To read the full report, please download PDF.

Price action continues to disappoint USD bulls

FX View:

There was a high level of conviction at the start of this year that the USD would strengthen further as evident in crowded long positioning that had reached the highest levels since 2018. However, those expectations have not yet materialized in reality with the USD on course for its fourth week of losses out of the last five. USD selling has continued this week despite President Trump outlining plans to impose 25% tariffs on steel and aluminium and “reciprocal tariffs” on a country-by-country basis. The tariffs will not be imposed until March and April which has added to the initial sense of relief that Trump’s tariffs won’t be as disruptive for global trade and growth as initially feared. However, the initial sense of optimism could still prove to be misplaced. There is a higher risk now that the reciprocal tariffs will be implemented widely and be more disruptive. Alongside the Fed keeping rates higher for longer, it is still premature to abandon our call for a stronger USD even if it may take a little longer to materialize.

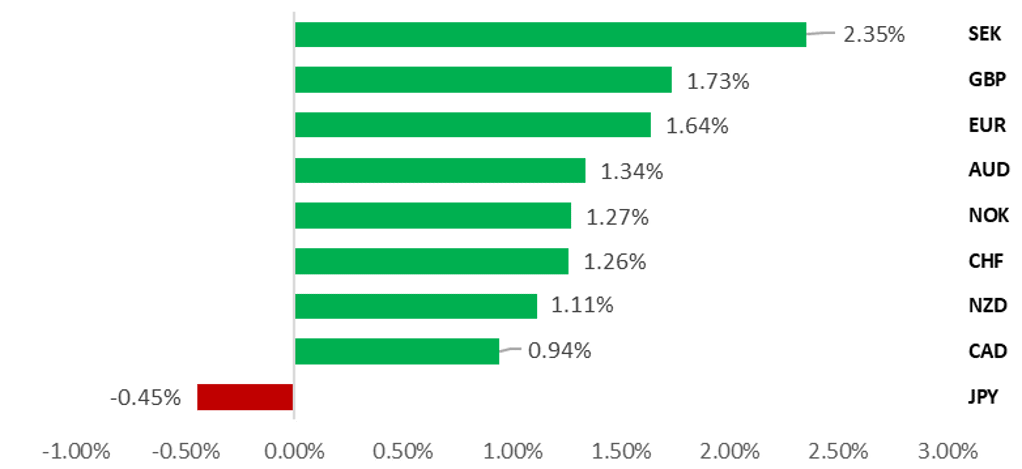

BROAD-BASED USD WEAKNESS APART FROM AGAINST JPY

Source: Bloomberg, 14:30 GMT, 14h February 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are sticking with our short EUR/JPY trade idea. The narrowing yield differential should continue to weigh down on EUR/JPY.

Weekly Calendar:

The RBA and RBNZ hold their latest policy meetings in week ahead. The RBA is expected to finally start their easing cycle by delivering a 25bps rate cut. The RBNZ is expected to continue cutting rates at a faster pace in the week ahead by delivering a third consecutive 50bps rate cut.

Short Term Fair Value Modelling:

This week we monitor the relationships between spot and fair value for our JPY, GBP and EUR short-term regression models. In recent periods we identify a convergence in the relationship for USDJPY, GBP/USD and EUR/USD where fair value models identify mis-valuations of 0.7%, -0.9% and -1.2% respectively.

FX Views

USD: Is the coast clear for further USD weakness?

The USD is on track to weaken for the second consecutive week with the dollar index falling back below the 107.00-level at the end of this week as it moves further below the high from 13th January set at 110.18. The US dollar has weakened further this week even as US yields have picked-up. The 10-year US Treasury yield has risen back above 4.50% after hitting a low of 4.38% on 7th February. Yield spreads are one factor that have remained supportive for the USD. Market participants still expect the Fed to leave rates on hold for longer at the start of this year while other G10 central banks continue to cut rates. The BoE, ECB and BoC have already cut rates at the start of this year and left the door open to further rate cuts in the near-term. The RBA is expected to start their own easing cycle in the week ahead alongside the RBNZ delivering another larger 50bps rate cut. In contrast, the Fed is currently expected to leave rates on hold at least through the 1H of this year. The Fed needs to see further evidence of slowing inflation and/or a weaker labour market to provide justification for another cut.

The positive impact of widening yields spreads in favour of the USD has been offset recently by two other factors that have been having more impact in weakening the USD. Firstly, this week’s phone call (click here) between US President Trump and Russian President Putin has boosted investor optimism that a ceasefire deal can reached to end the conflict in Ukraine. It has helped to lift European currencies against the USD to reflect the potential for an easing of geopolitical risk premium priced into regional assets. It has reinforced the outperformance of European over US equity markets at the start of this year. The Polish equity market has been one of the best performing so far this year with the WIG index up just over 20% in USD terms. After the phone call, President Trump stated that their teams would start negotiations immediately and he’ll probably meet President Putin in person in Saudi Arabia in the “not-too-distant future”.

For a peace deal between the Ukraine and Russia to have a bigger and more lasting positive impact on the performance of the EUR and other European currencies, it would have to have a significant impact in helping to lower energy prices in Europe. Natural gas prices in Europe (click here) have continued to move higher in Europe over the past year and remain a headwind to growth especially for the industrial sector which is one of the main reasons Germany’s economy has stagnated in recent years. The resumption of significant gas flows from Russia to Europe would provide a welcome positive shock to the growth outlook in the region. However, we are currently sceptical over the appetite amongst major European economies including Germany and Italy to quickly welcome back the return of gas flows from Russia after the painful adjustment to wean themselves off Russia’s cheap energy supply and efforts to find alternative sources in recent years even if a peace deal is reached soon. A slower and/or more limited return of Russian gas to Europe will dampen upside potential for the EUR and other European currencies against the USD.

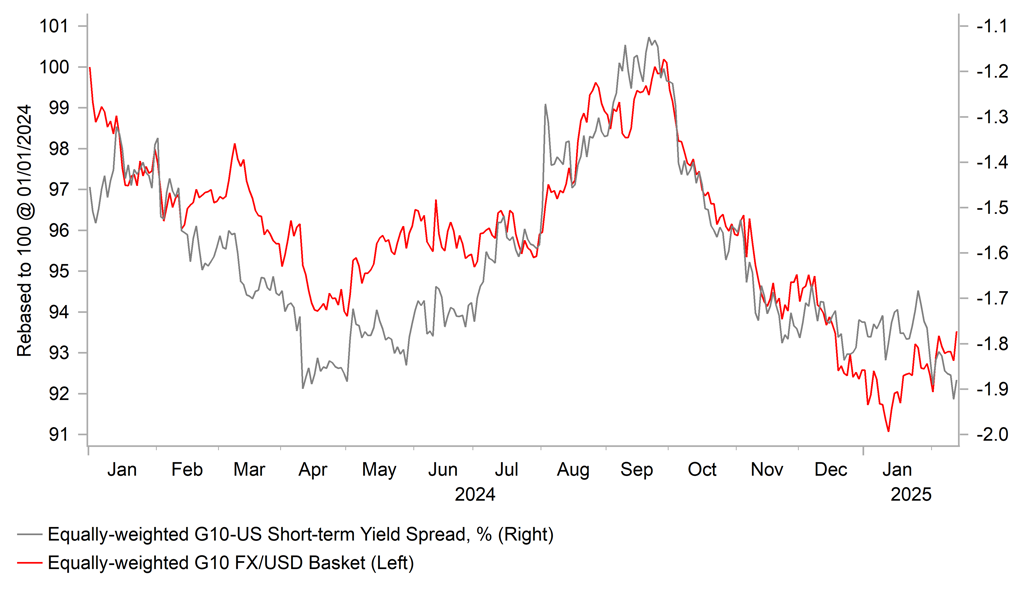

YIELD SPREADS STILL SUPPORTIVE FOR USD

Source: Macrobond & Bloomberg

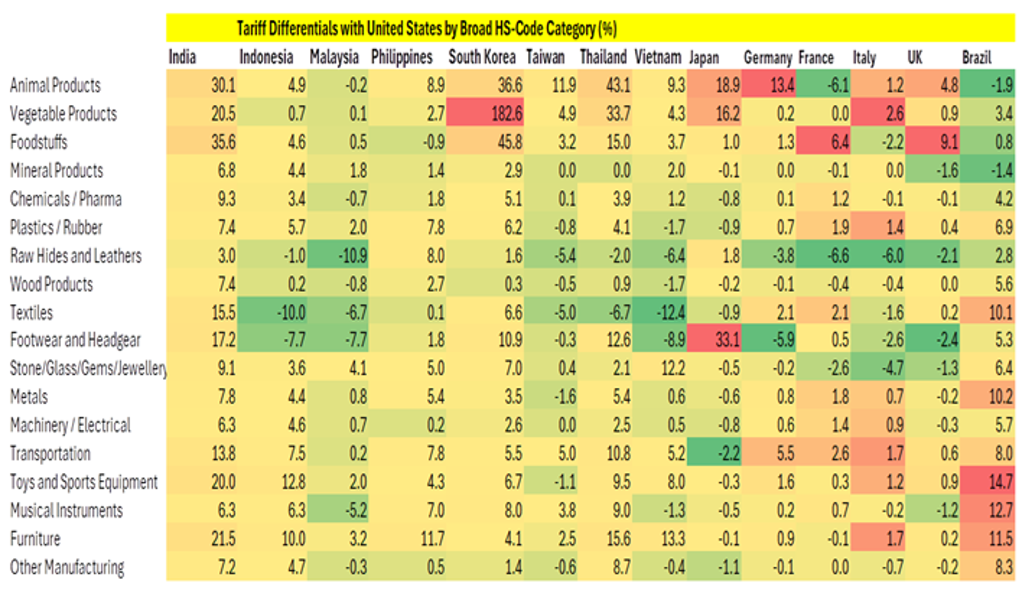

TARIFF DIFFERENTIALS WITH US

Source: World Bank WITS & MUFG Research

The other important factor that has contributed to a weaker USD has been the general sense of relief so far this year that President Trump’s tariff announcements have not been as bad as feared. So far the main tariff hikes implemented have been the 10% uplift on imports from China. He also announced plans to implement 25% tariff hikes on steel and aluminium from all trading partners although they are not scheduled to take effect until 12th March providing some time for trading partners to try to secure exemptions. The slower implementation of tariff hikes was again evident when President Trump announced his plans for “reciprocal tariffs”. He has ordered Commerce Secretary Howard Lutnick and US Trade Representative Jamieson Greer to propose new “reciprocal tariffs” on a country-by-country basis in an effort to rebalance trade relations. It would be a big structural change to the trading system and could take months to complete. Howard Lutnick is optimistic though that it should be complete by 1st April and then President Trump will act immediately.

The finer details of how President Trump will implement “reciprocal tariffs” remains unclear and will rest on the methodology that Howard Lutnick and Jamieson Greer will come up with. President Trump is directing that “reciprocity” is based not just on the tariffs imposed by other countries on US imports, but also a range of other non-tariff factors including: i) other countries’ taxes such as VAT imposed on US imports, ii) exchanges rates, iii) government subsidies for companies in their home countries iv) bilateral trade balances with the US and v) regulations which are more difficult to quantify and considered on a case-by-case basis. It will create additional uncertainty over the potential negative impact of the tariffs. We believe there is a higher risk now that the “reciprocal tariffs” will be implemented widely and could prove more disruptive. The incorporation of non-tariff factors makes a big difference.

The difference in average tariff rates between the US and other major developed economies is relatively small but larger for emerging market economies. But if you include value added taxes (VAT) which are applied to US imports then it could require President Trump to put in place much higher tariffs against other major economies as well. For example the standard VAT rate in EU countries is between 15% and 27% although there are reduced VAT rates applied to specific goods depending on which EU country. Similarly Japan’s consumption tax, which constitutes a VAT, applies a 10% rate (except to foods and some other items). When trying to quantify how much tariffs should be raised against each country based on exchange rates and domestic regulations it will be even more difficult to quantify. President Trump also told reporters yesterday that he would enact tariffs hikes on cars, semiconductors and pharmaceuticals “over and above” the reciprocal tariffs at a later date.

In light of these developments, we are not convinced that the recent US dollar sell-off will be sustained for long. The final methodology for determining what “reciprocal tariff” hikes to implement will be important in determining how disruptive they are for global trade and growth. We are wary of a more disruptive outcome now that non-tariff factors will be included. Additionally, ongoing trade policy uncertainty on its own should remain supportive for the US dollar until there is more clarity and could help limit room for USD weakness to extend further in the near-term. A deeper correction lower for the USD would provide more attractive levels to buy USD’s heading into Q2 while plans for reciprocal tariff hikes are finalized.

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

02/16/2025 |

23:50 |

GDP Annualized SA QoQ |

4Q P |

1.1% |

1.2% |

!! |

|

EUR |

02/17/2025 |

10:00 |

Trade Balance SA |

Dec |

-- |

12.9b |

!! |

|

AUD |

02/18/2025 |

03:30 |

RBA Cash Rate Target |

4.10% |

4.40% |

!!! |

|

|

GBP |

02/18/2025 |

07:00 |

Average Weekly Earnings 3M/YoY |

Dec |

-- |

5.6% |

!!! |

|

GBP |

02/18/2025 |

07:00 |

Employment Change 3M/3M |

Dec |

-- |

36k |

!!! |

|

SEK |

02/18/2025 |

07:00 |

CPI YoY |

Jan F |

-- |

1.0% |

!! |

|

EUR |

02/18/2025 |

07:45 |

France CPI YoY |

Jan F |

-- |

1.4% |

!! |

|

GBP |

02/18/2025 |

09:30 |

Output Per Hour YoY |

4Q |

-- |

-1.8% |

!! |

|

CAD |

02/18/2025 |

13:30 |

CPI YoY |

Jan |

-- |

1.8% |

!!! |

|

JPY |

02/18/2025 |

23:50 |

Trade Balance Adjusted |

Jan |

-¥319.4b |

-¥33.0b |

!! |

|

AUD |

02/19/2025 |

00:30 |

Wage Price Index YoY |

4Q |

3.2% |

3.5% |

!! |

|

NZD |

02/19/2025 |

01:00 |

RBNZ Official Cash Rate |

3.75% |

4.25% |

!!! |

|

|

GBP |

02/19/2025 |

07:00 |

CPI YoY |

Jan |

-- |

2.5% |

!!! |

|

EUR |

02/19/2025 |

09:00 |

ECB Current Account SA |

Dec |

-- |

27.0b |

!! |

|

USD |

02/19/2025 |

13:30 |

Housing Starts |

Jan |

1394k |

1499k |

!! |

|

USD |

02/19/2025 |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

!! |

|

|

AUD |

02/20/2025 |

00:30 |

Employment Change |

Jan |

15.0k |

56.3k |

!!! |

|

CNY |

02/20/2025 |

01:00 |

1-Year Loan Prime Rate |

3.10% |

3.10% |

!! |

|

|

USD |

02/20/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

02/20/2025 |

17:05 |

Fed's Musalem Speaks |

!! |

|||

|

JPY |

02/20/2025 |

23:30 |

Natl CPI YoY |

Jan |

3.9% |

3.6% |

!!! |

|

GBP |

02/21/2025 |

07:00 |

Public Sector Net Borrowing |

Jan |

-- |

17.8b |

!! |

|

GBP |

02/21/2025 |

07:00 |

Retail Sales Inc Auto Fuel YoY |

Jan |

-- |

3.6% |

!! |

|

EUR |

02/21/2025 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Feb P |

-- |

46.6 |

!! |

|

EUR |

02/21/2025 |

09:00 |

HCOB Eurozone Services PMI |

Feb P |

-- |

51.3 |

!! |

|

GBP |

02/21/2025 |

09:30 |

S&P Global UK Manufacturing PMI |

Feb P |

-- |

48.3 |

!! |

|

GBP |

02/21/2025 |

09:30 |

S&P Global UK Services PMI |

Feb P |

-- |

50.8 |

!! |

|

CAD |

02/21/2025 |

13:30 |

Retail Sales MoM |

Dec |

-- |

0.0% |

!! |

|

USD |

02/21/2025 |

14:45 |

S&P Global US Composite PMI |

Feb P |

-- |

52.7 |

!! |

|

USD |

02/21/2025 |

15:00 |

U. of Mich. Sentiment |

Feb F |

-- |

67.8 |

!! |

|

CAD |

02/21/2025 |

17:45 |

BoC Governor Tiff Macklem Speaks |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The RBA and RBNZ hold their latest policy meetings in week ahead. The RBA is expected to finally start their easing cycle by delivering a 25bps rate cut. The release last month’s softer than expected Australian CPI report for Q4 has encouraged expectations for lower rates. The report revealed a sharper than expected slowdown in core inflation measures. The RBA has not pushed back against market expectations for a rate cut in the week ahead. We expect the RBA to emphasize that further rate cuts will be data dependent and that any further rate cuts rates will be gradual.

- The RBNZ is expected to continue cutting rates at a faster pace in the week ahead by delivering a third consecutive 50bps rate cut lowering the policy rate to 3.75%. The updated policy guidance could signal more caution over the pace of further rate cuts as the policy rate moves closer to RBNZ’s estimate of the neutral rate closer to 3.00%. The case for another 50bps rate cut in the week ahead was supported by the latest labour market report from New Zealand which revealed that the unemployment rate rose to four-year high of 5.1% in Q4.

- The main economic data releases in the week ahead will be from the UK including the latest labour market and CPI reports. There was some positive news for the UK economy at the end of this week after the release of the GDP report for Q4 revealed that growth surprised to the upside expanding by 0.1% instead of contracting by -0.1% as expected by the BoE. The UK labour market data is attracting more attention from BoE policymakers after showing more signs of softening. It is one of the reasons why we expect the BoE to cut rates again in May despite ongoing discomfort over still above target inflation in the UK.