To read the full report, please download PDF.

USD holds up after dovish Fed policy update

FX View:

The USD’s performance has been more mixed over the past week. It has staged modest rebounds again the other major currencies of the EUR and JPY. After the heavy sell-off earlier this month, the USD has been consolidating at weaker levels ahead of the release of President Trump’s plans for “reciprocal tariffs” and sectoral tariffs on autos, semi-conductors and pharmaceuticals in early April. The risk of broad-based and more disruptive tariffs could provide more support for the USD. However upside potential for the USD is likely to be dampened by the market’s increased focus on downside risks to US growth, while fiscal spending plans in Germany are also helping to ease concerns over slower growth in Europe. Elevated overseas uncertainty made the BoJ more cautious over sending a stronger signal this week over the timing of another rate hike which has weighed on the JPY. We still expect the BoJ to hike rates again in July and can’t rule out an earlier hike in June. As a result, we expect the recent yen sell-off to be short-lived.

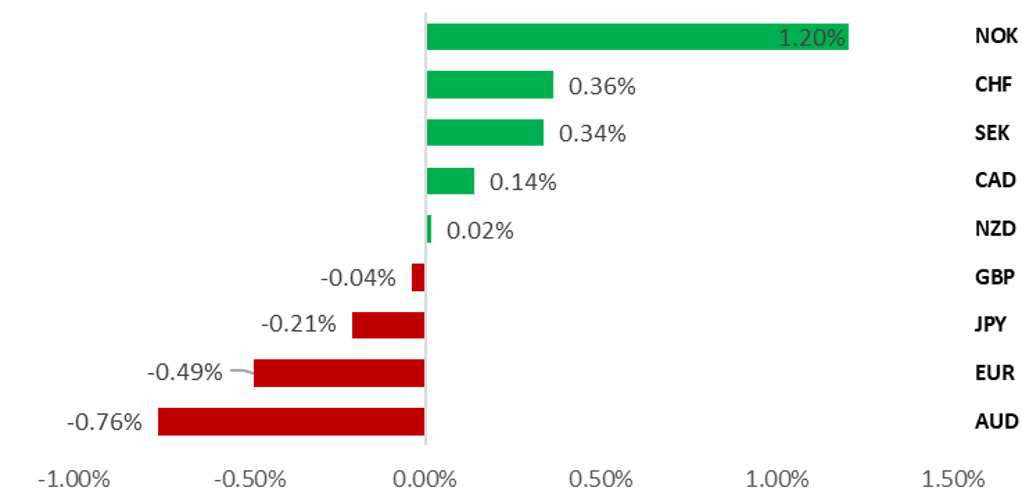

MIXED PERFORMANCE FOR USD FOLLOWING HEAVY SELL-OFF

Source: Bloomberg, 14.30 GMT, 21st March 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are sticking with our long USD/SEK trade idea, and have closed our short EUR/JPY trade idea after the stop-loss was hit this week.

Weekly Calendar:

Key highlights in the week ahead include the latest euro-zone PMI surveys for March, UK CPI report for February, US PCE deflator report for February, UK government’s Spring Statement and Norges Bank’s policy meeting.

Sentiment Analysis on the latest Fed Press Conference:

Conducting sentiment analysis across the latest Fed Press Conference transcript we highlight a strong negative shift in sentiment, primarily driven by a reduction in sentiment scores for inflation, the economy, and labour market related topics.

FX Views

FX Majors: Dovish Fed policy reaction function is a headwind for USD

It has been a mixed week for the USD. While the USD has continued to weaken against the NOK (+1.2% vs. USD), CHF (+0.4%), SEK (+0.3%) and CAD (+0.1%), it has rebounded against the AUD (-0.8% vs. USD), EUR (-0.5%), and JPY (-0.2%). The price action is consistent with our view that the USD has entered a period of consolidation at lower levels after the sharp sell-off earlier this month. It has been notable that this week’s dovish Fed policy update failed to inject fresh momentum into the US dollar sell-off. The Fed’s policy update had a bigger impact in lowering US yields than the USD. The 2-year and 10-year US Treasury bond yields have both fallen sharply by around 12bps and 10bps respectively since the FOMC meeting.

The dovish market reaction reflects the Fed’s updated policy reaction function. Chair Powell indicated that the Fed would be willing to look through higher inflation this year on the back of higher tariffs which is expected to prove transitory. The updated median projections for the core PCE deflator were raised by 0.3 point to 2.8% for this year but were left unchanged at 2.2% for 2026 and 2.0% for 2027. As a result, the Fed is sticking to plans to deliver two further 25bps rate cuts this year and in 2026. The Fed expects weaker growth to lead to looser labour market conditions creating room for rate cuts later this year. The US economy is now expected to grow just below the longer run estimate by 1.7% this year helping to lift the unemployment rate from around 4.0% up to 4.4% by the end of this year. Fed Chair Powell did emphasize though that the outlook for the US economy and policy is highly uncertain, and their base case scenario is based on the assumption that longer run measures of inflation expectations remain anchored. On that front he described the recent sharp adjustment higher for the University of Michigan’s long-term inflation expectations measure as an outlier. At the current juncture the Fed remains comfortable to keep rates on hold. It allows the Fed more time to assess the impact of President Trump’s plans for “reciprocal tariffs” and sector specific tariffs on autos, semi-conductors and pharmaceuticals that are set to be announced from 2nd April. Heightened policy uncertainty and tariff disruption already appear to be having a dampening impact on US growth at the start of this year. It has contributed to the recent correction lower for the USD.

Heightened overseas uncertainties prompted the BoJ to display more caution over tightening policy further at this week’s policy meeting. Governor Ueda described overseas uncertainties as “rising quickly”. In light of President Trump’s upcoming tariff policy announcement in early April, the BoJ refrained from providing a stronger signal over the likely timing of the next rate hike. The BoJ will be in a much better position to assess the outlook for the Japanese and global economies at their next policy meeting on 1st May. We still expect the BoJ to deliver another rate hike in July but acknowledge that it could be delivered sooner in May or June. Stronger wage negotiation results for the upcoming fiscal year and the close proximity of the upcoming Upper House election in Japan scheduled for 27th July just days before the BoJ policy meeting on 31st July could encourage the BoJ to hike rate again sooner than our forecast for another 25bps hike in July. The Japanese rate market continues to price in a higher probability of the next BoJ hike being delivered in July (~20bps) rather than in June (~14bps) or May (~6bps). The BoJ’s caution at this week’s policy meeting has contributed to a weaker JPY lifting USD/JPY back up towards the 150.00-level. It still leaves the JPY as the best performing major currency this year. With the BoJ remaining on course to hike rates further in the coming months, we expect the recent correction lower for USD/JPY to prove short-lived.

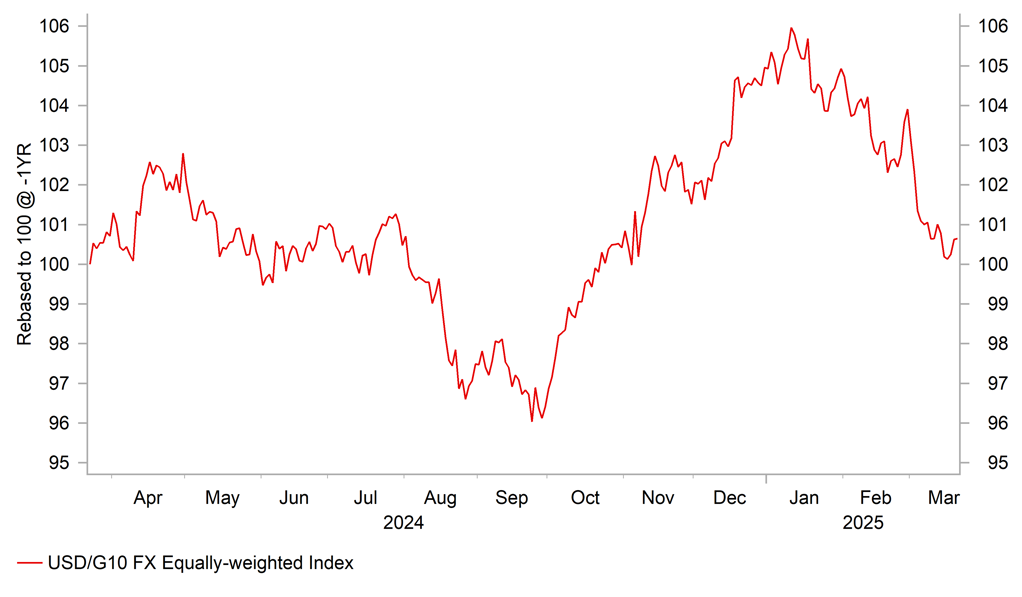

USD STARTS TO CONSOLIDATE AT LOWER LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

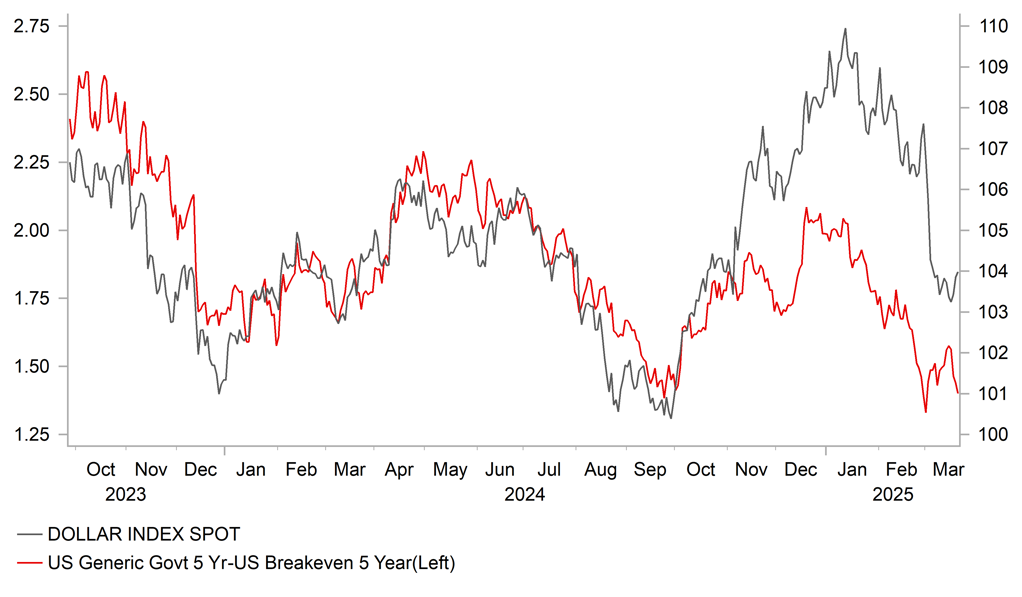

WER US REAL YIELDS WEIGH ON USD

Source: Bloomberg, Macrobond & MUFG GMR

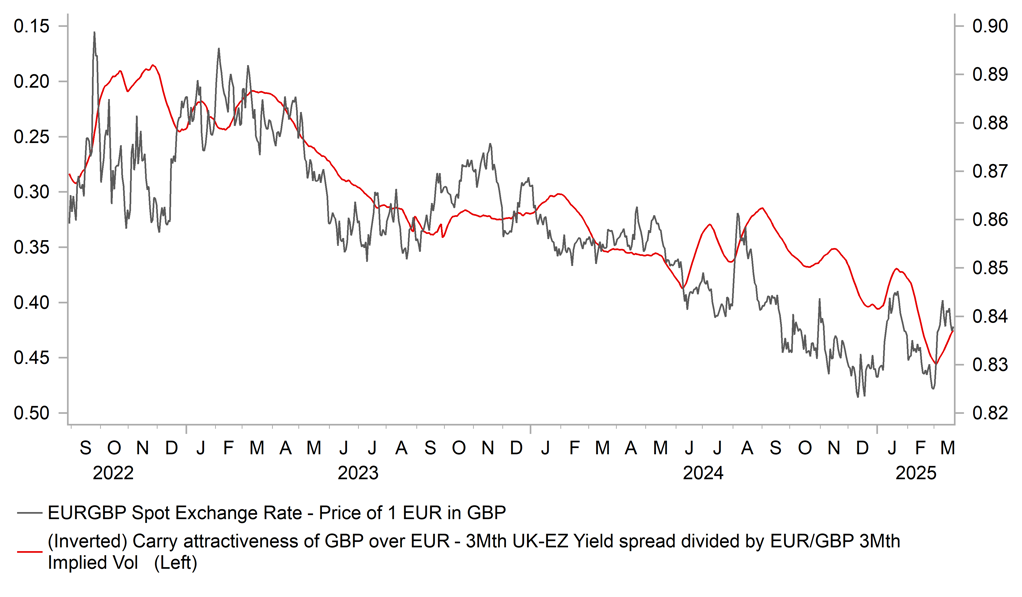

At the other end of the spectrum to the BoJ and Fed policy updates this week, the BoE delivered less dovish policy guidance. At yesterday’s MPC meeting (click here), the BoE signalled that they are less confident over continuing quarterly rate cuts reflecting heightened uncertainty over the economic outlook. The majority of MPC members stated that there was no presumption that monetary policy was on a pre-set path over the “next few meetings”. It highlights that it is not a done deal that the BoE will stick to the current path of quarterly rate cuts by lowering rates by a further 25bps in May. We still expect the BoE to deliver another rate cut in May but it will become more challenging to stick to quarterly rate cuts by the August MPC meeting when headline inflation is expected to pick-up to a peak of around 3.75% in Q3. It is a view shared by the UK rate market which is still pricing in around 17bps of cuts for the May MPC meeting but only 32bps in total by the August MPC meeting.

A more cautious approach to further BoE easing that keeps UK rates higher for longer is a supportive development for the GBP. After the updated BoE guidance which adds uncertainty over another rate cut in May, market participants will be watching even more closely in the week ahead the release of the latest UK CPI report for February and the UK government’s Spring Statement. Weaker growth, higher borrowing costs and higher than expected borrowing already this fiscal year is expected to result in the forecast of government borrowing rising by around GBP10 billion by fiscal year 2029/30. Chancellor Reeves will fill this financing gap by announcing plans to reduce spending on welfare contributing around GBP5 billion of savings by 2029/30 with other spending cuts expected to total another GBP5 billion. The spending cuts are not expected to be sufficient to significantly alter the BoE’s plans for monetary policy this year. Spending cuts are expected to be more back-loaded and implemented later on in the forecast profile limiting the negative near-term growth impact.

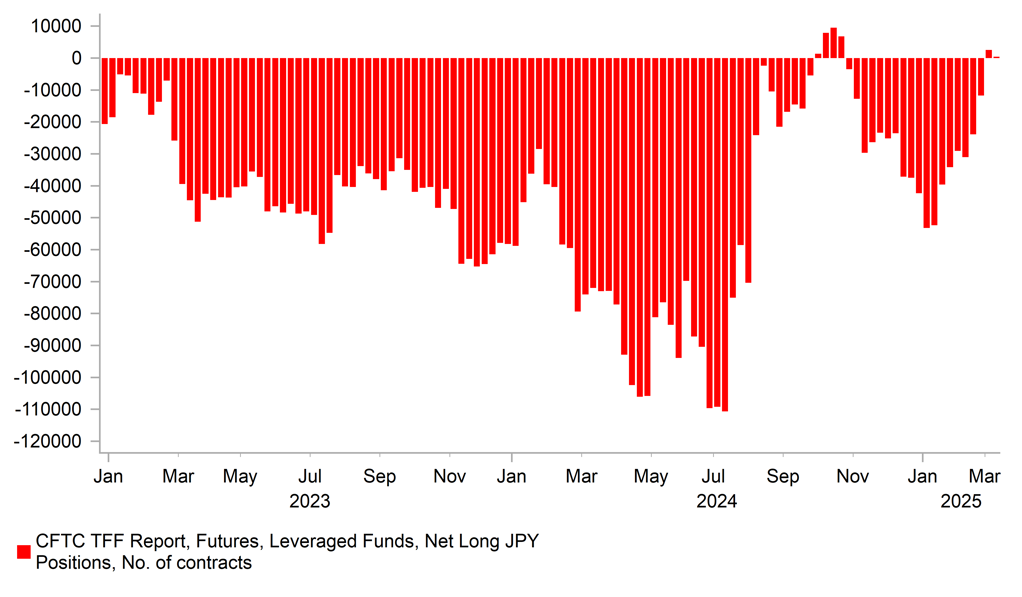

JPY SHORTS HAVE ALREADY BEEN SCALED BACK

Source: Bloomberg, Macrobond & MUFG GMR

GBP REMAINS ATTRACTIVE AS CARRY CURRENCY

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

24/03/2025 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Mar P |

-- |

47.6 |

!! |

|

EUR |

24/03/2025 |

09:00 |

HCOB Eurozone Services PMI |

Mar P |

-- |

50.6 |

!! |

|

GBP |

24/03/2025 |

09:30 |

S&P Global UK Manufacturing PMI |

Mar P |

-- |

46.9 |

!! |

|

GBP |

24/03/2025 |

09:30 |

S&P Global UK Services PMI |

Mar P |

51.4 |

51.0 |

!! |

|

USD |

24/03/2025 |

13:45 |

S&P Global US Composite PMI |

Mar P |

-- |

51.6 |

!! |

|

GBP |

24/03/2025 |

18:00 |

BoE Governor Bailey Speaks |

!!! |

|||

|

EUR |

25/03/2025 |

09:00 |

Germany IFO Business Climate |

Mar |

-- |

85.2 |

!! |

|

USD |

25/03/2025 |

13:05 |

Fed's Williams Speaks |

!! |

|||

|

USD |

25/03/2025 |

14:00 |

Conf. Board Consumer Confidence |

Mar |

94.0 |

98.3 |

!! |

|

AUD |

26/03/2025 |

00:30 |

CPI YoY |

Feb |

2.4% |

2.5% |

!!! |

|

GBP |

26/03/2025 |

07:00 |

CPI YoY |

Feb |

2.9% |

3.0% |

!!! |

|

GBP |

26/03/2025 |

12:00 |

Chancellor Presents Spring Statement |

!!! |

|||

|

USD |

26/03/2025 |

12:30 |

Durable Goods Orders |

Feb P |

-0.7% |

3.2% |

!! |

|

NOK |

27/03/2025 |

09:00 |

Deposit Rates |

4.25% |

4.50% |

!!! |

|

|

USD |

27/03/2025 |

12:30 |

GDP Annualized QoQ |

4Q T |

2.5% |

2.3% |

!! |

|

USD |

27/03/2025 |

12:30 |

Advance Goods Trade Balance |

Feb |

-$133.5b |

-$153.3b |

!! |

|

USD |

27/03/2025 |

12:30 |

Initial Jobless Claims |

-- |

223k |

!! |

|

|

JPY |

27/03/2025 |

23:30 |

Tokyo CPI YoY |

Mar |

2.8% |

2.9% |

!! |

|

GBP |

28/03/2025 |

07:00 |

GDP QoQ |

4Q F |

0.1% |

0.1% |

!! |

|

GBP |

28/03/2025 |

07:00 |

Current Account Balance |

4Q |

-- |

-18.1b |

!! |

|

GBP |

28/03/2025 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Feb |

-0.1% |

1.7% |

!! |

|

EUR |

28/03/2025 |

07:45 |

France CPI YoY |

Mar P |

-- |

0.8% |

!! |

|

EUR |

28/03/2025 |

08:55 |

Germany Unemployment Change (000's) |

Mar |

-- |

5.0k |

!! |

|

CAD |

28/03/2025 |

12:30 |

GDP MoM |

Jan |

-- |

0.2% |

!! |

|

USD |

28/03/2025 |

12:30 |

Personal Spending |

Feb |

0.6% |

-0.2% |

!! |

|

USD |

28/03/2025 |

12:30 |

Core PCE Price Index MoM |

Feb |

0.3% |

0.3% |

!!! |

|

USD |

28/03/2025 |

14:00 |

U. of Mich. Sentiment |

Mar F |

-- |

57.9 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- At the start of next week market participants will be closely scrutinizing the releases of the latest PMI surveys from the euro-zone and UK for May. Investor optimism over growth in Europe has picked up in recent weeks fueled by Germany’s plans for significantly looser policy. While it will take some time for additional government spending to be implemented, the plans could still hep to lift business confidence in the interim. Heightened uncertainty over President Trump’s upcoming tariff plans in early April remains a headwind.

- The majority of participants indicated at this week’s MPC meeting that monetary policy is not on a preset path over the next few meetings. It sends a clear signal that another quarterly rate cut in May is not a done deal. It could increase market sensitivity to the release in the week ahead of the latest UK CPI report for February, and the government’s Spring Fiscal Statement. The BoE acknowledged that headline inflation was slightly higher than expected in January and expects inflation to pick up to a temporary peak of around 3.75% in Q3. The government is expected to announce measures to modestly cut government spending in order to meet their self-imposed fiscal rules after the outlook for growth is expected to be downgraded and debt servicing costs increased.

- The Norges Bank is expected to finally start their easing cycle by delivering a 25bps cut to 4.25% in the week ahead. At their previous policy meeting in January, the Norges Bank signaled clearly that the “policy rate will likely be reduced in March” with the time to begin monetary easing judged to be soon approaching. Inflation picked up more than expected in February but we do not expect the Norges Bank to delay cutting rates further. We expect the Norges Bank to emphasize that they will be cautious over delivering further cuts.

- The Fed’s preferred measure of inflation, the core PCE deflator for February will be released in the week ahead. The already released CPI, PPI and import price reports indicate that there are upside risks to the consensus forecast for a +0.3%M/M increase in the core PCE deflator. A stronger print would encourage the Fed to leave rates unchanged although Chair Powell has indicated that they are willing to look through higher inflation this year and still plan to lower rates later this year.