To read the full report, please download PDF.

A turning point for USD/JPY?

FX View:

The JPY has become more volatile ahead of the latest policy meetings from the Fed and BoJ at the end of this month. Further intervention from Japan has proven more cost effective at pushing down USD/JPY supported by more compelling evidence of slowing US inflation. The Fed should be more confident to signal that they are moving closer to cutting rates in September. In contrast, we still believe that the BoJ will hike rates again this month and there is a risk of a faster pace of slowdown for JGB purchases as well. Furthermore, former President Trump has expressed concern over the high level of USD/JPY ahead of the US election later this year. Taken together the developments are supportive of our view that USD/JPY is in the process of topping out.

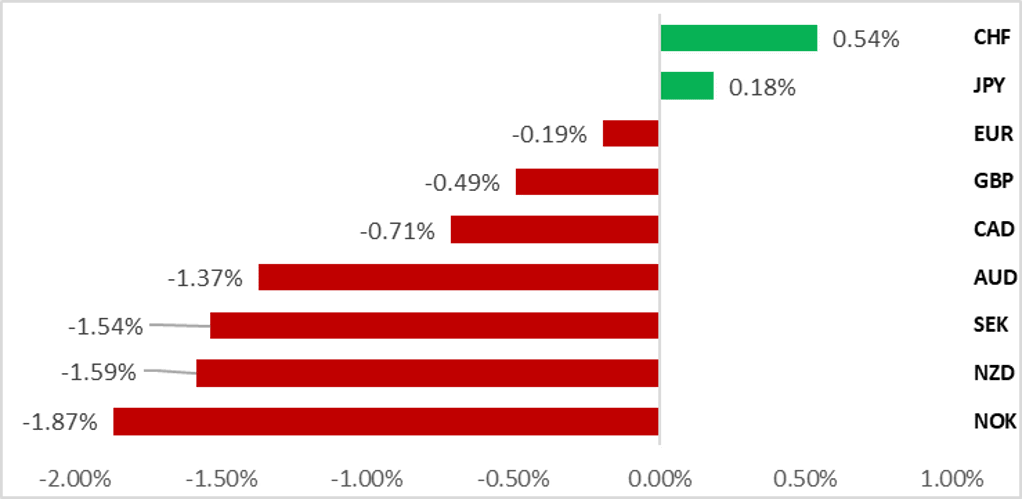

G10 FX PRICE ACTION IS CONSISTENT WITH RISK-OFF TRADING

Source: Bloomberg, 14:44 BST, 19th July 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining long GBP/SEK and long AUD/USD trade ideas.

IMM FX Positioning:

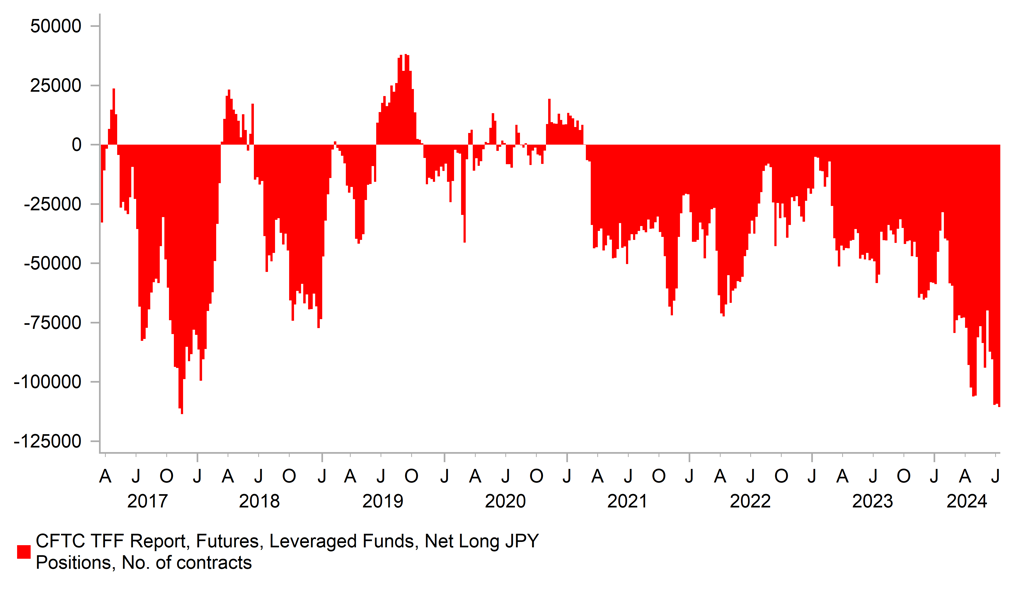

The latest IMM weekly positioning data covering the week to 9th July revealed that Leveraged Funds modestly scaled back long USD positions for the second consecutive week. Still, long USD positions remain close to recent highs from late April prior to intervention by Japan to support the JPY.

G10 Labour Market Analysis:

Job postings data signals labour market conditions have continued to soften across major economies since the start of this year. Our analysis identifies France, Canada and Germany as the top worst performing labour markets. There has been more divergence in the wage data between countries. Wage growth is proving more sticky in the UK which could discourage the BoE from cutting rates and encourage stronger GBP.

FX Views

JPY: Is the tide beginning to turn for USD/JPY?

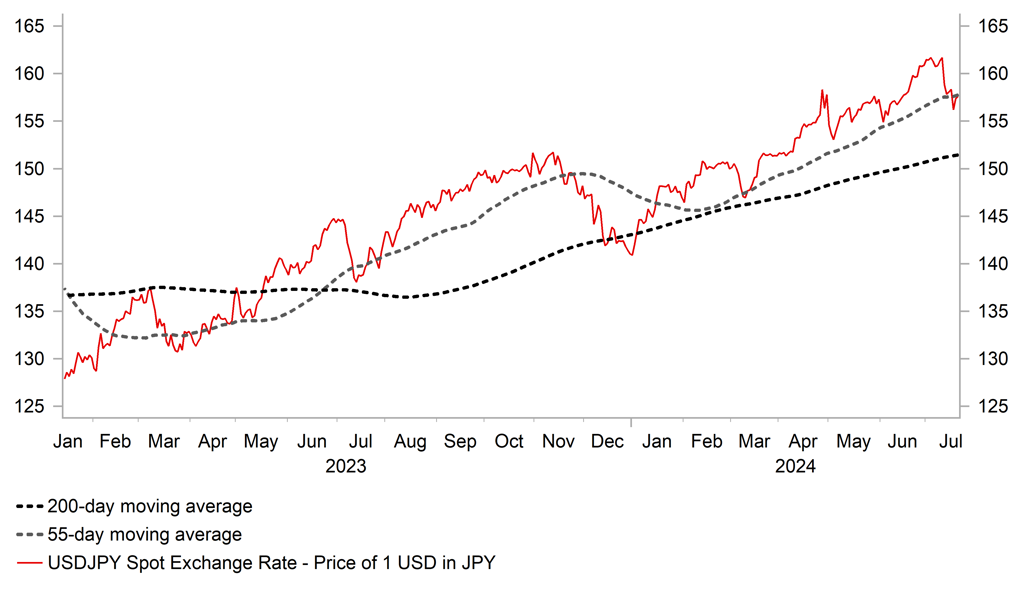

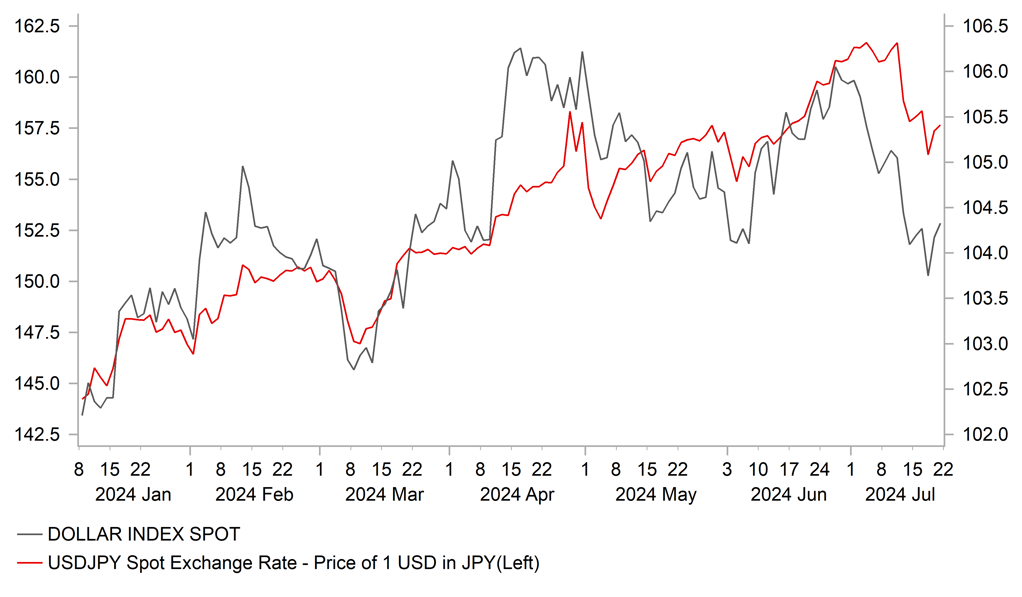

It has been another volatile week for the JPY. The JPY has continued to strengthen over the past week. It has resulted in USD/JPY falling sharply to an intra-day low of 155.38 recorded on 18th July as the pair corrected further below the recent peak at 161.95 from 3rd July. It has been the biggest adjustment lower for USD/JPY (-4.1%) since in late April and early May (-5.2%) when Japan intervened to support the JPY. It has since been officially confirmed that Japan purchased around JPY9.8 trillion of JPY in late April and early May. It was new record amount of intervention to support the JPY. For comparison, the previous bouts of intervention in September 2022 and October 2022 totalled around JPY9.1 trillion. After the intervention in late April and early May, it then took almost two months for USD/JPY to climb back to fresh highs back above the 160.00-level. The JPY weakening trend reversed only temporarily.

Similarly, the current correction lower for USD/JPY appears to have been triggered by further intervention from Japan to support the JPY at the end of last week. By looking at current account data from the BoJ, it has been estimated that Japan intervened again on Thursday and Friday totalling around JPY5.6 trillion. A smaller amount than in Iate April and early May suggesting that intervention has been more cost effective on this occasion. Japan’s strategy for intervention appears to have changed which has helped to provide more support for the JPY. Japan took a more proactive approach to push down USD/JPY just after the release of the much weaker US CPI report for June on 11th July. Whereas intervention previously appeared to be more reactive to JPY weakness as they started to intervene in late April after JPY weakness accelerated and USD/JPY broke above the 160.00-level. The change in intervention may have created more uncertainty among market participants over the potential timing of further intervention which is encouraging a lightening of elevated short JPY positions. The latest IMM report revealed that short JPY positions held by Leveraged Funds were at their highest level since November 2017 in the week ending the 9th July.

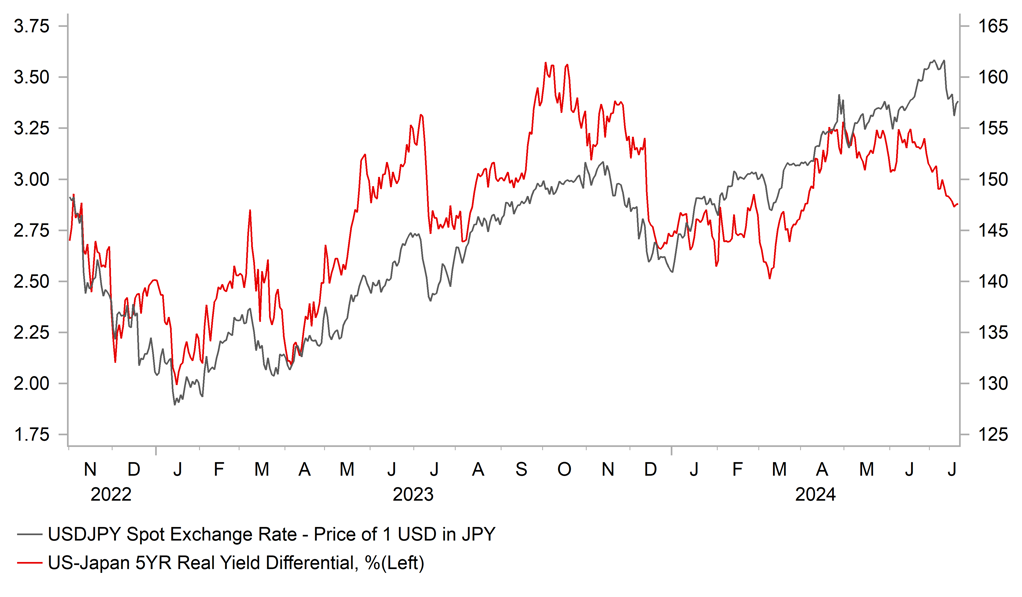

It is not just the apparent change in intervention strategy that has help to trigger a reversal lower for USD/JPY. The move lower for USD/JPY is deriving fundamental support from the ongoing adjustment lower in US yields. The June US CPI report has provided more compelling evidence that inflation in the US is continuing to slow back towards the Fed’s target which should give them more confidence to begin cutting rates.

IS A DEEPER CORRECTION LOWER ON THE CARDS?

Source: Bloomberg, Macrobond & MUFG GMR

SHORT JPY POSITIONS WERE AT MULTI-YEAR HIGHS

Source: MUFG & Global Markets Research

The favourable US inflation developments support our forecast for the Fed to begin cutting rates in September and to deliver multiple rate cuts in the 2H of this year. The US rate market has already moved to price back in around 63bps of cuts by year end. It has resulted in US yields continuing to adjust lower this month after peaking back in late April. The recent sharp adjustment lower for USD/JPY could reflect in part by some catch-up to the adjustment lower in US yields from previous months as well. We expect the Fed to send a stronger signal that they plan to begin cutting rates in September either at the next FOMC meeting on 31st July and/or at the annual Jackson Hole symposium which is scheduled to take place between 22nd and 24th August. The dovish repricing of Fed policy expectations should keep the USD trading on a softer footing over the summer.

In contrast, we expect the BoJ to tighten policy further at their next policy meeting on 31st July. We continue to believe that the Japanese rate market is underpricing the risk of a rate hike from the BoJ. There are currently around 4bps of hikes priced in according to Bloomberg which is well below our forecast for a 15bps hike from the BoJ. As a result, we see room for short-term yields in Japan to continue adjusting higher. The comments earlier this week from Japan’s Digital Transformation minister Taro Kono calling on the BoJ to hike rates to support the JPY and help dampen inflation triggered a rebuke from Finance Minister Shunichi Suzuki for talking so explicitly about the desire for stronger JPY. However, the government will be expecting the BoJ to do its part to provide more support for the JPY after intervening again in the FX market. If the BoJ disappoints expectations for tighter policy at the end of this month, USD/JPY will quickly rise back up to recent highs putting pressure on Japan to intervene again.

Market participants will also be closely watching the announcement of the BoJ’s plans to slowdown the pace of JGB purchases. The release today of minutes from the BoJ’s latest “Bond Market Group” meetings held with Japanese commercial banks, securities firms and buy-side firms between 9th and 10th July highlighted the risk that the BoJ could announce plans to slowdown JGB purchases more quickly than expected. Views on the amount of the reduction in JGB purchases included “it is desirable to reduce the amount of its monthly purchases to about one or two trillion yen”, “it is desirable to reduce monthly purchases to about two to three trillion yen”, and “an interim target should be about three trillion yen”. Comments on the pace of the reduction included: “the Bank should swiftly reduce the amount of its purchases of JGBs to its target level originally set to be achieved over around two year”, “initially reducing purchases by a significant amount and then implementing incremental reduction could prevent formation of investors’ vigilance against the reduction and expectations for further interest rate increases”, and “even if the Bank initially reduces its purchases of JGBs by a significant amount, an excessive raise in interest rates in unlikely to occur”. A faster pace of JGB purchase slowdown would reinforce upward pressure on long-term Japanese yields as well potentially providing more support for the JPY.

One additional factor that has encouraged a stronger JPY over the past week has been the release of a transcript of a recent interview by US President Donald Trump with Bloomberg’s Businessweek. In the wide-ranging interview, former President Trump expressed concern over the strength of the US dollar which is hurting the US manufacturing sector. He singled out Japan and China who he blamed for weakening their currencies, and threatened to place tariffs on them if they continue. The comments were similar to at the start of his first term when he tried to talk down the US dollar and was reasonably successful in his first year in office in 2017 when stronger global growth contributed to a weaker USD as well. The likely desire for a weaker US dollar during a second Trump term has attracted more attention this week following the selection of JD Vance to be Donald Trump’s vice-presidential nominee who has expressed a preference for a weaker USD. While Trump may desire a weaker US dollar, his inflationary policies (higher tariffs, lower taxes & lower immigration) could contribute to keeping the US dollar stronger for longer once they are implemented and start to have an impact. In the interim period we expect US inflation and growth to slow further into early next year allowing the Fed to cut rates and delivering the weaker USD to satisfy former President Trump. Trump’s desire for a lower USD/JPY indicates a higher likelihood that the US could consider joint intervention alongside Japan next year especially if the Fed is cutting rates as well.

Overall, recent developments have been moving more in favour of a stronger JPY with the pair potentially in the process of topping out. However, recent JPY gains could quickly reverse if the BoJ disappoints expectations for tighter policy at the end of this month lifting USD/JPY back up towards the 160.00-level. On the other hand, if the BoJ steps up to the plate and tightens more than expected, a deeper correction could see the pair falling back towards support from the 200-day average like back in late 2023 which currently comes in at around 151.50.

YIELD SPREADS LESS SUPPORTIVE FOR USD/JPY

Source: Bloomberg, Macrobond & MUFG GMR

BROADER USD WEAKNESS WEIGHING ON USD/JPY

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NZD |

07/21/2024 |

23:45 |

Trade Balance NZD |

Jun |

-- |

204m |

!! |

|

CNY |

07/22/2024 |

02:15 |

1-Year Loan Prime Rate |

3.45% |

3.45% |

!! |

|

|

EUR |

07/23/2024 |

08:00 |

ECB's Lane Speaks |

!!! |

|||

|

USD |

07/23/2024 |

15:00 |

Existing Home Sales |

Jun |

3.96m |

4.11m |

!! |

|

JPY |

07/24/2024 |

01:30 |

Jibun Bank Japan PMI Composite |

Jul P |

-- |

49.7 |

!! |

|

EUR |

07/24/2024 |

08:15 |

ECB's Guindos Chairs Panel |

!! |

|||

|

EUR |

07/24/2024 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Jul P |

-- |

45.8 |

!!! |

|

EUR |

07/24/2024 |

09:00 |

HCOB Eurozone Services PMI |

Jul P |

-- |

52.8 |

!!! |

|

GBP |

07/24/2024 |

09:30 |

S&P Global UK Manufacturing PMI |

Jul P |

-- |

50.9 |

!!! |

|

GBP |

07/24/2024 |

09:30 |

S&P Global UK Services PMI |

Jul P |

-- |

52.1 |

!!! |

|

EUR |

07/24/2024 |

13:00 |

ECB's Lane Speaks |

!! |

|||

|

USD |

07/24/2024 |

13:30 |

Advance Goods Trade Balance |

Jun |

-$98.0b |

-$100.6b |

!! |

|

CAD |

07/24/2024 |

14:45 |

Bank of Canada Rate Decision |

4.8% |

4.8% |

!!! |

|

|

USD |

07/24/2024 |

14:45 |

S&P Global US Composite PMI |

Jul P |

-- |

54.8 |

!! |

|

USD |

07/24/2024 |

15:00 |

New Home Sales |

Jun |

640k |

619k |

!! |

|

EUR |

07/25/2024 |

09:00 |

Germany IFO Business Climate |

Jul |

-- |

88.6 |

!! |

|

USD |

07/25/2024 |

13:30 |

GDP Annualized QoQ |

2Q A |

1.7% |

1.4% |

!!! |

|

USD |

07/25/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

07/25/2024 |

13:30 |

Durable Goods Orders |

Jun P |

0.5% |

0.1% |

!! |

|

JPY |

07/26/2024 |

00:30 |

Tokyo CPI YoY |

Jul |

2.3% |

2.3% |

!! |

|

SEK |

07/26/2024 |

07:00 |

Unemployment Rate SA |

Jun |

-- |

8.2% |

!! |

|

EUR |

07/26/2024 |

09:00 |

ECB 3 Year CPI Expectations |

Jun |

-- |

2.3% |

!! |

|

USD |

07/26/2024 |

13:30 |

Personal Spending |

Jun |

0.3% |

0.2% |

!! |

|

USD |

07/26/2024 |

13:30 |

Core PCE Price Index MoM |

Jun |

0.2% |

0.1% |

!!! |

|

USD |

07/26/2024 |

15:00 |

U. of Mich. Sentiment |

Jul F |

-- |

66.0 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The BoC will hold their latest policy meeting in the week ahead. The Canadian rate market is currently pricing in a high probability of the BoC delivering back to back rate cuts in June and July. There are currently around 23bps of cuts priced in for next week. In contrast. Canadian economists surveyed on Bloomberg are less convinced with the decision viewed as more finely balanced. Since the BoC’s last policy meeting in June, the unemployment rate has risen from 6.1% to 6.4% creating more room for the BoC to keep lowering rates. However, inflation pressures have picked up modestly after consistent run of downside surprises earlier this year. With the market well priced for a cut, we expect the BoC to take the opportunity to lower rates further but caution that the back to back cuts is not necessarily the normal pace of easing going forward.

- The main economic data releases in the week ahead will be the latest PMI surveys from Europe for July. Market participants will be watching closely to see if business confidence continues to deteriorate in the euro-zone after the pullback in June which could have been dampened by uncertainty over the political risk in France. We are expecting the euro-zone economy to continue recovering gradually in Q3. Political uncertainty has also eased recently in the UK after Labour won a large majority in parliament which could boost business confidence in the near-term. A third consecutive monthly drop in in the UK PMI surveys would be more concerning and signal that strong growth recorded in 2H of this year is unlikely to be sustained.

- The release of the latest monthly US PCE deflator report for June is expected to provide further confirmation that inflation has slowed in recent months. The average monthly prints of +0.4%M/M for core inflation were due to temporary factors and the disinflationary trend that was in place in 2h of last year has resumed. If confirmed it should make the Fed more confident that they can begin to cut rates soon. The next FOMC meeting in July is still too early for the first cut, but we expect a stronger signal that lower rates are likely to be delivered at the following meeting in September.