To read the full report, please download PDF.

BoJ offers little help in halting JPY selling

FX View:

The week is coming to an end with the yen sharply weaker after the BoJ left its policy stance unchanged and provided little evidence of concern over the continued yen decline. That has given market participants’ the belief that there may be greater scope for yen depreciation than previously assumed. Certainly in absence of intervention by the MoF, USD/JPY will quickly move higher to the 160-level. Given the sustained rhetoric from the MoF opposing this kind of move, we maintain that intervention is imminent and could come at any moment, including next week during the Golden Week holiday. Contrary to the view that US fundamentals will curtail action, the 10yr US-JP spread is below the intervention level in October 2022. Elsewhere, the dollar was largely weaker with increasing evidence that the economic conditions in Europe are improving which has given GBP and EUR added support. The developments underline our view that near-term upside risks for the dollar has limits in circumstances of better global growth.

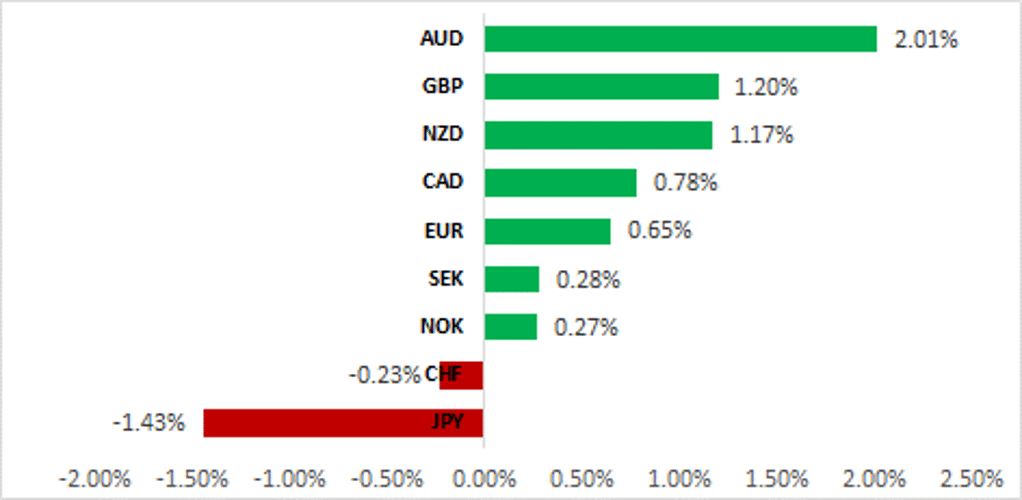

JPY THE STANDOUT UNDERPERFORMER IN G10 FX THIS WEEK

Source: Bloomberg, 13:45 BST, 26th April 2024 (Weekly % Change vs. USD)

Trade Ideas:

We have closed our short CHF/JPY trade idea after hitting our stop-loss level and are recommending a new long AUD/NOK trade idea.

JPY Flows – High Frequency:

This week we look at the weekly cross-border flow data that indicates recent selling of foreign bonds as US yields move back higher and Japan equity selling by foreigners after a period of heavy buying.

BoJ Intervention – Price Action Analysis:

We have found that BoJ intervention was more effective at sustaining a weaker JPY when selling momentum was stronger in the run up to intervention.

FX Views

JPY: BoJ caution continues – more JPY selling to meet intervention?

The BoJ policy announcement today was close to a carbon-copy of the last communication in March when QQE was effectively scrapped. There were some slight tweaks though that we believe certainly points to the prospect of future rate increases. Nonetheless, the changes were subtle enough to leave the markets interpreting this meeting as a ‘dovish hold’ of the monetary policy stance. There were also reports yesterday from JIJI Press that the BoJ would alter its commitment to purchase around JPY 6trn worth of JGBs per month. While there was no explicit mention of that in a footnote (like in March), the statement confirmed that the asset purchase plans would continue as laid out in the March statement and hence that guidance remains valid. From a markets perspective we see this outcome as a ‘green light’ to continue selling the yen and the onus to stop yen selling firmly rests with the MoF and not the BoJ. Without MoF intervention a quick move in USD/JPY to the 160.00-level is highly likely.

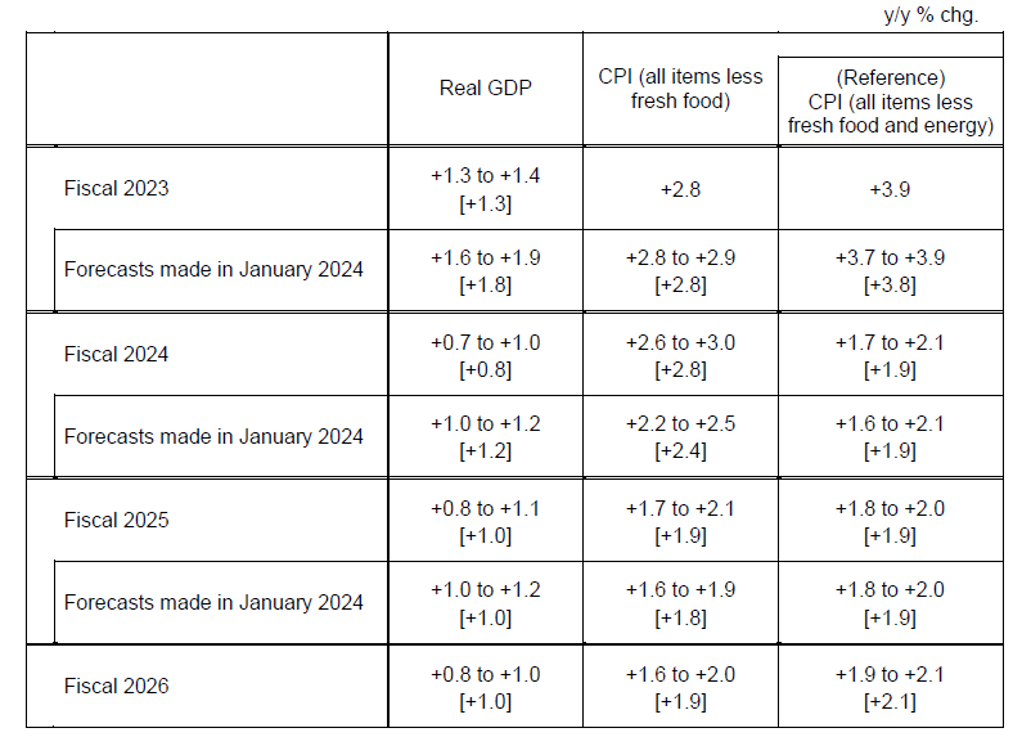

The updated Outlook for Economic Activity and Prices report revealed higher forecasts for inflation (2.8% vs 2.4% prev FY24; 1.9% vs 1.8% prev FY25; and 1.9% FY26) but a lower GDP forecast for this fiscal year (0.8% vs 1.2% prev) with FY25 unchanged at 1.0% and 1.0% again in FY26. The inflation forecasts for FY25 and certainly FY26 were a little on the cautious side perhaps and left open a degree of uncertainty over the achievement of the price stability goal. The wording on that specifically was roughly the same suggesting progress but no full achievement of the goal. The BoJ believes that underlying inflation “is likely to be at a level that is generally consistent with the price stability target”, but then adds in the next sentence “That said, there remain uncertainties regarding this outlook…” with a mention of needing to monitor factors such as “firms’ wage and price-setting behaviour”. This indicates that further evidence of how the ‘shunto’ wage negotiations feed through to small and medium sized firms will be important. The final Rengo wage figure covering all sized firms is due in June and that could provide the BoJ with greater confidence to hike rates in July. A July rate hike of 15bps remains the MUFG view.

Governor Ueda covered many aspects of the policy outlook as usual but from an FX perspective there was particular attention given to his comments on yen and inflation. Yen selling was reinforced as he spoke with an impression of indifference in some of his comments.

BOJ UPDATED FORECASTS FOR GDP AND INFLATION – INFLATION IN FY25 AND FY26 AT 1.9%

Source: BoJ Outlook for Economic Activity & Prices April 2024

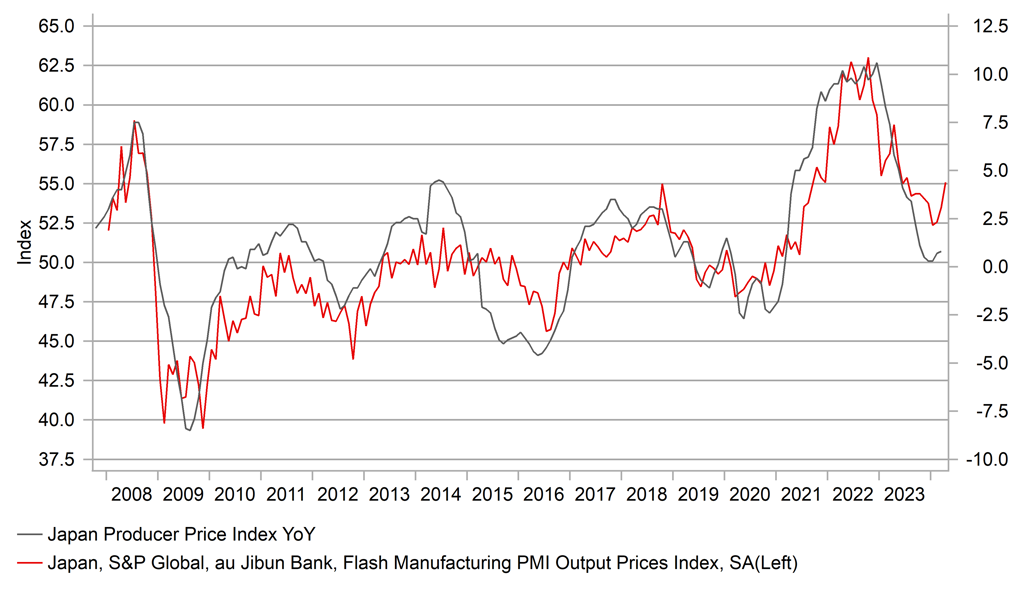

PMI DATA AND WEAK YEN POINT TO RENEWED INFLATION PICK-UP GOING FORWARD

Source: MUFG & Global Markets Research

As you would expect, Ueda emphasised that monetary policy is not used to target the exchange rate. However, he also added that yen weakness had had no meaningful impact on inflation (we can assume he meant recent weakness here) and there was a yen selling reaction to the comment that the impact on inflation was temporary. Nonetheless he did caveat this by adding that it could influence wage growth and become more lasting. Again, the wage data and the final ‘shunto’ wage negotiation outcome will be important going forward. It may well be the case that the BoJ were conscious of making a change in policy or much alteration to their views and communications in small part out of fear of being perceived as trying to influence the direction of the yen. What is clear from today’s meeting is that FX moves are a factor in policy deliberations but clearly not currently to a degree that warrants any change in view. It does make the job of the MoF that bit more difficult given the perception that the move is not impacting the economic or inflation outlook greatly.

We certainly expected communication today that was more forthright in messaging enough progress on inflation to help fuel market expectations of action sooner rather than later. FX moves, while driven of late by higher US yields do also indicate excessively loose policy. In nominal terms, the monetary stance looks quite normal at zero percent. But when viewed in real terms, the stance is unprecedented. Excluding times of sales tax increases that lifted inflation, the BoJ’s policy rate in real terms has ranged between -0.80% to +1.70% over the period since deflation first began back in 1995 (see chart below). However, now in real terms the BoJ’s rate remains below -2.00% and suggests to us that the BoJ will have to act by more than currently assumed.

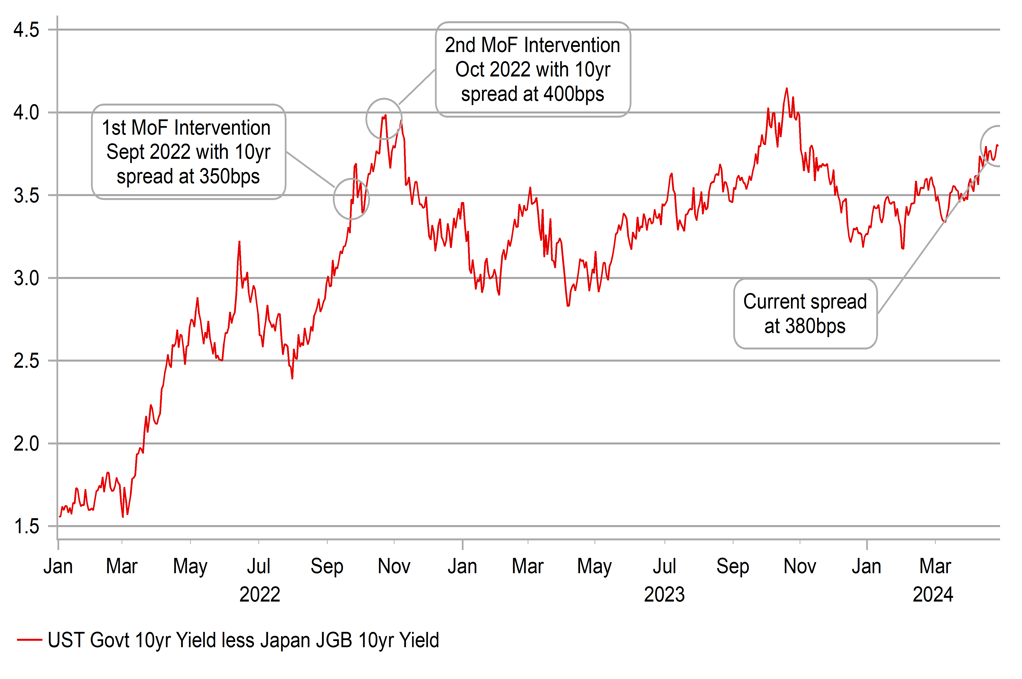

The recent rhetoric from the MoF and the joint statement between the US, S. Korea and Japan certainly mean intervention could take place at any moment. The price action is also now within the range consistent with intervention in 2022. Taking the previous obvious low-point as a starting point into the intervention days in September and October 2022 we saw moves in USD/JPY of 11% into the Sept 2022 intervention (over 37 days); and a 7% move into the October intervention (over 21 days) and today we have had a 7% move from the intra-day low on 8th March ( 34 days). Perhaps not quite the scale of move as back then but close enough and given the rhetoric of late is indicative of imminent action. The BoJ outcome does make it a little more difficult and the fear of failure may be holding the MoF back to allow more speculative selling. The longer the MoF waits, the quicker the move could become. We believe the comments over recent weeks will compel the MoF to act sooner rather than later, although given the BoJ stance will merely be buying time in the hope for a drop in US yields.

BOJ OVERNIGHT POLICY RATE IN REAL TERMS AT UNPRECEDENTED NEGATIVE LEVEL

Source: Bloomberg, Macrobond & MUFG GMR

CURRENT 10YR US-JP YIELD SPREAD AT 380BPS IS BETWEEN LEVELS OF JPY INTERVENTION IN 2022

Source: Bloomberg, Macrobond & MUFG GMR

European FX: Showing resilience amidst broad-based USD strength

The USD has lost some upward momentum over the past week when it has been the third worst performing G10 currency after the JPY and CHF. The USD has failed to extend its advance against most G10 currencies even as US yields have hit fresh year to date highs. The 10-year US Treasury yield hit a high of 4.74% and has now increased by around 56bps since the end of last month. It is currently on track to record the biggest calendar month increase since September 2022 which also coincided with the start of the last period of intervention from Japan to support the JPY between September and October 2022. Our correlation analysis highlights that USD/JPY has been more strongly correlated with long-term US yields than short-term US yields over the past month. The ongoing adjustment higher in long-term US yields is continuing to lift USD/ JPY and thereby increasing pressure on Japan to intervene again.

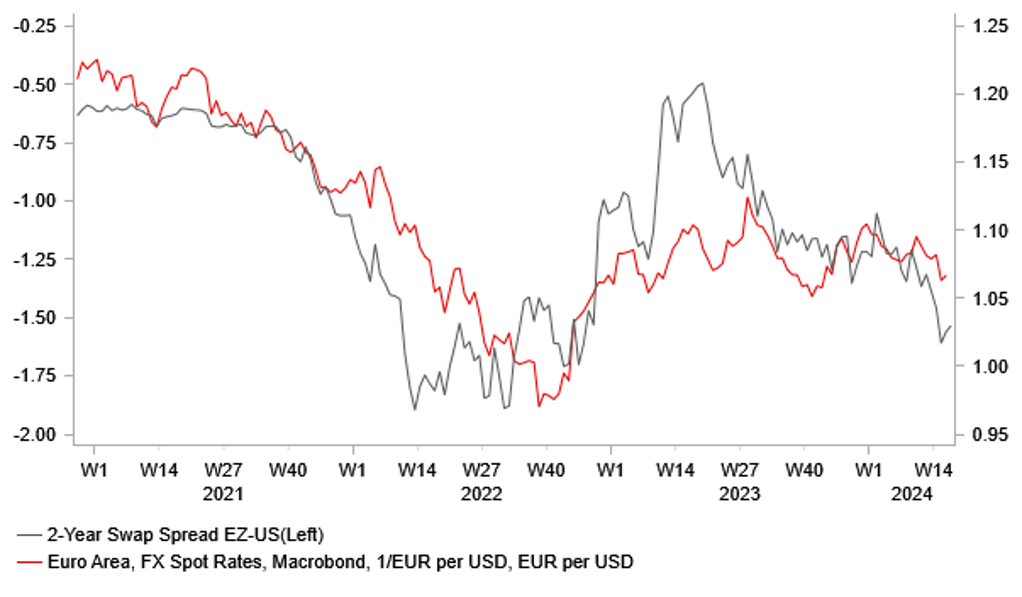

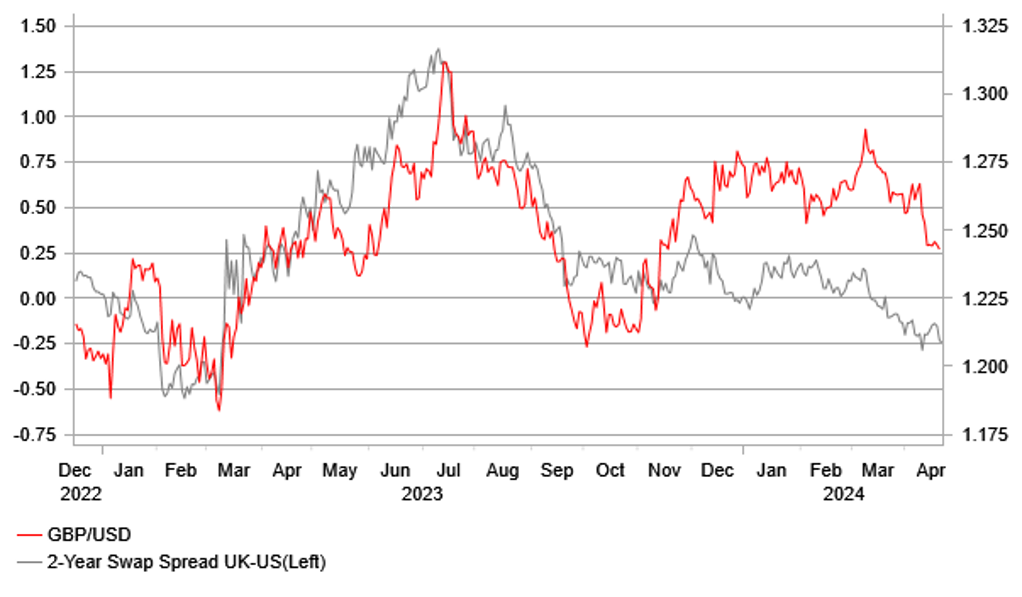

In contrast to the continued weakness for the JPY, the European currencies of the EUR and GBP have held up much better against the USD despite the unfavourable move in yield spreads. The two-year swap spread between the euro-zone and US has widened by just over 30bps so far this year in favour of US, and it has moved back to levels that were last recorded in late 2022 when EUR/USD was trading between 1.0000 and 1.0500. A similar adjustment has taken place in short-term yield spreads between the UK and US. Cable was trading closer to the 1.2000-level when yield spreads were last at current levels just over a year ago. Rate markets have moved along way now to price in more policy divergence this year between the Fed and major European central banks. A rate cut is not fully priced in now in the US until November compared to by July in the euro-zone and September in the UK. It should help to limit the room to price in further policy divergence in the near-term unless the US rate market really starts to seriously question whether the Fed will cut rates at all this year.

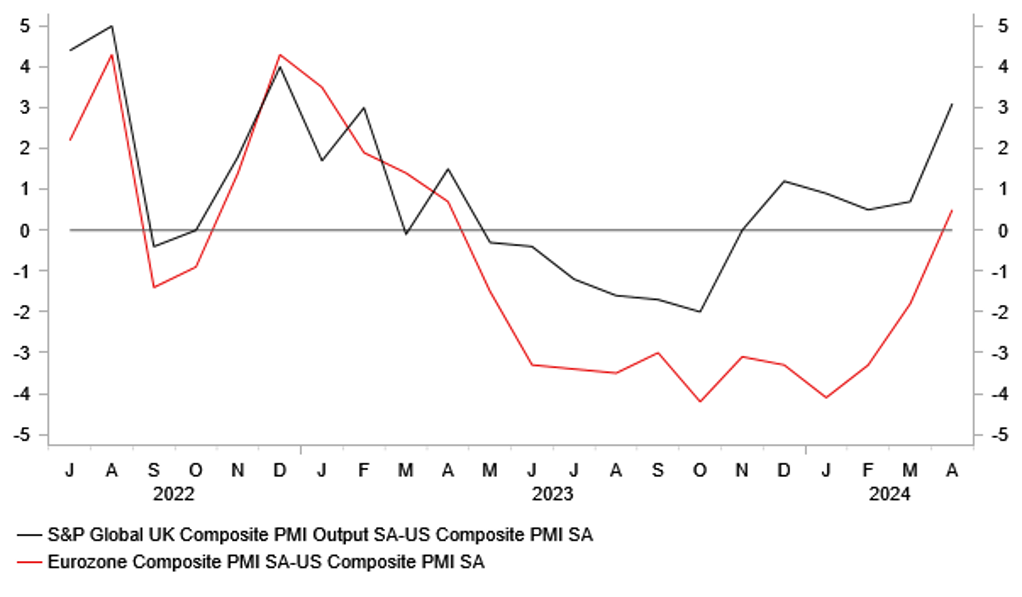

One of the reasons why we believe that the EUR and GBP have held up better against the USD than implied by yield spreads on their own, has been the improving cyclical outlook in Europe. The negative impact from the energy price shock in the region continues to fade, and we saw more convincing evidence over the past week that economic growth is beginning to pick up. The euro-zone and UK services PMI surveys both climbed to their highest levels in almost a year, and are signalling that the period of economic stagnation/mild recession has ended. It gives us more confidence that rising real incomes will drive a consumption-led recovery this year.

EUR/USD VS. SORT-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

GBP/USD VS. SHORT-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

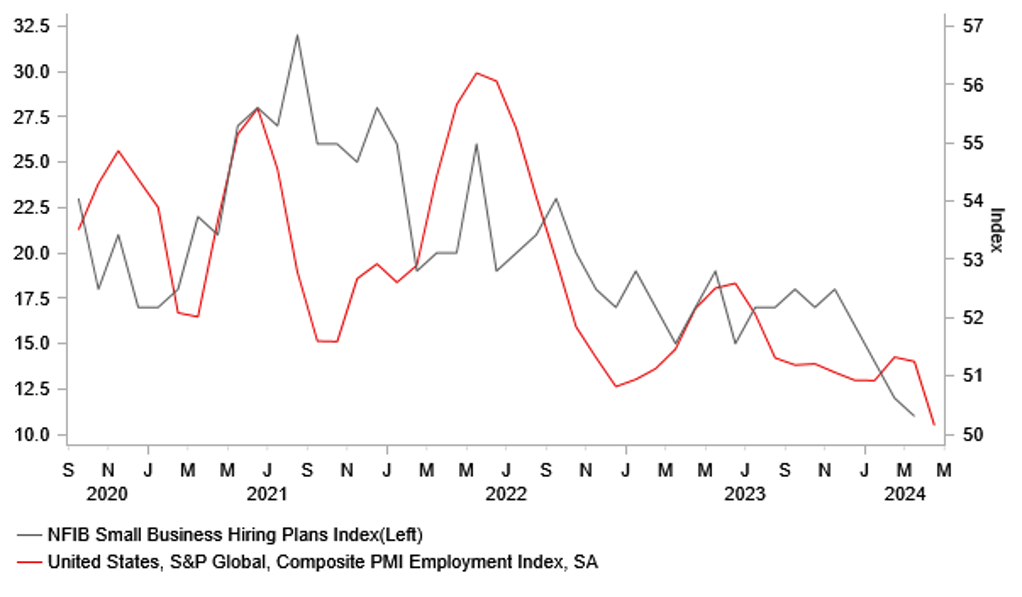

Our forecasts for a weaker USD in the 2H of this year are built on the assumption that the US economy will no longer appear as exceptional as US growth momentum moderates and growth picks up outside of the US. We have been encouraged by the recent pick-up in growth momentum in both China and the euro-zone at the start of this year, but so far there is little convincing evidence yet that the US economy is slowing in response to tighter Fed policy and the running down of COVID savings. While US growth slowed to 1.6% in Q1, private domestic demand (excluding inventories) remained strong expanding by just over 3% for the third consecutive quarter. In light of recent developments, it appears unlikely that the hawkish repricing of Fed policy will be sufficient to trigger a bearish break out of current trading ranges for EUR/USD and cable between 1.0500 and 1.1000, and 1.2000 and 1.3000 respectively. The US rate market is already well priced for a hawkish Fed policy update in the week ahead. We would expect a bigger USD reaction (sell off) if the US labour market revealed more evidence of softening demand.

CYCLICAL MOMENTUM IS TURNING

Source: Bloomberg, Macrobond & MUFG GMR

US LABOUR MARKET SET TO SOFTEN FURTHER?

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

|

EUR |

04/29/2024 |

10:00 |

Consumer Confidence |

Apr F |

-- |

- 14.7 |

|

EUR |

04/29/2024 |

13:00 |

Germany CPI YoY |

Apr P |

-- |

2.2% |

|

JPY |

04/30/2024 |

00:30 |

Jobless Rate |

Mar |

2.6% |

2.6% |

|

JPY |

04/30/2024 |

00:50 |

Retail Sales MoM |

Mar |

-- |

1.5% |

|

JPY |

04/30/2024 |

00:50 |

Industrial Production MoM |

Mar P |

3.2% |

-0.6% |

|

AUD |

04/30/2024 |

02:30 |

Retail Sales MoM |

Mar |

0.2% |

0.3% |

|

CNY |

04/30/2024 |

02:30 |

Composite PMI |

Apr |

-- |

0.527 |

|

CHF |

04/30/2024 |

08:00 |

KOF Leading Indicator |

Apr |

-- |

101.5 |

|

EUR |

04/30/2024 |

08:55 |

Germany Unemployment Change (000's) |

Apr |

-- |

4.0k |

|

NOK |

04/30/2024 |

09:00 |

Norges Bank Daily FX Purchases |

May |

-- |

350m |

|

EUR |

04/30/2024 |

10:00 |

CPI Estimate YoY |

Apr |

-- |

2.4% |

|

EUR |

04/30/2024 |

10:00 |

GDP SA QoQ |

1Q A |

-- |

0.0% |

|

USD |

04/30/2024 |

13:30 |

Employment Cost Index |

1Q |

1.0% |

0.9% |

|

CAD |

04/30/2024 |

13:30 |

GDP MoM |

Feb |

-- |

0.6% |

|

USD |

04/30/2024 |

15:00 |

Conf. Board Consumer Confidence |

Apr |

104.1 |

104.7 |

|

NZD |

04/30/2024 |

23:45 |

Employment Change QoQ |

1Q |

0.3% |

0.4% |

|

USD |

05/01/2024 |

13:15 |

ADP Employment Change |

Apr |

180k |

184k |

|

USD |

05/01/2024 |

15:00 |

JOLTS Job Openings |

Mar |

-- |

8756k |

|

USD |

05/01/2024 |

15:00 |

ISM Manufacturing |

Apr |

50.1 |

50.3 |

|

USD |

05/01/2024 |

19:00 |

FOMC Rate Decision (Upper Bound) |

5.50% |

5.50% |

|

|

USD |

05/01/2024 |

19:30 |

Fed Chair Powell Press Conference |

|||

|

CHF |

05/02/2024 |

07:30 |

CPI YoY |

Apr |

-- |

1.0% |

|

USD |

05/02/2024 |

13:30 |

Trade Balance |

Mar |

-$67.3b |

-$68.9b |

|

CAD |

05/02/2024 |

13:30 |

Int'l Merchandise Trade |

Mar |

-- |

1.39b |

|

USD |

05/02/2024 |

13:30 |

Nonfarm Productivity |

1Q P |

1.5% |

3.2% |

|

USD |

05/02/2024 |

13:30 |

Unit Labor Costs |

1Q P |

2.0% |

0.4% |

|

USD |

05/02/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

|

|

NOK |

05/03/2024 |

09:00 |

Deposit Rates |

4.50% |

4.50% |

|

|

GBP |

05/03/2024 |

09:30 |

S&P Global UK Services PMI |

Apr F |

-- |

54.9 |

|

EUR |

05/03/2024 |

10:00 |

Unemployment Rate |

Mar |

-- |

6.5% |

|

USD |

05/03/2024 |

13:30 |

Change in Nonfarm Payrolls |

Apr |

246k |

303k |

|

USD |

05/03/2024 |

15:00 |

ISM Services Index |

Apr |

52.0 |

51.4 |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The main event risk in the week ahead will the upcoming FOMC meeting. The Fed is expected to send a more hawkish signal over the outlook for rate cuts similar to recent comments from Fed Chair Powell when he indicated that “recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence” that inflation will return to target. The comments suggest that the Fed will need to see at least a couple of weaker inflation reports before beginning to cut rates ruling out a rate cut as soon as in June. At the same time, the Fed is expected to announce plans to slowdown the pace of USTs rolling off their balance by half from USD60 billion/month to UD30 billion.

- The Norges Bank also holds their latest policy meeting in the ahead. We expect the Norges Bank to leave rates on hold and stick to their forward guidance signaling that rate cuts are likely to begin from the autumn. Inflation in Norway has slowed more than expected recently but is unlikely to be sufficient yet to bring forward the Norges Bank’s rate cut plans.

- The main economic data releases in the week ahead will be: i) the latest US Employment Cost Index (ECI) for Q1, ii) euro-zone CPI report for April, iii) New Zealand labour market report for Q1, iv) nonfarm payrolls report for April and vi) ISM manufacturing and services surveys for April. The release of the US ECI index for Q1 will be important for the Fed to assess if wage growth continues to moderate in line with their expectations. The latest nonfarm payrolls report and ISM surveys are expected to provide further confirmation that domestic demand in the US remained strong at the start of this year.