To read the full report, please download PDF.

Fed & BoE could prompt bigger FX moves

FX View:

The ranges in FX this week have been quite modest with the ECB meeting not enough to spark any big moves, reflecting ECB guidance that did not undergo much change that could have prompted bigger moves. The FOMC next week and the BoE meeting along with the US jobs report makes it much more likely that we could see an increase market volatility going forward. A weak jobs report (that the FOMC may have some sense of on Wednesday) could prompt a more dovish than expected FOMC press conference guidance that would spark a yield decline and US dollar selling given it would revive prospects of a March rate cut. However, our leaning at this juncture favours continued moderate US dollar strength as the FOMC remains cautious on strong guidance. The BoE, while likely shifting to a more neutral guidance by scrapping its bias to tighten could still push-back on the May rate cut pricing given sticky services inflation and wages. EUR/GBP could extend declines.

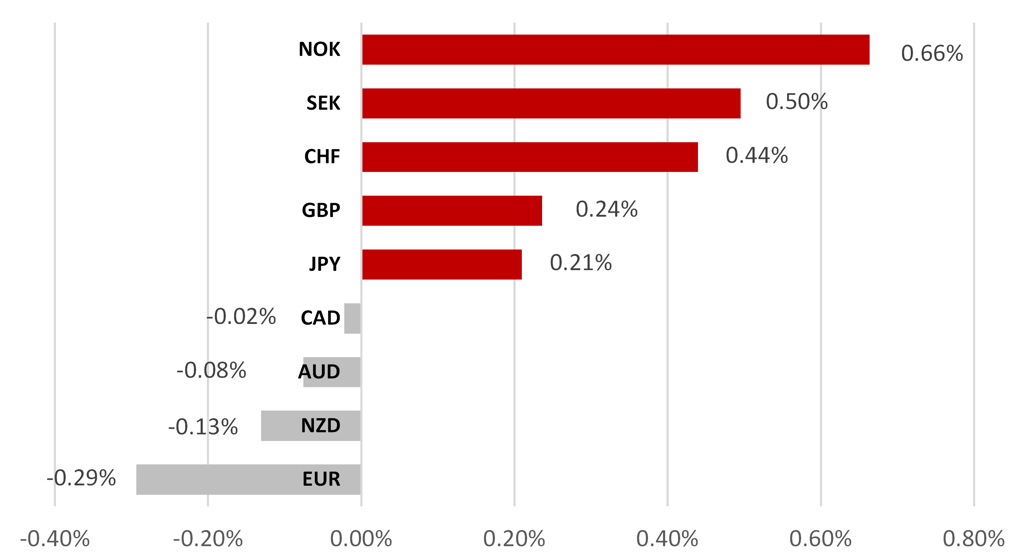

NOK OUTPERFORMANCE HELPED BY CRUDE OIL GAINS THIS WEEK

Source: Bloomberg, 13:30 GMT, 26th January 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new short EUR/GBP trade idea, and maintaining our long USD/CHF trade idea.

JPY Flows:

The monthly Balance of Payments data for November revealed the services trade balance on a 3mth basis moved to a surplus for the first time since March 2019, helping to lift the overall current account surplus.

Short Term Fair Value Modelling:

This week we monitor the relationship between spot and fair value for our JPY, GBP and EUR short-term regression models. We identify a divergence in the relationship between EUR/USD and the calculated fair value where EUR/USD has been consistently mis-valued by less than -3.5% for over a week. GBP/USD has seen a similar divergence where GBP remains under-valued at -1.6% while USD/JPY is currently overvalued at 2.7%.

FX Views

USD: An important week for the USD after a strong start to the new year

The USD has continued to rebound over the past week although it has lost some upward momentum. The dollar index is currently attempting to break above resistance provided by the 200-day moving average that comes in just above 103.50. Developments over the past week have been mixed for USD performance. On the bullish side, the USD has derived support both from: i) further evidence that the US economy is proving resilient to higher rates, and ii) the dovish ECB policy update (click here) that has encouraged euro-zone market participants to more fully (around 23bps) price in the first rate cut by the April policy meeting. US growth remained surprising for the second consecutive quarter in Q4. For the 2H of last year, the US economy expanded well above trend by an annualized rate of 4.1% and by 2.5% in 2023. Normally such strong growth would discourage the Fed from lowering rates.

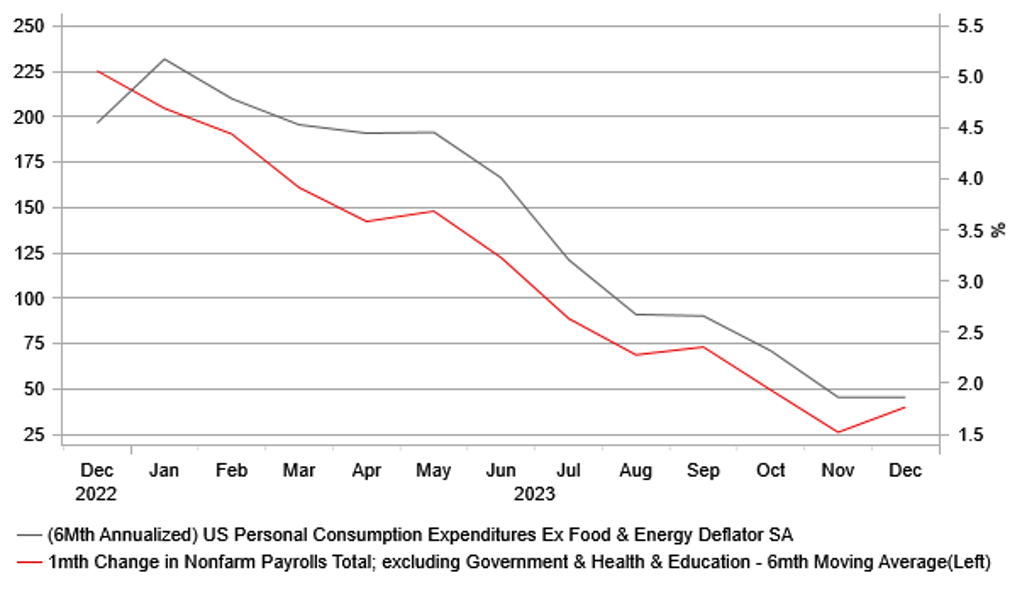

However, the period of strong growth did not prevent a faster than expected slowdown in US inflation. The core PCE deflator slowed back in line with the Fed’s 2.0% target in the second half of last year. Next week’s FOMC meeting will provide an important insight into how the Fed is weighing up the combination of stronger growth and slower inflation when calibrating the outlook for monetary policy. With US rate market pricing now finely balanced over the likelihood of a March Fed rate cut, next week’s policy update could prove to be pivotal for USD direction. After indicating that the Fed had already started to discuss rate cuts at the last FOMC meeting in December, the main downside risk for the USD in week ahead would be Chair Powell indicates that they are moving closer to lowering rates in response to slowing inflation. The case for a March cut would be reinforced if the releases next week of the latest nonfarm payrolls report for January and Employment Cost Index for Q4 are weak. There has been a clear slowdown in employment growth in more cyclically-sensitive sectors of the US labour market. It provides reassurance that labour demand is better aligned with supply.

A further near-term challenge to the USD’s near-term rebound has emerged over the past week. Investors have pared back pessimism related to Chinese assets and the economy reflecting building expectations that a more “forceful” policy response could be delivered in the coming weeks. So far the PBoC has announced a larger 50bps cut in the reserve requirement ratio, and there have been reports of plans to purchase domestic equities utilizing fuds from state-owned companies. In these circumstances, we are maintaining our bullish outlook for the USD in Q1 (click here) but are wary of the risks in the week ahead that could trigger a setback.

THE STRENGTHENING CASE FOR FED RATE CUTS

Source: Bloomberg, Macrobond & MUFG GMR

CHINA INVESTOR SENTIMENT HAS IMPACTED USD

Source: Bloomberg, Macrobond & MUFG GMR

GBP: BoE to highlight considerable shift

The pound is currently the top performing G10 currency along with the US dollar with the support provided by the expectation that the BoE will be the more cautious central bank relative to the Fed and the ECB especially given some tentative evidence emerging of some moderate pick-up in domestic demand conditions in the UK. The BoE will meet next Thursday and will coincide with the release of the latest quarterly Monetary Policy Report (MPR) that will help shape expectations on monetary policy changes going forward. The market is currently positioned for 100bps of rate cuts this year with a 50/50 probability of the rate cutting cycle commencing in May. May being the meeting when the BoE will next release the inflation projections means next week’s report will be crucial in shaping expectations for May. Pound support on a more cautious BoE has been reinforced by the general improvement in risk appetite which tends to correlate positively with the pound.

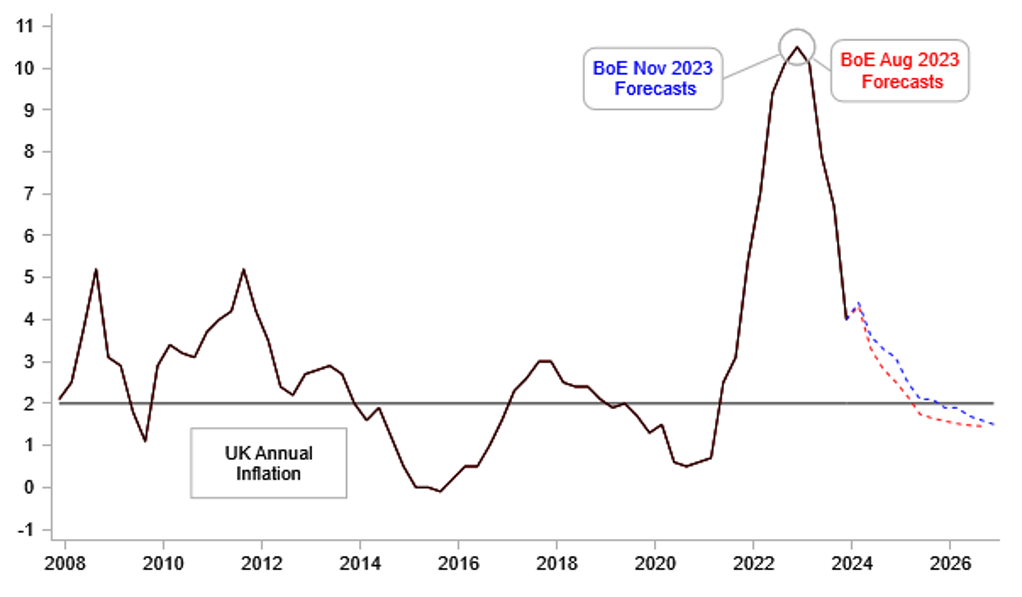

The risk rally globally of course reflects the very sharp declines in inflation that has opened up the potential for rate cuts and this large decline in inflation will be highlighted in the BoE’s MPR as well. As of the November MPR, the BoE is projecting inflation returning to 2.0% or less in Q4 2025. This is now way too pessimistic and the achievement of the 2.0% target may now be brought forward by at least a year or possibly five quarters to Q3 2024. Natural gas prices are currently at lows not seen since July last year and are 50% down from the most recent high in October. That will see the OFGEM price cap come down in April and again probably in July. This could well mean the headline CPI in April is below the 2.0% target. The notable easing of financial conditions since the last forecast update will likely see the GDP growth projections being nudged higher as well. The market rates profile used in the MPR next week is set to incorporate 100bps of cuts in 2024 and a similar lower profile over the forecast horizon.

The changes in the forecast profiles will be the key factor behind some inevitable changes to the forward guidance on policy. Two key components of forward guidance will be the primary driver of near-term reaction in the market. The vote in December was 6-3 with Megan Greene, Jonathan Haskel and Catherine Mann voting for a 25bp hike. There’s a strong chance two and possibly all three abandon their calls for a rate hike. Catherine Mann as the most hawkish could maintain that call. On the dovish side there is a chance that Swati Dhingra votes for a cut. So we could feasible see the most dovish vote composition of 8-1 with all hikes abandoned and one for a cut which would prompt the biggest dovish market reaction, which would leave GBP vulnerable to a

BOE NOVEMBER VS AUGUST CPI PROJECTIONS

Source: Bloomberg, Macrobond & MUFG GMR

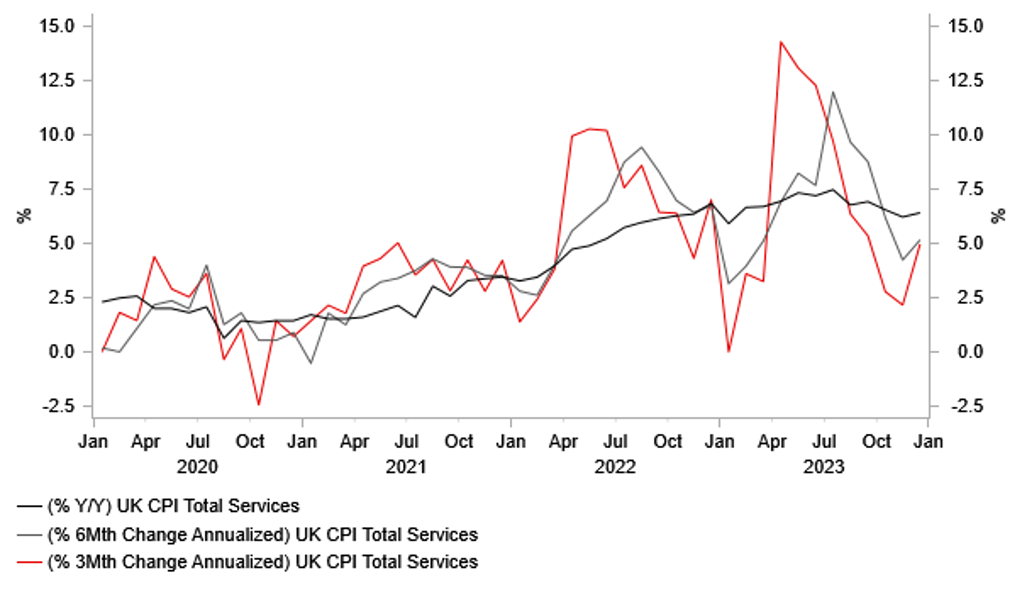

3 & 6MTH SERVICES CPI LOWER BUT STILL HIGH AT 5%

Source: Bloomberg, Macrobond & MUFG GMR

bigger near-term correction lower. 7-1-1 is also plausible and a first vote for a cut would be more significant for the markets that Mann holding out for a hike. The second pillar of forward guidance – the text in the statement – will also be crucial. The final two sentences will be the focus here. At present the MPC guidance is that monetary policy “is likely to need to be restrictive for an extended period of time” and that “further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures”. Both components should be changed with the tightening bias the most likely to be dropped. Restrictive policy it could be argued will be required and would still exist after a series of rate cuts so that could feasibly remain.

The forecasts in the MPR, the possible change in the MPC voting and the change in wording on guidance in the statement could all feasibly on the dovish side but Governor Bailey could then use the press conference to rein back any dovish market interpretation. The BoE will likely remain concerned over labour market conditions and in particular the risks from wages. Bailey could well emphasise the elevated level of services inflation as reason for caution even with headline inflation back at target. Services inflation picked up 0.1ppt to 6.4% in December and remains 3.0ppts above its 30yr average. With wage growth slowing but still elevated, the BoE seem highly likely to try and inject caution into market interpretations of the possible more dovish changes. Average Weekly Wages ex-bonuses on a 3mth YoY basis is still at 6.6% despite some slowdown. One wage survey (XpertHR) points to wage growth of 5.0% this year – still much too high. PMI data also point to a moderate pick-up in growth and consumer confidence data (GfK) released today hit a 2yr high.

Given the strong expectations of lower inflation forecasts, a less hawkish vote and more dovish guidance in the statement, we suspect positioning may leave the market reaction more prone to more hawkish surprises. Strong concerns expressed about sticky wage growth could see the market price out further the probability of a May cut and quickly see the market push back to June or even August. The 2yr Gilt yield has already rebounded (+40bps) more than in the US and the euro-zone and this could extend further on Bailey stressing caution due to sticky services inflation and wages.

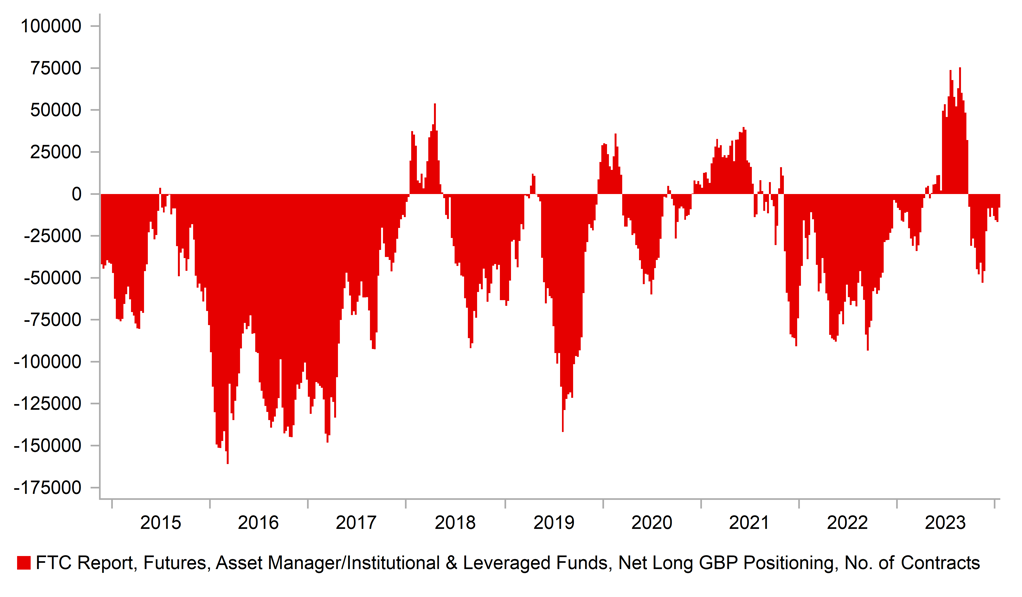

We continue to hold a USD bullish bias and if GBP is to respond to a less dovish than expected BoE policy update, we see scope for EUR/GBP to extend the current move to the downside. EUR/GBP is approaching the 2023 low of 0.8493 and a break of that level should open up a more rapid move back to the 0.8400-level that last traded in August 2022. IMM positioning certainly suggests capacity for further GBP buying.

COMBINED LEVERAGED & AM/II GBP SHORT POSITION

Source: Bloomberg, Macrobond & MUFG GMR

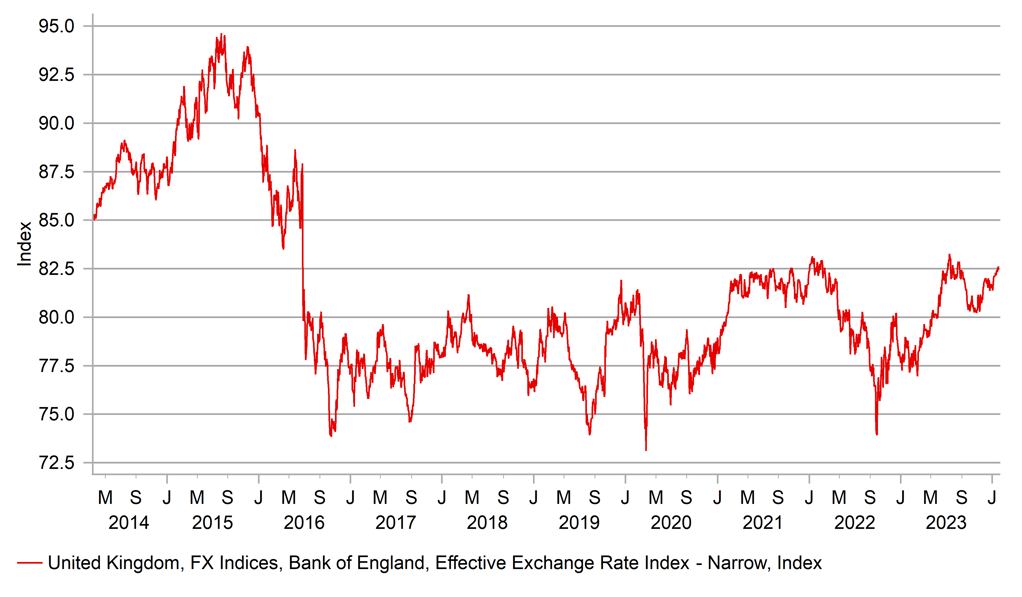

BOE GBP TWI APPROACHING POST-BREXIT HIGHS

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NZD |

01/29/2024 |

20:00 |

RBNZ Chief Economist Speaks |

!! |

|||

|

AUD |

01/30/2024 |

00:30 |

Retail Sales MoM |

Dec |

-1.5% |

2.0% |

!! |

|

EUR |

01/30/2024 |

06:30 |

France GDP QoQ |

4Q P |

-- |

-0.1% |

!! |

|

CHF |

01/30/2024 |

08:00 |

KOF Leading Indicator |

Jan |

-- |

97.8 |

! |

|

EUR |

01/30/2024 |

09:00 |

Germany GDP SA QoQ |

4Q P |

-- |

-0.1% |

!! |

|

EUR |

01/30/2024 |

10:00 |

GDP SA QoQ |

4Q A |

-- |

-0.1% |

!! |

|

USD |

01/30/2024 |

15:00 |

JOLTS Job Openings |

Dec |

-- |

8790k |

!! |

|

AUD |

01/31/2024 |

00:30 |

CPI YoY |

4Q |

4.3% |

5.4% |

!!! |

|

CNY |

01/31/2024 |

01:30 |

Composite PMI |

Jan |

-- |

50.3 |

!! |

|

EUR |

01/31/2024 |

07:45 |

France CPI EU Harmonized YoY |

Jan P |

-- |

4.1% |

!!! |

|

EUR |

01/31/2024 |

08:55 |

Germany Unemployment Change (000's) |

Jan |

-- |

5.0k |

!! |

|

EUR |

01/31/2024 |

13:00 |

Germany CPI EU Harmonized YoY |

Jan P |

-- |

3.8% |

!!! |

|

USD |

01/31/2024 |

13:15 |

ADP Employment Change |

Jan |

135k |

164k |

!! |

|

CAD |

01/31/2024 |

13:30 |

GDP MoM |

Nov |

-- |

0.0% |

!! |

|

USD |

01/31/2024 |

13:30 |

Employment Cost Index |

4Q |

1.0% |

1.1% |

!!! |

|

USD |

01/31/2024 |

19:00 |

FOMC Rate Decision (Upper Bound) |

5.50% |

5.50% |

!!! |

|

|

USD |

01/31/2024 |

19:30 |

Fed Chair Powell Press Conference |

!!! |

|||

|

SEK |

02/01/2024 |

08:30 |

Riksbank Policy Rate |

-- |

4.00% |

!!! |

|

|

EUR |

02/01/2024 |

09:00 |

HCOB Eurozone Manufacturing PMI |

Jan F |

-- |

46.6 |

!! |

|

GBP |

02/01/2024 |

09:30 |

Output Per Hour YoY |

3Q F |

-- |

-0.3% |

!! |

|

GBP |

02/01/2024 |

09:30 |

S&P Global UK Manufacturing PMI |

Jan F |

-- |

47.3 |

!! |

|

EUR |

02/01/2024 |

10:00 |

CPI Estimate YoY |

Jan |

-- |

-- |

!!! |

|

EUR |

02/01/2024 |

10:00 |

Unemployment Rate |

Dec |

-- |

6.4% |

!! |

|

EUR |

02/01/2024 |

11:30 |

ECB's Lane Speaks |

!!! |

|||

|

GBP |

02/01/2024 |

12:00 |

Bank of England Bank Rate |

-- |

5.3% |

!!! |

|

|

USD |

02/01/2024 |

13:30 |

Nonfarm Productivity |

4Q P |

1.2% |

5.2% |

!! |

|

USD |

02/01/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

02/01/2024 |

15:00 |

ISM Manufacturing |

Jan |

47.3 |

47.4 |

!! |

|

USD |

02/02/2024 |

13:30 |

Change in Nonfarm Payrolls |

Jan |

168k |

216k |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The week ahead will be important for the outlook for Fed policy. The Fed will hold their latest FOMC meeting on Wednesday, and the latest US Employment Cost Index for Q4 and nonfarm payrolls report for January will be released on Wednesday and Friday respectively. Market participants will be closely watching the comments from Fed Chair Powell at the accompanying press conference to see if he provides a clear signal over the likelihood of a rate cut as soon as at the following FOMC meeting on 20th Chair Powell provided a dovish policy surprise at the last meeting in December when he stated that the Fed had started to discuss dialing back the amount of policy restraint in response to slowing inflation. Labour market data could prove important in determining how quickly the Fed begin to cut rates. Weaker employment growth at the start of this year will likely be required to encourage the Fed to cut rates as soon as March. Fed Governor Waller indicated recently that he is becoming more confident in the likelihood of a soft landing for the US economy.

- We expect the BoE to present a less hawkish policy update in the week ahead. Inflation and wage growth slowed more than expected at the end of last year which should help to ease concerns over the risk of more persistent inflation in the UK. As a result, we expect the updated inflation projections to be revised lower. While the favourable developments should discourage hawkish MPC members from voting for further hikes, it is likely too soon to expect the BoE to signal that they will begin to reverse course and cut rates soon. The UK rate market is currently fully pricing in the first BoE rate cut by the June MPC meeting. We are not expecting the BoE to actively encourage expectations for even earlier rate cuts at next week’s MPC meeting. The release in March of an expansionary Budget from the government could make it more challenging for the BoE to cut rates as early as May.

- The other main economic data releases in the week ahead will be the latest CPI reports from Australia for Q4 and from the euro-zone for January. The Q4 CPI report for Australia is expected to provide further evidence that inflation pressures have moderated after the stronger readings recorded in 2022 and at the start of last year. In the euro-zone, inflation is expected to drop back closer to the ECB’s target in January and partially reverse the temporary adjustment higher in December.