To read the full report, please download PDF.

USD continues to rebound ahead of US election

FX View:

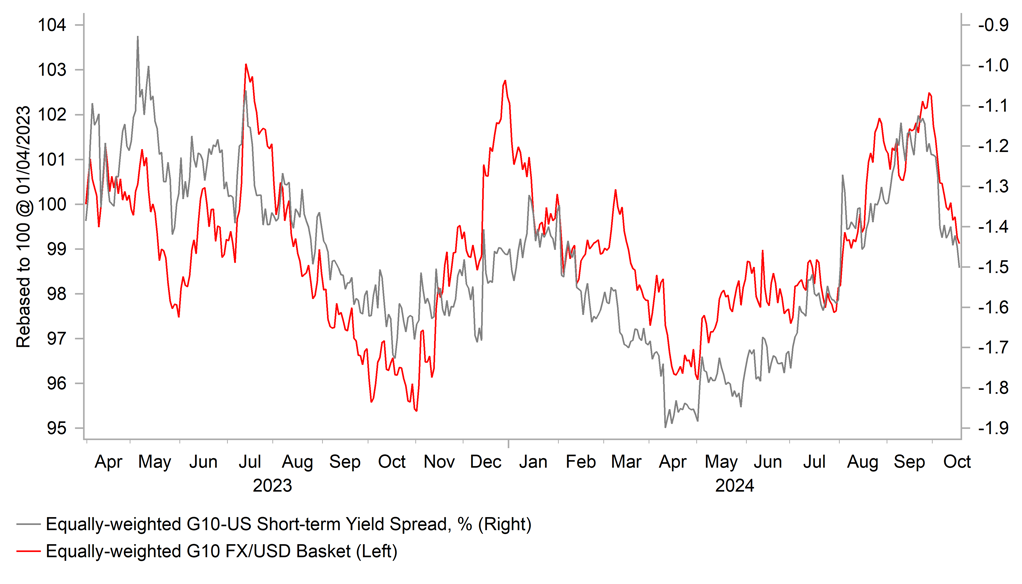

The USD is on course to advance for the third consecutive week. We expect the USD to continue to trade on a stronger footing ahead of the US election on 5th November. Market participants have been moving to price in a higher risk premium in the event of Trump election victory. An outcome that poses upside risks for US yields and the USD heading into year end. The rising odds of Trump winning the election in the betting markets has already encouraged a stronger USD in recent weeks. The rising probability of a Trump victory also plays into the recent change in monetary policy expectations. While the Fed is expected to slow down the pace of easing by delivering a smaller 25bps cut in November, the RBNZ and ECB have just picked up the pace of rate cuts. We expect the BoC to follow next week by delivering a larger 50bps rate cut, and we will be listening closely to comments from BoE officials for any indication they are more open to back-to-back rate cuts in November and December after further evidence of slowing UK inflation and wage growth in September. Yield spreads have moved in favour of a stronger USD.

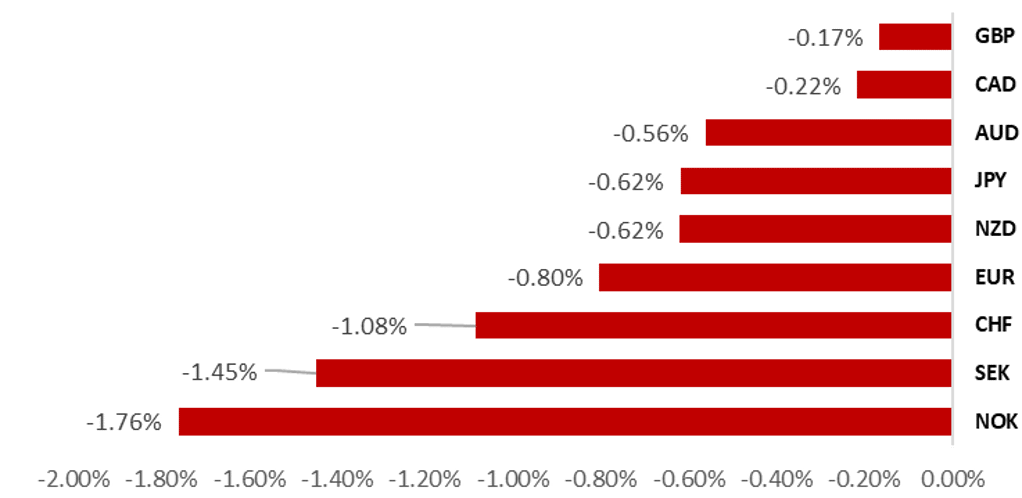

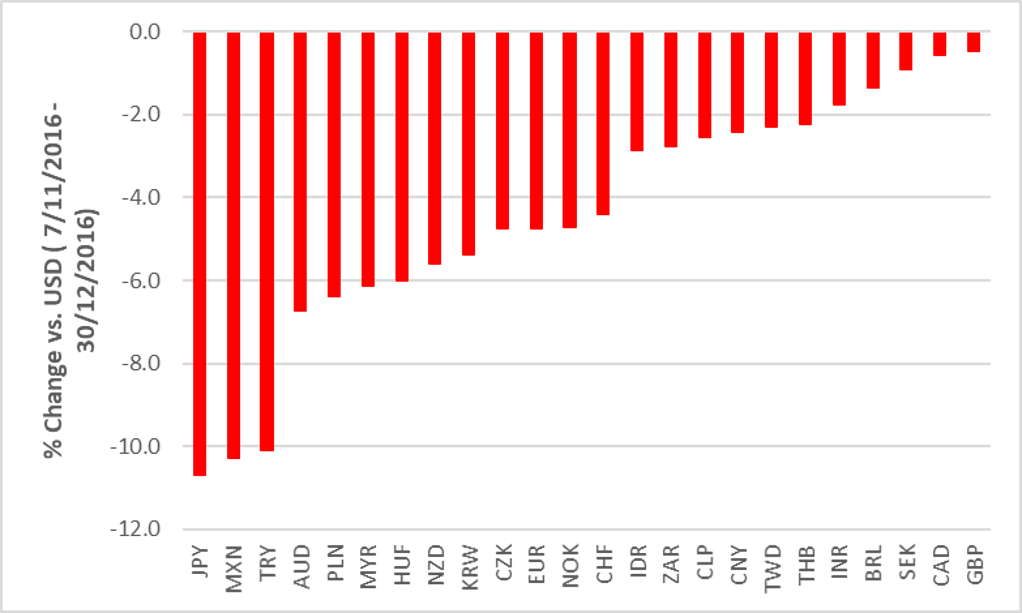

BROAD-BASED USD STRENGTH

Source: Bloomberg, 13:20 BST, 18th October 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our long USD/NOK trade idea which has been supported the rising probability of a Trump victory and the lower price of oil.

IMM Positioning:

Our two-year rolling z-scores signal revealed that long GBP, long AUD and long JPY positions were the most stretched amongst Leveraged Funds.

Short Term Fair Value Modelling:

This week we monitor the relationships between spot and fair value for our JPY, GBP and EUR short-term regression models. In recent periods we identify a convergence in relationship for both GBP/USD and EUR/USD where fair value models identify slight mis-valuations of 0.28% and 0.78% respectively. Whilst our USD/JPY fair value model has remained undervalued since late July 2024, the current mis-valuation lies at -1.46%.

FX Views

USD: Pricing in a higher Trump risk premium ahead of US election

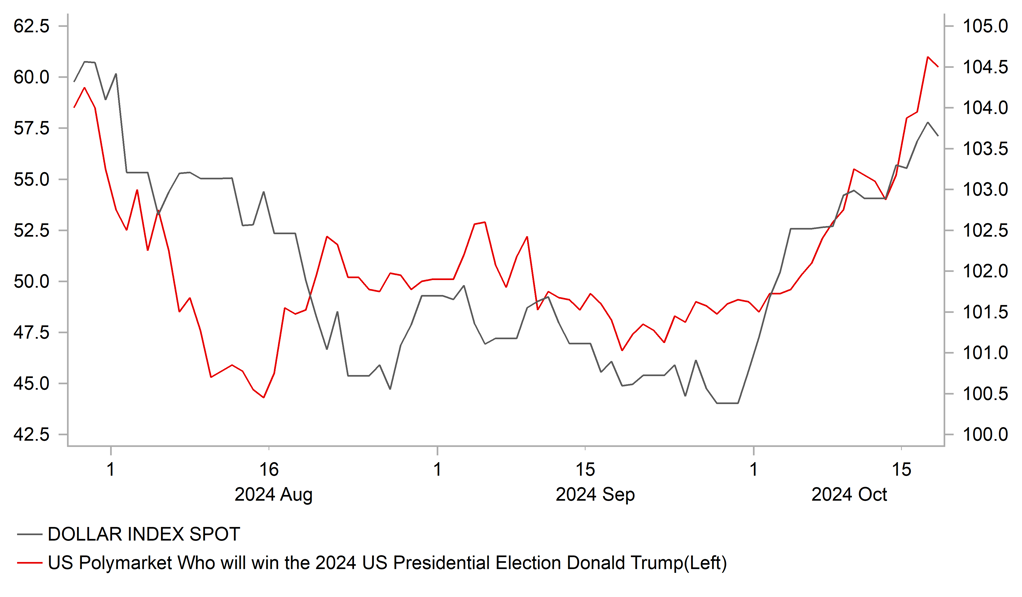

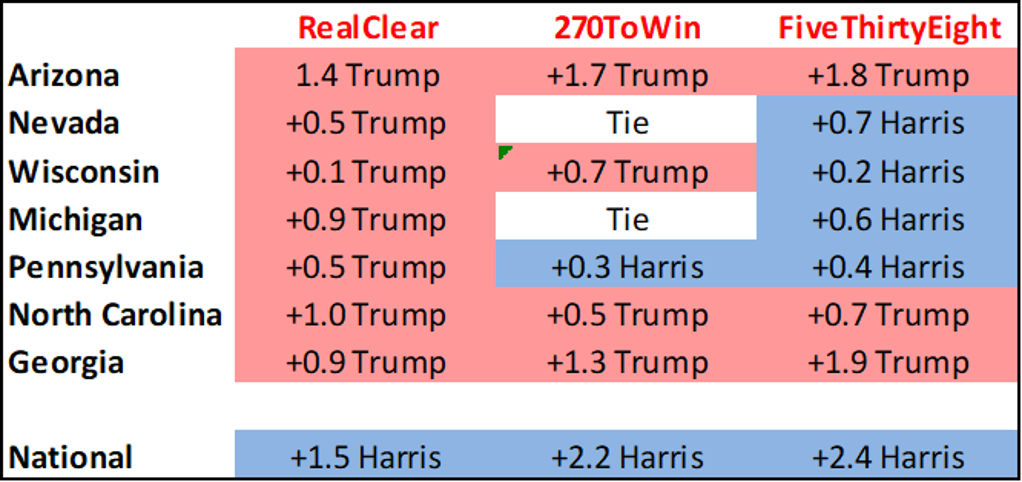

The USD has continued to rebound for the third consecutive week in the build up to the upcoming US election on 5th November. The dollar index has closed higher from the opening price for fourteen consecutive trading days which is the longest run in history going to back to the 1970’s. Over that period the dollar index has rebounded by around 3.5% which is the strongest gain recorded over an equivalent period of time in just over two years. The USD has strengthened the most against the NZD (-4.3% vs. USD) and JPY (-4.2%) this month while the CAD (-1.9%) and GBP (-2.4%) have held up relatively better. The broad-based rebound for the USD is being supported by building market expectations for a Trump election victory. Those expectations have been encouraged by recent moves in betting markets and opinion polls. According to PolyMarket, the probability of Trump being re-elected for a second term as President has risen back above 60%, and has returned to levels that were in place just after President Biden withdrew from the race. The latest opinion polls have been moving in favour of Trump as well. While Harris still holds a lead in national polling it has fallen to levels where she could win the popular vote but not the majority of electoral college seats. Trump also appears to be leading narrowly in key battleground states. The pricing in of a higher Trump risk premium into the FX market has been most evident this week by the sell-off for the MXN lifting USD/MXN back up to the 20.000-level.

In addition, the USD has been deriving support from the change in monetary policy expectations between the Fed and other G10 central banks. After starting their own easing cycle with larger 50bps cut in September, the Fed has indicated that they plan to slowdown the pace of easing by delivering a smaller 25bps cut at the next FOMC meeting in November. Alongside the recent run of stronger US economic data releases including the latest NFP, CPI and retail sales reports for September, US rate market participants have moved to scale back expectations for more aggressive Fed rate cuts. Doubts are even starting to creep in over whether the Fed will cut rates at the final policy meeting of this year in December as planned. An election victory for Trump would reinforce those doubts. In contrast, other G10 central banks are speeding up the pace of easing just as the Fed is set to slowdown. The RBNZ delivered a larger 50bps cut at their last policy meeting and left the door open to another larger cut as soon as next month. We expect the BoC to follow the RNBZ’s lead and deliver a larger 50bps rate cut in the week ahead. The CAD would weaken further if the BoC also signalled that it is open to another 50bps rate cut at the final policy meeting of this year in December. The Canadian rate market is currently priced more in favour of a 50bp cut next week followed by a smaller 25bps rate cut in December. The ECB has already joined the RBNZ in speeding up the pace of their easing cycle when they delivered the first back-to-back 25bps rate cut this week. The updated forward guidance from the ECB and subsequent Bloomberg source report have indicated that another 25bps rate cut is likely to be delivered at the final policy meeting of this year in December. However, the ECB is not ready to cut rates as quickly as the RBNZ and BoC by delivering a larger 50bps cut which was not discussed as a policy option. The ECB remains comfortable sticking to gradual 25bps rate cuts at upcoming policy meetings even as risks begin to tilt to the downside for the inflation outlook.

TRUMP ELECTION ODDS & A STRONGER USD

Source: Bloomberg, Macrobond & MUFG Research

POLLS FAVOURING TRUMP BUT REMAIN CLOSE

Source: RealClear, 270ToWin & FiveThirtyEight (18/10/2024)

The case for faster rate cuts outside of the US has been reinforced by further evidence that inflation is slowing more quickly than expected in Canada, New Zealand and the UK over the past week. It creates more room for domestic central banks to keep lowering rates from current restrictive levels as inflation returns to their targets. In light of the significant downside UK inflation surprise in September and further evidence of slowing wage growth, market participants will be listening closely to upcoming comments from MPC officials in the week ahead including Governor Bailey and MPC members Greene, Breeden and Mann to see if they provide any indication that they are considering speeding up the pace of rate cuts by the end of this year. Earlier this month Governor Bailey already stated that he would be more open to support more active easing if there was further positive inflation progress. The developments support our forecast for the BoE to cut rates at both the November and December MPC meetings. A faster pace of BoE easing could take some shine of the GBP which has been the best performing G10 currency this year although it has held up well this week.

In contrast, we see more room opening up for the BoJ to hike rates again before the end of this year. After strengthening sharply over the summer, the yen has since given back almost 50% of those gains resulting in USD/JPY rising back above the 150.00-level this week. At the same time the Japanese equity market has fully reversed losses recorded over the summer. The improvement in financial stability risks is supportive for the BoJ to continue raising rates if Japan’s economy performs in line with expectations as well. There is scope for BoJ rate hike expectations to be brought forward after the upcoming general election takes place on 27th October. A development that could provide afresh trigger for further JPY gains later this year although that the positive impact could be overwhelmed if Trump wins the US election lifting US yields and the USD.

YIELD SPREADS ENCOURAGING STRONGER USD

Source: Bloomberg, Macrobond & MUFG Research

FX PERFORMANCE AFTER 2016 TRUMP WIN

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

10/21/2024 |

02:00 |

1-Year Loan Prime Rate |

3.2% |

3.4% |

!! |

|

|

EUR |

10/21/2024 |

07:00 |

Germany PPI YoY |

Sep |

-- |

-0.8% |

!! |

|

USD |

10/21/2024 |

15:00 |

Leading Index |

Sep |

-0.3% |

-0.2% |

!! |

|

GBP |

10/22/2024 |

07:00 |

Public Sector Net Borrowing |

Sep |

-- |

13.7b |

!! |

|

GBP |

10/22/2024 |

14:25 |

BoE Governor Bailey speaks |

!!! |

|||

|

USD |

10/22/2024 |

15:00 |

Richmond Fed Manufact. Index |

Oct |

-- |

- 21.0 |

!! |

|

EUR |

10/22/2024 |

18:00 |

ECB's Villeroy speaks |

!! |

|||

|

CAD |

10/23/2024 |

14:45 |

Bank of Canada Rate Decision |

4.0% |

4.3% |

!!! |

|

|

EUR |

10/23/2024 |

15:00 |

Consumer Confidence |

Oct P |

-- |

- 12.9 |

!! |

|

EUR |

10/23/2024 |

15:00 |

ECB's Lagarde Speaks |

!!! |

|||

|

EUR |

10/23/2024 |

15:00 |

ECB's Lane Speaks |

!!! |

|||

|

USD |

10/23/2024 |

15:00 |

Existing Home Sales |

Sep |

3.88m |

3.86m |

!! |

|

NZD |

10/23/2024 |

18:00 |

RBNZ Governor Speaks |

!!! |

|||

|

USD |

10/23/2024 |

19:00 |

Fed Releases Beige Book |

!! |

|||

|

AUD |

10/24/2024 |

05:30 |

RBA-Annual Report |

!! |

|||

|

EUR |

10/24/2024 |

09:00 |

Eurozone Manufacturing PMI |

Oct P |

-- |

45.0 |

!!! |

|

EUR |

10/24/2024 |

09:00 |

HCOB Eurozone Services PMI |

Oct P |

-- |

51.4 |

!!! |

|

GBP |

10/24/2024 |

09:30 |

S&P Global UK Manufacturing PMI |

Oct P |

-- |

51.5 |

!!! |

|

GBP |

10/24/2024 |

09:30 |

S&P Global UK Services PMI |

Oct P |

-- |

52.4 |

!!! |

|

USD |

10/24/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

10/24/2024 |

14:45 |

S&P Global US Composite PMI |

Oct P |

-- |

54.0 |

!! |

|

USD |

10/24/2024 |

15:00 |

New Home Sales |

Sep |

713k |

716k |

!! |

|

JPY |

10/25/2024 |

00:30 |

Tokyo CPI YoY |

Oct |

1.7% |

2.2% |

!! |

|

EUR |

10/25/2024 |

09:00 |

Germany IFO Business Climate |

Oct |

-- |

85.4 |

!! |

|

EUR |

10/25/2024 |

09:00 |

M3 Money Supply YoY |

Sep |

-- |

2.9% |

!! |

|

CAD |

10/25/2024 |

13:30 |

Retail Sales MoM |

Aug |

-- |

0.9% |

!! |

|

USD |

10/25/2024 |

13:30 |

Durable Goods Orders |

Sep P |

-1.0% |

0.0% |

!! |

|

USD |

10/25/2024 |

15:00 |

U. of Mich. Sentiment |

Oct F |

-- |

68.9 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The upcoming US election will continue to attract more market attention as we move closer to the election date on 5th Market participants have moved to price in a higher probability of Donald Trump winning the election over the past week. The latest opinion polls will be followed closely in the week ahead.

- The BoC is the next G10 central bank to update policy in the week ahead. We expect the BoC to speed up the pace of easing by delivering a larger 50bps rate cut. The case for a larger 50bps cut has been strengthened by further evidence of slowing inflation in Canada and loosening labour market conditions. Market participants will be watching closely to see if the BoC leaves the door open for another larger 50bps cut in December as well.

- The main economic data releases in the week ahead will be the latest PMI surveys from Europe for October. Business confidence has deteriorated in recent months signaling a loss of growth momentum in the euro-zone and UK economies heading into year end. A further drop in confidence in October especially in the euro-zone would heighten concerns over the economy stagnating in Q4. ECB President Lagarde and Chief Economist Lane are both scheduled to speak at the IMF-World Bank week in Washington. We expect both to reiterate the dovish message from yesterday’s ECB policy meeting leaving the door open to another rate cut in December.

- A number of BoE policymakers will be speaking in the week ahead including Governor Bailey. After another downside inflation surprise in September, market participants will be watching for any further signals that the BoE could speed up the pace of rate cuts before the end of this year.