To read the full report, please download PDF.

Long-term downtrend for the US dollar

FX View:

As far back as Q1 2023 we expressed a view that the US dollar bull run that commenced in 2011 had come to an end based on the Fed’s Advanced Economies USD index hitting a high in September 2022. While the dollar advanced back toward those levels on Trump enthusiasm, we maintain that the record-long USD-bull run has now turned and a medium-to-long-run depreciation of the dollar is under way. This may be exacerbated by Trump and the associated uncertainties and damage to trade, but there were plenty of other factors that pointed this way prior to the tariff announcements. Over-valuation of the dollar, very expensive US equities and the notable shift in the international financial market landscape will all add to scope for the dollar to decline. The ebb-and-flow of tariff speculation and the ultimate removal of current unsustainable tariff rates won’t alter that outlook.

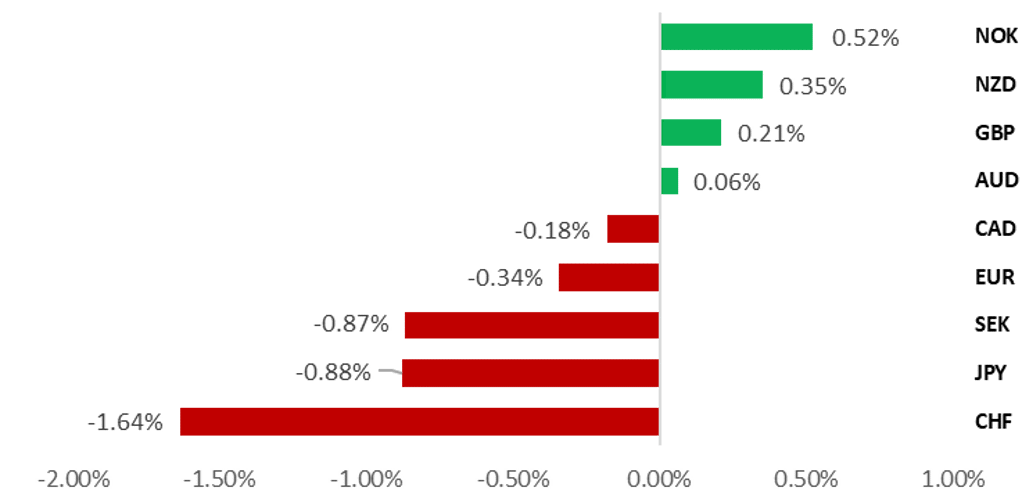

USD STAGES MODEST REBOUND AGAINST OTHER MAJOR CURRENCIES

Source: Bloomberg, 14.00 GMT, 25th April 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new long EUR/NZD trade idea, and are closing our short NOK/JPY trade idea.

JPY Flows:

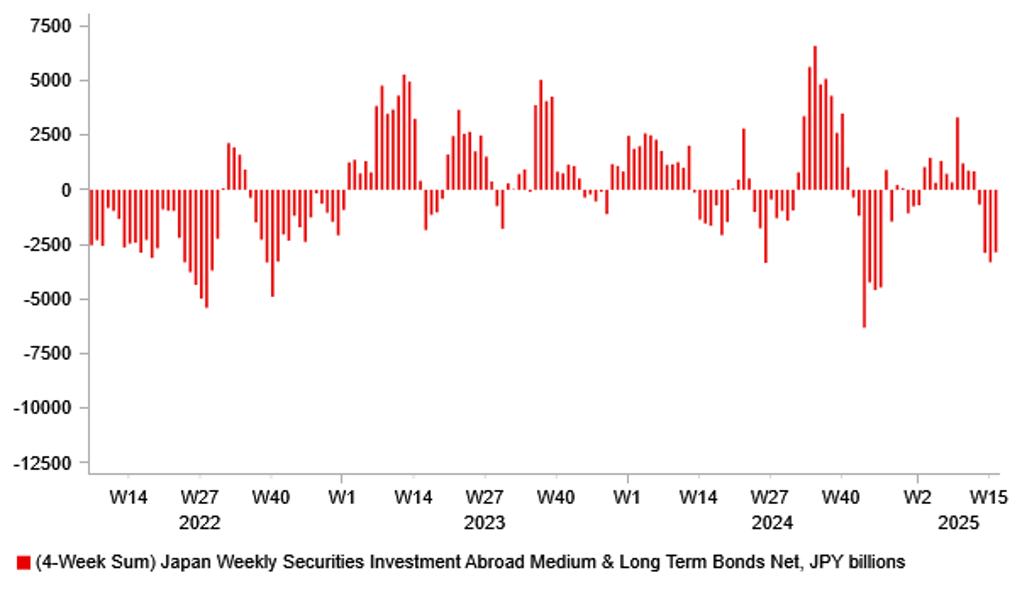

This week we take a look at the Balance of Payments flow data for the month of February. While Japan’s current account surplus has declined, the total external position remains substantial with FDI outflows the key channel for outflows from Japan. There was a notable pick-up in demand for core euro-zone debt in February – signs of improving sentiment possibly helped now by higher yields.

Sentiment Analysis on the latest Beige Book:

Our sentiment analysis of the April Beige Book reveals a definitive shift downward, with sentiment falling to levels not seen since January 2023. Surveyed participants expressed net negative views across all major macroeconomic topics, including inflation, commodities, demand, economy, housing, labour, manufacturing, trade, and tourism.

FX Views

USD: Long-term US dollar bear-trend

The US dollar looks set to recover this week after the sharp sell-off prior with the top performing safe-haven G10 currency, the Swiss franc, performing worst this week as risk aversion eases on the hope of US/China tariff rates being reduced to less damaging levels. China continues to deny that discussions are even taking place at the moment and this optimism is based on rumour and reports that do not include any on-the-record comment. So there is reason to be sceptical that we will see an imminent end to this stand-off between the US and China. Nonetheless, even if we do get confirmation and a reduction in tariff rates, we believe the scope for the US dollar to rebound will be limited. There are a number of factors behind that belief. Firstly, damage to some degree is already done. By announcing tariffs of such a scale, investors will remain cautious over what could come next. Secondly, we expected a cyclical slowdown to take place anyway in the US and Trump’s actions only reinforce that prospect and a policy reversal now won’t change that. Finally, we should not merely focus on the US, Trump and the demise in US exceptionalism as the reason for the dollar’s decline. There are key international factors that drove the dollar to overvalued levels and those factors should now help bring dollar valuation back down.

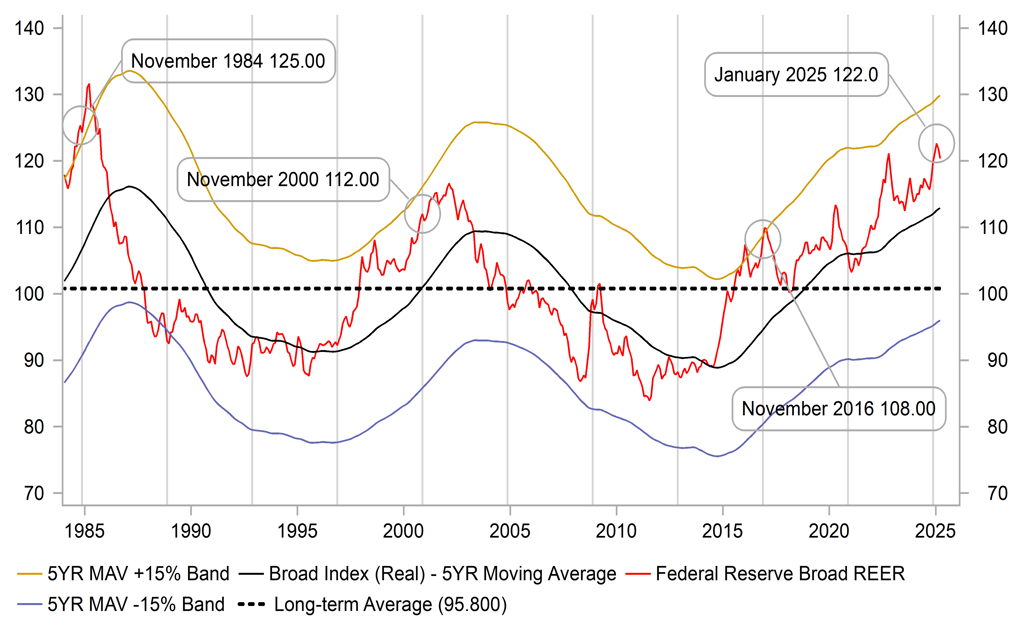

Our view that the US dollar has likely entered a long-term downtrend preceded the tariff announcements and the decline in investor confidence in US assets. Trump trade policies have made the dollar decline more likely but they are not the catalyst. Since 2015, the US dollar in REER terms advanced by 37% to the recent high in January, a huge move that left the REER level about 20% above the long-term average. On election day last year, the REER was at the highest level on election day since the 1984 election which was then followed by further gains that left the dollar at such elevated levels to prompt the Plaza Accord. In nominal terms, the Fed’s Advanced Economies USD index gained 53% over an 11-year period to the high in September 2022, the longest and second largest USD bull run. A turn lower is long overdue.

The turn higher for the dollar over ten years ago coincided with some key market developments abroad. Japan embarked on QQE under Abenomics and Governor Kuroda – the most aggressive monetary easing program in financial market history, which included increased QE in 2013 and ended with negative rates in 2016. The ECB launched negative rates in June 2014 and turned to QE in 2015 following the euro-zone debt crisis between 2011-2012. Then we had a CNY devaluation in August 2015 and Brexit in 2016 triggered a huge GBP devaluation. The consequence of all these different factors was pronounced uncertainty in international markets and monetary policy stances that resulted in global fixed income yielding negative rates reaching a peak of over USD 18trn before the global inflation shock began post-covid. That figure is now close to zero with Japan and the euro-zone and other smaller economies having all terminated negative policy rate regimes. That’s a huge change to the global financial landscape that will have consequences for the US dollar going forward. We certainly believe that Japan has permanently moved beyond its 30-year period of mild deflation with structural issues related to demographics and the labour market likely to ensure positive inflation and with that positive yields. In addition, the shift by Germany away from the constraints of the constitutional debt brake (introduced in 2009) announced earlier this year will also help to support long-term yields going forward. These shifts will help to rebalance global fixed income flows that could reinforce a weaker US dollar.

USD IN REER TERMS GAINED 37% IN 10YRS

Source: Bloomberg, Macrobond & MUFG GMR

VALUE OF NEGATIVE YIELDING BONDS BACK AT ZERO

Source: Bloomberg, Macrobond & MUFG GMR

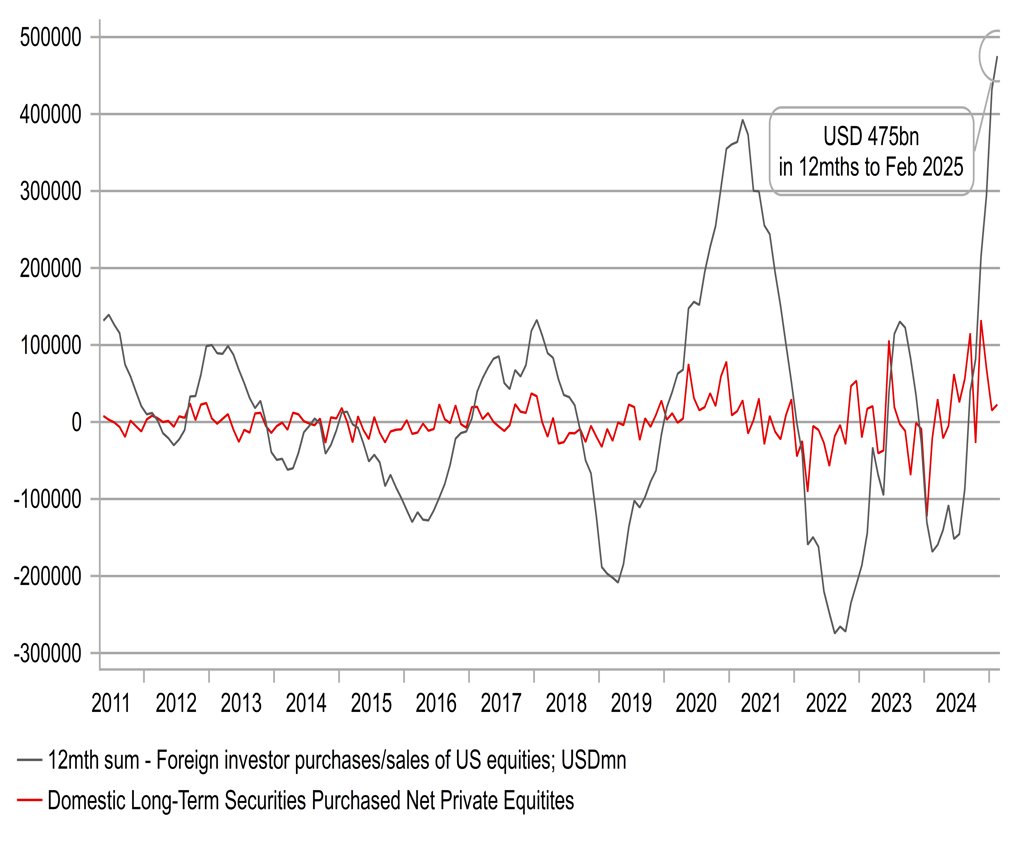

The basis of our long-term US dollar bearish view does not necessarily have to assume notable capital flight from the US. But even small shifts in investors’ holdings of US assets would have a notable impact on flows. The drivers of US exceptionalism are unlikely to all reverse and the US leading in tech along with productivity outperformance could well continue but the US fiscal position is alarming and the risk is that policies increasingly crowd out private sector growth through rates being higher than they otherwise would be. The current fiscal plans of the Trump administration are alarming and imply fiscal deficits continuing to run between 6-7% of GDP and potentially even higher. We see little net benefit from these fiscal plans (the most expensive element is merely extending current legislation) and that could undermine investor confidence and leave US equities overvalued relative to yields and expected growth. Even a 5% reduction on average of total foreign investor holdings of US equities (USD 18.4trn as of Q4 2024) would have a notable impact with potential implied dollar selling of between USD 900bn to USD 1.0trn.

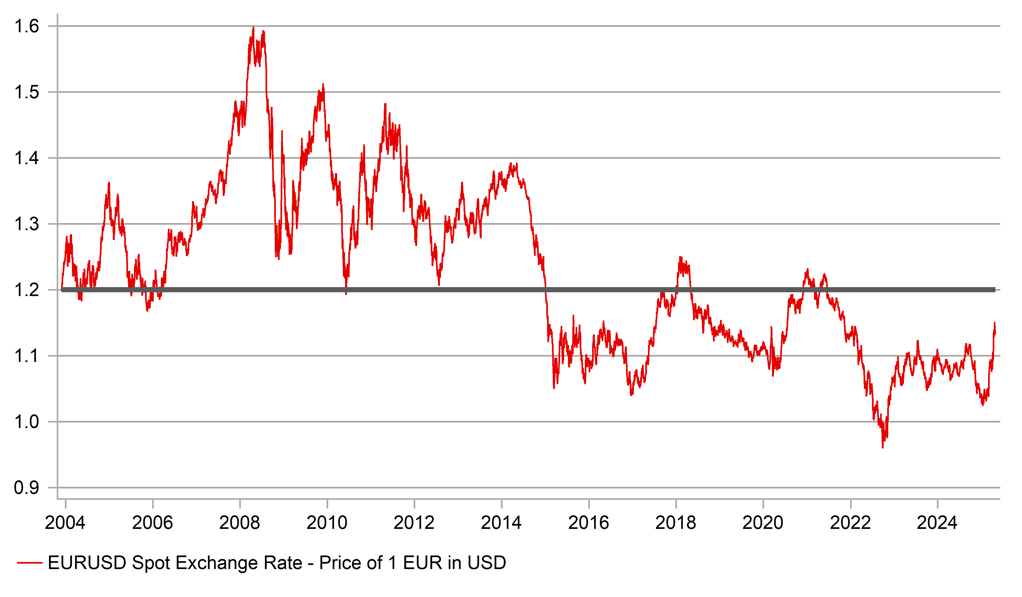

Following the initial heavy selling of the euro after its launch in 1999, central banks increased reserve holdings between 2002-2004 and there was a substantial appreciation of EUR. From 2004-2014, EUR/USD rarely traded below the 1.2000-level and then the onset of negative rates and QE resulted in a long-term shift lower and from 2014 onwards EUR/USD has rarely traded above the 1.2000-level. We now suspect that the shift away from negative rates in Europe and the scope for some rebalancing of exposures from US assets (even relatively modest shifts) will help propel EUR/USD higher, and by year-end to levels around 1.2000 with scope then in 2026-27 for further gains. The changes in Japan as well should help to prompt a retracement in USD/JPY over the coming years back to pre-global inflation shock levels below 120.00. The near-term ebb-and-flow of tariff speculation and the likely reversal of the current elevated tariff rates won’t alter the medium-to-long-term US dollar direction.

FOREIGN INVESTOR PURCHASES OF US EQUITIES AT A RECORD HIGH PRIOR TO TARIFFS ANNOUNCEMENT

Source: Bloomberg, Macrobond & MUFG GMR

20-YEAR EUR/USD PERIOD DEFINED BY ABOVE/BELOW THE 1.2000-LEVEL – WE SEE SCOPE TO TURN HIGHER

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Room for further JPY strength even if BoJ expresses more caution

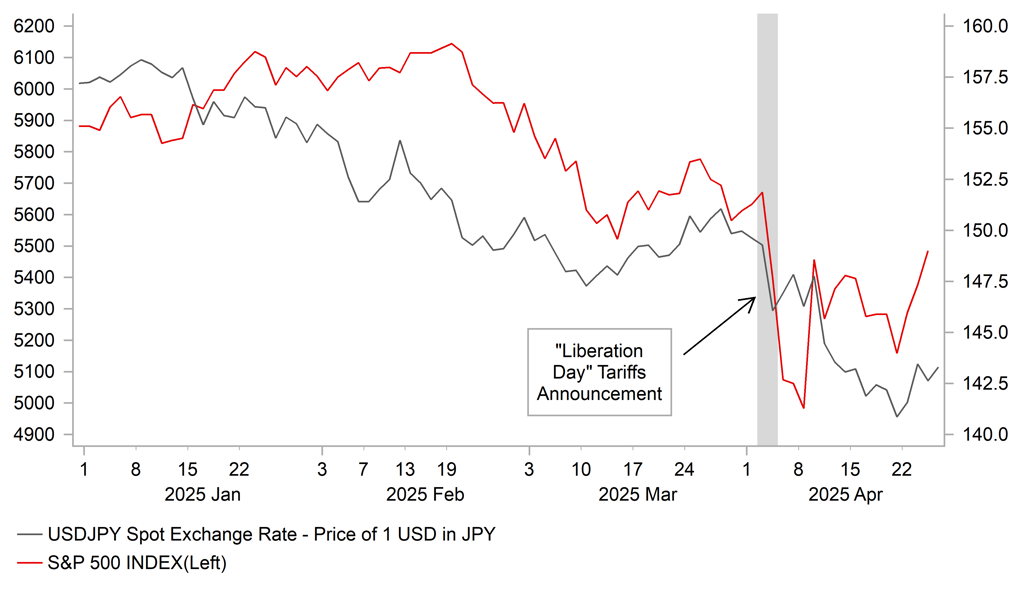

It has been a volatile week for the JPY. At the start of the week USD/JPY fell to a fresh year to date low of 139.89 before rebounding up to an intra-day high today of 143.85. It was the first time that USD/JPY albeit briefly had fallen back below the 140.00-level since last autumn when a low of 139.58 was set on 16th September. The low point for USD/JPY at the start of this week coincided with heightened fears over the threat to the Fed’s independence that triggered a broad-based USD sell-off. President Trump has since stated that he has no plans to fire Fed Chair Powell helping USD/JPY to rebound although investor concerns over political pressure on the Fed to lower rates will continue to linger during the remainder of Fed Cahir Powell’s term which is set to expire in May 2026.

At the same time, the tentative recovery in investor risk sentiment over the past week has been encouraged by building optimism that steps will be taken in the coming months to reverse the “unsustainable” tariffs that are currently in place between the US and China in order to dampen the negative economic damage from the “de facto” trade embargo. While the performance of US equities remains volatile, they have been staging a relief rebound since the lows set on 7th April during the initial aftermath of the President Trump’s “Liberation Day” tariffs announcement. The tentative improvement in risk sentiment has seen the traditional safe haven currencies of the CHF and JPY giving back some of their strong gains from earlier this month.

It has also been reported this week that the White House is closing in on general agreements with India and Japan to reverse higher tariffs. According to Politico, Trump administration officials are working towards “memorandums of understanding” or a broad “architecture” for future deals although it “may take months to hammer out the final details” before the 90-day delay on implementing higher reciprocal tariffs comes to an end in early July. Japanese Prime Minister Ishiba had previously stated that “we do not intend to make one compromise after another to conclude negotiations swiftly”. Ryosei Akazawa, Japan’s top tariff negotiator, met with President Trump, Treasury Secretary Bessent and US Trade Representative Greer last week when formal trade discussions began and they will meet again in the week ahead. Comments this week from Japanese Finance Minister Kato and US Treasury Secretary Bessent have dampened expectations the foreign exchange rate will be an important focus for the trade agreement. President Trump has previously voiced concern that Japan was weakening the JPY. However, Finance Minister Kato stated that “there was absolutely no discussion from the US regarding things like target levels for exchange rates or any kind of framework to manage them”. A view shared by US Treasury Secretary Bessent who stated that there will be “no currency target” as they prioritise addressing tariffs, no-tariff barriers and government subsidies for labour and fixed capital investment. He did add though that he hopes Japan will honour the G7 commitments on exchange rates by allowing them to be determined by market forces. The comments have helped to dampen expectations that the Trump administration could push back more strongly against the weak JPY which has contributed to the sell-off this week.

TENTATIVE IMPROVEMENT IN RISK SENTIMENT

Source: Bloomberg, Macrobond & MUFG GMR

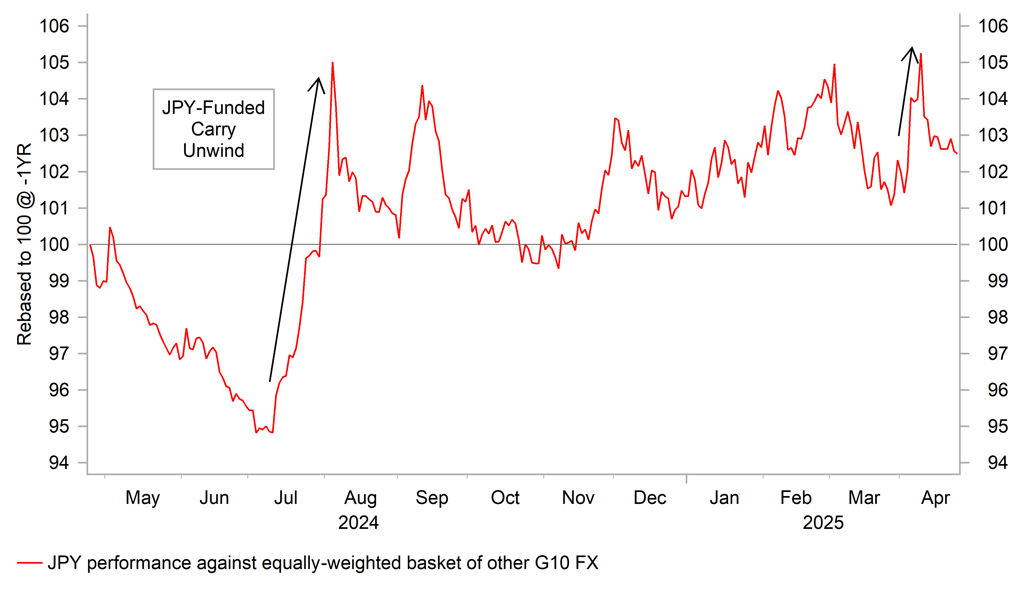

JPY GAINS SMALLER THAN DURING CARRY UNWIND

Source: Bloomberg, Macrobond & MUFG GMR

The BoJ will have to take into account the negative impact of trade disruption when they set monetary policy in the week ahead. At the previous policy meeting in March, the BoJ had already expressed caution when Governor Ueda stated that “it is not easy to make a judgement” on whether they are getting closer to their goal given high uncertainty surrounding trade and other policies from overseas while indicating he hoped things would become a clearer at the beginning of April. In light of the higher tariffs imposed on trade between Japan and the US including the 10% universal tariff, 25% tariffs on autos & certain parts, and on steel & aluminium, the BoJ is expected to lower their forecast for economic growth in Japan for the current fiscal year. The current GDP forecast of 1.1% for FY2025 is expected to be revised down by around 0.5ppt.

At the same time, the core inflation forecast for FY2025 is expected to be lowered modestly towards 2.0% to reflect waivers for high-school fees, the hit to demand from tariffs and lower energy prices. However, the updated forecasts should still show inflation remaining close to target in the coming fiscal year signalling that the BoJ is likely to normalize policy further if the economy evolves as expected. The significant upside from the Tokyo CPI report for April was supportive for further policy normalization in Japan. However, trade disruption will discourage the BoJ from hiking rates further in the near-term. A quick trade agreement between the US and Japan to reverse tariff hikes could give the BoJ more confidence to hike rates further but that appears unlikely until later this year. The Japanese rate market has already pushed back expectations for the timing of the next BoJ hike from June-July to September-December. There are currently around 9bps of hikes priced in by July compared to around 15bps for September. The dovish repricing that has already taken place should help to dampen JPY selling in response to more cautious BoJ policy communication next week unless they go further even than expected and completely drop plans for further rate hikes which appears unlikely at the current juncture.

Overall, the developments do not change our view that the JPY is likely to strengthen further alongside slowing global growth which will encourage other major central banks including the Fed to deliver deeper rate cuts that continue to narrow yield differentials with Japan. Over the past week officials from the BoE, ECB and Fed have all indicated that they are ready to lower rates in response to evidence of weakening economic growth in the coming months.

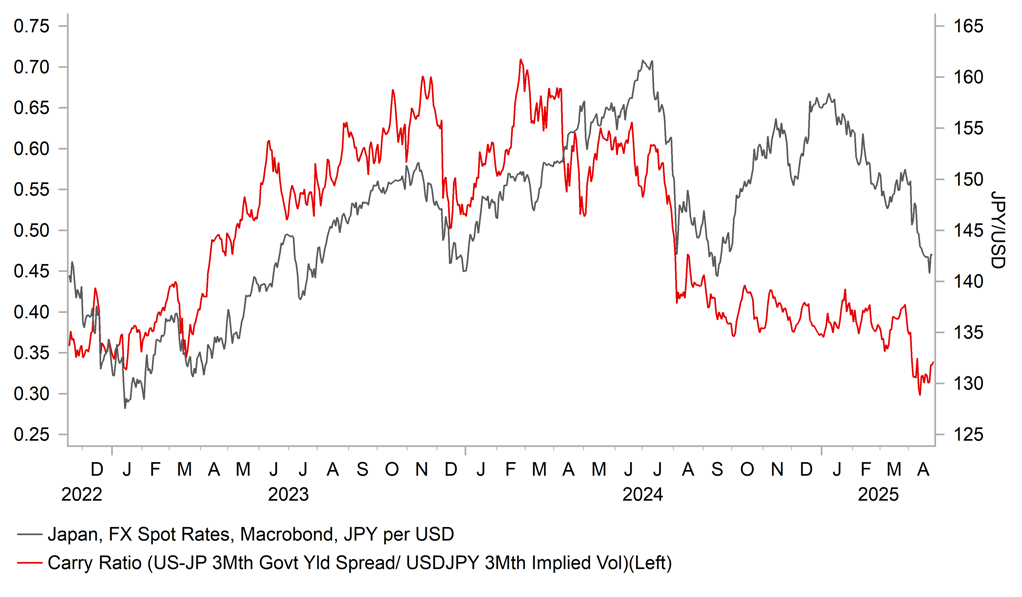

JPY-FUNDED CARRY TRADES ARE LESS ATTRACTIVE

Source: Bloomberg, Macrobond & MUFG GMR

JAPANESE INVESTORS SOLD FOREIGN BONDS IN APRIL

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EUR |

28/04/2025 |

14:00 |

ECB's Rehn Speaks |

!! |

|||

|

USD |

29/04/2025 |

13:30 |

Advance Goods Trade Balance |

Mar |

-$145.4b |

-$147.9b |

!! |

|

USD |

29/04/2025 |

15:00 |

JOLTS Job Openings |

Mar |

-- |

7568k |

!! |

|

USD |

29/04/2025 |

15:00 |

Conf. Board Consumer Confidence |

Apr |

87.0 |

92.9 |

!! |

|

CHF |

29/04/2025 |

17:30 |

SNB's Martin Speaks |

!!! |

|||

|

JPY |

30/04/2025 |

00:50 |

Retail Sales MoM |

Mar |

-1.0% |

0.5% |

!! |

|

JPY |

30/04/2025 |

00:50 |

Industrial Production MoM |

Mar P |

-0.7% |

2.3% |

!! |

|

AUD |

30/04/2025 |

02:30 |

CPI YoY |

Mar |

2.2% |

2.4% |

!!! |

|

CNY |

30/04/2025 |

02:30 |

Manufacturing PMI |

Apr |

-- |

50.5 |

!! |

|

CNY |

30/04/2025 |

02:30 |

Non-manufacturing PMI |

Apr |

-- |

50.8 |

!! |

|

EUR |

30/04/2025 |

06:30 |

France GDP QoQ |

1Q P |

-- |

-0.1% |

!!! |

|

EUR |

30/04/2025 |

07:45 |

France CPI YoY |

Apr P |

-- |

0.8% |

!!! |

|

EUR |

30/04/2025 |

08:55 |

Germany Unemployment Change (000's) |

Apr |

-- |

26.0k |

!! |

|

EUR |

30/04/2025 |

09:00 |

Germany GDP SA QoQ |

1Q P |

-- |

-0.2% |

!!! |

|

EUR |

30/04/2025 |

13:00 |

Germany CPI YoY |

Apr P |

-- |

2.2% |

!!! |

|

USD |

30/04/2025 |

13:15 |

ADP Employment Change |

Apr |

-- |

155k |

!! |

|

USD |

30/04/2025 |

13:30 |

GDP Annualized QoQ |

1Q A |

0.4% |

2.4% |

!!! |

|

USD |

30/04/2025 |

13:30 |

Employment Cost Index |

1Q |

1.0% |

0.9% |

!!! |

|

USD |

30/04/2025 |

15:00 |

Personal Spending |

Mar |

0.4% |

0.4% |

!! |

|

USD |

30/04/2025 |

15:00 |

Core PCE Price Index MoM |

Mar |

0.1% |

0.4% |

!!! |

|

JPY |

01/05/2025 |

Tbc |

BOJ Target Rate |

0.5% |

0.5% |

!!! |

|

|

GBP |

01/05/2025 |

09:30 |

S&P Global UK Manufacturing PMI |

Apr F |

-- |

44.0 |

!! |

|

USD |

01/05/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

01/05/2025 |

15:00 |

ISM Manufacturing |

Apr |

47.9 |

49.0 |

!! |

|

AUD |

02/05/2025 |

02:30 |

Retail Sales MoM |

Mar |

0.4% |

0.2% |

!! |

|

EUR |

02/05/2025 |

10:00 |

CPI Estimate YoY |

Apr P |

-- |

2.2% |

!!! |

|

USD |

02/05/2025 |

13:30 |

Change in Nonfarm Payrolls |

Apr |

123k |

228k |

!!! |

|

USD |

02/05/2025 |

15:00 |

Durable Goods Orders |

Mar F |

-- |

-- |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The BoJ is scheduled to hold their upcoming policy meeting in the week ahead. The BoJ are expected to leave rates on hold but market participants will be watching closely to see if there is any change in communication. The BoJ has been signalling that further rate hikes are likely if the economy evolves in line with expectations. The Japanese rate market has recently moved to push back the expected timing of further BoJ rate hikes until later this year in response to trade policy disruption. We expect the BoJ to downgrade their outlook for growth for the current fiscal year from the current projection of 1.1%. Overall we expect the BoJ to signal that further policy normalization is likely but they will proceed more cautiously.

- The main economic data release in the week ahead will be the latest nonfarm payrolls report for April. Employment growth has slowed at the start of this year averaging 152k jobs/month in Q1 compared to 209k/month in Q4 of last year. It has brought employment growth back in line with slower employment growth over the past year. Market participants will be watching closely to see if employment growth slows further in the coming quarters in response to trade disruption, heightened policy uncertainty and tighter financial conditions alongside DOGE’s ongoing efforts to cut the size of the public sector. For the Fed to cut rates by around 75bps as currently priced in the US rate market, the US labour market will need to loosen more than the Fed expects lifting the unemployment rate beyond 4.5%. Slower labour supply growth from tighter immigration controls could prevent a bigger move higher in the unemployment rate even if employment growth slows.

- The releases of the core PCE deflator report for March and Employment Cost Index for Q1 are expected to provide further confirmation that inflation pressures continued to ease at the start of this year prior to the implementation of tariffs. However, the data releases will be viewed as more backward looking than normal limiting their market impact.

- In Europe, the release of GDP reports for Q1 and the latest CPI reports for April are expected to leave the door open for the ECB to keep cutting interest rates with trade disruption expected to reinforce disinflation pressures in the euro-zone.