To read the full report, please download PDF.

USD/JPY enters intervention zone

FX View:

USD/JPY is back above the 150-level for the first time since November last year. The dollar on a DXY basis also hit the highest level since November fuelled by the stronger than expected inflation data. Nonetheless, the broader dollar has failed to hold on to these gains reversing from the Tuesday high despite weak GDP readings in Europe and Japan and strong US PPI data today. Could this be the first sign of fading upside momentum for the dollar? Minutes from the January FOMC meeting and the advance PMIs will be in focus next week while any further gains in USD/JPY could prompt renewed intervention in Japan. We don’t see the weaker than expected real GDP data as altering the outlook for the yen. Indeed, quite the opposite it will probably reinforce the determination of the MoF to limit further yen depreciation while the BoJ will likely view the GDP data as a consequence of the inflation shock and is unlikely to alter the prospects of a rate hike.

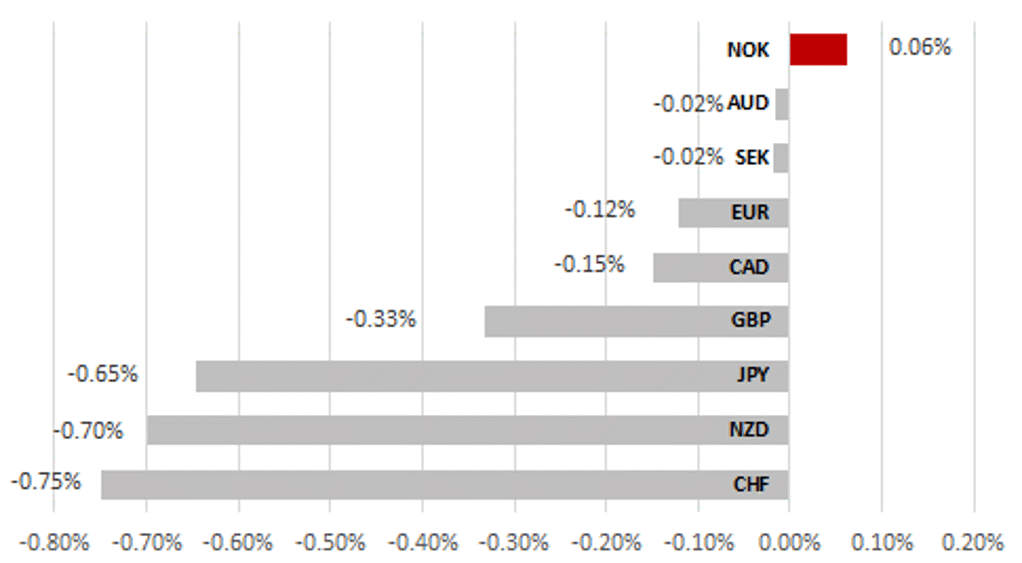

MODESTLY A MODEST MOVE WITH CHF UNDERPERFOMRING ON WEAK CPI

Source: Bloomberg, 12:50 GMT, 16th February 2024 (Weekly % Change vs. USD

Trade Ideas:

We are maintaining our two open trade views - short EUR/GBP and long USD/CHF given our continued favourable outlook for USD and GBP.

JPY Flows:

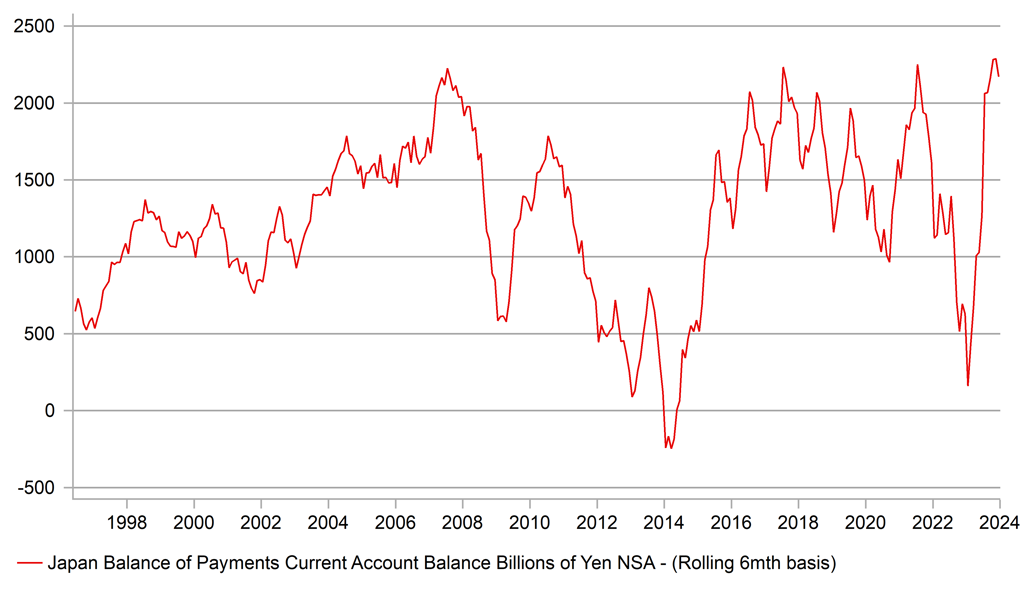

The MoF Balance of Payments data continues to show a growing external surplus. Indeed, the 6mth rolling sum of the current account saw a record surplus recorded, helped in part by a surging rebound in tourism.

GMR Behavioural Equilibrium Exchange Rate (BEER) model:

Our long-term BEER model suggests USDJPY is currently overvalued by +4% relative to historical performance, while EURUSD and GBPUSD is undervalued by -8% and -3% respectively.

FX Views

USD/JPY: Back in the intervention zone – what’s changed?

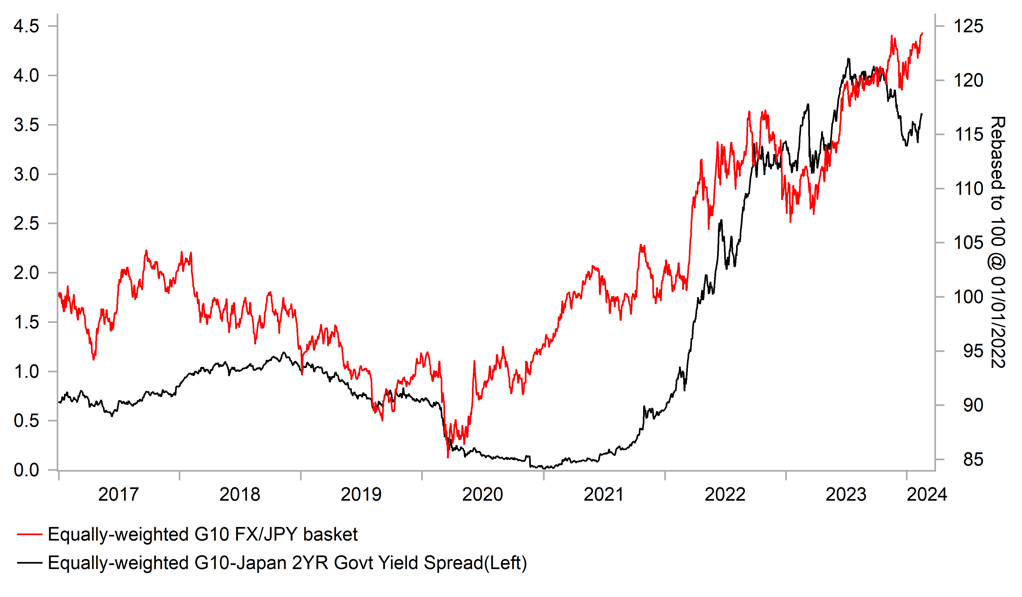

The yen remains the worst performing G10 currency on a year-to-date basis and this week was the third worst performing currency with USD/JPY moving back above the 150-level for the first time since November, fuelled primarily by the stronger than expected US inflation data on Tuesday. The yen has underperformed the wider move in non-dollar currencies versus the dollar and likely reflects the increased appetite for re-establishing carry positions given the view that a rate hike from the BoJ has become a reduced risk over the short-term. Positioning data clearly indicates a renewed build-up of JPY short positions since the turn of the year after the liquidation that took place into the end of last year. Could USD/JPY now extend further higher or will the threat of intervention continue to thwart a further move to the upside, like what has happened on previous occasions when trading at these levels?

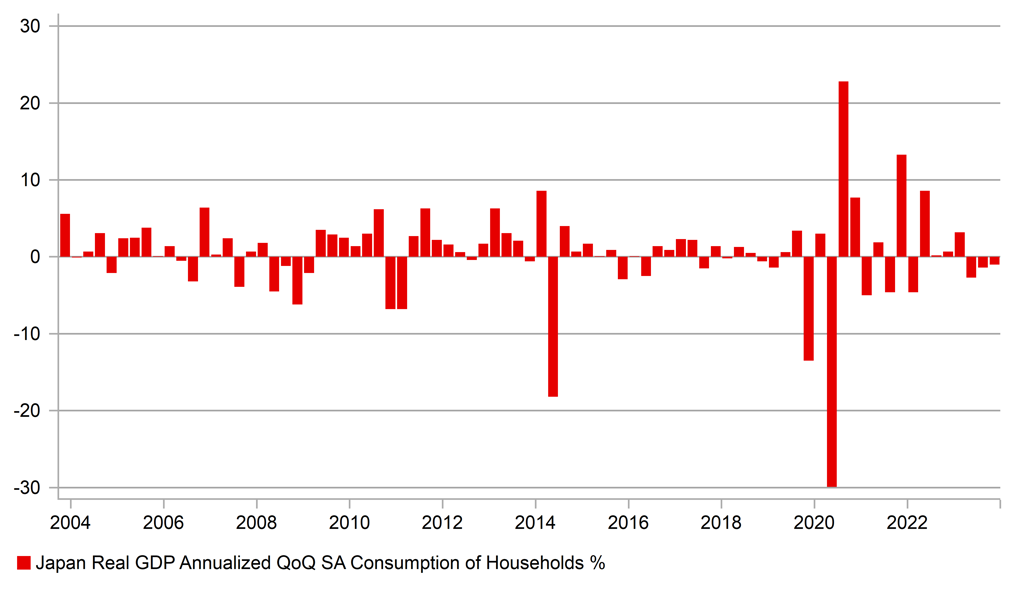

GDP data if anything could encourage intervention

We don’t think the weaker than expected GDP data this week alters the outlook for the yen in any meaningful way. Yes, Japan is now in a technical recession after the -0.4% Q/Q SAAR GDP print yesterday, which followed the -3.3% print for Q3. The weakness of the economy primarily reflects weak household consumption. For three consecutive quarters household consumption has contracted (-2.7%; -1.4%; -1.0% latest) and the huge inflation shock for Japanese households (it’s the first time household consumption has declined for three consecutive quarters since the GFC) has been a significant factor in this. While outright inflation levels were far lower in Japan, the scale of increase in underlying inflation was exactly the same in Japan as in the US and the euro-zone (core-core nationwide CPI increased 5.4ppts in Japan from the pre-shock low-point) and hence hit real consumption levels hard. Importantly, the level of contraction has diminished in each quarter suggesting better prospects going forward and suggesting subsiding inflation is playing a role in the improvement. That likely means the BoJ would be less concerned over lifting rates out of negative territory. It could help lift confidence that inflation is being brought under control. The Economy Watchers’ survey’s latest reading showed the biggest jump in confidence since March last year. The GDP data may also reinforce the determination of the government to intervene to diminish the negative impact of inflation on Japanese households.

WORST RUN OF HHOLD CONSUMPTION SINCE GFC

Source: Bloomberg, Macrobond & MUFG GMR

JAPAN’S CURRENT ACC SURPLUS SURGING (6MTH SUM)

Source: Bloomberg, Macrobond & MUFG GMR

That is certainly consistent with the rhetoric this week from the MoF. Finance Minister Suzuki stated that he was monitoring FX “with a greater sense of urgency” – a clear signal that concerns within the MoF have escalated notably. Vice Finance Minister for International Affairs, Masato Kanda also spoke referencing speculative selling of the yen as being part of the move and that excessive moves are undesirable. The approval rating of PM Kishida and his cabinet remains around record lows, mainly due to the LDP funding scandal but the cost of living crisis is playing a role as well. Hence, the prospect of intervention to stall yen depreciation remains high and a break above the high from November (151.91) is the obvious catalyst for action to take place.

The view that the GDP data won’t alter the thinking within the BoJ was highlighted today by comments from BoJ Governor Ueda who spoke in the Diet, in testimony to the Diet Finance and Financial Services Committee. He stated that if the BoJ forecasts are realised it would be “far from deflation, and we will make it happen”. Governor Ueda added that this would be helped by Japanese companies being “more aggressive than ever” in raising wages given the labour shortages that exist now. The most recent wage data on a like-for-like basis showed scheduled pay for full-time workers remaining at 2.0%. Shunto wage agreements are expected to surpass last year’s final average wage increase of 3.58% which would be consistent with the BoJ having the confidence to lift the policy rate out of negative territory. We still get the sense from BoJ communications that there is a strong will to end negative rates. The findings from the latest monetary policy framework assessment workshop and a speech from Deputy Governor Himino indicate the BoJ sees potential positives in lifting rates.

In the context of the BoJ position on lifting rates over the coming months (probably in April) we continue to see greater downside potential for USD/JPY. Of course BoJ policy deliberations is the smaller part of the equation and on the US side we see limited scope for US yields to continue to rebound from here. The stronger inflation print that triggered the move higher in yields is unlikely the start of a bigger move. The disinflation trend remains in place and even without a notable growth slowdown, the inflation picture alone should be enough to justify a rate cut possibly by May, certainly by June. But we do also expect slower growth based on less fiscal tailwinds and reduced excess savings to fuel consumer spending. The weakness of the yen was likely in part fuelled by NISA-related outflows which were likely front-loaded and hence should fade as an influence while Leveraged Funds have quickly reinstated short positions that should see that influence fade too. Nonetheless, our broader bullish USD bias may mean that intervention by the MoF/BoJ also plays a role in limiting the upside from here.

Just like on the previous occasions when USD/JPY reached these levels, we see momentum fading but broader US dollar strength that could continue near-term may mean intervention is required to stall the move.

SHUNTO WAGE AGREEMENT TO SURPASS LAST YEAR

Source: Bloomberg, Macrobond & MUFG GMR

YEN CARRY LESS ATTRACTIVE THAN LAST YEAR

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GBP |

02/19/2024 |

00:01 |

Rightmove House Prices MoM |

Feb |

-- |

1.30% |

! |

|

GBP |

02/19/2024 |

00:01 |

Rightmove House Prices YoY |

Feb |

-- |

-0.70% |

! |

|

EUR |

02/20/2024 |

10:00 |

ECB Euro-zone Negotiated Wage Rates |

Q4 |

-- |

4.70% |

!!! |

|

CAD |

02/20/2024 |

13:30 |

CPI Core- Trim YoY% |

Jan |

-- |

3.70% |

!!! |

|

CAD |

02/20/2024 |

13:30 |

CPI YoY |

Jan |

3.40% |

3.40% |

!!! |

|

CAD |

02/20/2024 |

13:30 |

CPI Core- Median YoY% |

Jan |

-- |

3.60% |

!!! |

|

USD |

02/20/2024 |

15:00 |

Leading Index |

Jan |

-0.30% |

-0.10% |

! |

|

JPY |

02/20/2024 |

23:50 |

Trade Balance Adjusted |

Jan |

¥47.8b |

-¥412.7b |

! |

|

GBP |

02/21/2024 |

07:00 |

Public Sector Net Borrowing |

Jan |

-- |

6.8b |

!! |

|

GBP |

02/21/2024 |

07:00 |

PSNB ex Banking Groups |

Jan |

-- |

7.8b |

! |

|

GBP |

02/21/2024 |

11:00 |

CBI Trends Total Orders |

Feb |

-- |

-30 |

!! |

|

USD |

02/21/2024 |

19:00 |

FOMC Meeting Minutes |

Jan-31 |

-- |

-- |

!!!! |

|

EUR |

02/22/2024 |

07:45 |

France Business Confidence |

Feb |

-- |

98 |

!! |

|

EUR |

02/22/2024 |

07:45 |

France Manufacturing Confidence |

Feb |

-- |

99 |

!! |

|

EUR |

02/22/2024 |

08:30 |

HCOB Germany Manufacturing PMI |

Feb P |

-- |

45.5 |

!!! |

|

EUR |

02/22/2024 |

08:30 |

HCOB Germany Services PMI |

Feb P |

-- |

47.7 |

!!! |

|

EUR |

02/22/2024 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Feb P |

-- |

46.6 |

!!! |

|

EUR |

02/22/2024 |

09:00 |

HCOB Eurozone Services PMI |

Feb P |

-- |

48.4 |

!!! |

|

GBP |

02/22/2024 |

09:30 |

S&P Global UK Manufacturing PMI |

Feb P |

-- |

47 |

!!! |

|

GBP |

02/22/2024 |

09:30 |

S&P Global UK Services PMI |

Feb P |

-- |

54.3 |

!!! |

|

EUR |

02/22/2024 |

10:00 |

Euro-zoneCPI YoY |

Jan F |

-- |

2.80% |

!! |

|

EUR |

02/22/2024 |

10:00 |

Euro-zone CPI MoM |

Jan F |

-- |

-0.40% |

!! |

|

EUR |

02/22/2024 |

10:00 |

Euro-zone CPI Core YoY |

Jan F |

-- |

3.30% |

!! |

|

CAD |

02/22/2024 |

13:30 |

Retail Sales MoM |

Dec |

-- |

-0.20% |

! |

|

CAD |

02/22/2024 |

13:30 |

Retail Sales Ex Auto MoM |

Dec |

-- |

-0.50% |

! |

|

USD |

02/22/2024 |

13:30 |

Initial Jobless Claims |

Feb-17 |

-- |

-- |

!! |

|

USD |

02/22/2024 |

14:45 |

S&P Global US Manufacturing PMI |

Feb P |

-- |

50.7 |

!! |

|

USD |

02/22/2024 |

14:45 |

S&P Global US Services PMI |

Feb P |

-- |

52.5 |

!! |

|

USD |

02/22/2024 |

15:00 |

Existing Home Sales |

Jan |

3.97m |

3.78m |

!! |

|

USD |

02/22/2024 |

15:00 |

Fed's Jefferson speaks |

-- |

!!! |

||

|

EUR |

02/23/2024 |

07:00 |

German GDP SA QoQ |

4Q F |

-- |

-0.30% |

! |

|

EUR |

02/23/2024 |

09:00 |

German IFO Business Climate |

Feb |

-- |

85.2 |

!! |

|

EUR |

02/23/2024 |

09:00 |

ECB 1 Year CPI Expectations |

Jan |

-- |

3.20% |

!! |

|

EUR |

02/23/2024 |

13:00 |

ECB’s Schnabel speaks |

Jan |

-- |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The week ahead has less top tier data than the week just passing and in that context it might be the FOMC minutes on Wednesday that grabs the most attention and has the greatest potential to move markets. These are the minutes from the meeting on 31st January when Powell played down the prospects of a rate cut in March, which fueled a jump in yields and the dollar. Powell also confirmed a more in-depth discussion about balance sheet policy will take place in March so the minutes may reveal some preliminary discussions that could give the markets a clue on what’s to come. How strong the push-back on early rate cuts were in the minutes may help shape market expectations on the scope for the first cut coming in May or now possibly in June.

- On the data front, next week will see the release of the preliminary PMIs, which will be important. The data from Europe this week has been poor with recession confirmed in the UK and flat growth in the euro-zone. There has been limited fallout in the markets from growth data this week in part due to expectations that growth is about to begin picking up. So if that does not show up in the advance PMIs next week it could prompt bigger rates and FX reactions. ECB’s Schnabel will also speak at the end of the week, after the advance PMIs – Schnabel remains on the hawkish side and argues against any near-term rate cuts.