To read the full report, please download PDF.

USD hit by more “good data”

FX View:

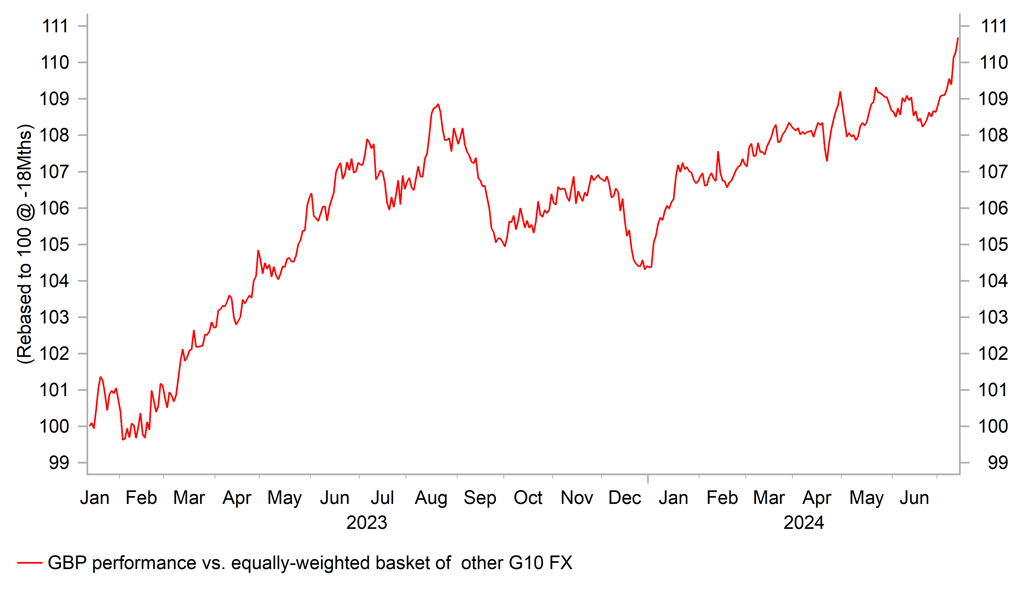

The USD’s recent weakening trend has continued over the past week. Fed Chair Powell was clear this week in his semi-annual testimony on monetary policy that he wants to see more “good data” before becoming confident enough to begin cutting rates. The release of the US CPI report for June has since provided the most compelling evidence yet that inflation continues to slow, and has encouraged US rate market participants to price back in a more aggressive path for Fed rate cuts in the year ahead. At this month’s FOMC meeting the Fed could provide stronger guidance that they are moving closer to cutting rates in September. The USD has been following US yields lower with a lag which we expect to continue heading into the summer. In contrast, the GBP continues to outperform supported by improving cyclical momentum of the UK economy. The releases of the latest UK CPI and labour market reports in the week ahead will be important in determining whether the BoE begins to cut rates next month or delays until later this year.

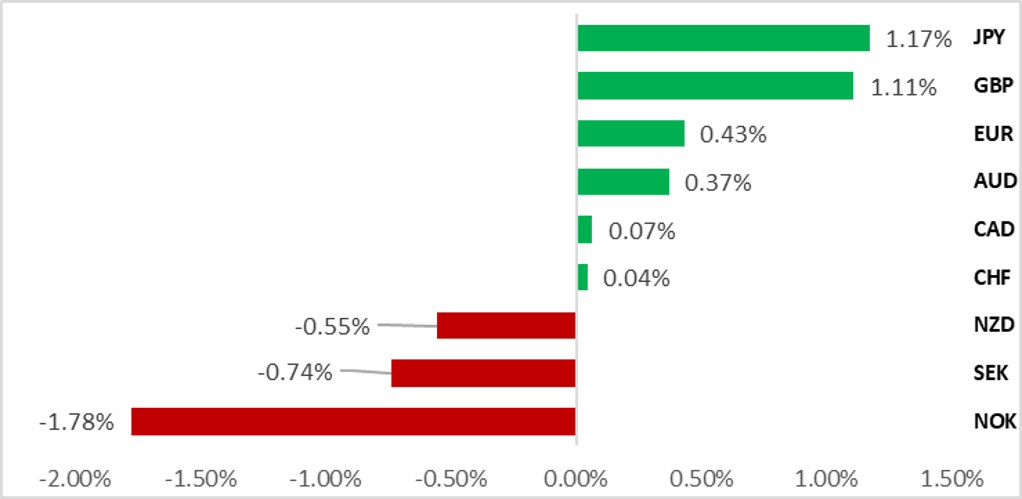

USD UNDERPERFORMS AGAINST OTHER FX MAJORS

Source: Bloomberg, 13:37 BST, 12th July 2024 (Weekly % Change vs. USD

Trade Ideas:

We have recommended a new long GBP/SEK trade idea, and are maintaining our long AUD/USD trade recommendation from last week.

IMM FX Positioning:

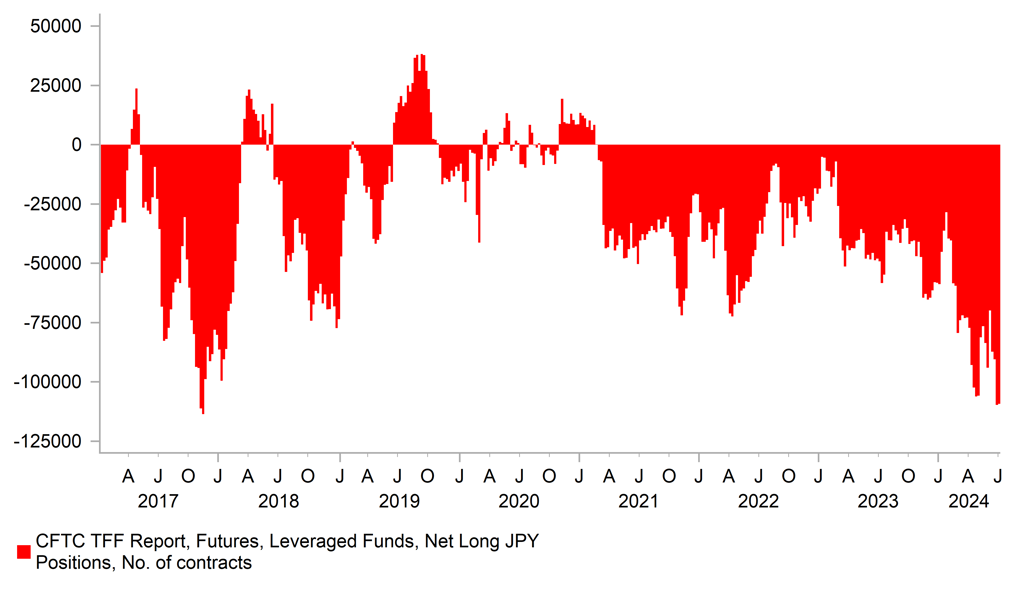

The latest IMM weekly positioning data covering the week to 2nd July revealed that Leveraged Funds modestly scaled back long USD positions. Short JPY positioning remains close to the highest level since November 2017.

G10 FX Momentum:

This week we monitor our momentum signals for all G10 currencies tracking the current strength of trend for both long and short time-horizons (1M, 6M, 12M). Our analysis highlights that by historical standards JPY momentum remains considerably negative (-0.751) while both GBP and AUD continue to flag strong positive momentum where current MoM values are 0.620 and 0.681 respectively. Should FX momentum persist we expect USD/JPY, GBP/USD and AUD/USD to appreciate in the week ahead.

FX Views

USD: Slowing US inflation support our forecast for weaker USD

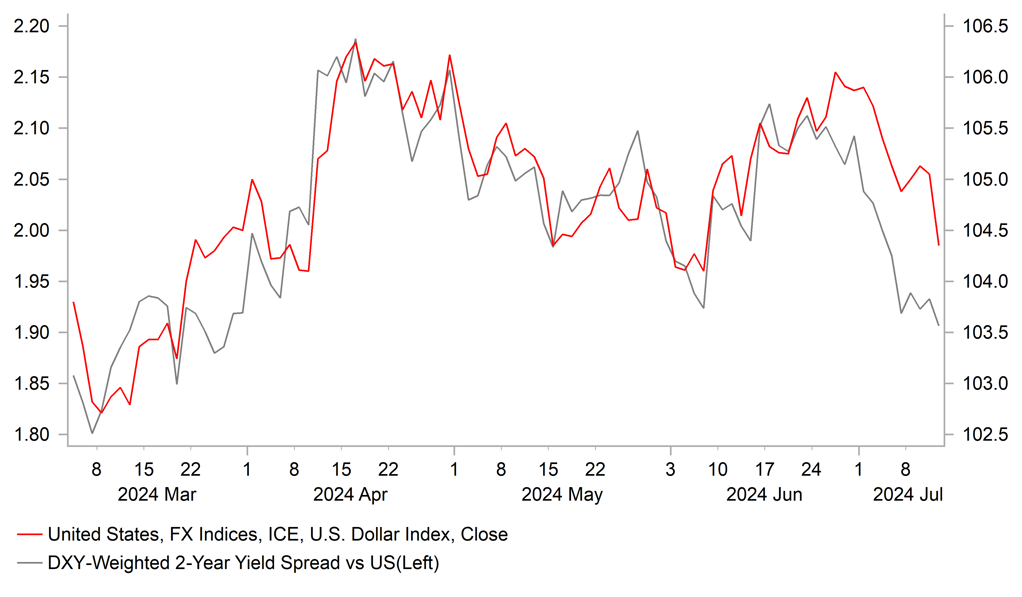

The USD has continued to weaken at the start of July resulting the dollar index giving back last month’s gains. The next important support level for the dollar index is provided by the 200-day moving average at around 104.40 which has not been broken on a sustained basis so far this year although it has already been tested on a number occasions in March and early June. The USD’s recent downward momentum has been encouraged by the ongoing adjustment lower in US yields. The yield on the 2-year Us Treasury bond has now fallen by just over 50bps since the year to date peak at the end of April. It is the biggest adjustment lower for US yields since between October and January when the 2-year US Treasury bond yield fell by around 110bps. For comparison the dollar index declined by around -6.2% between October and January and since the peak for US yield in late April the dollar has fallen by around -2.3% on this occasion. A relatively smaller USD adjustment for the equivalent adjustment lower in US yields.

The case for lower US rates and weaker USD has been reinforced by further reassuring evidence that inflation in the US has resumed its decline after the temporary pick-up in Q1. The release of the latest US CPI report revealed that the core inflation surprised to the downside for the third consecutive month in June. Core inflation increased by just +0.065%M/M in June which was the lowest reading since January 2021. Fed Chair Powell’s preferred measure of core services inflation excluding eve fell for the second consecutive month by -0.05%M/M in June following a decline of -0.04%M/M in May. A further positive for the Fed was that housing costs took a step down in June as well indicating that the much anticipated disinflationary impact from rental prices is starting to feed through to the official inflation data although it would need to be followed up in the coming months. Shelter costs increased by +0.17%M/M in June compared to an average of +0.44%M/M in the previous six months. In light of the more compelling evidence of slowing US inflation, we expect the Fed to send a stronger signal that it is close to cutting rates at their next policy meeting at the end of this month. While we would support a rate cut this month, it is unlikely that the Fed will move that quickly and are more likely to set up a cut in September. The developments leave the USD vulnerable to further weakness heading into the summer period. It is creating a favourable set up for carry trades to perform well as market volatility eases.

USD IS FOLLOWING US YIELDS LOWER

Source: Bloomberg, Macrobond & MUFG GMR

US HOUSING COSTS TAKE A STEP LOWER

Source: MUFG & Global Markets Research

The yen has recorded the strongest gains since the release of the much weaker US CPI report for June. USD/JPY fell sharply from around 161.40 prior to the release of the US CPI report to a low of 157.44. The pair has since recovered some lost ground overnight rising back above the 159.00-level. Reuters reported yesterday that Japan intervened to support the yen just after the release of the US CPI report although it has not been officially confirmed. Government officials reportedly told TV Asahi and the Mainichi Shimbun that Japan intervened again. Japan’s top currency official Masato Kanda told reporters yesterday that he wasn’t in a position to say if the move was intervention, and followed up those comments overnight by stating that the narrowing of the yield gap between the US and Japan, and speculation was probably behind those moves. USD/JPY had become increasingly detached from yield spreads recently while short yen positions built up by Leveraged funds have risen to their highest levels since back in 2017. The release today of the latest current account data from the BoJ suggests that intervention totalled around JPY3.5 trillion. It is smaller than the intervention undertaken in late April/early May that totalled JPY9.8 trillion. It also suggests a change in strategy to a more pro-active approach rather than reactive.

Even though the yen has strengthened it does not alter our forecast for the BoJ to tighten policy further later this month. We still expect the BoJ to deliver a 15bps rate hike and to announce details of their plans to slow down the pace of JGB purchases from around JPY6 trillion/month at present. Bloomberg reported earlier this week that Japan’s largest banks are calling on the BoJ to make deeper cuts its monthly bond purchases. According to the Bloomberg, the consensus forecast is for the BoJ to announce plans to initially cut JGB purchases to around JPY5 trillion/month. We continue to see upside risks for Japanese yields although the ongoing adjustment higher in yields has failed to provide more support for the yen so far this year.

The GBP has outperformed alongside the JPY over the past week. Th GBP continues to benefit from the higher yields on offer in the UK alongside favourable market conditions for carry trades. It has helped to lift cable back up towards the 1.3000-level for the first time in a year. In addition, the pound is deriving supporting from further evidence of improving cyclical momentum for the UK economy and hawkish comments from BoE chief Economist Huw Pill which together have dampened expectations for the BoE to begin cutting rates from next month. The release next week of the latest UK CPI and labour market could prove important in determining whether the BoE begins to cut rates next month. We are still holding on to our call for an August rate cut, but another upside surprise for services inflation and/or wages would challenge our view and encourage a further strengthening of the GBP in the week ahead.

SHORT JPY POSITIONS HAD BECOME EXTREME

Source: Bloomberg, Macrobond & MUFG GMR

GBP HAS REGAINED UPWARD MOMENTUM

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

07/15/2024 |

03:00 |

GDP YoY |

2Q |

5.0% |

5.3% |

!!! |

|

CNY |

07/15/2024 |

03:00 |

Industrial Production YoY |

Jun |

4.8% |

5.6% |

!! |

|

CNY |

07/15/2024 |

03:00 |

Retail Sales YoY |

Jun |

3.3% |

3.7% |

!! |

|

EUR |

07/15/2024 |

10:00 |

Industrial Production SA MoM |

May |

-1.0% |

-0.1% |

!! |

|

USD |

07/15/2024 |

17:00 |

Fed's Powell interviewed |

!!! |

|||

|

EUR |

07/16/2024 |

09:00 |

ECB Bank Lending Survey |

!! |

|||

|

EUR |

07/16/2024 |

10:00 |

Germany ZEW Survey Expectations |

Jul |

-- |

47.5 |

!! |

|

EUR |

07/16/2024 |

10:00 |

Trade Balance SA |

May |

-- |

19.4b |

!! |

|

USD |

07/16/2024 |

13:30 |

Retail Sales Advance MoM |

Jun |

-0.2% |

0.1% |

!!! |

|

CAD |

07/16/2024 |

13:30 |

CPI YoY |

Jun |

-- |

2.9% |

!!! |

|

NZD |

07/16/2024 |

23:45 |

CPI YoY |

2Q |

3.4% |

4.0% |

!!! |

|

GBP |

07/17/2024 |

07:00 |

CPI YoY |

Jun |

-- |

2.0% |

!!! |

|

EUR |

07/17/2024 |

10:00 |

CPI YoY |

Jun F |

-- |

2.5% |

!! |

|

USD |

07/17/2024 |

13:30 |

Housing Starts |

Jun |

1300k |

1277k |

!! |

|

USD |

07/17/2024 |

14:15 |

Industrial Production MoM |

Jun |

0.4% |

0.9% |

!! |

|

USD |

07/17/2024 |

19:00 |

Federal Reserve Releases Beige Book |

!! |

|||

|

JPY |

07/18/2024 |

00:50 |

Trade Balance |

Jun |

-¥146.3b |

-¥1221.3b |

!! |

|

AUD |

07/18/2024 |

02:30 |

Employment Change |

Jun |

20.0k |

39.7k |

!! |

|

GBP |

07/18/2024 |

07:00 |

Average Weekly Earnings 3M/YoY |

May |

-- |

5.9% |

!!! |

|

GBP |

07/18/2024 |

07:00 |

Employment Change 3M/3M |

May |

-- |

-139k |

!! |

|

EUR |

07/18/2024 |

13:15 |

ECB Deposit Facility Rate |

3.75% |

3.75% |

!!! |

|

|

USD |

07/18/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

EUR |

07/18/2024 |

13:45 |

ECB President Lagarde Press Conference |

!!! |

|||

|

JPY |

07/19/2024 |

00:30 |

Natl CPI YoY |

Jun |

2.9% |

2.8% |

!!! |

|

GBP |

07/19/2024 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Jun |

-- |

2.9% |

!! |

|

EUR |

07/19/2024 |

09:00 |

ECB Current Account SA |

May |

-- |

38.6b |

!! |

|

CAD |

07/19/2024 |

13:30 |

Retail Sales MoM |

May |

-- |

0.7% |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The ECB will hold their policy meeting in the week ahead. Policymakers have signalled clearly that they are not planning to deliver back to back rate cuts this month. We expect the ECB to reiterate that their policy stance is data dependent and that they do not have a predetermined path for further rate cuts which will require more evidence that inflation continues to slow in the coming months. The euro-zone rate market is currently pricing in around 21bps of ECB rate cuts by September in line with our outlook for further gradual rate cuts to be delivered in Q3 and Q4 of this year. We are not expecting the ECB to push back strongly against those expectations at next week’s policy meeting but a strong signal that they are already planning a September cut is also unlikely.

- It is an important week for UK economic data releases which could determine whether the BoE begins to cut rates as soon as next month. Comments from BoE Chief Economist Pill this week have indicated that he is not yet in favour of cutting rates. He noted that recent wage data and services inflation have been unfavourable. In the week ahead a softer UK CPI report for June and/or UK labour market report will be required to sustain market expectations for an August rate cut. Services inflation has been slowing but only gradually and remains uncomfortably elevated.

- The release of the latest CPI report from Canada, New Zealand and Japan will also be in focus in the week ahead. After surprising to the upside in May, the latest Canadian CPI report for June will be scrutinized closely ahead to the BoC’s upcoming policy meeting later this month. The Canadian rate market remains confident that the BoC will deliver back to back rate cuts this month. In contrast, we expect the BoJ to hike rate further at their next policy meeting later this month. The BoJ has been indicating more confidence that higher inflation can be sustained in Japan. Inflation would have to be much weaker than expected in June to prevent the BoJ from hiking later this month.