JPY 400bn per quarter reduction in monthly JGB purchases was roughly in line with the market expectations while only 30% of the market shared our view that the BoJ would also hike the policy rate by 15bps. So the hike certainly provided a hawkish outcome to the announcement. However, it was the press conference that we believe really surprised the market. Even after the rate hike, initial market commentary were making the assumption that the rate hike would be accompanied by a dovish press conference. So why was Ueda this hawkish? We would firstly argue that a key reason for Governor Ueda’s dovishness up to this point has been down to the fact that the primary initial objective for Ueda was dismantling the Kuroda monetary policy framework. That was a challenge that entailed significant risks. With that objective complete Ueda has now shifted the BoJ’s focus to adjusting policy under a normal framework to a correct setting. Secondly, all the communications from Ueda and Deputy Governor Uchida indicate to us a genuine belief that a fundamental shift is taking place in Japan (mainly via the labour market) that warrants more normal policy levels. And finally, the government’s efforts to halt yen depreciation may also have encouraged a shift to a more aligned stance between the BoJ and the government.

We make that last point given the communications on Wednesday emphasised the risks to the upside for inflation coming potentially from import prices. Ueda also stated that the yen had become a more important variable to monitor in regard to the inflation outlook, a shift in communications on the yen from the past. Given the intervention to buy the yen in July and this more hawkish communication emphasising the importance of the yen we can now see a much greater alignment between the government and the BoJ and this has helped reinforce the strengthening of the yen. We would imagine when the time is right over the coming months, a new updated statement between the government and the BoJ is warranted given the last statement is linked to the Kuroda BoJ policy framework and the battle to end mild deflation.

IS A DEEPER CORRECTION LOWER ON THE CARDS?

Source: Bloomberg, Macrobond & MUFG GMR

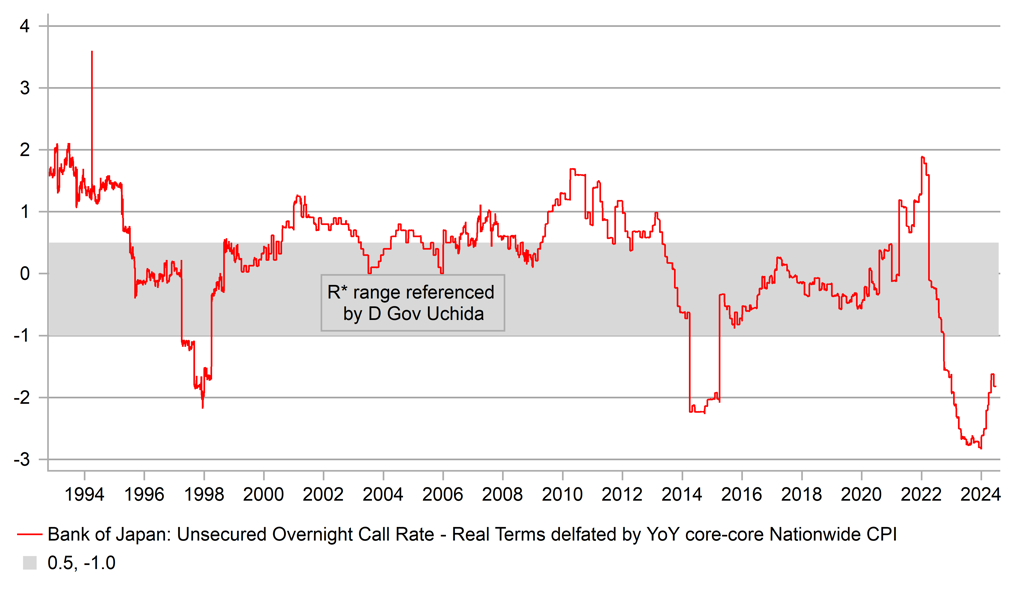

REAL BOJ POLICY RATE & R* RANGE CITED BY UCHIDA

Source: MUFG & Global Markets Research

Another aspect to the BoJ communication this week was the emphasis on the level of the real policy rate, which was described as “profoundly negative”. This comment could be viewed as a double-edged sword – reassuring for investors that policy remains very accommodative but equally signalling the potential extent of scope to hike rates. We have added an additional 25bp rate hike for this fiscal year, so we see the policy rate reaching 0.75% by the end of March 2025. Ueda now sees Japan as having a more normalised monetary policy structure and hence may choose to move in 25bp clips going forward – the global standard. Where might the policy rate end up if all went well and the BoJ was able to reach some level around R*? Deputy Governor Uchida in a previous speech has cited a range from academic works of -1.0% - +0.5%. If cited by the BoJ it is reasonable to assume it roughly concurs. Assuming the mid-point (-0.25%) and the 2% inflation goal you arrive at a nominal rate of 1.75%. But achieving 2% might prove a tall order but we certainly see 1.25%/1.50% as achievable.

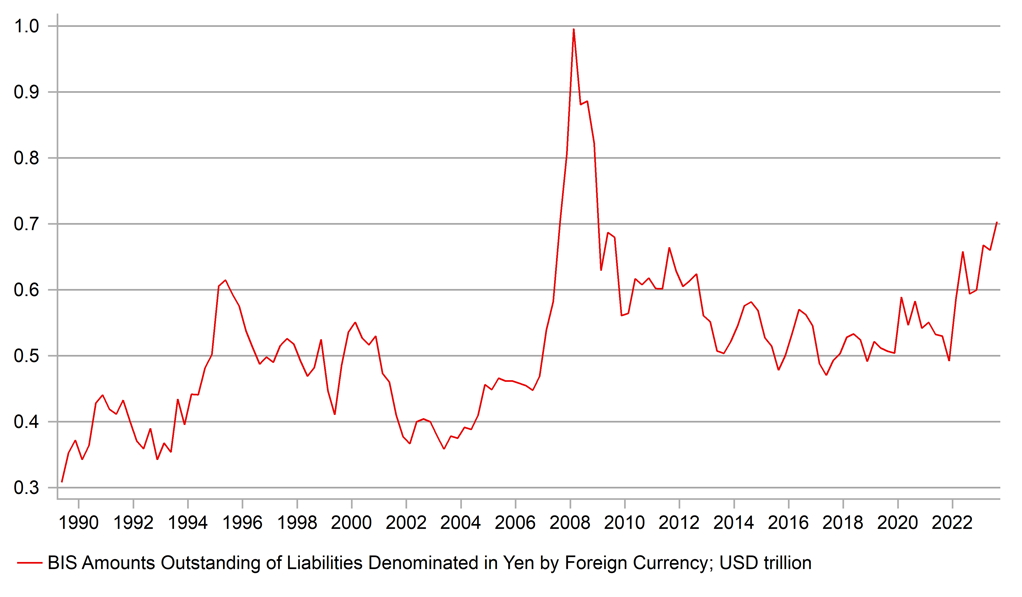

As we highlighted earlier this week, we are beginning to see the re-emergence of the correlation between risk-off and yen strength. This makes sense and the notable change in market dynamics that is strengthening this correlation is the plunge in US yields. Increased global growth concerns, weaker US growth and falling commodity prices coupled with the BoJ decision is fuelling carry unwind. It is difficult to put a precise figure on the size of the yen carry trade but the BIS cross-border lending data that measures JPY liabilities as a foreign currency points to a sizeable increase and to the largest amount since the run up to the GFC. Leveraged Funds have been aggressively liquidating short yen positions – the largest two-week reduction since 2011 – while the (negative) correlation between USD/JPY and USD/MXN has strengthened considerably. The plunge in Japanese equities could result in a self-fulfilling move as yen strength fuels equity selling which then fuels yen buying due to foreign investors being over-hedged on the falling value of their equity position. Still, we should not ignore the importance of developments abroad and assuming no hard landing materialises in the US, we would not expect USD/JPY to continue plunging given the bigger variable for USD/JPY remains US yields much more than Japan yields

BIS – JPY LIABILITIES AS A FOREIGN CURRENCY IN USD

Source: Bloomberg, Macrobond & MUFG GMR

BIG JUMP IN NEG CORRELATION RISK (VIX) & USD/JPY

Source: Bloomberg, Macrobond & MUFG GMR

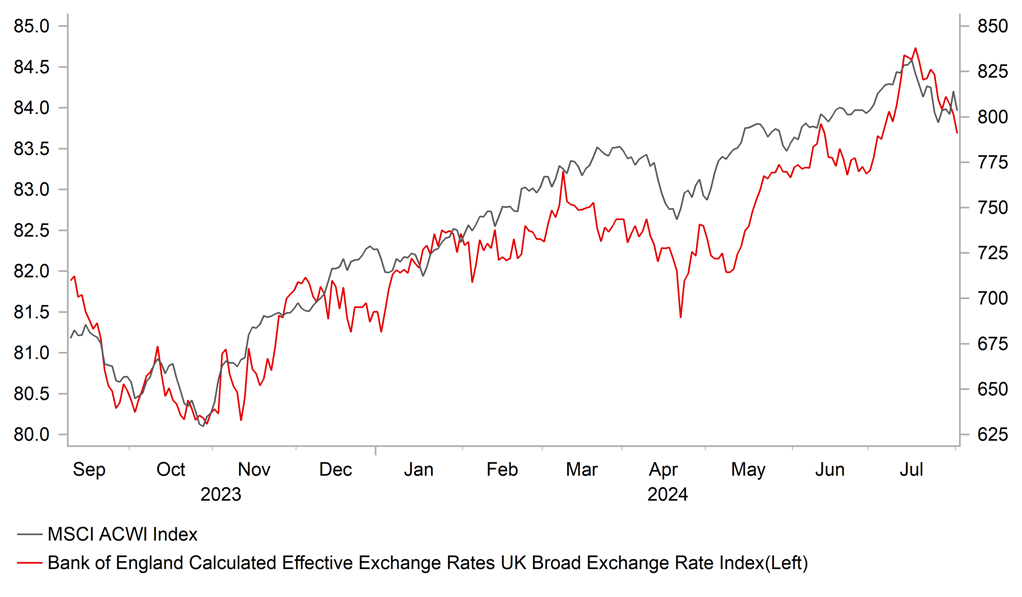

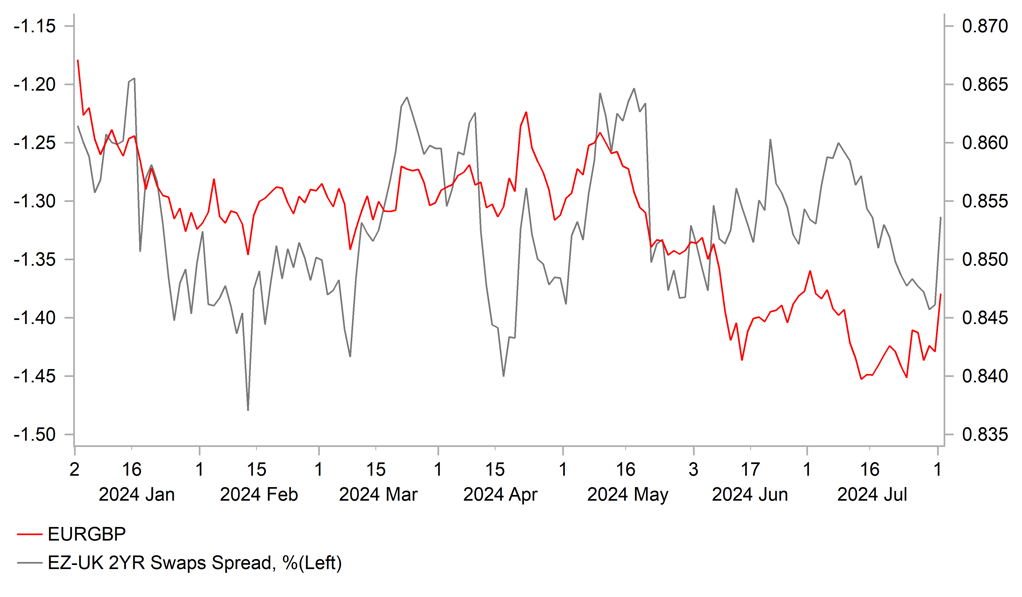

GBP: More troubled waters for the GBP over the summer period

The GBP has been the worst performing G10 currency this week resulting in EUR/GBP rising back up to the 0.8500-level. The GBP has been undermined by the ongoing deterioration in global investor risk sentiment. Global equity markets have been correcting lower since the middle of last month which is encouraging an unwind of carry trade positions. Long GBP positions held by leveraged funds prior to the recent correction lower for global equity markets had reached their highest levels since April 2018. It leaves the GBP vulnerable to further weakness in the near-term from the scaling back of excessive long positioning. A number of fundamental factors are currently challenging global investor risk sentient including: i) softer economic data releases that are casting some doubt on optimism over a soft landing for the global economy and ii) rising geopolitical tension in the Middle East as investors wait to see how Iran will respond to recent actions undertaken by Israel. Bloomberg’s commodity price index fell to a fresh year to date low this week as growth fears appear to be outweighing the risk of a negative energy price shock from the Middle East.

At the same time, the GBP has been undermined by the BoE’s decision to begin to lower rates at this week’s MPC meeting. The 0.25 rate cut was not fully priced in before the MPC meeting, and the UK rate market has since moved to price in more easing encouraged as well by global growth concerns. The UK rate market has moved to fully price in another rate cut in November. Another hike as soon as at the next meeting is judged as unlikely given that the decision to cut rates this week was such a close call (5-4 vote in favour of a cut and some members who voted for a cut noted their decision was finely balanced). At the September MPC meeting the main policy focus is likely to be the BoE’s updated plans for QT. The BoE will vote on the QT target for the next twelve months. Market participants expect the pace of QT to remain the same as in the previous twelve months at GBP100 billion even as the BoE begins to cut rates.

For the year ahead there are currently around 110bps of cuts priced. It roughly matches our own forecasts for the BoE policy rate (click here) with risks to the policy rate more skewed to the downside beyond the near-term. While the BoE remains concerned over the risk of more persistent inflation for now, we expect those risks to ease further heading into next year. Further evidence of a lagged slowdown in services inflation and wage growth will open up more room for the BoE to lower rates to less restrictive levels next year. The BoE’s own updated inflation forecasts show the median projections for headline CPI slowing to 1.7% in two years’ time and 1.5% in three years’ time although the skew is to the upside. The cautious pace of BoE cuts is unlikely to be sufficient to trigger a bigger correction lower for the GBP on its own in the near-term unless there is deeper pullback for risk assets as well.

GBP & RISK ASSETS ARE CORRECTING LOWER

Source: Bloomberg, Macrobond & MUFG GMR

BOE JOINS SYNCHRONISED EASING CYCLE

Source: Bloomberg

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

08/05/2024 |

09:00 |

HCOB Eurozone Services PMI |

Jul F |

-- |

51.9 |

!! |

|

EUR |

08/05/2024 |

09:30 |

Sentix Investor Confidence |

Aug |

-- |

- 7.3 |

!! |

|

GBP |

08/05/2024 |

09:30 |

S&P Global UK Services PMI |

Jul F |

-- |

52.4 |

!! |

|

EUR |

08/05/2024 |

10:00 |

PPI YoY |

Jun |

-- |

-4.2% |

!! |

|

USD |

08/05/2024 |

14:45 |

S&P Global US Services PMI |

Jul F |

-- |

56.0 |

!! |

|

USD |

08/05/2024 |

15:00 |

ISM Services Index |

Jul |

51.5 |

48.8 |

!!! |

|

USD |

08/05/2024 |

19:00 |

Senior Loan Officer Opinion Survey |

!!! |

|||

|

JPY |

08/06/2024 |

00:30 |

Labor Cash Earnings YoY |

Jun |

2.2% |

1.9% |

!!! |

|

AUD |

08/06/2024 |

05:30 |

RBA Cash Rate Target |

4.35% |

4.35% |

!!! |

|

|

EUR |

08/06/2024 |

10:00 |

Retail Sales MoM |

Jun |

-- |

0.1% |

!! |

|

USD |

08/06/2024 |

13:30 |

Trade Balance |

Jun |

-$72.5b |

-$75.1b |

!! |

|

NZD |

08/06/2024 |

23:45 |

Employment Change QoQ |

2Q |

-0.2% |

-0.2% |

!!! |

|

EUR |

08/07/2024 |

07:00 |

Germany Trade Balance SA |

Jun |

-- |

24.9b |

!! |

|

CAD |

08/07/2024 |

18:30 |

BoC Releases Summary of Deliberations |

!! |

|||

|

GBP |

08/08/2024 |

00:01 |

RICS House Price Balance |

Jul |

-- |

- 0.17 |

!! |

|

JPY |

08/08/2024 |

00:50 |

BoP Current Account Balance |

Jun |

¥1863.0b |

¥2849.9b |

!! |

|

AUD |

08/08/2024 |

03:40 |

Governor Bullock speaks |

!! |

|||

|

EUR |

08/08/2024 |

07:00 |

Germany Industrial Production SA MoM |

Jun |

-- |

-2.5% |

!! |

|

USD |

08/08/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

CNY |

08/09/2024 |

02:30 |

CPI YoY |

Jul |

0.3% |

0.2% |

!! |

|

NOK |

08/09/2024 |

07:00 |

CPI YoY |

Jul |

-- |

2.6% |

!! |

|

EUR |

08/09/2024 |

07:00 |

Germany CPI YoY |

Jul F |

-- |

2.3% |

!! |

|

EUR |

08/09/2024 |

07:45 |

France Wages QoQ |

2Q P |

-- |

1.3% |

!! |

|

CAD |

08/09/2024 |

13:30 |

Net Change in Employment |

Jul |

-- |

-1.4k |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The RBA will be the next G10 central bank to provide a policy update in the week ahead. Market participants have become more confident that the RBA will leave rates on hold at 4.35% next week after the release of the Australian CPI report for Q2 helped to ease concerns over a pick-up in inflation. The report revealed that headline and core inflation were in line with the RBA’s forecasts from the May Monetary Policy Statement. While the RBA may discuss raising rates again at next week’s meeting, we no longer expect them to follow through and raise rates further. Market participants will instead be looking for any signals over when the RBA will begin to consider lowering rates if inflation slows further in the year ahead.

- The main economic data releases in the week ahead will be:

- The latest labour cash earnings report from Japan for June which is expected to provide further evidence that stronger wage negotiations from earlier this year are feeding through into the official wage data. At his week’s BoJ policy update, Governor Ueda expressed more confidence that stronger wage growth is spreading out amongst small and medium-sized firms in Japan.

- The releases of the ISM services surveys for July and Senior Loan Officer Opinion Survey (SLOOS) for Q2. After dropping sharply to 48.8 in June, market participants will be watching closely to see if it rebounds in July. Another weak reading in July would reinforce expectations that US growth is likely to slow further in Q3 after growth stepped down to annualized rate of around 2% in 1H of this year.

- The release of the Canadian labour market report for July is expected to keep the BoC on track to lower rates further this year. Another 25bps rate cut is almost fully priced in for the next BoC policy meeting in September. While employment growth has picked up modestly in recent months, the unemployment rate has continued to move higher indicating more slack in the labour market.