To read the full report, please download PDF.

Some relief for high beta G10 FX

FX View:

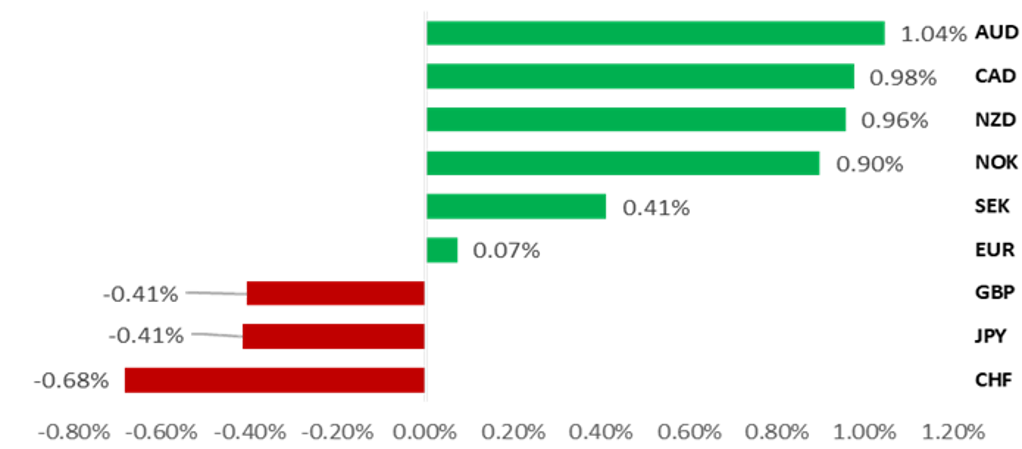

It has been another volatile week for financial markets. The plunge lower for the Japanese equity market at the start of this week and the further sharp strengthening of the JPY have been largely reversed in recent days. The tentative improvement in global investor risk sentiment has resulted in the high beta G10 currencies of the AUD, CAD, NZD, NOK and GBP outperforming this week. We expect risk off/risk on trading to continue dictating FX market performance in the week ahead. The other key events to watch will be the release of the latest US CPI report for July. We are expecting further evidence of slowing US inflation to encourage the Fed to cut rates in September. We expect the BoE to wait a little longer to begin cutting rates again in November unless services inflation and wage growth slows more over the summer. It is a closer call as to whether the RBNZ will pull the trigger and cut rates as soon as next week or wait until October.

HIGH BETA G10 FX STAGE TENTATIVE REBOUND

Source: Bloomberg, 11:49 BST, 9th August 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new short NZD/CAD trade recommendation, and have closed our short NZD/CHF trade idea after the target was hit.

IMM FX Positioning:

The biggest changes in Leveraged Funds’ positioning in the latest week have been: i) an increase in short CAD positions by 19,821 contracts, ii) an increase in short EUR positions by 22,504 contracts, iii) a decrease in long GBP positions by 11,497 contracts, and iv) a decrease in short JPY positions by 11,737 contracts. It was the largest short CAD position on record.

FX Correlation Trees:

The strong correlations between the JPY and both CHF, Nikkei could indicate the JPY is being increasingly perceived as a safe haven currency and should global equity markets continue to correct lower we may see further demand for the JPY.

FX Views

JPY: BoJ signals concern over sharp tightening in financial conditions

It has been a volatile week for financial markets which has likely been exacerbated by the less liquid summer trading conditions. The release of the weak nonfarm payrolls report for July that revealed employment growth of just 114k and the unemployment rate rising by a further 0.2 points to 4.3% has intensified investor concerns over the risk of a harder landing for the US economy if the Fed keeps higher rates in place for too long. While the Fed has already signalled that it is on course to begin cutting rates in September, it already looks like a small mistake on the Fed’s behalf not to have taken the opportunity to have started to gradually lower rates last month. Unless there is an significant upside surprise, the release of the US CPI report for July in the week ahead is expected to provide further evidence that inflation pressures continue to ease. Loosening labour market conditions have given us more confidence that wage growth will continue to moderate dampening upside risks from domestic demand. With the Fed’s policy rate still well above their estimate of the neutral rate at just below 3.00%, it leaves plenty of scope for the Fed to open up their rate cut cycle with a larger 50bps cut if they feel like they have fallen behind the curve by the September FOMC meeting.

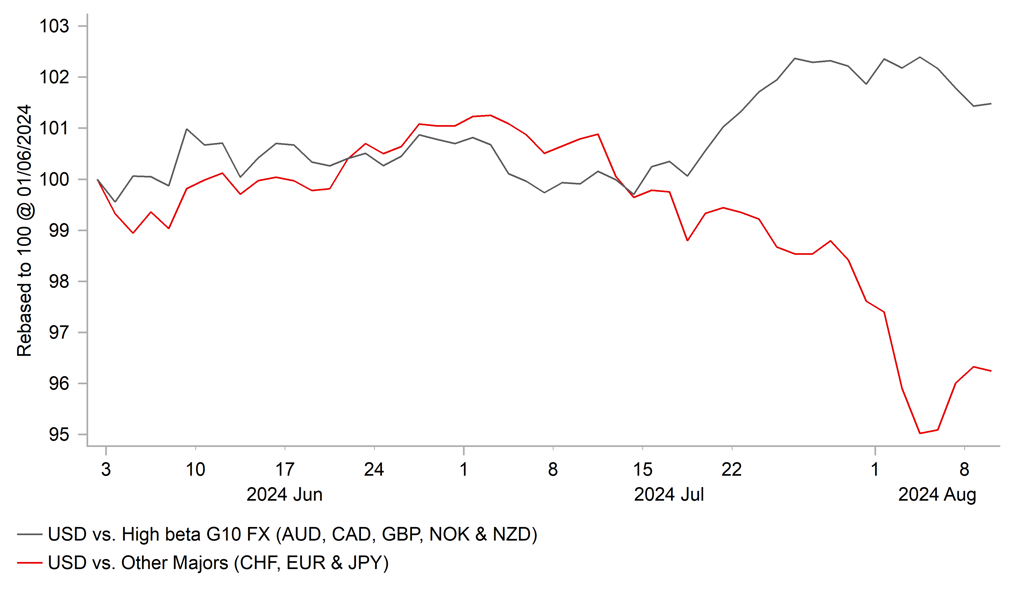

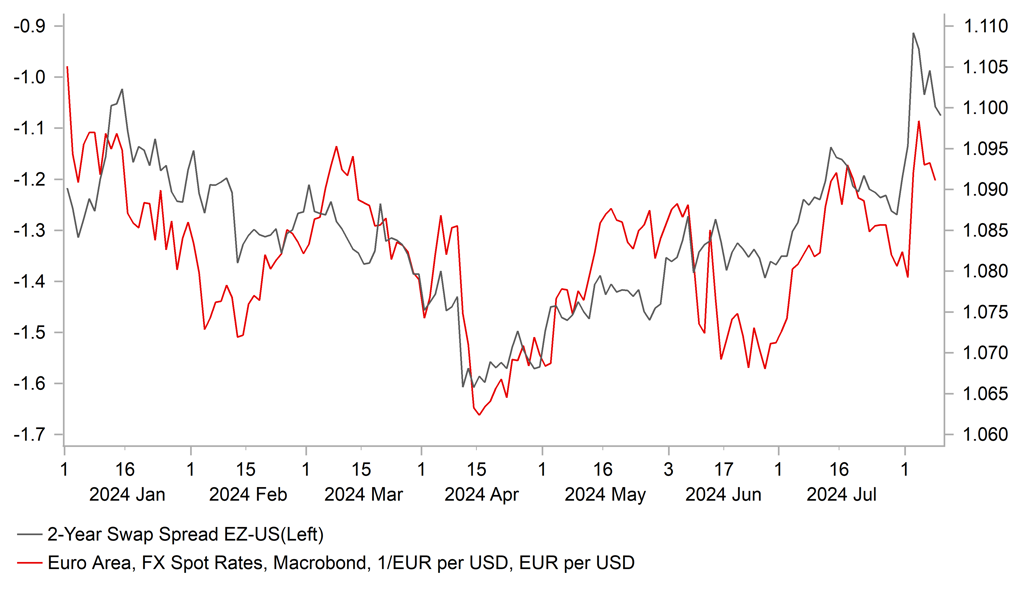

The US rate market has already moved a long way to price in the heightened risk of more aggressive and front-loaded Fed rate cuts. There are currently around 39bps of cuts priced in by September and close to 200bps of cuts in total for the year ahead. It has resulted in yields falling more in the US than in other major economies over the past month as the Fed is expected to play catch up. The yield on 2-year US governments bonds has declined by around 60bps compared to around 50bps in both the euro-zone and UK. However, the sharp drop in US yields has had a mixed impact on USD performance. While the USD has fallen alongside US yields against the other major currencies of the JPY, CHF and EUR, it has strengthened against the high beta currencies the AUD, NOK, NZD, CAD and GBP. Recent price action is more consistent with more risk-off trading conditions, and yield spreads have become less important in driving FX market since global equity markets peaked on 16th July.

In recent days, the high beta G10 currencies of the AUD, NOK, NZD, CAD and GBP have started to rebound encouraged by a tentative improvement in global investor risk sentiment. There have been two main triggers for the improvement in risk sentiment in recent days. Firstly, BoJ Deputy Governor Uchida dialled back on the hawkish message delivered by the BoJ at their last policy meeting on 31st July. At their last policy meeting, the BoJ had surprised market participants by sending a stronger signal that they plan to keep raising rates if Japan’s economy continues to evolve in line with their outlook. It had prompted us to bring forward our forecast for the timing of the BoJ’s next rate hike to 0.50% in Q4 of this year from Q1 2025. However, the comments from Deputy Governor Uchida have cast some doubt on our forecast for another rate hike this year. He emphasized that “Japan’s economy is not in a situation where the bank may fall behind the curve if it does not raise the policy rate at a certain pace. Therefore the bank will not raise its policy interest rate when financial and capital markets are unstable”. It follows the 13% plunge for Japanese equites at the start of this week, and the surge higher for the yen that resulted in USD/JPY hitting a low of 141.70. Those moves in Japanese equities and the JPY have now largely been reversed. The Japanese rate market is though still pricing in a much smaller probability of a further BoJ hike this year (around 8bps priced for December).

USD PERFORMANCE HAS DIVERGED RECENTLY

Source: Bloomberg, Macrobond & MUFG GMR

EUR/USD VS. SHORT-TERM YIELD SPREAD

Source: MUFG & Global Markets Research

Looking beyond unstable financial market conditions, other developments this week from Japan have been supportive for further BoJ hikes. The release of the latest cash earnings report for June revealed further evidence of stronger wage growth in Japan, the release of minutes from the last BoJ policy meeting contained hawkish opinions over rising rates further. One board member had the opinion that the policy rate should be raised to the level of the neutral rate in a timely and gradual manner which seems to be at least around 1.00%. If financial market conditions stabilize and the JPY does not continue to strengthen sharply, we still expect the BoJ to hikes rates further although our previous forecast for the next hike in Q1 2025 appears more likely now.

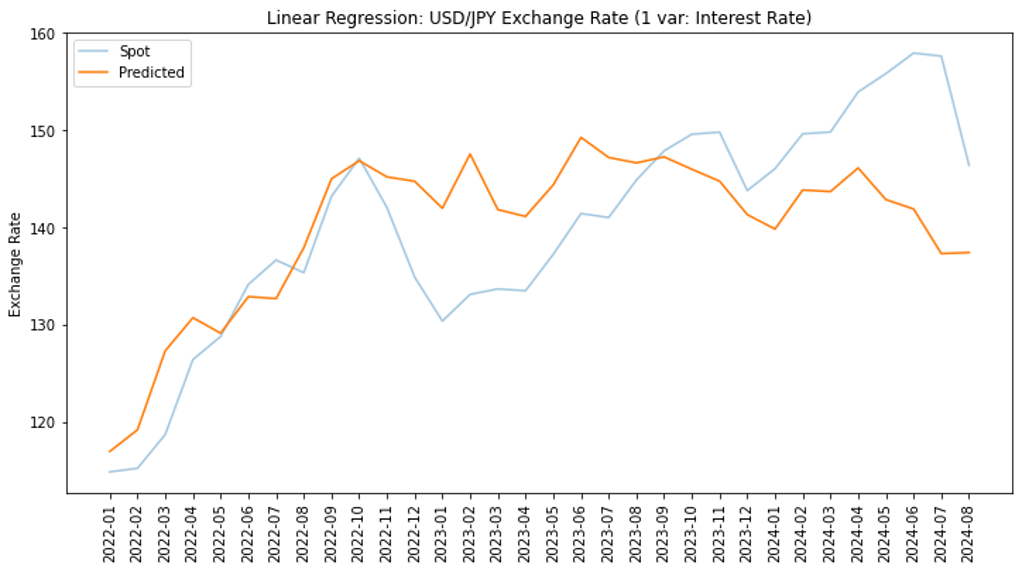

The second trigger for the improvement in risk sentiment in recent days was the release yesterday of the latest initial claims report which has helped to ease fears over a sharper slowdown for the US labour market. Initial claims dropped back after they had been lifted by the disruption from Hurricane Beryl. Still US yields remain significantly lower pricing in more aggressive Fed rate cuts. The narrowing of yield spreads between the US and Japan has been an important driver of the adjustment lower for USD/JPY. Our regression model (see chart below) which takes into account the historical relationship between USD/JPY and yield spreads was signalling that JPY weakness was significantly overshooting in prior months. A large part of the overshoot for USD/JPY has corrected over the past month, but our regression model is still signalling room for the correction lower to extend further if the Fed follows through with more aggressive rate cuts. One additional upside risk for the JPY that has emerged in recent days, is been the potential for a pick-up in repatriation flows if Japan is hit by major earthquake (click here) after the government issued a precautionary warning.

USD/JPY MOVES MORE IN LINE WITH YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG GMR

JPY STRENGTHENED AFTER 2011 EARTHQUAKE

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GBP |

08/13/2024 |

07:00 |

Average Weekly Earnings 3M/YoY |

Jun |

-- |

5.7% |

!!! |

|

GBP |

08/13/2024 |

07:00 |

Employment Change 3M/3M |

Jun |

-- |

19k |

!! |

|

EUR |

08/13/2024 |

10:00 |

ZEW Survey Expectations |

Aug |

-- |

43.7 |

!! |

|

USD |

08/13/2024 |

11:00 |

NFIB Small Business Optimism |

Jul |

91.7 |

91.5 |

!! |

|

USD |

08/13/2024 |

13:30 |

PPI Final Demand MoM |

Jul |

0.2% |

0.2% |

!! |

|

NZD |

08/14/2024 |

03:00 |

RBNZ Official Cash Rate |

5.50% |

5.50% |

!!! |

|

|

SEK |

08/14/2024 |

07:00 |

CPI YoY |

Jul |

-- |

2.6% |

!! |

|

GBP |

08/14/2024 |

07:00 |

CPI YoY |

Jul |

-- |

2.0% |

!!! |

|

EUR |

08/14/2024 |

07:45 |

France CPI YoY |

Jul F |

-- |

2.3% |

!! |

|

EUR |

08/14/2024 |

10:00 |

GDP SA QoQ |

2Q P |

-- |

0.3% |

!!! |

|

EUR |

08/14/2024 |

10:00 |

Employment QoQ |

2Q P |

-- |

0.3% |

!! |

|

EUR |

08/14/2024 |

10:00 |

Industrial Production SA MoM |

Jun |

-- |

-0.6% |

!! |

|

USD |

08/14/2024 |

13:30 |

CPI MoM |

Jul |

0.2% |

-0.1% |

!!! |

|

JPY |

08/15/2024 |

00:50 |

GDP Annualized SA QoQ |

2Q P |

2.3% |

-1.8% |

!!! |

|

CNY |

08/15/2024 |

02:20 |

1-Yr Medium-Term Lending Facility Rate |

2.30% |

2.30% |

!!! |

|

|

AUD |

08/15/2024 |

02:30 |

Employment Change |

Jul |

25.0k |

50.2k |

!!! |

|

CNY |

08/15/2024 |

03:00 |

Industrial Production YoY |

Jul |

5.5% |

5.3% |

!! |

|

CNY |

08/15/2024 |

03:00 |

Retail Sales YoY |

Jul |

2.6% |

2.0% |

!! |

|

JPY |

08/15/2024 |

05:30 |

Industrial Production MoM |

Jun F |

-- |

-3.6% |

!! |

|

GBP |

08/15/2024 |

07:00 |

GDP QoQ |

2Q P |

-- |

0.7% |

!!! |

|

NOK |

08/15/2024 |

09:00 |

Deposit Rates |

4.50% |

4.50% |

!!! |

|

|

GBP |

08/15/2024 |

09:30 |

Output Per Hour YoY |

2Q P |

-- |

0.1% |

!! |

|

USD |

08/15/2024 |

13:30 |

Retail Sales Advance MoM |

Jul |

0.3% |

0.0% |

!!! |

|

USD |

08/15/2024 |

13:30 |

Initial Jobless Claims |

Aug 10 |

-- |

-- |

!! |

|

USD |

08/15/2024 |

14:15 |

Industrial Production MoM |

Jul |

0.0% |

0.6% |

!! |

|

USD |

08/15/2024 |

15:00 |

NAHB Housing Market Index |

Aug |

42 |

42 |

!! |

|

AUD |

08/16/2024 |

00:30 |

RBA Governor Michele Bullock speaks |

!!! |

|||

|

NZD |

08/16/2024 |

01:30 |

RBNZ Governor speaks |

!!! |

|||

|

GBP |

08/16/2024 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Jul |

-- |

-1.2% |

!! |

|

USD |

08/16/2024 |

13:30 |

Housing Starts |

Jul |

1353k |

1353k |

!! |

|

USD |

08/16/2024 |

15:00 |

U. of Mich. Sentiment |

Aug P |

66.4 |

66.4 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The RBNZ (Wed) and the Norges Bank (Thurs) will be the latest G10 central banks to hold their policy meetings in the week ahead. The RBNZ policy update has the potential to be more market moving with building speculation that the RBNZ could begin to lower rates or at least signal strongly that they are planning to cut rates at the following meeting in October. The RBNZ is expected to significantly bring forward plans for rate cuts supported by a lowering of their outlook for growth and inflation in the updated MPS.

- In contrast, we expect the Norges Bank to leave their policy rate unchanged at 4.50%. Inflation slowed more than expected in June which will encourage the Norges Bank to consider lowering rates later this year although that will be partially offset by the inflationary impact from the weaker krone.

- There is a busy schedule of economic data releases in the week ahead including:

- The latest UK labour market report (Tues), CPI report for July (Wed) and GDP report for Q2 (Thurs). The BoE will be looking for further evidence that services inflation and wage growth is slowing to open the door for further rate cuts this year. The GDP report is expected to reveal that the economy continued to rebound strongly in Q2 for the second consecutive quarter although the BoE is sceptical that such strong growth can be sustained in 2H of this year.

- The main economic data release in the week ahead will be the US CPI report for July (Wed). The report is expected to reveal that core inflation remained weaker (+0.2M/M) in July for the third consecutive month laying the ground for the Fed to begin cutting rates in September.