To read the full report, please download PDF.

USD upside as macro supports Trump risks

FX View:

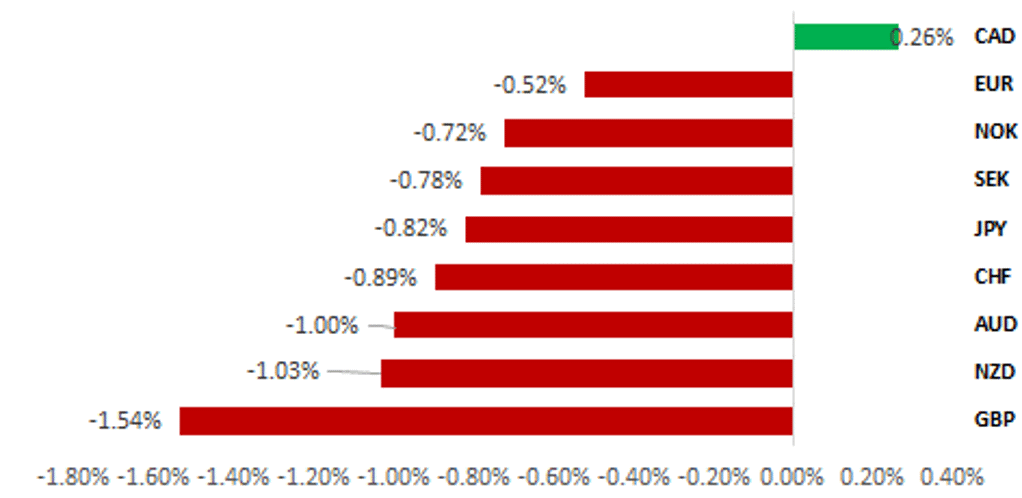

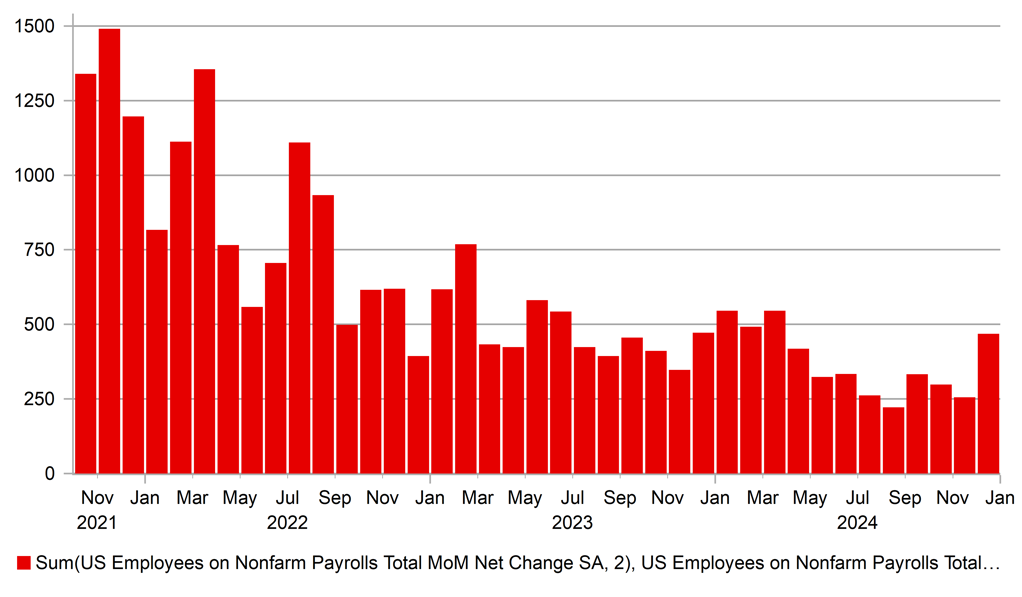

The last payrolls report covering 2024 was released this afternoon and we now know that the US labour market closed out the year with a strong gain in jobs with non-farm payrolls increasing 256k. The report has given the US dollar further impetus with gains versus most of the rest of G10. What the strong data does do is make the prospect of a rate hike from the BoJ more likely. Bloomberg today reported that the BoJ was still “mulling” the decision suggesting a hike in the policy rate was still possible. While the initial move higher in USD/JPY has been modest, gains next week will add to pressure on the BoJ. The strong jobs report could also mean the move higher in UK Gilt yields extends further which may mean the sense of crisis intensifies and adds further downside pressure to GBP/USD. While this is very different to the ‘Truss Crisis’ in 2022, it could still worsen over the near-term especially if Trump fuels further upward pressure on long-term yields after his inauguration on 20th January.

USD GAINS VERSUS MOST OF G10 WITH GBP LAGGING

Source: Bloomberg, 1415 GMT, 10th January 2025 (Weekly % Change vs. USD)

Trade Ideas:

We have established a short GBP/USD trade idea. While this move is already well under way, we don’t see an obvious catalyst for it to reverse over the short-term.

JPY Flows: High Frequency:

Heavy bond sales by Japanese investors has abated but last week saw the 2nd consecutive week of more modest selling. CFTC data indicates increasing appetite for yen selling while the TFX margin trading positioning data has revealed increased selling of EUR/JPY.

Sentiment Analysis on the latest FOMC Minutes:

Analysing the latest FOMC minutes we observe how the sentiment across macro topics has shifted positive for the first time since March 2024. Our analysis indicates this has been driven by progress towards inflation targets and reduced downside risks to the labour market and economic activity.

FX Views

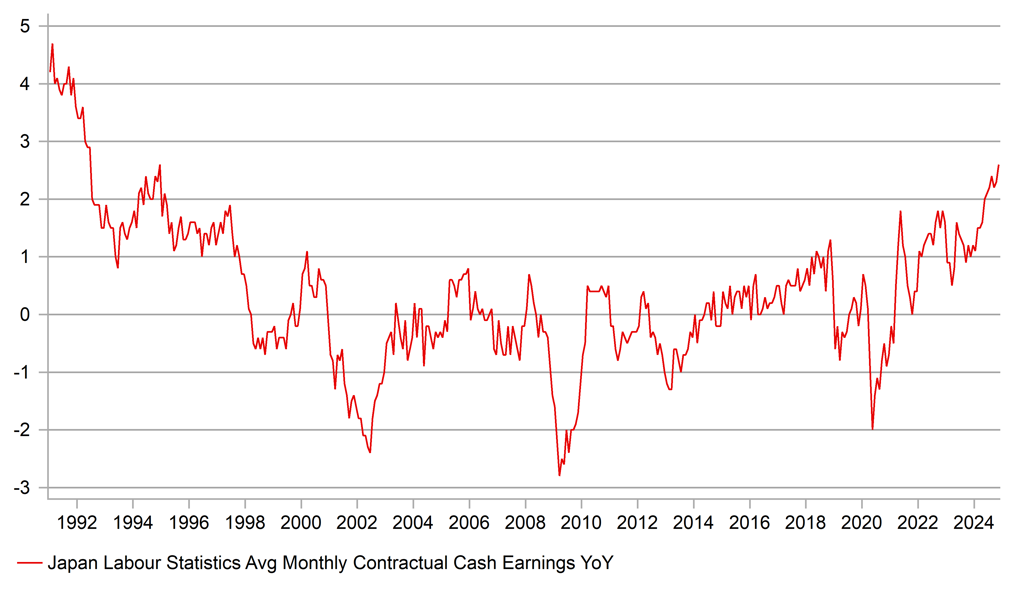

JPY: A January hike is still possible

The strong performance for the US dollar in the final quarter of last year has been maintained in the first full trading week of the new year with the dollar advancing modestly further. The US jobs report will give this trend further momentum with a much stronger non-farm payrolls increase of 256k. Investors will increasingly ponder the idea that the FOMC will pause for longer than just one or even two meetings. The OIS curve is now showing a full 25bp cut only being priced by the November meeting underlining the initial impact of the jobs report. Some of the strength of the US dollar versus the yen had actually reversed a little prior to the jobs data on the prospect of the BoJ still potentially hiking its key policy rate at its meeting on 24th January. We have generally argued that conditions were in place for another hike but the lack of BoJ guidance made us sceptical of a hike taking place this month. However, that could change (especially now after the jobs data) and hence we should not rule out the prospect of a hike this month and expectations therefore could quickly shift.

In regard to the need for some additional guidance on a rate hike, today we did get a media story suggesting the BoJ may now be guiding the market to a January hike. Bloomberg reported that the BoJ is “mulling its January rate decision” with an additional news story from Bloomberg stating that the BoJ is considering raising its inflation forecast due to an increase in rice prices and the ongoing depreciation of the yen. We believe this type of media guidance is integral to lifting expectations of a rate hike outside of direct communications from BoJ officials. Given the turmoil in the financial markets following the last rate hike in July, the BoJ is likely much more sensitive on ensuring as little surprise as possible on further decisions to hike rates.

The last speech by a senior BoJ official was a speech by Governor Ueda on 25th December and going forward there is only one speech scheduled ahead of the policy meeting on 24th January. Deputy Governor Himino will deliver a speech on 14th January at 10:30am local time to local business leaders in the Kanagawa prefecture, just south of Tokyo. Unless we have an unscheduled speech this will be the last opportunity for a senior BoJ official to guide the market on a possible rate hike. We are not sure Himino will be in a position by then to be more explicit than what we heard today via the media and hence a repeat by Himino that the BoJ is still considering its policy decision seems the most likely outcome from that speech. However, the tone of messaging beyond direct references to the meeting on 24th Jan will also be important, especially in relation to wage developments. Given there will be more info available by March on ‘shunto’ wage negotiations, any sense of increased confidence on another wage negotiation round that will result in another big wage increase would certainly help lift expectations of a hike at the January meeting. In that regard, the message from the quarterly BoJ regional meeting this week that “the view that continuous wage increases are necessary is spreading across companies in a wide range of sectors and of various sizes” is something that Himino could cite in his speech to argue that the BoJ is becoming more confident in the sustainability of the wage-price spiral.

JAPAN CASH EARNINGS CONTINUE TO TREND HIGHER

Source: Macrobond & Bloomberg

468K 2MTH GAIN IN NFP IN DECEMBER WAS THE LARGEST SINCE MARCH 2024

Source: Bloomberg, Macrobond & MUFG Research

Total cash earnings jumped from a downwardly revised 2.2% (vs 2.6%) to 3.0% while under a same sample basis to remove distortions the growth rate picked from 2.8% to 3.5% while scheduled full-time pay under the same sample basis dropped marginally from 2.9% to 2.8%. This is further evidence of the continued stability of wage growth at levels consistent with achieving the price stability goal and hence could be used to justify another rate hike by the BoJ. Real consumer spending data released today for November revealed a 0.4% drop, although that was a smaller drop than expected. The real terms drop reflects inflation but more recent months of inflation decline should translate into better real spending growth this year.

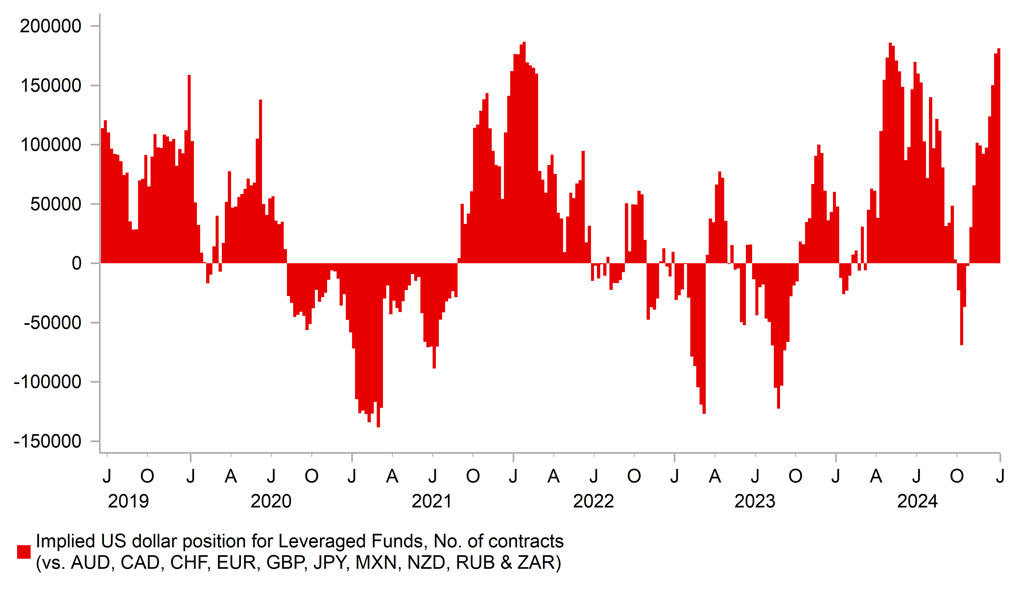

CFTC data does indicate recent increased appetite for yen selling again after yen short positions had been cleared out following the rate hike last July. The renewed increase in US yields and the more dovish communications from the BoJ fuelled the increased appetite. US yields remain key and the jobs data today highlights this with modest yen strength earlier on the BoJ rumours reversing as US yields jump on the back of the strong jobs data. Leveraged Funds’ long US dollar positioning has returned to the extremes we have seen over recent years which suggests limited capacity for buying the dollar. Aggressive tariff action and moves to increase deportations from the US could fuel another leg higher in USD/JPY and test the resolve of the MoF. Intervention remains a tool but there could be initial reluctance in the early days of a new Trump administration. At the very least we would expect it would strengthen the political support for a rate hike and could be the catalyst for a media report in the days between US policy announcements and the BoJ meeting. That window is just four days but is still enough for the BoJ’s decision to hike to harden, especially if the yen has weakened further in response to Trump’s policy announcements. So the prospect of a January BoJ rate hike is still very much alive especially now following the much stronger jobs report that will ensure UST bond yields remain supported.

LEVERAGED FUNDS’ USD POSITIONING CLOSE TO HIGHS IN RECENT YEARS

Source: Bloomberg, Macrobond & MUFG Research

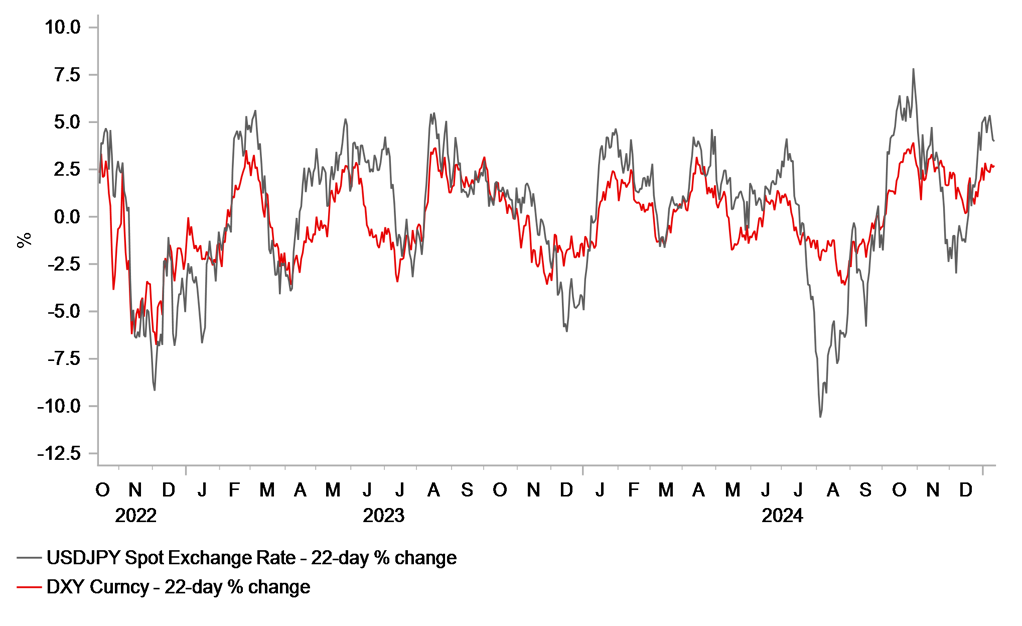

USD/JPY 1MTH % CHANGE VERSUS DXY 1MTH % CHANGE

Source: Bloomberg, Macrobond & MUFG Research

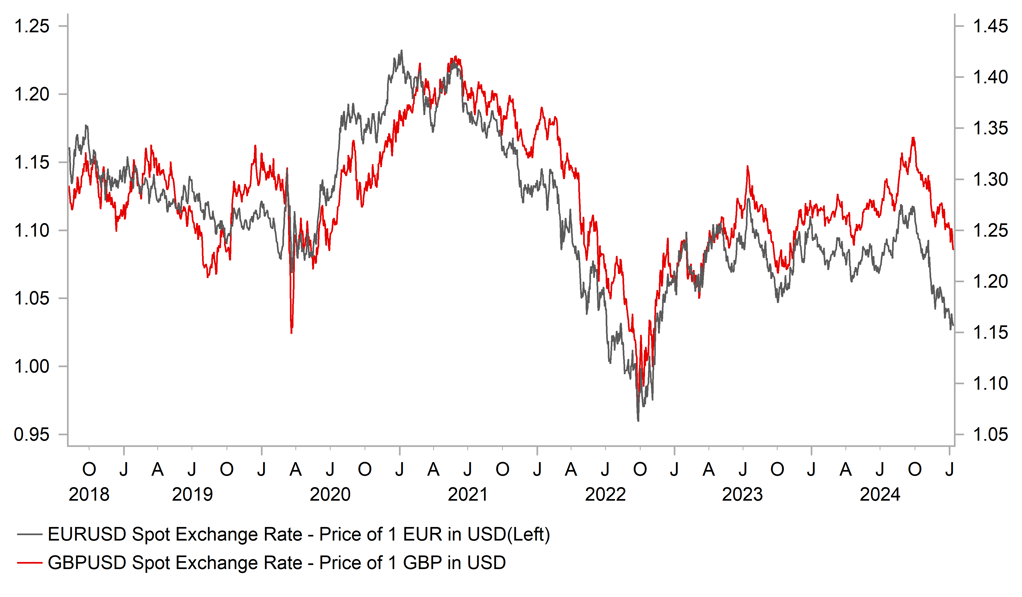

GBP: Worsening Gilt sell-off takes shine off GBP’s 2024 performance

It has been a bad start to the new calendar year for the GBP which is currently the worst performing G10 currency. The GBP has weakened sharply over the last couple of trading days resulting in cable breaking below the 1.2300-level and EUR/GBP rising back up to the 0.8400-level. The main trigger has heightened investor concerns over the ongoing sell-off in the Gilt market. Yields on 10-year and 30-year Gilts have risen to their highest levels since July 2008 and July 1998 respectively. The combination of Gilt and GBP selling has rekindled memories of the Liz Truss mini-Budget triggered market turmoil from autumn 2022 when the BoE had to step into the Gilt market to provide support and the UK government was forced to quickly back track on plans to implement unfunded tax cuts. On that occasion the GBP weakened sharply but it proved to be only short-lived. Cable hit a low of 1.0350 on 26th September 2022 before fully reversing those losses by early October. It ultimately proved to be a multi-year low point for the GBP as cable climbed back above the 1.3000-level last year.

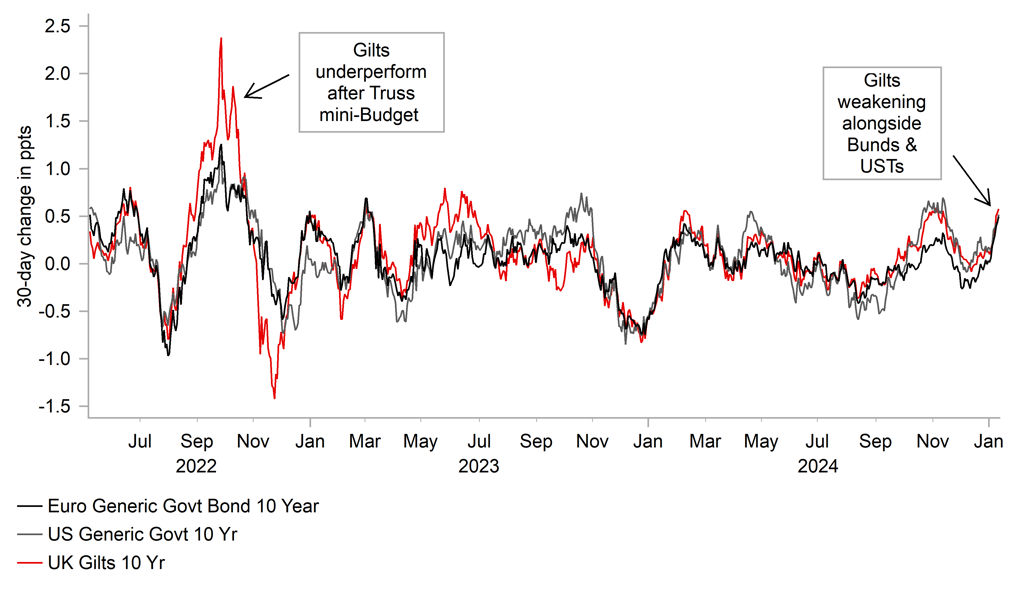

There has been no clear domestic catalyst for the sell-off over the past week rather it marks an extension of the move higher in Gilt yields since late last year. The 10-year and 30-year Gilt yields have increased by around 60 to 65bps respectively since the end of November. We have seen similar moves in long-term yields in other developed market bond markets as well. Over the same period the 10-year and 30-year US Treasury yields have increased by around 60 and 65bps, and by around 50bps for German 10-year and 30-year yields. The price action highlights that a broad-based repricing of long-term bonds is taking place as investors demand more compensation for holding longer maturities since President-elect Trump’s election victory. The New York Fed’s (ACM) measure of the term premia for the 10-year US Treasury yield has risen by around 50bps since late November to its highest level since June 2015.

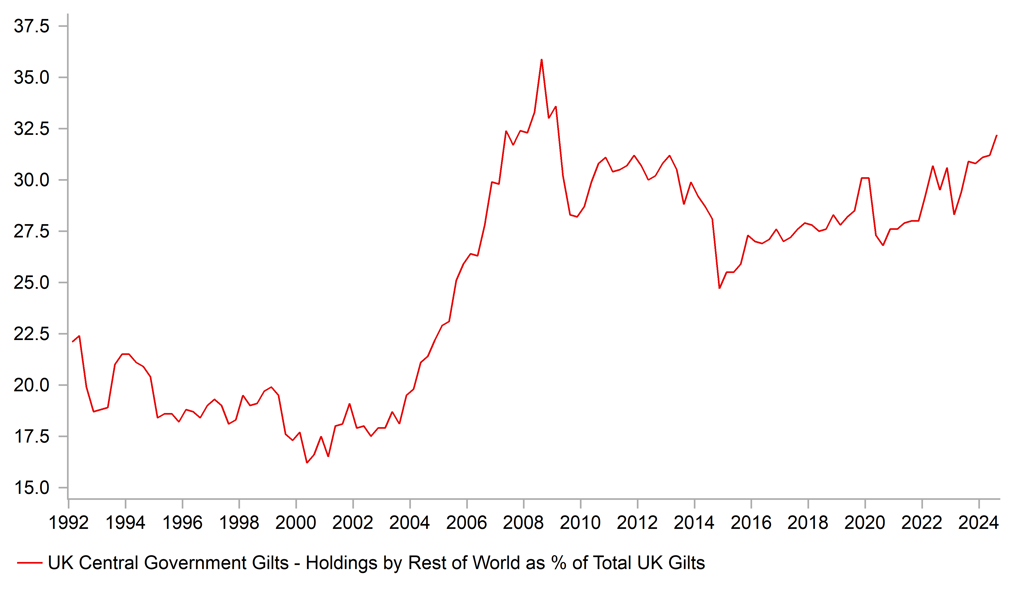

Domestically the BoE’s reluctance to lower rates as much as other major central banks last year has helped to keep government bond yields relatively higher in the UK than elsewhere both at the short and long-end of the curve. The BoE policy rate is currently around 42bps higher than the effective Fed funds rate and 175bps higher than the ECB’s deposit rate. The UK rate market is also expecting the BoE to remain cautious over delivering further rate cuts this year. There are currently only around 50bps of further rate cuts expected by December. The higher yields on offer in the UK alongside evidence of stronger economic recovery in the 1H of last year was one of the main reasons that the GBP outperformed in 2024 when it was the second best performing G10 currency after the USD. Recent price action highlights though that higher yields are not always supportive for a currency if they also reflect heightened concerns over the outlook for the government’s fiscal position and persistently higher inflation in the UK. Higher yields and a weaker GBP may be required to make Gilts more attractive to foreign investors. The latest quarterly Gilt holdings data reveals that there wasn’t a problem with foreign demand prior to the recent sell-off. The percentage of Gilts held by foreign investors rose to 32.2% in Q3 which was the highest level since Q1 2009.

GILTS SELLING OFF ALONGSIDE OTHER BOND MARKETS

Source: Bloomberg, Macrobond & MUFG GMR

FOREIGN INVESTOR HOLDINGS OF GILTS

Source: Bloomberg, Macrobond & MUFG GMR

Higher yields if they persist will increase pressure on the UK government to adjust fiscal policy plans. It has already been estimated that the increased cost of government funding is likely to use up all of the government’s fiscal headroom estimated at GBP9.9 billion in the Autumn Budget. Treasury officials have already tried to provide reassurance to market participants that the government will respect their self-imposed fiscal rules and tighten fiscal policy if judged as necessary by the independent Office for Budget Responsibility (OBR). The Spring Forecast takes place on 26th March and Spending Review in late Spring. The British press have already reported that the government is considering emergency tax hikes or spending cuts is required, and attempt to boost investor confidence in the their growth strategy. The Autumn Budget continues to draw criticism for outlining front-loaded fiscal stimulus which contributed to the BoE’s caution over cutting rates further. The BoE is closely monitoring the inflationary impact from the NI hike for employers alongside public sector wage deals and minimum wage hike. The sharp slowdown in UK growth in the 2H of last year has also cast doubt on the OBR’s optimistic GDP forecasts which the Budget was based on. In October the OBR forecast the UK economy would expand by close to 1.1% last year and by 2.0% this year. It compares to the current Bloomberg consensus forecast amongst UK economists for growth of 0.9% for last year and 1.4% for this year. Higher yields if sustained will add to the headwinds to growth this year.

Unlike in Autumn 2022 we are not expecting a quick response from the BoE to support the Gilt market at the current juncture. Financial stability concerns were much more acute as the sell-off in the Gilt market was amplified by forced sales by liability-driven investment funds (LDI funds) which the BoE estimated accounted for around half of the decline in Gilt prices during this period. On that occasion the BoE made temporary purchases of Gilts totalling GBP19.3 billion between late September and mid-October 2022. It has also been suggested that the BoE could slow QT to help ease upward pressure on Gilt yields. The BoE’s current plans are to shrink Gilt holding by a further GBP100 billion in the year from last October of which around GBP13 billion is due to active sales and the rest from not replacing existing holdings when they mature. However, it could open up the BoE to criticism that it is supporting the government’s fiscal plans undermining investor confidence. Overall, these developments have increase downside risks for the GBP in the near-term, and increase the likelihood that cable will fall below 1.2000 in Q1 when we expect EUR/USD to move below parity.

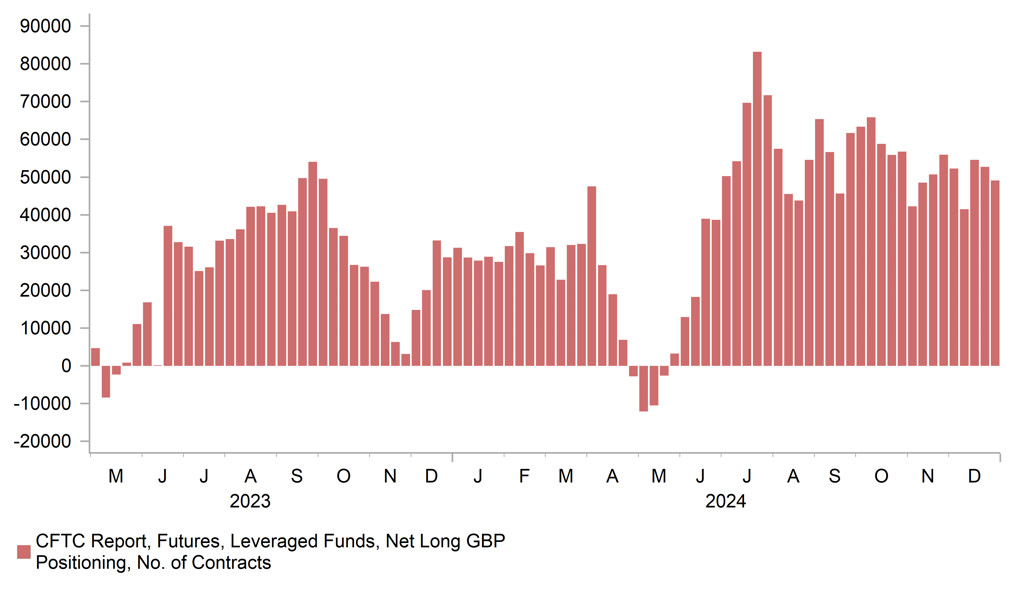

LONG GBP POSITIONS HAD BEEN POPULAR

Source: Bloomberg, Macrobond & MUFG GMR

GBP HAS BEEN HOLDING UP BETTER THAN EUR VS. USD

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

01/13/2025 |

03:15 |

ECB's Lane & Rehn Speak |

!! |

|||

|

USD |

01/13/2025 |

19:00 |

Federal Budget Balance |

Dec |

-- |

-$366.8b |

!! |

|

JPY |

01/13/2025 |

23:50 |

BoP Current Account Balance |

Nov |

¥2693.6b |

¥2456.9b |

!! |

|

JPY |

01/14/2025 |

01:03 |

BoJ Deputy Governor Himino Speaks |

|

|

|

!!! |

|

USD |

01/14/2025 |

11:00 |

NFIB Small Business Optimism |

Dec |

100.5 |

101.7 |

!! |

|

USD |

01/14/2025 |

13:30 |

PPI Final Demand MoM |

Dec |

0.4% |

0.4% |

!! |

|

SEK |

01/15/2025 |

07:00 |

CPI YoY |

Dec F |

-- |

0.8% |

!! |

|

GBP |

01/15/2025 |

07:00 |

CPI YoY |

Dec |

-- |

2.6% |

!!! |

|

EUR |

01/15/2025 |

07:45 |

France CPI YoY |

Dec F |

-- |

1.3% |

!! |

|

EUR |

01/15/2025 |

08:30 |

ECB's Villeroy speaks |

!! |

|||

|

EUR |

01/15/2025 |

09:00 |

Germany GDP NSA YoY |

2024 |

-- |

-0.3% |

!!! |

|

EUR |

01/15/2025 |

10:00 |

Industrial Production SA MoM |

Nov |

-- |

0.0% |

!! |

|

USD |

01/15/2025 |

13:30 |

CPI MoM |

Dec |

0.3% |

0.3% |

!!! |

|

USD |

01/15/2025 |

16:00 |

Fed's Williams Speaks |

!!! |

|||

|

GBP |

01/15/2025 |

16:30 |

BoE's Taylor Speaks |

!!! |

|||

|

AUD |

01/16/2025 |

00:30 |

Employment Change |

Dec |

20.0k |

35.6k |

!! |

|

EUR |

01/16/2025 |

07:00 |

Germany CPI EU Harmonized YoY |

Dec F |

-- |

2.8% |

!! |

|

GBP |

01/16/2025 |

07:00 |

Monthly GDP (MoM) |

Nov |

-- |

-0.1% |

!!! |

|

GBP |

01/16/2025 |

09:30 |

BoE Credit Conditions Survey |

!! |

|||

|

EUR |

01/16/2025 |

12:30 |

ECB Releases Account of Dec Meeting |

!! |

|||

|

USD |

01/16/2025 |

13:30 |

Retail Sales Advance MoM |

Dec |

0.5% |

0.7% |

!!! |

|

USD |

01/16/2025 |

13:30 |

Initial Jobless Claims |

-- |

201k |

!! |

|

|

CNY |

01/17/2025 |

02:00 |

GDP YoY |

4Q |

5.0% |

4.6% |

!!! |

|

CNY |

01/17/2025 |

02:00 |

Industrial Production YoY |

Dec |

5.4% |

5.4% |

!! |

|

CNY |

01/17/2025 |

02:00 |

Retail Sales YoY |

Dec |

3.5% |

3.0% |

!! |

|

GBP |

01/17/2025 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Dec |

-- |

0.2% |

!! |

|

EUR |

01/17/2025 |

10:00 |

CPI YoY |

Dec F |

-- |

-- |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The release of the latest US CPI report for December will be important in the week ahead. Stronger inflation readings in September and October was one reason why the Fed has become more cautious over delivering further rate cuts this year. However, the subsequent release of softer inflation data for November was provided some reassurance for the Fed. While headline inflation is expected to pick-up in December driven by higher energy prices, core inflation excluding housing costs is expected to slow further encouraging the Fed to keep lowering rates. The release of the US retail sales for December is expected to provide evidence that consumer spending remained strong in Q4 although not as robust as recorded in Q3. New York Fed President Williams is scheduled to speak a couple of times in the week ahead providing further insight into the Fed’s current thinking on policy. Fed Governor Waller sent a reminder to market participants this week that the Fed still plans to cut rates if inflation slows back towards target.

- The Gilt market sell-off and weakness in the GBP this week has attracted more market attention and will increase the focus on the releases of the latest UK CPI report for December and monthly GDP report for November in the week ahead. Still elevated core and services inflation and weakening growth momentum at the end of last year is creating a less favorable backdrop for Gilts. At the December MPC meeting, the BoE’s staff lowered their forecast for GDP growth in Q4 to 0.0% down from 0.3% expected in the November MPR. Inflation came in slightly higher than expected as well in November and is expected to rise slightly in December.

- The release of the latest GDP report from China for Q4 is expected to confirm that the government met its target for last of around 5.0%. It follows a pick-up in growth in Q4 supported by stimulus measures. Market participants will be scrutinizing the data closely to assess if the stronger growth momentum can be sustained at the start of this year.

- A speech by BoJ Deputy Governor Himino at start of next week will be closely watched for any signal over the timing of the BoJ’s next rate hike. The Japanese rate market currently expects the BoJ to wait until at least March to hike rates again. Next week’s speech provides an opportunity for the BoJ to signal to the market that the January policy meeting is live.