To read the full report, please download PDF.

Will G10 FX carry trades continue to outperform?

FX View:

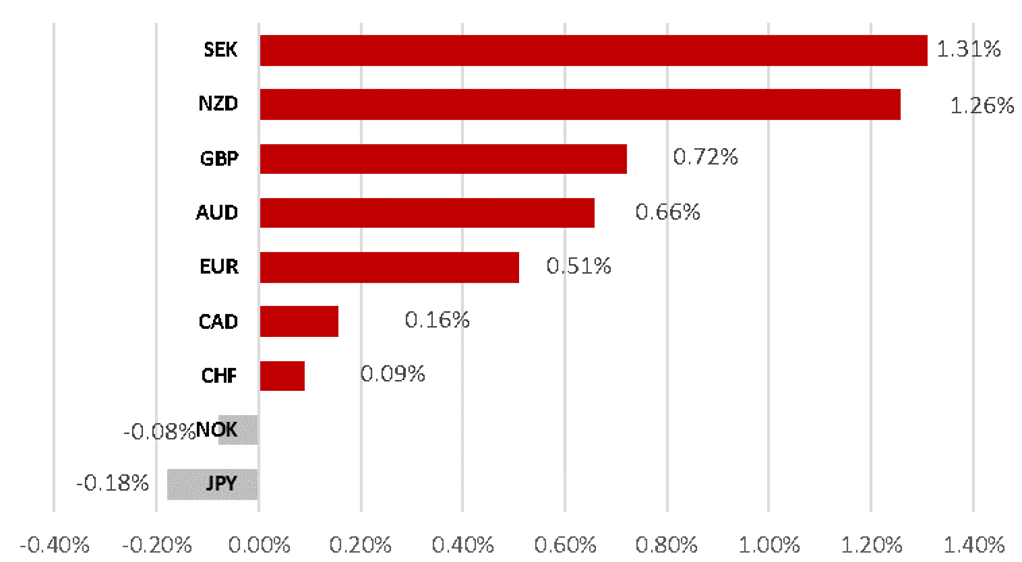

Global investor risk sentiment has continued to improve at the start of this year reflecting building optimism over a softer landing for the global economy, and further evidence revealing that the emergence of artificial intelligence is boosting corporate revenues. Along with low volatility in the FX market, current conditions have been favourable for G10 FX carry trades that have been performing strongly. The low yielding funding currencies of the CHF and JPY have underperformed while higher yielding G10 currencies such as the USD and NZD have benefited from the recent hawkish repricing of Fed and RBNZ rate expectations. The RBNZ’s policy update will be watched closely in the week ahead to see if they back up market expectations for a further rate hike. One potential threat to JPY-funded carry trades is the BoJ’s next policy meeting in March. There is an increasing risk of the BoJ delivering an earlier rate hike that could trigger a squeeze of JPY shorts.

USD GIVES BACK INITIAL POST US CPI REPORT GAINS

Source: Bloomberg, 14:00 GMT, 23rd February 2024 (Weekly % Change vs. USD

Trade Ideas:

We are maintaining our short EUR/GBP trade idea, and closing our long USD/CHF trade idea after the USD lost upward momentum over the past week.

JPY Flows:

The MoF weekly cross border flow data was released yesterday and Japanese investors look to have turned less favourable to foreign bonds last week with selling totalling JPY 561bn, which was the largest one-week selling of foreign bonds so far this year.

Sentiment Analysis on FOMC Minutes:

The latest FOMC minutes highlight participants are cautiously managing rate cut expectations. Our analysis highlights net sentiment towards ‘Demand’, ‘Inflation’, ‘Labour’ and ‘Economy’ are currently positive while references to ‘Manufacturing’, ‘Housing’, ‘Commodities’ remain negative. Net sentiment towards ‘risk’ is also the most positive value in our series.

FX Views

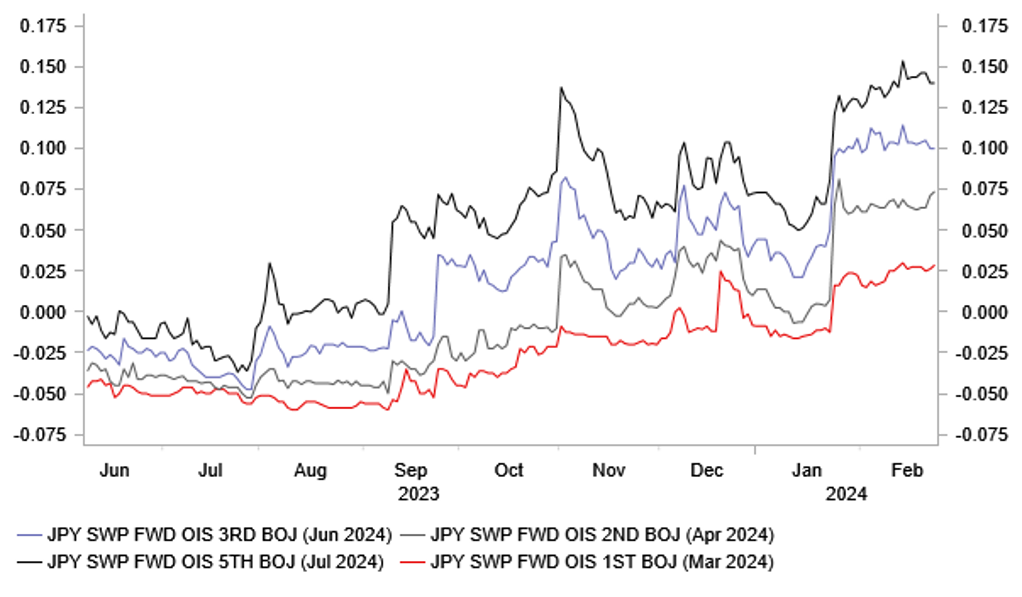

USD/JPY: BoJ optimism points to potential March hike

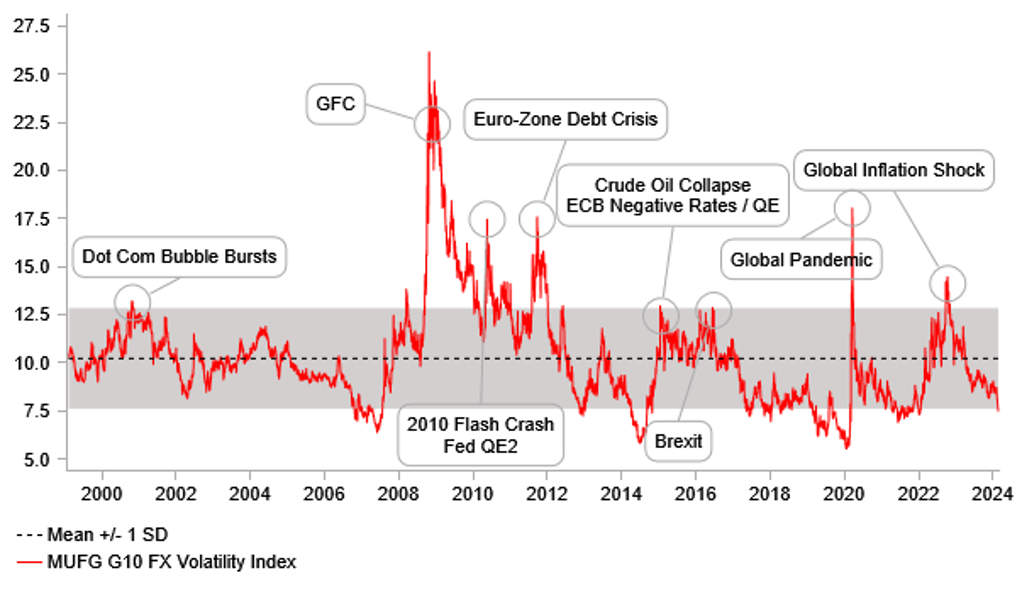

Last week our JPY FX View piece focused on USD/JPY being back in the “intervention zone” and we remain in that zone with the yen remaining weak. Indeed, were it not for the fact that USD/JPY is close to potential intervention action by the Japanese authorities, the USD/JPY rate probably would have jumped by more this week. The yen did underperform and was the worst performing G10 currency but has only weakened by 0.3% this week – this in a week when the 2yr UST note yield jumped another 10bps and global equity markets surged in response to continued AI-enthusiasm after strong earnings results from Nvidia. The Nikkei 225 surged 2.2% yesterday (Japan markets are closed today) and is 17% higher year-to-date and 50% higher since the start of 2023. The Nikkei 225 is at a new record high for the first time since December 1989. MUFG’s G10 FX implied volatility index has dropped to just 7.5%, the lowest level since January 2022 and over than one standard deviation from the long-term average. These are all perfect conditions for carry and fears over intervention have likely played a role in that very modest yen depreciation this week.

The global risk-on conditions and new record high in Japanese equities does put the BoJ in a position of likely having more confidence in the prospects of achieving price stability. Governor Ueda yesterday spoke in the Diet and our view of his comments is that BoJ confidence is rising and this is resulting in more forceful and explicit comments. Ueda spoke in the Diet yesterday and provided a more upbeat and confident message stating that he believed the virtuous cycle of higher wages and inflation would strengthen. He added that “signs have been observed that businesses are becoming more active when deciding wages as labour demand tightens”. Last week he stated that “companies in Japan will be more aggressive than ever”. Our sense is that BoJ confidence in relation to wage increases is strengthening and if they are being swayed by their own incoming information they may well decide in March to hike. The level of the yen could play a role here too. As stated above conditions are ripe for carry and if global risk conditions and low volatility continues, there’s a high chance of further moves higher in USD/JPY. But certainly confidence in wage growth is rising and that means the fundamental reasoning for a hike is looking more compelling.

A March rate hike is looking more likely and the risk looks under-priced. While USD aspects are key for USD/JPY, a rate hike would certainly fuel some JPY buying.

MARCH RATE HIKE PRICING HAS BARELY BUDGED

Source: Bloomberg, Macrobond & MUFG GMR

G10 FX VOLATILITY BREAKS LOWER

Source: Bloomberg, Macrobond & MUFG GMR

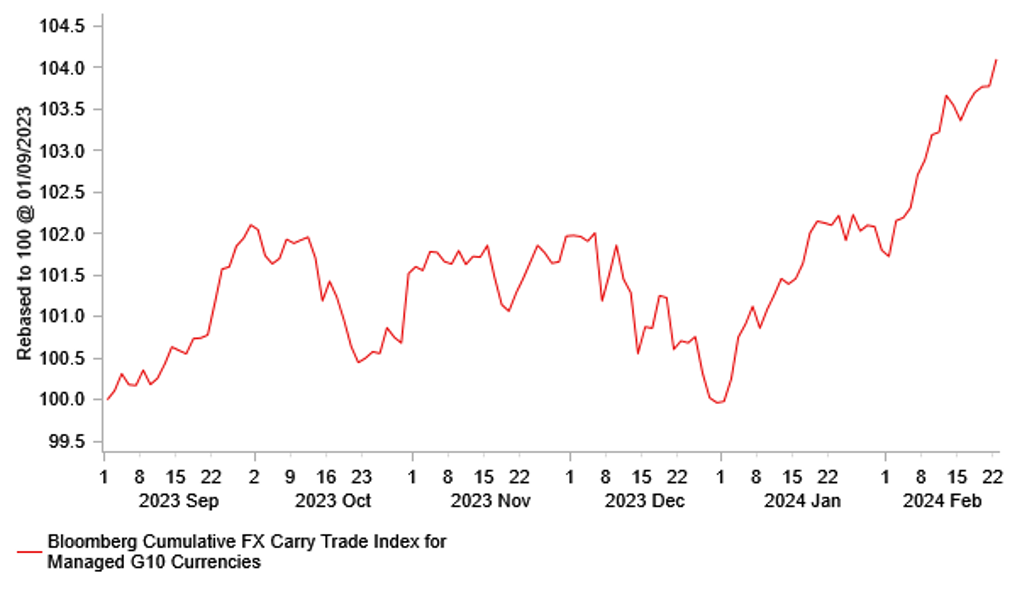

G10 FX: Carry trades performing well at start of 2024

Global equity markets have hit new record highs over the past week highlighting that investor risk sentiment continues to improve at the start of this year. The improvement in risk sentiment reflects building optimism over a softer landing for the global economy and further evidence that the emergence of artificial intelligence is helping to boost corporate revenues. The ongoing improvement in global investor risk sentiment is creating a supportive environment for G10 FX carry trades at the start of this year. Bloomberg’s G10 Carry trade index which measures the cumulative total return of a buy-and-hold carry trade position that is long the three highest yielding G10 currencies and is fully funded with short positions in the lowest three yielding G10 currencies has performed strongly so far this year increasing by around 4.0%. It follows a period of poor performance for G10 FX carry trade returns in Q4 of last year (-2.1%). The weak performance of the low yielding G10 funding currencies at the start of this year (JPY -6.4% vs. USD YTD & CHF -4.6%) has helped to boost carry trade returns. The broad-based rebound for the high yielding USD has also been a positive development for G10 FX carry trade returns. At the same time, G10 FX volatility has continued to decline making it more attractive to hold carry trades. G10 FX volatility has fallen back to its lowest level since early in 2022 prior to the Ukraine conflict.

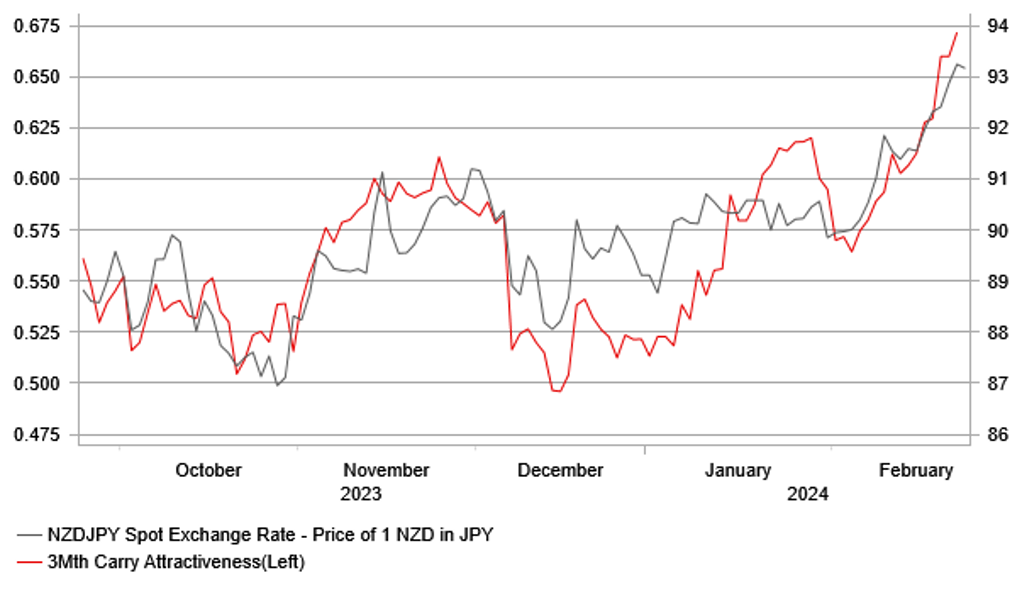

The NZD has been the best performing high yielding G10 currency in February driven not just by favourable conditions for FX carry trades but also by the hawkish repricing of the RBNZ policy outlook. The New Zealand rate market has become more confident this month that the RBNZ will raise rates further in the current tightening cycle even though the policy rate is already the highest amongst G10 central banks at 5.50%. The recent change in market expectations will make next week’s RBNZ policy update even more important than normal. While another rate hike is not expected a soon as next week (8bps of hikes priced in), the New Zealand rate market judges that one final hike in the 1H of this year is now more likely than not (15bps of hikes price in by May). In order to meet those hawkish market expectations, the RBNZ will have to at least deliver a signal that they are more seriously considering raising rates at upcoming policy meetings. At their last meeting in November, the RBNZ had already indicated that “if inflationary pressures were to be stronger than anticipated, the OCR would likely to need to increase further”. The November projections were raised to show the policy rate remaining at higher levels for longer with rate cuts unlikely until Q4 at the earliest.

In the current environment we expect G10 FX carry trades to continue to perform well in the near-term. The main downside risk for the high yielding NZD in the week ahead would be if the RBNZ doesn’t back up hawkish expectations for a further rate hike.

A STRONG START TO THE YEAR FOR G10 FX CARRY

Source: Bloomberg, Macrobond & MUFG GMR

HIGHER YIELDS HAVE BOOSTED NZD'S CARRY APPEAL

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

USD |

02/26/2024 |

15:00 |

New Home Sales |

Jan |

685k |

664k |

!! |

|

JPY |

02/26/2024 |

23:30 |

Natl CPI YoY |

Jan |

1.9% |

2.6% |

!!! |

|

EUR |

02/27/2024 |

09:00 |

M3 Money Supply YoY |

Jan |

-- |

0.1% |

!! |

|

USD |

02/27/2024 |

13:30 |

Durable Goods Orders |

Jan P |

-4.5% |

0.0% |

!! |

|

USD |

02/27/2024 |

14:00 |

S&P CoreLogic CS 20-City MoM SA |

Dec |

-- |

0.2% |

!! |

|

USD |

02/27/2024 |

15:00 |

Conf. Board Consumer Confidence |

Feb |

114.8 |

114.8 |

!! |

|

AUD |

02/28/2024 |

00:30 |

CPI YoY |

Jan |

3.5% |

3.4% |

!!! |

|

NZD |

02/28/2024 |

01:00 |

RBNZ Official Cash Rate |

5.50% |

5.50% |

!!! |

|

|

EUR |

02/28/2024 |

10:00 |

Consumer Confidence |

Feb F |

-- |

-15.5 |

!! |

|

CAD |

02/28/2024 |

13:30 |

Current Account Balance |

4Q |

-- |

-$3.22b |

!! |

|

USD |

02/28/2024 |

13:30 |

GDP Annualized QoQ |

4Q S |

3.3% |

3.3% |

!! |

|

JPY |

02/28/2024 |

23:50 |

Retail Sales MoM |

Jan |

0.5% |

-2.9% |

!! |

|

JPY |

02/28/2024 |

23:50 |

Industrial Production MoM |

Jan P |

-7.0% |

1.4% |

!! |

|

AUD |

02/29/2024 |

00:30 |

Retail Sales MoM |

Jan |

1.8% |

-2.7% |

!! |

|

SEK |

02/29/2024 |

07:00 |

GDP QoQ |

4Q |

-- |

-0.3% |

!! |

|

EUR |

02/29/2024 |

07:45 |

France CPI YoY |

Feb P |

-- |

3.1% |

!! |

|

CHF |

02/29/2024 |

08:00 |

GDP QoQ |

4Q |

-- |

0.3% |

!! |

|

EUR |

02/29/2024 |

08:55 |

Germany Unemployment Change (000's) |

Feb |

-- |

-2.0k |

!! |

|

NOK |

02/29/2024 |

09:00 |

Norges Bank Daily FX Purchases |

Mar |

-- |

350m |

!! |

|

GBP |

02/29/2024 |

09:30 |

M4 Money Supply YoY |

Jan |

-- |

-0.9% |

!! |

|

EUR |

02/29/2024 |

13:00 |

Germany CPI YoY |

Feb P |

-- |

2.9% |

!!! |

|

CAD |

02/29/2024 |

13:30 |

Quarterly GDP Annualized |

4Q |

-- |

-1.1% |

!!! |

|

USD |

02/29/2024 |

13:30 |

PCE Core Deflator MoM |

Jan |

0.4% |

0.2% |

!!! |

|

USD |

02/29/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

JPY |

02/29/2024 |

23:30 |

Jobless Rate |

Jan |

2.4% |

2.4% |

!! |

|

CNY |

03/01/2024 |

01:30 |

Composite PMI |

Feb |

-- |

50.9 |

!! |

|

EUR |

03/01/2024 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Feb F |

-- |

46.1 |

!! |

|

GBP |

03/01/2024 |

09:30 |

S&P Global UK Manufacturing PMI |

Feb F |

-- |

47.1 |

!! |

|

EUR |

03/01/2024 |

10:00 |

CPI Estimate YoY |

Feb |

-- |

-- |

!!! |

|

USD |

03/01/2024 |

15:00 |

U. of Mich. Sentiment |

Feb F |

-- |

79.6 |

!! |

|

USD |

03/01/2024 |

15:00 |

ISM Manufacturing |

Feb |

49.1 |

49.1 |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The RBNZ’s policy meeting will attract more market attention in the week ahead after the recent hawkish repricing in the New Zealand rate market. Yields in New Zealand have risen sharply this month to reflect market expectations that the RBNZ could raise rates further in the current tightening cycle. It follows the releases of the stronger than expected CPI and labour market reports for Q1. The New Zealand rate market has moved to price in around 8bps of hikes at next week’s RBNZ policy meeting and 15bps of hikes by the May RBNZ policy meeting. While the RBNZ is not expected to raise rates at next week’s meeting, market participants are anticipating a hawkish signal that indicates that rates could be raised further in the coming months.

- The main economic data releases in the week ahead will provide an update on inflation developments in G10 economies. The Fed’s preferred measure on US inflation, the core PCE deflator is scheduled to be released on Thursday. It is expected to confirm that inflation pressures picked up at the start of this year after the core deflator slowed back to the Fed’s 2.0% target in the 2H of last year. After the upside surprises for the CPI and PPI reports for January, the US rate market should be better priced ahead of the release of the PCE deflator report. The timing of the first Fed rate cut has already been pushed back to June.

- The latest CPI report from Japan for January is expected to reveal that inflation has slowed further at the start of this year. Still we expect the BoJ to exit negative rate policy in April but can’t rule out a rate hike as early as at the next meeting in March. Recent communication from the BoJ has signaled clearly that they are becoming more confident of achieving their inflation target. In the euro-zone, inflation picked up at the start of this year but we expect it to slow further by the middle of this year. Core inflation should drop back in February before the early timing of Easter could trigger some short-term volatility in the following months.