To read the full report, please download PDF.

Safe-haven demand eases but risks elevated

FX View:

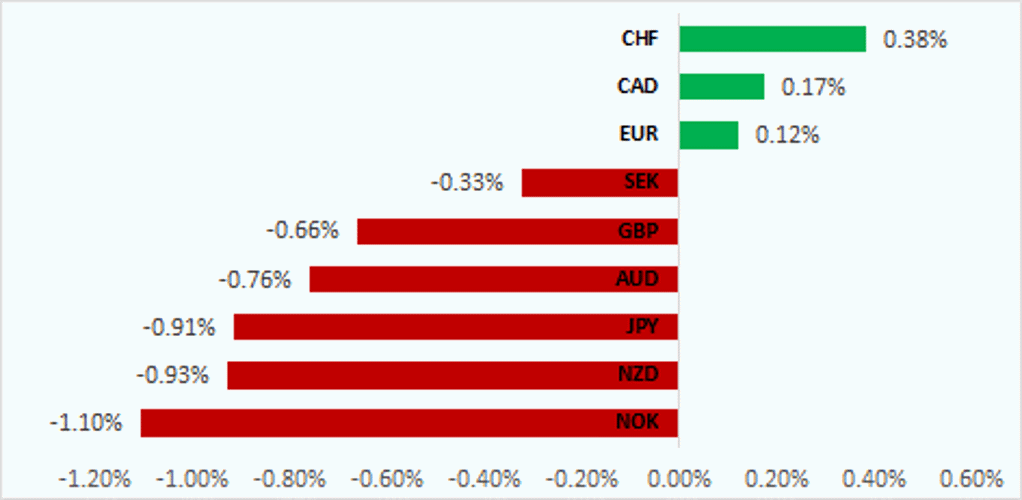

The retaliation by Israel against Iran overnight was relatively contained and the safe-haven demand initially triggered by Israel’s action has faded. However, the Swiss franc remains the top performing G10 currency this week highlighting more elevated geopolitical risks. The Israel action did prompt some localised ructions in the FX market with USD/MXN surging 6.7% today to the intra-day high and while triggered by Israel’s action was more a reflection of a large illiquid move as substantial carry positions were squeezed from the market. MXN/JPY carry positions are part of this dynamic and our own retail flows today indicated MXN selling that was over 50 times larger than the median selling flow over the last 12mths. We see elevated risks of intervention into next week and ahead of the BoJ policy meeting on Friday. Elevated risks of further big moves in the markets related to US yields remaining higher for longer are set to persist and in our view leaves the directional bias favouring further US dollar strength.

GEOPOLITICAL RISKS LEAVES CHF AS TOP G10 FX PERFORMER THIS WEEK

Source: Bloomberg, 13:45 BST, 19th April 2024 (Weekly % Change vs. USD)

Trade Ideas:

We have closed our long EUR/SEK trade idea after hitting our take-profit level and are maintaining our short CHF/JPY trade idea encouraged by the potential for intervention from the MoF in Japan.

JPY Flows – Portfolio flows by investor:

The data for February highlighted an increased current account deficit on a 3mth basis although March trade data indicates some potential for surpluses ahead.

FX Momentum Indicators:

Our sentiment analysis of the language used in the latest Beige Book shows that on balance regional economic activity is slightly more optimistic than in previous months. The improvement in the overall sentiment score was driven mainly by more positive descriptions of the economy, consumer and housing. One area that has deteriorated is inflation sentiment indicating more concern over upside risks.

FX Views

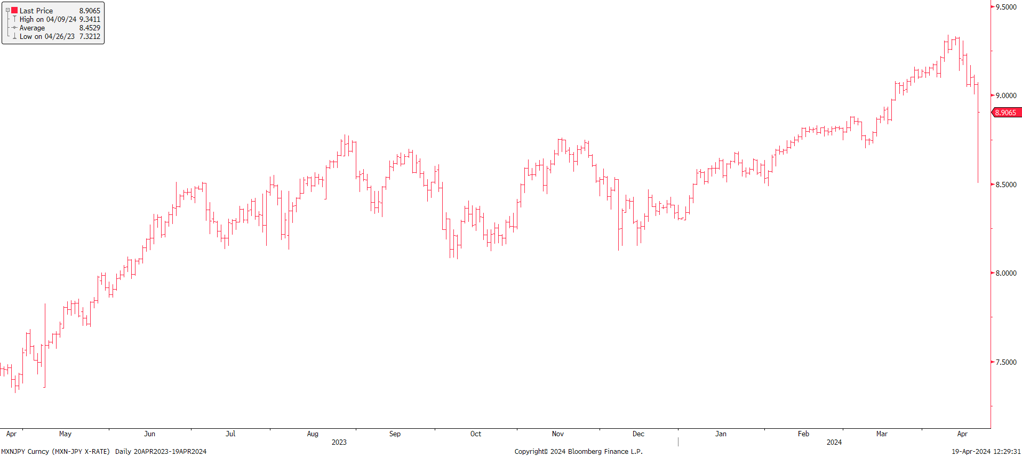

JPY: FX concerns elevated; MXN/JPY plunge and the BoJ

The relatively contained retaliation by Israel’s in its attack on Iran looks to have removed one imminent risk for the financial markets with Iran playing down the impact of the attack that should draw a line under this issue, over the short-term at least. The financial market reaction has been relatively contained too with UST bond yields now just a few bps lower and crude oil prices falling back after being 2% higher in London trading. We suspect the safe-haven demand will continue to subside and the focus will return to macro fundamentals and in particular, US fundamentals like inflation and what it means for US yields. The higher-for-longer theory will remain compelling until we see more convincing evidence of easing inflation and slowing growth. The US dollar should remain well supported in the meantime.

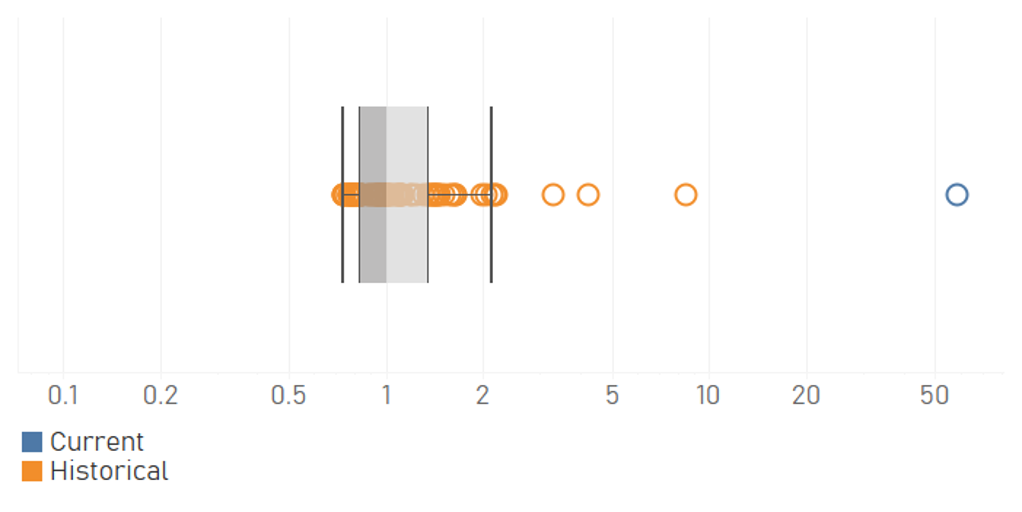

The news of Israel’s retaliation had a considerable outsized impact in the Mexican peso and the move was remarkable and clearly underlined the scale of long MXN positions in the market. While the trigger was the news of the Israel retaliation, the peso had already been weakening vs USD due to the higher-for-longer theme that was squeezing carry positions from USD/MXN. Prior to today’s move USD/MXN had already increased over 5% from the low on 9th April before then surging 6.7% today to the intra-day high before retracing a good portion of that move. We can see via our own flows here at MUFG that there has been significant MXN selling by the Japan retail segment of the market where long MXN has been a hugely attractive carry trade in retail. While the Israel retaliation was the trigger today, the fundamental backdrop of this move is carry and the diminishing attractiveness of carry in high-yielders given the grind higher in US yields. While increased yen volatility could signal JPY gains ahead, the retail sector is not generally positioned short yen and therefore it doesn’t seem likely that this Japan retail selling of MXN/JPY will necessarily spread. Nonetheless, the MXN move does underline potential risks ahead for carry positions more generally in circumstances of a continued grind higher in US yields. Our MXN/JPY sales today were over 50 times larger than the median selling flow over the last 12mths.

INTRA-DAY MXN/JPY FLASH CRASH DOWN BY -6.2%

Source: Bloomberg, Macrobond & MUFG GMR

TODAY’S MUFG MXN/JPY SELLING RELATIVE TO THE 1YR MEDIAN

Source: MUFG & Global Markets Research

The MXN/JPY move is quite isolated but the move will reinforce the concerns in Japan over the consequences of excessive speculative yen selling. While the retail sector does not look to be excessively positioned, IMM data certainly points to excessive positioning by professional traders. A mass liquidation of those positions could create unwarranted volatility and hence Japan’s opposition to speculative selling. The Washington gathering of finance ministers and central bankers included both Finance Minister Suzuki and BoJ Governor Ueda. There was no FX discussion at the G20 meeting but the statement from the US Treasury acknowledging Japan and South Korea concerns and the Japan/Korea bilateral meeting does open up the prospect of a more coordinated Asian resistance to the depreciation of Asian currencies versus the dollar. Indonesia has been intervening today while S. Korea regularly intervene (in both direction depending on USD direction) and others could be more willing if equities move further lower on USD strength. But Japan will be key in leading the way on any coordinated Asian action and for that the US Treasury statement still implies increased volatile conditions will be required to justify a move and get US Treasury acceptance.

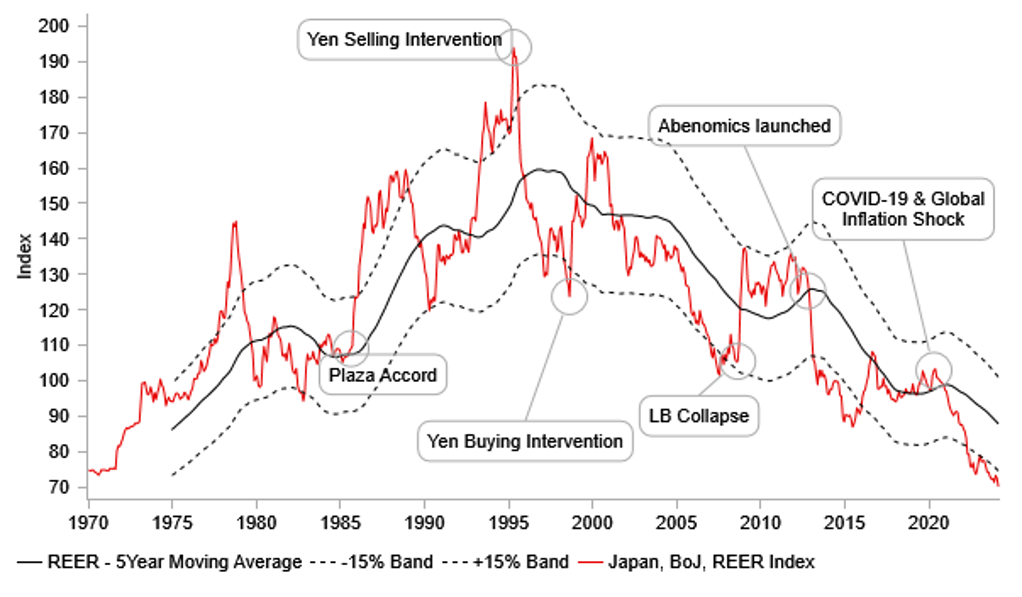

A key event for rates and FX next week will be the BoJ meeting on Friday. This meeting will see the BoJ publishing updated forecasts for GDP and inflation and given the rate hike in March we can expect the updated forecasts on inflation to confirm the price stability goal being met toward the end of the forecast horizon. The forecasts next week will include FY26 for the first time and it’s very likely this will show an inflation rate of at least 2.0%, consistent with Governor Ueda’s comments when policy was changed. The FY24 forecast (2.4%) and FY25 (1.8%) could both be tweaked higher too.

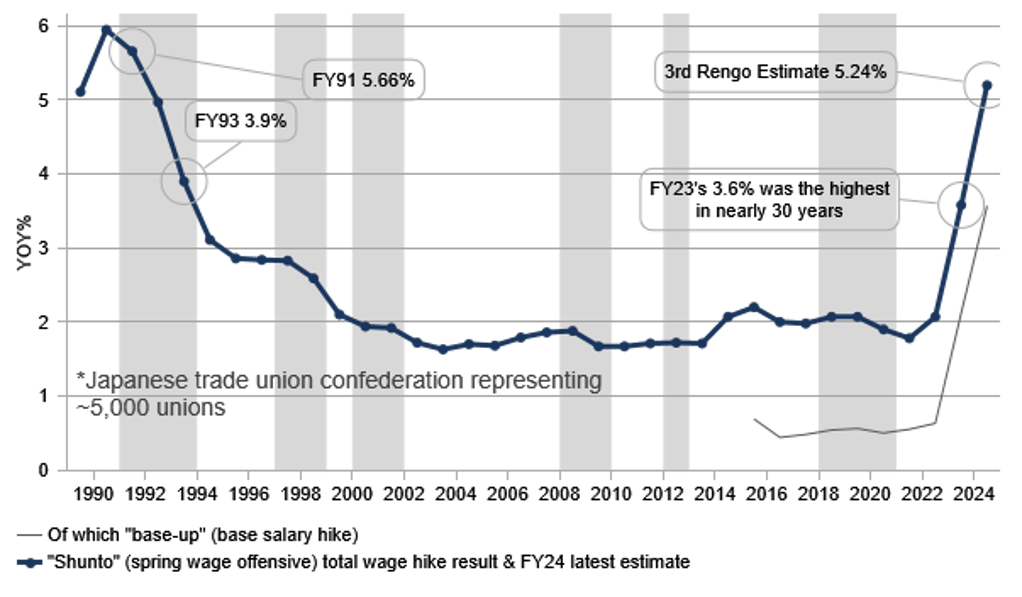

Other than the forecasts, the BoJ’s views on wage growth and FX will be key for the yen. As of the 3rd estimate from Rengo, the shunto wage negotiations have resulted in a wage increase of 5.24%, marginally down from the 2nd estimate of 5.25% and the 1st estimate of 5.28% and on track for the highest level since 1991. This year’s wage estimate is 1.5ppts higher than last year. The depreciation of the yen will very likely be given more attention by Ueda and could be a source for justifying a more hawkish communication. JPY weakness, the end of subsidised utility prices this month and higher energy prices are likely to all combine and result in a pick-up in inflation over the coming months. Whether the yen can gain any traction from next meeting is questionable. We believe it would take a considerably more hawkish communication perhaps expressing stronger concerns over yen weakness. However, that seems unlikely. FX remains the remit of the MoF outside of the inflation impact and while that is relevant for the BoJ, the FX move itself will hardly justify a much more hawkish communication. We still expect a rate hike in July and believe we are on “high-alert” for potential MoF intervention given the rhetoric and UST statement, and intervention ahead of the BoJ meeting is certainly a higher possibility now.

SHUNTO WAGE NEGOTIATED LEVEL AND LATEST FY24 ESTIMATE AND BASE SALARY INCREASE ESTIMATE

Source: Bloomberg, Macrobond & MUFG GMR

JPY REER LEVEL CONTINUES TO HIT NEW RECORD LOWS AHEAD OF BOJ MEETING NEXT WEEK

Source: Bloomberg, Macrobond & MUFG GMR

USD/CAD: Upside risks have increased as BoC leads the Fed in cutting rates

The recent broad-based strengthening of the USD has lifted USD/CAD back up to within touching distance of the highs from last autumn at just below the 1.3900-level. In recent years the pair topped out between 1.3800 and 1.4000 highlighting that it is now running into stronger technical resistance. So far year to date the CAD has weakened by around -3.7% against the USD. However, it has held up better against a basket of other G10 currencies. After stripping out the USD, the CAD has strengthened by around 2.3% against a basket of the other equally-weighted G10 currencies. It is the fourth best performing G10 currency this year after the three major currencies of the USD, GBP and EUR.

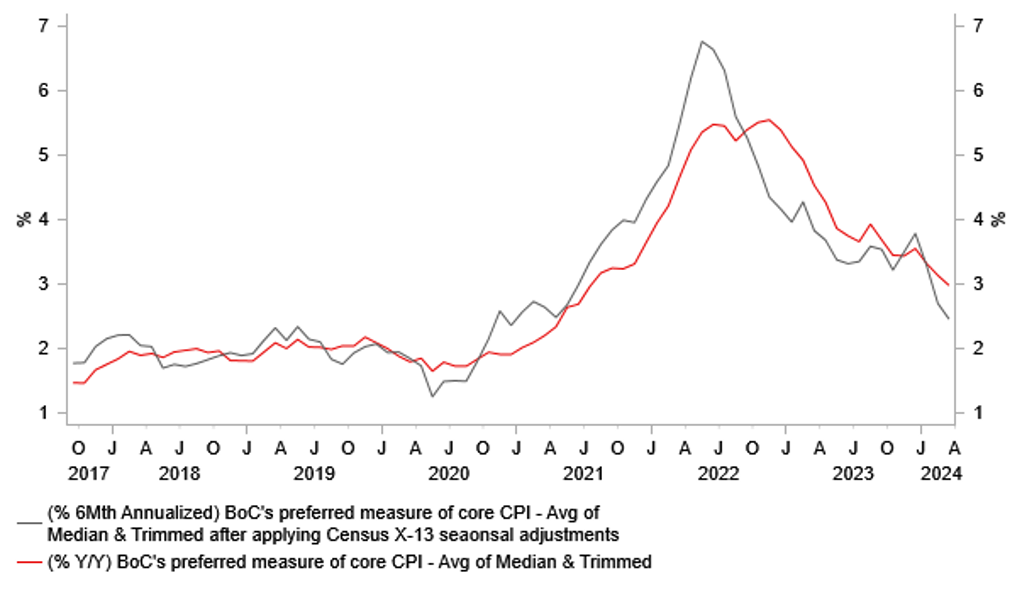

One of the main fundamental drivers for the move higher in USD/CAD at the start of this year has been the diverging paths for inflation in Canada and the US. Core inflation in Canada has surprised to the downside in the first three months of this year which stands in marked contrast to the recent run of upside inflation surprises in the US. After core inflation in Canada proved frustratingly persistent in the second half of last year, it has resumed its decent at the start of this year which is opening the door for the BoC to begin lowering interest rates. The BoC’s preferred measure of core inflation that is an average of the median and trimmed measures slowed to an annual rate of 3.0% in March. The slowdown in core inflation appears even more abrupt over the last six months when it has increased by an annualized rate of 2.5% after applying seasonal adjustments (Census X-13) to the data series. At the BoC’s last policy meeting, Governor Macklem stated that “we are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained. The softer March core CPI readings have increased the likelihood that the BoC will begin cutting rates at their next meeting in June and importantly ahead of the Fed. Chair Powell indicated this week that rate cut plans will be delayed into 2H of this year.

Not all recent developments have been negative for the CAD which is helping it to perform better against other non-USD G10 currencies. There has been encouraging evidence at the start of this year that Canada’s economy is picking up. After growing below potential by 1.1% in 2023, the recent run of stronger activity data has prompted the BoC to raise up their forecast for growth in Q1 to 2.8% and for it to average “around 2%” in the 1H 2024. Stronger growth has not discouraged the BoC from moving closer to lowering rates while core inflation has been slowing. At the same time, the BoC has become more optimistic over the supply side of the economy which helps to dampen the inflationary impact from stronger demand.

USD/CAD IS TESTING TOP OF TRADING RANGE

Source: Bloomberg, Macrobond & MUFG GMR

CORE INFLATION SLOWDOWN IN CANADA

Source: Bloomberg, Macrobond & MUFG GMR

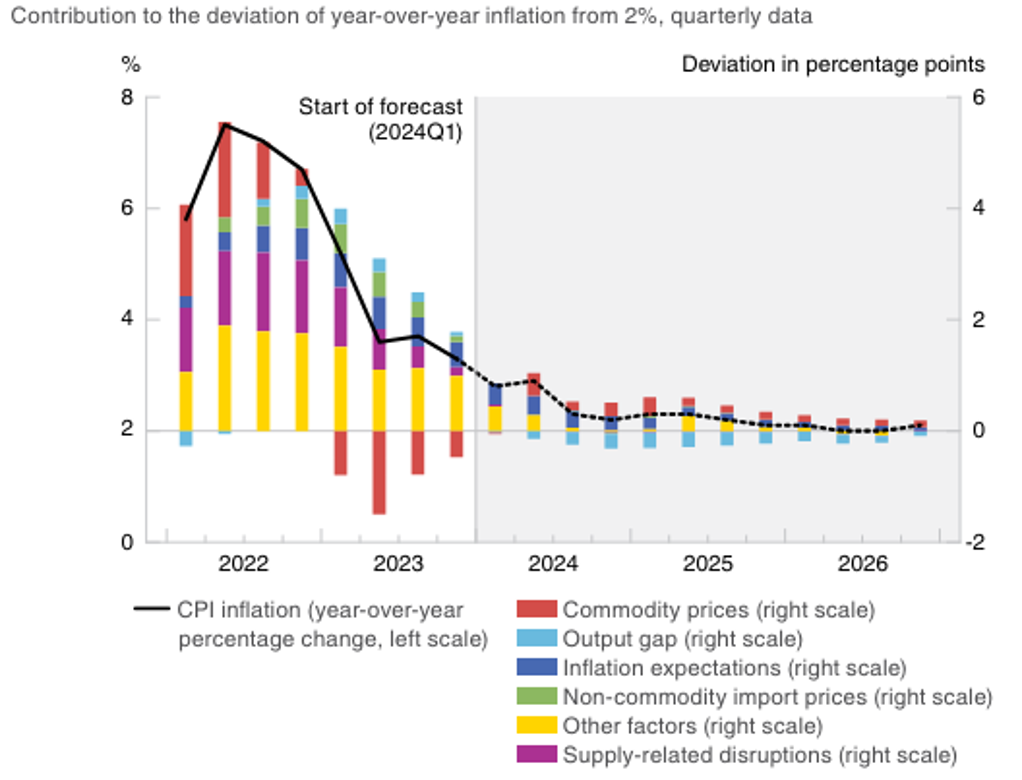

The BoC’s forecast range for potential output growth this year was raised to between 2.1%-2.8% on the back of strong immigration. As a result, the BoC still expects the amount of excess supply in Canada’s economy to remain similar to their previous forecasts. The output gap is expected to be remain between -0.5% and -1.5% of GDP in 1H 2024 which is supportive for further disinflation in Canada. In response to the upward revision to the potential output forecasts, the BoC also raised their estimate of the nominal neutral policy rate by 0.25 point to 2.25%-3.25%. It still leaves lots of room for the BoC’s policy rate to be lowered from the current restrictive rate of 5.00% in the coming years.

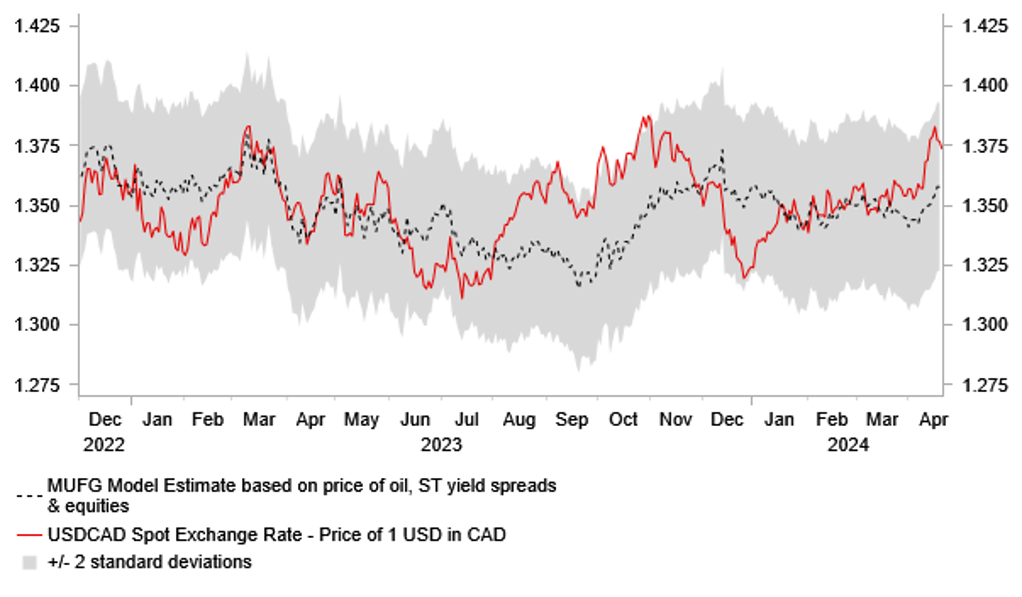

External events are important as well for driving USD/CAD performance. The price of oil has been rising at the start of this year driven in part by building optimism over a softer landing for the global economy and more recently by heightened geopolitical risks in the Middle East. The price of Western Canadian Select crude oil has risen by around a third so far this year and hit its highest level since the summer of 2022. The higher oil price is supportive for the CAD so long as it does not begin to significantly undermine confidence in the outlook for global growth. Our correlation analysis shows though that USD/CAD has been much more strongly correlated over the past month to US rates and global equity market performance. After advancing strongly over the previous five months, MSCI’s ACWI global equity index has suffered its largest correction lower (-4.4%) so far this month since October of last year. The hawkish readjustment of market expectations for the Fed to keep rates higher for longer is beginning to weigh down more on risk assets and the CAD.

In these circumstances, we expect USD/CAD to continue trading in the high 1.3000’s in the coming months. Recent developments have increased upside risks to our forecasts (click here) for USD/CAD especially for the current quarter. However, our short-valuation model that incorporates yield spreads, equity market performance and the price of oil does indicate that recent changes in fundamental drivers are already well priced in. It supports our view that it will be harder for USD/CAD to continue to moving higher beyond important resistance levels between 1.3800-1.4000.

OUTPUT GAP TO HELP LOWER INFLATION TO TARGET

Source: BoC MPR

USD/CAD VS. SHORT-TERM FUNDAMENTALS

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

04/22/2024 |

15:00 |

Consumer Confidence |

Apr P |

-14.3 |

-14.9 |

!! |

|

JPY |

04/23/2024 |

01:30 |

Jibun Bank Japan PMI Composite |

Apr P |

-- |

51.7 |

!! |

|

GBP |

04/23/2024 |

07:00 |

Public Sector Net Borrowing |

Mar |

-- |

7.5b |

!! |

|

EUR |

04/23/2024 |

09:00 |

HCOB Eurozone Composite PMI |

Apr P |

50.8 |

50.3 |

!!! |

|

GBP |

04/23/2024 |

09:00 |

BoE's Haskel speaks |

!!! |

|||

|

GBP |

04/23/2024 |

09:30 |

S&P Global UK Composite PMI |

Apr P |

-- |

52.8 |

!!! |

|

GBP |

04/23/2024 |

12:15 |

BoE's Pill speaks |

!!! |

|||

|

USD |

04/23/2024 |

14:45 |

S&P Global US Composite PMI |

Apr P |

-- |

52.1 |

!! |

|

USD |

04/23/2024 |

15:00 |

New Home Sales |

Mar |

675k |

662k |

!! |

|

AUD |

04/24/2024 |

02:30 |

CPI YoY |

Mar |

3.5% |

3.4% |

!!! |

|

AUD |

04/24/2024 |

02:30 |

CPI YoY |

1Q |

3.5% |

4.1% |

!!! |

|

SEK |

04/24/2024 |

07:00 |

Unemployment Rate SA |

Mar |

-- |

8.0% |

!! |

|

EUR |

04/24/2024 |

08:35 |

ECB's Cipollone Speaks |

!! |

|||

|

EUR |

04/24/2024 |

09:00 |

Germany IFO Business Climate |

Apr |

89.00 |

87.8 |

!!! |

|

CAD |

04/24/2024 |

13:30 |

Retail Sales MoM |

Feb |

0.0% |

-0.3% |

!! |

|

USD |

04/24/2024 |

13:30 |

Durable Goods Orders |

Mar P |

2.5% |

1.3% |

!! |

|

EUR |

04/24/2024 |

15:00 |

ECB's Schnabel Speaks |

!!! |

|||

|

CAD |

04/24/2024 |

18:30 |

BoC Releases Summary of Deliberations |

!!! |

|||

|

EUR |

04/25/2024 |

07:45 |

France Business Confidence |

Apr |

-- |

100.0 |

!! |

|

EUR |

04/25/2024 |

08:00 |

ECB's Schnabel Speaks |

!! |

|||

|

GBP |

04/25/2024 |

11:00 |

CBI Retailing Reported Sales |

Apr |

-- |

2.0 |

!! |

|

USD |

04/25/2024 |

13:30 |

GDP Annualized QoQ |

1Q A |

2.0% |

3.4% |

!!! |

|

USD |

04/25/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

JPY |

04/26/2024 |

00:30 |

Tokyo CPI YoY |

Apr |

2.5% |

2.6% |

!! |

|

JPY |

04/26/2024 |

Tbc |

BOJ Target Rate (Upper Bound) |

-- |

0.1% |

!!! |

|

|

EUR |

04/26/2024 |

09:00 |

M3 Money Supply YoY |

Mar |

0.6% |

0.4% |

!! |

|

CHF |

04/26/2024 |

09:00 |

SNB's Jordan Speaks |

!!! |

|||

|

USD |

04/26/2024 |

13:30 |

PCE Deflator YoY |

Mar |

2.6% |

2.5% |

!!! |

|

USD |

04/26/2024 |

15:00 |

U. of Mich. Sentiment |

Apr F |

78.0 |

77.9 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The BoJ’s upcoming policy meeting will be watched closely by market participants even though policy settings are likely to left unchanged after the exit from negative rates and YCC at the last policy meeting in March. The main focus will be the BoJ’s updated policy guidance and economic forecasts which will be scrutinized closely to assess the likely timing of the next BoJ rate hike. An upward revision to the inflation forecasts and/or risk assessment would signal more confidence in achieving the BoJ’s 2.0% inflation target. Any comments signaling upside risks to the inflation outlook from the recent sharp weakening of the yen could bring forward expectations for the timing of the next rate hike which we are currently penciling in for the July policy meeting.

- The main economic data releases in the week ahead will be: i) the latest US PCE deflator report for March (Fri), ii) US GDP report for Q1 (Thurs), iii) eurozone and UK PMI surveys for April (Tues), and iv) Australian CPI report for March and Q1 (Wed).

- The Fed has indicated that they are likely to delay cutting rates in response to the recent run of stronger US activity and inflation data. The release of the latest PCE deflator report for March is expected to provide further confirmation that core inflation pressures are proving stickier at the start of this year although inflation pressures should be less evident than in the already released CPI report for March. At the same time, the release of the latest US GDP report for Q1 is expected to reveal that economic growth continued to remain strong as evident in the latest retail sales report for March.

- The release of the latest PMI surveys from the euro-zone and UK are expected to provide a further positive signals that economic growth momentum in Europe is beginning to pick-up heading into the middle of this year supported by the fading of headwinds to growth from the inflation shock.