To read the full report, please download PDF.

Key week ahead of FX markets

FX View:

The low in USD/JPY yesterday brought the drop from the high on 3rd July to ten big figures and in our view could well be a sign of a turning point in USD/JPY. We have had corrections before but this has coincided with a drop in front-end yields in the US that we believe will be sustained. The BoJ announces its policy decision on Wednesday, ahead of the FOMC later that day which will then be followed by the BoE policy decision on Thursday and the key US jobs report on Friday. We see the BoJ hiking next week although the decision is now more finely balanced with little guidance from BoJ officials. The FOMC and Fed Chair Powell will likely convey greater confidence on the potential for a rate cut while the BoE decision on Thursday is also very finely balanced. We stick to our call of a 25bp rate cut. Given downside risks to US jobs data we see scope for further US dollar weakness next week and beyond.

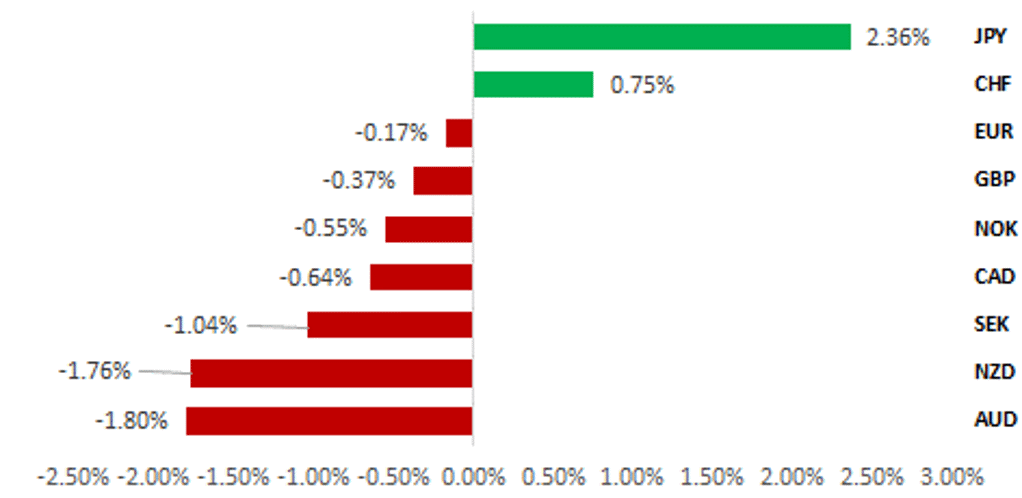

JPY SURGE AS US YIELDS FALL & RISK-OFF CORRELATION RETURNS

Source: Bloomberg, 14:30 BST, 26th July 2024 (Weekly % Change vs. USD

Trade Ideas:

We have taken profit on our long GBP/SEK trade idea and closed our long AUD/USD trade idea after the stop-loss was hit.

IMM FX Positioning:

The latest IMM weekly positioning data covering the week to 16th July revealed that Leveraged Funds significantly cut back on short JPY positions, by the largest amount since March 2011. In contrast, Leveraged Funds increased modestly further short CHF positions.

Historical analysis of FOMC rate decisions:

We have found that the impact of Fed policy updates so far this year have had a bigger impact on USD performance in the first 24 hours on average than since 2021. That is the case for all three currency pairs: USD/JPY, EUR/USD and GBP/USD.

FX Views

JPY: Position liquidation reinforces JPY gains ahead of BOJ policy update

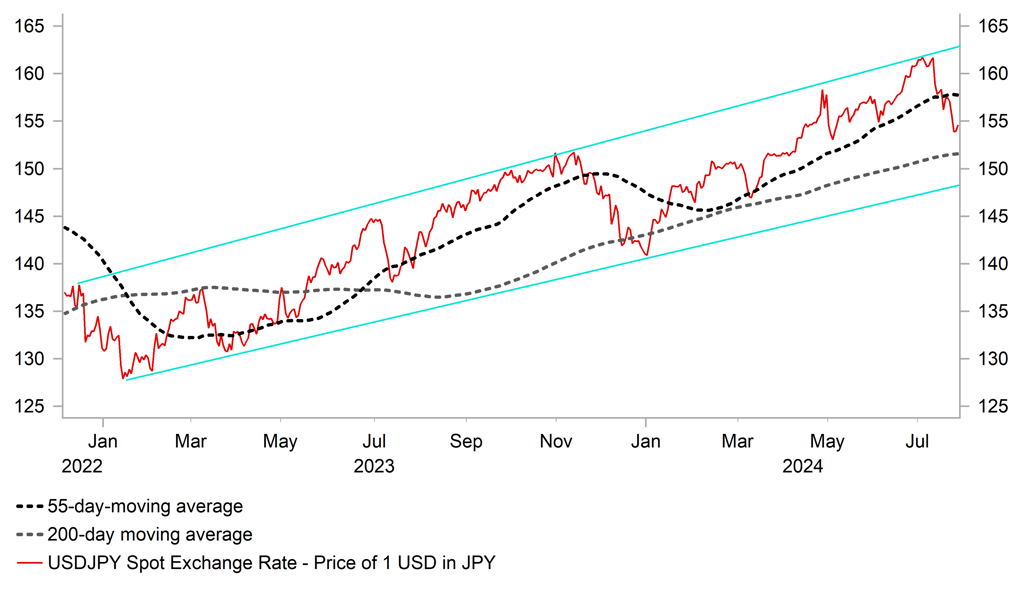

The JPY has continued to rebound over the past week resulting USD/JPY falling to an intra-day low yesterday at 151.94. The pair has now fallen by over 10 big figures from the high set earlier month on 3rd July at 161.95. It is the biggest correction lower for USD/JPY in percentage terms (-6.2%) since late last year (-7.7%). On that occasion USD/JPY failed to sustained levels below support from the 200-day moving average, and then rebounded to fresh highs. USD/JPY is again moving closer to support from the 200-moving average which comes in at around the 151.50-level. The risk reward balance of positioning for further JPY upside has become less attractive in the near-term after recent strong gains.

In our last week’s report (click here) we outlined why the tide is beginning to turn in favour of a stronger JPY. These included: i) more proactive/opportunist intervention from Japan to push down USD/JPY, ii) more compelling evidence that US inflation continues to slow and the US labour market is slackening thereby reinforcing expectations for more active Fed easing, iii) recent comments from leading Japanese politicians expressing frustration over the slow pace of BoJ policy easing ahead of next week’s meeting, and iv) recent comments from former President Trump expressing concern over the high level of USD/JPY alongside a warning that he will impose higher tariffs on Japan if action is not taken to address JPY weakness.

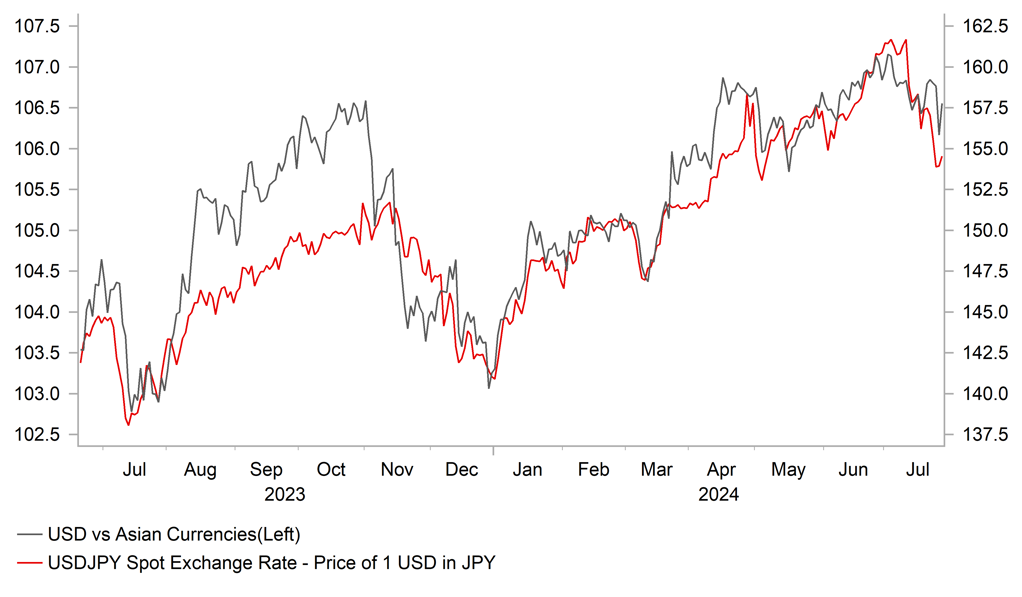

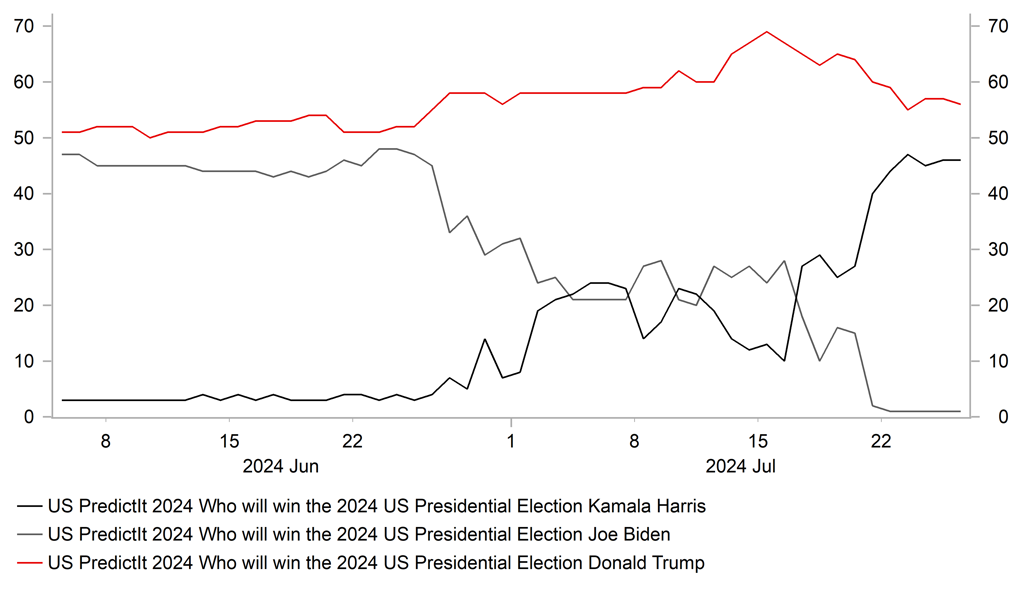

The JPY’s upward momentum has since been reinforced over the past week by the continued liquidation of FX carry trades. The JPY has outperformed alongside the other low yielding funding currency of the CHF while the higher yielding emerging currencies of the MXN, HUF and BRL have underperformed. Other Asian currencies such as the KRW, CNY, MYR and THB have all benefitted alongside the JPY from position liquidation highlighting that market participants were short Asian currencies. Sentiment towards Asian currencies has deteriorated recently in response to slowing growth momentum in China. The increasing likelihood of former President Trump winning the election in November and imposing higher tariffs on China have reinforced those growth concerns. President Biden’s decision to not seek re-election and his likely placement by Kamala Harris as the Democrat nominee has encouraged expectations that the election will be more closely contested but Trump still appears to be in a strong position. According to PredictIt, the probability of Trump winning the election has fallen back to around 57% from a recent high of 69%. While the unwinding of short positioning has helped lift he JPY and other Asian currencies, the move is unlikely to be sustained unless backed up by a change in fundamentals. We continue to believe that slowing growth momentum in China, the PBoC’s decision to lower rates (click here) further this week, and the heightened risk of higher tariffs being imposed on China will remain headwinds for the CNY and other Asian currencies in the 2H of this year.

IS ASIA FX REBOUND SUSTAINABLE?

Source: Bloomberg, Macrobond & MUFG GMR

CLOSER RACE EXPECTED AFTER BIDEN DROPS OUT

Source: MUFG & Global Markets Research

The main event risk for USD/JPY in the week ahead is the BoJ’s upcoming policy meeting on Wednesday. As outlined previously, we have been expecting the BoJ to hike rates by a further 15bps alongside announcing detailed plans to slowdown the pace of JGB purchases. However, our colleagues in Tokyo have become less confident over their rate hike call given the lack of guidance from BoJ officials. Bloomberg reported today that it has been 38 days since Governor Ueda last spoke about monetary policy which is an usually long time. The last time Governor Ueda spoke publicly was on 18th June, and he indicated in parliament that there’s a chance of rate hike if backed up by the incoming economic data. We believe that recent inflation developments including stronger wage growth should provide justification to raise rates further next week. However, it has been reported that some BoJ members could favour a delay given recent weakness in consumer spending. If the BoJ disappoints market expectations for a rate hike next week, the JPY could quickly give back some of the strong gains recorded over the past week resulting in USD/JPY rising back above 155.00-level. If the BoJ does not hike next week, the timing of any future hike could then be complicated by the timing of the LDP leadership election in September and US election in November. As a result, the BoJ may not be in a position to hike again until December if they skip next week. In contrast, we are more confident that the BoJ will announce plans for a “sizeable” slowdown the pace of JGB purchases from around JPY6 trillion/month to around JPY2 trillion/month over the next two years. It is consistent with purchases slowing in quarterly steps of around JPY500 billion. A development that should continue to place upward pressure on Japanese yields further out the curve even if the BoJ delays hiking rates next week.

On the other hand, we expect the Fed to signal that they are moving closer to cutting rates at next week’s FOMC meeting. Even former New York Fed President Bill Dudley who had been strongly advocating that the Fed keeps rates higher for longer based on his assessment that the policy rate was not as restrictive as the Fed believes, has performed an abrupt u-turn is now calling on the Fed to cut rates as soon as this month. He is more concerned by the ongoing rise in the unemployment rate. The releases in the week ahead of the nonfarm payrolls report for July and Employment Cost Index (ECI) for Q2 will shed further light on how the US labour market is becoming better balanced and helping to dampen upside risks for wages and inflation. The US rate market is already more than fully pricing in a 25bps cut at the September FOMC meeting so unless Chair Powell provides a signal that the Fed could consider cutting rates in larger increments then there is a high hurdle for the USD to weaken much further on the back of next week’s policy update. The Fed would have to become more concerned that it has fallen behind the curve to consider larger rate cuts which appears unlikely based on the recent data flow.

USD/JPY DROPS BACK TO SUPPORT FROM 200-DMA

Source: Bloomberg, Macrobond & MUFG GMR

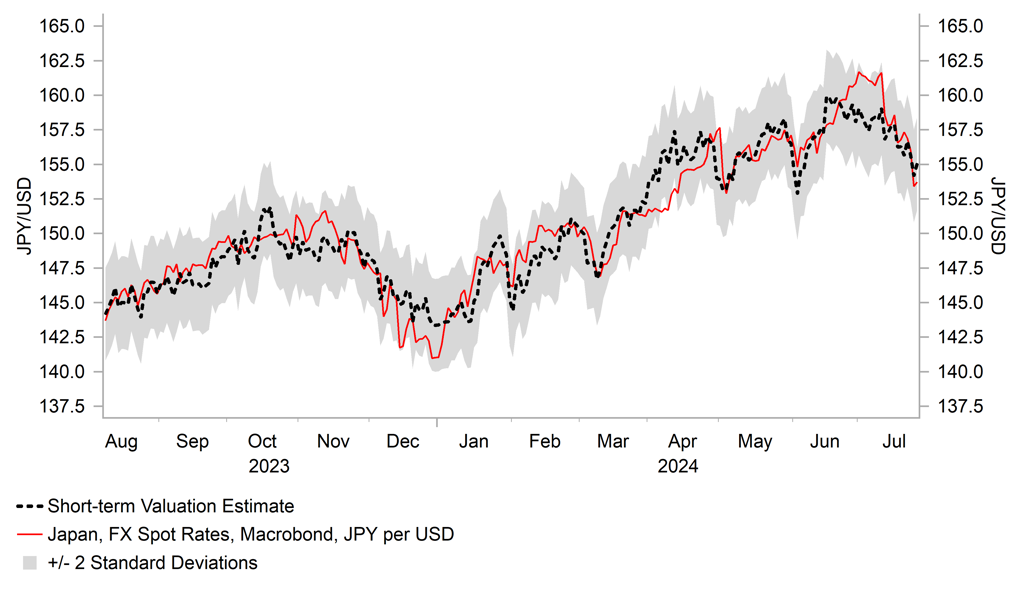

JPY WEAKNESS OVERSHOOT HAS CORRECTED

Source: Bloomberg, Macrobond & MUFG GMR

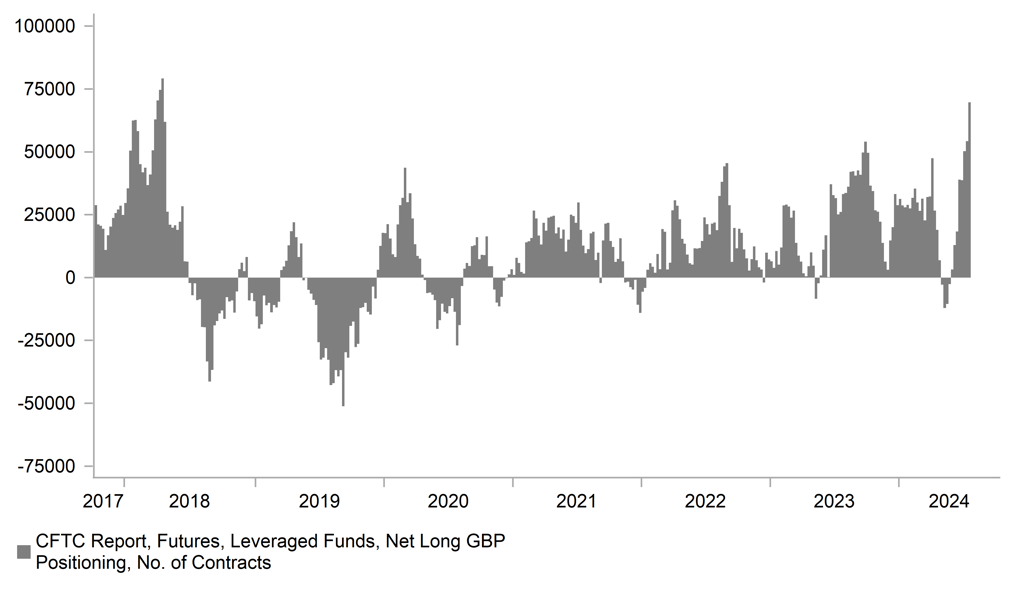

The other major central bank to hold a policy update next week will be the BoE on Thursday. The GBP has given back some of its recent gains over the past week as it has been caught up in the broad-based positioning unwind. It has resulted in cable falling back towards support at around 1.2850 after failing to sustain a break above the 1.3000-level. The latest IMM positioning report revealed that long positions held by Leveraged Funds prior to last week had jumped to their highest level since April 2018. For comparison in early 2018 cable had been attempting to break above the 1.4000-level before peaking in April and then falling back towards the 1.3000-level by mid- 2018. Looking beyond the near-term position adjustment, fundamental drivers remain supportive for the GBP. The UK economy’s cyclical momentum has been much stronger than expected in the 1H of this year. The large majority for the Labour government should provide greater political stability which should be more supportive for the growth outlook.

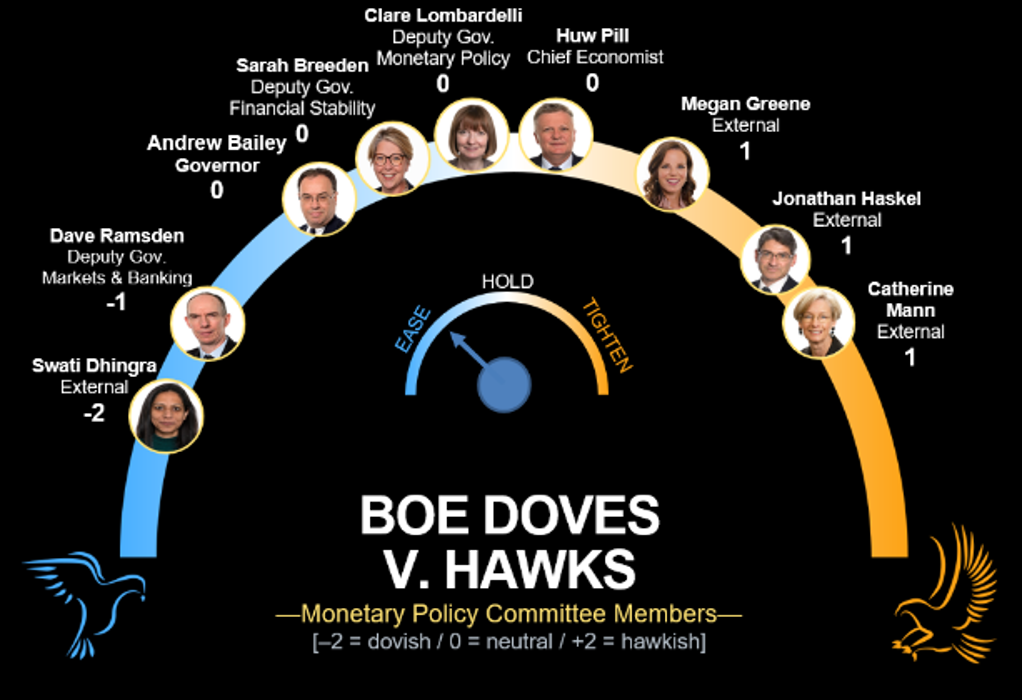

Yields on offer in the UK remain higher than in most other G10 economies, and we have become less confident that the BoE will begin to cut rates next week. Our call for a 25bps cut next week mainly rests on the guidance from the June meeting in which it was revealed that some MPC members’ decision to leave rates on hold was “finely balanced”. It would only take three MPC members to change their mind and vote for a rate cut next week. The most likely candidates to change their mind are Governor Bailey, Deputy Governor Breeden, and Chief Economist Pill. New Deputy Governor Lombardelli will also be voting for the first time. However in a recent speech Chief Economist Pill indicated that he was unlikely to vote for a cut as soon as next week. The UK rate market is currently pricing in around a 50:50 probability of a cut next week. We judge that the balance of risks to be skewed to the upside for the GBP. If the BoE disappoints and leaves rates on hold then the GBP will strengthen further. On the other hand if the BoE cuts rates, the GBP will initially weaken but could quickly rebound once the dust settles supported by cautious guidance from the BoE over further easing. We are expecting the BoE to deliver similar guidance to the ECB by indicating policy is not on a pre-determined path and they’ll continue to monitor inflation persistence risks

LONG GBP POSITIONS HAD HIT MULTI-YEAR HIGH

Source: Bloomberg, Macrobond & MUFG GMR

WILL 3 MPC MEMBERS SHIFT VOTE IN FAVOUR OF CUT?

Source: Bloomberg

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

07/30/2024 |

00:30 |

Jobless Rate |

Jun |

2.6% |

2.6% |

!! |

|

EUR |

07/30/2024 |

06:30 |

France GDP QoQ |

2Q P |

-- |

0.2% |

!!! |

|

EUR |

07/30/2024 |

09:00 |

Germany GDP SA QoQ |

2Q P |

0.1% |

0.2% |

!!! |

|

EUR |

07/30/2024 |

10:00 |

GDP SA QoQ |

2Q A |

-- |

0.3% |

!!! |

|

USD |

07/30/2024 |

15:00 |

JOLTS Job Openings |

Jun |

-- |

8140k |

!! |

|

JPY |

07/31/2024 |

00:50 |

Retail Sales MoM |

Jun |

0.1% |

1.6% |

!! |

|

AUD |

07/31/2024 |

02:30 |

Retail Sales MoM |

Jun |

0.4% |

0.6% |

!! |

|

CNY |

07/31/2024 |

02:30 |

Manufacturing PMI |

Jul |

49.3 |

49.5 |

!! |

|

CNY |

07/31/2024 |

02:30 |

Non-manufacturing PMI |

Jul |

50.5 |

!! |

|

|

AUD |

07/31/2024 |

02:30 |

CPI YoY |

Jun |

3.8% |

4.0% |

!!! |

|

JPY |

07/31/2024 |

Tbc |

BOJ Target Rate (Upper Bound) |

0.10% |

0.10% |

!!! |

|

|

EUR |

07/31/2024 |

07:45 |

France CPI YoY |

Jul P |

-- |

2.2% |

!! |

|

EUR |

07/31/2024 |

08:55 |

Germany Unemployment Change (000's) |

Jul |

-- |

19.0k |

!! |

|

EUR |

07/31/2024 |

10:00 |

CPI Estimate YoY |

Jul |

-- |

2.5% |

!!! |

|

USD |

07/31/2024 |

13:15 |

ADP Employment Change |

Jul |

170k |

150k |

!! |

|

USD |

07/31/2024 |

13:30 |

Employment Cost Index |

2Q |

1.0% |

1.2% |

!!! |

|

CAD |

07/31/2024 |

13:30 |

GDP MoM |

May |

0.2% |

0.3% |

!! |

|

USD |

07/31/2024 |

19:00 |

FOMC Rate Decision (Upper Bound) |

5.50% |

5.50% |

!!! |

|

|

EUR |

08/01/2024 |

10:00 |

Unemployment Rate |

Jun |

-- |

6.4% |

!! |

|

GBP |

08/01/2024 |

12:00 |

Bank of England Bank Rate |

5.00% |

5.25% |

!!! |

|

|

GBP |

08/01/2024 |

12:30 |

BoE Press Conference |

!!! |

|||

|

USD |

08/01/2024 |

13:30 |

Nonfarm Productivity |

2Q P |

1.6% |

0.2% |

!! |

|

USD |

08/01/2024 |

13:30 |

Unit Labor Costs |

2Q P |

-- |

4.0% |

!! |

|

USD |

08/01/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

08/01/2024 |

15:00 |

ISM Manufacturing |

Jul |

49.0 |

48.5 |

!! |

|

CHF |

08/02/2024 |

07:30 |

CPI YoY |

Jul |

1.3% |

1.3% |

!! |

|

USD |

08/02/2024 |

13:30 |

Change in Nonfarm Payrolls |

Jul |

188k |

206k |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The week ahead will be important for central bank policy updates. The BoJ and the Fed hold their latest policy meetings on Wednesday followed by the BoE on Thursday.

- We have been calling for the BoJ to hike rates further by 15bps at next week’s policy meeting supported by the improving inflation outlook. Ahead of the policy meeting the BoJ has come under more pressure from leading Japanese politicians to tighten policy. The LDP leadership election is scheduled to take place in September which are argues in favour of hiking rates next week. However, there has been no clear indication from the BoJ that they are planning to hike rates next week highlighting that it is far from a done deal. According to Bloomberg, some BoJ officials favoured delaying hiking rates given concerns over recent weakness in consumer spending. At the same time, the BoJ will outline plans to slowdown the pace of JGB purchases. The BoJ has indicated that is considering halving the current pace of monthly purchases from around JPY6 trillion over a couple of years, although that could be done in number of steps.

- The Fed is expected to leave rates on hold next week although we expect Chair Powell to at least acknowledge that they are moving closer to cutting rates at the following meeting in September. The June US CPI report provided the most compelling evidence that inflation continues to slow and the unemployment rate is continuing to move gradually higher strengthen the case for the Fed to begin lowering rates. The release of the latest nonfarm payrolls report for July and Employment Cost /Index for Q2 in the week ahead will be watched for further evidence of softening labour demand and moderating wage growth.

- The BoE’s policy decision in the week ahead is a close call. We are sticking to our forecast for the BoE to begin cutting rates by delivering a 25bps cut mainly based on the guidance from the last MPC meeting that some members decisions to keep rates on hold in June was already finely balanced. However, recent economic data since the June MPC meeting have been mixed and BoE Chief Economist Huw Pill indicated he is unlikely to vote for a cut.