To read the full report, please download PDF.

JPY vol picks up but what’s changed?

FX View:

Today saw a large 3.5-big figure drop in USD/JPY fuelled by the confirmation of Shigeru Ishiba winning the LDP leadership election which will be followed by a formal vote in the Diet on Tuesday to approve him as Japan’s new Prime Minister. Today we look at the implications of this change and our initial take is that policy direction will be broadly similar. An economic stimulus package to support household spending could come quickly and may alter expectations of the timing of the next rate hike. The timing of a possible general election will be important too. The focus now will shift to the US jobs report at the end of next week and another weak report would be much more influential on USD/JPY over the coming weeks than this election outcome. We also see an increased risk of back-to-back ECB rate cuts following very weak inflation data today. That will help limit the scale of any US dollar sell-off over the coming weeks, certainly against the euro.

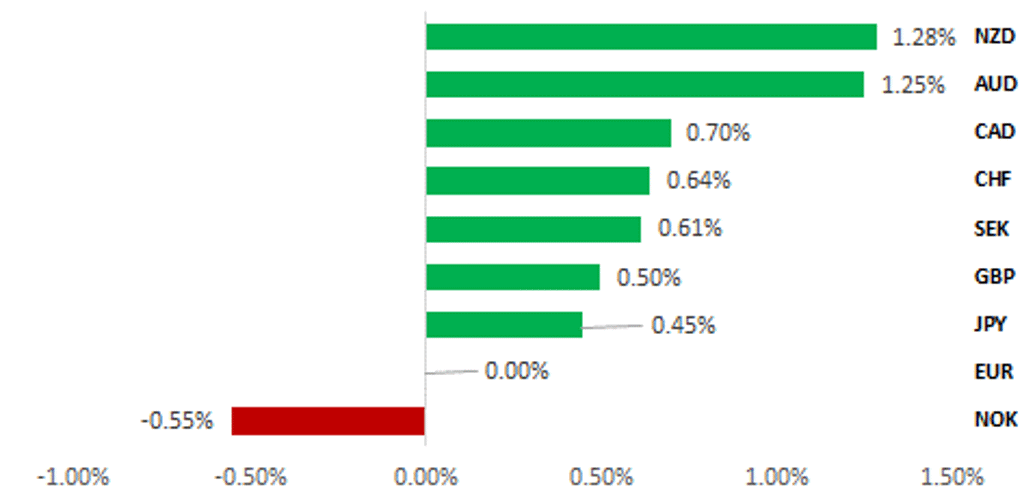

USD WEAKENS BROADLY BUT EUR & NOK UNDERPERFORM

Source: Bloomberg, 12:45 BST, 27th September 2024 (Weekly % Change vs. USD

Trade Ideas:

We are recommending a new long AUD/USD trade idea to capture building investor optimism over the growth outlook in China.

High frequency flows:

This week we look at the weekly cross-border flow data. Foreign investors remained heavy sellers of Japan equities last week and over a 4-week total basis sold a record JPY 6,660bn..

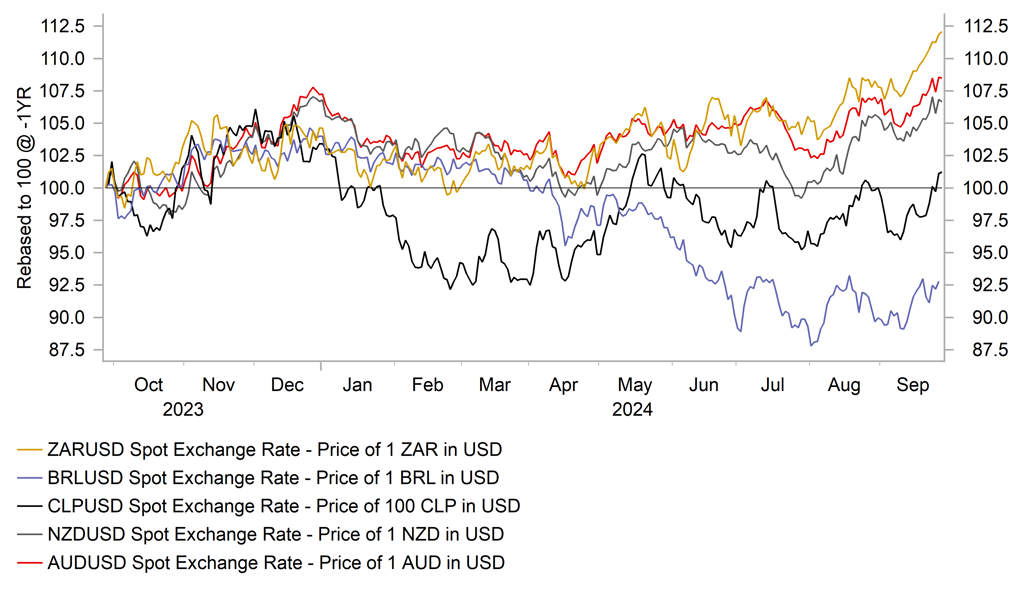

China optimism and Historical FX returns:

Looking back at previous periods of positive China sentiment, our analysis highlights that Asian currencies have been the main beneficiaries followed by Latam currencies. The top three performing Asian currencies have been the MYR, KRW and SGD. Amongst Latam currencies, the MXN and CLP have been the best performers. In contrast, the performance of VND, IDR and INR has been less impacted by positive China sentiment. It provides an indication of which currencies could strengthen further if China sentiment continues to improve on the back of this week’s policy pivot.

FX Views

JPY: Market implications of LDP leadership election result

The LDP leadership election today in Japan has prompted a significant swing in USD/JPY, which currently has dropped over 3.5-big figures from the intra-day high of 146.50 fuelled by the election victory for Shigeru Ishiba. The swing reflected the sharp divergence in economic views between Ishiba and the 2nd round head-to-head candidate of Sanae Takaichi. The markets (and us) under-estimated the support Takaichi received and indeed she came top in the first round of voting with 181 votes to Ishiba’s 154 votes. But in the second round, which was more weighted to the LDP Diet members, it seems the candidate with greater broader appeal amongst the electorate swung the majority of support behind Ishiba – just. He won the head-to-head 215 votes to 194 (52.6% vs 47.4%) a still very tight vote. So what does the change in leadership in Japan mean for economic policy in Japan and what are the implications for the yen?

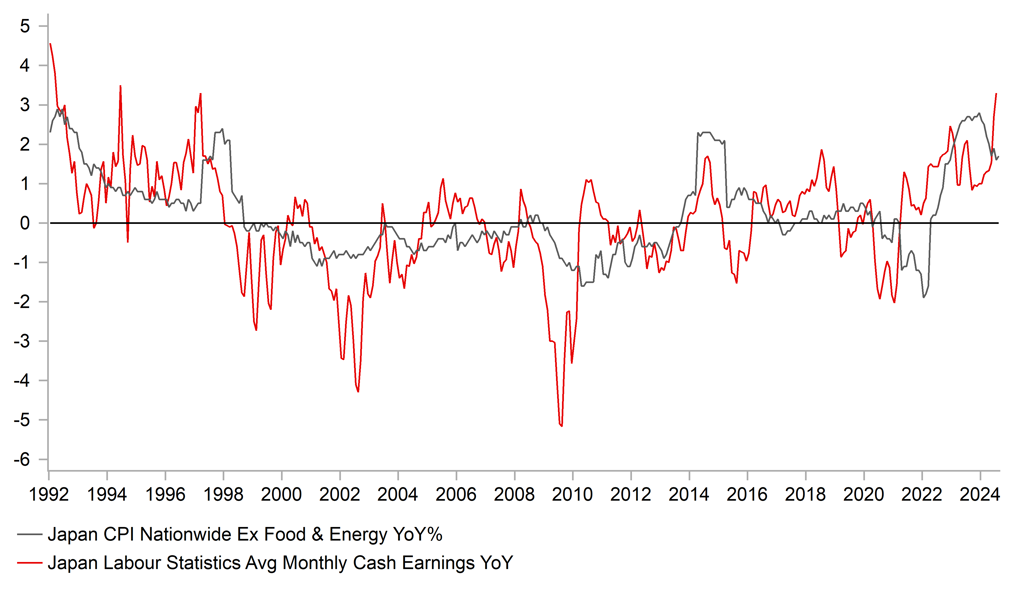

A 30-minute press conference took place in Tokyo earlier with Ishiba touching on some aspects of policy that he had mentioned while campaigning for the leadership. Defeating deflation remains the primary focus which it could be argued doesn’t exactly seem compatible with his strong support of the BoJ raising interest rates. He has also mentioned ensuring that wage growth is above the rate of inflation in order to support households and strengthen domestic demand. Prior to the leadership election Ishiba had indicated his intention to present an economic package of measures quickly to help with the cost of living crisis and support the economy and while that wasn’t repeated explicitly in the press conference the focus on the economy and emphasising the fight against deflation makes it likely that this will be the focus of his new administration once he is voted in as prime minister. The Diet will vote on Tuesday which is now just a formality. The vote will then be followed by the naming of his cabinet which Ishiba has promised today will be based on merit and not on past LDP political factions. Given this leadership election took place free of factional voting, it could mark the end of strong formal factional politics within the LDP.

Beyond this focus on the economy and defeating deflation, Ishiba has some clear views in regard to foreign policy. Ishiba has been quite vocal in his support for Taiwan and recently visited Taiwan. China’s foreign ministry spokesperson today in responding to a question repeated China’s opposition to Japan’s politicians visiting Taiwan. Ishiba has also expressed views on how to deal with China suggesting that Asia should manage relations with China with some greater degree of independence from the US. In the same vein Ishiba has expressed a view on the creation of an Asian NATO alliance to strengthen the region on the international stage. Ishiba in today’s press conference repeated his desire to reset the US forces agreement to give better balance to the current agreement. One can imagine that certainly with Trump in the White House this reset could create an upturn in US-Japan tensions that could see the relationship deteriorate if not managed carefully.

ISHIBA FOCUS - BOOSTING WAGES TO END DEFLATION

Source: Bloomberg, Macrobond & MUFG Research

OIS PRICING FOR UPCOMING BOJ MEETINGS

Source: Bloomberg, Macrobond & MUFG GMR

In today’s press conference there was no clear indication given over a possible dissolution of the Diet in order to hold a general election. If Ishiba’s primary initial goal is to implement an economic package to support household spending, then that could well mean we do not get an immediate dissolution and an election. An immediate dissolution would have presented the prospect of an election in November. A delay to finalise an economic package could still allow for an election toward the end of the year or January. This would certainly undermine the ability of the BoJ to make a policy change at the final meeting of the year on 19th December. The OIS market currently has about 7bps priced for that meeting. So we would argue that the prospect of a December rate hike has diminished somewhat. The first meeting of 2025 is on 24th January and that is now the more realistic timing for the next rate BoJ increase.

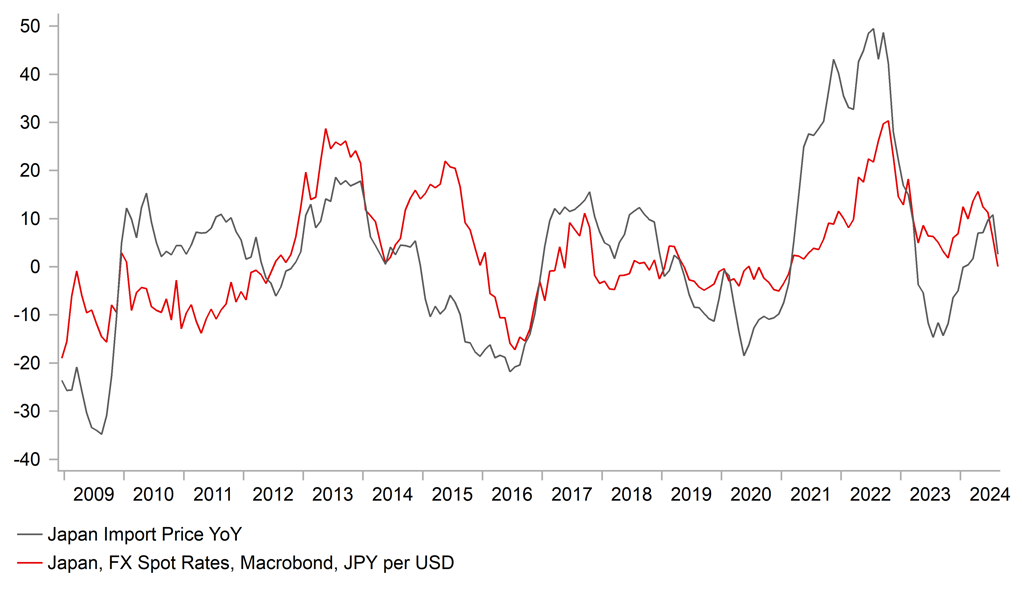

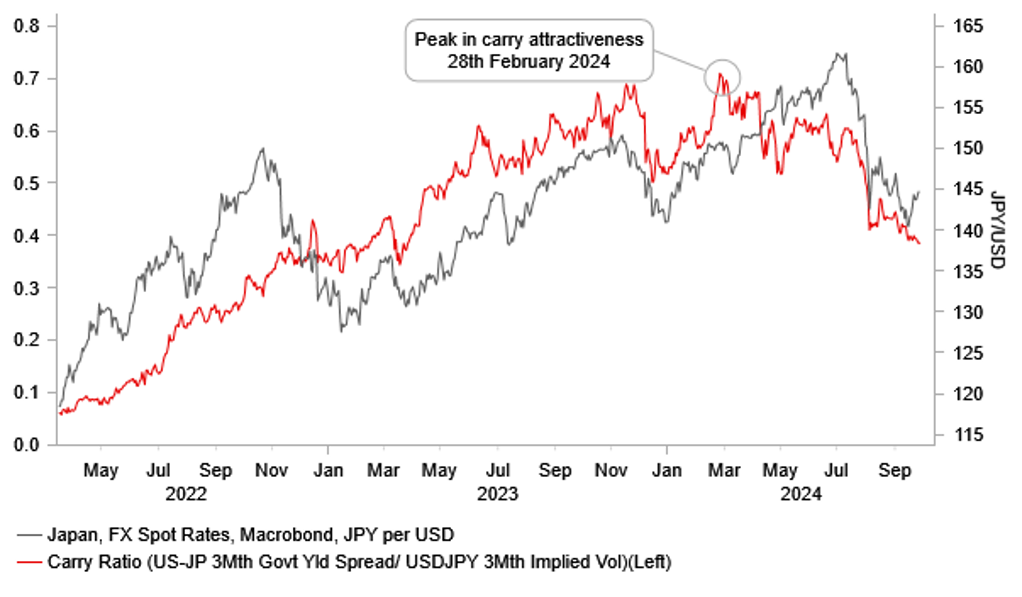

The surge of the yen after the result was as much about what Ishiba is not as what he is and he is not Sanae Takaichi who is a strong opponent of BoJ monetary tightening. Ishiba’s message giving focus to defeating deflation does not exactly sit with strong support of the BoJ policy stance and will be caveated by incoming economic data. But a fiscal package implemented over the near-term will likely be enough to justify further monetary tightening although the election timing will be important in dictating the timing of that next rate hike. We have already stated here in recent weeks that the huge drop in USD/JPY is altering expectations and behaviour. The USD/JPY market is shifting from a buy-on-dips market to a sell-on-rallies market as market participants remain under-hedged against yen upside risks. We would argue today’s election result is broadly consistent with status-quo in regard to the BoJ although a large enough fiscal support package could lift expectations of a BoJ rate hike coming sooner. In a status-quo scenario the speed of the move lower will therefore still mainly be determined by the speed of Fed rate cuts and hence incoming economic data like next Friday’s non-farm payrolls report. Therefore yen upside risks will prevail and a retest of the USD/JPY lows below 140.00 in Q4 remains very feasible.

JPY STRENGTH REDUCING UPSIDE INFLATION RISKS

Source: Bloomberg, Macrobond & MUFG Research

CARRY CONDITIONS NOT CONDUCIVE TO WEAKER JPY

Source: Bloomberg, Macrobond & MUFG GMR

CNY: Policy pivot provides support for Asian & commodity currencies

The main macro development over the past week has been the significant shift in domestic policy settings in China in response to further evidence of slowing growth momentum over the summer. Slowing growth in China had contributed to Bloomberg’s commodity price index falling to year to date lows over the summer and to the lowest level since back in 2021. It was making it increasingly difficult for the government to meet their GDP growth target for this year of around 5%. The unfavourable developments have finally triggered a significant policy response from domestic policymakers. The package of easing measures (click here) included further rate cuts and providing support more directly for the weak housing and domestic equity markets.

The new measures clearly represent a step-up in policy support that signals domestic policymakers are more serious in their efforts to prevent growth from weakening further heading into year end. It has been reported as well that fresh capital could be injected into the largest state banks for the first time since during the Global Financial Crisis. Policy action has been reinforced by the accompanying message delivered by the Politburo who signalled strongly that further policy support will be forthcoming if needed. It has even drawn some comparisons to ECB President Draghi’s “whatever it takes” speech during the euro-zone debt crisis. Market participants are now eagerly awaiting to see if the government announces plans to increase fiscal stimulus or at least sends instructions to speed up the implementation of current plans.

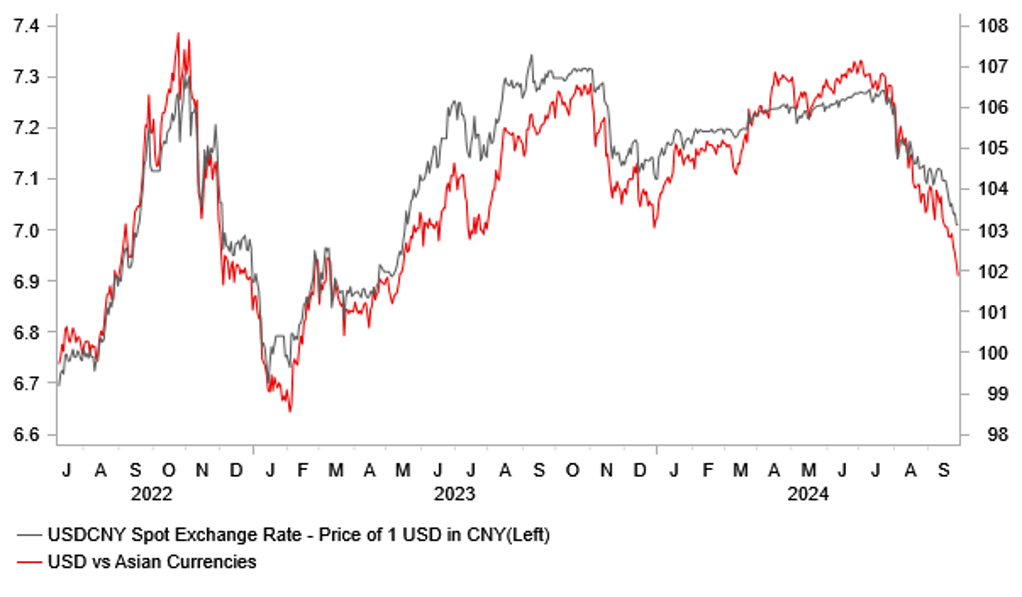

The important policy shift is already reverberating through financial markets. Sentiment towards Chinese assets and the renminbi is improving as evident by the almost 15% rebound for the Shanghai Composite index from this month’s lows which has fully reversed weakness over the summer. In the FX market, the upward trend for Asian currencies that has been in place in recent months driven by expectations for faster Fed easing has been reinforced. It has already resulted in USD/CNH trading back below the 7.0000-level for the first time since May of last year. The THB and MYR have continued to outperform alongside some catch up strength for the KRW. Beyond Asian currencies, the other main beneficiaries so far have been the commodity related EM currencies of the CLP, ZAR and BRL. After underperforming so far this year, the policy shift in China could trigger a further reversal of Latam FX weakness. USD/BRL and USD/CLP are currently testing key support at the 5.4000 and 900.00-levels respectively. Similar price action has been evident amongst G10 currencies with the commodity currencies AUD and NZD outperforming this week. AUD/USD is currently testing key resistance levels at around the 0.6900-level which if broken would open up room for an extended rebound into the low-to-mid 0.7000’s.

STRONGEST REBOUND FOR ASIA FX SINCE 2022/23

Source: Bloomberg, Macrobond & MUFG GMR

ZAR LEADS THE WAY WHILE BRL HAS LAGGED BEHIND

Source: Bloomberg, Macrobond & MUFG GMR

The policy shift from China quickly follows the dovish policy pivot from the Fed after they delivered a larger 50bps rate cut earlier this month. The Fed’s decision to lower rates has created more room for the PBoC and other global central banks to keep lowering rates without increasing the risk of much weaker domestic currencies. It is a favourable development for the global growth outlook and has helped to ease investor concerns over a harder landing for the global economy. Global commodity prices have already started to respond with Bloomberg’s commodity price index rising by around 7% from this month’s lows and reversing weakness over the summer. However, there are still pockets of weakness amongst commodity prices. In recent days the price of oil has fallen back towards year to date lows undermined by concerns that a shift could also take place in the strategy of OPEC+ members. The Financial Times reported that Saudi Arabia is ready to abandon its unofficial oil price target of USD100/barrel as it shifts its focus towards preserving market share. The report states that Saudi Arabia is committed to increasing production as planned on 1st December after the recent two month delay according to people familiar with the country’s stance. While the report has not been officially confirmed, it does pose downside risks to our forecast (click here) for the price of oil to be held between USD80 and 90/barrel in the year ahead. Oil supply concerns are currently dampening upward pressure on the price of oil from a potential pick-up in demand from China. The IEA recently downgraded their forecasts for China oil demand this year due to weakness over the summer. The lower oil price helps to explain why the NOK has underperformed this week.

In these circumstances, we expect the tailwinds for Asian and commodity-related currencies to remain in place in the near-term. The main down risk to the upward trends is still posed by the upcoming US election on 5th November. The election outcome remains closely balanced, and the chance of Donald Trump winning a second term as president would deliver a significant blow to improving sentiment towards Asian and commodity currencies primarily through his threat to start another trade war. In contrast, a win for Kamala Harris could see the upward trends for Asian and commodity currencies extend into early next year like back in late 2022/early 2023. On that occasion, USD/CNY fell by almost 9% to just below the 6.7000-level from a high of just above the 7.3000-level. It highlights the potential for further gains if a second Trump presidency is avoided. In contrast, if Trump wins we expect the upward trends to be brought to an abrupt end.

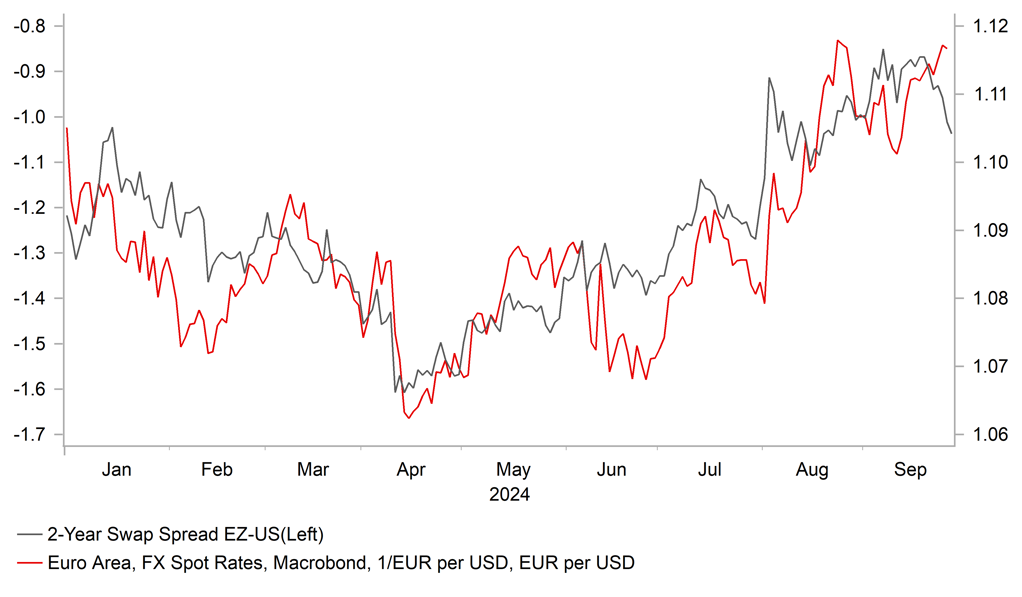

Additionally, the improving growth outlook in China is a supportive development for the EUR giving us more confidence that EUR/USD will continue to trade in a higher range between 1.1000 and 1.1500. However, further EUR upside is being curtailed by building expectations for the ECB to speed up the pace of rate cuts. Much weaker inflation in September provides justification to deliver a back-back rate cut in October.

SUPPLY CONCERNS HOLDING BACK OIL FX

Source: Bloomberg, Macrobond & MUFG GMR

FASTER ECB RATE CUT EXPECTATIONS WEIGH ON EUR

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

09/30/2024 |

00:50 |

Industrial Production MoM |

Aug P |

-0.5% |

3.1% |

!! |

|

JPY |

09/30/2024 |

00:50 |

Retail Sales MoM |

Aug |

0.5% |

0.2% |

!! |

|

CNY |

09/30/2024 |

02:30 |

Manufacturing PMI |

Sep |

49.5 |

49.1 |

!! |

|

CNY |

09/30/2024 |

02:30 |

Non-manufacturing PMI |

Sep |

50.4 |

50.3 |

!! |

|

EUR |

09/30/2024 |

07:00 |

Germany Retail Sales MoM |

Aug |

-- |

-- |

!! |

|

GBP |

09/30/2024 |

07:00 |

GDP QoQ |

2Q F |

0.6% |

0.6% |

!! |

|

CHF |

09/30/2024 |

08:00 |

KOF Leading Indicator |

Sep |

101.0 |

101.6 |

!! |

|

GBP |

09/30/2024 |

09:30 |

M4 Money Supply YoY |

Aug |

-- |

2.1% |

!! |

|

EUR |

09/30/2024 |

13:00 |

Germany CPI YoY |

Sep P |

-- |

1.9% |

!!! |

|

EUR |

09/30/2024 |

14:00 |

ECB's Lagarde Speaks |

!!! |

|||

|

USD |

09/30/2024 |

18:00 |

Fed's Powell Speaks |

!!! |

|||

|

JPY |

10/01/2024 |

00:30 |

Jobless Rate |

Aug |

2.6% |

2.7% |

!! |

|

JPY |

10/01/2024 |

00:50 |

Tankan Large Mfg Index |

3Q |

13.0 |

13.0 |

!! |

|

AUD |

10/01/2024 |

02:30 |

Retail Sales MoM |

Aug |

0.4% |

0.0% |

!! |

|

EUR |

10/01/2024 |

08:15 |

ECB's Nagel Speaks |

!! |

|||

|

EUR |

10/01/2024 |

09:00 |

Eurozone Manufacturing PMI |

Sep F |

-- |

44.8 |

!! |

|

GBP |

10/01/2024 |

09:30 |

S&P Global UK Manufacturing PMI |

Sep F |

-- |

51.5 |

!! |

|

EUR |

10/01/2024 |

10:00 |

CPI Estimate YoY |

Sep |

-- |

2.2% |

!!! |

|

USD |

10/01/2024 |

15:00 |

JOLTS Job Openings |

Aug |

-- |

7673k |

!! |

|

USD |

10/01/2024 |

15:00 |

ISM Manufacturing |

Sep |

47.0 |

47.2 |

!! |

|

GBP |

10/01/2024 |

15:00 |

BoE Chief Economist Pill Speaks |

!!! |

|||

|

EUR |

10/02/2024 |

10:00 |

Unemployment Rate |

Aug |

-- |

6.4% |

!! |

|

EUR |

10/02/2024 |

10:30 |

ECB's Lane Speaks |

!!! |

|||

|

USD |

10/02/2024 |

13:15 |

ADP Employment Change |

Sep |

125k |

99k |

!!! |

|

CHF |

10/03/2024 |

07:30 |

CPI YoY |

Sep |

1.1% |

1.1% |

!! |

|

EUR |

10/03/2024 |

09:00 |

HCOB Eurozone Services PMI |

Sep F |

-- |

50.5 |

!! |

|

GBP |

10/03/2024 |

09:30 |

S&P Global UK Services PMI |

Sep F |

-- |

52.8 |

!! |

|

USD |

10/03/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

10/03/2024 |

15:00 |

Factory Orders |

Aug |

-- |

5.0% |

!! |

|

USD |

10/03/2024 |

15:00 |

ISM Services Index |

Sep |

51.5 |

51.5 |

!!! |

|

USD |

10/04/2024 |

13:30 |

Change in Nonfarm Payrolls |

Sep |

140k |

142k |

!!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The main economic data release in the week ahead will be the latest nonfarm payrolls report for September. The Fed’s decision to deliver a larger 50bps rate cut this month was encouraged in part by the weaker US labour market. Employment growth has slowed significantly over the last five month to August averaging 135k jobs/month and even fell below 100k in July. It compares to average jobs gains of 255k/month in the previous five months. Another weaker employment report would reinforce expectations that the Fed may he to deliver further large 50bps rate cuts even if they are planning a gradual path of 25bps rate cuts. A further increase in the unemployment rate would cast doubt on the Fed’s updated forecasts for unemployment to increase only modestly to a peak of 4.4%. Before the release of the latest nonfarm payrolls report, Fed Cahir Powell is scheduled to delivered a keynote address at the National Association for Business Economics conference on Monday.

- Market participants will be watching even more closely than normal the release of the latest euro-zone CPI report for September on Tuesday. After the release of much weaker euro-zone PMI surveys earlier this week that have signalled an increased risk of economic stagnation later this year, the euro-zone rate market has moved to more fully price in a back-to-back ECB rate cut at the next meeting in October. Much weaker euro-zone inflation in September has reinforced ECB rate cut expectations. ECB President Lagarde and Chief Lane are scheduled to speak as well in the week ahead. At the same time, French Finance Minister Armand is scheduled to outline much anticipated details of their budget proposals for 2025 on Tuesday.

- After the announcement of a package of easing measures to support growth over the past week including rate cuts, direct support for the housing and domestic equity markets, market participants are waiting to see Chinese policymakers reveal further details over plans for fiscal policy in the week ahead.