To read the full report, please download PDF.

JPY continues to outperform in 2025

FX View:

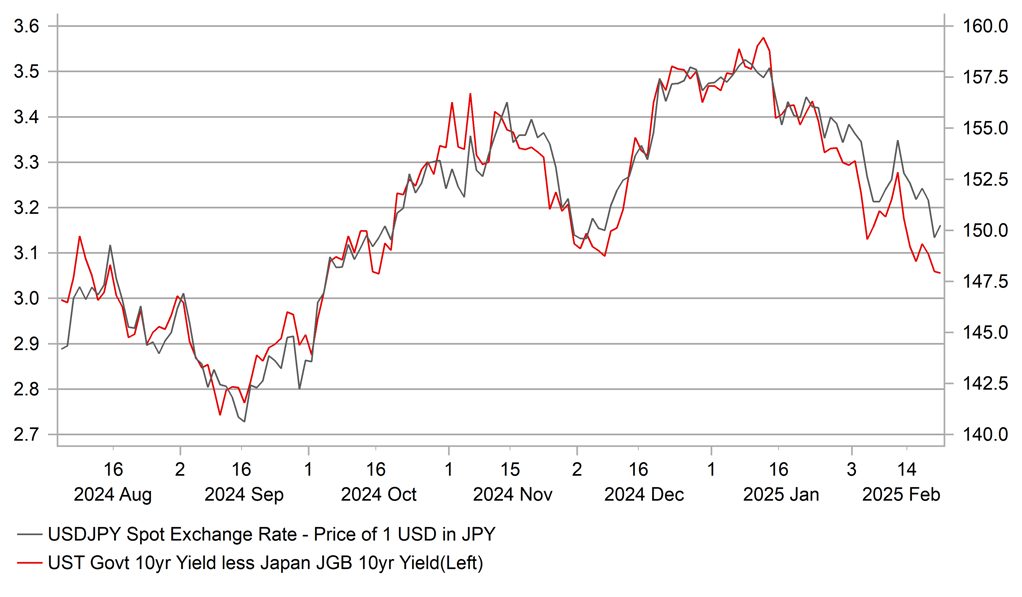

The JPY has been the best performing G10 currency so far this year which alongside broad-based USD weakness has resulted in USD/JPY dipping back below the 150.00-level. The JPY continues to benefit from the narrowing yield differentials between Japan and overseas. Yields in Japan have moved sharply higher in recent weeks encouraged by the hawkish repricing of BoJ rate hike expectations. However, recent market moves are starting to attract more attention from domestic policymakers. Governor Ueda indicated that the BoJ would willing to step in to support the JGB market if required to guard against a repeat of the financial market instability from last summer. The BoJ also has the option to tone down its recent hawkish policy comments that have been backed up by stronger activity and inflation data from Japan recently. Stronger push back against higher yields in Japan is one factor that could help to dampen the JPY’s current upward momentum.

JPY EXTENDS GAINS AT START OF THIS YEAR

Source: Bloomberg, 13.30 GMT, 21st February 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are sticking with our short EUR/JPY trade idea. The narrowing yield differential should continue to weigh down on EUR/JPY.

Weekly Calendar:

The main market focus at the start of next week will be the results from the German election held at the weekend. The latest opinion polls show that the CDU/CSU parties are on track to form the next government. It is not yet clear which parties they will need to join forces with to form a coalition government.

Sentiment Analysis on the latest FOMC Minutes:

Examining the historical sentiment scores from FOMC minutes, our findings point to an even stronger shift towards a positive macro sentiment relative to the previous minutes driven largely by continued progress towards inflation targets and reduced downside risks to the labour market.

FX Views

USD/JPY: Diverging paths for USD & JPY at start of this year

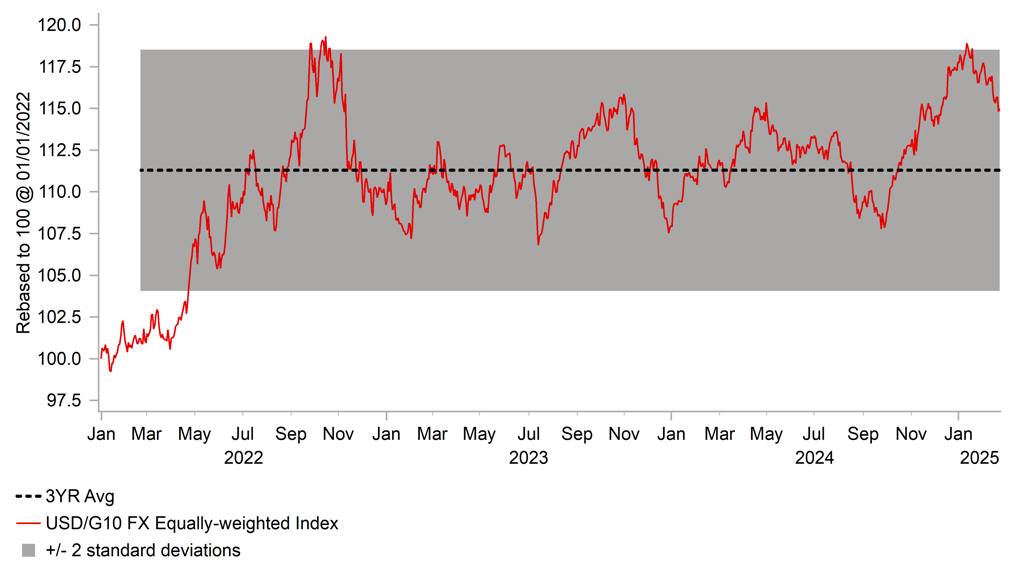

The weaker USD trend has continued over the past week resulting in the dollar index hitting a fresh year to date low yesterday at 106.34. It leaves on the dollar index currently on track for its third consecutive week of losses, and fifth out of the last six weeks. The ongoing reversal of the strong USD gains recorded at the end of last year following Donald Trump’s election win reflects in part building investor optimism that President Trump’s trade plans may not prove as disruptive as feared. Market participants are currently viewing Trump’s trade plans as if the glass is half-full. That mentality was again evident yesterday when President Trump was asked about a potential trade deal with China and stated that it is “possible”. It has helped to lower USD/CNY back below 7.2500 and lift EUR/USD back above 1.0500.

No further details have been provided but it has encouraged speculation that trade tensions between the US and China may not necessarily worsen further during his second term. It took much longer during his first term to reach a trade deal with China in early 2020 after tariffs had been raised on numerous occasions between 2018 and 2019. That “great trade deal” is widely judged as a failure (click here). At the start of President Trump’s second term, he has already raised tariffs on imports from China by a further 10% which could be reversed quickly if a trade deal is reached. It would be a development that would represent a positive shock for the renminbi and other Asian currencies alongside commodity-related currencies more tightly linked to demand from China like the Chilean peso and Australian dollar.

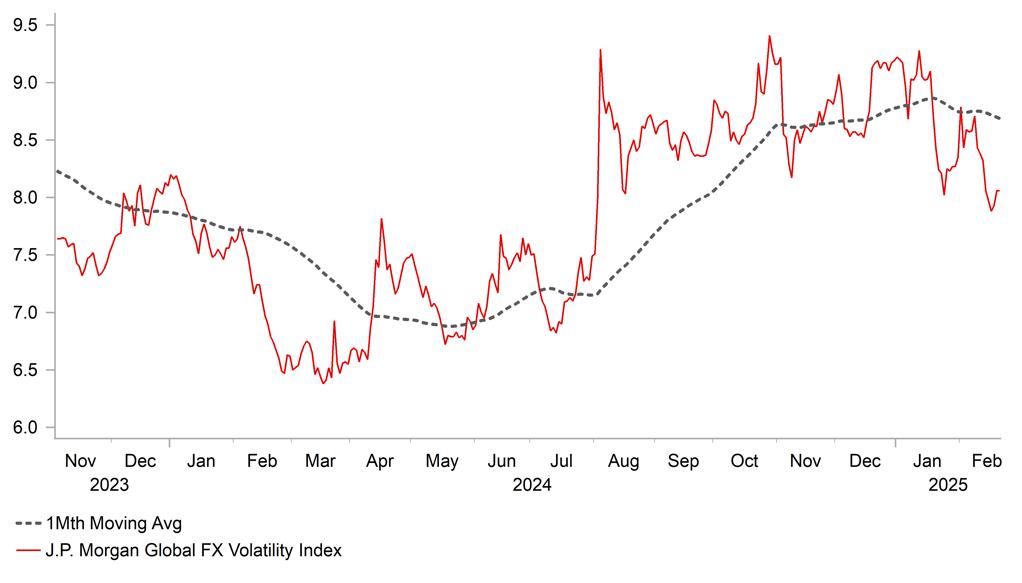

In contrast, market participants have largely looked through President Trump’s plans/threats this week to: i) hike tariffs by 25% on steel and aluminium from 12th March and to ii) hike tariffs by 25% on automobiles, semiconductors and pharmaceuticals from 2nd April. That comes on top of previous plans/threats to: i) hike tariffs by 25% on most imports from Canada and Mexico from 4th March and to ii) put in place reciprocal tariffs (click here) on all trading partners from 1st April. One thing is clear is that trade policy uncertainty is set to remain unusually elevated and act as a drag on global trade and growth in the near-term. The next couple of months is set up to be pivotal for US dollar performance. The US dollar should bounce back strongly in Q2 if Trump follows through and implements some of these more disruptive tariffs. It would likely trigger a pick-up in FX market volatility as well that has eased back at the start of this year. As such we still believe it is premature to drop our forecasts for a stronger US dollar which could just be delayed. In contrast, if all of Trump’s tariff threats are watered down significantly and trade deals emerge including one with China then the door would open for a deeper correction lower for the USD.

JUSTIFICATION REQUIRED FOR EVEN STRONGER USD

Source: Bloomberg, Macrobond & MUFG GMR

FX VOL HAS EASED AT START OF TRUMP’S 2ND TERM

Source: Bloomberg, Macrobond & MUFG GMR

At the other end of the spectrum, the JPY has been the best performing G10 currency so far this year. The JPY has benefitted from the hawkish repricing of BoJ rate hike expectations that has continued to lift yields in Japan. Market participants have become more confident that the BoJ will raise their policy rate up to and above 1.00% in the coming years (click here) after delivering the third rate hike in the current tightening cycle last month and following up with hawkish rhetoric talking up the likelihood of further hikes. The case for further rate hikes has been supported by the latest activity and inflation data from Japan. GDP growth in Japan was stronger than expected during the 2H of last year expanding by 2.8% in Q4 and 1.7% in Q3. Headline inflation picked up to 4.0% in January driven mainly by surging food prices while core and services inflation measures remained solid. The BoJ will be watching the release of preliminary results from the upcoming 2025 Shunto spring wage negotiations which are scheduled to be released by the middle of next month to assess if stronger wage growth will be sustained. At the current juncture, the fundamentals in Japan should encourage the BoJ to hike rates again by the middle of this year. With yields in other major economies such as the US and euro-zone consolidating at lower levels, the adjustment higher in Japanese yields is resulting in a significant compression of yield differentials. It is one of the main reasons why we are currently recommending a short EUR/JPY trade idea.

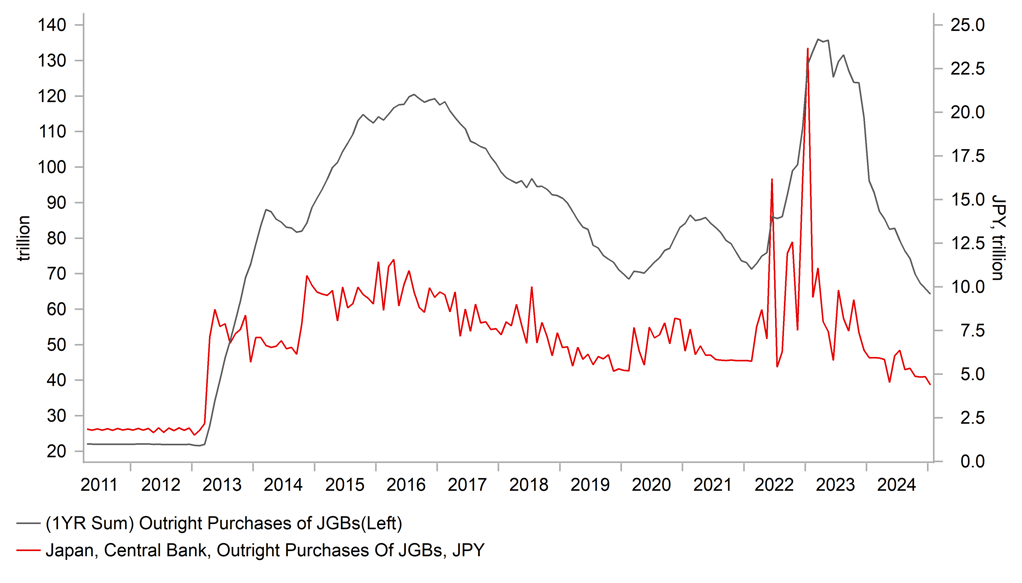

However, the recent pace of the sell-off in the JGB is starting to attract more concern from domestic policy makers. The 10-year JGB yield had risen by around 27bps since late last month when it hit a fresh year to date high overnight at 1.47%. Prime Minister Ishiba and Finance Minister Kato both expressed concern that higher yields will increase the government’s debt-servicing costs. When asked about higher yields in parliament, BoJ Governor Ueda signalled a readiness to intervene in the JGB market if required. More specifically he stated that “moves in bond yields fluctuate to a certain degree. However, we will purchase government bonds nimbly to foster the stable formation of yields in exceptional cases where long-term yields rise sharply”. He added that it has hard to say when to conduct bond operation in advance and that they would decide by watching the market closely. A sharper than desired move higher in market yields if sustained may also make the BoJ become more cautious over hiking rates further although Governor Ueda did not express that view. Trade policy and political uncertainty will need to be factored into the BoJ policy decisions as well. President Trump’s latest tariff plans/threats including on: i) steel & aluminium, ii) automobiles, semiconductors and pharmaceuticals, and iii) “reciprocal tariffs” have the potential to be more disruptive for the growth outlook both globally and in Japan. The Upper House election in July could provide another reason to make the BoJ cautious over hikes. These are all factors that need to be monitored and could dampen further JPY upside going forward.

BOJ HAS BEEN SLOWING PURCHASES OF JGBS

Source: Bloomberg, Macrobond & MUFG GMR

NARROWING YIELD DIFFERENTIALS FAVOUR JPY

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

02/23/2025 |

17:00 |

German Election 1st Results |

!!! |

|||

|

EUR |

02/24/2025 |

09:00 |

Germany IFO Business Climate |

Feb |

85.8 |

85.1 |

!! |

|

EUR |

02/24/2025 |

10:00 |

CPI YoY |

Jan F |

-- |

2.5% |

!!! |

|

EUR |

02/25/2025 |

07:00 |

Germany GDP SA QoQ |

4Q F |

-0.2% |

-0.2% |

!!! |

|

EUR |

02/25/2025 |

10:00 |

EA Indicator of Negotiated Wage Rates |

!!! |

|||

|

USD |

02/25/2025 |

14:00 |

S&P CoreLogic CS 20-City MoM SA |

Dec |

-- |

0.4% |

!! |

|

GBP |

02/25/2025 |

14:00 |

BoE Chief Economist Pill speaks |

!!! |

|||

|

USD |

02/25/2025 |

15:00 |

Conf. Board Consumer Confidence |

Feb |

103.5 |

104.1 |

!! |

|

AUD |

02/26/2025 |

00:30 |

CPI YoY |

Jan |

2.7% |

2.5% |

!!! |

|

USD |

02/26/2025 |

15:00 |

New Home Sales |

Jan |

680k |

698k |

!! |

|

CHF |

02/27/2025 |

08:00 |

GDP QoQ |

4Q |

0.2% |

0.4% |

!! |

|

EUR |

02/27/2025 |

10:00 |

Consumer Confidence |

Feb F |

-- |

-- |

!! |

|

EUR |

02/27/2025 |

12:30 |

ECB Publishes Account of Jan Meeting |

!! |

|||

|

CAD |

02/27/2025 |

13:30 |

Current Account Balance |

4Q |

-- |

-$3.23b |

!! |

|

USD |

02/27/2025 |

13:30 |

GDP Annualized QoQ |

4Q S |

2.3% |

2.3% |

!!! |

|

USD |

02/27/2025 |

13:30 |

Durable Goods Orders |

Jan P |

1.2% |

-2.2% |

!! |

|

USD |

02/27/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

JPY |

02/27/2025 |

23:30 |

Tokyo CPI YoY |

Feb |

3.3% |

3.4% |

!! |

|

JPY |

02/27/2025 |

23:50 |

Industrial Production MoM |

Jan P |

-1.2% |

-0.2% |

!! |

|

SEK |

02/28/2025 |

07:00 |

GDP QoQ |

4Q |

-- |

0.3% |

!! |

|

NOK |

02/28/2025 |

07:00 |

Retail Sales W/Auto Fuel MoM |

Jan |

-- |

-0.1% |

!! |

|

SEK |

02/28/2025 |

07:00 |

Retail Sales MoM |

Jan |

-- |

2.9% |

!! |

|

EUR |

02/28/2025 |

07:45 |

France CPI YoY |

Feb P |

-- |

1.7% |

!!! |

|

EUR |

02/28/2025 |

07:45 |

France GDP QoQ |

4Q F |

-- |

-0.1% |

!!! |

|

EUR |

02/28/2025 |

08:55 |

Germany Unemployment Change |

Feb |

-- |

11.0k |

!! |

|

EUR |

02/28/2025 |

13:00 |

Germany CPI YoY |

Feb P |

2.4% |

2.3% |

!!! |

|

CAD |

02/28/2025 |

13:30 |

Quarterly GDP Annualized |

4Q |

-- |

1.0% |

!!! |

|

USD |

02/28/2025 |

13:30 |

Advance Goods Trade Balance |

Jan |

-$113.3b |

-$122.1b |

!! |

|

USD |

02/28/2025 |

13:30 |

Core PCE Price Index MoM |

Jan |

0.3% |

0.2% |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The main market focus at the start of next week will be the results from the German election held at the weekend. The latest opinion polls show that the CDU/CSU parties are on track to form the next government. It is not yet clear which parties they will need to join forces with to form a coalition government. The next government is expected to pursue a more pro-growth policy agenda including tax cuts and loosening regulations, and potentially watering down the debt brake to allow more government investment. A more divided parliament could make implementing reforms more challenging to implement.

- The key US economic data releases in the week ahead will be the latest PCE deflator report for January and second estimate of the GDP report for Q4. The core PCE deflator is expected to have picked up by 0.3%M/M in January compared to lower readings of 0.2% and 0.1% in December and November respectively. However, it would still be slower than recorded in January of the previous two years when it increased by 0.5%. It should still fit with the Fed’s view inflation continues to slow but is not weak enough to trigger the Fed to consider rates again in the near-term.

- There are a large number of BoE speakers in the week ahead including Chief Economist Huw Pill. The BoE is holding a research conference. Market participants will be listening closely to comments from MPC members after the recent run of stronger UK activity and inflation data. Governor Bailey downplayed the upward revision to Q4 GDP this week.

- Inflation risks will be in focus in the euro-zone in the week ahead when the latest national CPI reports are released for February and the euro area negotiated wage data for Q4. The data is not expected to significantly alter market expectations for the ECB to deliver another 25bps rate cut next month.