To read the full report, please download PDF.

USD buying momentum to ease

FX View:

The cautious message from Fed Chair Powell yesterday has failed to provide the dollar with further upside impetus which could be an early signal of the Trump-related dollar buying is fading. After a gain of almost 7% for DXY from the late September low we have reached levels where more balanced two-way flows may emerge. USD/JPY through this move has entered a ‘danger zone’ of increased threat of intervention between 155.00-160.00. On Monday Governor Ueda will give a key speech which could signal increased intent on hiking rates to help stem yen selling. While the USD has lost some upward momentum at the end of this week, Trump’s picks for his leadership team have indicated that his disruptive policy agenda is likely to be implemented. The three favourite candidates to become the next Treasury Secretary have all voiced support for imposing higher tariffs.

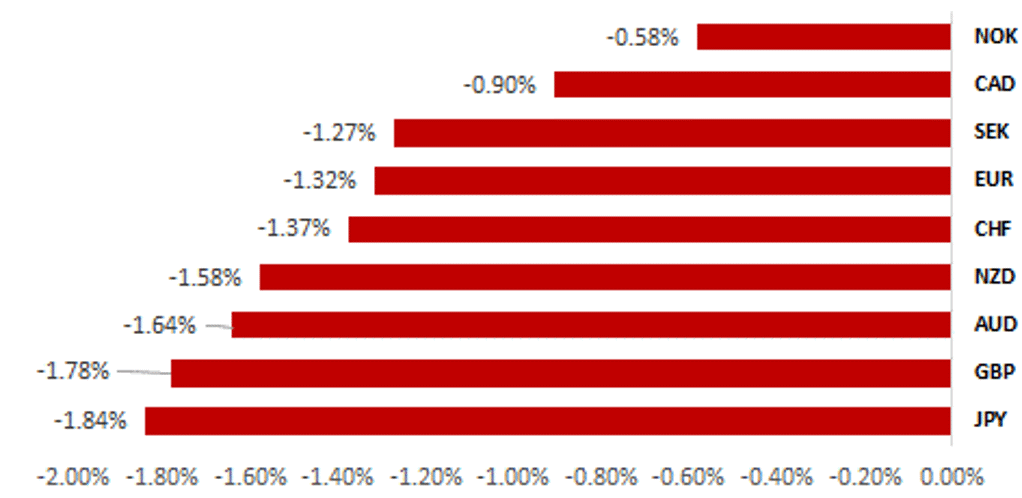

TRUMP TRADE APPARENT IN BROAD-BASED G10 FX USD STRENGTH

Source: Bloomberg, 12:00 BST, 15th November 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our short EUR/USD trade recommendation while lowering the target and stop-loss by two big figures.

Portfolio flows by investor type:

This week we look at the monthly Investments in International Securities by investor type which confirmed the sharp selling of foreign bonds in October was largely conducted by Japanese banks.

Post-Election Dollar Watch: FX Options Data Analysis:

Our analysis indicates that there has been an increased demand for USD calls across all currencies except AUD. Specifically, market participants anticipate a weakening of the GBP over the next six months, while expecting a rebound in the strength of BRL and AUD in the short to medium term.

FX Views

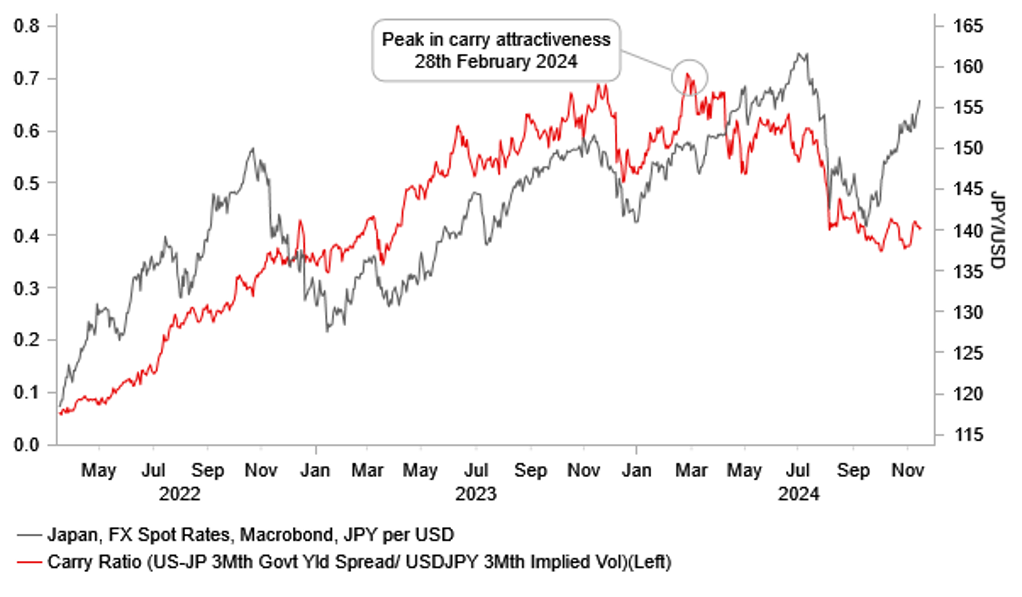

JPY: Entering the danger zone

In our recently published FX forecast update (here) in light of Donald Trump’s election victory we revealed across the board stronger dollar forecasts including USD/JPY which in 2025 is now estimated to be 4-6 big figures higher than our previous forecasts. The change in forecast for year-end 2024 is more modest (152 vs 150) in part given the scale of rebound we had in USD/JPY prior to Trump’s election victory and given the increasing prospect of a rate hike from the BoJ and given the high chance of FX intervention to limit the extent of yen depreciation. We do accept though that the risks to our new year-end USD/JPY forecast is to the upside.

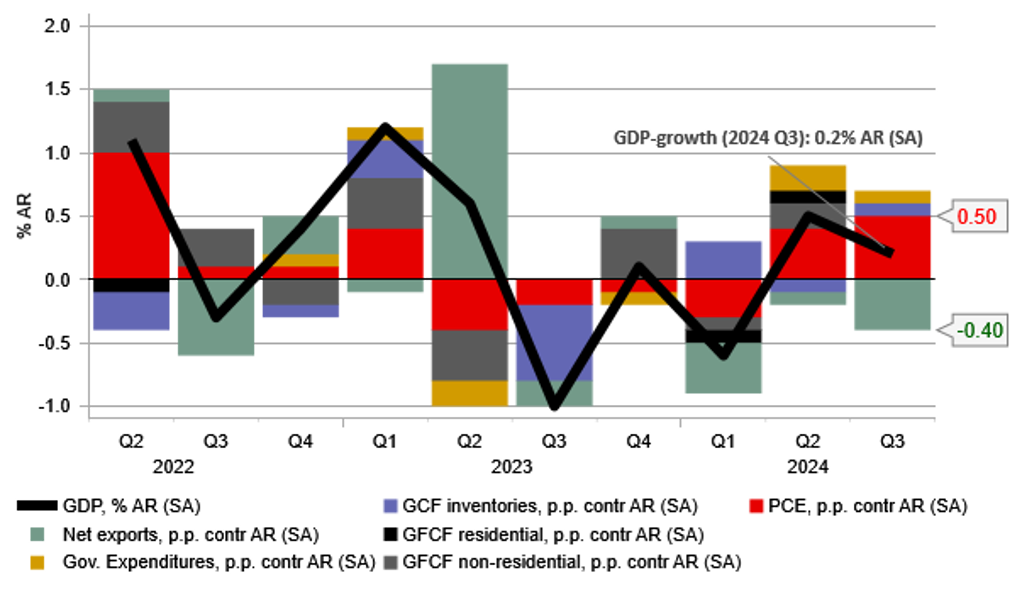

Real GDP data for Q3 released today was slightly stronger than expected but confirmed a slowdown with growth of 0.9% Q/Q SAAR, down from 2.2% in Q2. The consensus was for growth of 0.7%. The composition of the GDP growth was more positive with household consumption expanding by a non-annualised 0.9%, up from 0.7% in Q2. The main area of weakness was in external demand which shaved 0.4ppts from overall GDP growth. Growth likely would have been stronger were it not for a big drop in industrial production that was in part impacted by a typhoon and a mega-quake warning by the government. Overall the GDP data provided some good news on the consumer side of the economy but was also mixed enough to ensure the government continues with plans for a substantial fiscal support package as had been promised by PM Ishiba ahead of the general election in October. This has taken on greater urgency perhaps given the victory for Trump in the election and given the weakness in external demand evident in the Q3 GDP data. External demand conditions could be challenging in 2025 and hence boosting domestic demand will be key for the government.

The construct of the package is largely known with cash handouts of JPY 30,000 for low-income households and a further JPY 20,000 per child. The reinstatement of subsidies for electricity and gas bills from the Jan-Mar period has also been flagged. The package will also include JPY 10trn of support for the semi-conductor and AI industries with PM Ishiba confirming the package will be larger than the JPY 13trn package announced under a supplementary budget a year ago. However, this year the LDP coalition do not have a majority and therefore additional wishes of the opposition DPP could add to the size – it wants tax-free income for all to be expanded.

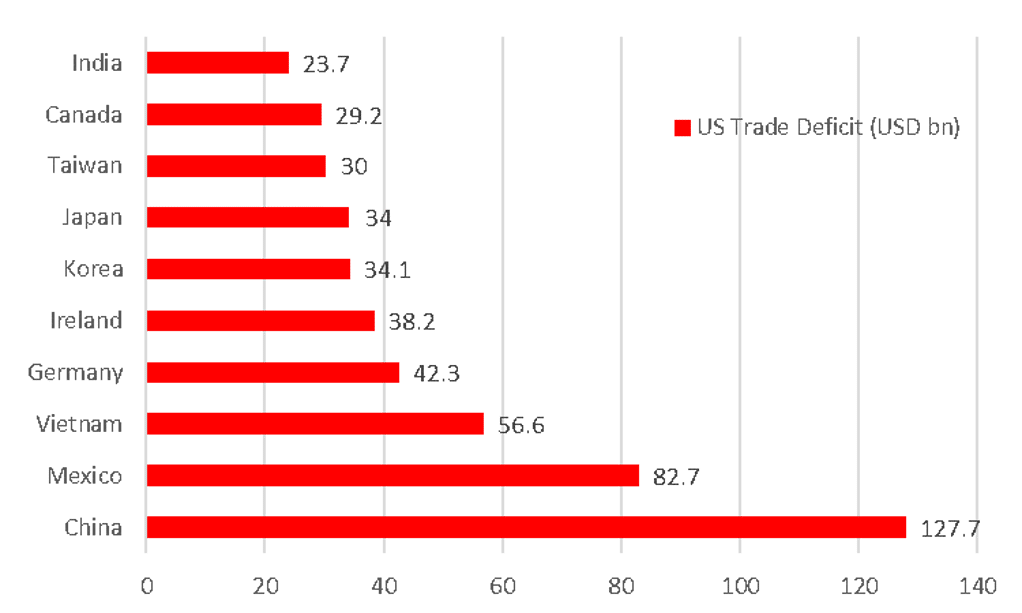

12MTH CHANGE IN 12MTH AVG US TRADE BALANCES

Source: Bloomberg, Macrobond & MUFG Research

JAPAN GDP Q/Q – COMPOSITION BREAKDOWN

Source: Bloomberg, Macrobond & MUFG GMR

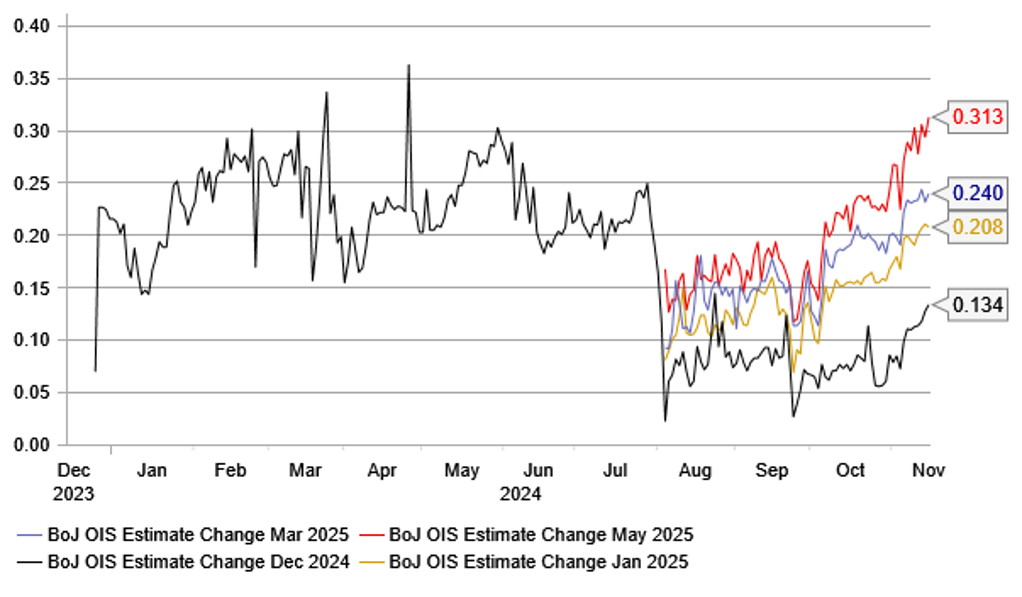

These growth-supportive fiscal measures have been known for a while but Trump’s election victory could encourage some last minute bolder steps to increase the overall size of the plan. The package could therefore lift further the expectations of a BoJ rate hike coming sooner. The sharp depreciation of the yen only adds to that prospect. The OIS market is currently priced at a little over 50% for a 25bp hike at the next meeting on 19th December and the probability rises to 80% for the meeting on 24th January. BoJ Governor Ueda is scheduled to speak on Monday at 10am local time in Nagoya in what could be an important speech in providing guidance on upcoming monetary policy decisions. Governor Ueda will also hold a press conference after the event at 13:45. Currently this is the last scheduled major speech by Governor Ueda ahead of the December monetary policy meetings. Given the turmoil in the FX and equity markets in July-August following the BoJ’s rate hike then, if there is a possibility of a rate hike in December Monday would be the ideal platform for attempting to shape expectations well ahead of the policy meeting. While unlikely to be explicit on actions in December a stronger comment on the inflation impact of the recent yen depreciation would certainly strengthen expectations of action and help provide the yen with some additional support after the recent Trump-fuelled selling.

The US Treasury yesterday released its semi-annual currency report and South Korea was added to the list and Malaysia was removed. Japan, China, Germany, Singapore, Taiwan and Vietnam remained on the list. These countries could be given more attention when it comes to tariffs under a Trump administration. We don’t think this alters the MoF’s determination to intervene again if the yen continues to weaker. The cost of living crisis remains a political issue and even through the general election has passed, the Upper House elections are scheduled for July next year and PM Ishiba will want to show an improvement after the poor general election result. Finance Minister Kato today was very clear stating that the MoF was watching FX “with a high sense of urgency” and that recent moves were “one-sided and rapid”. All the requirements for intervention could therefore be deemed to be met and the MoF may deem it best to act now ahead of inauguration-date to send a message to the markets that it’s foreign exchange policy has not been altered under Japan’s new government.

We believe we are in the ‘danger-zone’ for intervention to take place – between 155.00 and 160.00. In this area ahead of a new Trump presidency, the MoF will likely act if we see further moves higher toward the 160-level. We also expect the BoJ to play its part in providing support for the yen with a message from Governor Ueda that yen depreciation could expedite the need for a rate hike sooner than expected.

BOJ RATE HIKE EXPECTATIONS HAVE BEEN RISING

Source: Bloomberg, Macrobond & MUFG Research

CARRY RATIO HAS FAILED TO RECOVER WITH SPOT

Source: Bloomberg, Macrobond & MUFG Research

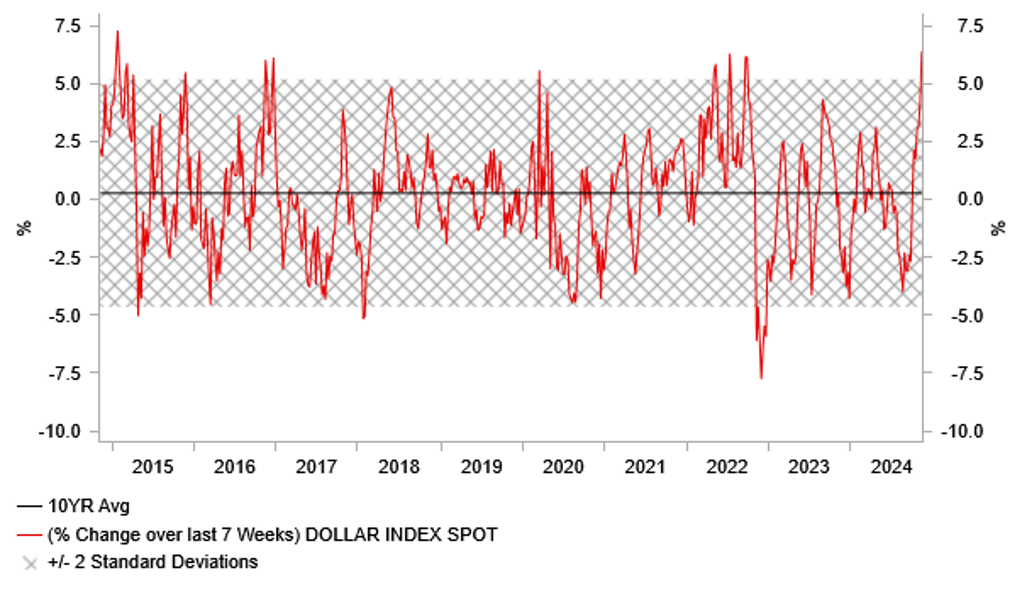

USD: Waiting to verify implementation of Trump’s policy agenda

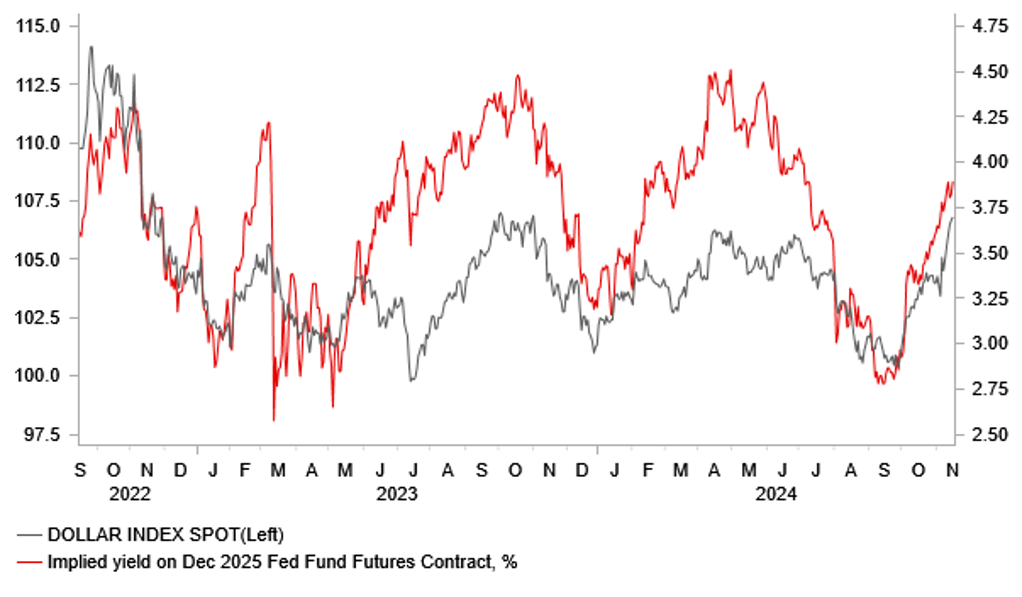

The USD has continued to strengthen sharply over the past week after last week’s US election. It has resulted in the dollar index rising up towards technical resistance provided by the highs from autumn of last year at just above the 107.00-level. The dollar index has now risen by almost 7% since late in September as market participants have moved to price in the recent run of stronger US economic data releases including activity and inflation alongside building expectations for the incoming Trump administration to put in place inflationary policies (import tariffs & tougher immigration rules) in the year ahead. The release of the latest US CPI and PPI reports for October have indicated that inflation firmed for the second consecutive month. The core PCE deflator is likely to come in above the Fed’s forecast of 2.6% for the end of this year that was set back at the September FOMC meeting. The stronger run of US data has already prompt the Fed to slow down the pace of easing by delivering a smaller 25bps rate cut this month, and Fed Chair Powell signalled yesterday that it was not a done deal that they will deliver another 25bps cut as planned next month. Fed rate cut expectations have been scaled back significantly with the implied yield on the December 2025 Fed fund futures contract rising by around 110bps since the low in September. As a result, market expectations for the terminal rate in the Fed’s current easing cycle has been lifted up to just below 4.00% which is well above the Fed’s estimate of the neutral rate at just below 3.00%.

Donald’s Trump picks this week for his leadership team have reinforced market expectations that he will put into place his disruptive policy pledges. Two well-known China hawks Marco Rubio and Mike Waltz have been chosen to be the next US Secretary of State and National Security Advisor. Furthermore, Donald Trump has chosen Tom Homan to be his new border czar. The former acting US Immigration and Customs Enforcement director has described the US border as “the biggest national security vulnerability this national has seen since 9/11 and we have to fix it”, and has vowed to run “the biggest deportation force this country has ever seen”. Higher immigration inflows have helped to boost the US labour supply in recent years and dampened upside inflation risks. A process that is now set to go into reverse which will make the Fed more cautious over continuing to lower rates in the year ahead. Financial market participants are now eagerly awaiting to see who Trump picks to be the new Treasury Secretary and Trade Representative. The current favourites to be the next Treasury Secretary according to PredictIt.com are Key Square Group LP founder Scott Bessent (72%) followed by Cantor Fitzgerald LP CEO Howard Lutnick (32%) and then former US Trade Representative Robert Lighthizer (1%).

USD HAS ALREADY STRENGTHENED SHARPLY

Source: Bloomberg, Macrobond & MUFG GMR

FED’S TERMINAL RATE IS EXPECTED TO BE HIGHER

Source: Bloomberg, Macrobond & MUFG GMR

Scott Bessent has expressed support for tariffs, aligning with Donald Trump’s economic policies. He believes that broad-based tariffs can be more effective than microeconomic intervention like industrial policy. He believes that tariffs should be layered in gradually to allow any inflationary side effects to appear over time and be counteracted by other policies such as deregulation. In contrast, Howard Lutnik has a more strategic view on tariffs. He believes that the US should impose tariffs on products that it manufactures domestically while avoiding tariffs on items it doesn’t produce. He argues that this approach would pressure foreign countries to lower their trade barriers allowing US companies to compete more fairly in overseas markets. He sees tariffs as a bargaining tool to negotiate better trade terms for the US. Out of the three potential contenders to be the next US Treasury Secretary, former US Trade Representative Robert Lighthizer has more aggressive and comprehensive views on the use of tariffs. He believes that tariffs are essential for protecting US industries and reducing the reliance on foreign imports. He was already instrumental in shaping Trump’s trade policies during his first term as president. He also sees tariffs as a strategic tool to negotiate better trade terms for the US.

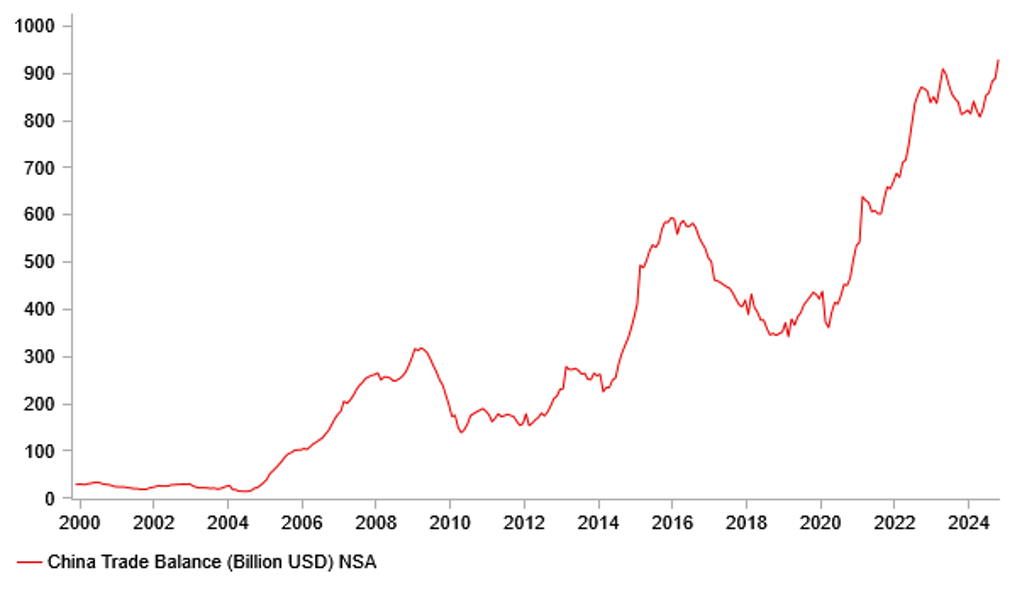

Politico reported earlier this year that Robert Lighthizer and other close economic advisors to Donald Trump were also actively debating ways to devalue the USD if he wins a second term as president. According to the report, Robert Lighthizer was considering ways to weaken the USD unilaterally or through negotiations with foreign nations using the threat of tariffs. Something which is viewed as more likely to be pursued by Donald Trump is he is chosen as the new Treasury Secretary. Lighthizer’s ideal situation as outlined in his 2023 book, is to try to strike a grand bargain with foreign governments on currency, similar to the Plaza Accords stuck in 1985 to weaken the USD relative to the JPY and European currencies. When the Plaza Accords were negotiated in the 1980’s, the implicit threat of tariffs from the US government helped to push foreign governments to adjust the value of their currencies. With China and European economies currently struggling with weak domestic demand, it is hard to see major trading partners agreeing to strengthen their currencies. Similarly, the likes of China and Germany have been reluctant to boost demand/consumption through loosening fiscal policy. Furthermore the incoming Trump administration plans to maintain loose fiscal policy in the US unlike the agreement reached to tighten US fiscal policy as part of the 1985 Plaza Accord Agreement. Overall we continue to believe it will be difficult for Donald Trump to weaken the USD if he implements his policy agenda. The imposition of retaliatory tariffs on US imports by foreign nations, and slowing US growth in response to higher inflation could though help to dampen USD strength.

US TRADE DEFICITS IN 1H 2024

Source: Bloomberg, Macrobond & MUFG GMR

CHNA’S RISING SURPLUS ADDING FUEL TO THE FIRE

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

11/18/2024 |

10:00 |

Trade Balance SA |

Sep |

-- |

11.0b |

!! |

|

EUR |

11/18/2024 |

13:00 |

ECB's Lane Gives Lecture |

!! |

|||

|

CAD |

11/18/2024 |

13:15 |

Housing Starts |

Oct |

240.0k |

223.8k |

!! |

|

USD |

11/18/2024 |

15:00 |

NAHB Housing Market Index |

Nov |

44.0 |

43.0 |

!! |

|

EUR |

11/18/2024 |

18:30 |

BOE's Greene Speaks |

!! |

|||

|

EUR |

11/18/2024 |

18:30 |

ECB's Lagarde Speaks |

!!! |

|||

|

AUD |

11/19/2024 |

00:30 |

RBA Minutes of Nov. Policy Meeting |

!! |

|||

|

EUR |

11/19/2024 |

09:00 |

ECB Current Account SA |

Sep |

-- |

31.5b |

!! |

|

EUR |

11/19/2024 |

10:00 |

Euro Area Negotiated Wage Indicator |

Q3 |

!!! |

||

|

EUR |

11/19/2024 |

10:00 |

CPI YoY |

Oct F |

-- |

2.0% |

!!! |

|

USD |

11/19/2024 |

13:30 |

Housing Starts |

Oct |

1340k |

1354k |

!! |

|

CAD |

11/19/2024 |

13:30 |

CPI YoY |

Oct |

1.9% |

1.6% |

!!! |

|

JPY |

11/19/2024 |

23:50 |

Trade Balance |

Oct |

-¥414.1b |

-¥294.3b |

!! |

|

CNY |

11/20/2024 |

01:00 |

1-Year Loan Prime Rate |

3.1% |

3.1% |

!!! |

|

|

GBP |

11/20/2024 |

07:00 |

CPI YoY |

Oct |

-- |

1.7% |

!!! |

|

EUR |

11/20/2024 |

09:00 |

ECB Financial Stability Review |

!! |

|||

|

GBP |

11/21/2024 |

07:00 |

Public Sector Net Borrowing |

Oct |

-- |

16.6b |

!! |

|

NOK |

11/21/2024 |

07:00 |

GDP Mainland QoQ |

3Q |

-- |

0.1% |

!!! |

|

AUD |

11/21/2024 |

08:00 |

RBA's Bullock-Speech |

!! |

|||

|

USD |

11/21/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

JPY |

11/21/2024 |

23:30 |

Natl CPI YoY |

Oct |

2.3% |

2.5% |

!!! |

|

GBP |

11/22/2024 |

00:01 |

GfK Consumer Confidence |

Nov |

-- |

- 21.0 |

!! |

|

GBP |

11/22/2024 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Oct |

-- |

0.3% |

!! |

|

EUR |

11/22/2024 |

07:00 |

Germany GDP SA QoQ |

3Q F |

-- |

0.2% |

!! |

|

EUR |

11/22/2024 |

08:30 |

ECB's Lagarde Speaks |

!!! |

|||

|

EUR |

11/22/2024 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Nov P |

-- |

46.0 |

!!! |

|

EUR |

11/22/2024 |

09:00 |

HCOB Eurozone Services PMI |

Nov P |

-- |

51.6 |

!!! |

|

GBP |

11/22/2024 |

09:30 |

S&P Global UK Manufacturing PMI |

Nov P |

-- |

49.9 |

!!! |

|

GBP |

11/22/2024 |

09:30 |

S&P Global UK Services PMI |

Nov P |

-- |

52.0 |

!!! |

|

CHF |

11/22/2024 |

12:40 |

SNB's Schlegel Speaks |

!! |

|||

|

CAD |

11/22/2024 |

13:30 |

Retail Sales MoM |

Sep |

0.3% |

0.4% |

!! |

|

USD |

11/22/2024 |

15:00 |

U. of Mich. Sentiment |

Nov F |

-- |

73.0 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The main economic data releases in the week ahead will be from Europe. The latest PMI surveys from he euro-zone and UK for November will be scrutinized closely to assess growth momentum heading into year ended. Business confidence has been declining since the summer signaling slowing growth momentum but that was not backed up by the hard data when euro-zone GDP growth picked-up in Q3. The US election result could have at least an initial dampening impact on business confidence in the region in anticipation of trade disruption ahead for the region.

- The release of the latest euro-area negotiated wage indicator for Q3 will be watched closely after the sharp slowdown in Q2 when it fell to 3.5% from 4.8% in Q1. Wage growth is likely to pick back up again in Q3 driven mainly by volatile German data due to one-off payments. President Lagarde acknowledged that negotiated wage growth was likely to remain high and volatile at the October policy meeting. A stronger print in the week ahead should not stop the ECB from cutting rates again in December on its own. The final update of the euro-zone CPI report for October is expected to confirm that headline inflation was in line with the ECB’s target.

- After inflation in the UK slowed more than expected in September it encouraged the BoE to cut rates for a second time in the current easing cycle. However, the BoE signaled that they remain cautious over the pace of monetary easing and plan to stick to gradual rate cuts. In the week ahead another material downside inflation surprise in October would be required to bring forward market expectations for the timing of the next BoE rate cut from February to December. The hurdle for a back-to-back rate cut in December appears relatively high after the last MPC meeting.