To read the full report, please download PDF.

Muted USD reaction as Fed easing begins

FX View:

This week the US dollar (DXY) is lower by only 0.4% following the FOMC decision to cut rates by 50bps. It’s clear market participants were well positioned for the larger cut and that has seen a more muted reaction. After this first rate cut we take a look back at more recent Fed easing cycles to assess the response of the USD to the start of easing cycles. Of course every cycle is different but whether a soft or hard landing materialises is one key factor for performance. We also take a look at FX responses to central bank action in Europe in this cycle. So far, the FX impact has been mixed. The GBP’s outperformance has been encouraged by the BoE’s reluctance to lower rates but the Norges Bank’s similar stance has proven less supportive for the NOK. On the other hand, the CHF and SEK have strengthened even as the SNB and Riksbank have led the way in cutting rates. The SNB would have to deliver a larger 50bps cut in the week ahead if they want to even temporarily weaken the CHF and ease downside risks to inflation in Switzerland.

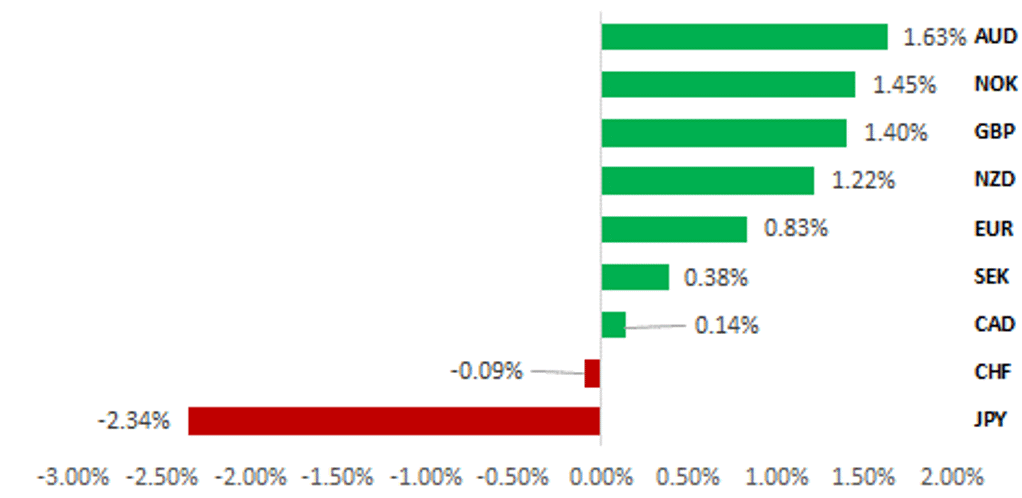

JPY REVERSES GAINS ON EXCESSIVE LONG JPY POSITIONING

Source: Bloomberg, 13:00 BST, 20th September 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are closing our short USD/JPY trade idea after the BoJ signalled more caution over the need for another rate hike as soon as October.

Portfolio flows by investor type:

This week we cover the monthly cross-border flows by Japanese investor type and indicate which investor type was behind the record buying of foreign bonds in August.

Sentiment Analysis on the latest FOMC press conference:

Our analysis highlights that the Fed opted for a 50bp cut instead of 25bp to respond more urgently to labour market concerns. On the other hand references to upside risks to inflation have diminished. The Fed’s greater sensitivity to labour market risks indicates that they could deliver further 50bps cuts if labour market sentiment becomes even more negative at upcoming FOMC meetings.

FX Views

USD: First cuts and US dollar direction

The US dollar is rebounding heading into the close of trading this week and on a DXY basis, the dollar is close to the level prevailing when the Fed announced its larger than expected 50bp rate cut on Wednesday evening. While the Fed’s decision was in line with the MUFG house view, the vast majority of banks’ researchers and strategists were calling for a 25bp cut. But based on price action since the cut it is certainly apparent that market traders were much better positioned for the 50bp cut that was delivered. The 2-year UST note yield fell 10bps in response to the announcement but then retraced the move and is currently only about 7bps below the pre-announcement yield. The 10-year UST bond yield is about 2bps higher. So given the Fed easing cycle is now officially underway can we make any conclusions on US dollar direction based on past examples of dollar performance following the first rate cut from the Fed?

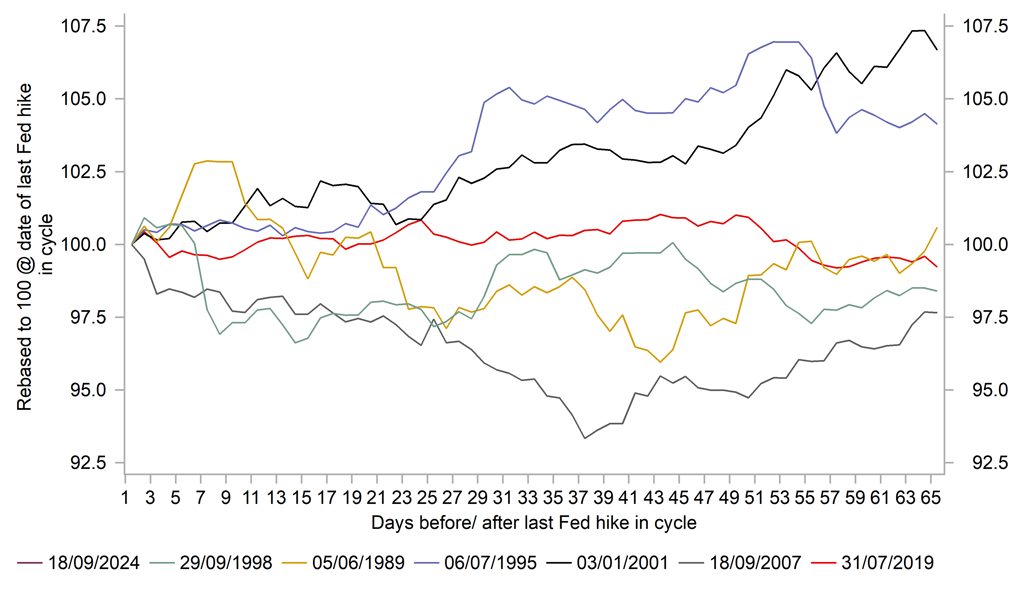

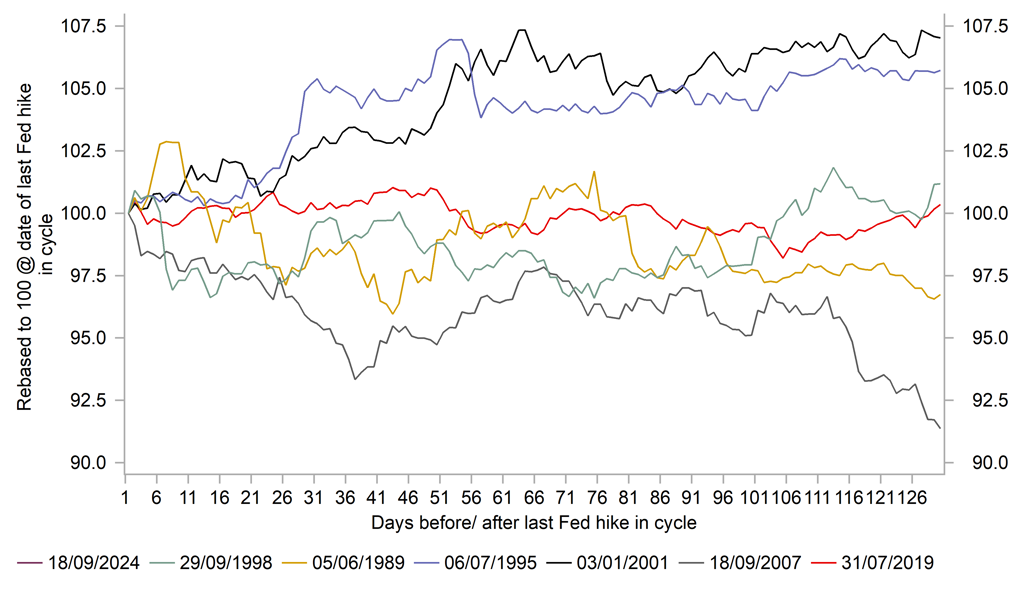

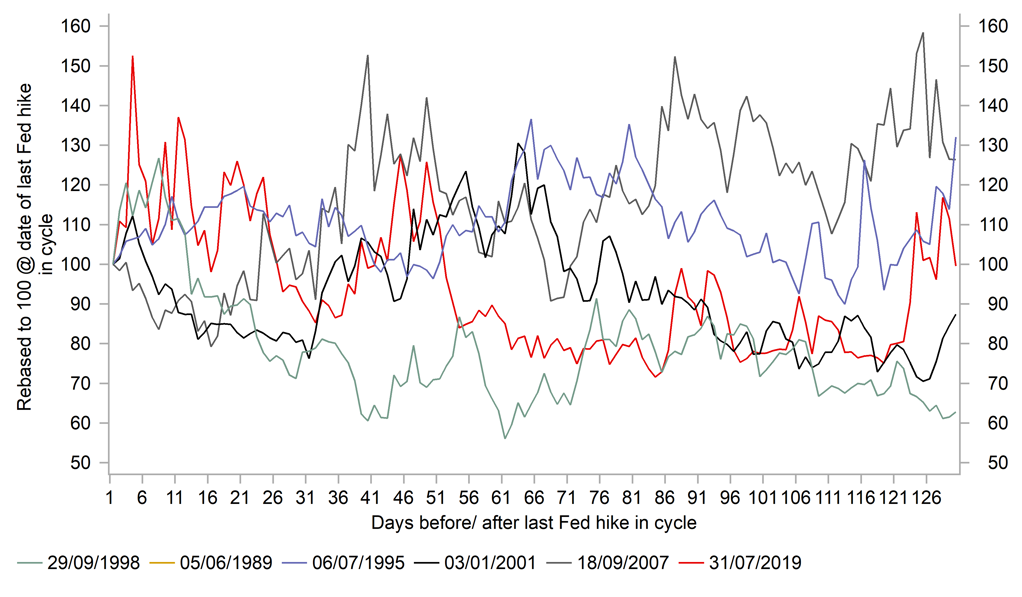

The two charts below show the performance of the Fed’s Advanced Economy USD Index over a 3mth and 6mth periods following the first rate cut in the last six Fed easing cycles. We have included 1998 although this “cycle” was extremely short if it can be classed as a cycle at all and was really more about implementing rapidly some monetary stimulus to curtail the contagion from the Asian financial crisis that had spread triggering a Russian debt default and rouble devaluation. In any case, the performance of the dollar following the first rate cut is mixed – in both the 3mth and 6mth periods, the dollar is stronger on two occasions, close to unchanged to two occasions and weaker on two occasions.

The dollar performed best over both the 3mth and the 6mth periods following the first rate cuts in 1995 and in 2001. 1995 is really the only clear example of the Fed engineering a soft landing for the economy. After hiking rates from 3.00% to 6.00% between February 1994 and February 1995, the FOMC did a rapid u-turn and cut for the first time in July 1995. Two further cuts were implemented and after sluggish growth in H1 1995 (1.3% Q/Q SAAR avg) the economy rebounded. The low for the fed funds was still an elevated 5.25%. Crucially, in addition to achieving a soft landing, in Europe, the German Bundesbank was cutting rates aggressively. From February 1994 to April 1996, the Bundesbank’s policy rate was cut from 5.75% to just 2.50%. Over a 5-quarter period starting in Q1 1995 to Q1 1996, German real GDP slowed from 3.0% Q/Q to 0.0% highlight the extent of weak fundamentals in Europe.

FED’S USD INDEX – 3MTHS AFTER LAST 6 1ST CUTS

Source: Bloomberg, Macrobond & MUFG Research

FED’S USD INDEX – 6MTHS AFTER LAST 6 1ST CUTS

Source: Bloomberg, Macrobond & MUFG GMR

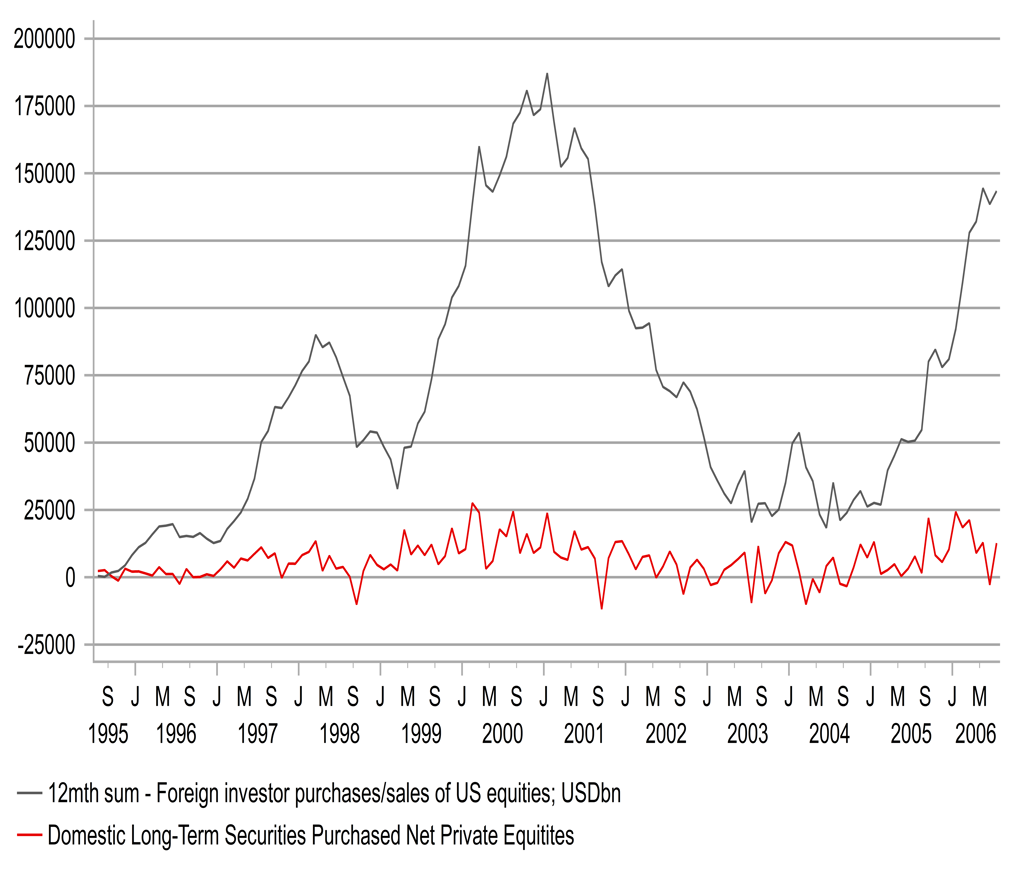

The 2001 example was not as successful as 1995 in achieving a soft landing as the economy contracted in both Q1 and Q3 2001 with annual GDP growth in Q4 2001 a mere 0.2%. The National Bureau of Economic Research that calls official recessions marked the recession from April to November 2001. But it was mild and was brought to an end ironically by 9/11 with then President George Bush implementing tax cuts to provide support for the US consumer. The Fed cut aggressively and by 50bps on the first five occasions with the fed funds falling from 6.00% to 1.75% by year-end. The economy was also suffering due to IT bubble bursting the previous year. The dollar advanced by 7% in the first 3mths and maintained that gain over 6mths. The ECB was much more conservative, cutting by 175bps between April and November. Despite the IT bubble bursting, the US dollar was supported by at that point record foreign investor demand for US securities in 2000 and 2001 through to 9/11. There was also USD buying intervention versus the yen after 9/11 by the Japanese authorities.

The worst dollar performance period in both the 3mth and 6mth was in 2007 going into the GFC. The Fed cut by 50bps on 18th September (!!) that year which was followed by two 25bp cuts (!!). The strains in the financial markets were emerging but in hindsight the Fed moved too slowly. On this occasion we had a clearer divergence with Europe with the ECB keeping the policy rate steady at 4.00% (after hiking from 2.00% in 18mths) from June 2007 through to July 2008 when incredibly the ECB hikes rates again to 4.25%. This helped drive the dollar weaker by 2.5% over 3mths and by 8.5% over 6mths.

A soft versus hard landing is therefore key to determining the performance of the dollar in periods following the first Fed rate cut with the response of other central banks key as well. We are currently assuming a continued slowdown and potentially a mild recession with the fed funds rate declining to 3.00%-3.25% by mid-2025, implying 175bps more cuts, 50bps this year and 125bps by June next year. That would still leave the Fed’s monetary stance slightly restrictive. We expect the ECB to be much less active, cutting 25bps per quarter (75bps by mid-2025) resulting in a notable narrowing of the spread. Even if the ECB is a little more active, the Fed’s stance is more restrictive and hence will be more pro-active in easing as the US economy slows.

No two economic or monetary policy cycles are the same but the message from past cycles is that there is no obvious pattern. The US presidential election is one distinct difference and none of the above examples were cycles that commenced with 3mth/6mth of a presidential election. The geopolitical and global macro backdrop also points to differences and a more contained dollar sell-off on this occasion. We assume around a 4% DXY drop by the middle of next year.

RECORD DEMAND FOR US STOCKS IN 2000-01

Source: Bloomberg, Macrobond & MUFG Research

VIX MOVES IN 6MTH PERIOD FOLLOWING 1ST RATE CUTS

Source: Bloomberg, Macrobond & MUFG GMR

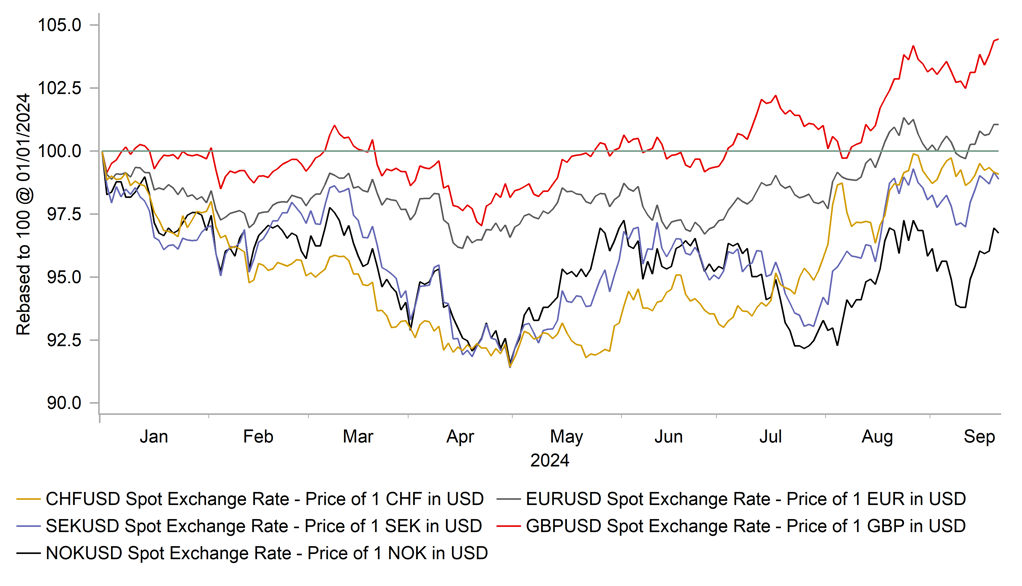

European FX: Mixed market impact from regional central bank policy paths

The European currencies of the GBP and EUR continue to outperform amongst G10 currencies this year. The GBP has been the top performer and is set up to extend its advance after the BoE’s latest policy update (click here). It has already resulted in cable breaking above the 1.3300-level and EUR/GBP falling below the July low at 0.8383. The BoE’s decision to leave rates on hold and lack of strong dovish signal that they are considering speeding up rate cuts anytime soon stands in marked contrast to the Fed’s decision to deliver a larger 50bps cut to kick off their own easing cycle while the ECB delivered a second smaller 25bps cut. The slower pace of BoE rate cuts has reinforced the GBP’s appeal as a high yielding G10 carry currency at a time when global investor risk sentiment is improving as well. The Fed’s larger 50bps rate cut has boosted investor optimism in a softer landing for the global economy that has helped to lift the MSCI’s ACWI global equity index to a new record high.

The other European currencies of the NOK and SEK have also benefitted from the recent improvement in global investor risk sentiment. It has resulted in EUR/SEK moving back towards the bottom of the year to date range between 11.100 and 11.800, and EUR/NOK has fallen to support from the 200-day moving average at around 11.600. In recent months the NOK has underperformed relative to the SEK driven in part by the lower price of oil with Brent moving closer to USD70/barrel. The IEA cut their oil demand forecast for his year reflecting softer demand from China which is now seen rising 180k bpd in 2024 compared to 410k in July. It has meant that the price of oil has fallen this month even as geopolitical tensions in the Middle East have escalated. Unlike the GBP, the NOK has failed to benefit as much from the Norges Bank’s decision to keep rates higher in Norway. At their latest policy meeting, the Norges continued to signal that they are planning to wait until early next year to cut rates.

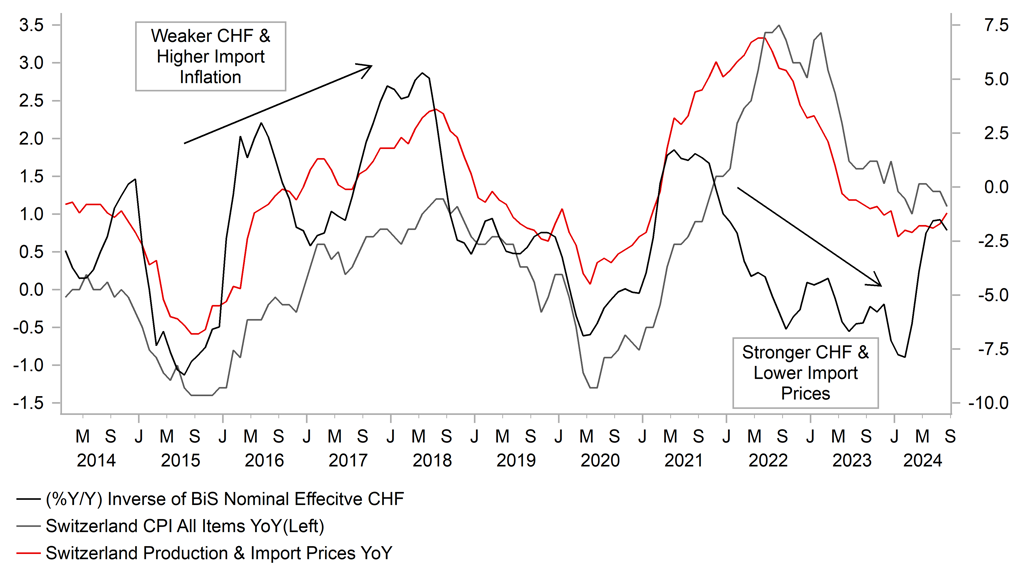

The next European central banks to provide policy updates in the week ahead will be the Riksbank (Wed) and SNB (Thurs). Both central banks are expected to continue lowering interest rates after starting to cut rates ahead of other G10 central banks back in March and May respectively. The SNB’s and Riksbank’s rate cutting cycles have not prevented the CHF and SEK from strengthening. The CHF strengthened sharply into early August resulting EUR/CHF hitting a low of 0.9211 on 5th August amidst market turbulence over the summer. It has since given back some of those gains as global investor risk sentient has improved. The stronger CHF and another downside inflation surprise in Switzerland (headline & core both at 1.1%Y/Y in August) will keep pressure on the SNB to follow the ECB and cut rates again in the week ahead. The SNB would have to deliver a larger 50bps cut if they want to at least temporarily weaken the CHF.

GBP TOP PERFORMER WHILE NOK UNDERPERFORMS

Source: Bloomberg, Macrobond & MUFG GMR

STRONGER CHF REMAINS A CHALLENGE FOR SNB

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

23/09/2024 |

08:15 |

French Manufacturing PMI |

Sep |

-- |

43.9 |

!! |

|

EUR |

23/09/2024 |

08:15 |

French Services PMI |

Sep |

-- |

55.0 |

!! |

|

EUR |

23/09/2024 |

08:30 |

German Manufacturing PMI |

Sep |

-- |

42.4 |

!!! |

|

EUR |

23/09/2024 |

08:30 |

German Services PMI |

Sep |

-- |

51.2 |

!!! |

|

EUR |

23/09/2024 |

09:00 |

Manufacturing PMI |

Sep |

-- |

45.8 |

!! |

|

EUR |

23/09/2024 |

09:00 |

Services PMI |

Sep |

-- |

52.9 |

!! |

|

GBP |

23/09/2024 |

09:30 |

Manufacturing PMI |

Sep |

-- |

52.5 |

!!! |

|

GBP |

23/09/2024 |

09:30 |

Services PMI |

Sep |

-- |

53.7 |

!!! |

|

GBP |

23/09/2024 |

11:00 |

CBI Industrial Trends Orders |

Sep |

-- |

-22 |

!! |

|

USD |

23/09/2024 |

13:00 |

FOMC voter Bostic Speaks |

-- |

-- |

-- |

!!! |

|

USD |

23/09/2024 |

14:45 |

Manufacturing PMI |

Sep |

48.5 |

47.9 |

!!! |

|

USD |

23/09/2024 |

14:45 |

Services PMI |

Sep |

55.2 |

55.7 |

!!! |

|

USD |

23/09/2024 |

15:15 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

USD |

23/09/2024 |

18:00 |

Fed Kashkari Speaks |

-- |

-- |

-- |

!! |

|

EUR |

24/09/2024 |

09:00 |

German Ifo Business Climate Index |

Sep |

-- |

86.6 |

!! |

|

USD |

24/09/2024 |

15:00 |

CB Consumer Confidence |

Sep |

102.8 |

103.3 |

!! |

|

USD |

25/09/2024 |

15:00 |

New Home Sales |

Aug |

693k |

739K |

! |

|

CHF |

26/09/2024 |

08:30 |

SNB Interest Rate Decision |

Q3 |

1.00% |

1.25% |

!!!! |

|

USD |

26/09/2024 |

13:30 |

Core Durable Goods Orders (MoM) |

Aug |

0.0% |

-0.2% |

!! |

|

USD |

26/09/2024 |

13:30 |

Core PCE Prices |

Q2 |

-- |

2.80% |

!! |

|

USD |

26/09/2024 |

13:30 |

GDP (QoQ) |

Q2 |

2.90% |

3.0% |

!!! |

|

USD |

26/09/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

-- |

!! |

|

USD |

26/09/2024 |

13:30 |

PCE Prices |

Q2 |

-- |

2.5% |

! |

|

USD |

26/09/2024 |

13:30 |

Real Consumer Spending |

Q2 |

-- |

2.9% |

! |

|

USD |

26/09/2024 |

14:20 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!! |

|

USD |

26/09/2024 |

14:25 |

FOMC voter Williams Speaks |

-- |

-- |

-- |

!!!! |

|

JPY |

27/09/2024 |

00:30 |

Tokyo CPI YoY |

Sep |

2.2% |

2.6% |

!!! |

|

EUR |

27/09/2024 |

08:55 |

German Unemployment Change |

Sep |

-- |

2K |

!! |

|

EUR |

27/09/2024 |

08:55 |

German Unemployment Rate |

Sep |

-- |

6.0% |

!! |

|

USD |

27/09/2024 |

13:30 |

Real consumer Spending |

Sep |

0.3% |

0.5% |

! |

|

USD |

27/09/2024 |

13:30 |

Core PCE Prices MoM |

Aug |

0.2% |

0.2% |

!!! |

|

USD |

27/09/2024 |

13:30 |

Core PCE Prices YoY |

Aug |

2.7% |

2.6% |

!!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

• Next week is a busy week of economic releases and events with the advance PMIs at the start of the week key for possibly setting the tone for EUR performance. We have also highlighted all the Fed speakers with the highlight Fed Chair Powell and Vice Chair Williams remarks at the 10th Annual US Treasury Market Conference. Powell’s remarks are pre-recorded and brief so the more important comments on policy could come from Williams. But the tone set from all the Fed speakers will be important next week with the key jobs market report coming the following week. Tokyo CPI on Friday and the PCE inflation data from the US will be the other key economic data releases next week.

• The SNB meeting will the highlight in terms of G10 central bank meetings and the consensus is for the SNB to cut the policy rate by 25bps to 1.00%. We have already argued in our FX Daily that the SNB should be considering a bigger cut to try and counter downside inflation risks. Annual CPI on a headline and core basis is already low at 1.1% which matches the SNB’s forecast for inflation in 2025. This week the Swiss government slashed its inflation forecasts for this year and next from 1.4% and 1.1% to 1.2% and 0.7% and will place further pressure on the SNB to ease its monetary stance and stall the appreciation of the franc. The Federation of the Swiss Watch Industry has called on the SNB to do more to counter franc strength. We believe the SNB should cut by 50bps next week and send a strong message of opposition to further currency appreciation.