To read the full report, please download PDF.

FOMC in focus as yields & USD drop

FX View:

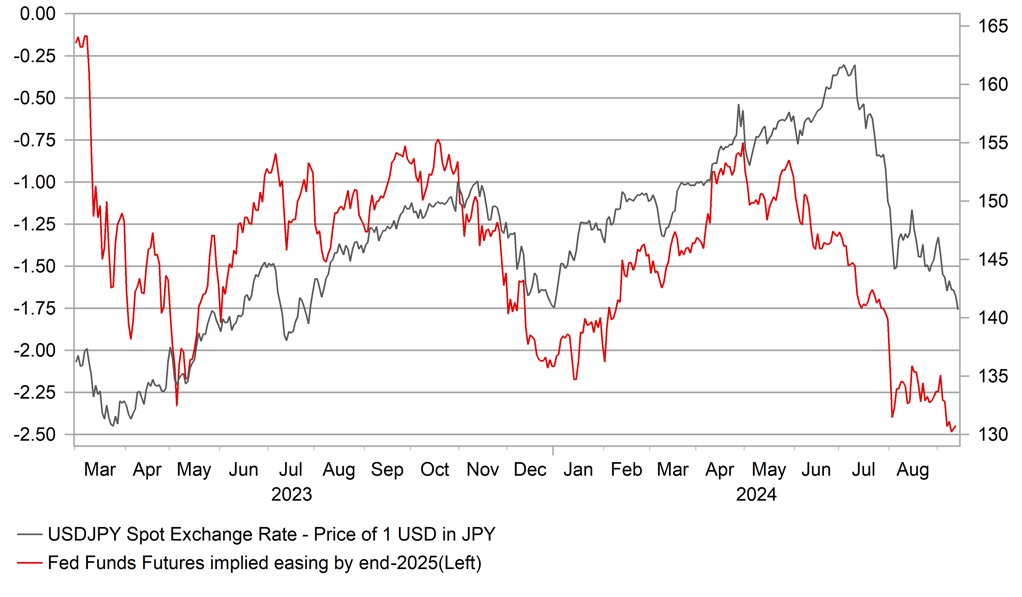

This week the US dollar (DXY) was stronger for most of the week relative to last Friday’s close but that strength has faded today and we look set to close at a weaker level to last Friday. The catalyst is the renewed speculation of a larger 50bp cut from the FOMC at its meeting next Wednesday following a WSJ article suggesting the decision is finely balanced. The WSJ article has increased our confidence in the MUFG house view, led by our US rates team, that the Fed will cut by 50bps next week. We have argued on numerous occasions that a bigger cut is justified and if delivered will prompt another leg lower for USD/JPY with a new trading range between 130.00-140.00 likely to be established. We expect the BoE to remain on hold but the MPC vote may highlight a more dovish leaning than expected. It will leave the BoE on course for cutting in November with the potential for a back-to-back cut in December. We expect the BoJ on Friday to reinforce its message of more rate hikes to come.

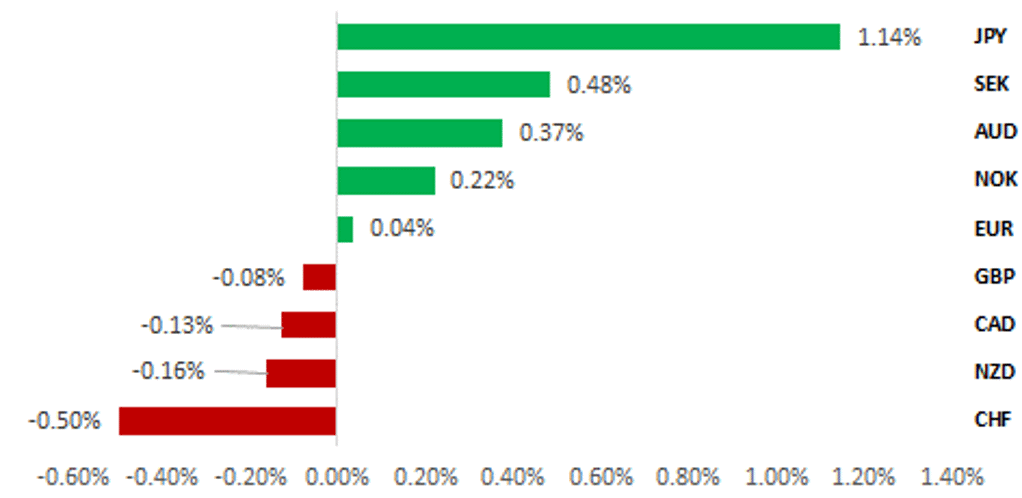

JPY OUTPERFORMS AS US YIELDS DROP FURTHER

Source: Bloomberg, 13:00 BST, 20th September 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our short USD/JPY trade idea based on momentum and the fundamental backdrop, including the potential for a larger FOMC rate cut next week.

IMM Positioning:

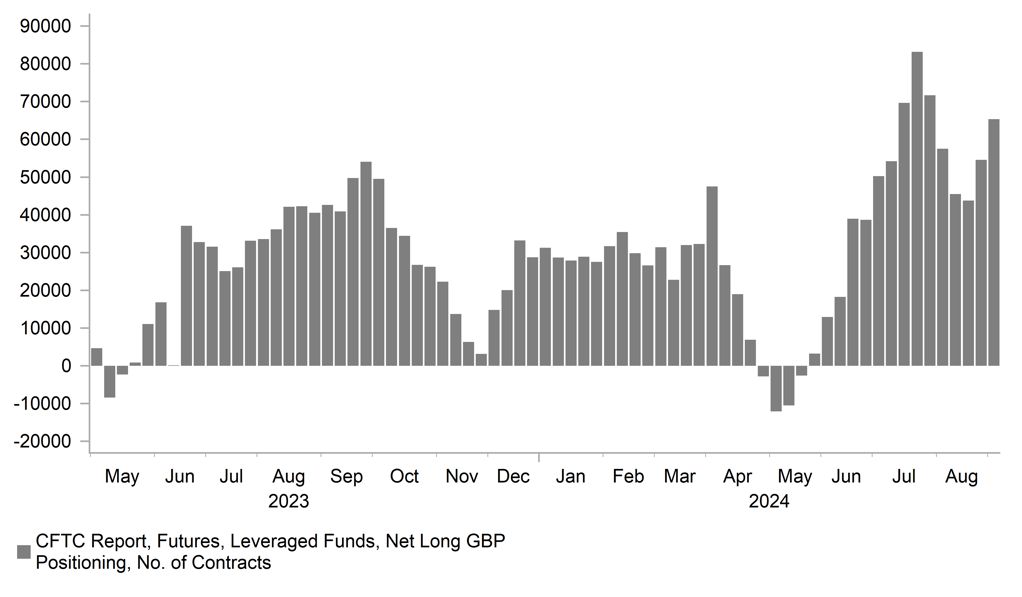

Our two-year rolling z-scores signal revealed that long GBP positions were the most stretched amongst Leveraged Funds heading into next week’s MPC meeting.

How does the Fed’s Easing Cycles impact DXY direction?:

Our analysis challenges consensus to highlight there is no clear pattern on USD performance around the first Fed cut. We found that the USD weakened significantly on four occasions in the first six months following the first cut, and strengthened significantly on three occasions out of the nine easing cycles we analysed.

FX Views

USD/JPY: Fall set to continue

The yen continues to outperform and USD/JPY today has fallen to a new intra-day low not seen since December last year and the risk bias remains firmly to the downside over the near-term at least. The latest catalyst for the move lower has come from the USD side with renewed expectations that the FOMC next week could well cut by 50bps despite the higher than expected core CPI print on Wednesday. A 50bp rate cut next week remains the MUFG house view as we believe if the FOMC wants to truly implement policy changes on a forward-looking basis, then there are grounds for cutting by 50bps. A larger cut would also be broadly consistent with recent communications. Fed Chair Powell’s speech in Jackson Hole highlighted increased concerns over the labour market with Powell stating the Fed would “do everything we can to support a strong labor market” while Fed Governor Waller stated last week that he believed that the “balance of risks is now weighted more toward downside risks to the FOMC’s maximum-employment mandate”. The market viewed last week’s NFP as not weak enough to warrant a 50bp cut. But net of revisions, non-farm payrolls gained a mere 56k which we would argue is a very weak employment gain. The Sahm rule is also in place and is historically a reliable indicator of recession 100% of the time. For the FOMC to get merely to a neutral policy stance (2.75% fed funds rate according to the Fed’s SEPs in June) by the middle of next year, three 50bp rate cuts will be required out of the seven FOMC meetings through to June 2025. We see it therefore as reasonable for the FOMC to go bigger from the onset.

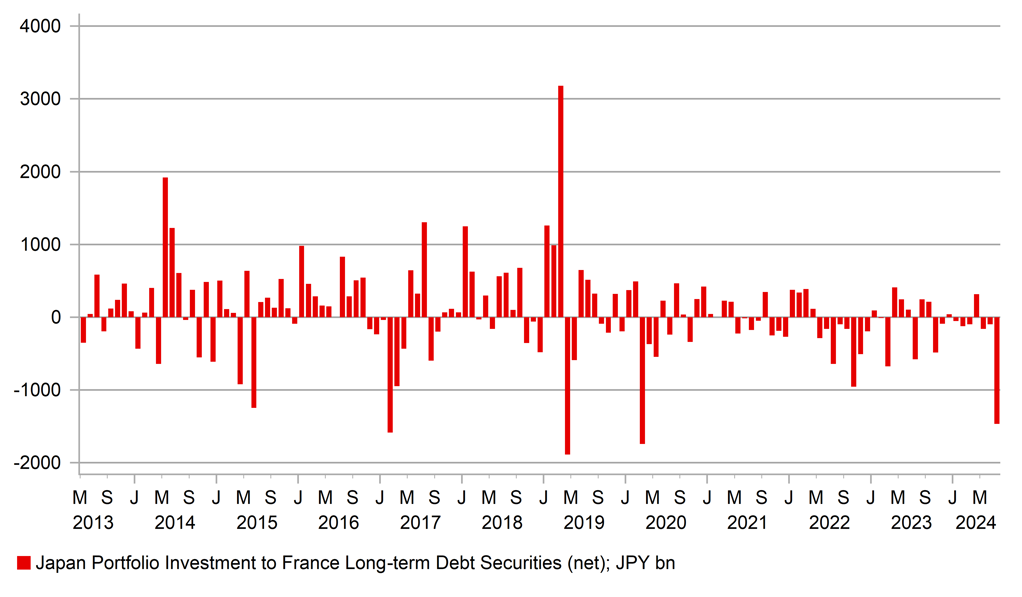

The Ministry of Finance this week released the Balance of Payments data for July and the International Transactions in Securities data for August. The BoP data provided very clear evidence of Japanese investors cutting back notably on exposure to European bond markets. Japanese investors sold JPY 1,467bn (EUR8.6bn) of French bonds in July, the largest since the onset of Covid. While the election result on 7th July saw RN fail to gain a majority in parliament, the prospect of gridlock was enough to prompt heavy selling. Japanese investors also sold Dutch bonds heavily as well – JPY 518bn worth were sold in July after selling of JPY 512bn in June. The July selling was the largest since 2014 when political risk also prompted heavy selling. The combined selling over June and July was a record. Japanese investors also sold German bonds heavily in June, by the largest amount since 2015. The history of the bond flow data

JAPAN SALES OF FRENCH BONDS JUMP IN JULY

Source: Bloomberg, Macrobond & MUFG Research

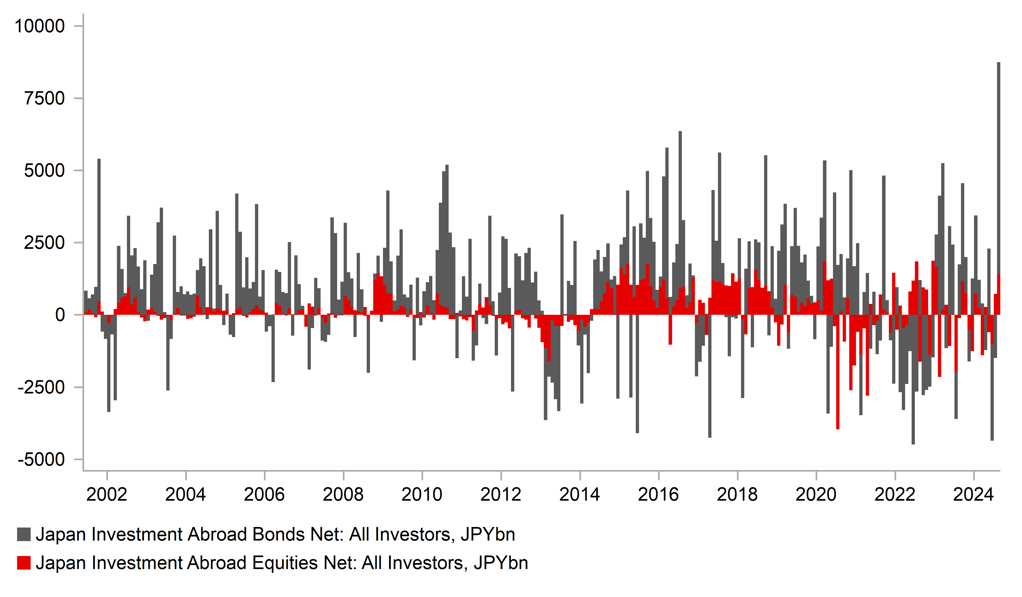

TOTAL FOREIGN BOND PURCHASES SURGED IN AUG

Source: Bloomberg, Macrobond & MUFG GMR

does show that Japanese investors are sensitive to political developments in the euro-zone and are quick to sell on any increased uncertainty. However, appetite tends to return quite quickly and given there has been no further deterioration in the political climate, we have likely seen some renewed buying. No doubt the surge of the yen may have encouraged the selling of foreign bonds in July as risk aversion intensified and while we can’t be sure what type of investors were selling euro-zone bonds in July we do know that Japanese banks were sellers of foreign bonds in July. Banks’ purchases of foreign bonds can have less impact on FX spot given banks alternative sources of funding foreign bond purchases.

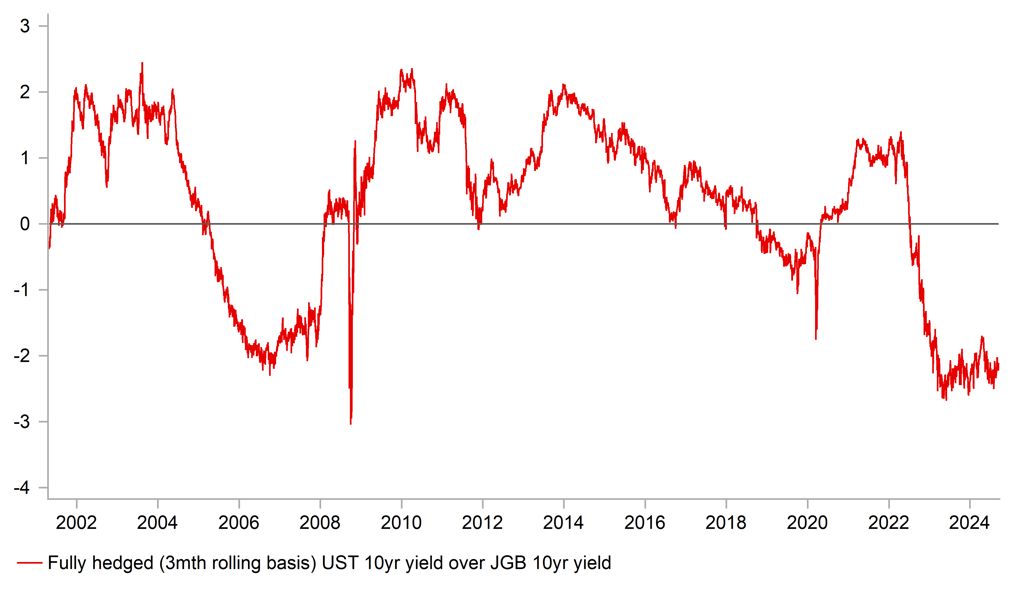

It’s the August International Transactions in Securities data that provides the strongest evidence that the selling of euro-zone debt could well have abated. The August data revealed a record JPY 7,337bn (USD 50bn approx.) of foreign bond buying by Japanese investors. This is by a record total going back to the start of the series in 2001 and the investor-type breakdown indicates that Japanese banks and trusts were the main buyers. Japan banks bought JPY 2,657bn while trusts bought JPY 2,807bn, the second largest total on record. Trust buying could well have been done more an an unhedged basis, taking advantage of the huge surge of the yen. Certainly, buying on a hedged basis remains too expensive. Even through the 2yr UST note yield has fallen sharply, 3mth & 6mth rates have moved by much less and hence hedging costs on a shorter-term basis remain high. Japanese life insurance companies sold JPY 538bn worth of foreign bonds in August, the largest since November 2023. Overall, given the scale of foreign bond buying and the still elevated hedging costs some of that foreign bond buying was likely done on an un-hedged basis.

If a sizeable portion of the non-bank buying of the record foreign bond buying was un-hedged it does suggest there continued to be heavy yen buying by other market participants. IMM data points to only moderate further yen short liquidation but the OTC FX margin data for August was released today (FFAJ data) and revealed a sharp reversal of the yen short position from July equating to about USD 8bn worth of yen buying. Foreign investors’ FX short yen hedge positions of equity holdings could also have been pared back given the Topix remains 12% below the record high. Finally, yen liability hedging has likely picked up given the shift in expectations and the increased risks of further yen gains ahead.

A 50bp cut from the Fed next week, if delivered as we expect, would certainly send front-end US yields lower and fuel another leg lower for USD/JPY and likely result in USD/JPY settling into a new 130.00-140.00 range. The BoJ meeting next Friday should reinforce the current message of more rate hikes to come.

FULLY HEDGED UST YIELD OVER JGBS UNATTRACTIVE

Source: Bloomberg, Macrobond & MUFG Research

USD/JPY RISKS REMAIN FIRMLY TO THE DOWNSIDE

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Will BoE policy update cast more doubt on GBP carry trades?

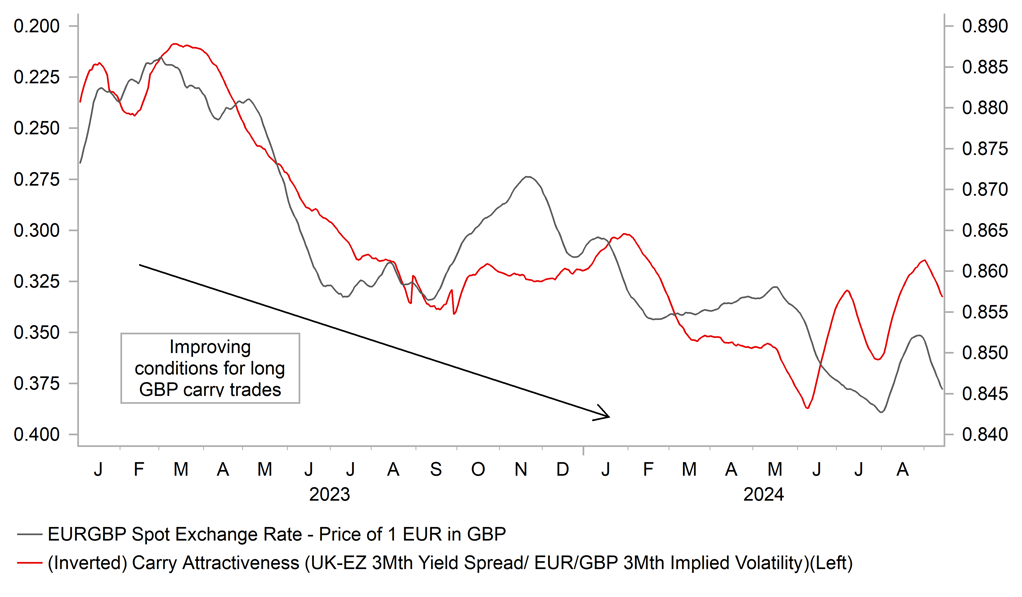

The summer was a volatile period for the GBP following strong gains in the first seven months of this year. The GBP was initially hit hard by the market turbulence at the start of August. The pick-up in financial market volatility triggered an unwind of popular carry trades. Yields on offer in the UK have been amongst the highest amongst G10 economies encouraging the build-up of long GBP positions. Fortunately, the period of market turbulence has proven to be short-lived which has allowed the GBP to rebound ahead of next week’s BoE policy meeting. After falling to a low of 1.2665 on 8th August cable has since risen to fresh year to date highs at 1.3266 on 27th August. Similarly, EUR/GBP has fallen back to levels where it was trading prior to the August market turbulence between 0.84000 and 0.8450 after hitting a high of 0.8625 on 8th August.

Recent price action suggests that short-term fundamental drivers for the GBP have not changed significantly beyond the pick-up in market volatility over the summer. The latest IMM report revealed that Leveraged Funds have been rebuilding long GBP positions over the last couple of weeks and longs have moved back to multi-year highs. Market participants are still anticipating that yields will remain relatively higher in the UK in the year ahead than in other major economies. The UK rate market is pricing in around 150bps of BoE rate cuts by August of next year that would see the policy rate fall to 3.50%. In comparison the euro-zone and US rate markets are expecting the ECB and Fed policy rates to fall to around 2.25% and 2.80% respectively by next August.

However, the recent data flow from the UK has increased the likelihood that the BoE could deliver faster and deeper rate cuts which would take some of the shine off the GBP’s outperformance so far this year. Services inflation, wages and GDP growth have all recently been weaker than the BoE had been forecasting. While the weakness is unlikely to be sufficient to trigger a back-to-back rate cut next week after the decision to begin cutting rates in August was finely balanced. It should encourage the BoE to deliver a dovish policy signal that another rate hike is likely in November. If the BoE continues to become less concerned over persistent upside inflation risks there is room to price in deeper rate cuts in the year ahead. After adjusting for forecasted UK inflation, the BoE’s real policy rate is expected to remain much higher than for other major central banks implying that BoE rate cuts are relatively underpriced in our view. The UK rate market could be encouraged to price in more BoE easing after next week’s policy meeting if the decision to leave rates on hold is closer than expected. It will be the first MPC meeting for new member Alan Taylor who could lean the MPC in a more dovish direction. He replaced Jonathan Haskel who was one of the most hawkish MPC members and voted to leave rates on hold in August.

The other policy decision that the BoE will announce next week are their plans for further balance sheet reduction in the year ahead. The BoE continues to emphasize that their quantitative tightening programme should be “gradual, predictable, and not disrupt financial markets”. According to a recent survey of market participants conducted by the BoE’s market intelligence team, the median view is for the BoE to announce another GBP100 billion of quantitative tightening for the year ahead. It would represent a continuation of the current pace of reduction over the last twelve months. With GBP80 billion of gilts set to roll off the BoE’s balance sheet in the year ahead, it would also require active Gilt sales of GBP10 billion. That would be a slowdown in active Gilt sales in the year ahead compared to active saes of around GBP50 billion over the last twelve months when there was a slower pace of Gilt roll offs. If there is a risk to next week’s QT announcement, we believe it is tilted in favour of a slower pace of QT for the year ahead. However, we do not expect the QT announcement to have a significant impact on GBP performance.

In these circumstances, we judge that risks are tilted to the downside for the GBP from next week’s MPC meeting. The GBP has tended to weaken following recent MPC meetings. Cable declined in the first six hours after 3 out of the last 4 MPC meetings by an average of -0.2%. The biggest sell-off was following the March MPC meeting when cable fell by -0.7%. For an even bigger negative GBP reaction, the BoE would have to deliver a surprise back-to-back rate cut next week which appears unlikely. We see a higher probability that back-to-back cuts could be delivered in November and December weighing more heavily on GBP performance later this year. Until then next week’s BoE meeting is unlikely to be sufficient on its own to significantly undermine the GBP’s carry appeal. With the BoE still expected to cut rates more slowly than the Fed in the coming months, any pullback for cable next week will be viewed as a short-term buying opportunity in anticipation that it can still rise further above the August high at 1.3266.

ARE THE BEST DAYS OVER FOR GBP CARRY TRADES?

Source: Bloomberg, Macrobond & MUFG GMR

LONG GBP POSITIONS REMAIN POPULAR

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

09/16/2024 |

10:00 |

Trade Balance SA |

Jul |

-- |

17.5b |

!! |

|

EUR |

09/16/2024 |

10:00 |

Labour Costs YoY |

2Q |

-- |

5.1% |

!!! |

|

EUR |

09/17/2024 |

10:00 |

Germany ZEW Survey Expectations |

Sep |

-- |

19.2 |

!! |

|

USD |

09/17/2024 |

13:30 |

Retail Sales Advance MoM |

Aug |

-0.1% |

1.0% |

!!! |

|

CAD |

09/17/2024 |

13:30 |

CPI YoY |

Aug |

2.1% |

2.5% |

!!! |

|

USD |

09/17/2024 |

14:15 |

Industrial Production MoM |

Aug |

0.1% |

-0.6% |

!! |

|

USD |

09/17/2024 |

15:00 |

NAHB Housing Market Index |

Sep |

40.0 |

39.0 |

!! |

|

GBP |

09/18/2024 |

07:00 |

CPI YoY |

Aug |

-- |

2.2% |

!!! |

|

GBP |

09/18/2024 |

07:00 |

PPI Output NSA YoY |

Aug |

-- |

0.8% |

!! |

|

EUR |

09/18/2024 |

10:00 |

CPI YoY |

Aug F |

-- |

2.2% |

!! |

|

USD |

09/18/2024 |

13:30 |

Housing Starts |

Aug |

1311k |

1238k |

!! |

|

CAD |

09/18/2024 |

18:30 |

BoC Summary of Deliberations |

!! |

|||

|

USD |

09/18/2024 |

19:00 |

FOMC Rate Decision |

5.25% |

5.50% |

!!! |

|

|

NZD |

09/18/2024 |

23:45 |

GDP SA QoQ |

2Q |

-0.3% |

0.2% |

!! |

|

AUD |

09/19/2024 |

02:30 |

Employment Change |

Aug |

30.0k |

58.2k |

!!! |

|

NOK |

09/19/2024 |

09:00 |

Deposit Rates |

4.50% |

4.50% |

!!! |

|

|

EUR |

09/19/2024 |

09:00 |

ECB Current Account SA |

Jul |

-- |

50.5b |

!! |

|

GBP |

09/19/2024 |

12:00 |

Bank of England Bank Rate |

5.00% |

5.00% |

!!! |

|

|

USD |

09/19/2024 |

13:30 |

Current Account Balance |

2Q |

-$262.0b |

-$237.6b |

!! |

|

USD |

09/19/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

09/19/2024 |

15:00 |

Existing Home Sales |

Aug |

3.90m |

3.95m |

!! |

|

JPY |

09/20/2024 |

00:30 |

Natl CPI YoY |

Aug |

3.0% |

2.8% |

!!! |

|

CNY |

09/20/2024 |

02:00 |

1-Year Loan Prime Rate |

3.35% |

3.35% |

!! |

|

|

JPY |

09/20/2024 |

Tbc |

BOJ Target Rate |

0.25% |

0.25% |

!!! |

|

|

GBP |

09/20/2024 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Aug |

-- |

0.5% |

!! |

|

GBP |

09/20/2024 |

07:00 |

Public Sector Net Borrowing |

Aug |

-- |

2.2b |

!! |

|

CAD |

09/20/2024 |

13:30 |

Retail Sales MoM |

Jul |

0.4% |

-0.3% |

!! |

|

EUR |

09/20/2024 |

16:00 |

ECB's Lagarde Delivers Lecture |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- It is an important week for G10 central bank policy updates. The Fed is expected to begin their rate cutting cycle. After the pick-up in employment and core inflation in August, the Fed is expected to begin their easing cycle with a 25bps rate cut although a larger 50bps can’t be completely ruled out if they take a more forward looking risk management approach to setting policy to guard against the risk of a sharper slowdown in the US labour market. Market participants will be listening closely to comments from Fed Chair Powell to assess how likely the Fed is to deliver larger 50bps cuts if there is a 25bps cut next week. The case for lower rates will be supported by a downward revision to the core PCE deflator forecasts.

- The BoE is expected to leave rates on hold in the week ahead after the finely balanced decision to begin cutting rates last month. Economic growth, wages and services inflation have been weaker recently strengthening the case of further rate cuts, although we expect the BoE to wait until the following policy meeting in November to cut rates for a second time. The BoE’s updated guidance should indicate another rate cut is likely in November. The latest UK CPI report for August will be released just before the BoE’s upcoming policy meeting. It is unlikely to change the BoE’s policy decision in the week ahead but could impact market expectations for the scale of BoE easing through the rest of this year. Further evidence of slowing inflation would open up more room for the BoE to keep cutting rates.

- The BoJ will be the last major central bank to hold their policy meeting next week. We expect the BoJ to leave rates on hold after raising rates for the second time at their last policy meeting in July. We expect the BoJ to stick to the hawkish message delivered at the July policy meeting and leave the door open to further rate hikes this year if Japan’s economy performs in line with their outlook. The BoJ is currently assessing the impact of recent policy tightening on Japan’s economy. The recent strengthening of the yen and weakness in the domestic equity market is unlikely to trigger a dovish shift in the BoJ’s policy communication in the week ahead.