To read the full report, please download PDF.

JPY weakens ahead of political risks

FX View:

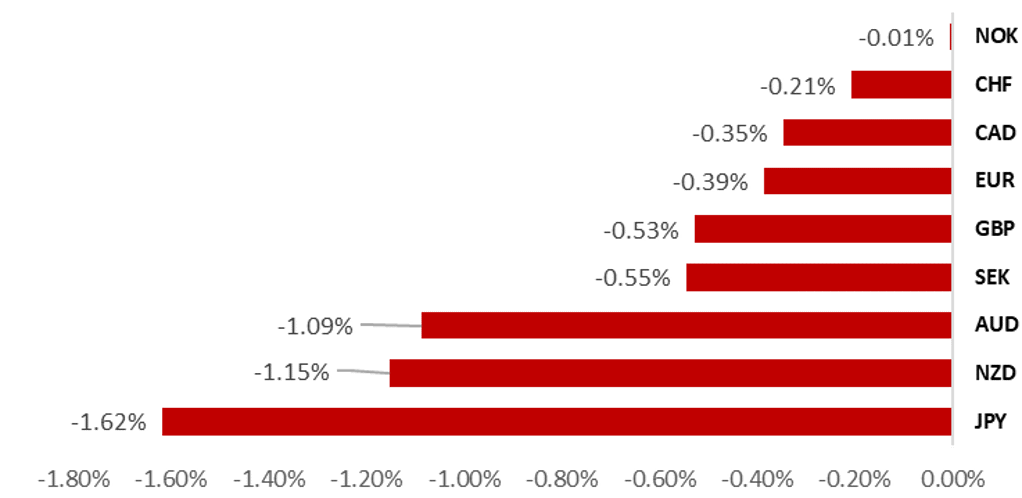

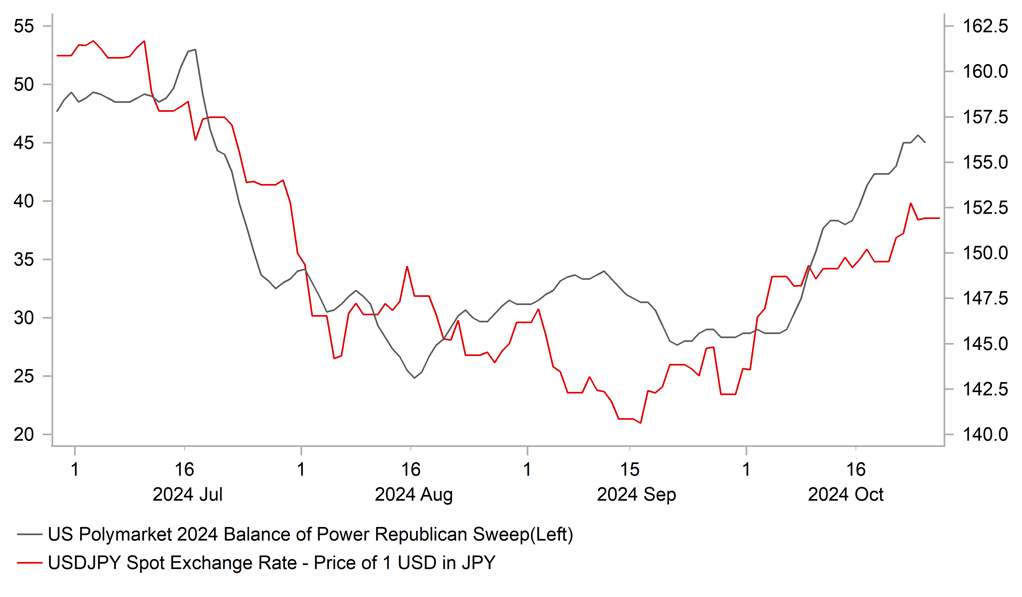

The USD and US yields have continued to move higher over the past week as market participants price in a higher probability of a Trump win and Red Sweep outcome from the US election. It has helped to lift USD/JPY back above the 150.00-level drawing concern from Japanese officials over renewed JPY weakness. One-sided price action has raised the risk of another bout of intervention to support the JPY although it appears unlikely until after the US election. Heightened political uncertainty in Japan may also have contributed to JPY selling over the past week ahead of this weekend’s election. The government led by new PM Ishiba is hoping to hold on to their majority in the Lower House. While we are not expecting a significant shift in the domestic policy framework after the election, the JPY could weaken further at the start of next week if the current government falls short of a majority. Other key events for USD/JPY in the week ahead include the release of the nonfarm payrolls report for October and the BoJ’s latest policy update. Will the weaker JPY encourage the BoJ to bring forward rate hike plans?

BROAD-BASED USD STRENGTH

Source: Bloomberg, 13:25 BST, 25th October 2024 (Weekly % Change vs. USD)

Trade Ideas:

We have taken profit after the target was hit on our long USD/NOK trade recommendation.

Balance of Payments:

Japan’s current account on a 3mth sum basis is improving and reaching close to a new record high. The investment income surplus widened out to JPY 10,684bn over the 3mths to August, the second largest total on record.

Hedging US Election Risk using FX Options:

Our analysis shows FX market participants are ramping up bullish USD positions against other major currencies in anticipation of Trump wining the US presidential election. Relative to overall FX option flows by currency pairs we have found that USD call demand has picked up the most against the JPY, CHF, and MXN this month.

FX Views

USD/JPY: Weighing up political risks as intervention threat steps up

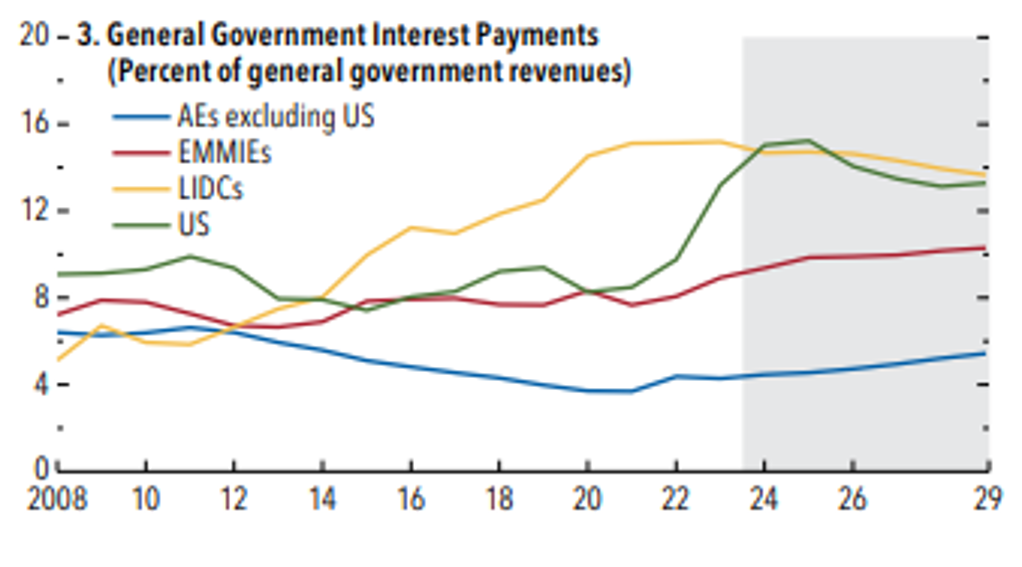

The USD is on track for its fourth consecutive week of gains as measured by the dollar index. It is the longest run of USD gains since June and the largest adjustment higher for the dollar index since the first four months of this year. The USD’s upward momentum over the past week has been reinforced by rising US yields especially at the long end of the curve. After consolidating at higher levels at just above 4.0% in previous weeks, the 10-year US Treasury yield has regained upward momentum over the past week climbing back above resistance from the 200-day moving average at around 4.18%. Higher US yields and a stronger USD are being encouraged both by the recent run of stronger US economic data and rising probability of a Trump victory and Red Sweep at the US election on 5th November. According to PolyMarket, the probability of a Red Sweep where the Republicans take control of Congress allowing them to put in place their fiscal policy platform has risen closer to 50% from around 30% at the start of this month. The costing of Trump’s fiscal policy proposals by the Committee for a Responsible Federal Budget totalled USD7.5 trillion through to 2035 in their central scenario. Of which the bulk of the cost would come from extending and modifying tax cuts implemented during his first term totalling USD5.35 trillion. By extending tax cuts that are already in place, the stimulative and inflationary impact on the US economy could be less than initially feared.

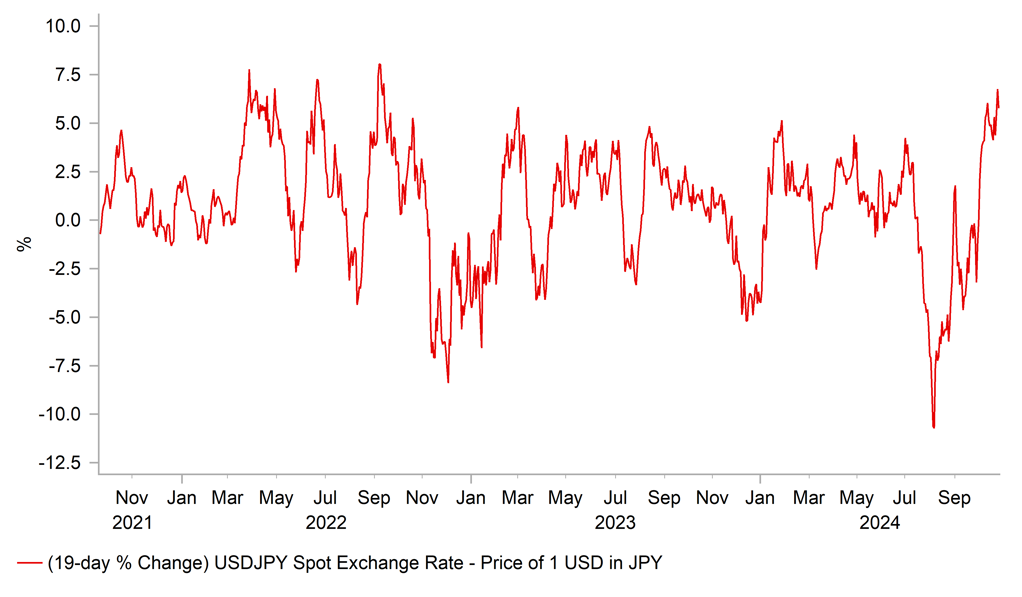

The pick-up in global bond yields over the past week has been one reason why the JPY has underperformed. It has helped to lift USD/JPY to a high this week at 153.19 marking almost a full reversal of the sharp gains for the JPY recorded in late July/early August when JPY-funded carry trades were unwound. So far this month, USD/JPY risen by around 6-7% which is the largest upward move over an equivalent period since back in late August/early September 2022. A period which was quickly followed up by Japan intervening to support in the JPY in both September and October 2022. Market participants have become more wary of the risk of another bout of intervention to support the JPY following comments from Japanese officials in recent days. Finance Minister Kato warned that “we are seeing one-sided, rapid moves”, and “we will closely monitor the foreign exchange market with a stronger sense of urgency, including watching for speculative trading”. While verbal intervention provides temporary support the JPY, we do not expect direct intervention until after the US election. The case for intervention would strengthen further if USD/JPY rises back closer to year to date highs after the US election on the back of a win for Donald Trump and a Red Sweep. In contrast, a divided Congress under Trump or Harris could help to ease upward pressure on USD/JPY. The latter could trigger a bigger reversal lower.

NEED FOR FISCAL CONSOLIDATION IN US

Source: IMF WEO October 2024

LARGEST INCREASE FOR USD/JPY SINCE SEPT 2022

Source: Bloomberg, Macrobond & MUFG GMR

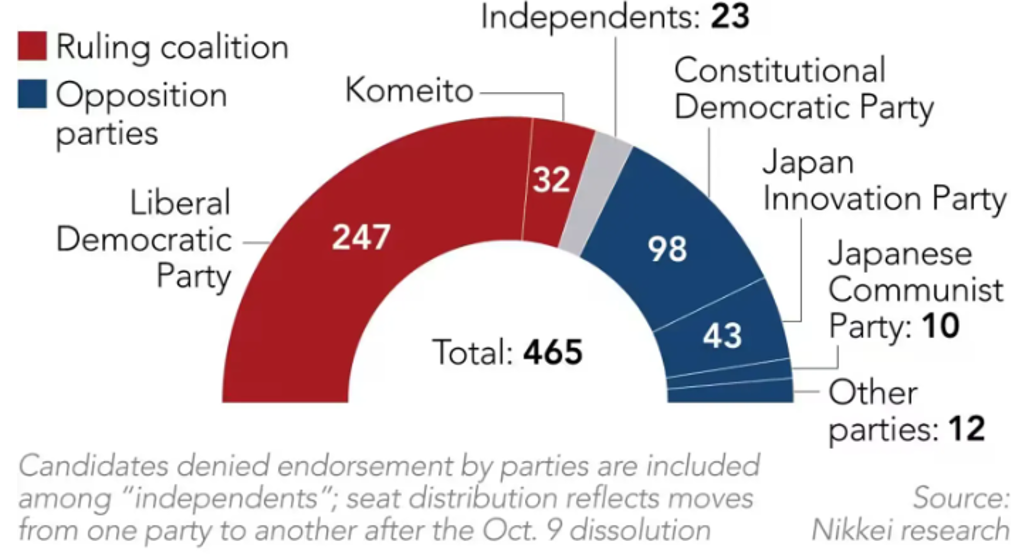

The JPY sell-off over the past week could also reflect unease over political developments in Japan ahead of this Sunday’s Lower House election. After winning the LDP leadership contest last month, new Prime Minister Ishiba immediately called a snap election. The decision to call a snap election could backfire if the LDP fail to hold on to their majority. The ruling parties of the LDP (247) and Komeito (32) currently hold 279 seats out of the 465 available in the Lower House. With a further 12 seats held by unendorsed former LDP candidates. An opinion poll released last week by the Asahi newspaper revealed that there is a risk that the LDP (200) and Komeito (25) could fall short of winning a majority of 233 seats even with 5 seats from unendorsed former LDP candidates. Other forecasts from political experts have though indicated that the government is likely to hold on to a smaller majority.

We are not expecting major changes to the economic policy framework in Japan after the election. It has been reported that the LDP could go all out to recruit other parties to join their coalition government such as the Democratic Party for the People (DPP) if they lose their majority. DPP President Yuichiro Tamaki has left open the possibility of a “partial coalition” on which they would cooperate on individual policies. Its election pledges include to lowering the consumption tax to 5% from 10% overall until real wage growth becomes positive and cutting gasoline taxes. Bringing the DPP into the fold should favour maintaining loose fiscal policy. After the election, the LDP will focus on the supplementary budget for FY2024 which is expected to include cash handouts for low-income households and an extension of energy-related subsidies that will help to support consumption.

Market participants will also be scrutinizing closely the BoJ’s upcoming policy update at the end of next week. At the last policy meeting in September, the BoJ indicated that they have more time to assess when they may need to raise rates further in light of the sharp strengthening of the JPY over the summer and financial market instability after Japanese equity markets plunged lower in early August. However, the JPY has since re-weakened sharply creating more room for the BoJ to raise rates further in the near-term. Market participants will be scrutinizing comments from Governor Ueda closely in the week ahead to see if they provide any indication that another rate hike could be delivered before the end of this year. We are still sticking to our forecast for a December rate hike although acknowledge it could be a little delayed until January.

RISING PROBABILITY OF RED SWEEP LIFTING USD/JPY

Source: Bloomberg, Macrobond & MUFG Research

LOWER HOUSE COMPOSITION PRIOR TO ELECTION

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

10/27/2024 |

Tbc |

Japan Election |

|

|

|

!!! |

|

USD |

10/29/2024 |

12:30 |

Advance Goods Trade Balance |

Sep |

-$96.0b |

-$94.3b |

!! |

|

USD |

10/29/2024 |

14:00 |

JOLTS Job Openings |

Sep |

-- |

8040k |

!! |

|

USD |

10/29/2024 |

14:00 |

Conf. Board Consumer Confidence |

Oct |

99.0 |

98.7 |

!! |

|

CHF |

10/29/2024 |

18:00 |

SNB's Schlegel Speaks |

!!! |

|||

|

AUD |

10/30/2024 |

00:30 |

CPI YoY |

3Q |

3.0% |

3.8% |

!!! |

|

EUR |

10/30/2024 |

06:30 |

France Consumer Spending MoM |

Sep |

-- |

0.2% |

!! |

|

EUR |

10/30/2024 |

06:30 |

France GDP QoQ |

3Q P |

-- |

0.2% |

!!! |

|

EUR |

10/30/2024 |

08:55 |

Germany Unemployment Change |

Oct |

-- |

17.0k |

!! |

|

EUR |

10/30/2024 |

09:00 |

Germany GDP SA QoQ |

3Q P |

-- |

-0.1% |

!!! |

|

EUR |

10/30/2024 |

10:00 |

Euro-zone GDP SA QoQ |

3Q A |

-- |

0.2% |

!!! |

|

USD |

10/30/2024 |

12:15 |

ADP Employment Change |

Oct |

108k |

143k |

!! |

|

USD |

10/30/2024 |

12:30 |

GDP Annualized QoQ |

3Q A |

3.0% |

3.0% |

!!! |

|

GBP |

10/30/2024 |

12:30 |

UK Budget |

!!! |

|||

|

EUR |

10/30/2024 |

13:00 |

Germany CPI YoY |

Oct P |

-- |

1.6% |

!!! |

|

EUR |

10/30/2024 |

15:00 |

ECB's Schnabel Speaks |

!! |

|||

|

JPY |

10/30/2024 |

23:50 |

Retail Sales MoM |

Sep |

-0.1% |

0.8% |

!! |

|

JPY |

10/30/2024 |

23:50 |

Industrial Production MoM |

Sep P |

0.9% |

-3.3% |

!! |

|

AUD |

10/31/2024 |

00:30 |

Retail Sales MoM |

Sep |

0.4% |

0.7% |

!! |

|

JPY |

10/31/2024 |

Tbc |

BOJ Target Rate |

0.3% |

0.3% |

!!! |

|

|

EUR |

10/31/2024 |

07:45 |

France CPI YoY |

Oct P |

-- |

1.1% |

!! |

|

EUR |

10/31/2024 |

10:00 |

CPI Estimate YoY |

Oct |

-- |

1.7% |

!!! |

|

EUR |

10/31/2024 |

10:00 |

Unemployment Rate |

Sep |

-- |

6.4% |

!! |

|

USD |

10/31/2024 |

12:30 |

Employment Cost Index |

3Q |

1.0% |

0.9% |

!!! |

|

CAD |

10/31/2024 |

12:30 |

GDP MoM |

Aug |

-- |

0.2% |

!! |

|

USD |

10/31/2024 |

12:30 |

Core PCE Price Index MoM |

Sep |

0.3% |

0.1% |

!!! |

|

USD |

10/31/2024 |

12:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

CHF |

11/01/2024 |

07:30 |

CPI YoY |

Oct |

-- |

0.8% |

!! |

|

USD |

11/01/2024 |

12:30 |

Change in Nonfarm Payrolls |

Oct |

135k |

254k |

!!! |

|

USD |

11/01/2024 |

14:00 |

ISM Manufacturing |

Oct |

47.6 |

47.2 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- It is an important week for Japan. New Prime Minister Ishiba called a snap election which is scheduled to take place on Sunday. The ruling LDP government is expected to remain the biggest party in Japan although the size of their majority is likely to shrink. There has even been some concern over the past week that they could lose their majority in the Lower House. The BoJ will also hold their latest policy meeting in the week ahead just after the election. The BoJ are expected to leave monetary policy unchanged after signaling at their last meeting that they have more time to asses when to hike rates further. Market participants will be watching closely to see if the BoJ indicates plans for rate cuts could be brought forward if the JPY continues to weaken.

- The main economic data releases in the week ahead include: i) the latest nonfarm payrolls report for October, ii) US Employment Cost Index for Q3, iii) US GDP report for Q3, iv) US PCE deflator report for September, v) euro-zone GDP report for Q3 and vi) euro-zone CPI report for October. The nonfarm payrolls report for October is expected to have been negatively impacted by temporary disruption of the recent Hurricane and strikes making it harder for market participants and the Fed to interpret. After the sharper than expected inflation slowdown in the euro-zone in September, the October CPI report will be important in determining whether the ECB cuts rates again this year in December.

- The other main focus in week ahead will be the release of the much anticipated UK Budget from the new Labour government. It has been reported that the government is seeking to fill fiscal hole of around GBP 20 billion and may implement additional tightening measures to give it headroom. A larger package of tax hikes poses downside risks to the UK growth outlook. At the same time, the government has confirmed it will adjust the definition of debt used in the debt rule to create some more leeway to borrow for investment over the course of parliament.