Please note that there will be no FX Weekly on Friday 30th August 2024. The next release will be on Friday the 6th September.

To read the full report, please download PDF.

All to play for in final leg of US presidential election

FX View:

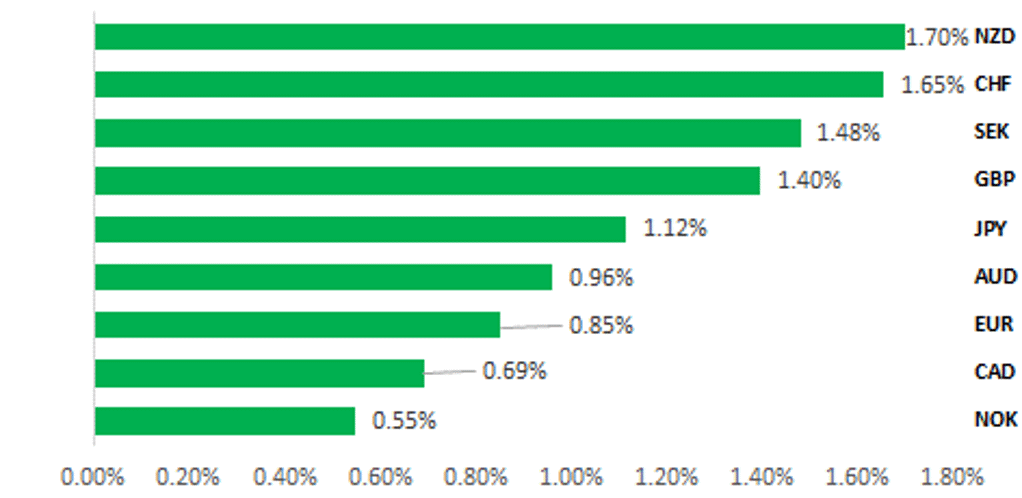

This week the US dollar (DXY) has fallen a further 1.0% as markets position with increased confidence for the start of the Fed easing cycle in September. We expect this to be fully endorsed by Fed Chair Powell in his Jackson Hole speech this afternoon, which would be no surprise given the steady stream of Fed rhetoric from other officials throughout this week. Given this week also saw Vice President Kamala Harris formally accept the Democratic party Presidential nomination we provide an update and assess potential financial market implications after the election on 5th November. Our message on a Trump victory remains the same – the impact on the US dollar from a second Trump presidency would be different to the first for numerous reasons while a Harris victory could coincide with social unrest if as close as Biden’s victory in 2020. Prospects of a weakening labour market in the coming months leaves Trump the slight favourite in our view.

BROAD-BASED USD SELL-OFF VERSUS G10

Source: Bloomberg, 13:15 BST, 23rd August 2024 (Weekly % Change vs. USD

Trade Ideas:

We are maintaining a short NZD/CAD trade recommendation.

JPY High Frequency Flows:

The high frequency cross-border flow data from Japan this week revealed a sharp pick-up in demand for foreign bonds by Japanese investors. The 4-week total buying was the largest since October last year with investors likely enticed by receding inflation fears and the sharp drop in USD/JPY.

Sentiment Analysis on FOMC Minutes:

Our analysis of the FOMC minutes from the meeting on 31st July suggests Fed participants remain directed by developments in the labour market, should August payrolls surprise to the downside this may push participants towards a 50bps cut, ultimately putting further downward pressure on the USD.

FX Views

USD: An election outcome with FX impact less predictable

The US dollar has weakened notably since the beginning of July, falling by close to 5% over that period and the drop is closely aligned to the increased speculation of larger rate cuts coming from the Fed – over that same period, the 2-year UST note yield has dropped by about 85bps to hit a closing low below 3.90% earlier this month. Over this same period we have seen a dramatic shift in the US presidential election and the prospects of a Trump victory has gone from a near shoe-in to close to a 50-50 call, or perhaps even to Trump being the underdog. President Biden’s decision to step down and endorse Kamala Harris was never expected to result in such a dramatic shift. The general market consensus had been that a Trump victory would lift the dollar and steepen the yield curve. We concurred with the curve steepening view but had more doubts on the US dollar view. A too-close-to-call election brings with it greater uncertainty, in particular in the immediate aftermath of the election and that could certainly result in or reinforce unfavourable financial market conditions at a time when the US economy could be deteriorating more markedly.

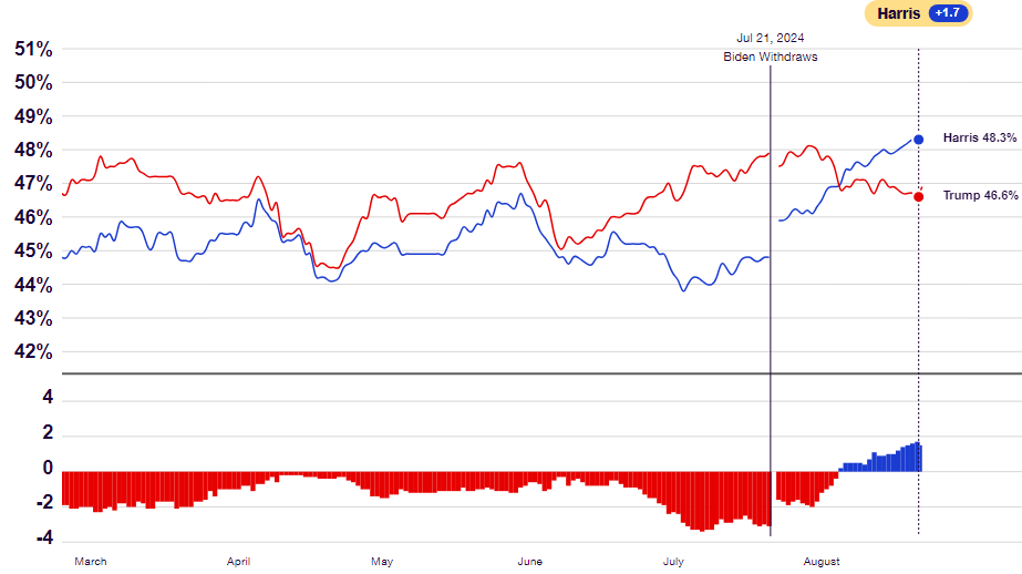

One well-known US pollster this week stated that he had never witnessed such a shift in presidential election polling in the 35yrs he had been in the industry. Real Clear Politics (RCP) currently has Harris 1.7ppts ahead of Trump nationally (48.3% vs 46.6%) in contrast to Trump leading Biden by 3.1ppts (47.9% vs 44.8%) on 21st July, the day Biden announced his withdrawal. The key swing states have also seen a dramatic shift toward Harris. RCP currently has nine states in the “Toss Up” column accounting for 110 electoral college votes with Harris ahead in four of those accounting for 42 of those college votes and Trump ahead in the other five accounting for the other 68 college votes. On that division of the “Toss Up” states Trump wins the White House with 276 college votes (270 required to win). Still, the key point now is that these swing states are in play for the Democrats and the margin on average in the well-known seven swing states within RCP’s “Toss Ups” is just +/-1.3ppts, well within the margin of error. But a weakening labour market leaves Trump a slight favourite in our view.

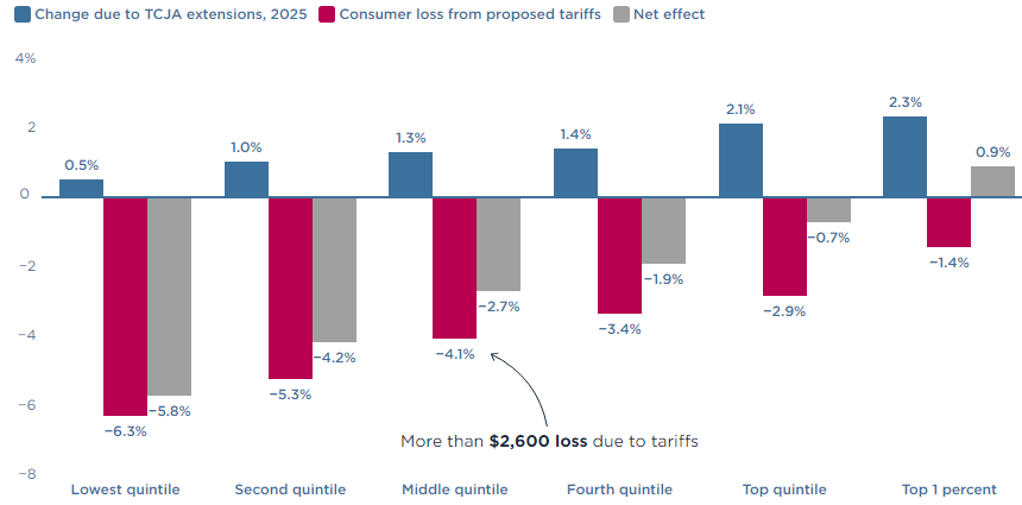

There are now some similarities and big differences in the economic policies outlined by both camps. Harris last week outlined some key policies and the focus on making housing more affordable is a similarity in policies with Trump. The provision of USD 25,000 to support down payments for first time buyers and incentives to boost the construction of residential homes by 3mn are part of the Harris plan that are similar to Trump. Ending taxes on tips is another similarity. Child tax credits, an increase in the corporate tax rate from 21% to 28% and the expiry of the Trump tax cuts on those earning over USD 400k are key differences. Harris’ calls for ending “price gauging” in the food sector. The Committee for a Responsible Federal Budget (non-partisan) estimated that Harris’ measures announced in her speech would cost USD 1.7trn over 10yrs with the corporate tax increase financing USD 1trn over the same period. It looks on the face of it that her left-leaning policies and increased expenditure and higher taxes are unlikely to entice disaffected Republicans. But the biggest differences in policy still lie in the approach to trade not because Harris is planning to roll back tariffs but because of the aggressive plans of Trump to raise tariffs considerably. The now 20% increase on most imports (suggested recently by Trump) and up to 60% on China imports would have significant economic implications. The Peterson Institute has estimated that the gains for a typical middle-income household from Trump extending his Tax Cuts & Jobs Act (TCJA) would be more than offset by the costs on the same households from the implementation of the Trump tariffs. Even under his original 10% tariff proposal, the costs would more than offset the TCJA gains.

POSITIVE MOMENTUM IN POLLS IS WITH HARRIS

Source: Real Clear Politics; as of 23rd August 2024

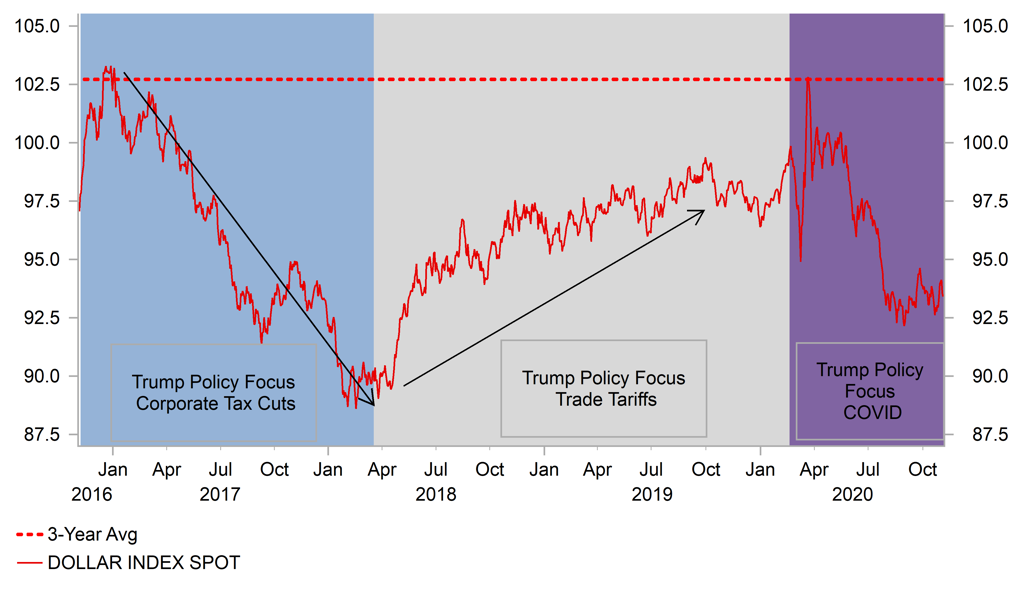

TRUMP’S 2016 POLICY FOCUSES MATTERED FOR USD

Source: Bloomberg, Macrobond & MUFG GMR

Given the trade policies alone it is certainly likely that the dollar would strengthen on the implementation of Trump’s proposed tariffs. But policy sequencing is really important here. Would Trump implement these tariffs immediately? With inflation such a negative for the Biden administration there is a plausible scenario of Trump stalling and at least initially using this as a threat in initial meetings with President Xi. In his first term, trade and tariffs only became a key focus in the spring of 2018. Secondly, the point in economic cycle is completely different today with the Fed in 2016 at the very start of a tightening cycle (Dec 2016 was when the Fed raised rates for just the 2nd time) whereas now of course the Fed is likely to be cutting. Thirdly, the Trump victory in 2016 was a big surprise for the markets and the dollar surged by 6% after the victory through to end-2016. While Trump has lost ground of late in the polls, a win in November would be far less of a surprise and hence the reaction would be much more muted. Finally, the Trump camp appear more serious about pushing a weak US dollar policy. While we believe the fundamentals would ultimately dictate US dollar direction, a forceful campaign to weaken the dollar would certainly have an impact.

There is also a risk of a repeat of 2020. Now that the polls are again suggesting a tight race, a repetition of the 2020 election result could trigger social unrest if Trump is on the losing end of a tight election and again repeats accusations of the election being “stolen”. This would create additional uncertainty, leading to increased financial market volatility and potentially increased US dollar selling.

TRUMP’S TARIFFS TO MORE THAN OFFSET TAX CUTS

Source: Peterson Institute for International Economics

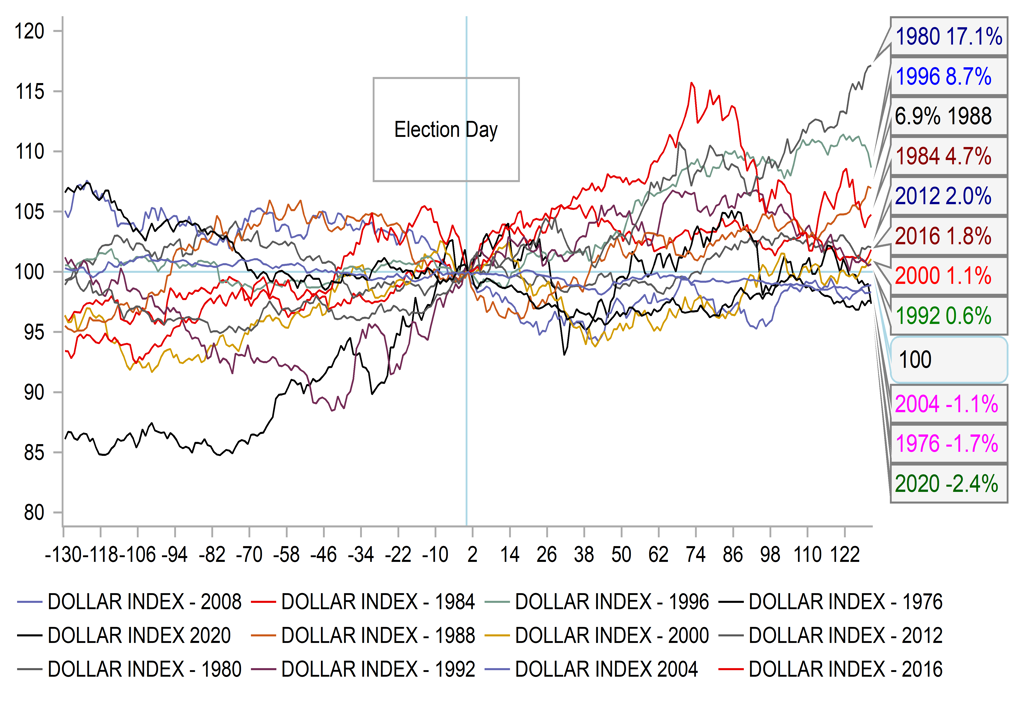

POST-ELECTION UPSIDE BIAS FOR THE US DOLLAR

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

08/26/2024 |

09:00 |

IFO Business Climate |

Aug |

-- |

87 |

!! |

|

USD |

08/26/2024 |

13:30 |

Cap Goods Orders Nondef Ex Air |

Jul P |

0.10% |

0.90% |

!! |

|

JPY |

08/27/2024 |

00:50 |

PPI Services YoY |

Jul |

-- |

3.00% |

!!! |

|

EUR |

08/27/2024 |

07:00 |

German GDP SA QoQ |

2Q F |

-- |

-0.10% |

!! |

|

GBP |

08/27/2024 |

11:00 |

CBI Total Dist. Reported Sales |

Aug |

-- |

-30 |

!! |

|

USD |

08/27/2024 |

15:00 |

Conf. Board Consumer Confidence |

Aug |

100 |

100.3 |

!! |

|

EUR |

08/28/2024 |

07:00 |

German GfK Consumer Confidence |

Sep |

-- |

-18.4 |

! |

|

GBP |

08/28/2024 |

13:15 |

BoE's Mann speaks |

!!! |

|||

|

USD |

08/28/2024 |

23:00 |

Fed's Bostic speaks |

!!! |

|||

|

EUR |

08/29/2024 |

10:00 |

EZ Consumer Confidence |

Aug F |

-- |

-- |

! |

|

EUR |

08/29/2024 |

10:15 |

ECB's Lane speaks on inflation |

!!!! |

|||

|

EUR |

08/29/2024 |

13:00 |

German CPI EU Harmonized YoY |

Aug P |

-- |

2.60% |

!!! |

|

CAD |

08/29/2024 |

13:30 |

Payroll Employment Change - SEPH |

Jun |

-- |

41.0k |

!! |

|

USD |

08/29/2024 |

13:30 |

GDP Annualized QoQ |

2Q S |

2.80% |

2.80% |

!! |

|

USD |

08/29/2024 |

13:30 |

Core PCE Price Index QoQ |

2Q S |

-- |

2.90% |

!! |

|

USD |

08/29/2024 |

13:30 |

Advance Goods Trade Balance |

Jul |

-$97.3b |

-$96.8b |

!! |

|

USD |

08/29/2024 |

13:30 |

Initial Jobless Claims |

Aug-24 |

-- |

-- |

!!! |

|

JPY |

08/30/2024 |

00:30 |

Tokyo CPI Ex-Fresh Food YoY |

Aug |

2.30% |

2.20% |

!!! |

|

JPY |

08/30/2024 |

00:30 |

Tokyo CPI Ex-Fresh Food, Energy YoY |

Aug |

1.40% |

1.50% |

!!! |

|

JPY |

08/30/2024 |

00:50 |

Industrial Production MoM |

Jul P |

4.00% |

-4.20% |

!! |

|

EUR |

08/30/2024 |

06:30 |

France Total Payrolls |

2Q |

-- |

0.30% |

!! |

|

EUR |

08/30/2024 |

07:45 |

France Consumer Spending MoM |

Jul |

-- |

-0.50% |

!! |

|

EUR |

08/30/2024 |

07:45 |

France CPI EU Harmonized YoY |

Aug P |

-- |

2.70% |

!! |

|

EUR |

08/30/2024 |

08:55 |

German Unemployment Change (000's) |

Aug |

-- |

18.0k |

!! |

|

GBP |

08/30/2024 |

09:30 |

Mortgage Approvals |

Jul |

-- |

60.0k |

! |

|

EUR |

08/30/2024 |

10:00 |

EZ CPI Estimate YoY |

Aug |

-- |

2.60% |

!!! |

|

EUR |

08/30/2024 |

10:00 |

EZ CPI Core YoY |

Aug P |

-- |

2.90% |

!!! |

|

CAD |

08/30/2024 |

13:30 |

Quarterly GDP Annualized |

2Q |

1.80% |

1.70% |

!! |

|

CAD |

08/30/2024 |

13:30 |

GDP MoM |

Jun |

0.10% |

0.20% |

!! |

|

USD |

08/30/2024 |

13:30 |

Personal Spending |

Jul |

0.50% |

0.30% |

!! |

|

USD |

08/30/2024 |

13:30 |

Core PCE Price Index MoM |

Jul |

0.20% |

0.20% |

!!!! |

|

USD |

08/30/2024 |

13:30 |

Core PCE Price Index YoY |

Jul |

2.70% |

2.60% |

!!!! |

|

USD |

08/30/2024 |

14:45 |

MNI Chicago PMI |

Aug |

-- |

45.3 |

!! |

|

USD |

08/30/2024 |

15:00 |

U. of Mich. Sentiment |

Aug F |

-- |

67.8 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- After recent weeks of top-tier data and then the Jackson Hole symposium last week, the week ahead is a little lighter in terms of central bank officials speaking with Atlanta Fed President Bostic the only scheduled speaker at the moment. Given this week’s speaker culminating with today’s Jackson Hole speech by Powell there is unlikely now to be much shift in messaging. The highlight on the ECB side is probably ECB Chief Economist Philip Lane’s appearance on a panel to discuss inflation. BoE MPC member Catherine Mann is the highlight for the UK and it will be interesting to garner whether Mann’s level of hawkishness is subsiding now that the MPC has cut and inflation fears have eased given the recent declines in wage growth.

- In terms of economic data, the following week will be key with the release of the ISM reports and the nonfarm payrolls data on Friday 6th The key highlight next week will be the consumer confidence report on Tuesday and then the PCE inflation data. It is clear from the CPI and PPI data that the disinflation process remains intact in the US and there will be high expectations of a favourable PCE inflation reading on Friday as well. Friday will also be key from an inflation perspective for Japan and the euro-zone with Tokyo CPI and then the flash estimate for CPI in the euro-zone. The negotiated wage data released this week, which was much weaker than expected will diminish inflation fears going into that key inflation release on Friday.