To read the full report, please download PDF.

Uncertainties and safe-havens in FX

FX View:

The financial markets appear largely immune to the ongoing uncertainties but a sudden development could materialise that prompts a sharp change in conditions and much higher FX volatility. This week we look at safe-havens in FX, what have influenced FX performance in past episodes and what might we expect going forward. History and current market conditions certainly lead us to believe that not all roads lead to US dollar appreciation. Certain factors like positioning, valuation and policy responses along with whether the shock is demand-side or supply-side will be important in determining whether the dollar remains the safe-haven of choice. In the context of uncertainty, we also look at potential GBP performance after UK PM Rishi Sunak called an election to be held on 4th July, sooner than was widely assumed by political analysts and market participants.

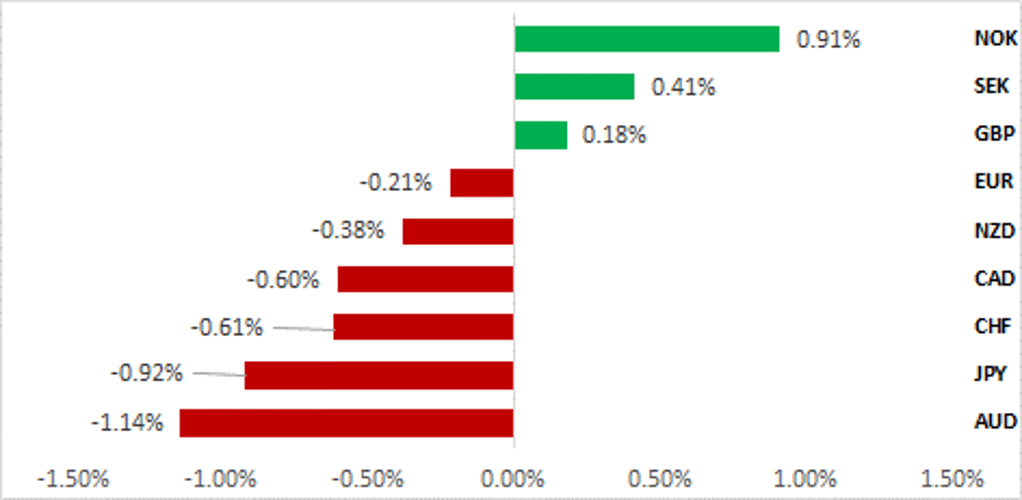

UK ELECTION ANNOUNCEMENT HAS LITTLE IMPACT ON GBP THIS WEEK

Source: Bloomberg, 14:45 BST 24th May 2024 (Weekly % Change vs. USD)

Trade Ideas:

Given the CPI data from the UK this week, a BoE rate cut in June is now very unlikely and hence we have closed our long EUR/GBP trade but have maintained our long EUR/USD trade.

JPY Flows – High Frequency :

The weekly cross-border flow data from the MoF was released yesterday and there was a sharp upturn in demand for foreign bonds by Japanese investors last week, with the largest buying since December last year when a falling USD/JPY drew in demand.

Sentiment Analysis on FOMC minutes :

The latest FOMC minutes released earlier this week suggests a willingness from participants to raise the key policy rate citing ‘insufficiently restrictions on aggregate demand and inflation’. However, our analysis suggests despite the hawkish rhetoric relative to historical periods the Fed remains positive on its inflation outlook, with participants referencing disinflation within the labour market and core-services sector.

FX Views

FX safe-havens & FX performance in risk-off

We seem to be in a permanent state of uncertainty with geopolitical risks, inflation and politics all reasons to keep the outlook cloudy. For all of these uncertainties, FX volatility remains remarkably low reflecting the still reasonably coordinated monetary cycles (in the forward market) limiting the conviction in trading on expected divergences. But what if this low volatility suddenly changes? What if there is a considerable risk event, a collapse in risk appetite and a rush to protect the return OF capital rather than the return ON capital. A safe haven asset is defined simply as “an investment that is expected to retain its value, or even increase in value during times of market turbulence”. In FX, reserve currency status, liquidity and size of capital markets, current account position, real yield, and political stability tend to be the most reliable characteristics of a safe-haven currency. The US dollar ticks most of those boxes, so is it a simple case of buy the dollar and forget about all other currencies?

While having the characteristics of a safe-haven currency are important in determining the performance in FX during bouts of turmoil, other factors also need to be considered. Positioning, valuation, terms of trade, the timing of a risk event and the ability to implement a quick policy response are all important additional more variable factors that can shape FX performance during bouts of turmoil.

Looking back at risks events over the past 25yrs, two stand out due to the complete unpredictability of the events. 9/11 in 2001 and the earthquake and tsunami in Japan in March 2011. 9/11 being very US-specific saw the dollar weaken with JPY and CHF outperforming. However, growth supportive tax cuts by President Bush and a revival in confidence via patriotic spirit saw a 12% equity plunge reverse sharply. USD buying intervention in USD/JPY also helped stabilise the dollar, which was stronger over a 3mth period versus most currencies, bar CHF. The tsunami in Japan saw the yen surge on expectations of repatriation from abroad (Japan’s strong IIP) but intervention by the MoF saw JPY strength partially reverse. A government commitment to finance restructuring helped restore confidence quickly. So even in the most un-hedgeable risks events, the specific nature of the events and the rapid policy responses helped to contain the FX moves. The US dollar in 2011 was also already weakening for Fed policy reasons that helped provide JPY support against the dollar in that period.

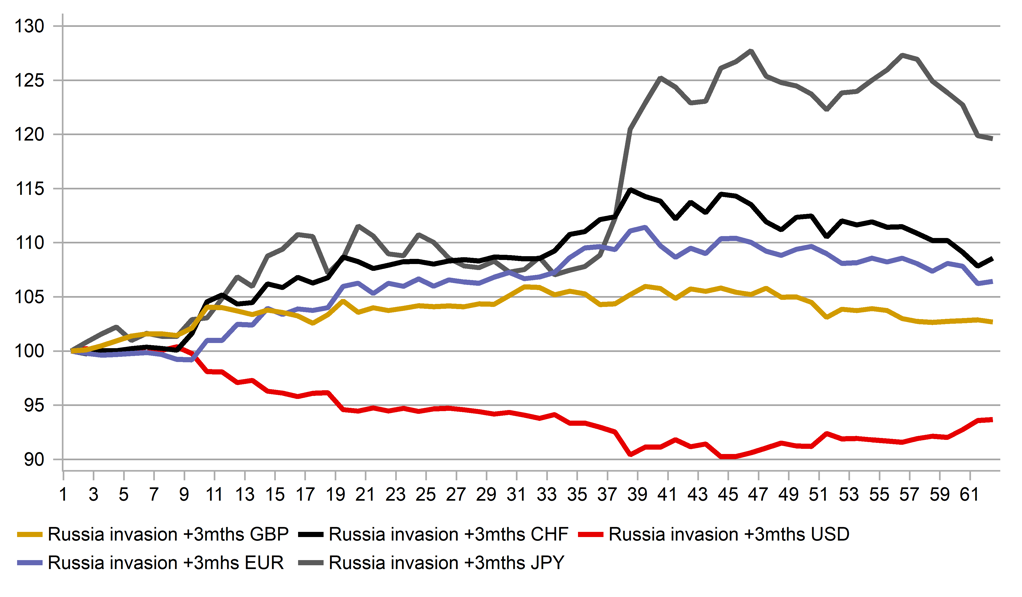

FX PERFORMANCE FOR KEY G10 CURRENCIES 3MTHS FOLLOWING RUSSIA DEFAULT IN 1998

Source: Bloomberg, Macrobond & MUFG GMR

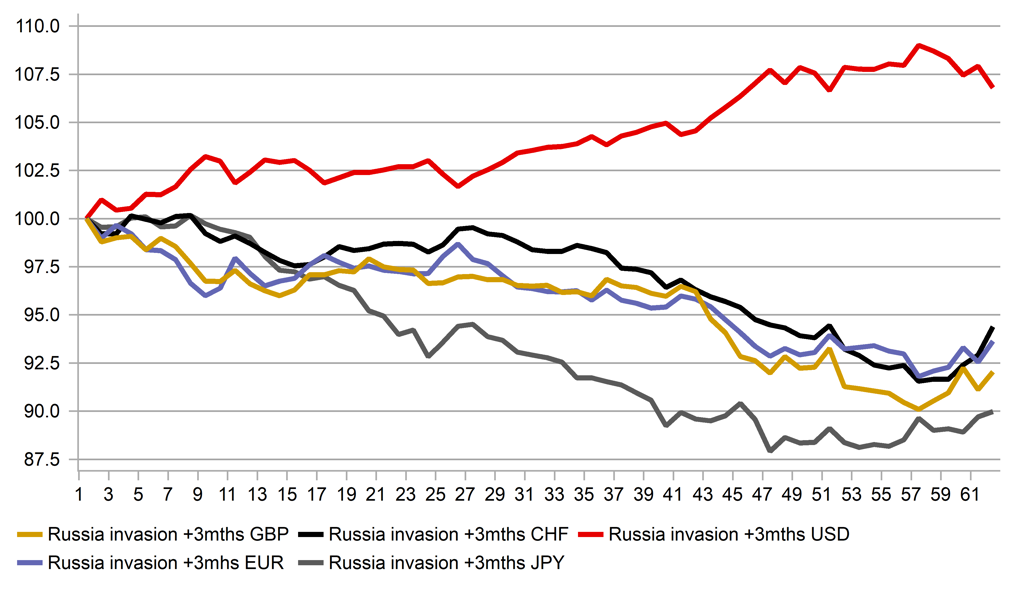

FX PERFORMANCE FOR KEY G10 CURRENCIES 3MTHS FOLLOWING RUSSIA INVASION OF UKRAINE IN 2022

Source: Bloomberg, Macrobond & MUFG GMR

In addition to FX responses to events impossible to predict, the variable factors that help determine FX performance are also important when it comes to the risk events that are more predictable. Positioning is one of those variables and there is no better example of the importance of positioning than 1998 and the Russian default and collapse of LTCM. The yen carry trade was in vogue, the MoF and the Fed intervened to buy the yen in June 1998 and then turmoil unfolded with a Russian default on 17th August. In the space of six trading days the S&P 500 fell 15%. The Fed responded quickly cutting rates three times (once inter-meeting) in September/November and in three trading days in October, USD/JPY plunged from 134 to 111!

The Global Financial Crisis between in 2008-09 was by far the largest risk-off event. Taking FX performance from the point in which Lehman Brothers collapsed, FX performance was mixed initially (the US equity market fell but then rallied!) but one month and three months later the yen was the top performer followed by the dollar. Global rates were plunging and the yen was the main beneficiary. By the time of the collapse of Lehman Brothers, the Fed had slashed rates by 325bps and Japan’s real policy rate was higher than in the US. Momentum, yield and positioning all served to reinforce yen outperformance, reinforced by its strong external position.

The energy price shock that followed the invasion of Ukraine by Russia had a hugely negative terms of trade impact on large energy importers. The yen, euro and pound were three of the worst performing G10 FX currencies in the three month period following the invasion of Ukraine. The US as a natural gas producer experienced a positive terms of trade shock, which enhanced its safe-haven currency status and performed strongly in the aftermath of the invasion.

Safe-haven FX performance ahead

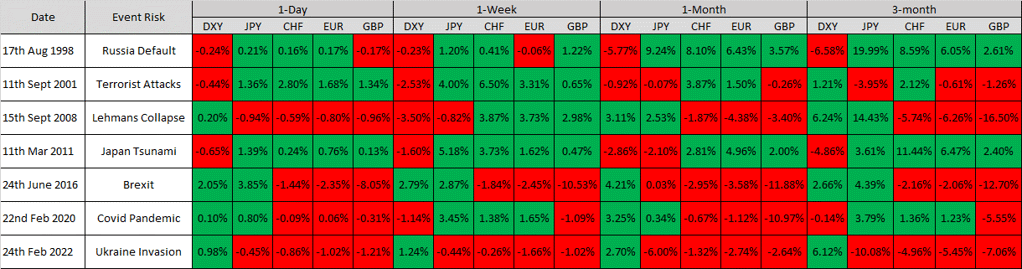

Considering the table below, past risk events highlight a very important fact – FX performance post risk-off events being triggered varies due to numerous factors. Prior to the 2022 Russia invasion of Ukraine, the yen’s strong performance was more reliable than the dollar’s. Yield and positioning at the starting point of an event can play a key role in FX performance. Policy response post-covid and the high level of uncertainty given the unprecedented nature of the event saw the dollar flip back and forth from strength to weakness. Systemic risks related to solvency and liquidity strongly favours the dollar. But given current circumstances, it is certainly not a given that the US dollar would be the currency to necessarily perform best in a risk-event.

PAST RISK-OFF EVENTS AND KEY FX PERFORMANCES

Source: Bloomberg, MUFG Research. JPY, CHF, EUR & GBP appreciation/depreciation versus USD

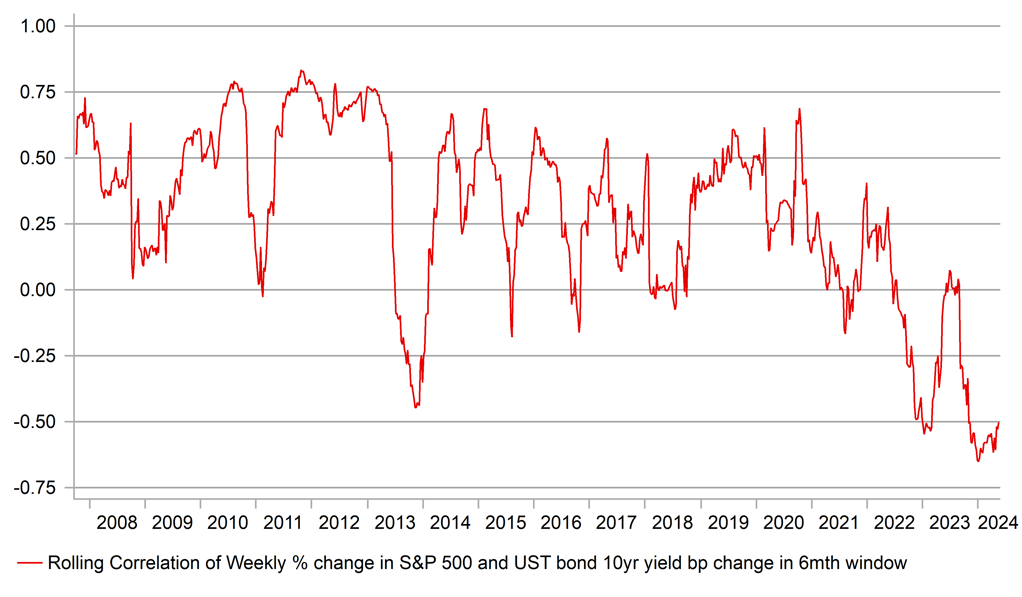

The consequences in the post-global inflation shock era is that the reliability of the US Treasury market being a safe-haven destination for investors has certainly deteriorated. The rolling correlation between weekly percentage changes in the S&P 500 and weekly changes in the UST bond 10yr yield (in bps) over a 6mth window is now clearly negative. The current length of period of this level of negative correlation was last seen way back in 1997. With inflation more unanchored than at any time in decades, the reliability of the US Treasury market is less than before. That does raise certain questions over the potential for a risk-off event to involve turmoil in the UST bond market that could undermine the US dollar’s safe-haven credentials. In addition, the loss of the yen’s safe-haven appeal is very much a yield driven development. If a risk-off event was inflation-related that resulted in global yields remaining high, the yen would again fail to perform strongly.

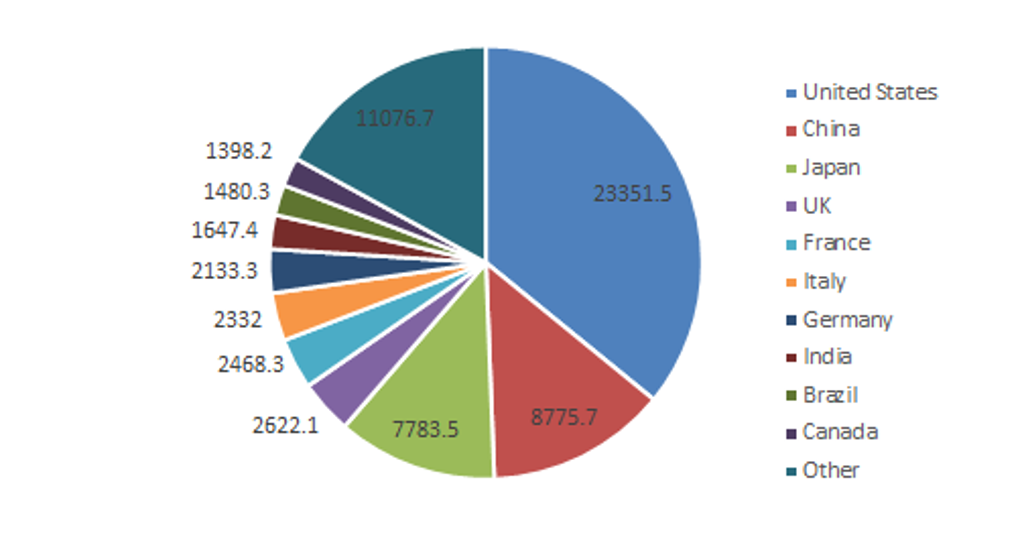

Looking at the potential risk events that could lie ahead and given investor concerns over inflation a supply-side shock is certainly a higher risk than before. An invasion of Taiwan by China that saw severe disruptions to the global supply of the most advanced semiconductors (Taiwan and S. Korea have a near 100% global production level) could have severe implications for inflation. The potential for retaliatory sanctions on China and the economic hit to the region would likely see USD/Asia move sharply higher. An escalation of the conflict in the Middle East that involved attacks on energy production facilities would likely have FX performance similarities to the Russia invasion of Ukraine and result in a potential serve energy price shock that would hit the euro, yen and pound and see the dollar perform best. A specific shock to the US Treasury market due to say excessive fiscal spending is a scenario that could hit the US dollar. A sudden loss of confidence would likely see capital shift to the very front-end of the curve, possibly driving short-end yields negative with capital also moving to where global bond markets are next biggest – Japan and the euro-zone. It’s a scenario certainly in which the dollar would fail to perform well to the benefit of the yen and euro although it is difficult to see such a crisis lasting with a swift Fed policy response to provide support and possible swift action from Congress.

Many roads do still lead to US dollar strength in risk-off scenarios. However, the scope for the Fed to cut rates aggressively and the less reliability of the UST bond market do create some uncertainties. A demand-side shock that is deflationary could well see yen safe-haven status returning. Positioning and valuation both point to scope for USD/JPY to drop as investors rush to take profits and retrench. But anything solvency/liquidity related strongly favours US dollar outperformance.

S&P 500 / UST YIELD CORRELATION NOW NEGATIVE

Source: Bloomberg, Macrobond & MUFG GMR

SIZE OF GOVERNMENT BOND MARKETS USD BN (2022)

Source: BIS

GBP: Will UK election risk take the shine off the GBP’s outperformance?

The GBP has continued to strengthen over the past week resulting in cable rising back above the 1.2700-level and EUR/GBP falling back towards the 0.8500-level. It leaves the GBP as one of the top performing G10 currencies so far this year alongside the USD. The next important resistance levels for cable are located at the 1.2800-level and then the high from 8th March at 1.2894. EUR/GBP is already testing important support at the 0.8500-level which has been tested and held on a number of occasions since the middle of last year.

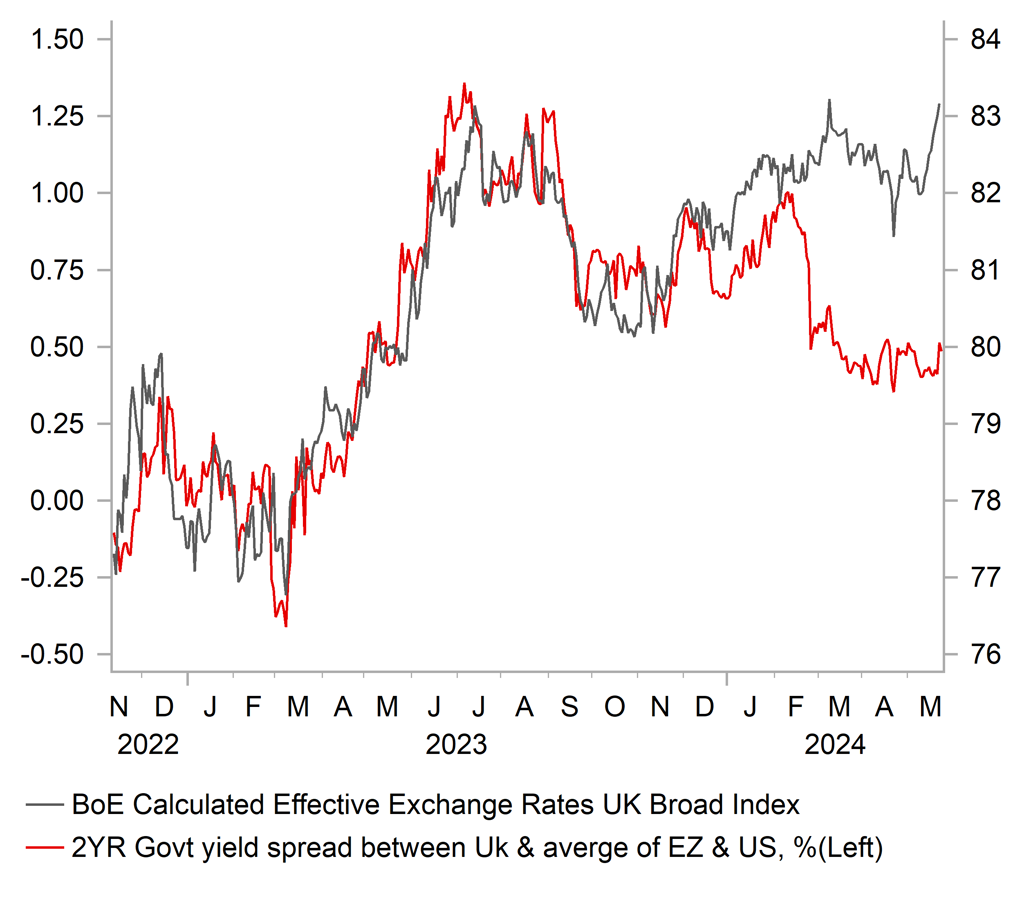

The GBP is continuing to benefit from the higher yields on offer in the UK combined with favourable market conditions for carry trades at the start of this year. The GBP’s upward momentum has been reinforced this week by the release of the latest UK CPI report for April. While headline inflation fell sharply back towards the BoE’s target hitting 2.3% in April, it was mainly driven by a reduction in energy prices which fell by around 13% as the Ofgem energy price cap was lowered. The BoE had already emphasized that they would be focusing on measures of core and services inflation to assess whether inflation persistent risks continue to ease when setting policy.

Unfortunately for the BoE, the report revealed that core and services inflation slowed much less than expected in April. Services inflation slowed by only 0.1ppt to 5.9% which came in well above the BoE’s own forecast of 5.5%. The 10% increase in the National Living Wage (NLW) is one factor that contributed to stronger inflation at the start of the new fiscal year. The subsequent release of the services PMI survey for May has provided some encouragement that the pick-up in inflation from the NLW impact is already starting to fade. The survey revealed that “service providers experienced their weakest cost pressures in over three years, which partly reflected a reduced impact from the higher National Living Wage…amid the softer rise in input costs, prices charged inflation fell to its lowest level since February 2021”. The headline PMI readings for May also signalled that growth is likely to moderate in Q2 after expanding robustly by 0.6% in Q1 which exaggerated the strength of underlying demand.

The developments have encouraged UK rate market participants to push back the timing of BoE rate cuts this year. Our forecast for a rate cut as soon as at the June MPC meeting now appears to be off the table and there is more doubt over whether a rate cut will be delivered over the summer as indicated recently by MPC members. The UK rate market is currently pricing in only around 9bps of cuts by the August MPC meeting and 17bps of cuts by the September MPC meeting. However, we do think that the UK rate market has gone too far now in pricing out BoE rate cuts for this year as there is only a cumulative total of 33bps of cuts left priced in.

GBP PERFORMING BETTER THAN IMPLIED BY YIELDS

Source: Bloomberg, Macrobond & MUFG GMR

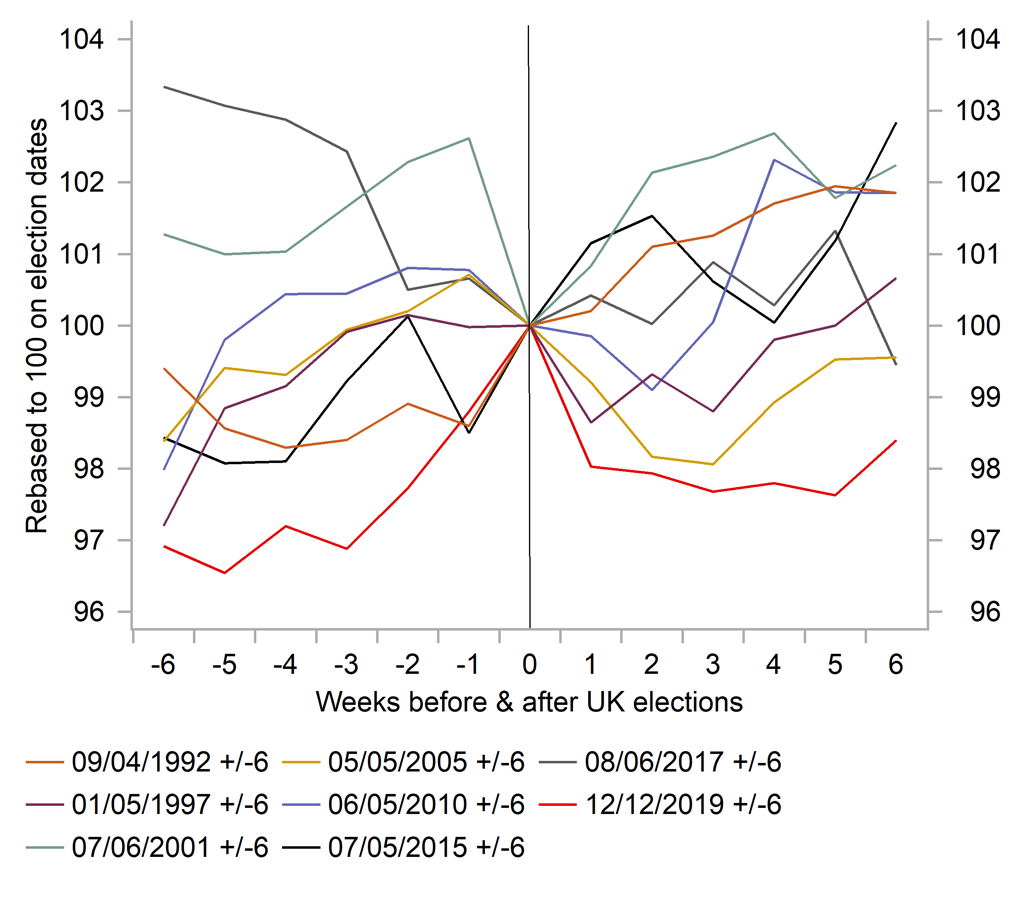

MIXED GBP PERFORMANCE AROUND UK ELECTIONS

Source: Bloomberg, Macrobond & MUFG GMR

The other main development from the UK this week was the announcement yesterday from Prime Minister Sunak that a general election will be held sooner than expected on 4th July. The early timing of the election is somewhat surprising given that another leadership challenge failed to materialize after the disappointing local election results at the start of this month, and considering that the government continues to languish well behind in the polls providing little to no encouragement that they can remain in power. The pick-up in UK political uncertainty in the coming months could be viewed as a potential dampener on the GBP’s recent outperformance. However, we expect the election impact on the GBP to be limited.

Firstly, market participants should already be well prepared for the Labour party winning the election. Labour has held a commanding lead in the polls since the short-lived Truss premiership was brought to an in the autumn of 2022. After an initial bounce in support after Prime Minister Sunak was brought in as a safe pair of hands, the government’s support has recently fallen back close to the lows under former Prime Minister Truss. According to the BBC’s poll tracker, the Labour party currently has a substantial lead of over 20ppts which should be sufficient to comfortably win a majority in parliament. Unless there is major surprise, the best the Conservative party can hope for is to avoid a heavy defeat.

Secondly, we do not expect a Labour government to significantly alter domestic policy settings enough to alter our outlook for the GBP this year (click here). Labour leader Starmer has emphasized recently that he will initially prioritize economic stability and has pledged alongside shadow chancellor Reeves to keep the net debt rule which stipulates that the debt ratio should be on a declining trajectory in five years’ time. While the overall fiscal stance is unlikely to change significantly, a Labour government is likely to seek to reverse some of the current government’s tax cuts to help fund an increase government spending. Similar to the current government, a Labour government would find that it’s room to run looser fiscal policy will be curtailed by the appetite of the gilt market to absorb higher deficits. We expect that they would be keen to avoid a repeat of the gilt market sell-off in the autumn of 2022 when the BOE had to step to provide support.

Another area of policy which is attracting some attention ahead of the election is the possibility of relations between the EU and UK improving under a Labour government. However, there will be limited appetite from the Labour government to renegotiate the Trade and Cooperation Agreement with the EU. The next scheduled review is set for May 2026 but is expected to be a technical exercise. We are not expecting to see a significant easing of trade frictions that would be required to encourage a stronger GBP.

Finally, we have looked at the historical performance of the trade-weighted GBP around previous UK elections dating back to the early 1990’s. In the six weeks ahead of prior elections, the performance of the GBP has been mixed. Please see chart above. The GBP had its best performance ahead of the 1997 and 2019 elections when it strengthened by around 3%. In contrast the worst GBP performance was in the run up to the 2017 election when the GBP weakened by around 3%. The GBP reaction has been greater at the last two elections in 2017 and 2019 given that they were judged as important in helping to determine the outcome of Brexit negotiations. The current political set up is closest to the 1997 election when Labour last removed the Conservative party from power wining a landslide a majority under former Prime Minister Blair. However, UK economic fundamentals in 1997 were also more supportive for a stronger GBP including robust GPD growth of 4.9% and the BoE raised their policy rate to 7.25% by the end of the year.

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

27/05/2024 |

09:00 |

Germany IFO Business Climate |

May |

-- |

89.4 |

!! |

|

EUR |

27/05/2024 |

13:00 |

ECB's Lane Speaks |

!!! |

|||

|

AUD |

28/05/2024 |

02:30 |

Retail Sales MoM |

Apr |

0.3% |

-0.4% |

!! |

|

USD |

28/05/2024 |

15:00 |

Conf. Board Consumer Confidence |

May |

96.5 |

97.0 |

!! |

|

AUD |

29/05/2024 |

02:30 |

CPI YoY |

Apr |

3.4% |

3.5% |

!!! |

|

EUR |

29/05/2024 |

08:00 |

ECB's Villeroy speaks |

!! |

|||

|

EUR |

29/05/2024 |

09:00 |

M3 Money Supply YoY |

Apr |

-- |

0.9% |

!! |

|

EUR |

29/05/2024 |

13:00 |

Germany CPI YoY |

May P |

-- |

2.2% |

!!! |

|

USD |

29/05/2024 |

19:00 |

Federal Reserve Releases Beige Book |

!! |

|||

|

AUD |

29/05/2024 |

02:30 |

CPI YoY |

Apr |

3.4% |

3.5% |

!!! |

|

AUD |

30/05/2024 |

02:30 |

Private Capital Expenditure |

1Q |

0.3% |

0.8% |

!! |

|

SEK |

30/05/2024 |

07:00 |

GDP QoQ |

1Q |

-- |

-0.1% |

!! |

|

CHF |

30/05/2024 |

08:00 |

GDP QoQ |

1Q |

0.3% |

0.3% |

!! |

|

EUR |

30/05/2024 |

10:00 |

Consumer Confidence |

May |

-14.3 |

-14.7 |

!! |

|

EUR |

30/05/2024 |

10:00 |

Unemployment Rate |

Apr |

-- |

6.5% |

!! |

|

CAD |

30/05/2024 |

13:30 |

Current Account Balance |

1Q |

-- |

-$1.62b |

!! |

|

USD |

30/05/2024 |

13:30 |

GDP QoQ |

1Q |

1.3% |

3.4% |

!!! |

|

USD |

30/05/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

30/05/2024 |

17:05 |

Fed's Williams speaks |

!!! |

|||

|

GBP |

30/05/2024 |

19:50 |

BoE's Gov Baily speaks |

!!! |

|||

|

JPY |

31/05/2024 |

00:30 |

Jobless Rate |

Apr |

2.6% |

2.6% |

!! |

|

JPY |

31/05/2024 |

00:30 |

Tokyo CPI YoY |

May |

2.1% |

1.8% |

!!! |

|

JPY |

31/05/2024 |

00:50 |

Industrial Production MoM |

Apr P |

1.7% |

4.4% |

!! |

|

JPY |

31/05/2024 |

00:50 |

Retail Sales MoM |

Apr |

-- |

-1.2% |

!! |

|

CNY |

31/05/2024 |

02:30 |

Manufacturing PMI |

May |

50.4 |

!! |

|

|

CNY |

31/05/2024 |

02:30 |

Non-manufacturing PMI |

May |

51.2 |

!! |

|

|

EUR |

31/05/2024 |

07:45 |

France CPI YoY |

May P |

-- |

2.2% |

!! |

|

GBP |

31/05/2024 |

09:30 |

M4 Money Supply YoY |

Apr |

-- |

0.5% |

!! |

|

EUR |

31/05/2024 |

10:00 |

CPI Estimate YoY |

May |

2.6% |

2.4% |

!!! |

|

CAD |

31/05/2024 |

13:30 |

Quarterly GDP Annualized |

1Q |

1.8% |

1.0% |

!!! |

|

USD |

31/05/2024 |

13:30 |

PCE Core Deflator MoM |

Apr |

0.3% |

0.3% |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The main economic data release in the week ahead will be the latest US PCE deflator report for April. After the release earlier this month of the US CPI and PPI reports for April, market participants have become less concerned over the risk of another upside inflation surprise when the PCE deflator report for April is released in the week ahead. The core PCE deflator is expected to increase by around 0.2/0.3%M/M in April after increasing by an average of 0.4%M/M in Q1. The second release of the US GDP report for Q1 is expected to reveal that growth sowed more than initially estimated at the start of this year. New York Fed President Williams is also scheduled to make a keynote speech at the Economic Club of New York in the week ahead.

- The release of latest CPI report from Australia and the euro-zone will be released in the week ahead. After the significant upside inflation surprise in March, the Australian CPI report for April will attract more market attention in the week ahead. The RBA revealed that they discussed raising rates further at their last policy meeting but decided to leave rates on hold for now preferring not to fine tune policy at the current juncture. Another upside inflation surprise would increase pressure on the RBA to raise rates further. In contrast, the inflation data from the euro-zone has been more in line with expectations in recent months keeping the ECB on track to cut rates next month. Inflation will have to slow further to encourage the ECB to continue cutting rates in the 2H of this year.

- The release of the latest GDP report from Canada in the week ahead could attract more market attention than normal with expectations finely balanced over whether the BoC will begin to cut rates as soon as at their next meeting in June. The release of the latest CPI report for Canada for April revealed core inflation surprised to the downside for the fourth consecutive month this year. Growth is expected to have picked up in Q1 after growing below potential last year but is not expected to prevent the BoC from cutting rates.