To read the full report, please download PDF.

Turning point for BoJ policy & JPY?

FX View:

The major G10 FX rates have continued to trade in tight trading ranges over the past week. Further evidence of a pick-up in US inflation at the start of this year has helped to lift US yields back close to year to date highs and encouraged a stronger USD. It has increased the likelihood of a more hawkish policy message from the Fed at next week’s FOMC meeting. The timing of first Fed rate cut could be delayed into the 2H of this year. The other main development over the past week has been stronger wage negotiation results from Japan that should make the BoJ more confident in meeting their inflation target. Stronger wage negotiation results support our view that the BoJ will begin tightening monetary policy next week. We expect an end to NIRP and YCC. However, it may not prove to be as significant as a turning point for the JPY unless the BoJ’s updated guidance casts some doubt on market expectations for only a gradual pace of tightening going forward.

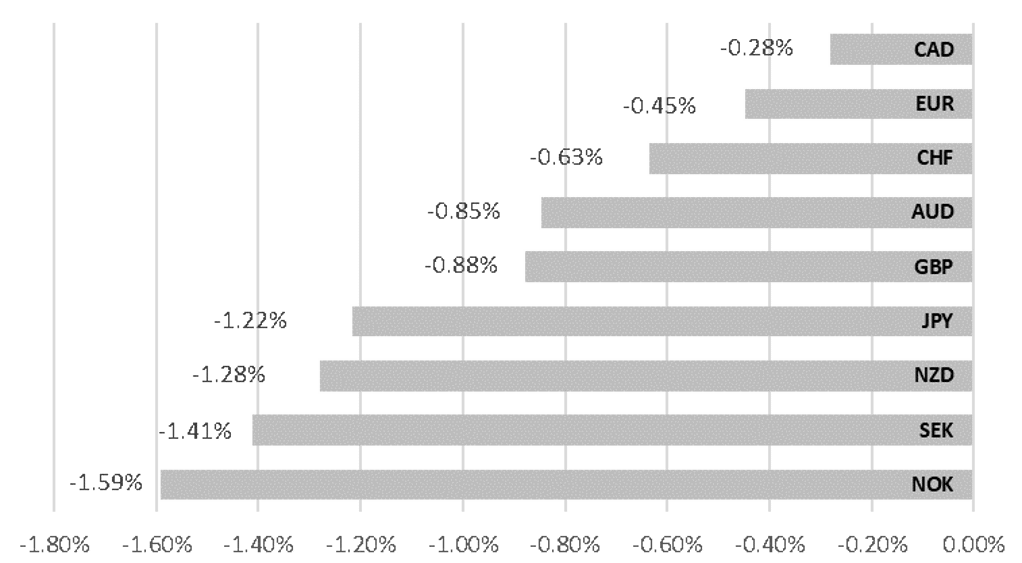

USD STAGES MODEST REBOUND ON BACK OF STRONGER US INFLATION

Source: Bloomberg, 15:00 GMT, 8th March 2024 (Weekly % Change vs. USD

Trade Ideas:

We are maintaining our short EUR/GBP and CHF/JPY trade ideas.

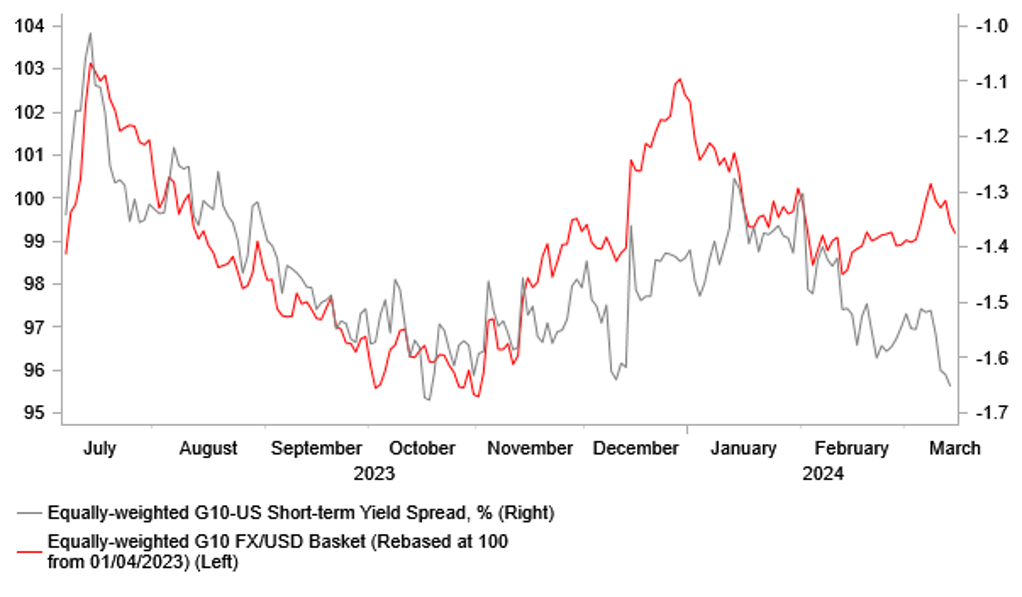

G10 FX Correlations:

G10 FX rates have been strongly correlated to US rates at the start of this year both at the short and long end of the curve. The strength of correlations has been broadly similar across G10 FX pairs. USD/CAD and NZD/USD have had the weakest correlations to US rates.

Short-term FX Momentum Signals:

This week we focus on the distribution of short-term FX momentum signals for G10 currencies. Considering performances across 7-week and 9-week horizons we identify AUD/USD, EUR/USD, GBP/USD have broken above their respective upper-bound threshold (BUY-signal) while USD/JPY has broken below its lower-bound threshold (SELL-signal). We expect these moves to continue in the week ahead.

FX Views

USD/JPY: A decisive week ahead after BoJ given green light to tighten policy

The USD has rebounded over the past week bringing an end to three consecutive weeks of declines for the dollar index. The main trigger for the reversal of the USD’s recent weakening trend has been more evidence that US inflation is proving stronger than expected at the start of this year. The releases of the US CPI and PPI reports for the February have both surprised to the upside for the second consecutive month providing more of a challenge to market expectations that the Fed will begin to cut rates as early as in June. It has resulted in yields both at the short-end and long end of the US curve rising back up close to year to date highs ahead of next week’s FOMC meeting. Market participants are understandably wary that the Fed’s latest policy update could prove to be relatively more hawkish at least acknowledging that recent progress to meet their inflation target has been disappointing.

The Fed’s updated projections for the policy rate and economic outlook will be updated at next week’s FOMC meeting. We are expecting the updated projections to remain largely unchanged compared to at the December FOMC meeting. The median dot from back in December revealed that the Fed favoured cutting rates three times this year. However, looking back at the dispersion of the dots reveals that it would take just two participants to change from three cuts to two for the median dot to move to a total of two cuts this year. It poses the main upside risk for the USD in the week ahead should it encourage the US rate market to further scale back Fed rate cut expectations. US rate market pricing is currently aligned with the Fed’s projections from back in December for three cuts by the end of this year.

Higher US yields and the stronger USD over the past week has helped to lift USD/JPY back up to the 149.00-level after hitting a low of 146.49 at the end of last week. It has meant that the JPY has failed to strengthen this week on the back of stronger wage negotiation results in Japan. The Japanese Trade Union Confederation (Rengo) revealed today that 771 unions secured a 5.28% total pay hike which is well above the corresponding increase secured at the same stage last year of 3.8%. The break down revealed that 654 unions achieved an average increase of 3.7% in monthly base wages which was also higher than at the same stage last year of 2.33%. While the final wage agreements could be somewhat softer than the preliminary results, the large uplift compared to the same stage of last year should clearly give the BoJ more confidence that stronger wage growth will be sustained in the upcoming fiscal year.

The BoJ had clearly signalled that they were focusing closely on today’s wage announcement when setting the outlook for monetary policy in Japan. The much stronger Rengo wage agreement results support our view that the BoJ should finally be sufficiently confident to tighten monetary policy at next week’s meeting. We are expecting the BoJ to tighten monetary policy next week by outlining the following policy steps: i) Abolition of negative interest rates, ii) Termination of Yield Curve Control (YCC) and clarification of new government bond purchase policy, iii) Elimination of asset purchase limits for ETFs, etc, and iv) Withdrawal of the overshoot-type inflation commitment. Firstly, we expect the BoJ to abandon the three-tiered structure for current account balances that was introduced to help reduce the negative impact of Japanese banks’ profitability from negative rate policy. The BoJ will return to paying +0.1% interest on the excess reserves of the BoJ’s current account holders, and to guide the uncollaterialized overnight call rate into a higher range between 0.00% and 0.10%. In effect it would equate to around a 10bps rate hike from the BoJ.

Secondly, we expect the BoJ to bring an end to YCC after already watering down the cap on the 1.00% 10-year JGB yield last year. However we expect the BoJ to provide reassurance that it will continue to purchase a significant amount of JGBs even after YCC is brought to an end. One option that has been touted in the media would be for the BoJ to pre-commit to a monthly pace of JGB purchases. Jiji Press reported that the initial monthly pace could be set at around JPY6 trillion which would be similar to the amount of purchases in February. Thirdly, we expect the BoJ to end purchases of equity ETFs and corporate debt. Fourthly, we expect the BoJ remove their inflation “overshoot commitment” that states they will continue expanding the monetary base until inflation exceeds 2.0% and stays above target in a stable manner.

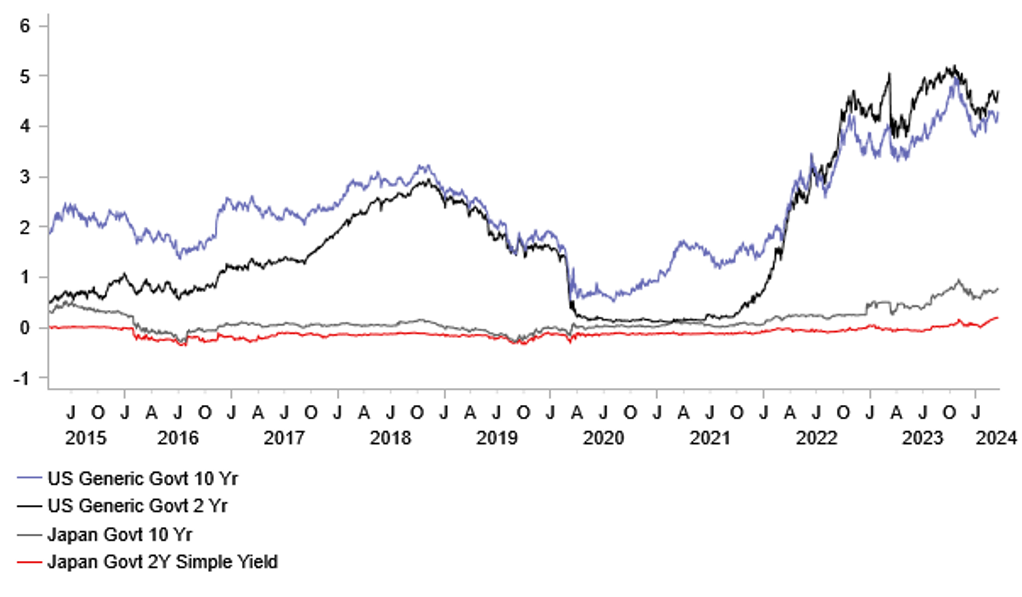

We believe these upcoming policy changes have been well telegraphed and are designed to enable a smoother transition away from the exceptionally loose policy settings that have been in place in Japan. It should help to ease market disruption in the near-term. Without a sharp adjustment higher for yields in Japan in the week ahead, it is difficult to see the JPY strengthening significantly even as the BoJ ends negative rates and YCC. Indeed, price action over the week past suggests that market participants may already be anticipating that the JPY could weaken further once the event risk is out of the way next week. Market participants are assuming that the BoJ accompanies policy changes with cautious guidance that dampens speculation over further policy tightening through the rest of this year. Yields in Japan are expected to remain low even after next week’s BoJ policy meeting leaving the JPY as an attractive funding currency for carry trades that are benefitting from low volatility at the start of this year. The BoJ would have to deliver a hawkish policy surprise to trigger a squeeze of elevated short JPY positions. Potential triggers include: i) forward rate guidance that encourages market participants to price in the policy rate rising beyond 0.25% by the end of this year and ii) the BoJ indicating more flexibility to slow down the pace of JGB purchases alongside ending QT that could put upward pressure on long-term yields.

In these circumstances, we are not convinced that next week’s BoJ’s policy meeting will prove to be a decisive turning point for the JPY even as we expect NIRP and YCC to end. The BoJ would have to signal more confidence that policy needs to be tightened further to trigger a stronger JPY. We are currently expecting the BoJ to deliver only one more hike this year in Q4. Our outlook for a lower USD/JPY in the 2H of this year will also require the Fed to lower rates back closer to 4.00% in response to inflation slowing back towards their 2.0% target. For a sharper decline in USD/JPY, hard landing fears for the US economy would have to resurface.

US YIELDS MOVING IN FAVOUR OF STRONGER USD

Source: Bloomberg, Macrobond & MUFG GMR

CAUTIOUS BOJ POLICY NORMALIZATION IS PRICED

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

03/18/2024 |

02:00 |

Retail Sales YTD YoY |

Feb |

5.0% |

-- |

!! |

|

CNY |

03/18/2024 |

02:00 |

Industrial Production YTD YoY |

Feb |

5.2% |

-- |

!! |

|

NOK |

03/18/2024 |

07:00 |

GDP MoM |

Jan |

-- |

0.5% |

!! |

|

EUR |

03/18/2024 |

10:00 |

CPI YoY |

Feb F |

-- |

2.6% |

!! |

|

AUD |

03/19/2024 |

03:30 |

RBA Cash Rate Target |

4.35% |

4.35% |

!!! |

|

|

JPY |

03/19/2024 |

Tbc |

BOJ Policy Balance Rate |

-0.10% |

-0.10% |

!!! |

|

|

EUR |

03/19/2024 |

10:00 |

ZEW Survey Expectations |

Mar |

-- |

25.0 |

!! |

|

EUR |

03/19/2024 |

10:00 |

Labour Costs YoY |

4Q |

-- |

5.3% |

!! |

|

CAD |

03/19/2024 |

12:30 |

CPI YoY |

Feb |

-- |

2.9% |

!!! |

|

GBP |

03/20/2024 |

07:00 |

CPI YoY |

Feb |

-- |

0.04 |

!!! |

|

EUR |

03/20/2024 |

08:45 |

ECB's Lagarde Speaks |

!! |

|||

|

EUR |

03/20/2024 |

09:30 |

ECB's Lane Speaks |

!! |

|||

|

CAD |

03/20/2024 |

17:30 |

BoC Releases Summary of Deliberations |

!! |

|||

|

USD |

03/20/2024 |

18:00 |

FOMC Rate Decision (Lower Bound) |

5.25% |

5.25% |

!!! |

|

|

NZD |

03/20/2024 |

21:45 |

GDP SA QoQ |

4Q |

0.1% |

-0.3% |

!! |

|

AUD |

03/21/2024 |

00:30 |

Employment Change |

Feb |

30.0k |

0.5k |

!! |

|

GBP |

03/21/2024 |

07:00 |

Public Sector Net Borrowing |

Feb |

-- |

-17.6b |

!! |

|

CHF |

03/21/2024 |

08:30 |

SNB Policy Rate |

1.75% |

1.75% |

!!! |

|

|

NOK |

03/21/2024 |

09:00 |

Deposit Rates |

4.50% |

4.50% |

!!! |

|

|

EUR |

03/21/2024 |

09:00 |

HCOB Eurozone Composite PMI |

Mar P |

-- |

49.2 |

!! |

|

CHF |

03/21/2024 |

09:00 |

SNB's Jordan Speaks |

!!! |

|||

|

GBP |

03/21/2024 |

09:30 |

S&P Global UK Composite PMI |

Mar P |

-- |

53.0 |

!! |

|

GBP |

03/21/2024 |

12:00 |

Bank of England Bank Rate |

5.25% |

5.25% |

!!! |

|

|

USD |

03/21/2024 |

12:30 |

Current Account Balance |

4Q |

-$209.0b |

-$200.3b |

!! |

|

USD |

03/21/2024 |

12:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

03/21/2024 |

13:45 |

S&P Global US Composite PMI |

Mar P |

-- |

52.5 |

!! |

|

JPY |

03/21/2024 |

23:30 |

Natl CPI YoY |

Feb |

2.9% |

2.2% |

!!! |

|

GBP |

03/22/2024 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Feb |

-- |

3.4% |

!! |

|

EUR |

03/22/2024 |

09:00 |

Germany IFO Business Climate |

Mar |

-- |

85.5 |

!! |

|

CAD |

03/22/2024 |

12:30 |

Retail Sales MoM |

Jan |

-- |

0.9% |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

• There is a heavy schedule of G10 central bank policy updates in the week ahead. First up will be the RBA and BoJ on Tuesday. The RBA is expected to leave their policy rate unchanged at 4.35% for the third consecutive meeting. We expect the RBA to stick to the forward guidance from February when they signaled that “ a further increase in interest rates cannot be ruled out”.

• Building evidence that stronger wage growth will be sustained in the upcoming fiscal year should provide justification for the BoJ to finally bring an end to current loose policy settings. We expect the BoJ to raise rates by 10bps bringing an end to NIRP and leaving the door open for further hikes later this year. At the same time, the BoJ may formally end YCC but provide reassurance that it will continue to support the JGB market through maintaining the recent pace of monthly purchases

• The main focus at the Fed’s upcoming policy meeting will be the updated economic and policy projections. We are expecting the Fed to stick to plans favouring three rate cuts this year although there is a risk that support could shift more in favour of fewer cuts in light of the upside inflation surprises at the start of this year. The policy update could prove impro in signaling whether the June FOMC meeting remains the most likely start to the Fed’s rate cut cycle. The Fed is also expected to outline plans over how they will slow down the pace of quantitative tightening.

• The SNB’s upcoming policy meeting could attract more market attention than usual in the week ahead. There has been speculation recently that the SNB could begin to cut rates ahead of the ECB in response to CHF strength and weaker than expected inflation.

• We are not expecting any significant changes to the BoE’s policy guidance in the week ahead. A further moderation in wage growth at the start of this year has encouraged speculation that the BoE could begin cutting rates sooner in June rather than in August.