To read the full report, please download PDF.

Stars aligning for an even stronger USD

FX View:

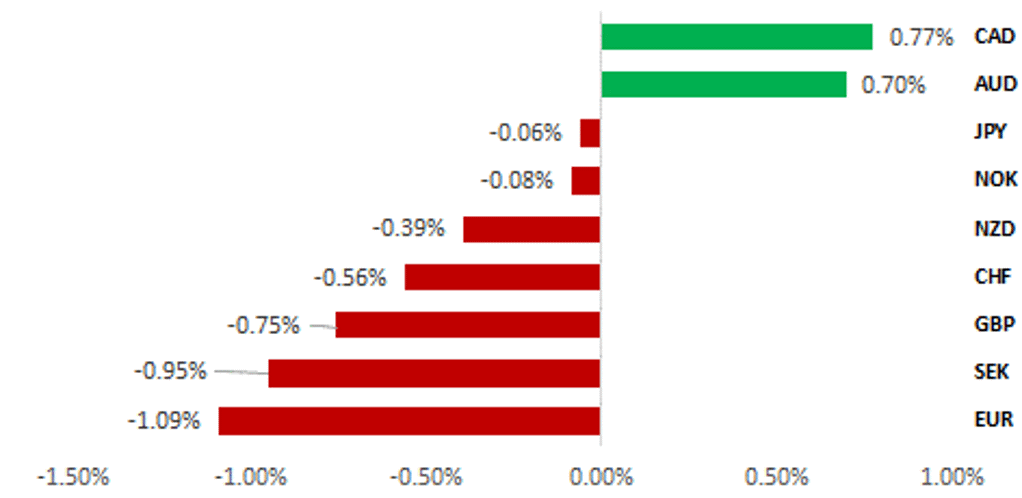

The USD has regained upward momentum at the end of this week lifting the dollar index back to its highest levels since autumn 2022 which was at the peak of the negative energy price shock. Over the past week the USD’s upward momentum has been reinforced by building concerns over the outlook for growth outside of the US. The looming risk of a another trade war under President elect Donald Trump and escalating geopolitical tensions between Russia and the West have boosted demand for the USD. We also highlight that political risks in France could return as a bigger market focus before the end of this year with the National Rally threatening to bring down the government over the Budget. It has encouraged market participants’ to price in widening expectations for policy divergence between the Fed and European central banks moving yields in favour of a stronger USD.

EUR THE UNDERPERFORMER AS DOMESTIC FACTORS ADD TO RISKS

Source: Bloomberg, 13:30 BST, 22nd November 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our short EUR/USD trade recommendation while lowering the target and stop-loss by one big figure.

JPY Flows: Balance of Payments:

The investment income surplus on a 3mth sum basis hit a new record high in Japan and in annualised terms amounted to over 8% of GDP. FDI remains the main recycling outflow and on a 6mth sum basis recently surpassed the record set in 2019.

The Trump Trade - Navigating Market Momentum:

While the future of the ‘Trump Trade’ remains uncertain and relies on realised Trump policies in tandem with global economic conditions, our FX analysis observes that the USD’s current upward momentum is strong against all G10 currencies. The risk-adjusted momentum signals flag positive for all currencies (excluding 6m-JPY). Our signals highlight that the USD has the strongest upward momentum against CAD then EUR. In contrast, it has weakest momentum against JPY then CHF.

FX Views

USD: Pieces keep falling into place for an even stronger US dollar

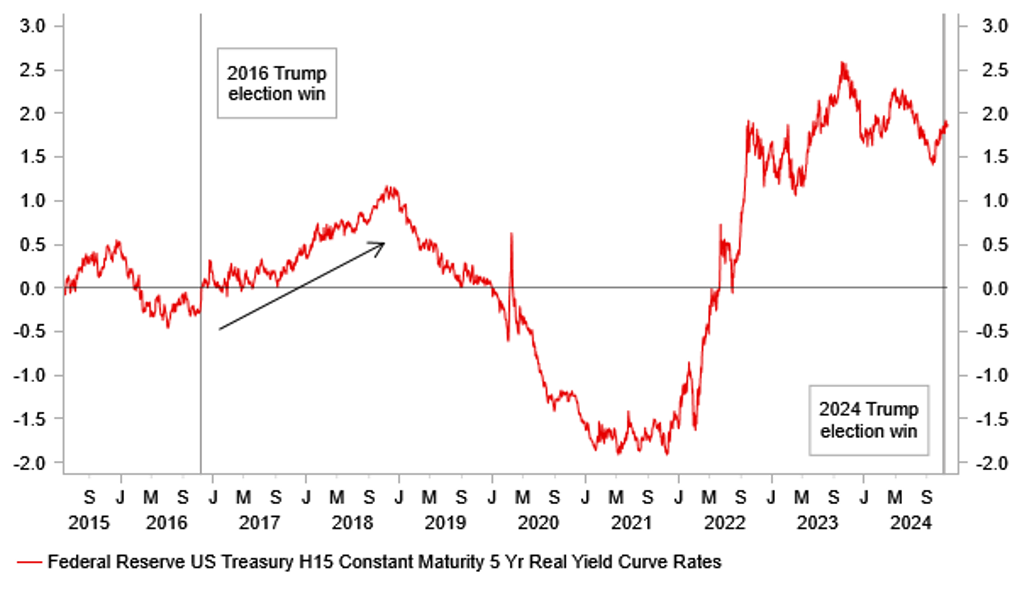

The USD has regained upward momentum at the end of this week and is on course to close higher for the third consecutive week since the US election. USD gains accelerated earlier today after the dollar index broke above the highs from October of last year and reached its highest level in just over two years. The next key resistance levels for the dollar index are provided by the highs from autumn 2022 between 110.00 and 115.00 leaving room for further USD upside heading into next year. The USD has been able to extend its advance even as US yields have been consolidating at higher levels since the US election. It highlights that the stronger USD is not just driven by the hawkish repricing of Fed policy expectations, and perhaps more questionably by any optimism over a boost to US growth from Trump’s policy agenda to maintain low taxes and deregulate. Unlike after Trump’s prior election victory in November 2016, US real yields have increased only modestly so far implying market participants are initially more cautious over the US growth outlook under a second Trump Presidency. The increased risk of higher inflation from tighter immigration policies and a significant broad-based increase in tariffs would dampen US growth and real yields.

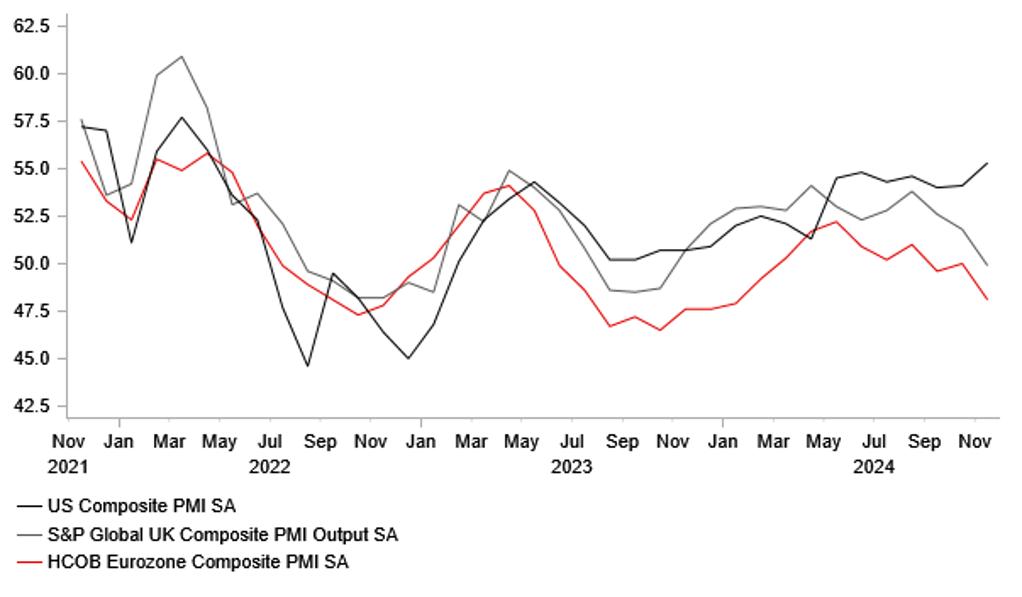

The price action suggests that recent USD strength has been driven more by the weakening outlook for growth outside of the US. President-elect Trump has decided to appoint Howard Lutnick as the next US Commerce Secretary who will also have direct responsibility for the Office of the United States Trade Representative. It means he will oversee the US trade department and lead the administration’s tariff and trade agenda. He has been vocal supporter of Donald Trump’s policy agenda to raise tariffs, and his appointment has reinforced expectations that higher tariffs will be imposed at the start of Trump’s second term as President. Trade disruption will provide another headwind to growth for the Chinese and European economies which are expanding weakly. Those fears have contributed to the sharp decline in business confidence in Europe this month. The composite PMI surveys for the euro-zone and UK both fell sharply by 1.9 point to 48.1 and 49.9 respectively in November. For the euro-zone it was the weakest reading since January and for the UK since October 2023. The surveys provide a clear signal that downside risks to growth are intensifying.

At the same time, geopolitical risks in Europe have escalated significantly over the past week providing another reason to buy the USD. Russia has reportedly stepped up efforts to expand territorial gains in Ukraine ahead of the change in political leadership next year in the US. In response the US and UK have allowed Ukraine to strike back at military targets in Russia using their longer range missiles. Russia has since sent a warning shot to the West by striking Ukraine with a new medium-range hypersonic missile. Geopolitical tensions could escalate further in the near-term, but are then expected to be followed by a period of de-escalation next year when Trump comes into power. He has vowed to quickly end the conflict, and there have already been reports of potential ceasefire plans. One proposed plan involves creating a demilitarized zone in Ukraine which would be overseen by European troops. It would require Ukraine giving up significant territory and delaying its NATO membership ambitions.

USD IS BREAKING OUT TO THE UPSIDE

Source: Bloomberg, Macrobond & MUFG Research

REAL YIELDS STARTING FROM MUCH HIGHER LEVEL

Source: Bloomberg, Macrobond & MUFG GMR

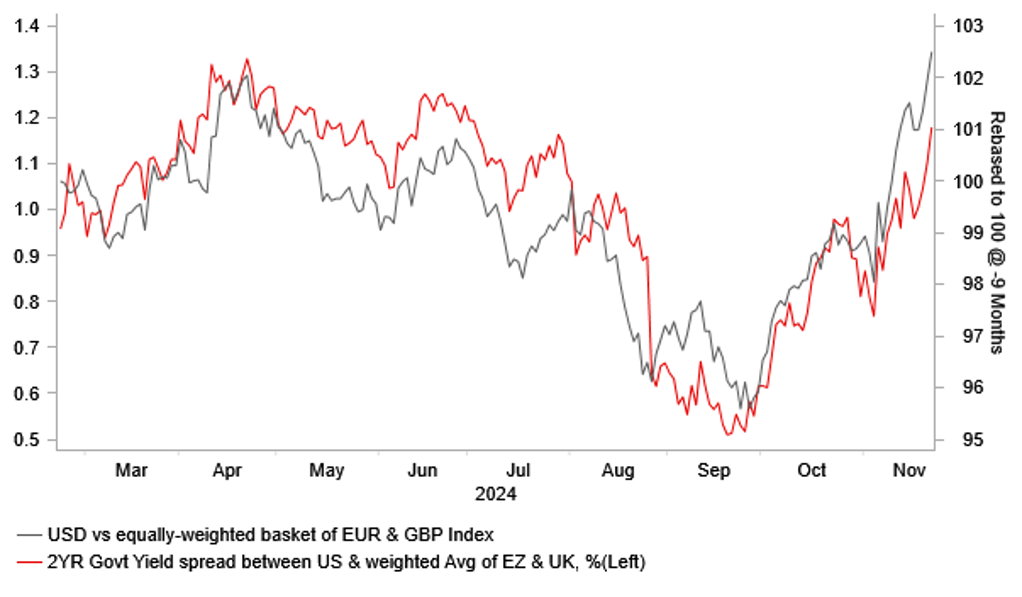

The weakening growth outlook outside of the US is encouraging expectations for widening monetary policy divergence between the Fed and European central banks. Recently Fed Chair Powell indicated that plans for another rate cut as soon as next month are not a done deal and are data dependent. The second consecutive month of stronger US inflation in November is expected to be confirmed in the week ahead by the release of the latest PCE deflator report. The core PCE deflator is currently on track to exceed the projection from the September FOMC meeting of 2.6% for the end of this year. Despite the stronger run of US inflation data we still expect the Fed to follow through and cut rates by 25bps again in December unless there is significant upside surprise in the November nonfarm payrolls report. Continuing claims hit a fresh year to date high this week suggesting that labour market demand has continued to weaken initially after the US election. It supports our view that the Fed is more likely to skip cutting rates in January than December. If we are wrong and the Fed passes on a December rate cut it will reinforce the USD’s upward momentum.

In contrast, market speculation has intensified over the possibility of the ECB delivering a larger 50bps cut in December encouraged by building downside risks to growth in the euro-zone. The euro-zone rate market has moved to price in around 38bps of cuts for next month’s ECB policy meeting. Comments from ECB officials over the past week have continued to strike a dovish tone signalling concern that risks to growth and inflation in the euro-zone are tilting more to the downside, and indicating a desire to lower the policy rate quickly towards neutral at around 2.00%. It’s not clear though that the ECB shares the markets’ enthusiasm to deliver larger 50bps cuts. We think a bigger cut is more likely early next year than in December. Unlike the ECB, the BoE is still dragging its feet over cutting rates. After inflation in the UK surprised to the upside in November, there is a very high hurdle for the BoE to deliver back to back rate cuts next month. Comments from BoE officials this week have indicated they are open to speeding up the pace of rate cuts but want to wait to see how the government’s decision to raise National Insurance contributions for employers feeds through to the economy. We expect the next rate cut to be delivered in February alongside a signal to deliver faster easing if the UK economy continues to slow. Overall, it leaves EUR/USD and cable on track to fall back closer towards parity and 1.2000 respectively.

GROWTH FEARS BUILDING OUTSIDE OF US

Source: Bloomberg, Macrobond & MUFG Research

USD STRENGTH IS RUNING AHEAD OF YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG Research

EUR: France politics back in focus

EUR/USD has plunged further today with the advance PMI data from the euro-zone pointing to increased risks of renewed recession. The markets have moved to priced in nearly 75bps over the next two meetings with an 80% probability of a 50bp cut by the ECB at the next meeting on 12th December. The data was certainly weak with the Composite index for the euro-zone falling to 48.1 in November to nearly fully retrace the move higher earlier this year. The drop is indicative of real GDP slowing back from the Q/Q rate of 0.4% recorded in Q3 to between flat and 0.1% growth recorded between Q2-Q4 last year. The OIS market is now implying around 150bps of rate cuts from the ECB by Oct 2025 versus about 65bps from the Fed. We remain sceptical of the ECB cutting to such an extent even after today’s data given the increased inflation risks if Trump does follow through with aggressive tariffs. The scale of EUR depreciation may also now make the ECB more cautious.

The political landscape in France may well add to EUR downside pressure over the coming weeks with the risks of a break higher in the OAT/Bund spread increasing. The passing of the budget by year-end has become more challenging after parliament rejected the revenue-raising measures by 362 votes to 192 votes. PM Barnier has indicated the likelihood of passing the budget under Article 49.3 which will likely trigger a no-confidence motion being tabled by the Left Alliance. National Rally’s (RN) views on joining a vote of no-confidence seem to be shifting with a higher risk RN supporting a motion. That will potentially scupper a budget being passed meaning a worsening of the deficit rather than the deficit under the planned budget falling from 6.1% of GDP to 5.0%. Debate on the budget is scheduled to end by 12th December suggesting mid-to-late December could be when we might see the government collapsing. In the meantime we have the S&P ratings review next Friday evening. S&P downgraded France to AA- on 31st May and then lowered the outlook from stable to negative on 11th October. Given these actions and given the important point of budget debate, it seems unlikely that S&P would act again so quickly to downgrade.

The worst case scenario is a collapse of the government and an early presidential election if President Macron was not in a position to form a government. We maintain our view for now that RN will avoid voting for a no-confidence motion with the focus on showing responsibility and being the party that is ensuring political stability with an eye to Le Pen winning the presidential election in 2027. But the risks are rising, at least over the near-term, that we see a break in the OAT/Bund spread above the 80bp-level that will only add to the negative momentum in EUR/USD. A test and break of parity is an increasing risks given the speed of decline in EUR/USD is picking up again.

CAC 40/EURO STOXX 600 PERFORMANCE VS EUR/USD

Source: Bloomberg, Macrobond & MUFG GMR

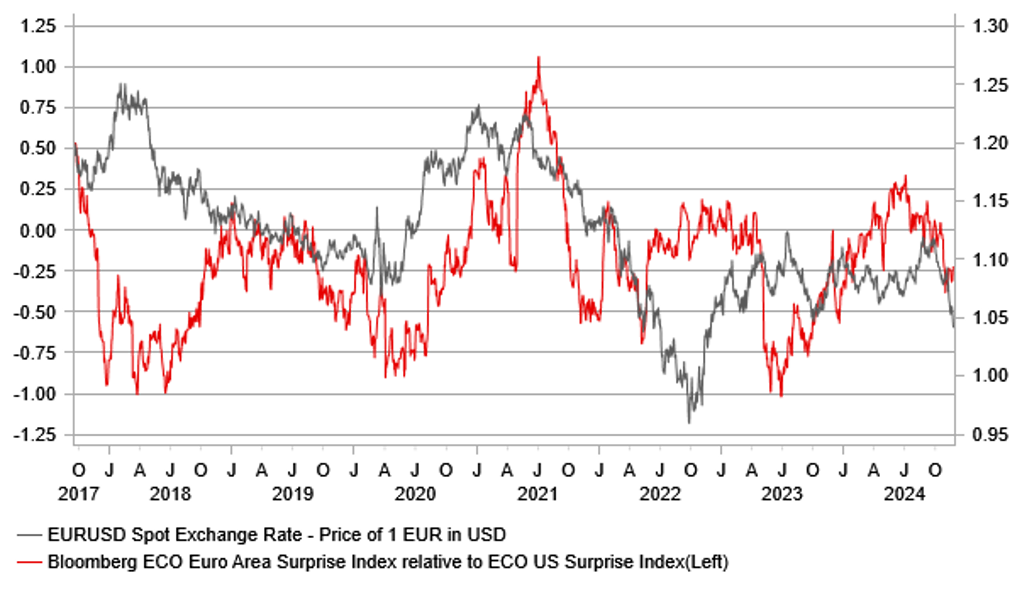

EUR/USD VS EU-US RELATIVE SURPRISE INDEX

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NZD |

11/24/2024 |

21:45 |

Retail Sales Ex Inflation QoQ |

3Q |

-0.7% |

-1.2% |

!! |

|

EUR |

11/25/2024 |

09:00 |

Germany IFO Business Climate |

Nov |

-- |

86.5 |

!! |

|

GBP |

11/25/2024 |

09:00 |

BoE's Lombardelli speaks |

!!! |

|||

|

EUR |

11/25/2024 |

16:30 |

ECB's Lane Speaks in London |

!!! |

|||

|

GBP |

11/26/2024 |

11:00 |

CBI Retailing Reported Sales |

Nov |

-- |

- 6.0 |

!! |

|

USD |

11/26/2024 |

14:00 |

S&P CoreLogic CS 20-City MoM SA |

Sep |

-- |

0.4% |

!! |

|

USD |

11/26/2024 |

15:00 |

New Home Sales |

Oct |

725k |

738k |

!! |

|

USD |

11/26/2024 |

15:00 |

Conf. Board Consumer Confidence |

Nov |

112.5 |

108.7 |

!! |

|

USD |

11/26/2024 |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

!!! |

|

|

AUD |

11/27/2024 |

00:30 |

CPI YoY |

Oct |

2.5% |

2.1% |

!!! |

|

NZD |

11/27/2024 |

01:00 |

RBNZ Official Cash Rate |

4.25% |

4.75% |

!!! |

|

|

USD |

11/27/2024 |

13:30 |

GDP Annualized QoQ |

3Q S |

2.8% |

2.8% |

!!! |

|

USD |

11/27/2024 |

13:30 |

Advance Goods Trade Balance |

Oct |

-$99.2b |

-$108.7b |

!! |

|

USD |

11/27/2024 |

13:30 |

Durable Goods Orders |

Oct P |

0.4% |

-0.7% |

!! |

|

USD |

11/27/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

11/27/2024 |

15:00 |

Core PCE Price Index MoM |

Oct |

0.3% |

0.3% |

!!! |

|

AUD |

11/28/2024 |

00:30 |

Private Capital Expenditure |

3Q |

1.0% |

-2.2% |

!! |

|

AUD |

11/28/2024 |

08:55 |

RBA's Bullock-Speech |

!! |

|||

|

EUR |

11/28/2024 |

09:00 |

M3 Money Supply YoY |

Oct |

-- |

3.2% |

!! |

|

EUR |

11/28/2024 |

13:00 |

Germany CPI YoY |

Nov P |

-- |

2.0% |

!!! |

|

JPY |

11/28/2024 |

23:30 |

Tokyo CPI YoY |

Nov |

2.2% |

1.8% |

!! |

|

JPY |

11/28/2024 |

23:50 |

Retail Sales MoM |

Oct |

0.4% |

-2.2% |

!! |

|

SEK |

11/29/2024 |

07:00 |

GDP QoQ |

3Q |

-- |

-0.3% |

!! |

|

NOK |

11/29/2024 |

07:00 |

Unemployment Rate SA |

Nov |

-- |

2.1% |

!! |

|

EUR |

11/29/2024 |

07:45 |

France CPI YoY |

Nov P |

-- |

1.2% |

!!! |

|

CHF |

11/29/2024 |

08:00 |

GDP QoQ |

3Q |

-- |

0.7% |

!! |

|

EUR |

11/29/2024 |

08:55 |

Unemployment Change (000's) |

Nov |

-- |

27.0k |

!! |

|

GBP |

11/29/2024 |

09:30 |

M4 Money Supply YoY |

Oct |

-- |

3.5% |

!! |

|

EUR |

11/29/2024 |

10:00 |

CPI Estimate YoY |

Nov |

-- |

2.0% |

!!! |

|

CAD |

11/29/2024 |

13:30 |

Quarterly GDP Annualized |

3Q |

-- |

2.1% |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The RBNZ is scheduled to hold their final policy meeting of 2024 in the week ahead. The RBNZ is expected to deliver the second consecutive 50bps rate cut lowering the policy rate to 4.25%. An outcome that is fully priced into the New Zealand rate market ahead of next week’s policy meeting. It will bring the policy rate more quickly towards the RBNZ estimate of what rate is judged as neutral for the economy at somewhere between 2.50%-4.00%. Market participants will be watching closely to see if the RBNZ leaves the door open to another larger 50bps cut early next year or alternatively indicates that the pace of cuts will slow as the policy rate moves closer to neutral. Currently another 50bps cut in February is judged as more likely than not.

- The main economic data releases in the week ahead will includes the latest US PCE deflator report for October. After the release earlier this month of the CPI and PPI reports for October, the core PCE deflator is expected to increase at a faster rate of 0.3%M/M for the second consecutive month. If confirmed it increases the likelihood that the Fed will have to raise their inflation forecasts at the December FOMC meeting. It is one reason why it is not a done deal that the Fed will follow through with plans to cut rates by 25bps next month. The release of minutes from the last FOMC meeting November could also provide further insight into how likely another rate cut is next month, and could include some tentative thoughts on potential policy implications from the US election outcome.

- The main economic data releases in Europe in the week ahead will be the last euro-zone CPI report for November. With headline inflation back in line with the ECB’s target, the ECB has indicated recently that the balance of risks is beginning to shift to the downside. A potential trade conflict with the US would add to downside risks to growth in the euro-zone. The euro-zone rate market is fully pricing in another cut in December supported by dovish ECB rhetoric. Unless there is significant upside inflation surprise in November, then market expectations for further ECB rate cuts are unlikely to be change materially. .