To read a full report, please download PDF

BoJ to stay on hold & JPY strength ahead

FX View:

The US dollar has weakened sharply this week in response to the pivot from the Fed that has fuelled another sharp drop in US yields. We are sceptical that this US dollar sell-off can be sustained and the scale of the move could quickly be viewed as excessive. What would be the catalyst for an even more dovish turn for the Fed now with a March rate cut close to priced? We seem to be at peak optimism in terms of Fed cuts next year and a correction seems more likely than not. USD/JPY could be part of that given the drop to the most recent low amounted to 10 big figures. We do not expect a BoJ policy change next week and the BoJ could also be cautious on making changes to the statement that fuels expectations of a hike in January. The BoJ probably want maximum flexibility. However, any yen selling from here is unlikely to last long given the bulk of the recent decline in global yields will likely hold as the global inflation declines are real.

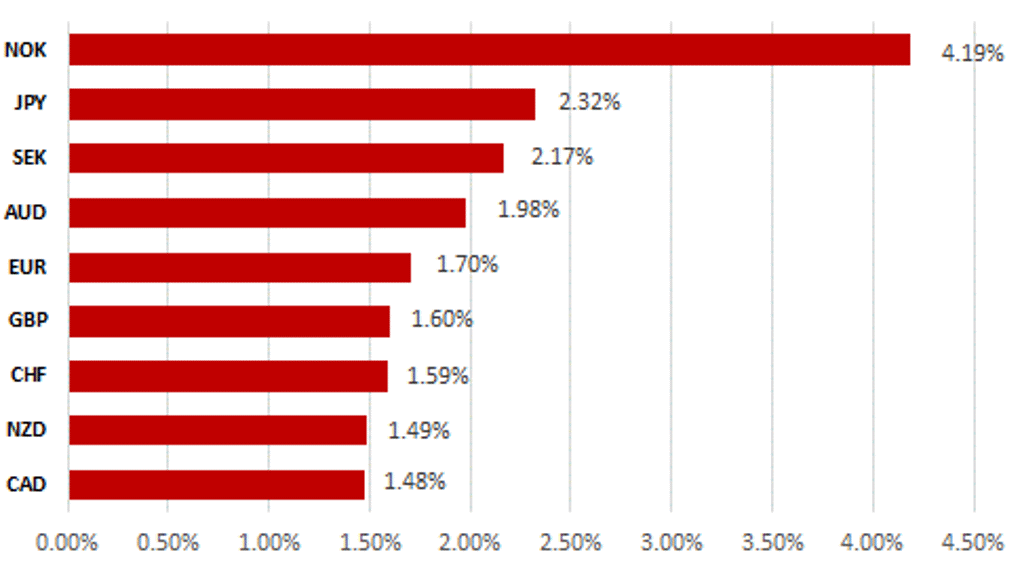

FED PIVOT FUELS ACROSS THE BOARD GAINS FOR G10 FX VS USD

Source: Bloomberg, 13:00 GMT, 15th December 2023 (Weekly % Change vs. USD

Trade Ideas:

We are recommending a new short EUR/NOK trade idea and maintaining our short EUR/JPY trade idea established last week.

JPY Flows:

The monthly Balance of Payments data for October revealed the largest ever services trade surplus reinforcing the gradual improvement in overall trade balances and the still substantial investment income surpluses.

FX Seasonality:

Our analysis suggests that EUR, NZD, CHF and SEK exhibit seasonal effects and tend to outperform the underlying trends in December by a minimum of 1%. This persists over January for two of those currencies - NZD and SEK.

FX Views

JPY: BoJ on hold at meeting next week

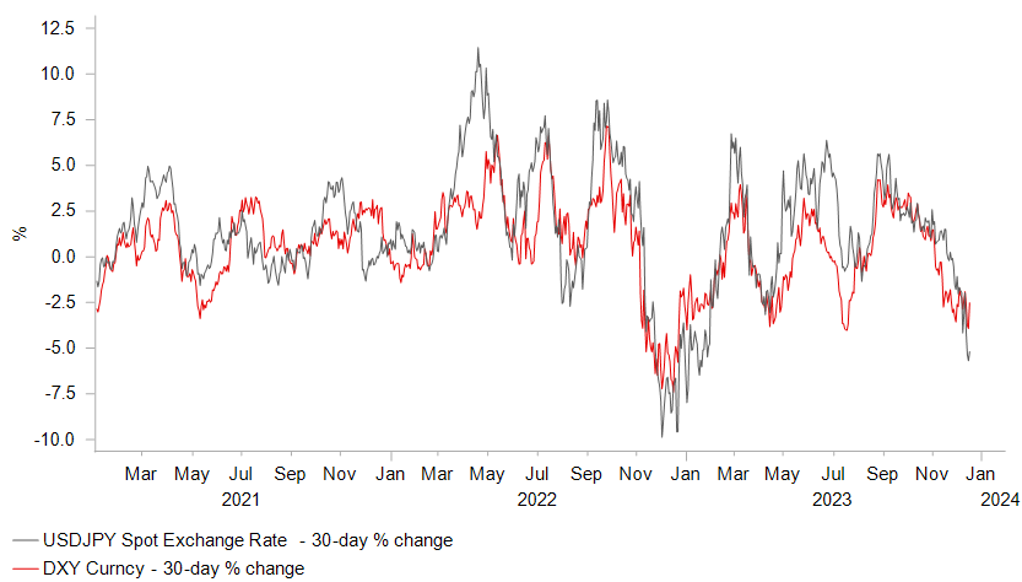

The surge of the yen last Thursday on comments from BoJ Governor Ueda and from Deputy Governor Himino the day before that sparked speculation of a tightening of monetary policy by the BoJ at next week’s meeting was nearly fully reversed by Monday after the Bloomberg reported “sources familiar with the matter” as saying that the BoJ was not planning any policy change at next week’s meeting. Since Monday however, yen appreciation has resumed and indeed USD/JPY yesterday hit a new low, not seen since the end of July. The renewed strength this week even as speculation of a BoJ policy move next week subsided highlights a key point – while the yen can swing around on BoJ monetary policy speculation, developments abroad will likely be more important in terms of the sustained trend for the yen. The dovish pivot by the Fed played a big part in yen strength and even though the ECB and the BoE did not pivot like the Fed, the growth and inflation trajectory means lower global yields ahead which will keep the yen on a firmer footing.

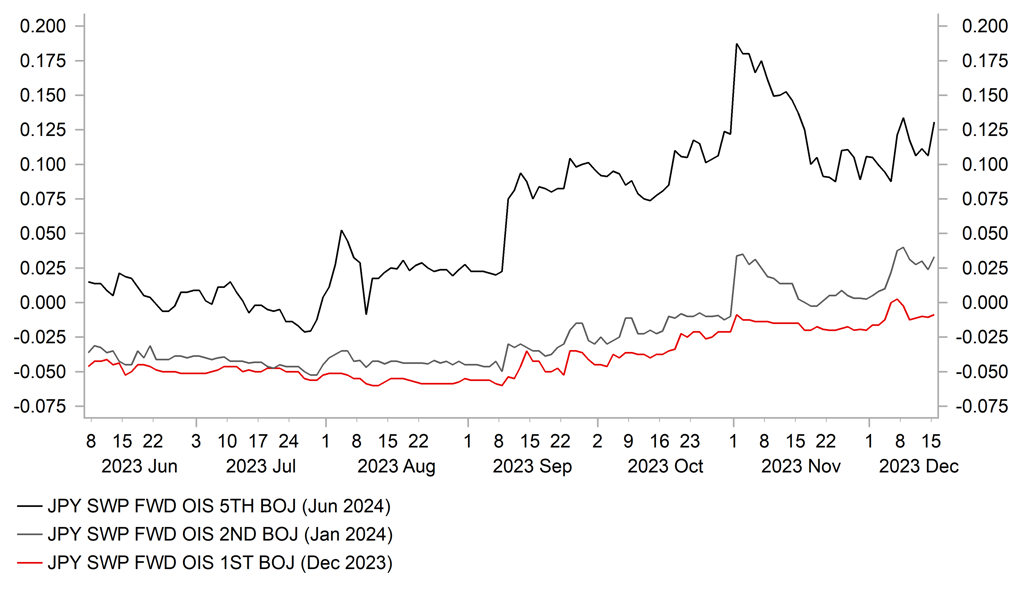

After the Bloomberg reports on Monday, expectations are very low for a change to NIRP with the OIS implied change at this meeting close to zero. So the focus for the financial markets next week will be on the statement and then the comments from Governor Ueda in his press conference. The most obvious potential alteration to the statement would be to the final sentence – “The Bank will continue to maintain the stability of financing, mainly of firms, and financial markets, and will not hesitate to take additional easing measures if necessary”. If the BoJ were to remove the bias to ease, that would be a strong signal to the markets and would prompt a clear rates and FX reaction. Making changes to the assessment of the economy or inflation seems less likely given it was the last meeting when we had an updated release of forecasts. That said, there have been some developments that could prompt some tweak in wording related to inflation and wages to indicate progress is being made.

The BoJ ahead of the meeting next week will be pleased with the details of the Tankan survey released this week and certainly helps support the view that domestic economic conditions are more supportive of inflation remaining stickier. The overall diffusion indices increased in Q4 which relative to business sentiment indicators globally is a positive. Price indices also revealed easing price pressures but the declines in output prices were still relatively modest relative to the declines we have seen elsewhere. The Output Price for non-manufacturing enterprises in particular remained at very elevated levels compared to long-term averages. In addition, the trade union umbrella group in Japan – Rengo – announced a target objective in upcoming wage negotiations of 5% or more. Certain unions in November also confirmed they would seek increases of a similar magnitude. UA Zensen announced a target to gain an increase of 6% for restaurant and retail workers. The government this week announced a new reform plan of tax incentives to encourage large companies to pay wages of 7% or more.

CLOSE TO ZERO % PRICED FOR BOJ NEXT WEEK

Source: Bloomberg, Macrobond & MUFG GMR

TANKAN OUTPUT PRICES STILL ELEVATED

Source: Bloomberg, Macrobond & MUFG GMR

So it could be argued that there have been developments that could sway the BoJ to alter its views more notably on the inflation outlook and signal through its guidance in the statement that a policy change is imminent. However, many of the comments from Governor Ueda last Thursday did also suggest a high level of uncertainty that means the BoJ’s cautious approach could continue for now. To alter the guidance through an upgrade to the inflation or wage view and/or a dropping of the easing bias would reduce the BoJ’s flexibility at the January meeting. We still believe the BoJ will act at that meeting to end NIRP and YCC but at the same time the BoJ will likely see the benefits of not providing reason for speculation, especially given the decline global yields and the strengthening of the yen. Governor Ueda’s press conference and his views on evolving progress toward price stability and wage growth may be where we get an indication that gradual progress has continued, thus leaving open the possibility of a change in policy in January but also leaving the BoJ with some flexibility.

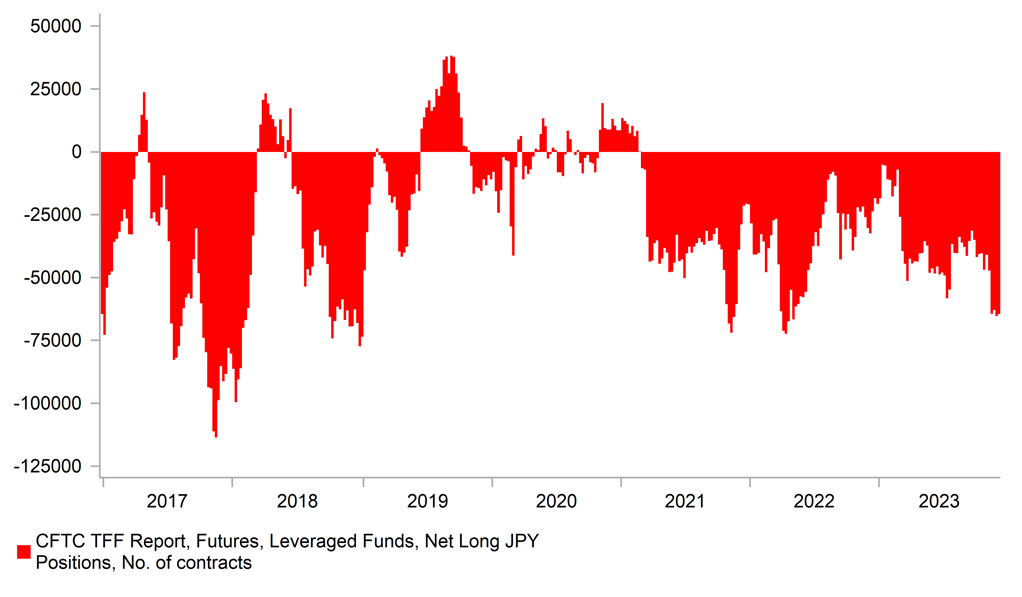

The correction stronger of the yen is now the most significant since the period from October last year to January. Any hawkish surprise next week like the removal of the bias to ease or a more explicit signal of the price stability goal being close to achieved will certainly see the yen advance further. IMM positioning data still indicates, as of last Tuesday, substantial short JPY positions held amongst Leveraged Funds. The pattern of changes in positioning does tend to show a lightening of positions although in some years it is modest (2019) or is more an early January event (2018-19). Fundamentals as a driver of FX over the coming weeks can certainly play less of a role and liquidity and positioning can be key. USD/JPY though has now dropped 10 big figures from the high in November and hence further big moves to the downside are much less likely. Indeed, a status-quo message from Ueda on Tuesday could prompt some renewed selling although yields abroad will also remain important.

The significant drop in USD/JPY leaves the balance of risks around the BoJ meeting on Tuesday more balanced. The BoJ in wanting flexibility may be reluctant to provide any strong signals of a change in policy in January. If that were to prompt yen selling, we doubt it would amount to much given the global backdrop is conducive to the yen remaining under upward pressure going forward.

SHORT JPY POSITIONS STILL SUBSTANTIAL

Source: Bloomberg, Macrobond & MUFG GMR

USDJPY 30-DAY % CHANGE LARGER THAN DXY CHANGE

Source: Bloomberg, Macrobond & MUFG GMR

USD: Fed leads the way to cut rates but will the USD continue to weaken?

The USD has suffered a heavy sell-off in recent days resulting in the dollar index falling back towards year to date lows between 100.00 and 102.00. Over the last two trading days the dollar index has declined by -1.8% on a closing price basis which is the largest sell-off over an equivalent period since 13th July. On that occasion it proved to be the worst point for USD selling, and was then quickly followed by a powerful rebound into the autumn. Could history repeat itself and the current sharp sell-off provide attractive levels to buy US dollars in anticipation of another rebound at the start of next year?

The main trigger for the USD sell-off has been the Fed’s dovish policy pivot (click here). Chair Powell provided the strongest indication that the Fed is beginning to actively consider cutting rates in response to slowing inflation. The updated guidance has opened up the possibility of the first cut being delivered as early as in Q1. In contrast, the European central banks of the BoE (click here) and ECB (click here) are lagging behind the Fed and have not yet actively discussed rate cuts. The relatively hawkish guidance reduces the likelihood that the BoE and ECB will begin to cut rates as soon in Q1. We continue to expect their first hikes in Q2. With the Fed leading the way to cut rates, it has increased downside risks for the USD heading into early next year.

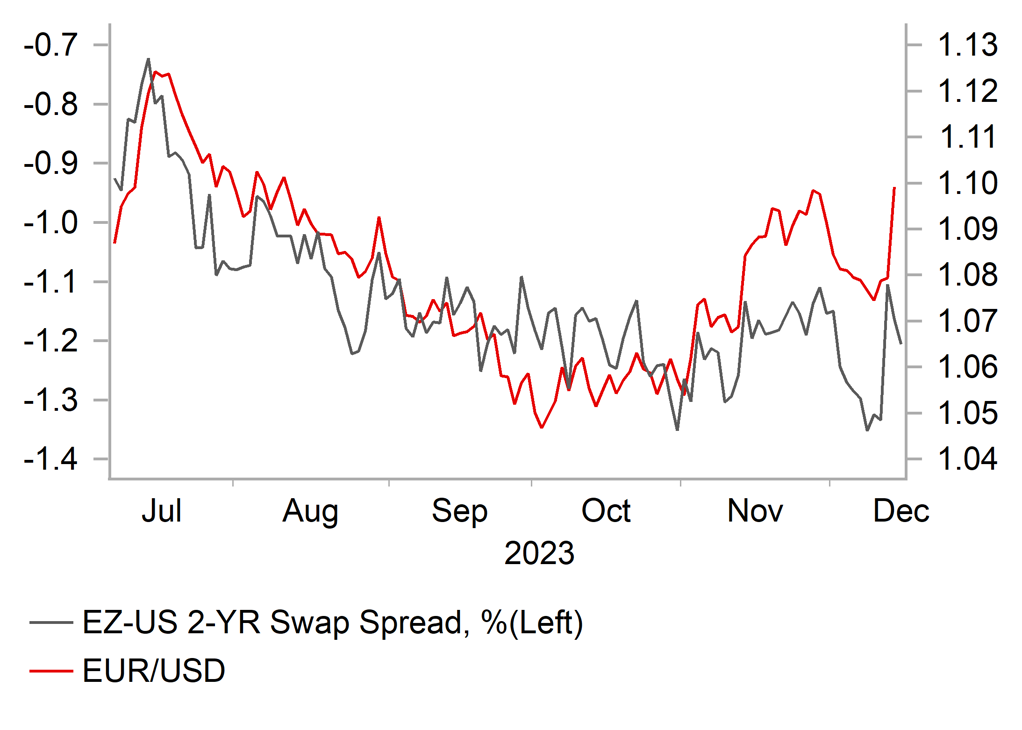

Yet we remain wary over chasing further USD weakness in the near-term, and conditions could fall into place early next year for a rebound against the EUR and GBP. Firstly, the US rate market is already pricing in expectations for earlier and deeper Fed rate cuts which provides a higher hurdle for further dovish policy surprises. The US rate curve is currently pricing in 20bps of cuts by March, 87bps of cuts by July and 144bps of cuts by December which appears well priced to us at this stage unless the Fed starts off by cutting rates in larger 50bps increments. Additionally, New York Fed President Williams has just pushed back against more imminent rate cut speculation by stating that it is “premature” to be thinking about a cut in March. The comments suggest that Q2 is more likely as a base case for the timing of the first rate cut.

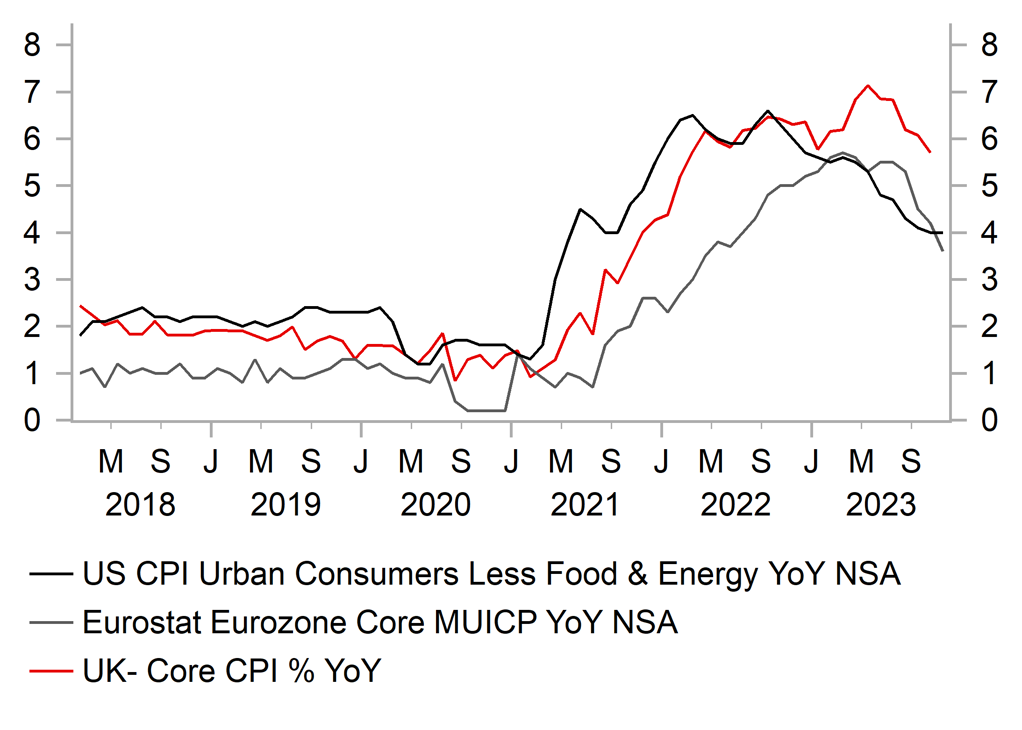

Secondly, the weakening economic data flow from Europe could quickly trigger a bigger dovish policy shift from European central banks early next year. Further evidence that core inflation is falling more quickly alongside ongoing economic stagnation/recession risks in the euro-zone could force the ECB to abandon their commitment to keep rates at restrictive levels, and start moving back towards more neutral levels closer to around 1.50-2.00%. Even in the UK where the BoE is more concerned over persistent inflation risks, there have been encouraging disinflationary developments this week. Wage growth is slowing and GDP contracted in October

In these circumstances, the window for further USD weakness against the EUR and GBP could prove short-lived. The JPY remains best placed to outperform amongst the majors currencies as the Fed, ECB and BoE all begin to lower rates next year.

YIELD SPREADS HAVE NOT MOVED MUCH AGAINST USD

Source: Bloomberg, Macrobond & MUFG GMR

CORE INFLATION IN EZ IS SLOWING DOWN QUICKLY

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

12/18/2023 |

Tbc |

ECB Biennial Conference |

!! |

|||

|

EUR |

12/18/2023 |

09:00 |

Germany IFO Business Climate |

Dec |

-- |

87.3 |

!! |

|

GBP |

12/18/2023 |

10:30 |

BoE Deputy Governor Broadbent speaks |

!!! |

|||

|

USD |

12/18/2023 |

15:00 |

NAHB Housing Market Index |

Dec |

38.0 |

34.0 |

!! |

|

EUR |

12/18/2023 |

15:00 |

ECB's Lane Chairs Panel |

!!! |

|||

|

AUD |

12/19/2023 |

00:30 |

RBA Minutes of Dec. Policy Meeting |

!! |

|||

|

JPY |

12/19/2023 |

Tbc |

BOJ Policy Balance Rate |

-0.10% |

-0.10% |

!!! |

|

|

EUR |

12/19/2023 |

10:00 |

CPI YoY |

Nov F |

-- |

2.4% |

!!! |

|

USD |

12/19/2023 |

13:30 |

Housing Starts |

Nov |

1360k |

1372k |

!! |

|

CAD |

12/19/2023 |

13:30 |

CPI YoY |

Nov |

2.8% |

3.1% |

!!! |

|

USD |

12/19/2023 |

17:30 |

Fed's Bostic speaks |

!! |

|||

|

JPY |

12/19/2023 |

23:50 |

Trade Balance |

Nov |

-¥962.4b |

-¥662.5b |

!! |

|

GBP |

12/20/2023 |

07:00 |

CPI YoY |

Nov |

-- |

4.6% |

!!! |

|

EUR |

12/20/2023 |

09:00 |

ECB Current Account SA |

Oct |

-- |

31.2b |

!! |

|

USD |

12/20/2023 |

13:30 |

Current Account Balance |

3Q |

-- |

-$212.1b |

!! |

|

EUR |

12/20/2023 |

14:00 |

ECB's Lane Speaks |

!!! |

|||

|

USD |

12/20/2023 |

15:00 |

Conf. Board Consumer Confidence |

Dec |

103.3 |

102.0 |

!! |

|

CAD |

12/20/2023 |

18:30 |

BoC Releases Summary of Deliberations |

!!! |

|||

|

GBP |

12/21/2023 |

07:00 |

Public Sector Net Borrowing |

Nov |

-- |

14.0b |

!! |

|

CAD |

12/21/2023 |

13:30 |

Retail Sales MoM |

Oct |

0.8% |

0.6% |

!! |

|

USD |

12/21/2023 |

13:30 |

GDP Annualized QoQ |

3Q T |

5.2% |

5.2% |

!! |

|

USD |

12/21/2023 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

JPY |

12/21/2023 |

23:30 |

Natl CPI YoY |

Nov |

2.7% |

3.3% |

!!! |

|

GBP |

12/22/2023 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Nov |

-- |

-0.3% |

!! |

|

GBP |

12/22/2023 |

07:00 |

GDP QoQ |

3Q F |

-- |

0.0% |

!! |

|

GBP |

12/22/2023 |

07:00 |

Current Account Balance |

3Q |

-- |

-25.3b |

!! |

|

CAD |

12/22/2023 |

13:30 |

GDP MoM |

Oct |

-- |

0.1% |

!! |

|

USD |

12/22/2023 |

13:30 |

PCE Core Deflator MoM |

Nov |

0.2% |

0.2% |

!!! |

|

USD |

12/22/2023 |

15:00 |

New Home Sales |

Nov |

685k |

679k |

!! |

|

USD |

12/22/2023 |

15:00 |

U. of Mich. Sentiment |

Dec F |

69.4 |

69.4 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The BoJ is the last of the major central G10 central banks to provide their final policy update of 2023. We expect the BoJ to leave their policy settings unchanged in the week ahead. It follows reports on Bloomberg earlier this week stating that the BoJ still believed it was premature to bring an end to negative rates as soon as next week which was clearly intended to put a dampener on imminent rate hike speculation. However, we continue to believe that the BoJ is moving closer to raising rates at the start of next year. We will be watching closely comments from Governor Ueda in the press conference to see if he starts to prepare markets for a hike in January by displaying more confidence in the outlook for wage growth next year.

- The main economic data releases in the week ahead will be the latest CPI reports from the euro-zone (Tues), Canada (Tues), UK (Wed) and Japan (Thurs). The US PCE deflator report for November will also be released on Friday. After the release of the softer than expected US PPI report this week, market participants are expecting a soft PCE deflator report next week. It has already contributed to the Fed’s dovish policy pivot this week.

- The Fed’s dovish policy guidance has also encouraged expectations that the BoC will begin to cut rates earlier next year as well. Those expectations could be reinforced in the week ahead if the latest CPI report from Canada provides further evidence that core inflation is slowing more in recent months alongside below trend growth. In contrast, core inflation has proven more persistent so far in the UK. It has made the BoE push back more strongly against expectations for earlier rate cuts.