To read a full report, please download PDF

USD sell-off extends further

FX View:

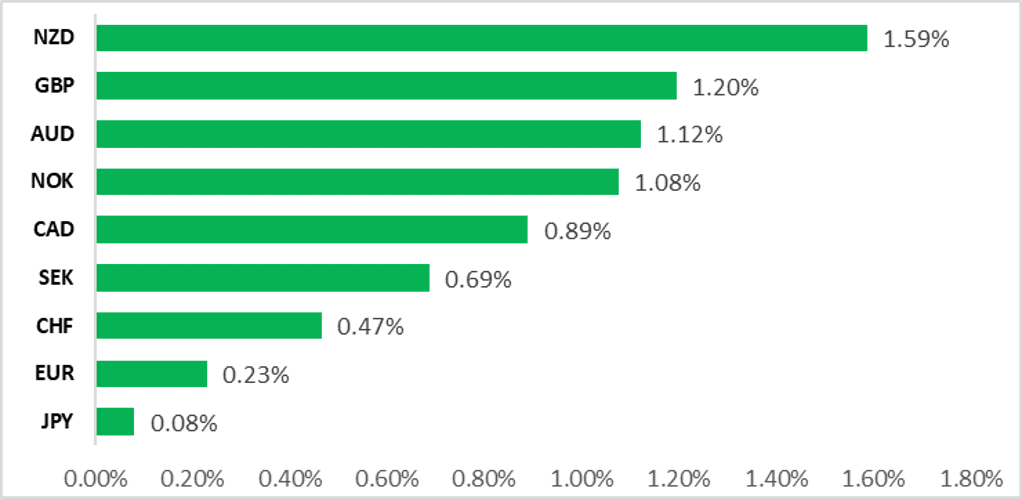

The USD has continued to weaken over the past week undermined by increased confidence amongst market participants that the Fed has ended their hiking cycle. Further evidence of slowing inflation is boosting investor optimism over a softer landing for the global economy. The supportive developments have triggered a strong rebound in global investor risk sentiment this month leading to the outperformance of high beta G10 currencies. The GBP is outperforming amongst the other major currencies supported as well the scaling back of BoE rate cut expectations. In contrast, the EUR has underperformed alongside the JPY and USD. Fiscal and political uncertainty in the euro-zone has picked up after the surprise Dutch election results and the recent ruling by the German Constitutional Court. Alongside continued weak growth momentum in the euro-zone, the developments are helping dampen further upside for the EUR against the USD.

HIGH BETA G10 FX OUTPERFORMS

Source: Bloomberg, 15:50 GMT, 24th November 2023 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our short USD/JPY trade idea.

JPY Flows:

The weekly data shows that in three of the last five weeks, Japanese investors have been net sellers of foreign bonds. Last week purchases totalled a mere JPY 2.5bn and that negligible amount of buying followed two weeks of net sales. The 4-week total saw the second week of net sales, the first time since toward the end of July.

Sentiment Analysis on FOMC Minutes:

This week we highlight the latest FOMC minutes that reveal a cautiously optimistic Fed, the net sentiment across all broad topics (Commodities, Demand, Economy, Housing, Labour and Manufacturing) flashed positive for the first time since January 2022.

FX Views

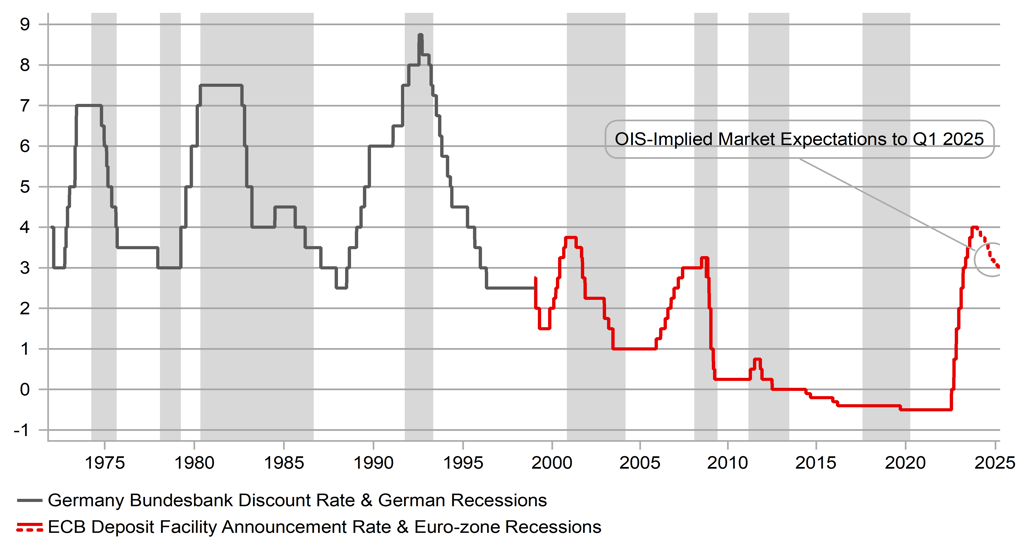

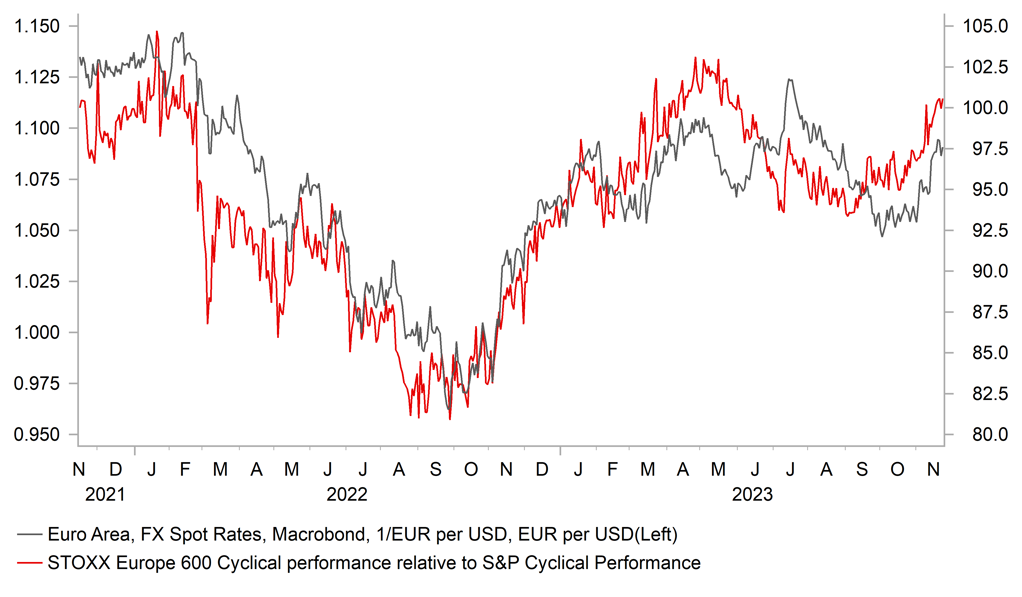

EUR: Upside limited from here

From a momentum and technical perspective, the argument could be made that the recent break higher for EUR/USD has opened up scope for further gains over the short-term. The last time we broke higher through the 50/100/200-day moving averages in such a short period of time was back in May 2020 which triggered the start of a rally from levels around 1.1000 to highs around 1.2300 by January 2021. We don’t believe those technical breaches on this occasion will trigger anything like the scale of the rally back then. The macro backdrop in the euro-zone remains challenging and there is a building risk that the ECB shifts its rhetoric to a more dovish tone more quickly than the Federal Reserve. There is the added political risk factor too now following the victory for the Freedom Party and Geert Wilders in the Dutch elections this week. While a victory was not that shocking, the scale of the victory was and that alters the power-base in Dutch politics quite notably.

The minutes of the ECB meeting held on 25th-26th October were released yesterday and there were no big surprises and as with most central banks the ECB minutes revealed a desire amongst Governing Council members to “avoid an unwarranted loosening of financial conditions”. That makes it likely that the ECB will continue to talk tough and emphasise the need for policy rates to be “sufficiently restrictive levels for as long as necessary to being inflation back to target in a timely manner”. While that is understandable and no surprise, we did also sense an increasing level of confidence on tackling inflation. The minutes cited the adjusted “Persistent and Common Component of inflation” measure as being a good predictor of future inflation, which was now close to 2%. Domestic inflation however was cited as still too high at 5.2% and “underscored the significance of continuing wage pressures for underlying and domestically driven inflation. ECB President Lagarde expressed caution today in a speech stating the inflation battle was not won. Again, we should expect that but it doesn’t necessarily reflect private thinking on the progress being made in bringing inflation back to target.

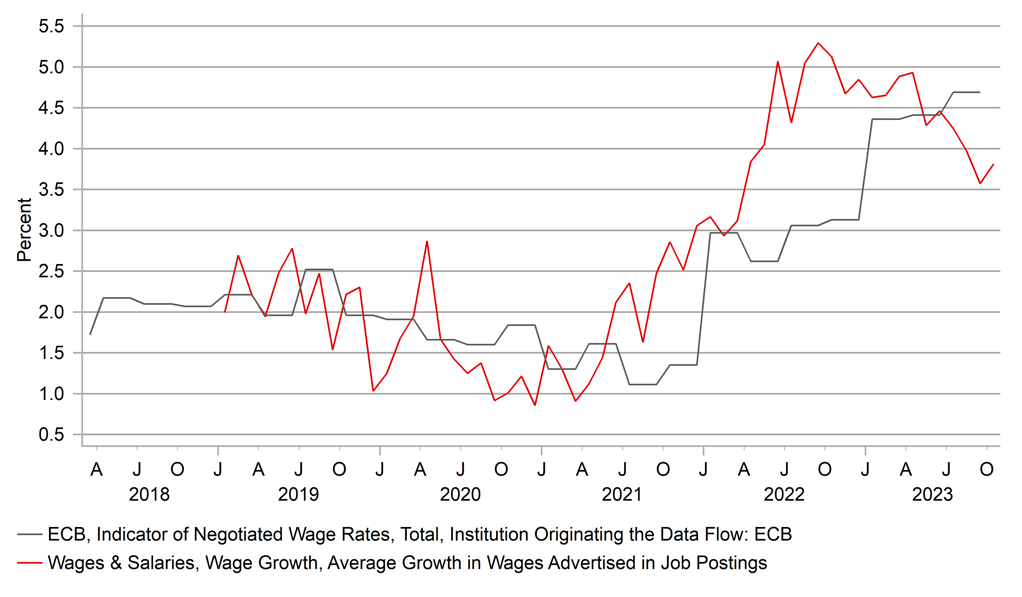

The issue of wages driving domestically driven inflation is unlikely to remain as big a concern going forward. ECB Governing Council member Pierre Wunsch yesterday stated that the ECB could not lower its policy rate with annual wage growth around 5.0%, even if the economy is contracting slightly. But the wage inflation risks do not seem as great in the euro-zone as elsewhere like the UK or the US. The negotiated annual wage growth rate is currently high at 4.7% and is certainly inconsistent with the ECB’s price stability goal. But the Indeed wage tracker is telling a less alarming story and is viewed by the ECB itself as a potential reliable leading indicator. The data is relatively short though but is being compiled by the Irish central bank in collaboration with Indeed. As can be seen above, the Indeed wage tracker is slowing. After peaking 5.3% in 2022 it slowed to a level of 4.9% in April this year but then slowed more markedly to 3.8% in the latest reading. This may still be slightly above the required level consistent with price stability but the deceleration could well signal a slowdown ahead in the negotiated wages series.

ECB NEGOTIATED WAGES VS INDEED WAGE TRACKER

Source: Bloomberg, Macrobond & MUFG GMR

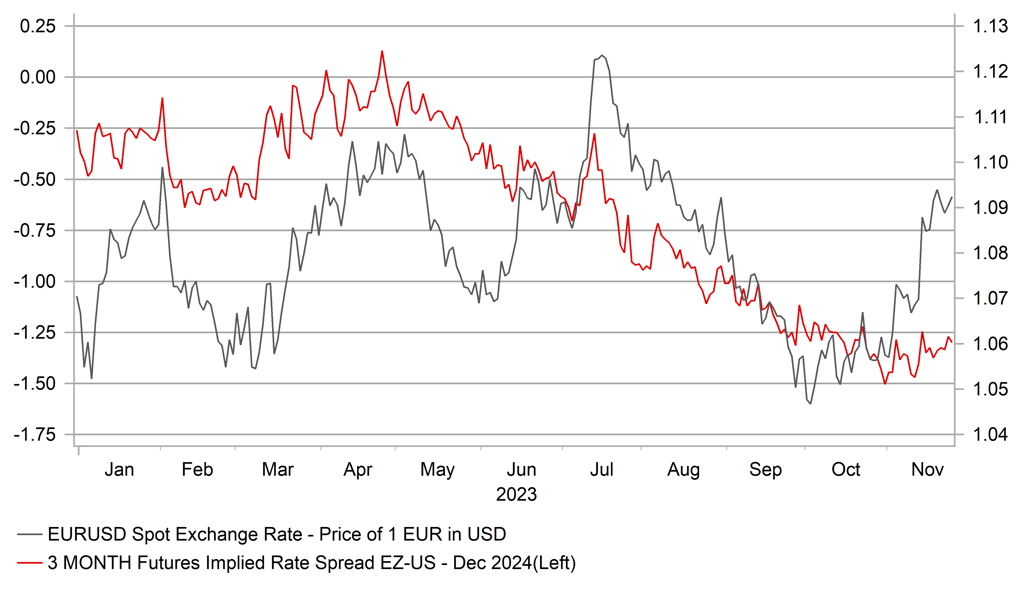

EUR/USD & 3-MONTH FUTURES IMPLIED SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

ECB President Lagarde today stated that the ECB is now in a position to assess the impact of the past tightening, implying less need for further action, a probable peak and the rising chance of a cut being next. The timing and the extent are the only questions. Around 70bps of cuts are priced by mid-October, similar to the Fed pricing by early November. The 3mth futures implied spread has moved around 25bps in favour of EUR this month but that move is unlikely to advance much further for now and if anything we may see the market start to price more from the ECB in cuts throughout 2024 which would likely see this EUR/USD rally peter out.

The victory yesterday to the Freedom Party and Geert Wilders in the Netherlands has highlighted the renewed building tensions over immigration in Europe. The scale of the victory (37 seats, 12 more than 2nd placed) means it is likely that Wilders will become the new PM. His anti-Islam and anti-EU rhetoric will certainly create instability at the heart of the euro-zone. He has promised a referendum on leaving the euro-zone which would mean ‘Nexit’ following Brexit although being part of the single currency makes that prospect much less likely. Opinion polls also suggest Dutch voters are aligned with his immigration policies more than his EU policies. But the surge in immigration is impacting politics elsewhere with the AfD in Germany the second most popular party. Finland has just reported a surge in immigrants coming over the border with Russia implying this has been assisted by Russia while last night in Ireland there was the worst social unrest in decades prompted by anger over the surge in immigration. Further victories for anti-immigrant, anti-EU political parties will undoubtedly lead to increased uncertainty over the social cohesion within the euro-zone and undermine confidence.

The still weak economic backdrop in the euro-zone and the signs of increased confidence in lowering inflation could see increased ECB easing speculation that lowers yields further in the euro-zone. Political uncertainty and social unrest risks are also rising which combined may act to limit EUR advances from here.

ECB/BUNDESBANK POLICY RATE & RECESSIONS

Source: Bloomberg, Macrobond & MUFG GMR

EURO STOXX CYCLICAL OUTPERFORMANCE MAY FADE

Source: Bloomberg, Macrobond & MUFG GMR

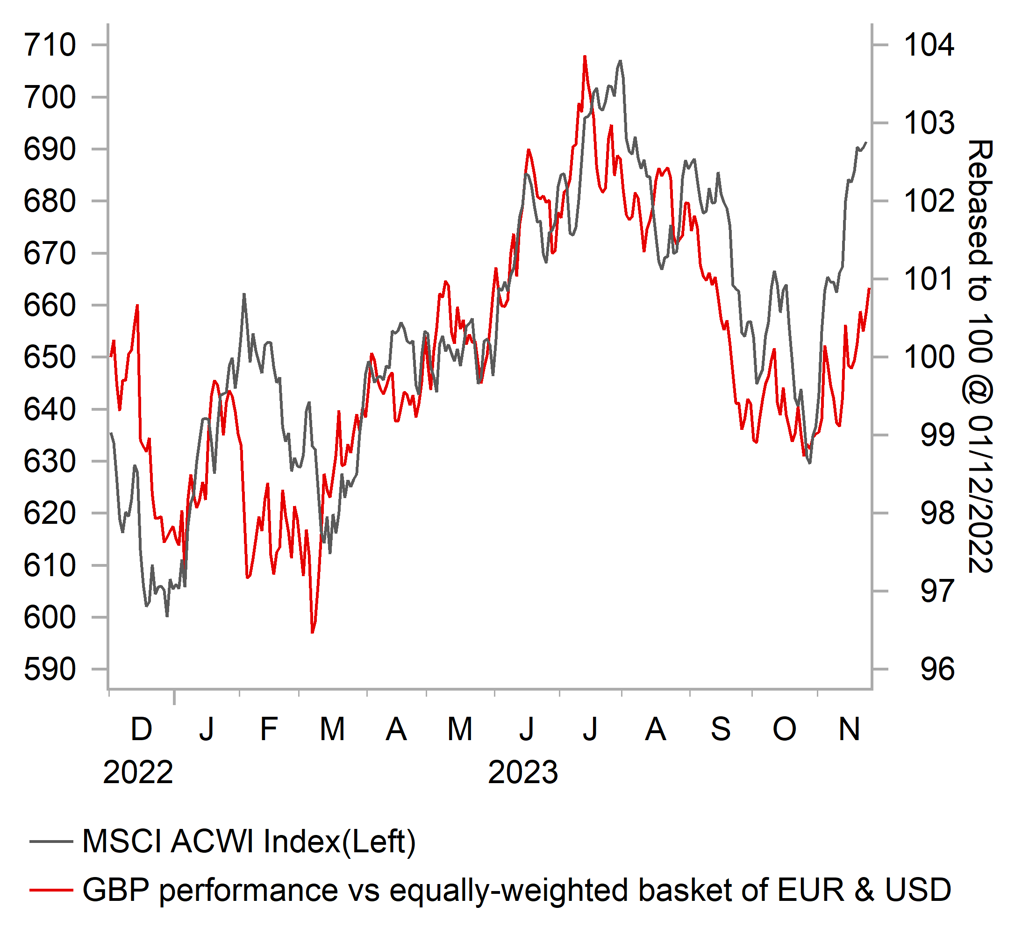

GBP: BoE rate cut expectations have been pared back supporting GBP

The GBP has strengthened modesty over the past week against both the EUR and USD. It has resulted in EUR/GBP falling back below the 0.8700-level after hitting a high of 0.8768 on 20th November, while cable has risen back above 1.2600 as it moves further above the 200-day moving average that comes in at around 1.2455. The GBP is continuing to benefit from the improvement in global investor risk sentiment this month which has helped it to outperform against other major currencies (EUR, CHF, JPY & USD) in November. After bottoming in late October, MSCI’s ACWI global equity index has staged a strong rebound (~10%) and moved back closer to the calendar year highs set back in late July. The recent less hawkish change in guidance from major central banks and slowing inflation have made market participants more confident that rate hike cycles are at an end helping to diminish hard landing fears.

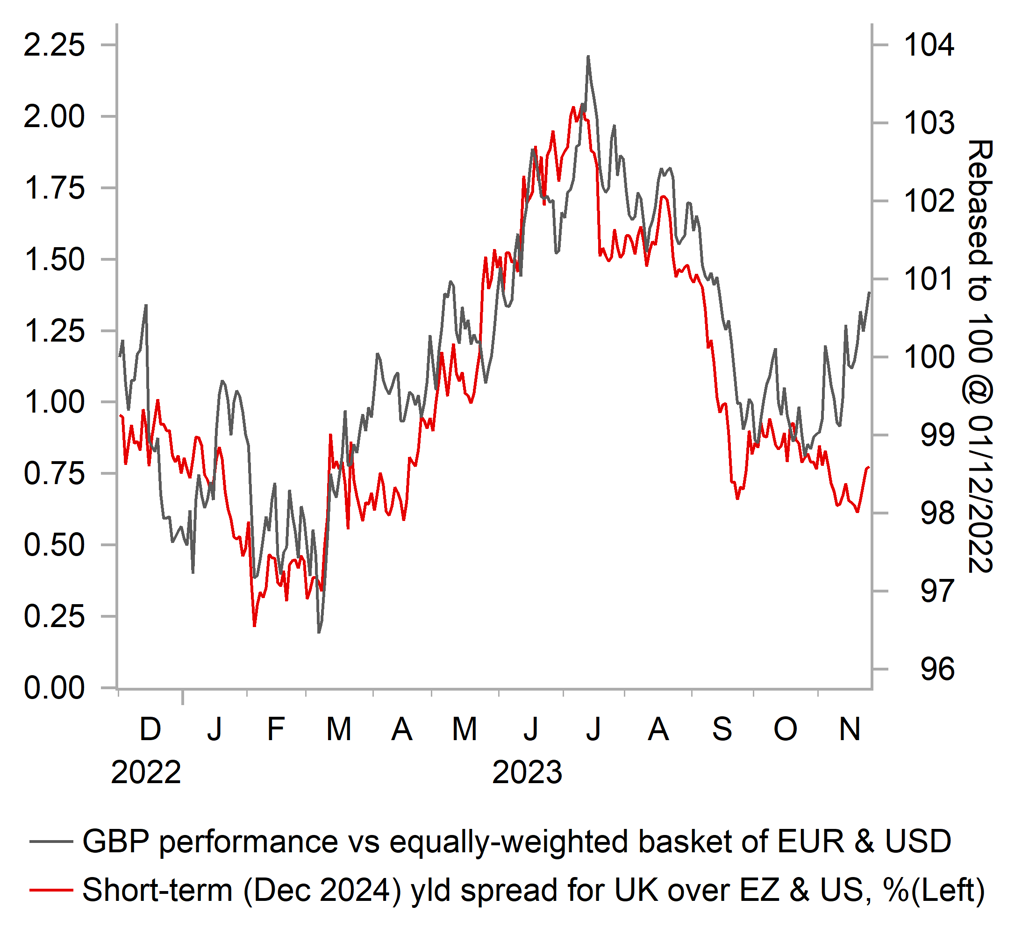

At the same time, the GBP has derived more support over the past week from the scaling back of BoE rate cut expectations. The implied yield on the December 2024 SONIA futures contract has risen by around 28bps over the past week to 4.68%. It leaves the UK rate market pricing in just over 50bps of BoE cuts by the end of next year, and the expected timing of the first rate cut has been delayed until the September MPC meeting. There have been three main triggers for the hawkish repricing of the UK rate curve over the past week: i) stronger pushback from BoE officials against market expectations for earlier rate cuts, ii) the fiscal giveaways in the UK government’s autumn statement alongside a strong indication that further tax cuts are likely to be delivered in next year’s budget, and iii) the unexpected improvement in UK business confidence in November that has helped to ease concerns over a further loss of cyclical momentum for the UK economy heading into year end.

The developments are making market participants relatively cautious over pricing in rate cuts from the BoE compared to the ECB and Fed, who are both expected to begin cutting rates sooner (from June) and by more next year (around 85bps of cuts by the end of next year). While inflation fell more sharply in the UK in October, it remains higher than in the euro-zone and US, and stronger wage growth is contributing to concerns that inflation will prove more persistent in the UK. The developments should help to provide more support for the GBP in the near-term in so far as short-term yield spreads are moving back in favour of the UK. However, we remain sceptical that the recent upward adjustment for UK rates will be sustained. We expect weak growth and slowing inflation in the coming quarters to encourage market participants to price back in more BoE rate cuts. The OBR’s updated growth forecasts revealed that they expect growth to remain weak after incorporating the impact from the new fiscal measures.

In these circumstances, the GBP could strengthen further in the near-term against EUR and USD, but the gains are built on shaky foundations.

GBP SUPPORTED BY IMPROVING RISK SENTIMENT

Source: Bloomberg, Macrobond & MUFG GMR

GBP REBOUND NOT FULLY BACKED BY YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

AUD |

11/28/2023 |

00:30 |

Retail Sales MoM |

Oct |

-- |

0.9% |

!! |

|

EUR |

11/28/2023 |

09:00 |

M3 Money Supply YoY |

Oct |

-- |

-1.2% |

!! |

|

USD |

11/28/2023 |

15:00 |

Conf. Board Consumer Confidence |

Nov |

101.0 |

102.6 |

!! |

|

AUD |

11/29/2023 |

00:30 |

CPI YoY |

Oct |

-- |

5.6% |

!!! |

|

NZD |

11/29/2023 |

01:00 |

RBNZ Official Cash Rate |

-- |

5.50% |

!!! |

|

|

SEK |

11/29/2023 |

07:00 |

GDP QoQ |

3Q |

-- |

-0.8% |

!! |

|

GBP |

11/29/2023 |

09:30 |

M4 Money Supply YoY |

Oct |

-- |

-3.9% |

!! |

|

EUR |

11/29/2023 |

13:00 |

Germany CPI YoY |

Nov P |

-- |

3.8% |

!!! |

|

CAD |

11/29/2023 |

13:30 |

Current Account Balance |

3Q |

-- |

-$6.63b |

!! |

|

USD |

11/29/2023 |

13:30 |

Advance Goods Trade Balance |

Oct |

-$86.7b |

-$85.8b |

!! |

|

USD |

11/29/2023 |

13:30 |

GDP Annualized QoQ |

3Q S |

5.0% |

4.9% |

!! |

|

USD |

11/29/2023 |

19:00 |

Federal Reserve Releases Beige Book |

!! |

|||

|

JPY |

11/29/2023 |

23:50 |

Retail Sales MoM |

Oct |

0.4% |

-0.1% |

!! |

|

JPY |

11/29/2023 |

23:50 |

Industrial Production MoM |

Oct P |

1.1% |

0.5% |

!! |

|

AUD |

11/30/2023 |

00:30 |

Private Capital Expenditure |

3Q |

-- |

2.8% |

!! |

|

EUR |

11/30/2023 |

07:45 |

France CPI YoY |

Nov P |

-- |

4.0% |

!!! |

|

EUR |

11/30/2023 |

07:45 |

France GDP QoQ |

3Q F |

-- |

0.1% |

!! |

|

CHF |

11/30/2023 |

08:00 |

KOF Leading Indicator |

Nov |

-- |

95.8 |

!! |

|

EUR |

11/30/2023 |

08:55 |

Germany Unemployment Change (000's) |

Nov |

-- |

30.0k |

!! |

|

EUR |

11/30/2023 |

10:00 |

CPI Estimate YoY |

Nov |

-- |

2.9% |

!!! |

|

EUR |

11/30/2023 |

10:00 |

Unemployment Rate |

Oct |

-- |

6.5% |

!! |

|

CAD |

11/30/2023 |

13:30 |

Quarterly GDP Annualized |

3Q |

-- |

-0.2% |

!!! |

|

USD |

11/30/2023 |

13:30 |

Initial Jobless Claims |

-- |

209k |

!! |

|

|

USD |

11/30/2023 |

13:30 |

PCE Deflator YoY |

Oct |

3.1% |

3.4% |

!!! |

|

JPY |

11/30/2023 |

23:30 |

Jobless Rate |

Oct |

2.6% |

2.6% |

!! |

|

JPY |

11/30/2023 |

23:50 |

Capital Spending YoY |

3Q |

-- |

4.5% |

!! |

|

EUR |

12/01/2023 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Nov F |

-- |

43.8 |

!! |

|

GBP |

12/01/2023 |

09:30 |

S&P Global/CIPS UK Manufacturing PMI |

Nov F |

-- |

-- |

!! |

|

CAD |

12/01/2023 |

13:30 |

Net Change in Employment |

Nov |

-- |

17.5k |

!!! |

|

USD |

12/01/2023 |

15:00 |

ISM Manufacturing |

Nov |

47.7 |

46.7 |

!!! |

|

USD |

12/01/2023 |

16:00 |

Fed’s Powell speaks |

|

|

|

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The RBNZ holds their latest policy meeting at the start of next week. The RBNZ is expected to leave their policy rate unchanged at 5.50% for the fourth consecutive meeting and continue to signal a slight risk of further hikes next year. The release of weaker than expected CPI and labour market reports for Q3 have increased the risk of a less hawkish policy update in the week ahead. Ahead of the meeting, the New Zealand rate market has become more confident that the RBNZ will not raise rates further and is pricing in the first rate cut by August of next year.

- The man economic data highlights in the week ahead will be the release of the latest CPI reports from Australia and euro-zone, and PCE deflator report from the US. Inflation has picked up again in recent months in Australia which alongside comments from RBA officials have encouraged market expectations that the RBA remains one of the G10 central banks still likely to hike rates further. One more 25bps RBA hike is almost fully priced into the first half of next year. In contrast, the latest inflation reports from the euro-zone and US have provided reassurance that inflation pressures continue to slow. It has given market participants more confidence that the ECB and Fed have finished their hiking cycles.

- The release of the latest GDP report from Canada may attract more attention than normal in the week ahead. The report is expected to confirm that Canada’s economy has stagnated in recent quarters, and may even have fallen into technical recession in Q3. BoC Governor Governor Macklem has stated this week that interest rates may now be restrictive enough to get us back to price stability with the economy approaching balance. It follows the release of the softer CPI report for October.