To read the full report, please download PDF.

US rates correction possibly complete

FX View:

The OIS market pricing now shows that the scale of monetary easing expected by the end of 2025 has declined from 215bps at the end of September to around 145bps now. That’s quite a shift in expectations over a short period of time and we suspect the pull-back in 2-year yields yesterday from the intra-day high close to 4.10% likely signals this adjustment may be complete for now. That may take some of the momentum out of the move higher in USD/JPY. This week we take a look ahead to the general election in Japan on 27th October and assume over the coming weeks there will be little from Japan to trigger volatility given that could work against the government going into the election. The LDP should still maintain its majority but will of course lose seats. We also look ahead to the UK budget on 30th October and see downside GBP risks associated with the possible details announced. USD upside risks will possibly now be less about yields and more about geopolitical risks and we feel potential disappointment related to China stimulus.

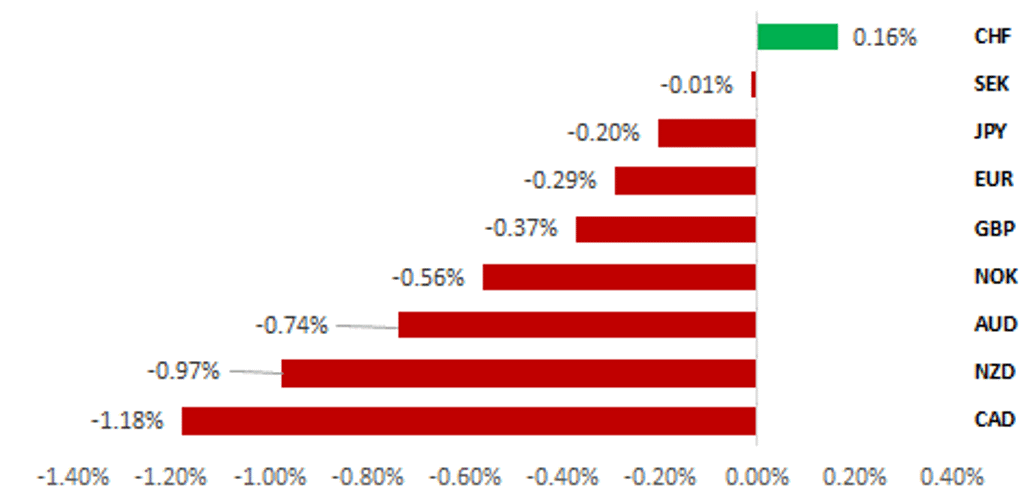

GEOPOLITICAL RISKS KEEP SAFE-HAVEN G10 PERFORMING WELL

Source: Bloomberg, 13:30 BST, 11th October 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new long USD/NOK trade idea to reflect the rising probability of a Trump victory in the US election.

High frequency flows:

This week we look at the monthly International Transactions in Securities for September which showed further buying of foreign bonds but at a much slower pace than the record buying recorded in August.

Sentiment Analysis on FOMC Minutes:

The FOMC minutes from the meeting on the 17th September revealed more uniform opinions expressed by Fed officials across a range of topics. Our analysis flags that net sentiment fell to its lowest level since February 2023 and for the labour market to a series low. It highlights that the Fed is sensitive to further evidence of labour market weakness.

FX Views

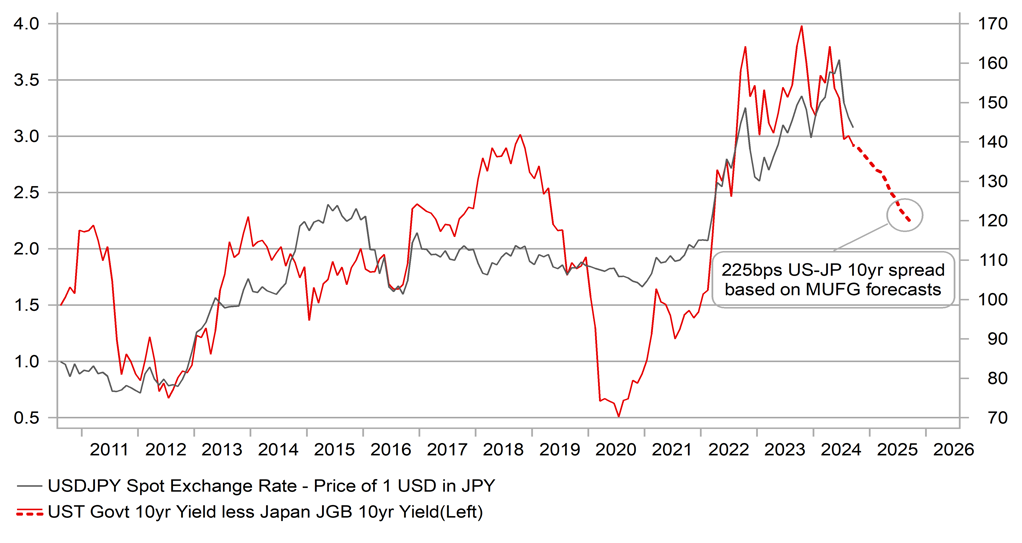

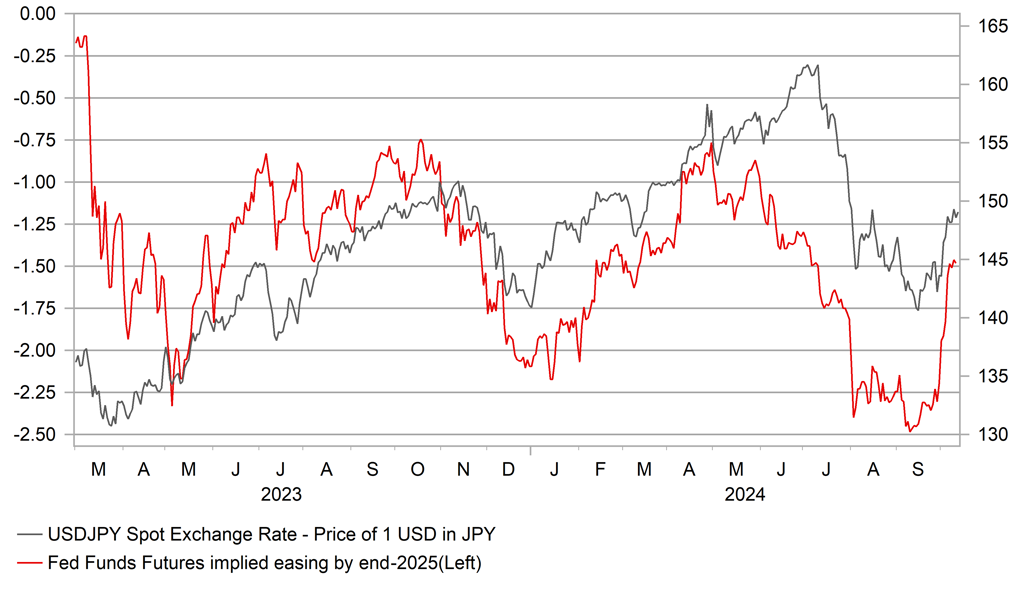

JPY: Rangebound into the general election

The yen has depreciated sharply since the US jobs report on 4th October with USD/JPY around 5 big-figures higher. The shift higher in US yields has been notable with the 2-year UST note yield jumping 60bps from the low on 25th September to the high yesterday when the US CPI data was released. Since then the 2-year yield has dropped back by about 10bps and this price action certainly suggests to us that the readjustment in the pricing of Fed rate cuts ahead has probably run its course for now. Since the end of September, the fed funds futures implied pricing for rate cuts by the end of 2025 has declined from 215bps to 145bps today. Many are arguing that the extent of rate cuts priced at the end of September was excessive but we would argue that the scale of removal of rate cuts since, on the back of one stronger than expected jobs report, is also excessive. In any case, this move was the primary catalyst for the rebound in USD/JPY. If that yield rebound is now largely complete, like we believe, the upside for USD/JPY from here is also likely limited.

The general election in Japan takes place on 27th October and there will be a strong interest within the government for financial markets to remain relatively stable and to certainly avoid any repetition of the turmoil that took place in late July / early August. PM Ishiba’s comment on now not being the time for further rate increases was likely made in that context rather than necessarily reflecting an ideological opposition to monetary tightening. In addition, that comment from PM Ishiba was in fact a reflection of BoJ thinking given BoJ Governor Ueda had stated at the September policy meeting that upside inflation risks had receded and therefore the BoJ had time to assess the monetary stance. So we expect very little in the way of communications from the BoJ that would potentially unsettle the markets. Nonetheless, if USD/JPY was to break above the 150.00-level ahead of the election it could prompt rhetoric from the government opposing the move given the cost of living crisis remains an issue for voters that could see the LDP suffer further losses on top of the probable losses reflecting anger over the LDP campaign funding scandal.

The LDP-led government goes into this general election in a strong position. Of the 465 seats in the Lower House of the Diet, the LDP has 258 seats (including one independent aligned with LDP) while it’s stable coalition partner – New Komeito – has 32 seats giving the government 290 seats with the opposition holding 167 seats. There are a further 8 seats held by independents not affiliated with either the government or opposition parties. PM Ishiba has set himself a low target for election success – to gain a majority. The LDP could lose a little over 50 seats and still maintain a majority although currently political analysts in Japan assume the losses will be less than that. Constitutional Democratic Party of Japan leader Yoshihiko Noda is attempting to strongly argue that this election can result in a loss of the majority for the LDP-New Komeito government. Initial polling does give some credence to Noda’s point of view. A Nikkei poll after Ishiba’s victory showed an approval rating of 51% for Ishiba’s cabinet, which compared to 59% for former PM Kishida. The 51% reading was the lowest for a comparable poll going back to 2002. Other polls were similarly disappointing. We are currently assuming the LDP will suffer losses but not to the extent to lose its majority.

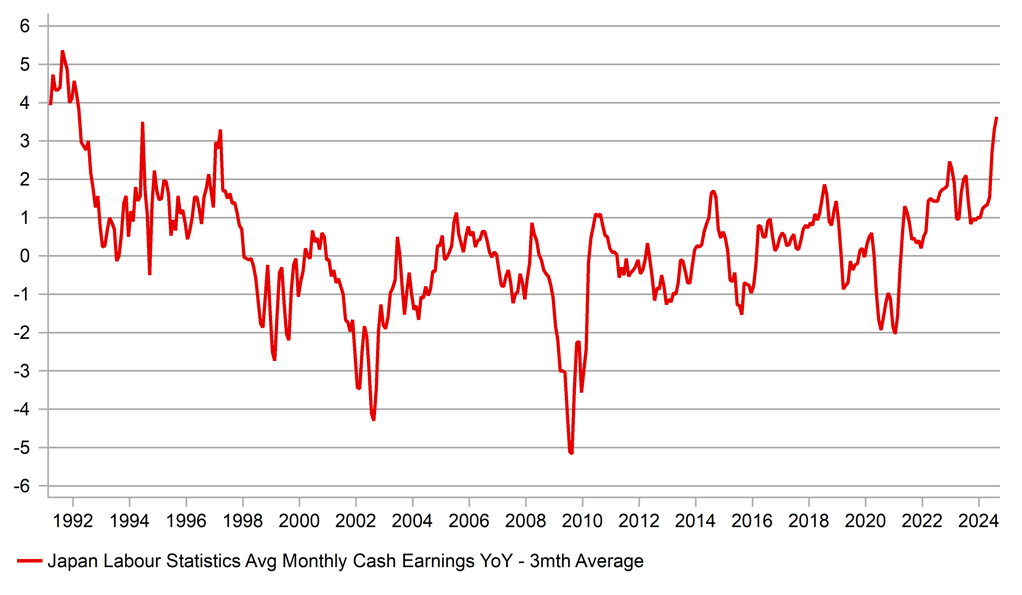

WAGE GROWTH IN JAPAN STILL AS BOJ EXPECTS

Source: Bloomberg, Macrobond & MUFG Research

10-YEAR US-JP YIELD SPREAD FORECAST & USD/JPY

Source: Bloomberg, Macrobond & MUFG GMR

Last weekend Itsunori Onodera, the policy chief of the LDP confirmed that the government, if successful in the election, will compile a “large-scale supplementary budget so that cost of living relief money can be disbursed by year-end. This followed comments from PM Ishiba who called on his party to act aggressively in order to ensure that deflation is finally defeated. It remains to be seen whether this is more rhetoric ahead of the election and the full scale of the fiscal package will only be known after the general election. But PM Ishiba likely wants to emphasise policy continuity in order to maintain party unity. A fiscal package will certainly be announced but the true scale of that package remains somewhat unclear.

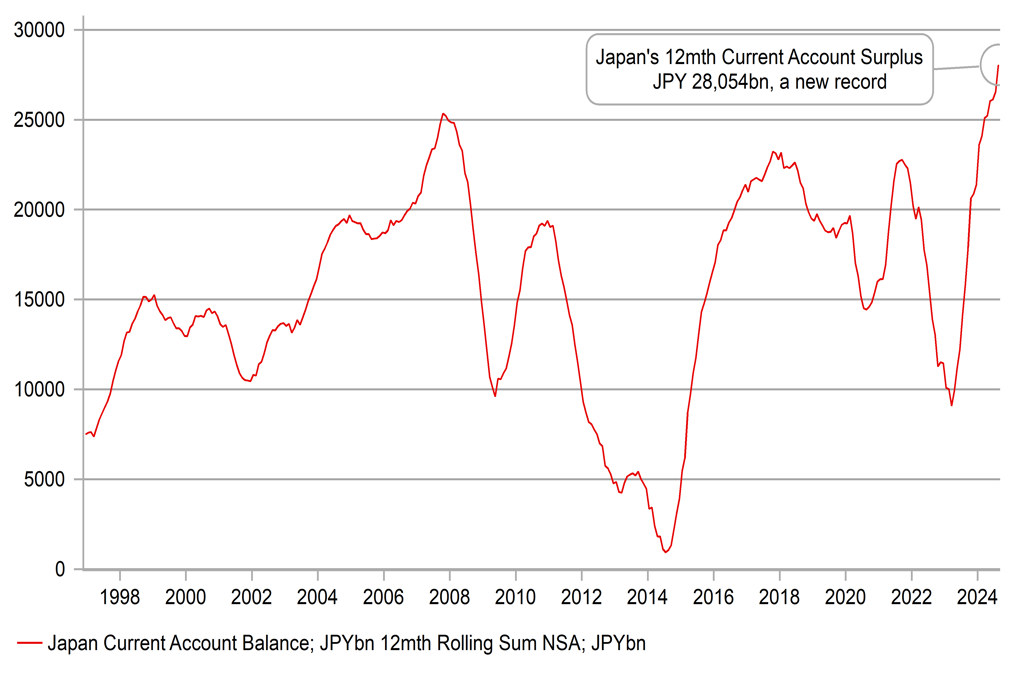

The scale of a fiscal package will play a role in BoJ rate hike expectations as will broader financial market conditions, US soft-landing optimism and the scale of potential China fiscal stimulus. Making reasonable assumptions on these factors point to the OIS pricing for the BoJ rate hikes being too conservative. A full 25bp hike is not priced until July 2025 which is much too far ahead. We would not rule out December still and certainly see scope for a hike by January when the BoJ will update its forecasts (from the forecasts to be published on 31st Oct). While the wage data this week in Japan saw a slowdown in growth rates, the levels are still consistent with the BoJ’s overall views. If we are correct that the US rates market has potentially found a new short-term equilibrium level, the upside momentum for USD/JPY should fade. Carry attractiveness also incorporates volatility and the horizon suggests the potential for bigger FX swings ahead. Geopolitics, the US election, the general election in Japan, the outlook for Fed policy and China policy developments could all fuel renewed volatility over the short-term. A break higher to levels over 150.00 would likely prove short-lived.

JAPAN’S CURRENT ACCOUNT SURPLUS HITS RECORD

Source: Bloomberg, Macrobond & MUFG Research

FED EASING ADJUSTMENT DRIVES USD/JPY HIGHER

Source: Bloomberg, Macrobond & MUFG GMR

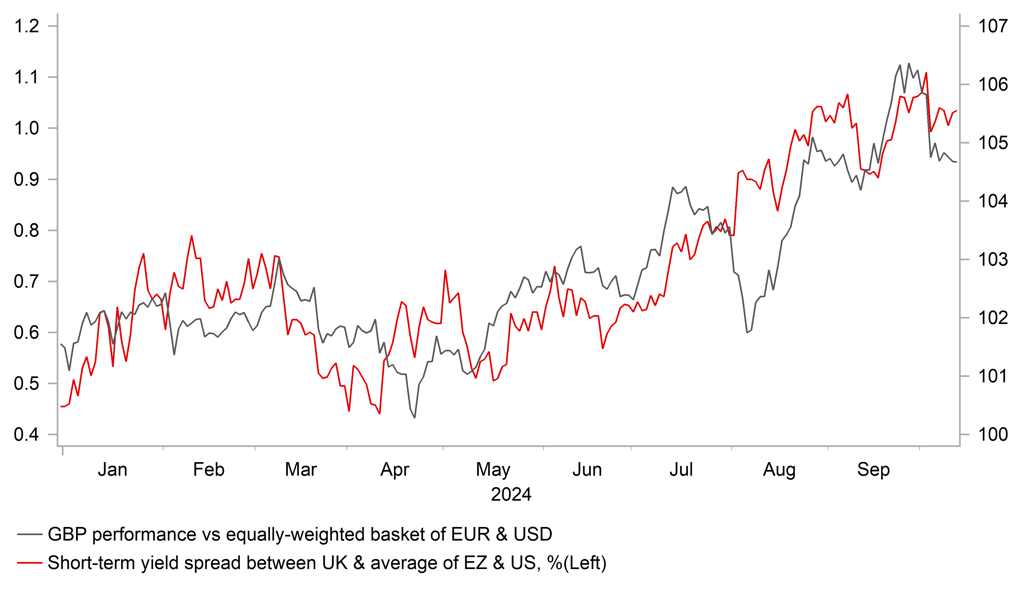

GBP: Faster BoE rate cuts & Budget unease pose downside risks

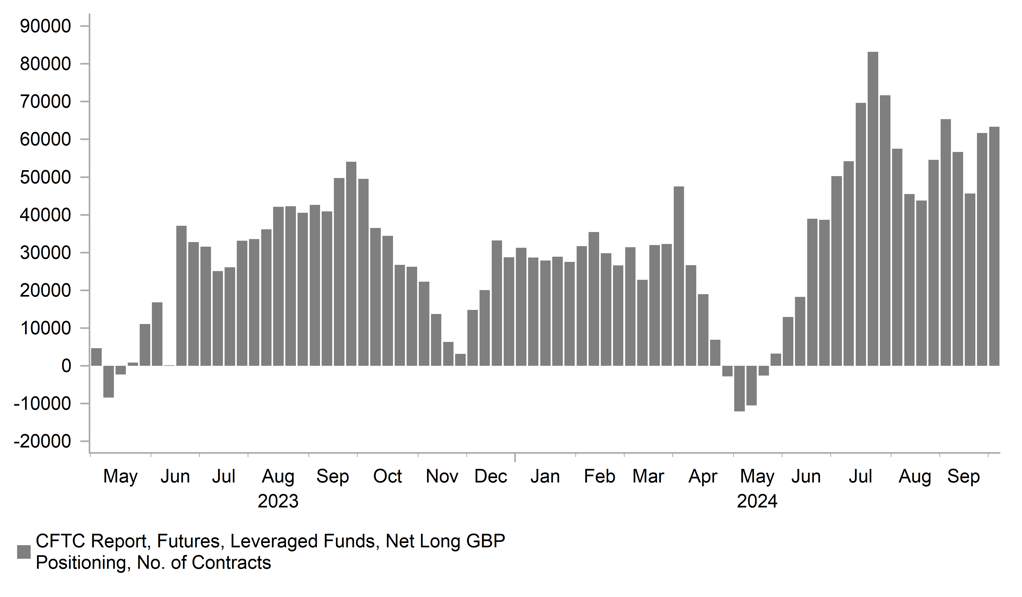

The GBP has corrected modestly lower so far this month following strong gains recorded over the summer. It has resulted in cable falling back towards support at the 1.3000-level after hitting a year to date high of 1.3434 on 26th September. Similarly, EUR/GBP has risen back up towards the 0.8400-level after hitting a year to date low of 0.8310 on 1st October. Despite the recent setback the GBP remains by far the best performing G10 currency this year having strengthened by 2.7% against the USD and 3.6% against the EUR.

The recent correction lower for the GBP has been driven by a combination of external and domestic fundamentals drivers. The significant escalation of tensions in the Middle East with market participants still waiting to see how Israel retaliates to the missile attacks from Iran could be encouraging a lightening of long GBP positions. The attractiveness of long GBP carry positions would be undermined by higher financial market volatility and the UK economy would be hurt again if there was another negative energy price shock. At the same time, carry attractiveness was challenged recently by dovish comments from BoE Governor Bailey who indicated that he was open to a faster pace of rate cuts if there is further positive progress in slowing inflation back towards their 2.0% target. The comments are supportive of our forecasts for the BoE to deliver back-to-back rate cuts in November and December. They will need to be backed up by further evidence of slowing inflation and wage growth in the week ahead. Recent comments form Chief Economist Pill indicated that the dovish sentiment expressed by Govern Bailey may not be shared yet by a majority of MPC members. He continued to express caution over cutting rates “too far or too fast”. The UK rate market remains confident that the BoE will cut rate again by 25bps in November but is not yet convinced that a back-to-back cuts in December are the most likely scenario.

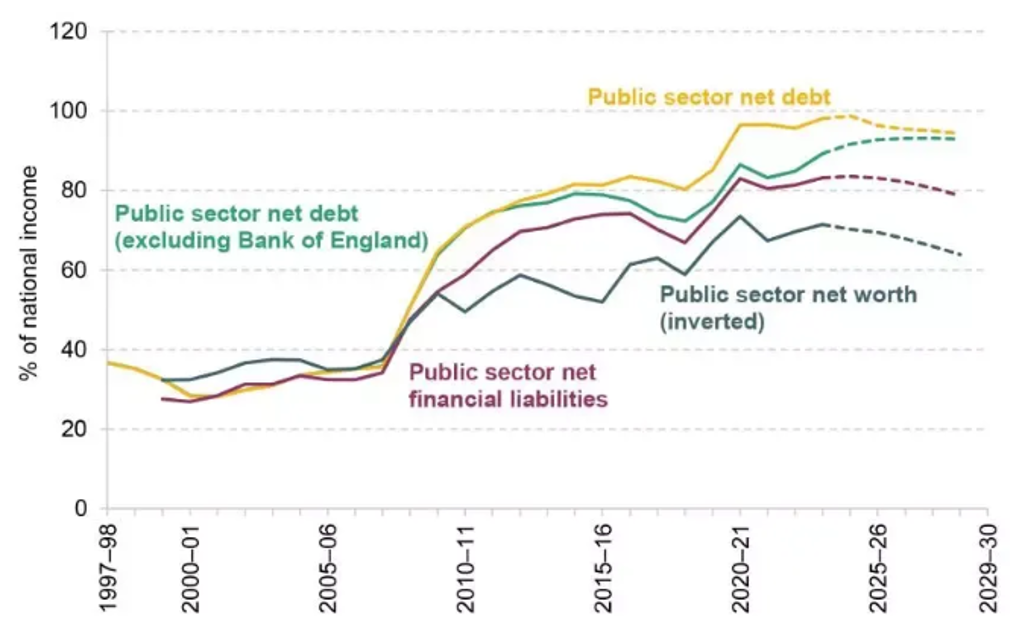

The upcoming release of the Labour government’s first Budget on 30th October is beginning to attract more market attention as the Chancellor and her team test public sentiment to see which policies current under discussion will make the final cut. The government has been the laying the ground to announce a package of tax raising measures to help fill a projected GBP22billion overspend in this year’s budget. Just over the past week policy measures such as raising the capital gains tax as high as 40% and introducing a national insurance charge to be paid by employers on pension contributions have been floated in the media. Adding to the uncertainty amongst Gilt market participants are reports that the government could adjust the fiscal rules to allow more leeway to borrow more to invest. The Labour manifesto committed to two “non-negotiable” fiscal rules: i) to get debt falling as share of national income by year 5 of the forecast (debt rule) and ii) to bring the current budget into balance (borrowing rule). Those commitments allow some leeway for the government as they did not specify what measure of debt to target. The previous government’s fiscal rule targeted public sector net debt excluding the contribution from the BoE’s balance sheet (PSND ex. BoE). It excludes loans made by the BoE to large companies under the Term Funding Scheme. The Labour government could go further and strip out other further components from the measure of debt such as any debt taken on by publicly owned or underwritten banks such as the new “National Wealth Fund”, or any valuation losses associated with the BoE’s quantitative easing programme. BoE losses on its quantitative easing programme are expected to push up the measure of PSND ex.BoE over the coming years. One bigger jump that has also been suggested would be for the government to target public sector net financial liabilities (PSNFL) or even public sector net worth (PSNW). Chancellor Reeves has indicated that the government is keen to recognise better the benefits of investments as well as the costs.

GBP PERFORMANCE VS. SHORT-TERM YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG Research

LONG GBP POSITIONS REMAIN ELEVATED

Source: Bloomberg, Macrobond & MUFG Research

A switch to those alternative measures from the previous government’s measure of PSND ex. BoE would create more fiscal headroom for the government. The Institute for Fiscal Studies (IFS) estimates that in the March 2024 Budget with: i) PSND as the alternative target, the government would have added around GBP16 billion of headroom, ii) PSNFL would have added around GBP53 billion of headroom, and iii) PSNW would have added around GBP58 billion of headroom. However if the government sticks to its commitment to balance the current budget (borrowing rule), the headroom opened up for additional borrowing will not be allowed to fund tax cuts or day-to-day spending. The aim would be to create more room to borrow to invest for the government. Having said that any change to the debt rule measure could create some unease at least initially amongst market participants who remember the adverse gilt market reaction to the unfunded tax cuts announced by the short-lived Truss government back in autumn 2022.

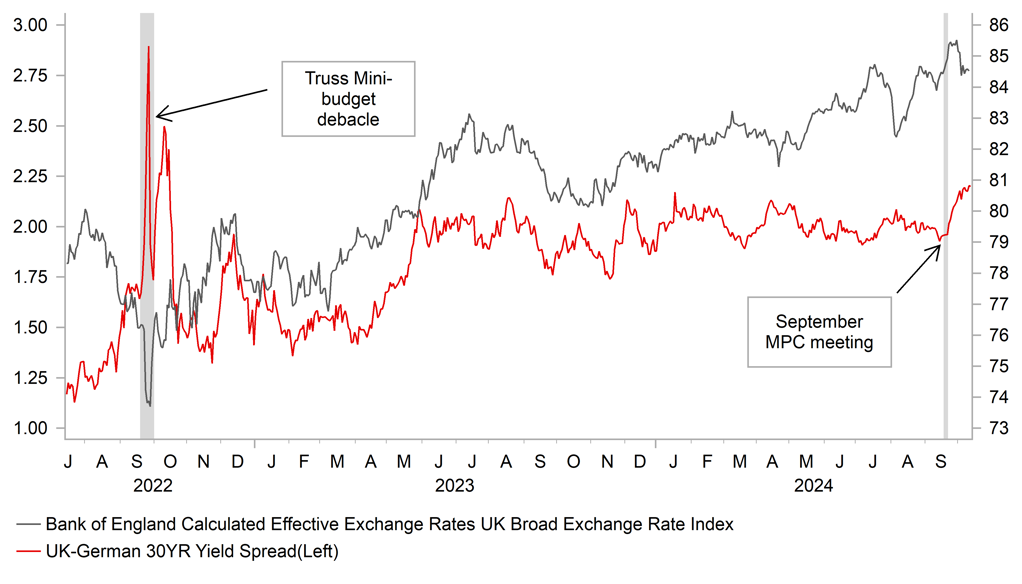

On that occasion the sharp sell-off in the gilt market was reinforced by the forced liquidation of positions held by Liability Driven Investment (LDI) funds until the BoE stepped into provide support to preserve financial stability after the 30-year yield spread between UK and German government bonds more than doubled to a peak closer to 3 percentage points. Recently long-term yield spreads between UK and German bonds have been widening back out and reached their widest levels since autumn 2022. It follows the BoE’s last policy meeting on 19th September when they left rates firmly on hold compared to rate cuts delivered by the ECB and Fed in September. While we are not expecting a repeat of the unfavourable market reaction to the Truss budget when the GBP temporarily fell sharply by over 3%, the government’s upcoming budget does pose some downside risk for the GBP if it triggers investor unease.

ALTERNATIVE MEASURES OF PUBLIC DEBT & WORTH

Source: IFS: “Outlook for public finances in new parliament”

LONG-TERM GILT YIELDS RISING AHEAD OF BUDGET

Source: Bloomberg, Macrobond & MUFG Research

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

10/12/2024 |

01:00 |

China Fiscal Policy Announcement |

!!! |

|||

|

JPY |

10/15/2024 |

05:30 |

Industrial Production MoM |

Aug F |

-- |

-3.3% |

!! |

|

SEK |

10/15/2024 |

07:00 |

CPI YoY |

Sep F |

-- |

1.6% |

!! |

|

GBP |

10/15/2024 |

07:00 |

Average Weekly Earnings 3M/YoY |

Aug |

-- |

4.0% |

!!! |

|

GBP |

10/15/2024 |

07:00 |

Employment Change 3M/3M |

Aug |

-- |

265k |

!! |

|

EUR |

10/15/2024 |

07:45 |

France CPI YoY |

Sep F |

-- |

1.2% |

!! |

|

EUR |

10/15/2024 |

09:00 |

ECB Bank Lending Survey |

!! |

|||

|

EUR |

10/15/2024 |

10:00 |

Germany ZEW Survey Expectations |

Oct |

-- |

3.6 |

!! |

|

EUR |

10/15/2024 |

10:00 |

Industrial Production SA MoM |

Aug |

-- |

-0.3% |

!! |

|

CAD |

10/15/2024 |

13:30 |

CPI YoY |

Sep |

1.9% |

2.0% |

!!! |

|

NZD |

10/15/2024 |

22:45 |

CPI YoY |

3Q |

-- |

3.3% |

!!! |

|

GBP |

10/16/2024 |

07:00 |

CPI YoY |

Sep |

-- |

2.2% |

!!! |

|

USD |

10/16/2024 |

13:30 |

Import Price Index MoM |

Sep |

-0.3% |

-0.3% |

!! |

|

JPY |

10/17/2024 |

00:50 |

Trade Balance |

Sep |

-¥167.6b |

-¥703.2b |

!! |

|

AUD |

10/17/2024 |

01:30 |

Employment Change |

Sep |

23.7k |

47.5k |

!! |

|

EUR |

10/17/2024 |

10:00 |

CPI YoY |

Sep F |

-- |

2.2% |

!! |

|

EUR |

10/17/2024 |

13:15 |

ECB Deposit Facility Rate |

-- |

3.50% |

!!! |

|

|

USD |

10/17/2024 |

13:30 |

Retail Sales Advance MoM |

Sep |

0.2% |

0.1% |

!!! |

|

USD |

10/17/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

EUR |

10/17/2024 |

13:45 |

President Lagarde Press Conference |

!!! |

|||

|

USD |

10/17/2024 |

14:15 |

Industrial Production MoM |

Sep |

-0.1% |

0.8% |

!! |

|

USD |

10/17/2024 |

15:00 |

NAHB Housing Market Index |

Oct |

-- |

41.0 |

!! |

|

JPY |

10/18/2024 |

00:30 |

Natl CPI YoY |

Sep |

2.5% |

3.0% |

!!! |

|

CNY |

10/18/2024 |

03:00 |

GDP SA QoQ |

3Q |

0.9% |

0.7% |

!!! |

|

CNY |

10/18/2024 |

03:00 |

Industrial Production YoY |

Sep |

4.6% |

4.5% |

!! |

|

CNY |

10/18/2024 |

03:00 |

Retail Sales YoY |

Sep |

2.5% |

2.1% |

!! |

|

GBP |

10/18/2024 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Sep |

-- |

1.0% |

!! |

|

USD |

10/18/2024 |

13:30 |

Housing Starts |

Sep |

1349k |

1356k |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- China’s finance ministry have announced that they will hold a press conference on Saturday to detail plans on fiscal stimulus. Finance Minister Lan Fo’an will attend the press conference with the theme of the conference “intensifying countercyclical adjustment of fiscal policy to promote high-quality economic development”. The press conference will be followed later next week by the release of the latest Chinese GDP report for Q3 and monthly activity data for September. Slowing growth over the summer increased pressure on domestic policymakers in China to step-up policy support in order to meet their growth target of around 5% for this year.

- The ECB has signaled that it is likely to speed up the pace of easing in the week ahead by delivering a back-to-back 25bps rate cut. We expect the ECB to welcome the faster drop in September but highlight more concern over the loss of growth momentum heading into year end. The updated forward guidance should leave the door open to another 25bps rate cut at the following policy meeting in December. We expect larger 50bps cuts to remain off the table for the ECB.

- It is an important week for economic data releases from the UK including the latest UK CPI report for September and labour market report. Inflation and wage growth has been running modestly below the BoE’s forecasts from the August Quarterly Inflation Report. Further downside surprises in the week ahead would reinforce market expectations for the BoE to deliver a second 25bps rate cut in November and encourage market expectations for the BoE to speed up the pace of easing by delivering a third rate cut in December as well. Lingering concerns over the persistence of services inflation is the main road block preventing the BoE from following the Fed and ECB by delivering more active easing.