To read the full report, please download PDF.

FX Trump trade to resume

FX View:

The depreciation of the US dollar yesterday was an indication that a Trump election victory was well priced in the FX markets. However, this price action should not take away the high probability of further dollar appreciation over the coming months. President-elect Trump won a very strong mandate to deliver the policies he campaigned on and that will encourage him to act on trade tariffs, deportations of illegal immigrants and to extend this tax cuts and increase fiscal spending. The extent of these policies will remain unclear for some time but investors will likely position for quick implementation that will support yields and lift the US dollar. We highlight today certain factors that suggest over the medium term dollar strength may prove unsustainable but over the coming 3-6mths we see upside potential for the dollar.

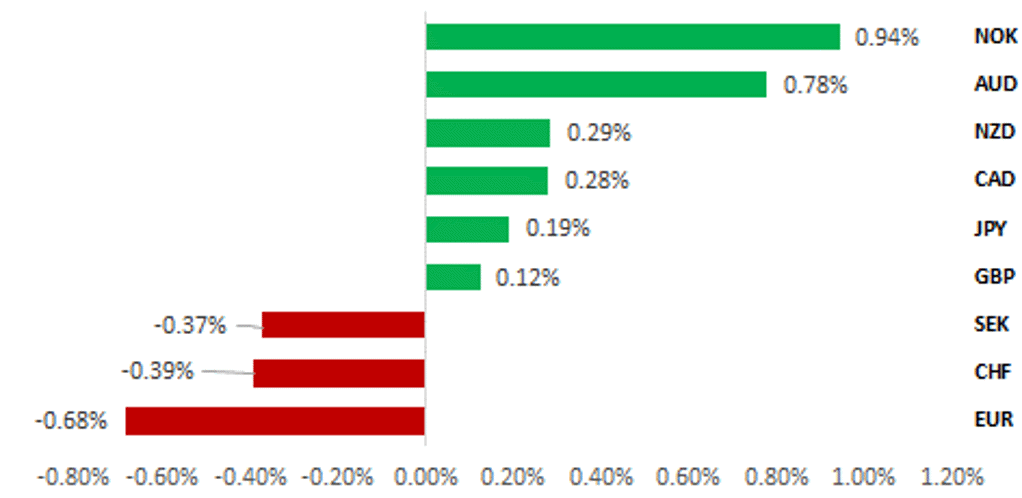

SURPRISINGLY MIXED PERFORMANCE FOR USD AFTER TRUMP WIN

Source: Bloomberg, 14:20 BST, 8th November 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new short EUR/USD trade idea to reflect heightened downside risks for the EUR from escalating trade tensions.

High frequency flows:

This week we look at the higher frequency weekly cross-border flow data from Japan that has seen Japanese investors turn net sellers possibly to reduce risk ahead of the key US election.

Sentiment Analysis on the MPC Monetary Policy Summary and Minutes:

The deterioration in sentiment towards inflation combined with the improvement in sentiment towards the economy and labour market are encouraging the BoE to stick to gradual rate cut plans. The slower pace of BoE rate cuts stands in contrast to the faster pace of easing by the ECB and Fed, and will continue to encourage a stronger GBP heading into year end.

FX Views

USD: The counters to a strong dollar during a Trump presidency

Next Tuesday we will publish updated MUFG foreign exchange forecasts following this week’s election victory for Donald Trump and those forecasts will convey a stronger US dollar profile relative to the forecasts published on 1st November in the Foreign Exchange Outlook monthly report. As highlighted then in that report (click here), a stronger US dollar profile of around 7-8% relative to the forecasts published then in the G10 space still seems plausible for some of those currencies. However, there are many ways in which Trump can act going forward and while tariffs and tax and fiscal policy are important elements for dollar direction, there are differences today relative to Trump’s first term in office and other factors that need to be considered that suggest dollar strength could be less than anticipated or that the gains are not sustained.

There are considerable differences today relative to 2016 when Trump first came to power that would likely mean a much more negative impact domestically in the US from tariffs than in 2018-19. In the 12mth period to the election in 2016, annual CPI averaged just 0.9% whereas now that average is 3.1%. After having just come out of the largest global inflation shock since the 1970’s-80’s longer-term inflation expectations are far less anchored. The 10-year breakeven rate averaged 1.5% in the 12mth period to the 2016 election while today that level is 2.25%. There was generally more spare capacity in the economy then. The 12mth average of the unemployment rate in 2016 was 4.9%, today it is 3.9%. Real GDP growth over a 4Q period in 2016 was 1.8% and today the average is 2.7%. General gross government debt as a percentage of GDP was 104.7% at the end of 2015 while at the end of 2023 that figure was 118.7% according to IMF data and is projected to reach 132% by 2029. Therefore the capacity of the US economy to fuel stronger real GDP growth through increased debt is going to be far more difficult going forward. Furthermore, the increased spending over 10yrs of President Trump’s plans (potentially USD 7.5trn) is in large part (70%) to pay for merely keeping the status quo by extending the Tax Cuts & Jobs Act of 2017 and will therefore have only a limited impact on boosting growth.

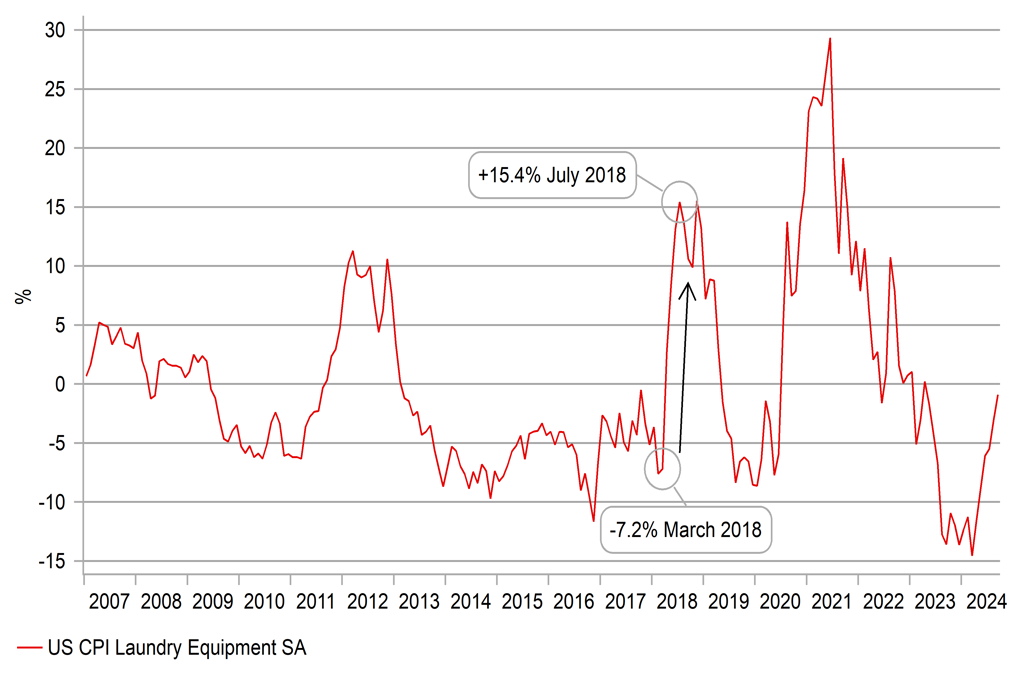

The current law under which President-elect Trump could use to implement tariffs on all US imports doesn’t look obvious and a dubious interpretation of trade law will be required in order to justify tariffs on all imports. Section 201 of the 1974 Trade Act was used in 2018 for tariffs on solar panels and washing machines and is justified when imports are deemed harmful to certain industries. Section 201 will therefore be difficult to use. Section 232 of the Trade Expansion Act 1962 can be used when national security is compromised. Section 232 was used by Trump in 2018 for the steel and aluminium tariffs and was initially applied to all countries before exemptions were granted to certain countries. This section again will be difficult to use if not sector-specific. Section 338 of the Trade Act 1930 allows for up to 50% tariffs on imports from countries that discriminates US goods in its own markets. The International Economic Emergency Powers Act can be used in an “emergency” and Trump threatened Mexico with tariffs under this law in order to halt illegal immigration into the US. Trump could possibly class the US trade deficit as a “national emergency” in order to implement tariffs on all imports. Finally, Section 301 of the Trade Act 1974 covers tariffs on a country to obtain “the removal of any act, policy or practice of a foreign government” and could also be difficult to use across all trading partners. All that said, one or two of these sections are open to some degree of interpretation and given the scale of Trump’s election victory that included widescale tariffs it is reasonable to assume he will explore taking aggressive action. While legal challenges would be likely, winning a legal challenge given Trump’s mandate would be difficult.

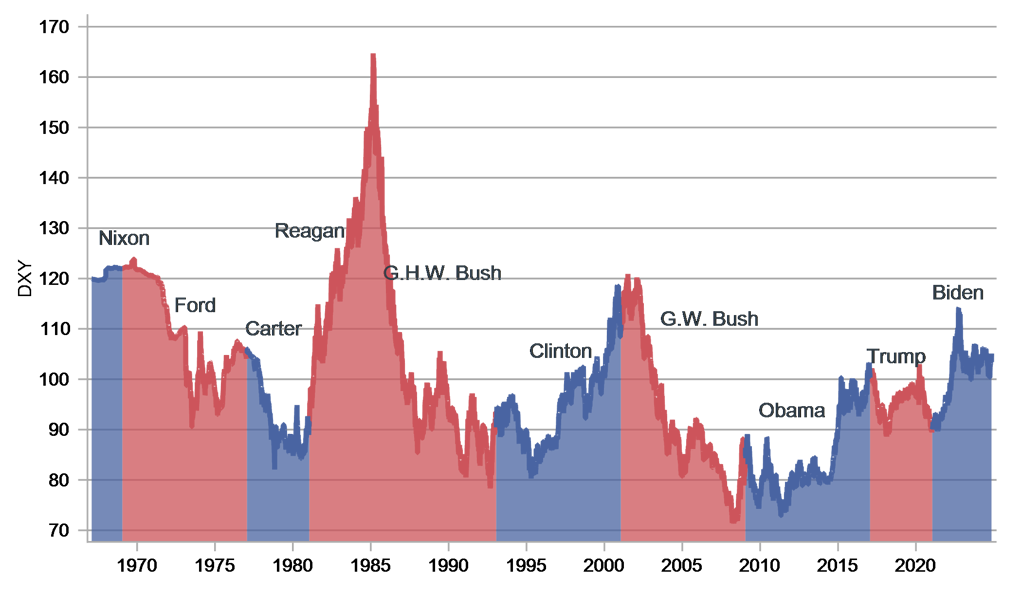

WHERE WILL TRUMP TAKE THE US DOLLAR NEXT?

Source: Bloomberg, Macrobond & MUFG Research

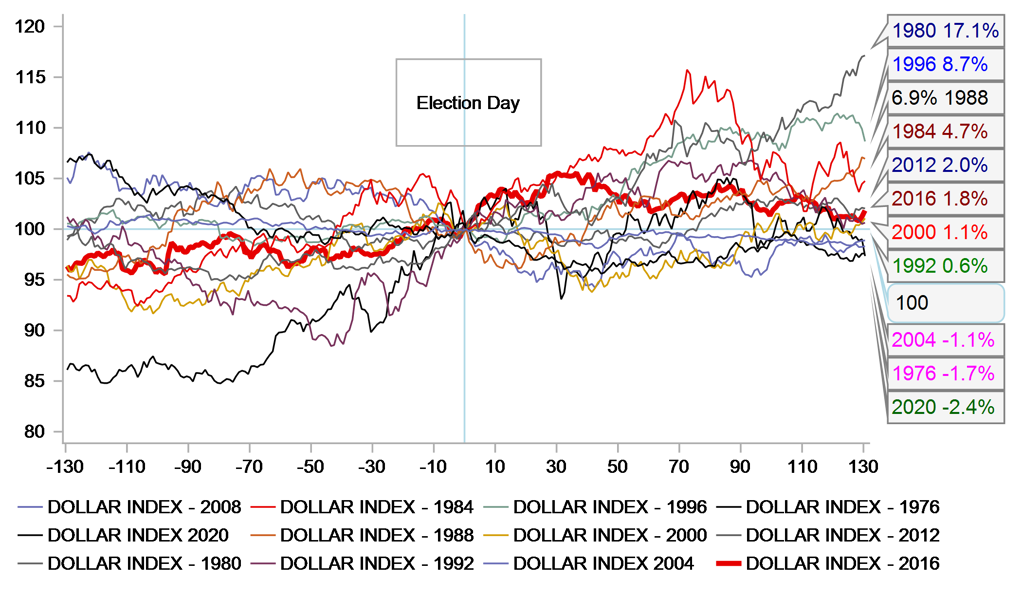

6MTHS AFTER ELECTIONS SKEWED TO STRONGER USD

Source: Bloomberg, Macrobond & MUFG GMR

The S&P Financial Index surged 6.2% on the day of Trump’s election victory in anticipation of deregulation of the banking sector. Complicating those efforts is Fed Vice Chair for Supervisory Michael S. Barr and there is an anticipation of the new administration wanting to fire him. There has also been comments from Trump that he had considered firing Powell. However, to many it is believed that there is no legal framework to take such action. Powell’s term as Chair expires in May 2026 while Barr’s term expires in July 2026. The prospect of Fed interference is a clear negative for the US dollar and if Trump goes aggressively on this we could see this encourage heavy US dollar selling. Trump could test the legal frameworks around this and could go further with the nuclear option of challenging Fed independence under Article II of the Constitution which states that “The executive power shall be vested in a President of the United States”.

US dollar strength ahead is likely but there are factors that could see that reverse over time

As stated at the beginning we see scope for the US dollar to strengthen over the coming months as investors get clarity on trade tariffs to come and plans for fiscal spending and increased deportations from the US. However, inflation expectations are nowhere close to as anchored as they were in 2016. There is a risk that higher inflation starts to undermine the dollar, especially in circumstances of increased White House interference in the Fed and increased fears over the sustainability of US debt levels and if US economic conditions still warrant monetary easing, not tightening.

2018 TARIFFS HAD IMMEDIATE IMPACT ON INFLATION

Source: Bloomberg, Macrobond & MUFG Research

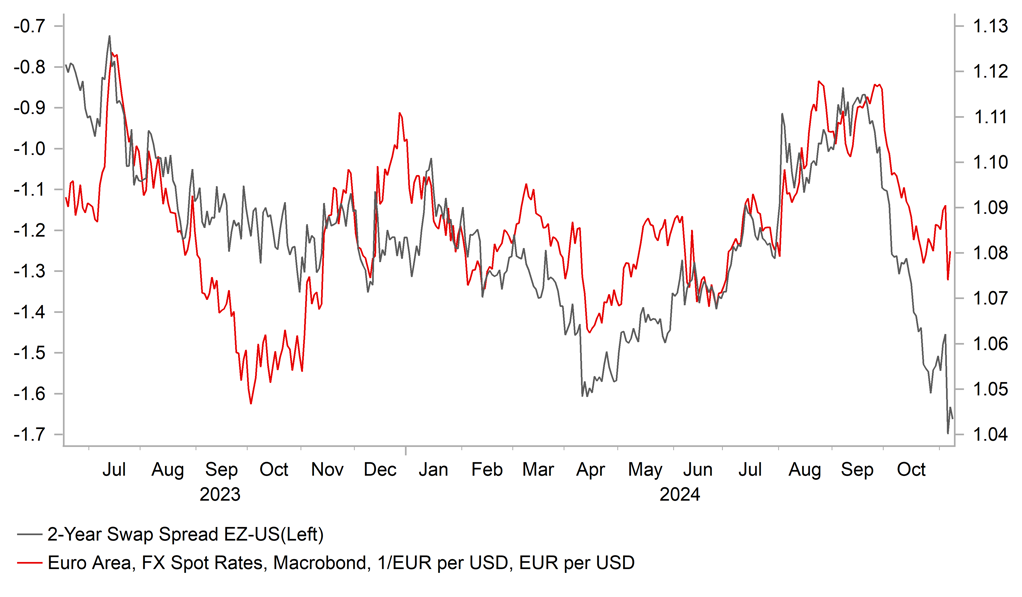

2YR RATE SPREAD POINT TO EUR/USD DOWNSIDE RISK

Source: Bloomberg, Macrobond & MUFG Research

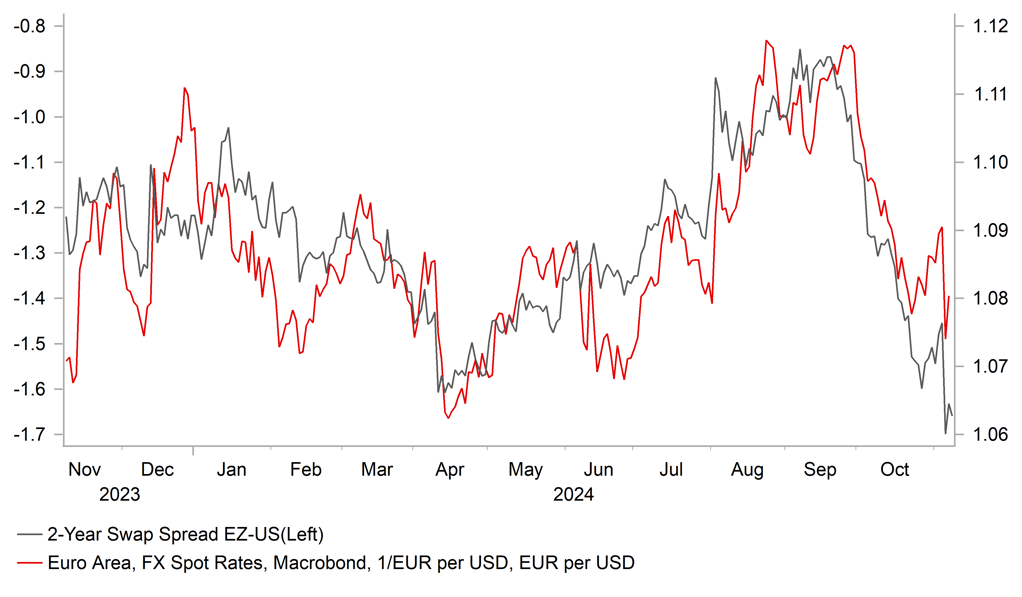

EUR: Trump tariffs & German political uncertainty in focus

The EUR has been the worst performing G10 currency this week with weakness most evident against the G10 commodity currencies of the NOK, AUD and NZD. It has resulted in EUR/USD testing support at around the 1.0700-level where the lows from February and June of this year are located. The EUR has been hit harder by the outcome from the US election than other G10 currencies. It reflects market participants views that the victory for Donald Trump and likely Red Sweep will deliver more of a negative growth shock for the euro-zone economy in contrast to an inflationary shock for the US economy. The expected economic impacts have reinforced market expectations for widening policy divergence between the ECB and Fed in the coming years. Yields have already adjusted sharply higher in the US relative to in the euro-zone since the end of September. The yield on the 2-year US Treasury bond has risen by around 60bps over that period compared to a much more modest increase of around 15bps for the 2-year German government bond. Short-term yield spreads have returned back to levels from in late 2022 when EUR/USD last traded below 1.0500.

While the Fed indicated that they remain on track to cut rates again as planned in December, it is not a done deal and a more cautious quarterly pace of rate cuts appears more likely now in 2025 to reflect uncertainty over upside inflation risks posed by Trump’s policy agenda. In contrast, we are more confident that the ECB will continue to lower the deposit rate closer to 2.00% in the year ahead. The ECB have already identified trade disruption from the incoming Trump administration as one of the main downside risks to the growth outlook in the euro-zone. We are expecting Trump to implement higher tariffs against the EU during the first half of next year. Our European macro economist currently estimates (click here) that the negative impact of trade disruption could lower euro-zone GDP growth by around 0.4 percentage point next year. The weaker growth outlook is viewed as disinflationary but will be offset at least in the year ahead by upward pressure on prices from retaliatory tariffs imposed on imports from the US and the weaker euro. It supports our view that the euro-zone rate market has gone too far in pricing in the ECB policy rate falling below 2.00%. Downside risks for the euro-zone economy from trade tariffs could be dampened if the Trump administration encourages lower energy prices or encourages economies hit by tariffs to step up fiscal stimulus including China and Europe. Our commodity analyst (click here) has recently lowered his forecast for the price of oil and believes that risks are skewed further to the downside potentially lowering the price of Brent towards USD60/barrel. Lower energy prices would be a positive development for terms of trade in Europe and support domestic demand growth.

EUR/USD VS. SHORT-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

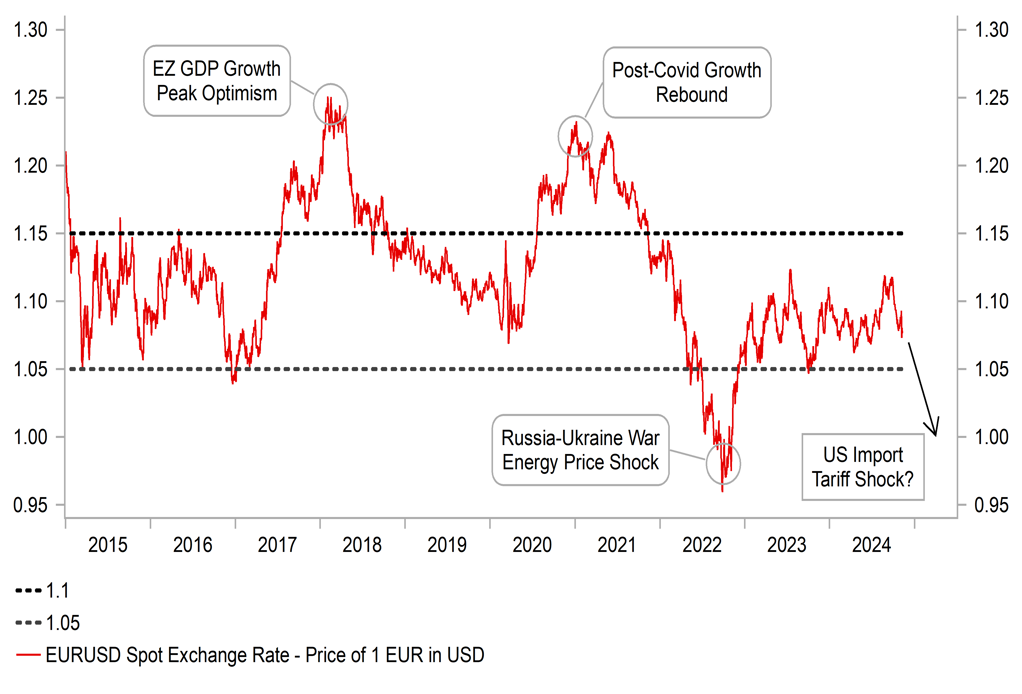

BRACED FOR US IMPORT TARIFF SHOCK

Source: Bloomberg, Macrobond & MUFG GMR

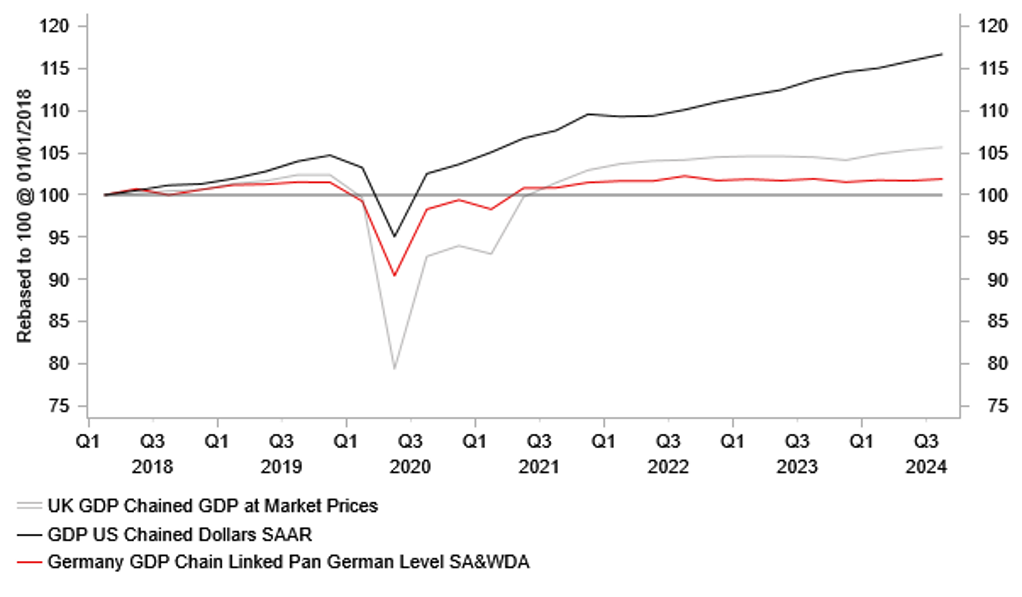

With the incoming Trump administration threatening to impose import tariffs on the EU after it comes to power at the start of next year, the breakdown of the coalition government (SPD, FDP & Greens) in Germany this week is badly timed. It follows Chancellor Scholz’s decision to dismiss the finance minister prompting the FDP to leave the coalition. Chancellor Scholz’s SPD party is aiming to continue to work with the Greens in a minority government until a confidence vote is held on 15th January. With the confidence motion likely to fail, it would set up a snap election by late March 2025. However, Chancellor Scholz is coming under mounting pressure to agree to an earlier election in January. Two thirds of voters want a national vote as soon as possible. The head of the main opposition CDU party Merz has stated that the chancellor’s tactics are “irresponsible”, and is ready to discuss cooperation in parliament in the coming weeks but only if Chancellor Scholz submits as soon as possible to a confidence vote.

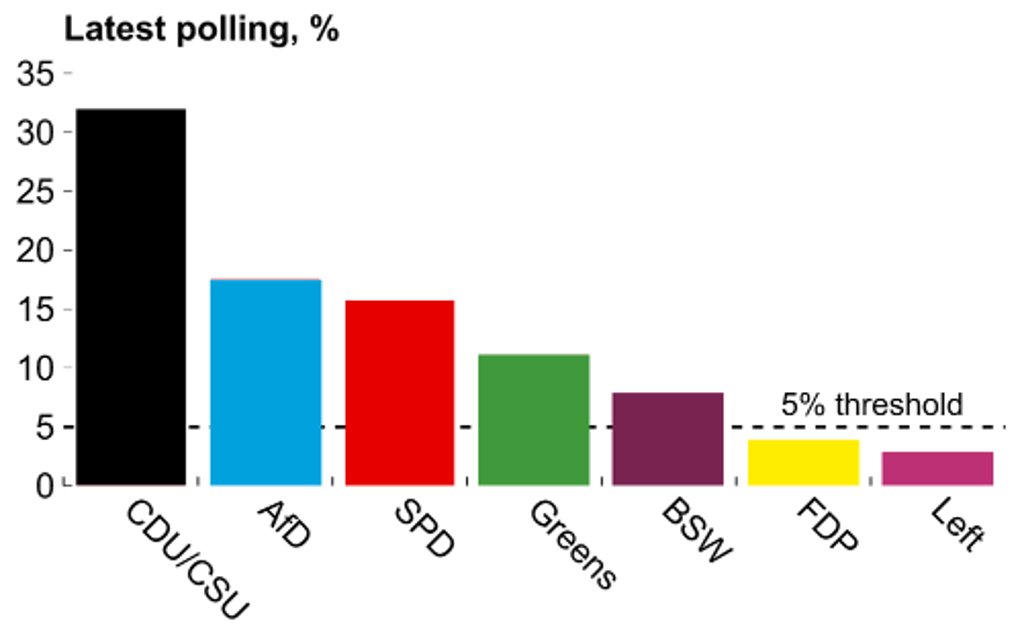

The snap election is expected to bring an end to the current coalition’s grip on power following the trend of national elections held so far this year including in the UK, France and US where the incumbent parties all saw their vote shares tumble undermined in part by challenging macroeconomic conditions in recent years. A change in government and shift to the right would be welcomed by the public and business leaders in Germany after a prolonged period of stagnation. Germany’s economy has struggled to grow since the end of 2021 and has continued to lag behind other euro-zone economies as they have started to recover in the first nine months of this year. The latest opinion polls from Germany indicate that the centre-right CDU/CSU parties have been one of the main beneficiaries from the loss of support in the current coalition government alongside the populist right and left wing parties of the AfD and BSW.

The BSW is the new left-wing alliance founded on 8th January by former members of Die Linke which has roots in the former communist party that ruled East Germany. BSW espouses anti-NATO, anti-immigrant populist rhetoric while promoting left-wing economics. Public support for the populist parties is currently running at around 17%-18% for the right-wing AfD and at around 6%-9% for the left-wing BSW. At the last election, the AfD captured 10.3% of the vote and Die Linke for comparison captured 4.9% of the vote. If the populist parties perform as well as indicated in the polls or even better, it could complicate coalition building after the election although a repeat of the political instability in France is not on the cards. In the most likely scenario, the CDU/CSU could be forced into another coalition with the SPD and even Greens if the liberal FDP fall short of securing 5% of the vote required to enter parliament. A shorter period of political uncertainty would help to ease downside risks for the euro but is unlikely to prevent EUR/USD falling into a lower range between 1.0000 and 1.0500 in anticipation of higher US tariffs on imports from the EU.

PERFORMANCE SINCE TRUMP’S FIRST TRADE WAR

Source: Bloomberg, Macrobond & MUFG GMR

CDU/CSU ON COURSE TO LEAD NEXT GOVERNMENT

Source: MUFG ERO & Wahlrecht.de

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NOK |

11/11/2024 |

07:00 |

CPI YoY |

Oct |

-- |

3.0% |

!! |

|

EUR |

11/12/2024 |

07:00 |

Germany CPI YoY |

Oct F |

-- |

2.0% |

!! |

|

GBP |

11/12/2024 |

07:00 |

Employment Change 3M/3M |

Sep |

-- |

373k |

!!! |

|

USD |

11/12/2024 |

15:00 |

Fed's Waller speaks |

!! |

|||

|

USD |

11/12/2024 |

19:00 |

Senior Loan Officer Opinion Survey |

!! |

|||

|

AUD |

11/13/2024 |

00:30 |

Wage Price Index YoY |

3Q |

3.7% |

4.1% |

!! |

|

EUR |

11/13/2024 |

10:00 |

Industrial Production SA MoM |

Sep |

-- |

1.8% |

!! |

|

USD |

11/13/2024 |

13:30 |

CPI Ex Food and Energy MoM |

Oct |

0.3% |

0.3% |

!!! |

|

AUD |

11/13/2024 |

23:00 |

RBA's Bullock-Panel |

!! |

|||

|

AUD |

11/14/2024 |

00:30 |

Employment Change |

Oct |

20.0k |

64.1k |

!! |

|

SEK |

11/14/2024 |

07:00 |

CPI YoY |

Oct F |

-- |

1.6% |

!! |

|

EUR |

11/14/2024 |

10:00 |

GDP SA QoQ |

3Q P |

-- |

0.4% |

!! |

|

EUR |

11/14/2024 |

10:00 |

Employment QoQ |

3Q P |

-- |

0.2% |

!! |

|

EUR |

11/14/2024 |

12:30 |

ECB Account From October Meeting |

!! |

|||

|

USD |

11/14/2024 |

13:30 |

PPI Ex Food and Energy MoM |

Oct |

0.3% |

0.2% |

!! |

|

USD |

11/14/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

11/14/2024 |

20:00 |

Fed's Powell speaks |

!!! |

|||

|

GBP |

11/14/2024 |

21:00 |

BoE's Bailey speaks |

!!! |

|||

|

USD |

11/14/2024 |

21:15 |

Fed's Williams speaks |

!! |

|||

|

JPY |

11/14/2024 |

23:50 |

GDP SA QoQ |

3Q P |

0.1% |

0.7% |

!!! |

|

JPY |

11/15/2024 |

04:30 |

Industrial Production MoM |

Sep F |

-- |

1.4% |

!! |

|

GBP |

11/15/2024 |

07:00 |

GDP QoQ |

3Q P |

-- |

0.5% |

!!! |

|

EUR |

11/15/2024 |

07:45 |

France CPI YoY |

Oct F |

-- |

1.2% |

!! |

|

USD |

11/15/2024 |

13:30 |

Retail Sales Advance MoM |

Oct |

0.3% |

0.4% |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- Market participants will continue to weigh up implications from the US election result in the week ahead. After cutting rates by a further 25bps this week, market participants will be listening to comments from Fed officials including Chair Powell and New York President Williams in the week ahead to assess how the Fed could alter their policy plans in response to the new US government in the coming years. After picking up in September, market participants will be closely watching the release of the latest US CPI report for October in the week ahead. Another upside surprise could cast more doubt on the Fed’s current plans to cut rates again as soon as in December. The release of the latest US retail sales report for October will shed light on whether strong personal consumption continued at the start of Q4.

- After cutting rates for the second time in the current easing cycle this week, the BoE signaled that they are not yet confident to speed up the pace of rate cuts. We recently dropped our forecast for a back-to-back rate cut in December. For the BoE to become more confident to speed up rate cuts, more evidence of slowing inflation and wage growth will be required. The latest UK labour market report will be released in the week ahead alongside the GDP report for Q3. Similar to in the euro-zone leading indicators are pointing to a slowdown in growth in Q3 although the hard data proved stronger than expected in the euro-zone. Will the UK economy also prove to be more resilient than expected in Q3? Governor Bailey is scheduled to speak again towards the end of next week.

- The latest GDP report for Q3 is also scheduled to be released in Japan in the week ahead. It is expected to show growth slowed in Q3 after the strong pick-up in Q2. Private consumption and business investment are both expected to slow. At the their latest policy meeting, the BoJ indicated that they are still planning to raise rates further if the economy performs in line with expectations. Recent political developments both in Japan and the US have made the timing of the next BoJ hike more uncertain. The LDP party in Japan is still attempting to put together a new government and will be waiting to see if Trump puts higher tariffs in place against imports from Japan. While the weaker JPY keeps pressure on the Japanese government and BoJ to step up support especially if the sell-off intensifies heading into year-end.