To read the full report, please download PDF.

USD moves dictated by level of Trump action

FX View:

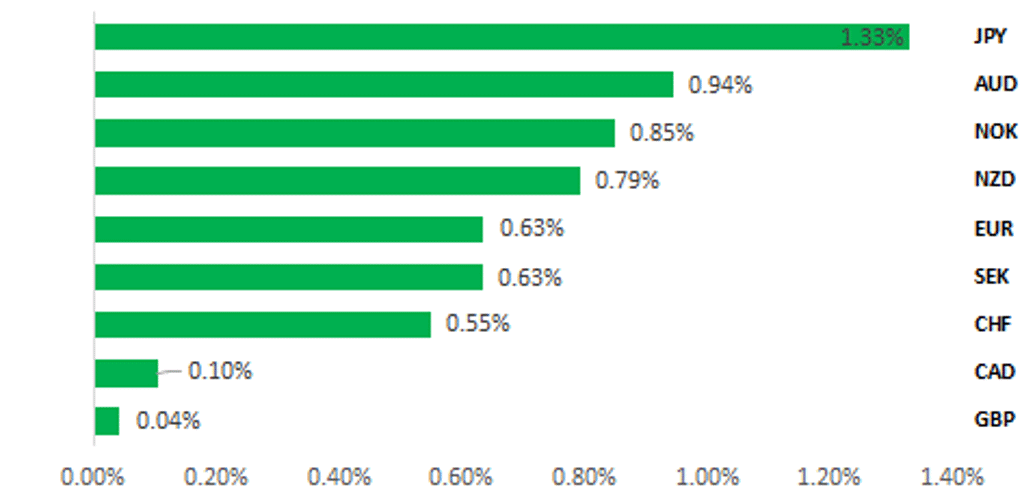

There is a high level of anticipation of trade tariff policies being announced quickly following President-elect Trump’s inauguration on Monday. Hence, the bar is quite high for Trump triggering notable US dollar appreciation next week and his policy announcements would likely need to be quite aggressive and widespread in order to trigger dollar strength. Given the high bar we believed is implied by market pricing and recent US dollar performance, the risk could be skewed, initially at least, toward disappointment and some modest retracement of dollar strength. The yen is the top performing G10 currency this week in part on the drop in US yields after the weaker CPI data but also due to the increased anticipation of a rate hike by the BoJ next Friday. We expect the BoJ to deliver a hike and see market participants as well positioned for this outcome which will likely curtail the extent of yen appreciation. Guidance from the BoJ could prove important for initial FX reaction.

BROAD-BASED USD DEPRECIATION AS JPY OUTPERFORMS AHEAD OF BOJ

Source: Bloomberg, 1130 GMT, 17th January 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are sticking with our short cable trade idea. The GBP has continued to underperform over the past week even as Gilts have rebounded.

JPY Flows: Portfolio by Investor Type:

December flow data revealed selling of foreign bonds and equities. For the whole of 2024 the data confirmed record buying of foreign equities by Investment Trusts reflecting expanded NISA limits for households while Japan Trusts were heavy sellers of foreign equities.

FX Option Flows Post-US Election:

Over the past week we have seen a strong pick-up in demand for short-term AUD/USD calls, and continued strong demand for short-term USD/CNY calls and short-term USD/JPY puts indicating that speculators are anticipating that the AUD and JPY could strengthen vs. USD, and CNY could weaken.

FX Views

JPY: BoJ to hike next week

Last week, we argued here that the prospect of a January rate hike was very much alive and that the BoJ could use a speech by Deputy Governor Himino to lift rate hike expectations. As we suspected Himino did not provide explicit guidance given the uncertainties around inauguration day on Monday but the tone of this comments was certainly consistent with keeping the prospect of a hike alive. We also then had a last-minute scheduled speech by Governor Ueda and he too helped reinforce the prospect of a hike next week by repeating what Deputy Governor Himino stated that day before that a discussion over hiking rates would take place at the meeting next week. Both Himino and Ueda mentioned the “encouraging” update at the BoJ Branch Managers’ meeting that had revealed positive information on the continued strong growth in wages. That information from the Branch Managers’ meeting could be used as justification for action next week given the importance of the wage growth outlook.

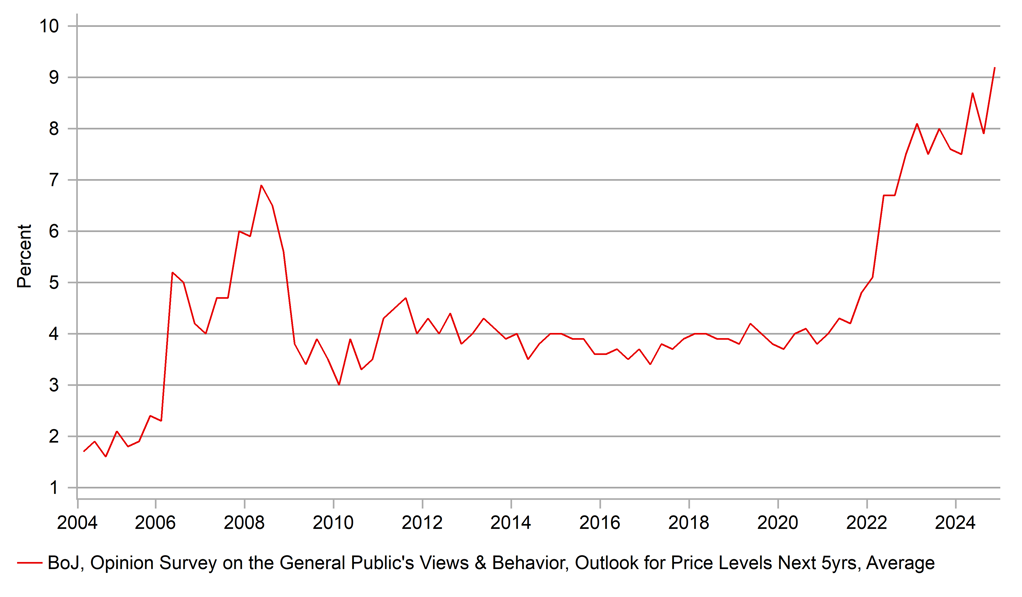

One factor that may have delayed a rate hike in December was the political uncertainty following the LDP losing its working majority in the Diet following the election in late October. But the political landscape is now more stable and the government have been clear recently that the decision to hike rests with the BoJ. Finance Minister Kato this week stated that the “specifics of monetary policy” should be left to the BoJ. Secondly, data this week will also encourage the BoJ to act. BoJ survey data released today revealed an average inflation rate expected over the next five years of 9.2%, the highest in the data series going back to 2006. A record 45.8% of households expect prices to rise “significantly” over the next five years. Finally, as stated last week, media newswire reports have become common ahead of BoJ rate hikes and today the Nikkei is reporting that a majority of Monetary Policy Members will vote to hike next week.

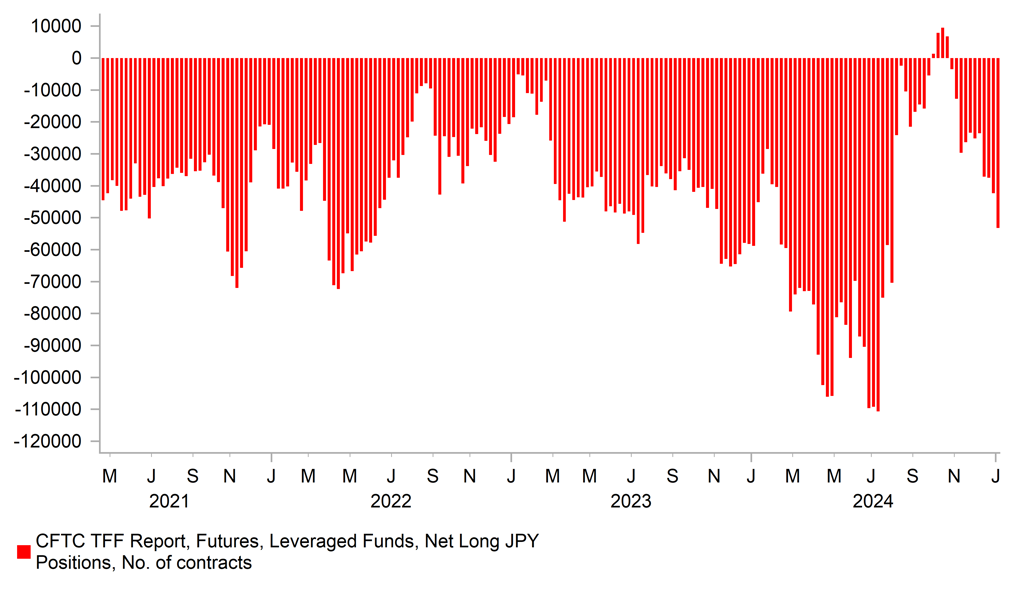

The yen is the top performing G10 currency this week fuelled by the surge in pricing for a hike next week. The probability of a 25bp hike next week has jumped from 40% last Thursday to 90% today with the yen appreciation likely a result of a lightening of speculative short yen positions, which have picked up in recent weeks. 1-week USD/JPY vol has spiked today underlining the anticipation of a hike next Friday. Risk-Reversals have not moved much however suggesting better positioning in anticipation of a move. Of course inauguration in the US on Monday could fuel volatility although recent US dollar appreciation suggests Day One tariff announcements are highly anticipated which will likely limit the scope for US dollar appreciation next week. The BoJ meeting is another event that could well curtail USD demand but equally we doubt the yen will strengthen significantly now given the high level of expectations of a hike.

JAPAN OPINION SURVEY – AVERAGE INFLATION EXPECTATIONS OVER 5YRS HITS A NEW RECORD HIGH

Source: Macrobond & Bloomberg

JPY SHORT POSITIONING HAS JUMPED NOTABLY WHICH COULD GET REDUCED NOW ON BOJ RATE HIKE

Source: Bloomberg, Macrobond & MUFG Research

USD: Pivotal week ahead for the US dollar & Trump’s policy plans

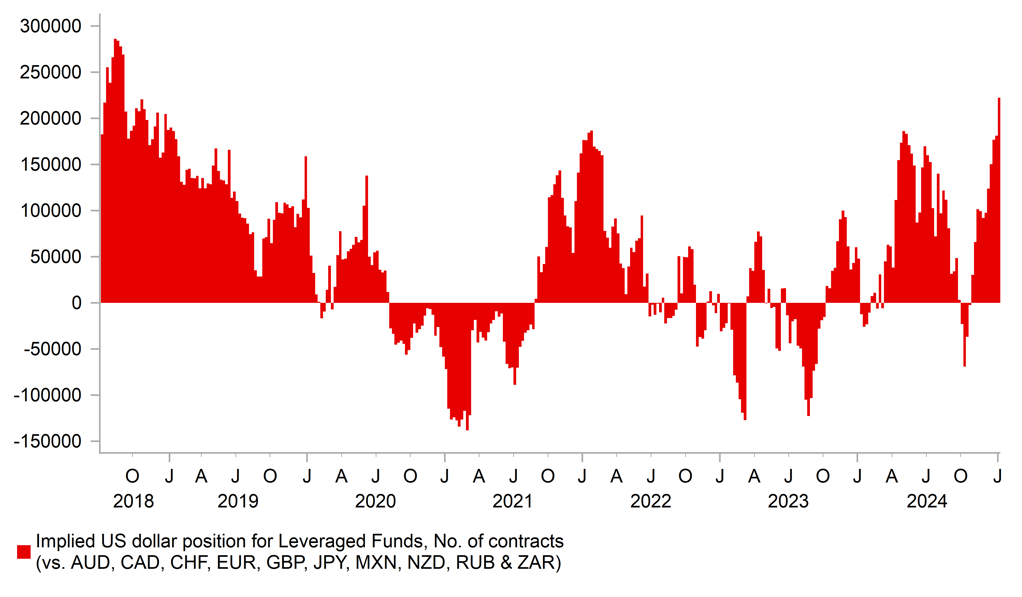

The USD has lost upward momentum over the past week ahead of next week’s inauguration of Donald Trump as the 47th president of the United States. After running into resistance at the 110.00-level at the end of last week following the release of the much stronger nonfarm payrolls report for December, the dollar index has since corrected modestly lower and is on track for its first weekly decline since the end of November. It would bring an end to six consecutive weeks of strong gains for the USD when the dollar index has strengthened by around 3.5%. Market participants have been rebuilding long USD positioning since the US election victory for Donald Trump. The latest CFTC report revealed another large increase in long USD positions held by Leveraged Funds in the week ending the 7th January, and they have now reached their highest level since all the way back in September 2018. It clearly highlights that long USD positions have become a very crowded trade leaving it vulnerable to a correction lower if market expectations for initial policy implementation under Trump disappoint.

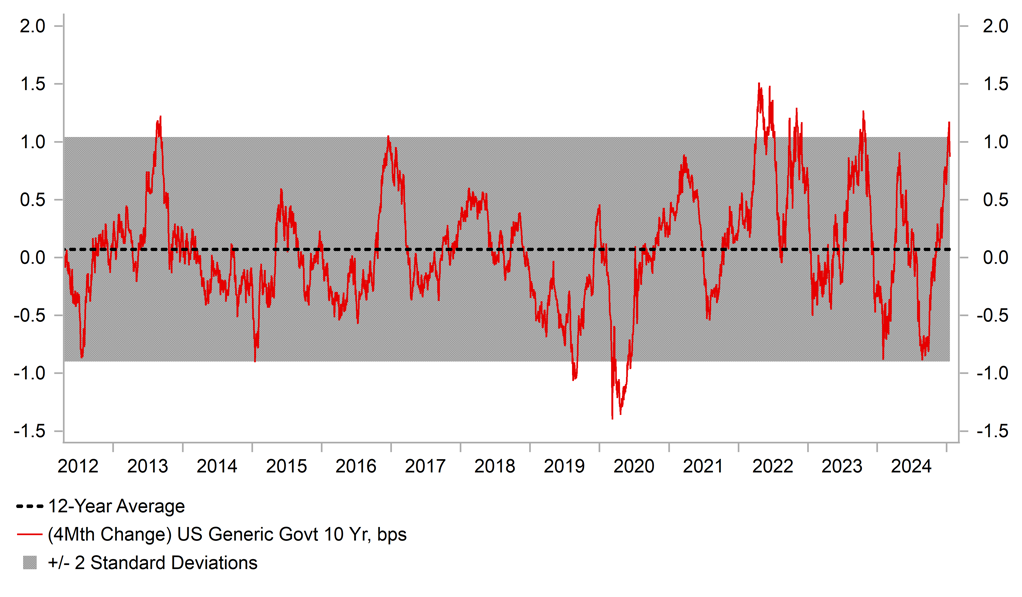

Similar price action has been evident in the US Treasury market as well in recent days. After hitting a high of 4.81% earlier this week, the 10-year US Treasury yield has since fallen by just over 20bps after the release of the monthly inflation data (CPI & PPI) for December provided a timely reminder that underlying inflation in the US continues to slow ahead of Trump’s second term. It raises the question of whether market participants have become too fearful recently over the risk of higher inflation in the coming years that has contributed towards the heavy global bond market sell-off. The Fed has already indicated that it plans to take some time at the start of this year to assess how the economic outlook evolves before cutting rates further. While further evidence of slowing US inflation is encouraging, the Fed will still be wary of upside risks to inflation from the implementation of Trump’s policies alongside the recent pick-up in employment growth. It will be difficult for the Fed to cut rates further if the labour market continues to improve at the start of this year. In light of these uncertainties, we remain more confident that other major centrals banks such as the BoE, ECB and PBoC will keep cutting rates compared to the Fed providing a tailwind for USD strength.

In these circumstances, the week ahead is likely to prove pivotal for the performance of the USD and US yields in the near-term. Reports suggest 100 or more executive orders on Day 1. If the Trump’s initial policy plans fall short of market expectations for more front-loaded and broad-based tariff hikes, then the recent highs for the USD and US yields could turn out to be more significant peaks at the start of this year, and it would undermine our forecasts (click here) for further USD strength during the first half of this year. However, we still doubt how sustainable any setback for the USD be with growth outside of the US set to remain weak and even more gradual and/or less broad-based tariffs should still ultimately be supportive for the USD.

LONG USD HAS BECOME A VERY CROWDED TRADE

Source: Bloomberg, Macrobond & MUFG GMR

GREATER THAN 2 SD MOVE HIGHER IN US YIELDS

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

01/20/2025 |

01:00 |

1-Year Loan Prime Rate |

3.1% |

3.1% |

!! |

|

|

JPY |

01/20/2025 |

04:30 |

Industrial Production MoM |

Nov F |

-- |

-2.3% |

!! |

|

EUR |

01/20/2025 |

10:00 |

Construction Output MoM |

Nov |

-- |

1.0% |

!! |

|

USD |

01/20/2025 |

Tbc |

Inauguration of Donald Trump |

!!! |

|||

|

CAD |

01/20/2025 |

15:30 |

BoC Business Outlook Future Sales |

4Q |

-- |

13.0 |

!! |

|

GBP |

01/21/2025 |

07:00 |

Average Weekly Earnings 3M/YoY |

Nov |

-- |

5.2% |

!!! |

|

GBP |

01/21/2025 |

07:00 |

Employment Change 3M/3M |

Nov |

-- |

173k |

!! |

|

EUR |

01/21/2025 |

10:00 |

Germany ZEW Survey Expectations |

Jan |

-- |

15.7 |

!! |

|

CAD |

01/21/2025 |

13:30 |

CPI YoY |

Dec |

-- |

1.9% |

!!! |

|

NZD |

01/21/2025 |

21:45 |

CPI YoY |

4Q |

-- |

2.2% |

!!! |

|

GBP |

01/22/2025 |

07:00 |

Public Sector Net Borrowing |

Dec |

-- |

11.2b |

!! |

|

USD |

01/22/2025 |

15:00 |

Leading Index |

Dec |

-0.1% |

0.3% |

!! |

|

EUR |

01/22/2025 |

15:05 |

ECB's Lagarde Speaks in Davos |

!! |

|||

|

JPY |

01/22/2025 |

23:50 |

Trade Balance |

Dec |

-¥62.5b |

-¥117.6b |

!! |

|

NOK |

01/23/2025 |

09:00 |

Deposit Rates |

-- |

4.50% |

!!!! |

|

|

CAD |

01/23/2025 |

13:30 |

Retail Sales MoM |

Nov |

-- |

0.6% |

!! |

|

USD |

01/23/2025 |

13:30 |

Initial Jobless Claims |

Jan-18 |

-- |

-- |

!! |

|

JPY |

01/23/2025 |

23:30 |

Natl CPI YoY |

Dec |

3.4% |

2.9% |

!!! |

|

GBP |

01/24/2025 |

00:01 |

GfK Consumer Confidence |

Jan |

-- |

- 17.0 |

!! |

|

JPY |

01/24/2025 |

Tbc |

BOJ Target Rate |

0.5% |

0.3% |

!!! |

|

|

SEK |

01/24/2025 |

07:00 |

Unemployment Rate SA |

Dec |

-- |

8.3% |

!! |

|

EUR |

01/24/2025 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Jan P |

-- |

45.1 |

!! |

|

EUR |

01/24/2025 |

09:00 |

HCOB Eurozone Services PMI |

Jan P |

-- |

51.6 |

!! |

|

GBP |

01/24/2025 |

09:30 |

S&P Global UK Services PMI |

Jan P |

-- |

51.1 |

!! |

|

EUR |

01/24/2025 |

10:00 |

ECB's Lagarde Speaks in Davos |

!!! |

|||

|

GBP |

01/24/2025 |

11:00 |

CBI Total Dist. Reported Sales |

Jan |

-- |

- 30.0 |

!! |

|

USD |

01/24/2025 |

14:45 |

S&P Global US Composite PMI |

Jan P |

-- |

55.4 |

!! |

|

USD |

01/24/2025 |

15:00 |

U. of Mich. Sentiment |

Jan F |

-- |

73.2 |

!! |

|

USD |

01/24/2025 |

15:00 |

Existing Home Sales |

Dec |

4.17m |

4.15m |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The main event next week for financial market participants will be the inauguration of Donald Trump as the 47th president of the United States. He is also reportedly schedule to speak at the Davos in the week ahead. Market participants are eagerly waiting to see further details of policy proposals that are likely to be implemented at the start of his second term. Recent press reports have suggested that key figures in Trump’s administration are pushing for a more gradual phase-in and/or less broad implementation of tariff hikes than threatened.

- The BoJ have signaled that they are likely to raise rates for the third time in the week ahead unless there is a disruptive market reaction at the start of Trump’s second term as president. We expect the BoJ to deliver a 25bps rate hike lifting the policy rate to 0.50% in the week ahead. Governor Ueda and Deputy Governor Himino have both indicate din recent days that they have more confidence that stronger wage growth will be sustained providing the foundations for further rate hikes. In order to reduce the risk of an unfavorable market reaction to another rate hike like back in late July, the BoJ have clearly communicated that a rate hike is likely to be delivered ahead of next week’s meeting.

- The main economic data releases in the week ahead will be: i) the latest labour market report from the UK, and ii) the latest CPI reports from Canada, New Zealand and Japan. After this week’s softer UK CPI and monthly GDP data, the UK rate market has moved to price back in more BoE rate cuts this year. Those expectations would be supported further if the latest UK labour market report shows some further softening in demand for labour and slowing wage growth. Confidence in our call for a BoE cut in February has been reinforced by the run of softer economic data releases from the UK.