To read the full report, please download PDF.

USD bullish bias intact after NFP surge

FX View:

The leaning we currently hold favouring US dollar strength is being maintained after a week of key events that culminated today with a huge non-farm payroll increase of 353k, well above market expectations. While the probability of a rate cut in March is not nil (another NFP and two CPIs and a PCE report to come) the chances of a March rate cut are greatly reduced. The global backdrop continues to be supportive for the US dollar especially in the context of China given sentiment remains dire reflecting ongoing concerns over policy inaction to tackle the real estate crisis. The euro-zone outlook remains mixed with stagnating growth continuing. Hence, the US stands out for now and with the real fund funds rate the highest in the G10 space, there remains scope for further dollar strength. An escalation in regional banking sector concerns related to commercial real estate is the primary risk to the continuation of positive dollar momentum..

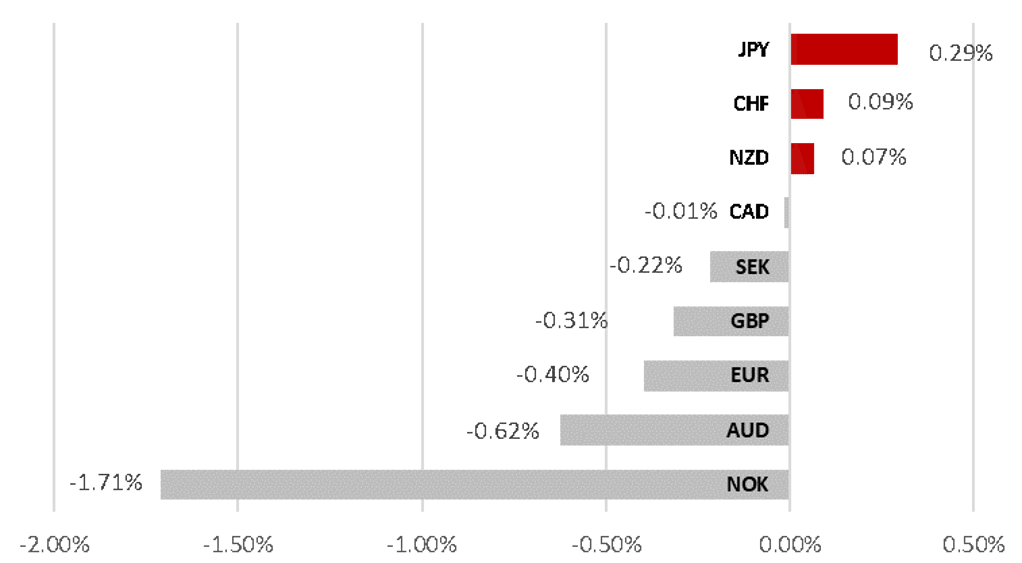

STRONG US JOBS REPORT RESULTS IN WEEKLY GAINS FOR USD VS MOST OF G10 FX

Source: Bloomberg, 14:45 GMT, 2nd February 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our two open trade views - short EUR/GBP and long USD/CHF given our continued favourable outlook for USD and GBP.

JPY Flows:

This week we cover the high frequency weekly cross-border flow data from the MoF. The data indicates strong buying of foreign bonds and equities by Japanese investors on a 4-week sum basis.

Yen Flow – Buy-Sell Indicator:

Our analysis highlights falling net buying of USD/JPY this week. This is the 2nd consecutive week of falling demand for USD/JPY.

FX Views

USD: Jobs data to reinforce USD gains

The US dollar was weaker against most of the rest of G10 this week with the Swiss franc and the yen two of the top three best performing currencies indicating a degree of risk aversion had influenced FX performance this week. However, that has just changed after the NFP data threw out a huge upside surprise with NFP printing +353k, way above the consensus of 185k. More on that below. The incoming economic data will of course remain key for the financial markets over the coming weeks ahead of the FOMC meeting in March and today’s jobs report was one of those critical data points that dents March cut holes but the regional banking sector uncertainties could shape Fed policy expectations as well. The US regional banking sector has come back into focus with signs of increased losses related to the US commercial real estate sector. The Fed dropped its reference in its statement to the US banking sector being “sound and resilient” which may have been done in the context of financial conditions no longer being as restrictive as they were and perhaps as a sign that this reference was no longer needed given the turmoil that prompted that has passed (March 2023). Bad timing perhaps given unfolding events since Wednesday and certainly an issue that could deteriorate rapidly again and bring renewed conviction of the Fed cutting sooner.

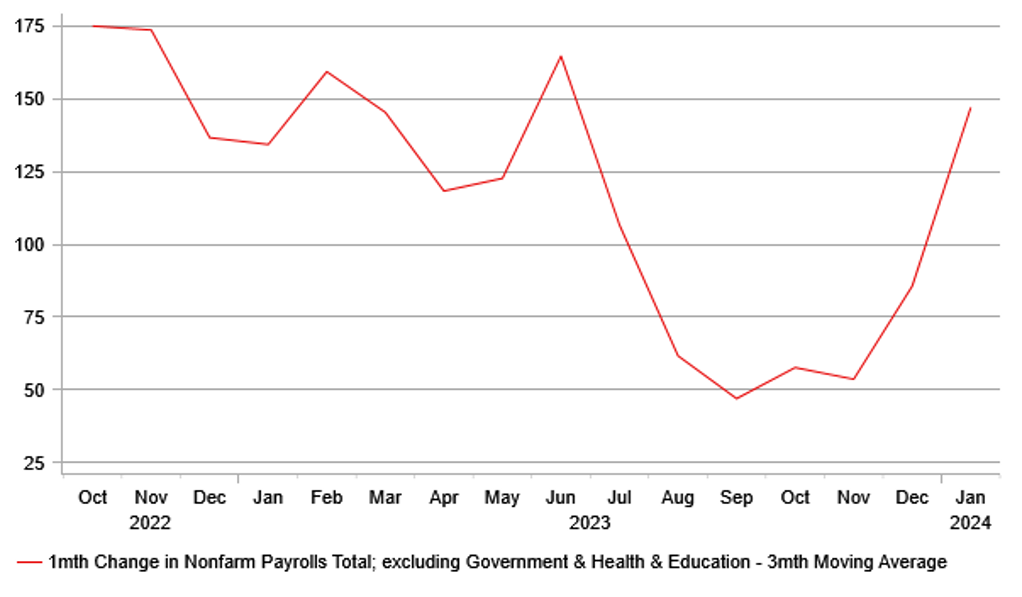

But first – the jobs data today. The 353k gain in NFP has prompted the move you would expect – the 2yr UST note yield is now up 17bps with the 2s10s curve inverting by about 5bps. The probability of a March rate cut has plunged from nearly 40% to 20% and we see that probability falling further still. There is another NFP print and two CPI prints along with a PCE release, so the March probability won’t fall to zero just yet but the prospects of a March cut now look very slim (unless banking sector turmoil returns). The data is strong across the board. We have highlighted the recent weakness of cyclical employment (NFP ex-education, health & government) which was running at a 3mth average of just 25k. That measure rebounded by 205k in today’s report. On top of that the benchmark revisions for 2023 revealed an upward revision of 10k on average per month last year. Average hourly earnings MoM growth doubled from 0.3% to 0.6% with the annual rate at 4.5%, the first acceleration since June last year and the highest rate since September.

Trepp, a commercial real estate data provider estimates that USD 2.2trn worth of CRE loans will mature through to 2027 and that will mean ongoing strain in particular for the US regional banking sector. These renewed concerns certainly looks to have encouraged US dollar selling this week considering the probability of a rate cut in March has nudged down following the FOMC meeting on Wednesday.

CYCLICAL NFP REBOUNDS AFTER STRONG JAN PRINT

Source: Bloomberg, Macrobond & MUFG GMR

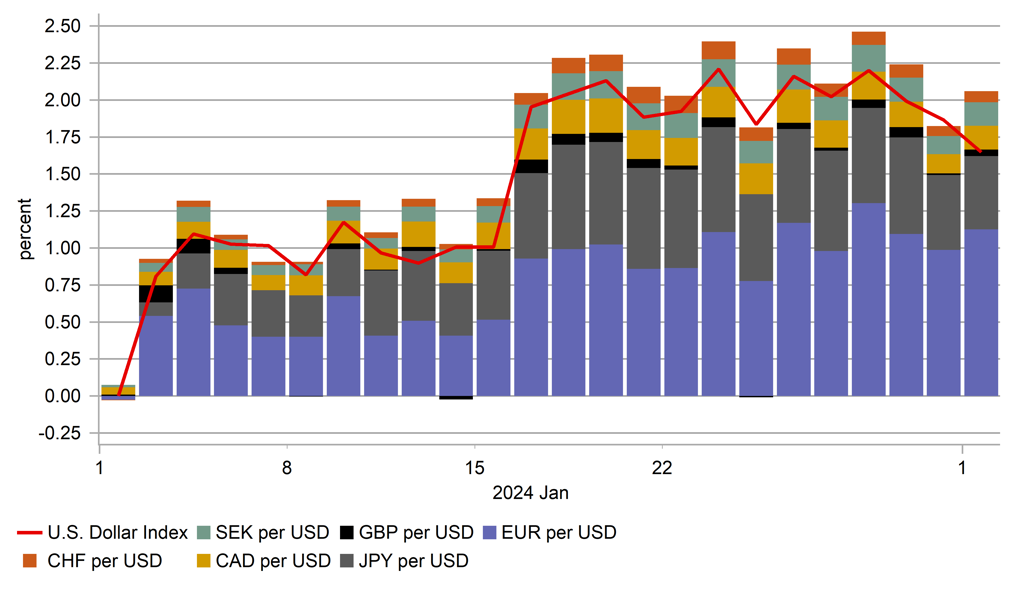

DXY GAIN YEAR-TO-DATE BY CURRENCY

Source: Bloomberg, Macrobond & MUFG GMR

This is what happened last year when we had the banking sector turmoil – the DXY on an intra-day basis fell nearly 5% from the high in March before the escalation of concerns to the low in April. That suggests a similar type price action could emerge although we doubt at this stage that we will see a repeat of the scale of risk aversion. In addition, Europe risks in the CRE space are also higher given rates and the scale of leverage. An ESMA report (click here) released in January highlighted the scale of increase in leverage. Bank loans to public and private real estate corporations increased by a record EUR 84BN in 2021, which was 121% larger than the 5-year moving average. Real estate corporate bond issuance also surged in 2021 and since 2018 a combined EUR 422bn of loans and bonds have been issued in the EEA. The ECB ‘higher for longer’ mantra could quickly spark stresses in the European market too.

The guidance from Fed Chair this week was clear – a rate cut in March was deemed unlikely unless incoming data surprised either with weaker than expected CPI prints or a worsening of the labour market. Chair Powell will quickly have another opportunity to update that guidance with an interview scheduled on 60 Minutes on Sunday and according to CBS News will discuss inflation risks, expected rate cuts and the banking system. Powell won’t be the only speaker over the coming week. Next week there will be eight Fed speakers at ten separate events so there will be plenty of opportunity for Fed officials to give there take on the jobs data and the upturn in regional banking sector uncertainties and what it may mean for policy. The scale of increase in the jobs data will undoubtedly be the focus of speeches and of course the NFP data makes it much more easy for speakers next week to credibly argue that more time is needed before rushing into cutting rates.

This data was much stronger than expected but it is consistent with a mildly bullish USD bias over the short-term. The risk of course is that the dollar extends further stronger than we were assuming. The global backdrop is still not conducive to dollar selling. In fact, the China outlook is deteriorating based on the January equity market price action while growth in the euro-zone is set to remain subdued. There really is no other positive news story beyond the US and the dollar for now. The Fed has been one of the most aggressive hikers in G10 in this cycle, has currently the highest policy rate in real terms and has the strongest looking economy. An escalation of regional banking sector turmoil seems the only risk near-term that could dent the positive momentum.

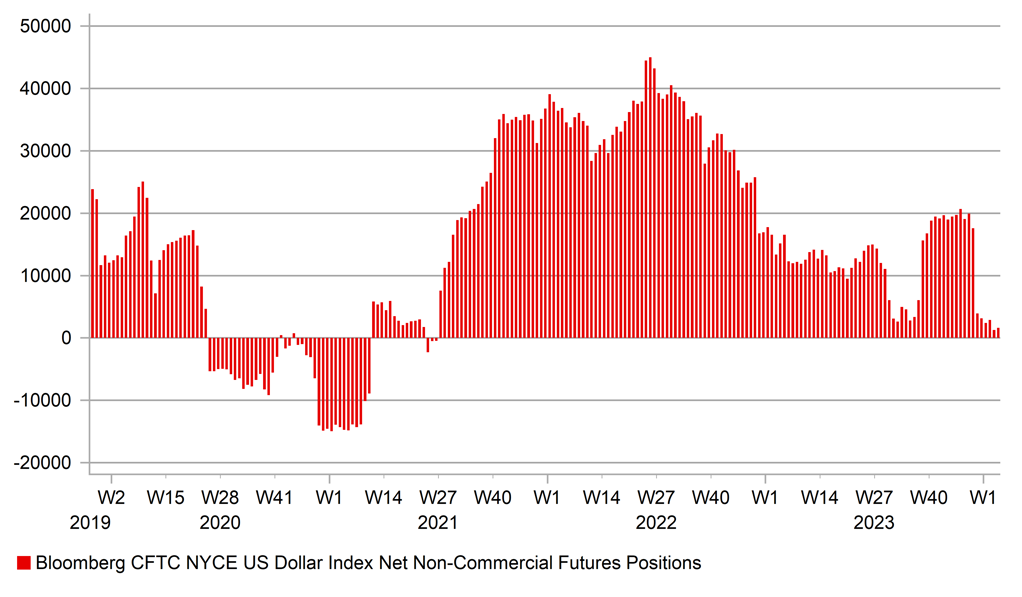

The DXY today held support at the 50-day MAV and briefly hit a new year-to-date high so the technical and fundamental backdrop looks favourable. Long positioning also lightened up and hence there is ample capacity for longs to be rebuilt

USD SPEC LONGS NEARLY COMPLETELY UNWOUND

Source: Bloomberg, Macrobond & MUFG GMR

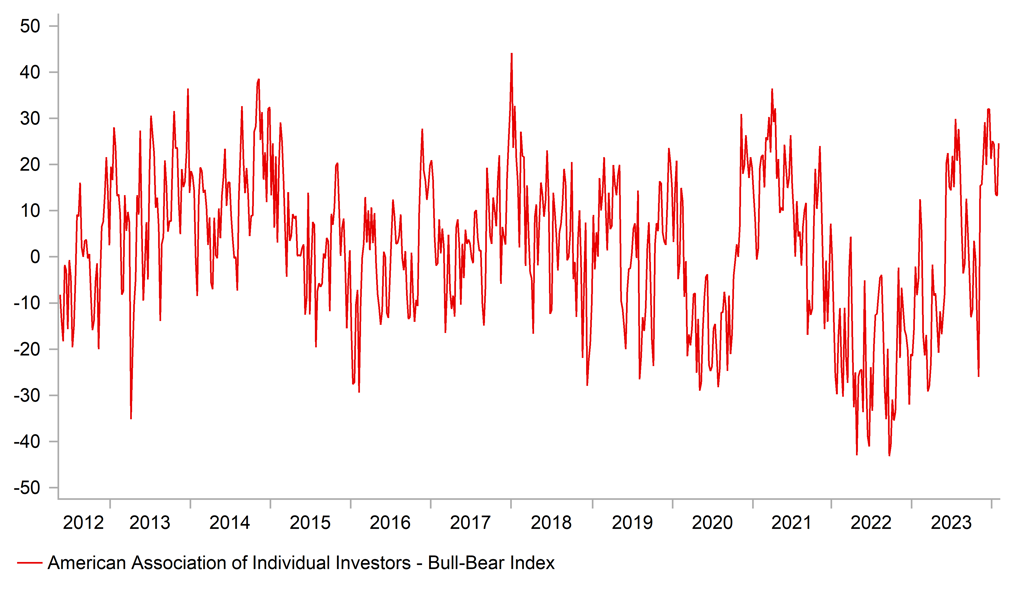

BULLISH US EQUITY SENTIMENT CONTINUES

Source: Bloomberg, Macrobond & MUFG GMR

G10 FX: Implications for FX market from recent G10 central bank updates

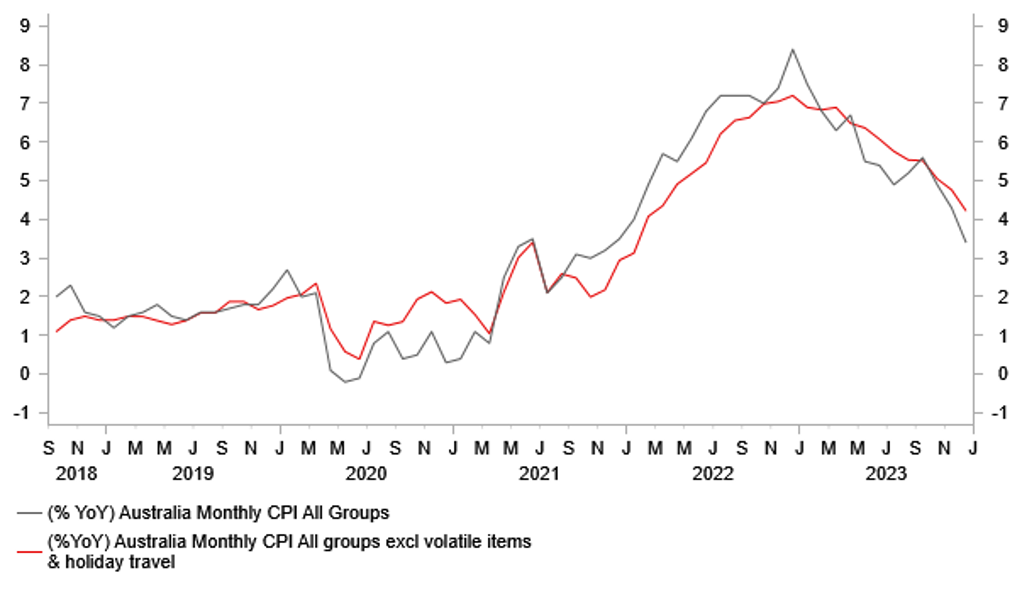

It has been a busy couple of weeks for G10 central bank policy updates which has provided further important guidance over the timing of rate cuts this year. So far this year, seven out of ten G10 central banks have provided policy updates with the RBA scheduled to be the next central bank to provide an update in the week ahead on Tuesday. The RBA is likely to drop their tightening bias in the week ahead in response to slowing inflation at the end of last year. Headline inflation slowed to an annual rate of 4.1% in Q4 coming well below the RBA’s forecast of 4.5%. The favourable developments have encouraged the Australian rate market to bring forward expectations for the timing of the first RBA rate cut to May or June. The May meeting is currently pricing in around 10bps of cuts. We are expecting the RBA’s updated policy guidance to push back against market expectations for earlier hikes similar to recent updates from the BoC, BoE (click here) and Fed. A development that could trigger a relief rally for the Aussie at the start of next week.

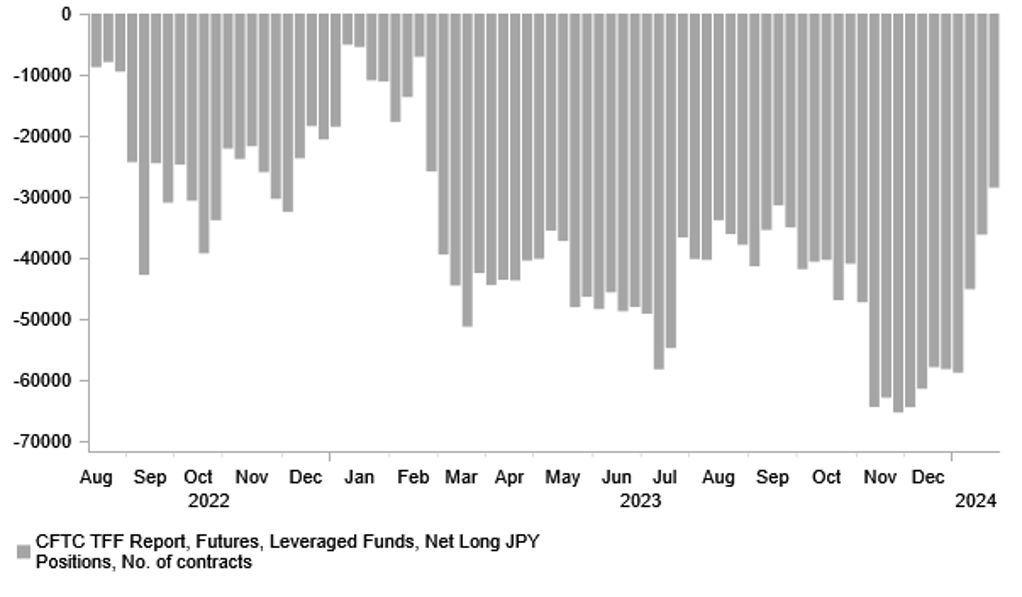

The most hawkish G10 central bank update so far this year was from the BoJ who are setting the stage for an exit from negative rates. Governor Ueda sent a clear signal that the BoJ is becoming more confident that they will meet their inflation target. A message that was backed up by the release this week of the summary of opinions from that policy meeting. The summary of opinions revealed that there is increasing confidence amongst BoJ members that the upcoming spring wage negotiations will result in favourable outcome for the inflation outlook, and that conditions are falling into place for an exit from negative rates. Recent communication has increased the risk that the BoJ could raise rates sooner at the next policy meeting in March rather than wait until April which is our base case scenario. It has helped the yen to recover some of the heavy losses recorded in the 1H of January and should continue to encourage further JPY gains heading into March/April.

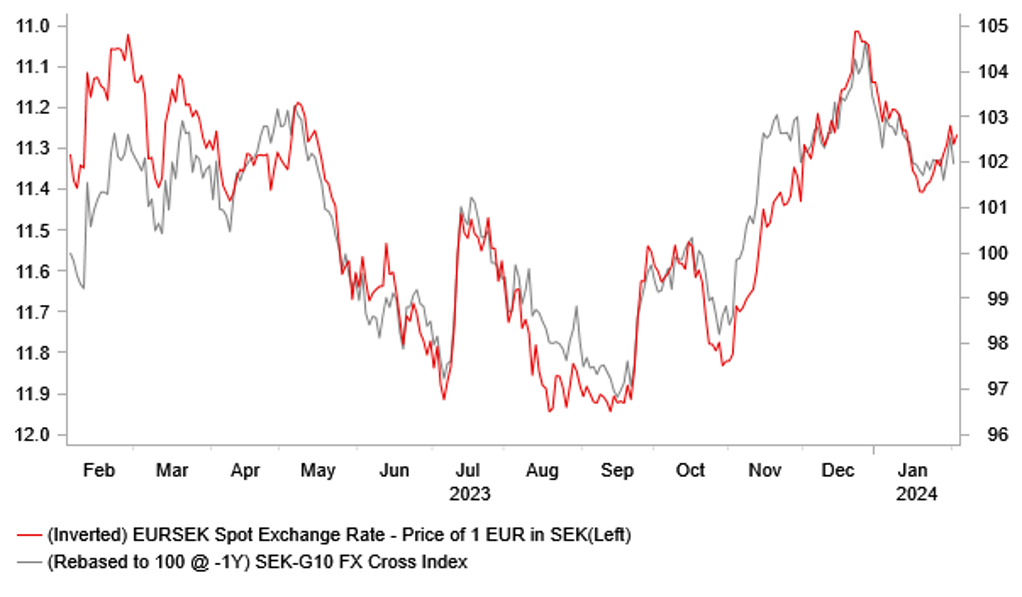

In contrast, recent policy updates from the ECB (click here) and Riksbank were more dovish than expected and have encouraged market participants to bring forward expectations for the timing of rate cuts. The euro-zone rate market has moved to more fully (17bps) price in the first ECB cut being delivered in April, and the Swedish rate market is positioned for even earlier Riksbank cut. The March meeting is now priced at just below a 50:50 probability and 17bps of cuts are priced in by May. It follows the Riksbank’s updated guidance that signalled clearly that the policy rate can probably be cut sooner as there is less risk of inflation becoming entrenched at levels that are too high. If inflation developments remain favourable than the Riksbank flagged that a rate cut could be delivered during the 1H of this year.

RBA TO RESPOND TO SLOWING INFLATION

Source: Bloomberg, Macrobond & MUFG GMR

RIKSBANK IS LESS CONCERNED BY SEK WEAKNESS

Source: Bloomberg, Macrobond & MUFG GMR

The increased likelihood of an earlier start to the Riksbank’s rate cut cycle has increased downside risks for the SEK at the start of this year. The SEK was already in the process of reversing strong gains recorded in the final two months of last year when EUR/SEK fell sharply from around 11.800 back to within touching distance of the 11.000-level. After those strong gains the Riksbank appears much less concerned than in autumn of last year over upside inflation risks posed by a weaker SEK. One of the measures the Riksbank introduced to help provide more support for the SEK last autumn is now coming to an end as well. The latest weekly data from the Riksbank reveals that sales of USDs and EURs to partially hedge FX Reserves are on course to be completed in the coming weeks. It has almost met its target to sell USD8 billion and EUR2 billion. One partial offsetting factor is the announcement from the Riksbank that it will speed up the pace of quantitative tightening from SEK5 billion per month to SEK6.5 billion. Overall, the developments have increased downside risks for the SEK in the near-term.

The main take away for the FX market from recent G10 central bank updates is that the start of rate cutting cycles appear on course to be relatively synchronized which is contributing to stable FX market conditions at the start of this year. We expect the Fed, ECB, BoE, BoC, Riksbank and SNB to have all started cutting rates by Q2. There is a higher risk though that the BoE and BoC could wait a little later to begin cutting rates, and be closer in timing to the laggards of the Norges Bank, RBA and RNBZ. We have already recommended a short EUR/GBP trade idea to benefit from the BoE lowering rates after the ECB. One clear exception was the BoJ’s updated policy stance which indicated that they are moving in the opposite direction from other G10 central banks by setting the stage for a higher rates and an exit from negative rates for the first time since 2016. The increased risk of the BoJ exiting negative rates a soon as in March could prove to be a catalyst for the JPY to rebound further by the end of this quarter.

LEVERAGED FUNDS HAVE SCALED BACK JPY SHORTS

Source: Bloomberg, Macrobond & MUFG GMR

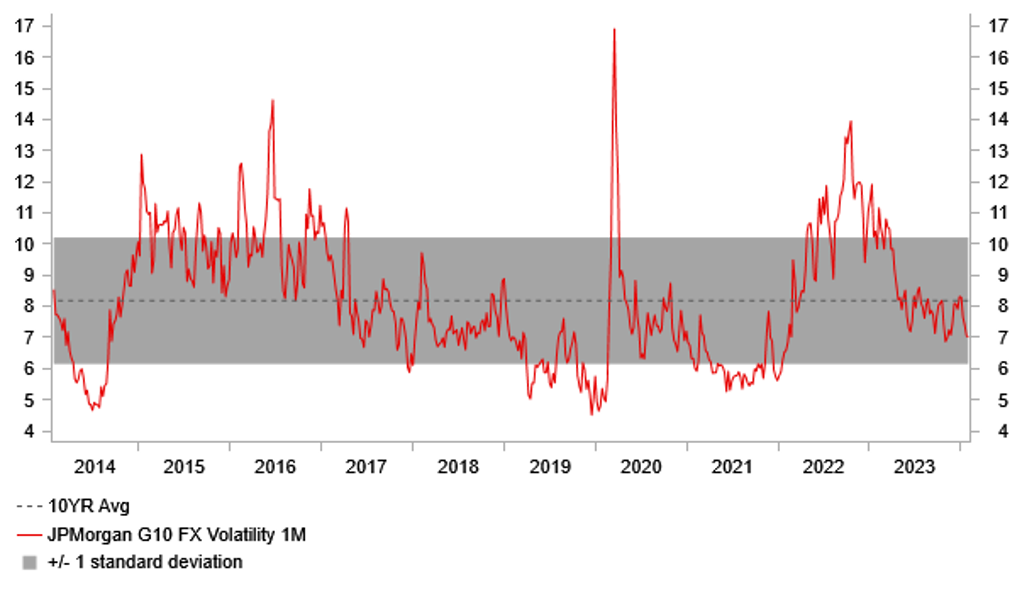

G10 FX VOLATILITY CONTNUES TO FALL

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

02/05/2024 |

07:00 |

Germany Trade Balance SA |

Dec |

-- |

20.4b |

!! |

|

GBP |

02/05/2024 |

07:00 |

ONS publish LFS data for Sept. to Nov. 2023 |

!!! |

|||

|

EUR |

02/05/2024 |

09:30 |

Sentix Investor Confidence |

Feb |

-- |

- 15.8 |

!! |

|

GBP |

02/05/2024 |

09:30 |

S&P Global UK Services PMI |

Jan F |

-- |

53.8 |

!! |

|

EUR |

02/05/2024 |

10:00 |

PPI YoY |

Dec |

-- |

-8.8% |

!! |

|

USD |

02/05/2024 |

14:45 |

S&P Global US Services PMI |

Jan F |

-- |

52.9 |

!! |

|

USD |

02/05/2024 |

15:00 |

ISM Services Index |

Jan |

52.2 |

50.6 |

!!! |

|

USD |

02/05/2024 |

19:00 |

Senior Loan Officer Opinion Survey |

!!! |

|||

|

JPY |

02/05/2024 |

23:30 |

Labor Cash Earnings YoY |

Dec |

1.5% |

0.2% |

!!! |

|

AUD |

02/06/2024 |

00:30 |

Retail Sales Ex Inflation QoQ |

4Q |

0.2% |

0.2% |

!! |

|

AUD |

02/06/2024 |

03:30 |

RBA Cash Rate Target |

4.35% |

4.35% |

!!! |

|

|

EUR |

02/06/2024 |

07:00 |

Germany Factory Orders MoM |

Dec |

-- |

0.3% |

!! |

|

EUR |

02/06/2024 |

10:00 |

Retail Sales MoM |

Dec |

-- |

-0.3% |

!! |

|

NZD |

02/06/2024 |

21:45 |

Employment Change QoQ |

4Q |

0.2% |

-0.2% |

!!! |

|

EUR |

02/07/2024 |

07:00 |

Germany Industrial Production SA MoM |

Dec |

-- |

-0.7% |

!! |

|

USD |

02/07/2024 |

13:30 |

Trade Balance |

Dec |

-$62.3b |

-$63.2b |

!! |

|

USD |

02/07/2024 |

16:00 |

Fed Governor Kugler speaks |

!!! |

|||

|

JPY |

02/07/2024 |

23:50 |

BoP Current Account Balance |

Dec |

¥796.9b |

¥1925.6b |

!! |

|

GBP |

02/08/2024 |

00:01 |

RICS House Price Balance |

Jan |

-- |

-30.0% |

!! |

|

CNY |

02/08/2024 |

01:30 |

CPI YoY |

Jan |

-0.5% |

-0.3% |

!! |

|

USD |

02/08/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

EUR |

02/08/2024 |

15:30 |

ECB's Lane Speaks |

!!! |

|||

|

AUD |

02/08/2024 |

22:30 |

RBA Governor Bullock - Testimony |

!!! |

|||

|

NOK |

02/09/2024 |

07:00 |

CPI YoY |

Jan |

-- |

4.8% |

!! |

|

EUR |

02/09/2024 |

07:00 |

Germany CPI EU Harmonized YoY |

Jan F |

-- |

3.1% |

!! |

|

EUR |

02/09/2024 |

07:45 |

France Wages QoQ |

4Q P |

-- |

0.5% |

!! |

|

CAD |

02/09/2024 |

13:30 |

Net Change in Employment |

Jan |

-- |

0.1k |

!!! |

|

USD |

02/09/2024 |

Tbc |

Revisions: CPI |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The RBA is expected to leave their policy rate unchanged at 4.35% for the second consecutive meeting. We expect the RBA to signal that it is more confident that their policy rate has peaked. Inflation at the end of last year fell more than the RBA was expecting. CPI slowed to an annual rate of 4.1% in Q4 compared to the RBA’s forecast of 4.5%. The Australian rate market has moved to bring forward the timing of the first rate cut from the RBA to the June policy meeting. We are not expecting the RBA to provide a strong signal in the week ahead that they are planning to cut rates imminently.

- The main economic data releases in the week ahead will be: i) the updated labour market data from the UK for the period from September to November (Monday), ii) the ISM services survey for January (Monday), iii) the latest US SLOOS (Monday), iv) the labour cash earnings data from Japan for December (Monday), v) the labour market reports from New Zealand (Tuesday) and Canada (Friday), and vi) revisions to the US CPI data from last year. Market participants will continue to closely follow the latest wage data from Japan as the BoJ moves closer to raising rates.

- The release of the minutes from the January BoJ policy meeting revealed that the they are becoming more confident that stronger wage growth will be sustained. It has increased the risk of the BoJ raising rates sooner in March rather than waiting until April. The Fed has already stated that it will be focusing on the updated CPI data after the upcoming revisions to give it more confidence that inflation will continue to slow.