To read the full report, please download PDF.

USD support to be helped by cautious FOMC

FX View:

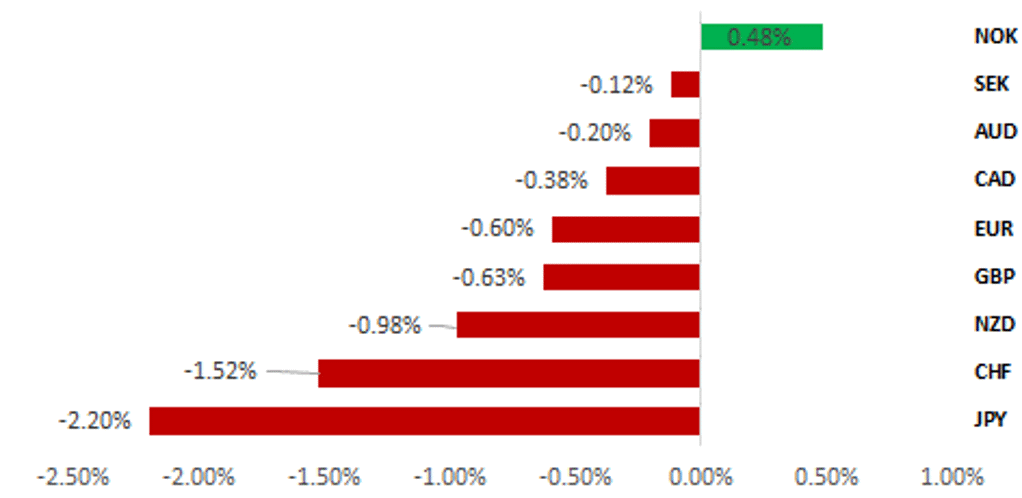

The dollar gained across most of G10 this week with the yen and Swiss franc the two worst performing currencies. Policy divergence remains a driver in FX with the SNB this week cutting by 50bps and expectations of a BoJ rate hike next Friday declining notably. The FOMC on Wednesday is still set to cut by another 25bps despite core CPI running hotter than anticipated with four consecutive months of 0.3% MoM increases. The dollar should remain supported though with a high chance of a much more cautious communication by Fed Chair Powell and given our view that we could well see a median dot reduction in the Summary of Economic Projections to three versus the four cuts signalled in September. The BoE’s MPC is set to remain on hold next week although the recent run of weak data may mean the MPC is more willing to shift its communication a little more dovishly in anticipation of cutting in February. The impact on GBP should be limited.

USD GAINS ACROSS MOST OF G10 WITH LOW-YIELDERS LAGGING

Source: Bloomberg, 14:00 GMT, 13th December 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our long USD/CAD trade idea.

JPY Flows: Portfolio, by investor:

The MoF this week released its monthly International Transactions in Securities data for November and after record selling of foreign bonds in October, net purchases in November was close to zero.

Sentiment Analysis on ECB Monetary policy statements (including Q&A):

The ECB's recent rate cut has driven improvements in inflation sentiment. The rate cut aims to stimulate economic activity and counter disinflationary pressures. This move could potentially result in a weaker euro in the short-term. Additionally, a slower economic recovery signals weaker growth, which may prompt market participants to seek returns elsewhere, further weighing on the euro.

FX Views

USD: A cautious cut from the Fed

The dollar remains well supported for numerous factors but has been supported in the last 24hrs from the larger than expected policy rate cut from the SNB and the expected cut from the ECB. Yields in China are also plunging as market participants position for an imminent easing of the monetary stance. The 10-year government bond yield has fallen to a record low this week with the drop in yields this week (around 20bps), close to the biggest since 2018. The dollar’s performance has not been negatively impacted by the prospect of another rate cut at the FOMC meeting next week – a 25bp cut is fully priced with recent data just about consistent with a further cut. If the FOMC does cut as expected, the fed funds rate will have been cut by 100bps which could well be viewed as enough to warrant at least a skip at the next meeting in January. The focus for the markets will therefore be on elements of guidance on what 2025 might bring. That will be key for the dollar and given the dovish signals presented by President Lagarde yesterday (here) we see expectations of policy divergence remaining in place.

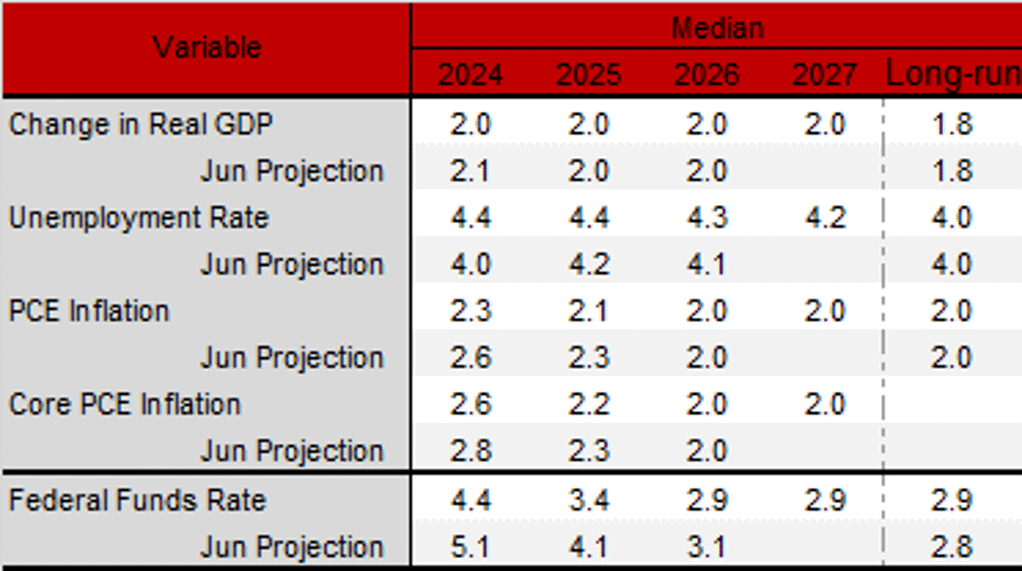

The key guidance for the markets will of course be the median dot profile in the Summary of Economic Projections. One of the reasons why the FOMC will likely cut next week despite mixed inflation data is that it was signalled in the median dots in September. The FOMC then also signalled four further rate cuts in 2025 and then another two cuts in 2026 taking the fed funds rate to 2.875%. We see it as most likely that the FOMC will drop one of the cuts signalled for 2025 in the updated dots profile next week. That would still imply one more rate cut than currently priced in the fed funds futures curve which by end-2025 is 78bps lower than today’s level implying roughly 50bps only of additional cuts in 2025. We see the risk relative to market pricing skewed to a longer pause taking place sooner than expected. Sentiment data and a potential bounce in activity data on Trump’s win might sway the Fed to pause beyond March, especially if Trump acts aggressively on trade tariffs in January.

Fed Chair Powell’s press conference will also be key for guidance and Powell will have a difficult task in ensuring he does not come across as overly hawkish in anticipation of Trump’s policies being implemented next year. With nothing confimed Powell will try and avoid second-guessing Trump’s policies and will likely instead emphasise the progress the Fed is making in bringing inflation back to target. But even on this topic Powell is likely to at least express some concerns over the recent flow of data.

SUMMARY OF ECONOMIC PROJECTIONS – SEP 2024

Source: Federal Reserve; SEPs September 2024

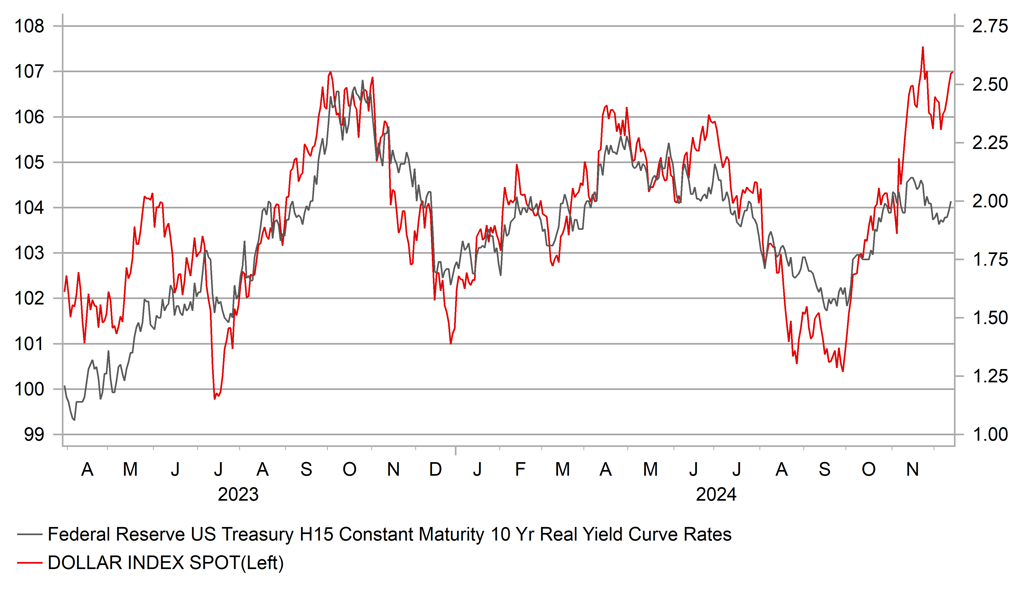

USD PERFORMANCE VS 10-YEAR REAL UST YIELD

Source: Bloomberg, Macrobond & MUFG GMR

The CPI reports over the last four months have recorded an underlying core MoM increase of 0.3% which is certainly not consistent with price stability. There are some volatile components but we are seeing signs of core goods inflation ticking higher as some elements of services inflation recede. Since the last SEPs update in September, the 10-year breakeven rate has jumped 30bps so even excluding Trump-related factors there are fundamental reasons for Chair Powell to express a more cautious approach to cuts going forward. If we see clear evidence of that, the dollar is likely to have another leg higher into year-end.

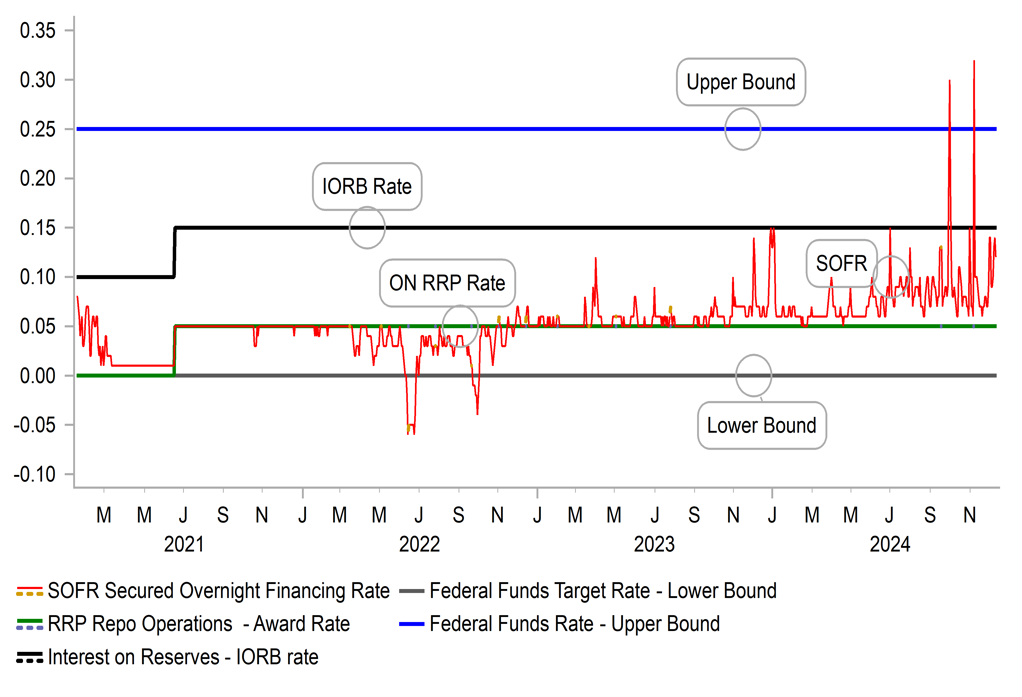

In addition to the upper and lower bounds for federal funds rate being cut (to 4.50% and 4.25%) there is a high chance of a technical change to one of the key rates within the bands. The IORB (Interest rate on reserve balances) is likely to be cut by 25bps as well taking that rate to 4.40%. The rate on the overnight reverse repurchase agreement facility (ON RPP) could well be cut by a slightly larger 30bps, 5bps more than the other rates. That rate currently stands at 4.55%, 5bps above the lower fed funds bound and hence the FOMC may well announce the removal of this 5bp spread. This was referenced in the FOMC minutes from November when “some participants” thought there “would be value” in removing this spread and returning it to the bottom bound where it had existed when the facility was started.

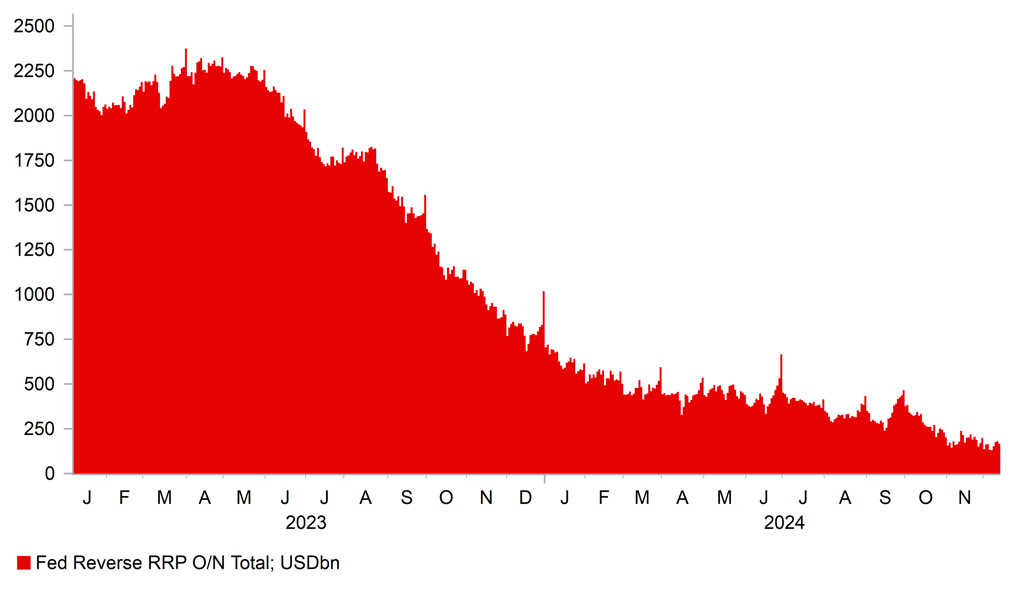

This will certainly be communicated as a technical change by the FOMC and we doubt there will be any major market impact and certainly from an FX perspective it is unlikely to impact the dollar. But it could be interpreted as a step toward the end of QT. The ON RRP facility currently totals USD 165bn and nearly the entire shrinkage of the Fed’s balance sheet since QT began has been through the reduction of the ON RRP – it peaked at around USD 2.3trn in April 2023 and has declined steadily since. The pace of decline has been much slower this year and by removing the 5bp spread over the bottom fed funds bound would likely incentivise funds out of RRP and into the broader markets. Fed officials have previously stated they would like to see RRP fall to zero before ending QT so hence this technical change may be a step in that direction although we don’t expect the Fed to announce an end to QT next week. We see that happening possibly in Q2 next year. While the effective fed funds rate will be more aligned to the IORB, market rates tend to be more aligned to RRP and hence this change could see some softening in market rates.

As stated this technical change will have little impact on dollar performance and we see scope for a cautious guidance from the FOMC as reinforcing expectations of US policy divergence with the rest of the world that will help ensure continued demand and strengthening into year-end and then beyond into Q1 2025.

FED FUNDS BOUNDS; BPS FROM LOWER BOUND & SOFR

Source: Bloomberg, Macrobond & MUFG Research

RRP APPROACHING ITS END – QT FINISH NEXT?

Source: Bloomberg, Macrobond & MUFG Research

GBP: BoE to stand pat despite weakening growth momentum in UK

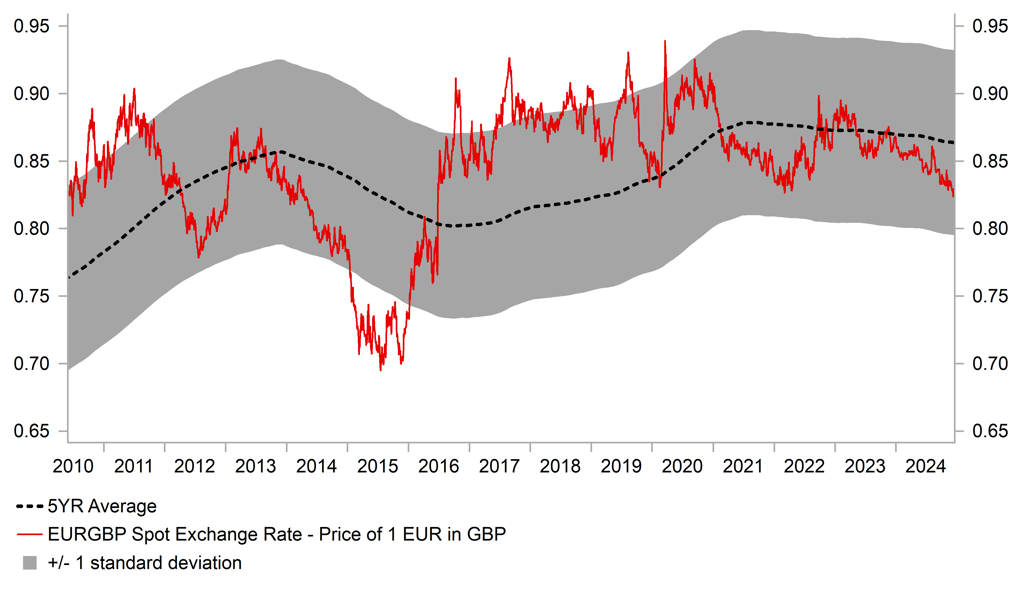

The GBP has hit a fresh year to date high against the EUR over the past week extending the upward trend that has been in place for most of this year. It has resulted in EUR/GBP moving closer to the low from March 2022 at 0.8203. The pair has not traded below the 0.8200-level since the Brexit referendum vote in June 2016. For this year as a whole the GBP has been the only G10 currency that has been able to hold its ground against the stronger USD. While all other G10 currencies are on course to decline by over 5% against the USD this year, the GBP has weakened by less than 1%. On a trade-weighted basis the GBP is set to record its second consecutive calendar year of gains which is the largest gain over an equivalent period since 1997.

The GBP’s continued outperformance has been encouraged by widening yields spreads between the UK and other major economies. While the yields on 2-year government bonds in the euro-zone and US have both declined by around 73bps and 6bps this year, they have risen by around 27bps in the UK as market participants have scaled back expectations over the scale of the BoE’s monetary easing cycle. The rise in short-term yields in the UK is similar to in Japan, Norway and Australia whereas the larger decline in yields in the euro-zone is similar to in Switzerland, Sweden and New Zealand. It leaves the UK rate market currently discounting only 75bps of further rate cuts by the end of next year with market expectations for the terminal rate in the current easing cycle at around between 3.50% and 3.75% in the coming years. With UK yields expected to remain higher for longer in the UK than in the euro-zone where the terminal rate has recently fallen to between 1.75% to 2.00%, the GBP has become relatively more attractive than the EUR. The policy rate spread between the BoE and ECB has already reached the widest level since the Global Financial Crisis in 2008.

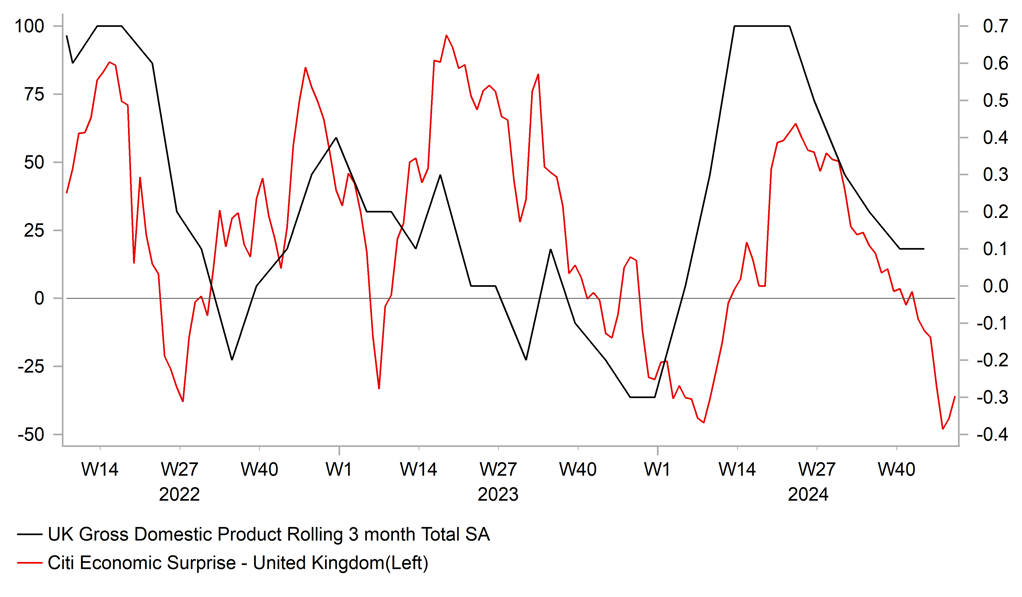

The widening policy divergence will be in focus again in the week ahead when the BoE holds their final MPC meeting of this year. After the ECB delivered a dovish policy update this week (click here) leaving the door wide open for further rates cuts next year, the BoE is expected to stand pat next week. At the last MPC meeting in November, the BoE lowered the policy rate for the second time in the current easing cycle to 4.75% but provided no indication that they are ready to speed up the current quarterly pace of rate cuts. It leaves February as the next likely MPC meeting for another rate cut. The recent run of disappointing UK economic data releases is unlikely to prompt the BoE to cut rates next week but if sustained will encourage expectations for faster cuts next year. The UK economy has slowed more than expected in the 2H of this year and the UK labour market has continued to soften. Developments which should help to dampen BoE concerns over upside inflation risks. It is unlikely to trigger a reversal of the GBP’s bullish trend right now but is a downside risk to watch for early next.

EUR/GBP MOVES CLOSER TO MULTI-YEAR LOWS

Source: Bloomberg, Macrobond & MUFG GMR

UK ECONOMY IS SLOWING SHARPLY INTO YEAR END

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

12/16/2024 |

02:00 |

Industrial Production YoY |

Nov |

5.5% |

5.3% |

!! |

|

CNY |

12/16/2024 |

02:00 |

Retail Sales YoY |

Nov |

5.0% |

4.8% |

!! |

|

EUR |

12/16/2024 |

07:30 |

ECB's Lagarde Speaks |

!!! |

|||

|

EUR |

12/16/2024 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Dec P |

-- |

45.2 |

!!! |

|

EUR |

12/16/2024 |

09:00 |

HCOB Eurozone Services PMI |

Dec P |

-- |

49.5 |

!!! |

|

GBP |

12/16/2024 |

09:30 |

S&P Global UK Manufacturing PMI |

Dec P |

-- |

48.0 |

!!! |

|

GBP |

12/16/2024 |

09:30 |

S&P Global UK Services PMI |

Dec P |

-- |

50.8 |

!!! |

|

EUR |

12/16/2024 |

10:00 |

Labour Costs YoY |

3Q |

-- |

4.7% |

!! |

|

GBP |

12/17/2024 |

07:00 |

Average Weekly Earnings 3M/YoY |

Oct |

-- |

4.3% |

!!! |

|

EUR |

12/17/2024 |

09:00 |

Germany IFO Business Climate |

Dec |

-- |

85.7 |

!! |

|

USD |

12/17/2024 |

13:30 |

Retail Sales Advance MoM |

Nov |

0.5% |

0.4% |

!!! |

|

CAD |

12/17/2024 |

13:30 |

CPI Core- Median YoY% |

Nov |

2.4% |

2.5% |

!! |

|

USD |

12/17/2024 |

15:00 |

NAHB Housing Market Index |

Dec |

46.0 |

46.0 |

!! |

|

JPY |

12/17/2024 |

23:50 |

Trade Balance |

Nov |

-- |

-¥461.2b |

!! |

|

GBP |

12/18/2024 |

07:00 |

CPI YoY |

Nov |

-- |

2.3% |

!!! |

|

EUR |

12/18/2024 |

09:00 |

ECB's Lane Speaks in MNI Webcast |

!! |

|||

|

EUR |

12/18/2024 |

10:00 |

CPI YoY |

Nov F |

-- |

2.0% |

!! |

|

USD |

12/18/2024 |

13:30 |

Current Account Balance |

3Q |

-- |

-$266.8b |

!! |

|

USD |

12/18/2024 |

19:00 |

FOMC Rate Decision (Upper Bound) |

4.50% |

4.75% |

!!! |

|

|

NZD |

12/18/2024 |

21:45 |

GDP SA QoQ |

3Q |

-- |

-0.2% |

!!! |

|

JPY |

12/19/2024 |

Tbc |

BOJ Target Rate |

0.25% |

0.25% |

!!! |

|

|

SEK |

12/19/2024 |

08:30 |

Riksbank Policy Rate |

2.50% |

2.75% |

!!! |

|

|

NOK |

12/19/2024 |

09:00 |

Deposit Rates |

4.50% |

4.50% |

!!! |

|

|

GBP |

12/19/2024 |

12:00 |

Bank of England Bank Rate |

4.75% |

4.75% |

!!! |

|

|

USD |

12/19/2024 |

13:30 |

GDP Annualized QoQ |

3Q T |

2.8% |

2.8% |

!! |

|

USD |

12/19/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

JPY |

12/19/2024 |

23:30 |

Natl CPI YoY |

Nov |

-- |

2.3% |

!!! |

|

GBP |

12/20/2024 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Nov |

-- |

-0.7% |

!! |

|

USD |

12/20/2024 |

13:30 |

Core PCE Price Index MoM |

Nov |

0.2% |

0.3% |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- There is a heavy schedule of G10 central bank policy updates before the Christmas holiday period. The Fed is expected to deliver a third consecutive rate cut by lowering rates by a further 25bps in the week ahead. Recent comments from Fed officials have indicated more caution over continuing to cut rates in light of stronger inflation readings in September and October. The release of the US PCE deflator report for November at the end of next week is expeted to provide some reassurance that inflation eased. However, it is unlikely to prevent the Fed from revising up their inflation forecasts. Market participants will also be watching closely to see if the median projection amongst FOMC participants is still in favour of 100bps of rate cuts next year. The US rate market is currently priced for around 50bps of cuts next year.

- The BoJ has indicated that next week’s policy meeting is a “live” one and the final decision on whether to deliver another hike or leave rates on hold will be determined by incoming data and events. While the incoming data has been in line with the BoJ’s outlook providing justification to hike rates further, recent press reports have signaled that they are more likely to wait until early next year before hiking again. However, it appears only a matter of time before another hike is delivered.

- The BoE has signaled that it is not yet planning to speed up the current pace of quarterly rate cuts. After cutting rates at the last policy meeting in November, we expect the BoE to leaves rates on hold in the week ahead. Further evidence of slowing service sector inflation and wage growth is needed in the week ahead to support our expectations for the BoE to deliver another rate cut in February of next year.

- The Norges Bank and Riksbank are also scheduled meet next week. The Norges is expected to leave rates on hold again, and has signaled that it plans to begin cutting rates at the start of next year. In contrast, the Riksbank is expected to continue cutting rates although by smaller 25bps after delivering a larger 50bps cut in November.