To read the full report, please download PDF.

Loss of confidence in the USD

FX View:

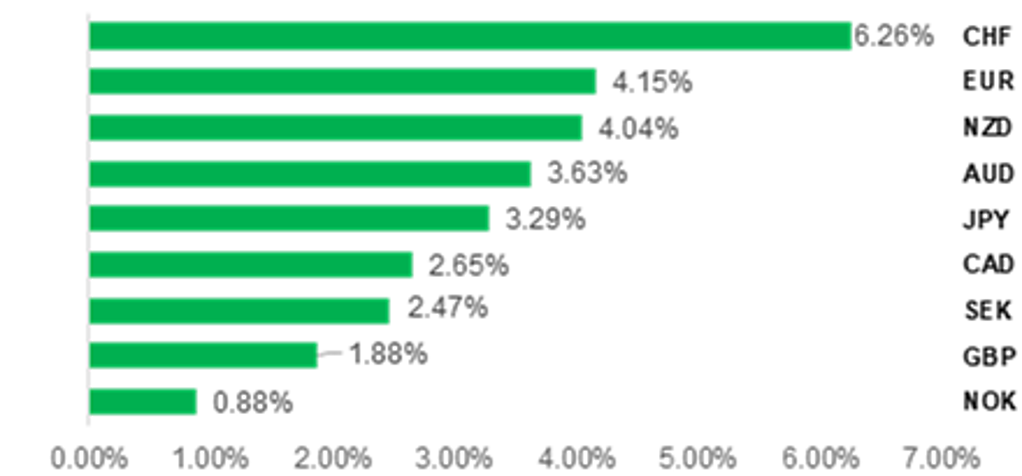

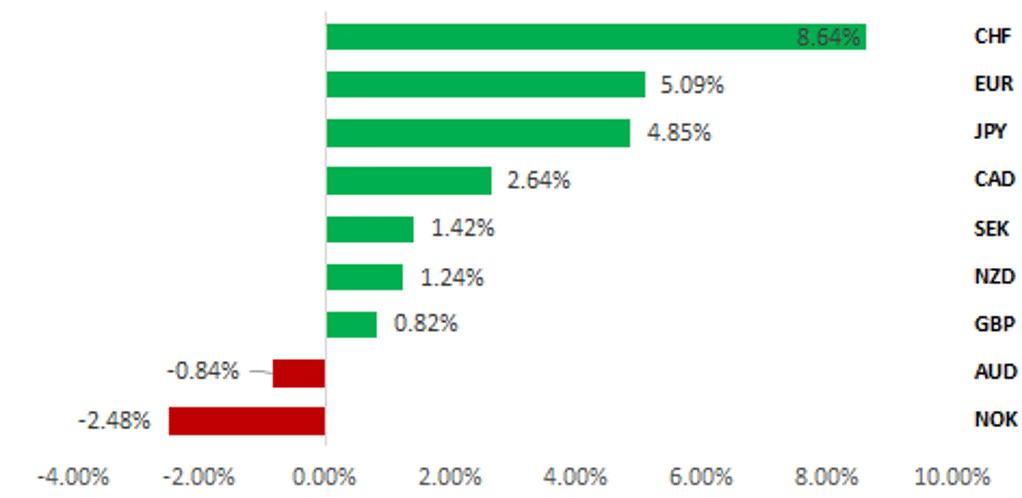

The USD has weakened sharply over the past week resulting in the dollar index falling to its lowest level since April 2022. USD weakness started to broaden out towards the end of week. The USD has weakened even as yield spreads have been moving in favour of the US. The triple sell-off in US bonds, equities and the USD which has been evident at times this week suggesting that market participants are losing confidence in the USD and are re-allocating away from US assets. President Trump’s decision to delay higher “reciprocal tariffs” provided only short-term relief. Furthermore, we are not convinced other steps will be taken quickly to restore confidence in the USD leaving it vulnerable to further weakness. The EUR and CHF remain best positioned to benefit further. Another ECB rate cut in the week ahead is unlikely to derail the EUR’s strengthening trend.

USD SELL-OFF HAS BROADENED OUT OVER THE PAST WEEK

Source: Bloomberg, 14.15 GMT, 11th April 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining a short NOK/JPY trade idea to position for a slowdown in global growth in response to trade tensions and elevated policy uncertainty.

FX Correlations:

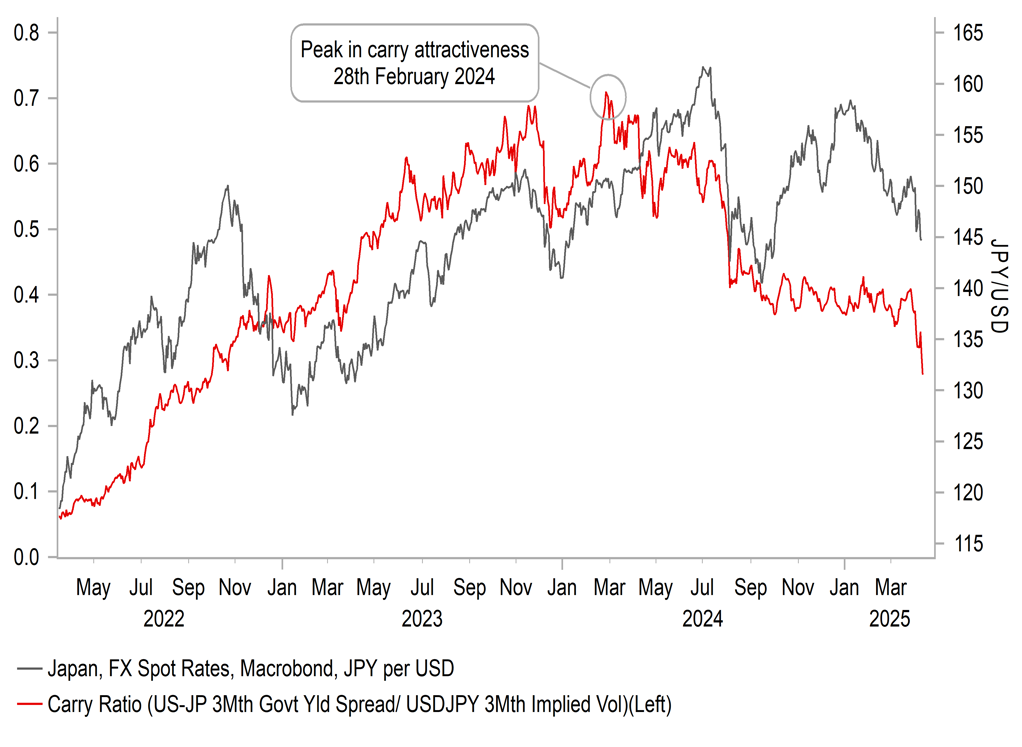

The correlations between G10 FX rates and US rates have been weak on average over the past month especially at the long end of the curve. The USD has even weakened recently against other major G10 currencies when US yields have risen. However, the correlation between USD/JPY and US rates over the past month as a whole remains much stronger than for other G10 FX pairs.

Price Action Analysis: Concurrent Declines in US Assets & USD:

Following significant declines across USD, US equities, and US Treasuries, the DXY tends to show further depreciation over the subsequent 1-month, 2-month, and 3-month periods. This emphasises the continued downward pressure on the USD in the aftermath of such broad-based market disruptions.

FX Views

USD: Crisis of confidence in US assets emerging

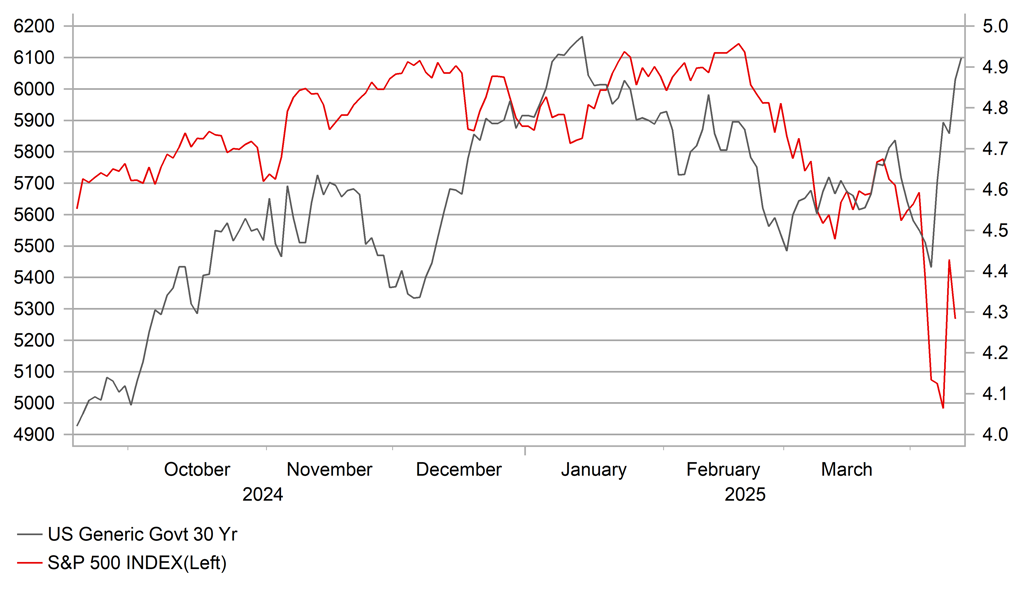

The US dollar continues to sell-off sharply and it is clear that the announced trade tariffs by the Trump administration has created a crisis of confidence given investors never believed the tariff rates announced on China would ever reach such an elevated level. Furthermore, the 145% tariff rate may not be the end after China this morning retaliated matching the reciprocal rates announced last week of 125%. These tariff rates alone will do profound damage to global supply chains and result in economic harm not just for the US and China but for the global economy. Since the closing level on 2nd April, the S&P 500 is down 7.1%, the 30-year UST bond is 45bps higher and the US dollar (DXY Index) is down 4.1%. The DXY index has now fallen below the lows from 2023 and 2024 and we are back at levels not seen since May 2022 after Russia’s invasion of Ukraine. The US dollar has also completely detached from rate spreads underlining the crisis of confidence feel to US dollar moves. There are numerous factors that have created these financial market conditions and until some of these are addressed it is difficult to see a turnaround in current market direction.

The key question hence is what might be the end game here for the financial markets to return to some level of order? Given what triggered this turmoil off, the obvious answer would be a pull-back on the level of the tariff rate on imports from China (145%) and in China on imports from the US (125%). This bilateral tit-for-tat was started by the US and hence any initiative to postpone or reduce the tariff rates would have to come from the US. ‘Saving Face’ is engrained in Chinese culture and China’s actions this week suggest little chance of a climbdown from the China side. Given the latest retaliation from China this morning (from 84% to 125% effective 12th April) it is now perhaps more difficult for the Trump administration to initiate dialogue and a climbdown. China indicated today that given US goods are “no longer marketable in China” it would not retaliate any further. Near-term, a postponement of these bilateral US-China tariffs can never be ruled out and congressional pressure on Trump could play a role.

We believe it’s no coincidence that the turmoil has unfolded in the same week that we have had developments in regard to Trump’s proposed tax cut plans. House Speaker Mike Johnson and Senate Majority Leader John Thune agreed a framework for advancing to more detailed negotiations on the budget. The House voted 216-214 for a budget that includes extending or making permanent the 2017 tax cuts. This along with other tax cutting measures is estimated by the CBO to add over USD 5trn to debt. Republicans in the House and Senate remain divided over spending cuts but a figure of USD 1.5trn has been cited by Mike Johnson as achievable. We see this lack of clarity on spending cuts as a clear catalyst for a further deterioration in investor sentiment and is adding fuel to the long-end sell-off. The US fiscal deficit is simply out of control and there appears little appetite in Congress amongst Republicans to tackle the issue. We see no end in sight here and certainly do not expect a catalyst from improved sentiment coming from this issue. Indeed, sovereign debt downgrades are more likely. Moody’s recently put out a report which pointed to a high risk of a downgrade. Moody’s is the last of the three major agencies to have the US on triple A and hence it would not be a huge surprise to see a downgrade. The risk of S&P’s AA+ stable outlook being lowered to negative is rising. Resolving the debt-ceiling issue is more achievable but until it happens the possible x-date will get closer. The CBO’s reasonable estimate is for August but lower tax receipts could see the x-date move to as early as late May.

30-YEAR UST BOND YIELD SURGE A BAD SIGNAL

Source: Bloomberg, Macrobond & MUFG GMR

HER VOL SIGNALLING UPSIDE FOR JPY

Source: Bloomberg, Macrobond & MUFG GMR

Clients have asked whether the Fed would step in if the bond market sell-off was to continue. We suspect the Fed would be extremely reluctant to act. The turmoil is self-inflicted and without a shift in policy on matters laid out above, the Fed would see limited prospects of success without a meaningful policy shift. QT has already been slowed dramatically to just USD 5bn per month. It could end QT but reverting to QE with inflation risks so high is very unlikely to happen. Disorderly price action and disfunction in the UST bond market is different and if it came to that we could see the Fed acting to bring order and market functioning back to normal standards. FX intervention to support the dollar is also highly unlikely. Although buying the dollar could be seen as more aligned with current Fed concerns over tariff-related inflation risks, the US is not flush with foreign currency to sell and like with UST bonds, intervening without a policy shift would be futile. We certainly believe a rate cut in June could soon be questioned by the markets if curve steepening and dollar selling continues.

The Stephen Miran piece (here) on the US dollar and realigning the global trading system has got lots of airtime and is adding to the perception that the moves we are seeing now in FX are exactly what the administration wants. This is a terrible backdrop for the dollar and could easily lead to extended declines. An explicit endorsement of a strong dollar policy and that the Trump administration is not planning to ever pursue the “Mar-a-Lago Accord” idea plaid out by Miran or any other plan to weaken the dollar would certainly help. But Trump’s key advisors appear to believe a strong dollar is part of the problem fuelling trade deficits and hence this explicit message of not pursuing a weak US dollar seems unlikely. Furthermore, would any dollar policy message be credible given what Trump’s team is pursuing in terms of global trade.

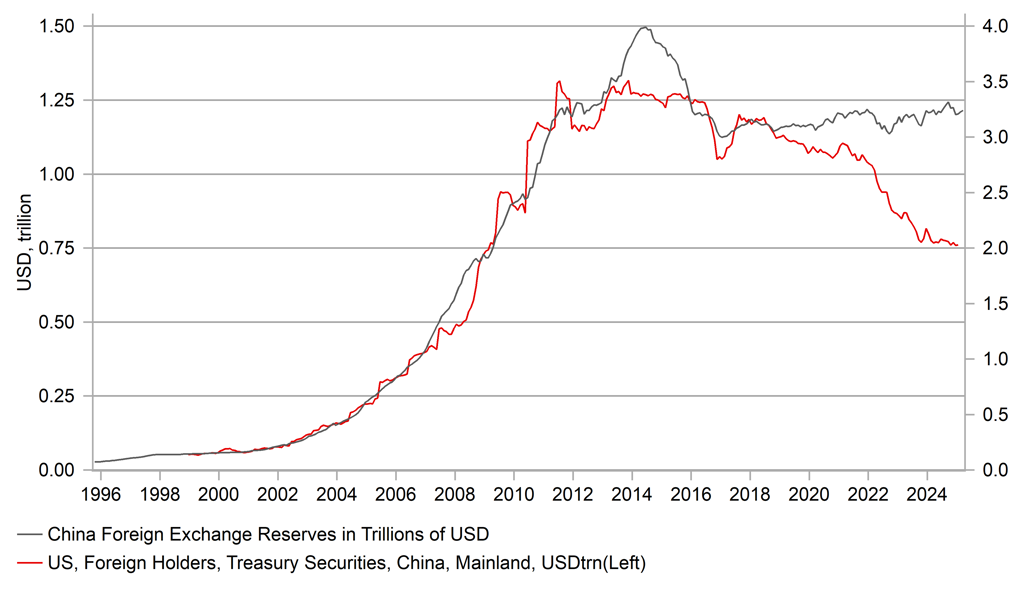

There has also been a notable pick-up in interest in relation to China’s treatment of its UST bond holdings going forward following the aggressive tariff actions announced.

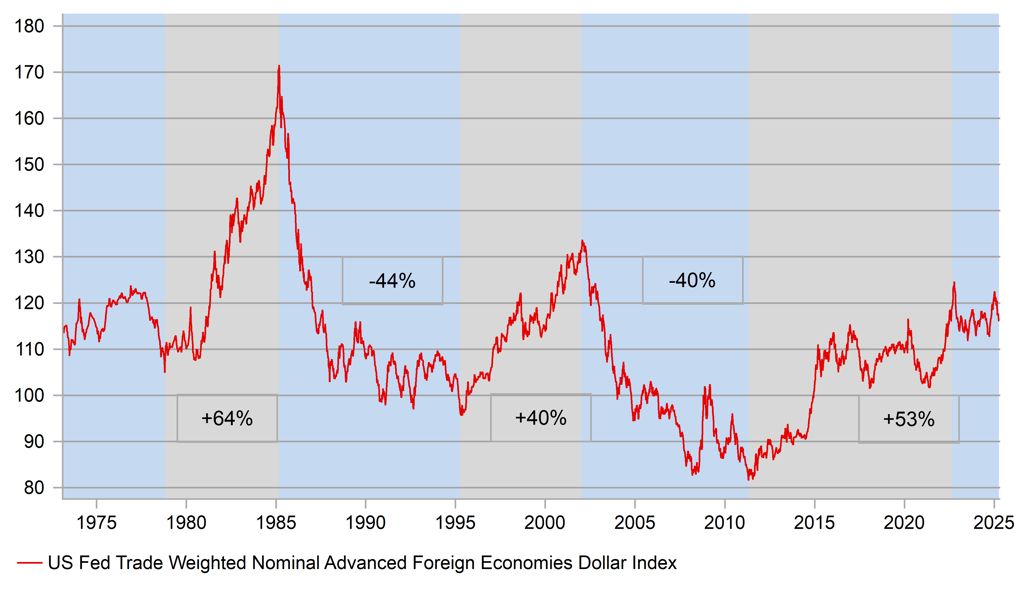

WE MAINTAIN OUR LONG-HELD VIEW THAT THE USD BULL RUN ENDED IN SEPTEMBER 2022

Source: Bloomberg, Macrobond & MUFG GMR

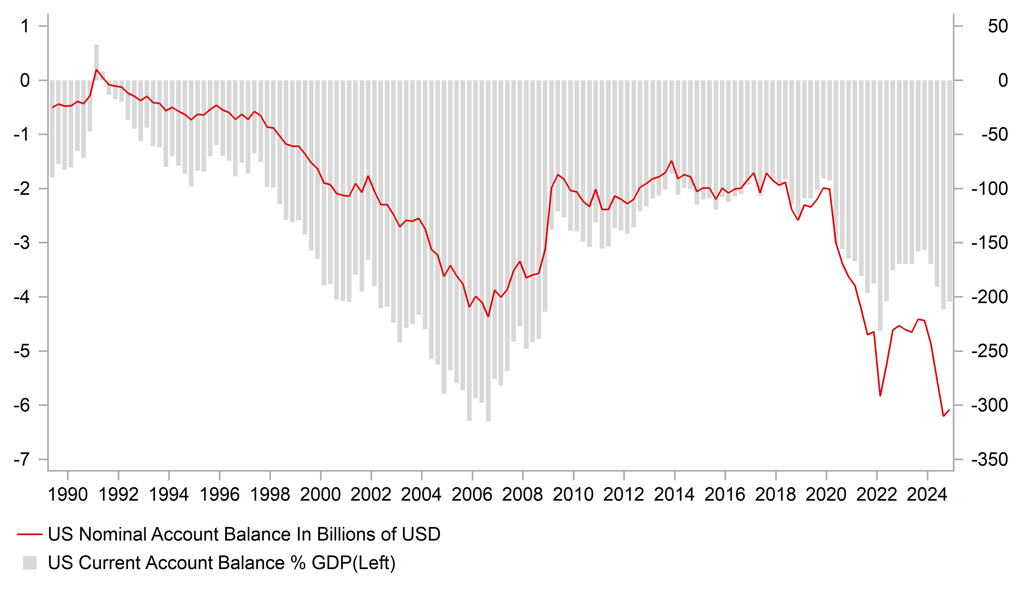

US CURRENT A/C DEFICIT $ TERMS & % GDP THE ISSUE THAT TRUMP WANTS TO ADDRESS WITH TARIFFS

Source: Bloomberg, Macrobond & MUFG GMR

Data reliability is certainly an issue in terms of getting any near-term sense of what China is currently doing. When we discussed the risk of China selling its UST bond holdings we were always quite sceptical. However, we never assessed that risk against the backdrop of a 145% tariff rate! What we can see from the official TIC data is that China’s reported holdings have declined notably despite reported China FX reserves remaining roughly stable. Long-term UST bond holdings have declined from USD 1,040bn at the end of 2021 to USD 761bn as of January. In 2022 and 2023 China increased purchases of US Agency debt, but by much less than the UST bond selling, by USD 68bn but in 2024 nearly all of that increase was reversed. China is likely using other entities/countries to buy US assets so it remains unclear to what extent UST bond holdings have been reduced. Still, all it would take in current market conditions would be for China to hint at action to likely trigger another wave of volatility and selling.

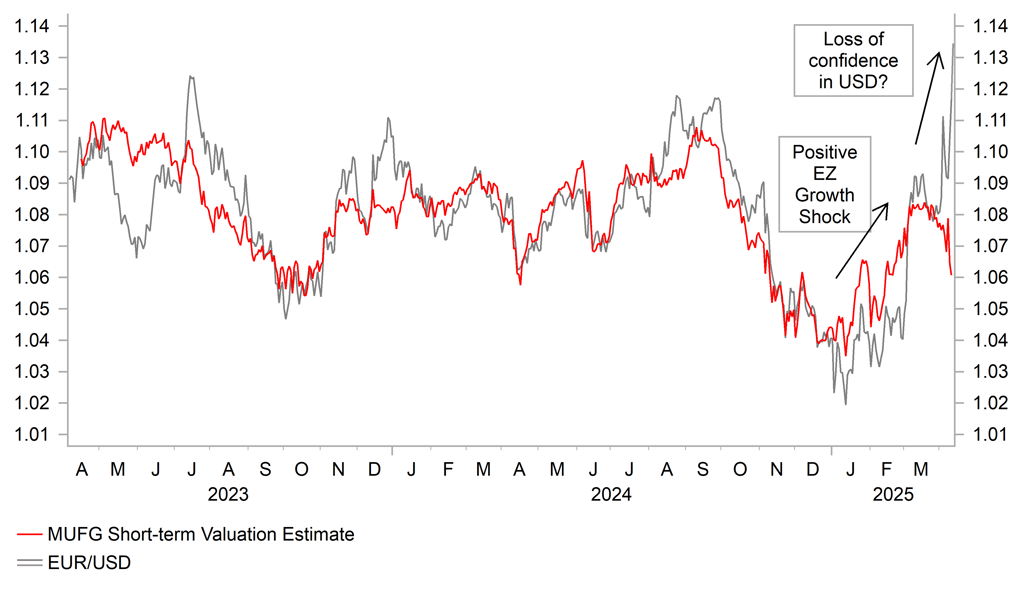

If we are possibly entering a crisis of confidence period, then there tends to be a breakdown in the normal financial market variables that drive FX. This is happening to some degree now with short-term rate spread moves not aligned to the scale of dollar sell-off. Levels that look unachievable can suddenly appear as not just achievable, but likely. EUR/USD at 1.2000 a week ago looked too far away to consider but now is certainly reachable.

If confidence in the UST bond market remains fragile, there really are only two alternatives to take capital flows – the euro-zone and Japan bond markets. Japan for the first time in a long time now also has the added advantage of a more attractive yield. But yield doesn’t necessarily matter either with capital protection key, which is evident in CHF being the top G10 FX performer. We see no reason to doubt the continuation of core G10 being where investors express their shift away from the US. The scale of dollar selling in core G10 is helping drag non-core, high-beta G10 stronger too. But we remain sceptical of the likes of AUD, NZD, NOK and SEK performing strongly and expect higher volatility and sharp swings back and forth. Until we see some form of policy shift from Washington, the dangers are high that we see confidence deteriorate further. UST bond yields are on the rise again and in this market we position for CHF, JPY and EUR to continue outperforming. Our Price Action Analysis further below highlights that periods of triple asset selling (bonds, equities and FX) to the extent we have had this week tends to signal further US dollar depreciation over a two and three-month period.

CHINA UST HOLDINGS DECLINE RELATIVE TO TOTAL CHINA FX RESERVES

Source: Macrobond & Bloomberg

USD SELLING IS BEGINNING TO BROADEN OUT BEYOND JUST THE SAFE-HAVEN CURRENCIES (SINCE 2ND APR)

Source: Bloomberg & MUFG Research; as of 14:30 BST

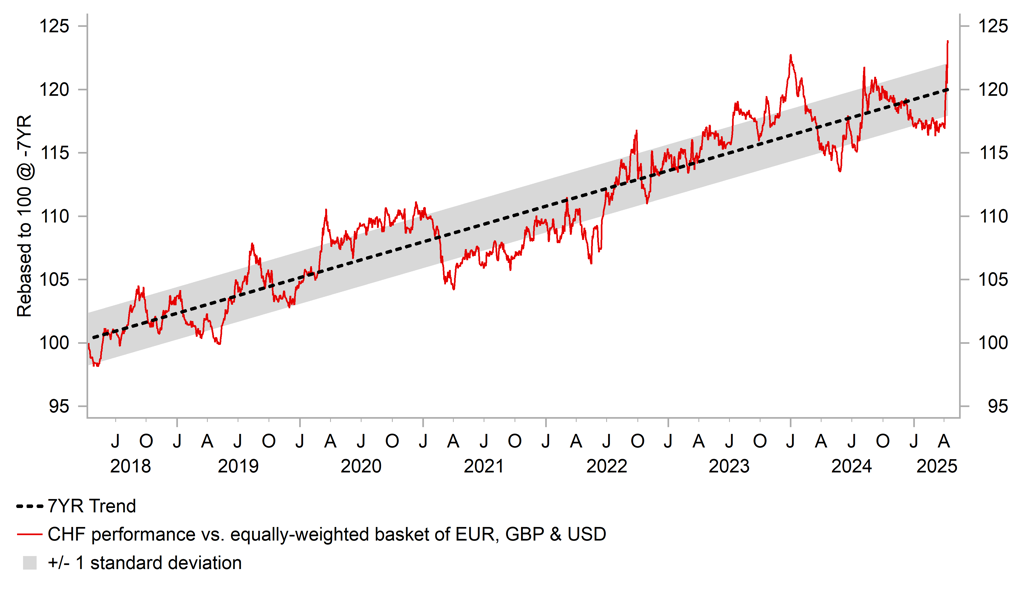

European FX: EUR & CHF benefit from loss of confidence in USD

The European currencies of the EUR and CHF continue to be two of the main beneficiaries from the ongoing loss of confidence in the USD and reallocation out of US assets. Upward momentum for EUR/USD has accelerated after important technical resistance levels were breached from the highs in recent years between 1.1200 and 1.1276 opening the door for a potential retest of the highs from in early 2022 close to the 1.1500. At the same time, the CHF has strengthened even more sharply against the USD than the EUR resulting USD/CHF falling to the lowest levels since the SNB removed the EUR/CHF floor at 1.2000 floor in January 2015. On a daily closing price basis it is the lowest level USD/CHF has reached since August 2011 just after S&P decided to downgrade the US sovereign credit rating for the first time from AAA to AA+. That was another occasion when investors lost confidence albeit briefly in the domestic policymaking in the US after a stand-off to raise the debt ceiling.

The EUR is mainly benefitting from its role as the most liquid alternative to the USD. It has helped the EUR to strengthen sharply against the USD even as short-term yield spreads have moved in favour of the US. It marks a shift from the price action in Q1 when EUR/USD and EUR/CHF both moved higher alongside short-term yield spreads moving in favour of the euro-zone driven by the positive growth shock from Germany’s plans to significantly loosen fiscal policy by potentially as much as EUR1 trillion or more over the next decade. The 10-year German government bond yield jumped higher by around 50bps hitting a high of 2.94% on 12th March but has since reversed most of that initial move higher as fears have intensified over a bigger negative impact to global and European growth from trade disruption and elevated policy uncertainty.

In light of these negative external developments, we expect the ECB to deliver another 25bps rate cut in the week ahead. Governing Council member Villeroy de Galhau stated earlier this week that he expects the trade war to take off about 0.25ppts from growth this year. At the last policy meeting in March, the ECB staff forecast growth of 0.9% for this year. President Trump’s decision to temporarily lower the reciprocal tariff rate on the EU from 20% to 10% for 90-days will help to dampen direct trade disruption. In response the EU has decided to delay the implementation of retaliatory tariffs of between 10-25% on US imports totalling EUR21 billion to “give negotiations a chance”. The EU’s decision to pause retaliatory tariffs should help to keep inflation lower in the euro-zone alongside downside risks to growth. Other disinflationary developments have been the sharp decline in energy prices and stronger EUR as indicated by Governor Council member Villeroy de Galhau. The escalating trade war between the China and the US could also result in more Chinese goods being exported into European markets putting downward pressure on prices. It will create room for the ECB to cut rates further this year. The euro-zone rate market has already moved to fully price in three more 25bps ECB rate cuts by the end of this year that would lower the policy rate to 1.75% and is towards the bottom of President Lagarde’s estimate of the neutral range between 1.75% and 2.25%. A sharper than expected slowdown in growth would argue more strongly in favour of moving to stimulative rates.

CHF RESUMES UPWARD TREND VS. MAJORS

Source: Bloomberg, Macrobond & MUFG GMR

LOSS OF CONFIDENCE IN USD BOOSTS EUR DEMAND

Source: Bloomberg, Macrobond & MUFG GMR

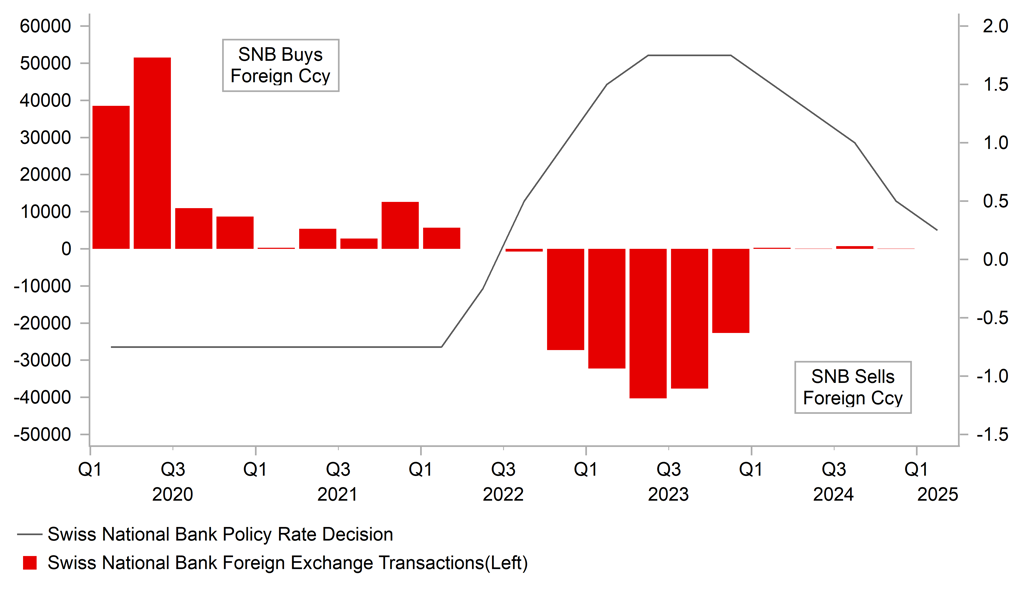

The sharp strengthening of the CHF is an even bigger headache for the SNB who have already lowered their policy rate back closer to the zero bound at 0.25% in response to inflation significantly undershooting their target. Headline inflation remained at just 0.3%Y/Y in March. If the CHF continues to trade at much stronger levels, it will increase pressure on the SNB to act more forcefully to dampen downside risks to the inflation outlook. The SNB’s two main policy options as we have seen in the past would be to intervene to sell the CHF, and/or consider a return to negative rates in Switzerland. SNB Chairman Martin Schlegel stated earlier this year that “the SNB doesn’t like negative interest rates, at the same time we can’t rule out negative interest rates”. He added that negative rates had been effective when previously used by the SNB, although they would only return to the policy if it was “really necessary” and would “not do lightly”. The SNB’s next policy meeting is not until 19th June which alongside the comments from Chairman Martin Schlegel suggest that intervention to sell the CHF is the more likely first step. If financial market conditions have not improved and/or the CHF is uncomfortably strong by the 19th June policy meeting then a return to negative rates would need to be more seriously considered in Switzerland.

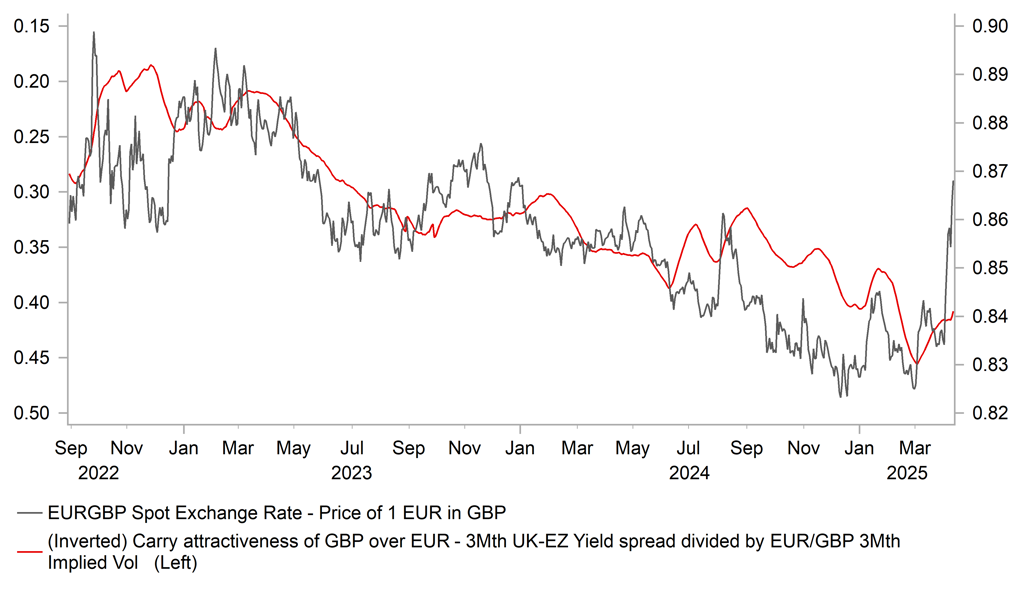

In contrast to the EUR and CHF, the GBP has underperformed this month alongside the other high beta G10 currencies (NOK, AUD & NZD). It has resulted in EUR/GBP rising sharply up to a high of 0.8738 which is the highest levels since the end of 2023. As a result the pair has reversed all of the move lower since the ECB started their more front-loaded rate cutting cycle in comparison to the BoE. Long GBP positions built up to capture the widening yield spread between the UK and euro-zone have squeezed recently by demand from the EUR on the back of the loss of confidence in the USD, and more volatile financial market conditions that hurts carry currencies such as the GBP. President Trump’s decision to temporarily apply a smaller 10% tariff to the EU matching the tariff on the UK was less important in justifying the sharp move higher in EUR/GBP. At the same time, long-term yields in the UK have more closely followed the move higher in US yields compared to those in the euro-zone. The 30-year Gilt yield hit a new high this week at 5.66% and has risen by around 40bps from recent lows. Similar to the US the UK runs a current account deficit (~2.5% of GDP) and relies on funding for overseas. The sell-off in Gilts as we’ve seen in the past following UK-specific fiscal events has coincided with temporary periods of GBP weakness and will add to downside risks to growth in the UK if higher yields are sustained. In these circumstances, the EUR and CHF should continue to outperform the GBP and USD until confidence begins to returns and/or SNB pushes back against CHF strength.

SNB FX INTERVENTION & POLICY RATE

Source: Bloomberg, Macrobond & MUFG GMR

SHARP REVERSAL OF GBP’S CARRY DRIVEN GAINS

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

14/04/2025 |

05:30 |

Industrial Production MoM |

Feb F |

-- |

2.5% |

!! |

|

AUD |

15/04/2025 |

02:30 |

RBA Minutes of April Policy Meeting |

!! |

|||

|

GBP |

15/04/2025 |

07:00 |

Average Weekly Earnings 3M/YoY |

Feb |

-- |

5.8% |

!!! |

|

GBP |

15/04/2025 |

07:00 |

Employment Change 3M/3M |

Feb |

-- |

144k |

!! |

|

EUR |

15/04/2025 |

09:00 |

ECB Bank Lending Survey |

!! |

|||

|

EUR |

15/04/2025 |

10:00 |

ZEW Survey Expectations |

Apr |

-- |

39.8 |

!! |

|

EUR |

15/04/2025 |

10:00 |

Industrial Production SA MoM |

Feb |

-- |

0.8% |

!! |

|

CAD |

15/04/2025 |

13:30 |

CPI YoY |

Mar |

-- |

2.6% |

!!! |

|

USD |

15/04/2025 |

13:30 |

Import Price Index MoM |

Mar |

0.0% |

0.4% |

!! |

|

CNY |

16/04/2025 |

03:00 |

GDP YoY |

1Q |

5.2% |

5.4% |

!!! |

|

CNY |

16/04/2025 |

03:00 |

Retail Sales YoY |

Mar |

4.2% |

-- |

!! |

|

CNY |

16/04/2025 |

03:00 |

Industrial Production YTD YoY |

Mar |

5.9% |

5.9% |

!! |

|

GBP |

16/04/2025 |

07:00 |

CPI YoY |

Mar |

-- |

2.8% |

!!! |

|

EUR |

16/04/2025 |

10:00 |

CPI YoY |

Mar F |

-- |

-- |

!!! |

|

USD |

16/04/2025 |

13:30 |

Retail Sales Advance MoM |

Mar |

1.4% |

0.2% |

!!! |

|

USD |

16/04/2025 |

14:15 |

Industrial Production MoM |

Mar |

-0.2% |

0.7% |

!! |

|

CAD |

16/04/2025 |

14:45 |

Bank of Canada Rate Decision |

2.75% |

2.75% |

!!! |

|

|

USD |

16/04/2025 |

15:00 |

NAHB Housing Market Index |

Apr |

37.0 |

39.0 |

!! |

|

NZD |

16/04/2025 |

23:45 |

CPI YoY |

1Q |

-- |

2.2% |

!!! |

|

JPY |

17/04/2025 |

00:50 |

Trade Balance |

Mar |

¥234.4b |

¥584.5b |

!! |

|

AUD |

17/04/2025 |

02:30 |

Employment Change |

Mar |

-- |

-52.8k |

!!! |

|

GBP |

17/04/2025 |

09:30 |

BoE Credit Conditions Surveys |

!! |

|||

|

EUR |

17/04/2025 |

13:15 |

ECB Deposit Facility Rate |

2.25% |

2.50% |

!!! |

|

|

USD |

17/04/2025 |

13:30 |

Housing Starts |

Mar |

1410k |

1501k |

!! |

|

USD |

17/04/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

EUR |

17/04/2025 |

13:45 |

ECB President Christine Lagarde Speaks |

!!! |

|||

|

JPY |

18/04/2025 |

00:30 |

Natl CPI YoY |

Mar |

-- |

3.7% |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- Market participants will continue to watch closely for any further changes to global trade policies in the week ahead although after President Trump announced a 90-day pause for higher “reciprocal tariff” rates it points towards a quieter week ahead. However, there is still a high risk that trade tensions escalate further between China and the US.

- The BoC and the ECB are scheduled to hold their latest policy meetings in the week ahead amidst the elevated level of uncertainty over the outlook for global trade and growth. Of the two upcoming policy meetings, the BoC ‘s decision is judged to be more finely balanced. The Canadian rate market is pricing in less than a 50:50 probability of another 25bps rate cut o next week. Canada has already retaliated to US tariffs imposed due to the border dispute and on autos, steel and aluminium which adds to upside inflation risks in the near-term in Canada. We believe that the BoC should cut rates in anticipation of a sharper slowdown in growth rather than standing pat waiting to see more evidence of the economic fallout.

- The euro-zone rate market has become more confident that the ECB will cut rates again by 25bps in the week ahead. The EU’s decision to delay retaliation to President Trump’s tariff announcements indicates that it should be more of a negative growth shock for the euro-zone economy. It should encourage the ECB to cut rates again despite Germany passing legislation recently to significantly increase room for fiscal spending over the next decade or so.

- The main economic data releases in the week ahead will be: i) the latest CPI reports from Canada, euro-zone, UK and Japan for March, and Q1 CPI report from New Zealand ii) the Q1 GDP report from China and monthly activity data (retail sales, IP and FAI) for March, iii) US retail sales report for March, and iv) the latest UK labour market report. The reports will provide an update on growth and inflation in major economies at the start of this year prior to the latest more intense phase of trade policy uncertainty. It may mean that the economic data is viewed as more dated than normal and have less market impact.