To read the full report, please download PDF.

Safe haven currencies benefit from growth fears

FX View:

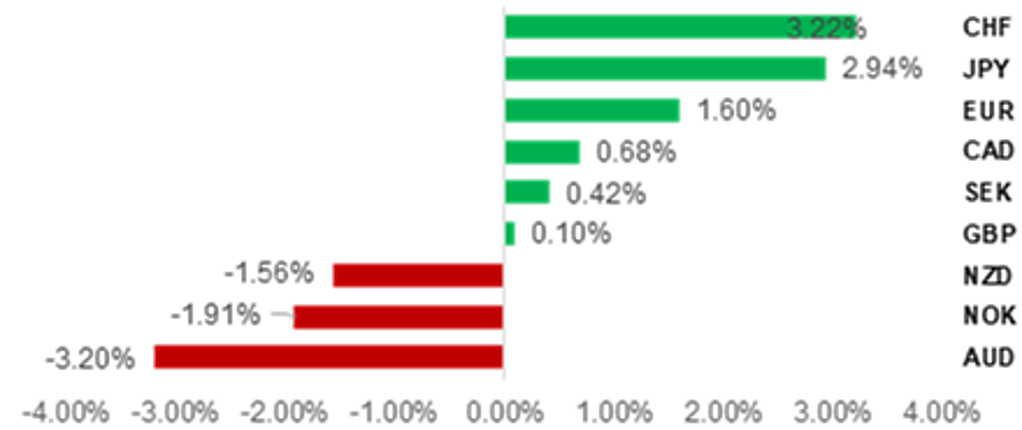

Volatility in the FX market has picked up over the past week following President Trump’s plans for “reciprocal tariffs”. It would raise the US trade-weighted average tariff rate to the highest levels since the 1930’s if implemented as planned. One still hopes that the tariffs will be quickly watered down or reversed to reduce the disruptive impact on global trade and growth. However, China’s decision to retaliate more strongly has raised the risk of a more disruptive global trade war. The negative developments have triggered a safe haven bid for the CHF and JPY in the FX market. The USD initially weakened sharply but has since rebounded strongly against high beta G10 currencies such as the commodity currencies of the AUD and NZD, and emerging market currencies as global growth fears have intensified and market participants have retrenched from risk assets. We expect higher FX market volatility and the bid for safe haven currencies to continue in the near-term.

SAFE HAVEN CURRENCIES OF CHF AND JPY OUTPERFORM

Source: Bloomberg, 15.20 GMT, 4th April 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new short NOK/JPY trade idea, and have closed long USD/SEK and USD/CAD trade ideas after stop-losses were hit.

Weekly Calendar:

The main economic data releases in the week ahead will be: i) the latest US CPI and PPI reports for March and ii) FOMC minutes from 19th March. The economic data and FOMC minutes will be viewed as more dated than normal following this week’s “reciprocal tariff” plans for President Trump. The higher and broad-based tariff hikes if implemented as currently planned will increase the likelihood of a bigger pick-up in inflation in the coming months. It will create more challenging backdrop for the Fed.

Price Action Analysis: USD Performance post Reciprocal Tariffs:

Historically, following a sharp decline in U.S. equities there has been a strong tendency for the USD to appreciate in the subsequent periods. However, the current simultaneous decline in the USD and U.S equities represents a broader loss of confidence in the US economy and challenges the concept of US exceptionalism.

FX Views

USD: Global trade war & slowdown fears driving FX market

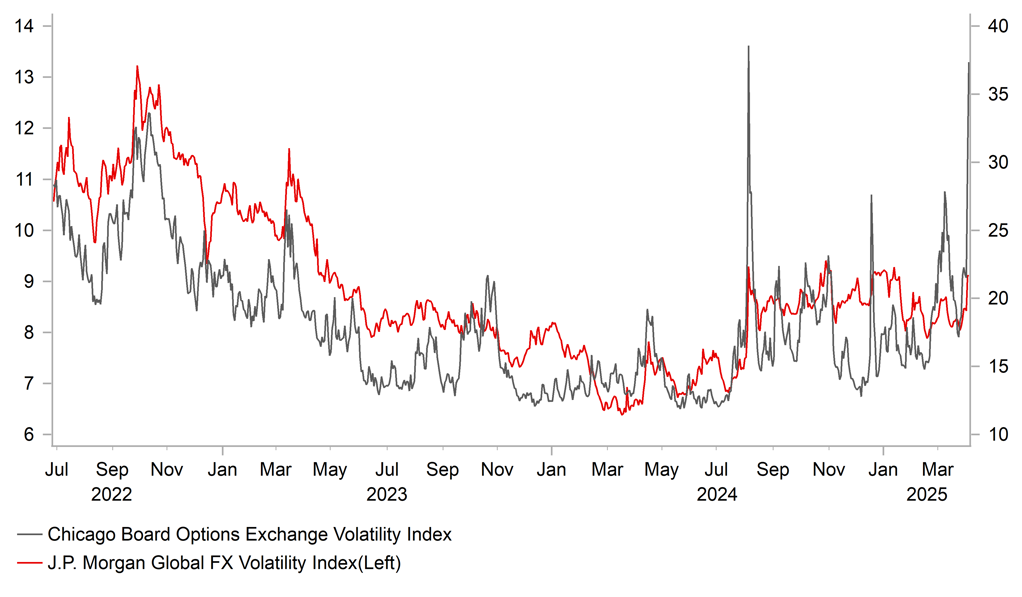

It has been a volatile week for the foreign exchange market triggered by President Trump’s plans for “reciprocal tariffs”. Measures of global FX market volatility have picked back up towards the highs over the past year although remain at relatively lower levels than in global equity markets volatility. President Trump’s plans (click here) would raise the US trade-weighted average tariff rate up closer to 25%. It would represent the highest average tariff rates since the Smoot-Hawley Tariff Act was introduced in 1930 and subsequent global trade war that contributed to the Great Depression. In these circumstances, it is understandable why market participants have become more fearful over a sharper slowdown in global growth. Prior to the “reciprocal tariffs” announcement it was already becoming more evident that elevated policy uncertainty was beginning to weigh more heavily on economic activity at the start of this year by encouraging businesses to delay spending decisions. Measures of consumer confidence in the US have collapsed recently as households anticipate higher inflation and are less confident in outlook for the labour market.

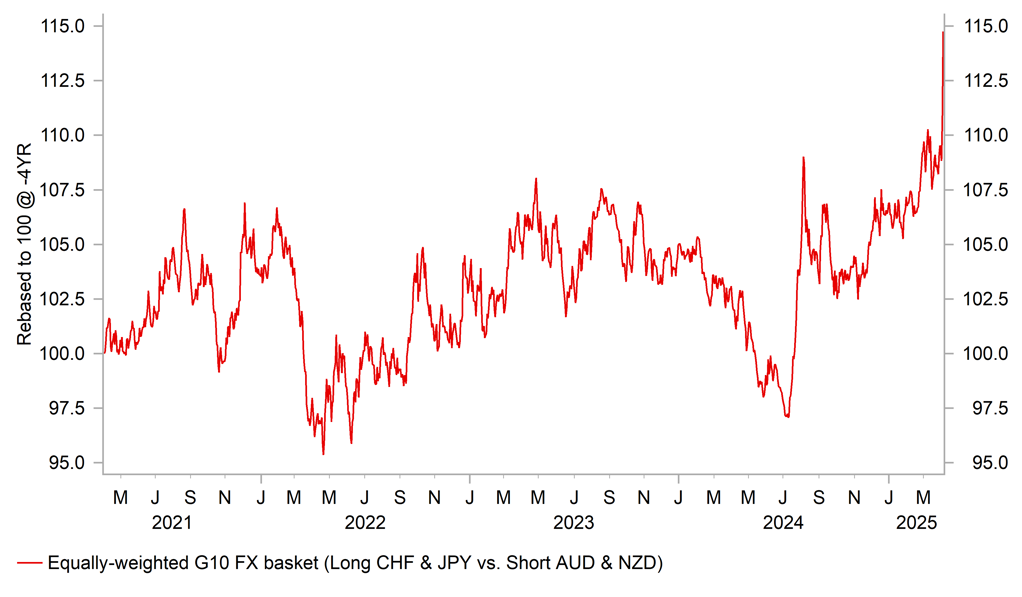

The unfavourable developments have triggered higher volatility and more risk-off trading conditions in the foreign market. It has boosted demand for the traditional safe haven currencies of the CHF and JPY. It has meant that the JPY has continued to strengthen even as the Japanese rate market has scaled back expectations for further BoJ rate hikes. Downside risks to Japan’s economy have increased from President Trump’s decision to implement a 24% reciprocal tariff on Japan alongside the 25% tariffs on auto and certain parts which when combined with slowing global growth could deter the BoJ from hiking rates further. The timing of the next rate hike has been pushed back until the end of this year. Similarly, the CHF has strengthened even as Switzerland’s economy will be hit by an even higher tariff of 32%. We expect both currencies to continue to outperform while market participants become more fearful over a sharper slowdown for global growth and price in more active easing from major central banks despite an initial tariff driven pick-up in inflation in the year ahead.

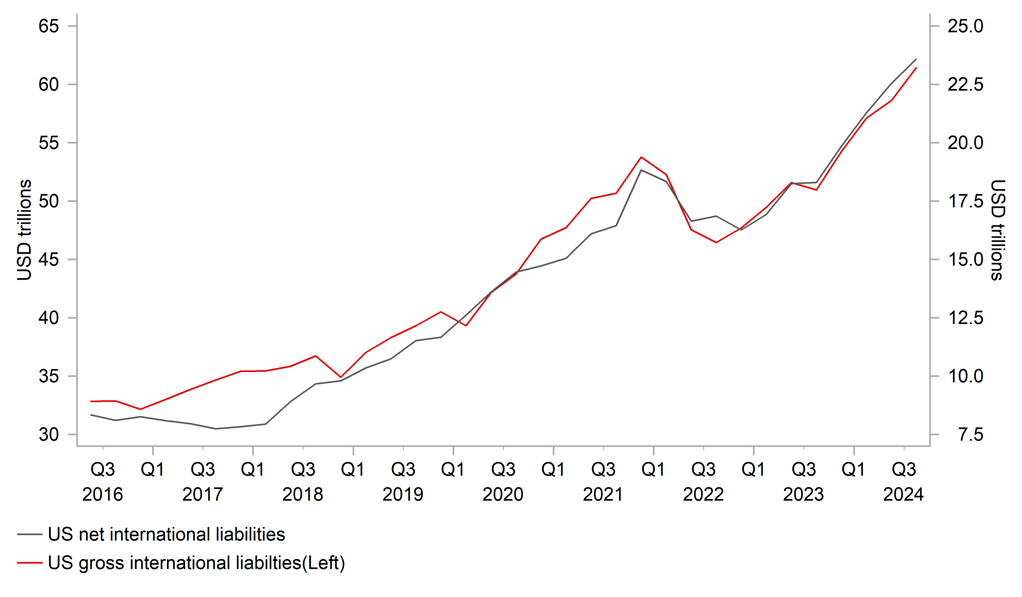

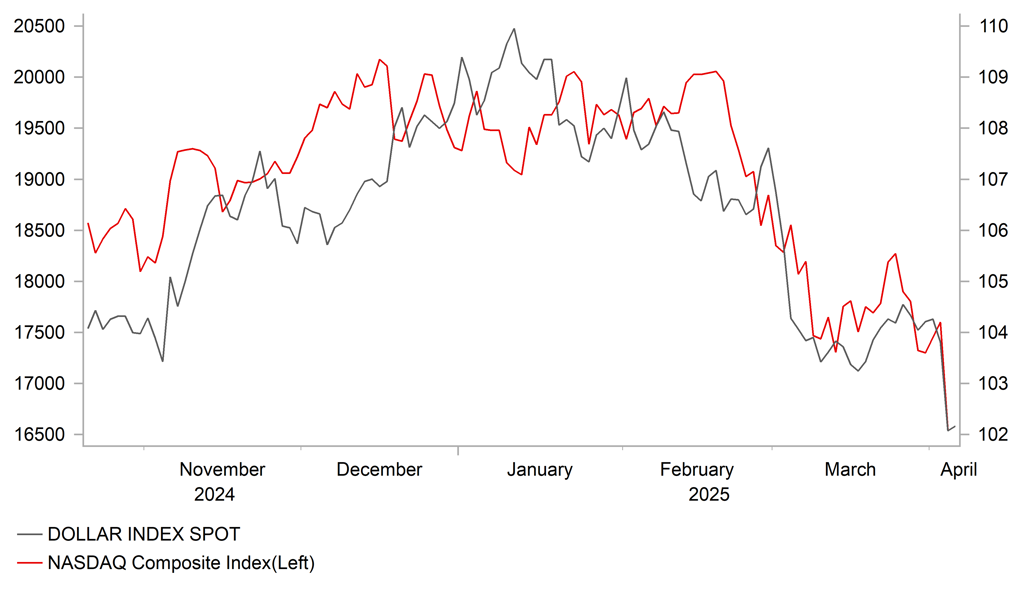

The performance of the USD has been more unusual which is adding to foreign exchange market volatility. Normally the USD tends to strengthen when the outlook for global growth deteriorates, there are more risk-averse trading conditions and higher financial market volatility. However, the sell-off for the USD initially accelerated further after the ”reciprocal tariffs” announcement from President Trump. The DXY index declined sharply yesterday by -1.7% resulting EUR/USD hitting a high of 1.1144. The USD has since recovered some of those initially losses as fears over global growth and the retrenchment from risk assets have continued to intensify. The initial USD weakness could reflect a number of factors including: i) building expectations for a more stagflationary outcome for the US economy which is bringing down real yields in the US, ii) a further unwind of popular positions built up in US assets as US exceptionalism trades continue to unwind, and iii) a broader loss confidence in policy making in the US that is undermining confidence in the USD and US assets as the Trump administration lashes out at the rest of the world. Finally, the maximalist US tariff approach could play into speculation that it is part of the grand plan to set up a “Mar-a-Lago” Accord to force trading partners to work with the US to devalue the USD. Our colleagues in Capital Market Strategy (click here) provided a summary of what it could entail. We remain sceptical that other trading partners would all agree through force to weaken the USD and to a US debt swap, but acknowledge such speculation can impact market sentiment towards the USD. Stephen Miran told Market News yesterday that a “Mar-a-Lago” accord is “not currently in the works”.

FX VOL PICKING UP BUT NOT AS MUCH AS EQUITY VOL

Source: Bloomberg, Macrobond & MUFG GMR

SAFE HAVEN DEMAND FOR CHF & JPY

Source: Bloomberg, Macrobond & MUFG GMR

weakness could reflect a number of factors including: i) building expectations for a more stagflationary outcome for the US economy which is bringing down real yields in the US, ii) a further unwind of popular positions built up in US assets as US exceptionalism trades continue to unwind, and iii) a broader loss confidence in policy making in the US that is undermining confidence in the USD and US assets as the Trump administration lashes out at the rest of the world. Finally, the maximalist US tariff approach could play into speculation that it is part of the grand plan to set up a “Mar-a-Lago” Accord to force trading partners to work with the US to devalue the USD. Our colleagues in Capital Market Strategy (click here) provided a summary of what it could entail. We remain sceptical that other trading partners would all agree through force to weaken the USD and to a US debt swap, but acknowledge such speculation can impact market sentiment towards the USD. Stephen Miran told Market News yesterday that a “Mar-a-Lago” accord is “not currently in the works”.

The USD reaction function to tariffs has changed significantly at the start of this year. Up until year US tariffs were viewed as justification for an even stronger USD and contributed to the DXY index rising by over 5% at the end of last year after President Trump won the US election. However, recent tariffs announcements including this week have initially been viewed more negatively for the USD. The slowdown in the US economy at the start of this year has already started to cast more doubt on the ability of the US economy to hold up as well as previously expected amidst elevated policy uncertainty and broad-based tariff hikes. As a result, market participants have been placing more weight recently on the downside risks to growth in the US from President Trump’s tariff hikes than the hit to growth outside of the US shifting the balance in favour of a weaker USD. It has been estimated that the tariff hikes, if implemented as planned and remain in place, could potentially raise revenues for the US government of around USD400 billion per year although that is clearly highly uncertain. While the tariffs could be watered down and/or removed and imports could fall more than expected, at face value it could deliver just over 1% of GDP of fiscal tightening to the US economy. Importantly in terms of sequencing the fiscal tightening is being put in place alongside DOGE’s recent efforts to cut back the size of the state, and before President Trump’s plans for tax cuts and deregulation that should provide support for growth further down the line. The US rate market has moved to price in a sharper US slowdown/recession by discounting over 100bps of Fed rate cuts by year end at a time when US inflation is expected to move further above their 2.0% inflation target when tariffs are put in place. It would require the US labour market to roll over and the unemployment to raise more quickly above the Fed’s year end forecast of around 4.5%.

FOREIGN HOLDINGS OF US ASSETS

Source: Bloomberg, Macrobond & MUFG GMR

SCALING BACK EXPOSURE TO US EXCEPTIONALISM

Source: Bloomberg, Macrobond & MUFG GMR

However, the market’s focus as we can see from today’s price action can quickly switch back from the US to the broader downside risks to global growth helping the USD to rebound strongly against high beta G10 commodity currencies and emerging market currencies as the flight to quality intensifies. The AUD is currently down by around 4% today lowering AUD/USD closer to 0.6000-level. The sell-off in commodity prices has accelerated in anticipation of weaker global demand. Bloomberg’s commodity price index has fallen by sharply by over 5% over the last couple of trading days. It is a negative development for emerging market currencies such as the Latam currencies of the BRL and CLP which initially rallied on the back of President Trump’s tariff plans for only the minimum baseline reciprocal tariff of 10% for Brazil and Chile.

Fears over a more disruptive outcome for global growth have been encouraged further by China’s decision to retaliate to President Trump’s tariffs. China significantly stepped up retaliation today by announcing plans to impose a 34% tariff on all imports from the US effecting from 10th April. It matches the rate of the “reciprocal tariffs” applied by President Trump to imports from China. Prior to today’s retaliation, China was charging an average tariff rate on US imports of close to 18% according to Bloomberg which will now have the new 34% rate added on top. China imported almost USD164 billion of US goods last year. The retaliation will add to downside risks to growth in the US, and increases the risk that President Trump raises tariffs further on China. The US trade-weighted average tariff rate on China is already set to rise to around 64% having a chilling impact on trade with China, and making it harder for domestic policymakers to offset weakness in external demand through stimulating domestic demand. China alongside other Asian countries have been hit harder by President Trump’s “reciprocal tariff” plans who are judged to be amongst the “worst offenders” for running trade surpluses with the US. The reciprocal tariff rates to be applied to China (34%), India (27%), Japan (24%), South Korea (26%), Taiwan (32%) and Vietnam (46%) are amongst the highest. The negative impact for growth in the region should favour Asian currency underperformance. One additional downside risk would be China chooses to devalue the CNY although it has emphasized that it is prioritizing currency stability recently.

In these circumstances, the USD can continue to rebound against high beta G10 and emerging market currencies while global growth fears intensify. Retaliatory action from trading partners that have stronger bargaining positions such as China and EU would increase the risk of the global trade war escalating reinforcing the flight to quality. On the other hand, the USD can continue to weaken against other safe haven currencies of the CHF and JPY, and possibly the EUR although the impact on EUR/USD is less clear cut. Plans for significantly looser fiscal policy in Germany and reports of EU-wide support measures for growth to offset the negative impact from tariffs are helping to provide support for the EUR at the time when US tariffs will significantly tighten fiscal policy in the US. As the second most liquid alternative to the USD, the EUR tends to hold up better during periods of risk aversion. Hopefully, the deepening financial market sell-off will put pressure on President Trump and other countries to quickly reach deals to water down the proposed tariff hikes and provide some relief for financial markets. Amidst the worsening equity market sell-off today President Trump stated that he had held positive talks with Vietnam who indicated that they would be willing to cut tariff rates on US imports to 0%. The weighted average MTN tariff Vietnam applies on US imports is only around 5%. President Trump’s decision to apply a “reciprocal tariff” of 46% would imply that non-tariff barriers are the main problem for trade with Vietnam alongside the size of the trade surplus. We expect policy uncertainty and FX market volatility to remain elevated for some time to come.

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

JPY |

07/04/2025 |

00:30 |

Labor Cash Earnings YoY |

Feb |

3.0% |

2.8% |

!!! |

|

NOK |

07/04/2025 |

07:00 |

Industrial Production MoM |

Feb |

-- |

-1.7% |

!! |

|

EUR |

07/04/2025 |

07:00 |

Germany Trade Balance SA |

Feb |

-- |

16.0b |

!! |

|

EUR |

07/04/2025 |

09:30 |

Sentix Investor Confidence |

Apr |

-- |

- 2.9 |

!! |

|

EUR |

07/04/2025 |

10:00 |

Retail Sales MoM |

Feb |

-- |

-0.3% |

!! |

|

CAD |

07/04/2025 |

15:30 |

BoC Overall Business Outlook Survey |

1Q |

-- |

- 1.2 |

!! |

|

JPY |

08/04/2025 |

00:50 |

BoP Current Account Adjusted |

Feb |

¥2723.3b |

¥1937.5b |

!! |

|

AUD |

08/04/2025 |

02:30 |

NAB Business Confidence |

Mar |

-- |

- 1.0 |

!! |

|

JPY |

08/04/2025 |

06:00 |

Eco Watchers Survey Outlook SA |

Mar |

45.8 |

46.6 |

!! |

|

USD |

08/04/2025 |

11:00 |

NFIB Small Business Optimism |

Mar |

-- |

100.7 |

!! |

|

NZD |

09/04/2025 |

03:00 |

RBNZ Official Cash Rate |

3.50% |

3.75% |

!!! |

|

|

USD |

09/04/2025 |

19:00 |

FOMC Meeting Minutes |

-- |

-- |

!!! |

|

|

GBP |

10/04/2025 |

00:01 |

RICS House Price Balance |

Mar |

-- |

11.0% |

!! |

|

NOK |

10/04/2025 |

07:00 |

CPI YoY |

Mar |

-- |

3.6% |

!! |

|

SEK |

10/04/2025 |

07:00 |

Industrial Orders NSA YoY |

Feb |

-- |

16.7% |

!! |

|

SEK |

10/04/2025 |

07:00 |

GDP Indicator SA MoM |

Feb |

-- |

-0.5% |

!! |

|

EUR |

10/04/2025 |

11:00 |

Bundesbank Monthly Report |

!! |

|||

|

USD |

10/04/2025 |

13:30 |

CPI Ex Food and Energy MoM |

Mar |

0.3% |

0.2% |

!!! |

|

USD |

10/04/2025 |

13:30 |

Initial Jobless Claims |

-- |

219k |

!! |

|

|

SEK |

11/04/2025 |

07:00 |

CPI YoY |

Mar F |

-- |

-- |

!! |

|

GBP |

11/04/2025 |

07:00 |

Monthly GDP (MoM) |

Feb |

-- |

-0.1% |

!!! |

|

GBP |

11/04/2025 |

07:00 |

Industrial Production MoM |

Feb |

-- |

-0.9% |

!! |

|

EUR |

11/04/2025 |

07:00 |

Germany CPI YoY |

Mar F |

-- |

2.2% |

!! |

|

EUR |

11/04/2025 |

10:45 |

ECB's Lagarde Speaks |

!!! |

|||

|

USD |

11/04/2025 |

13:30 |

PPI Final Demand MoM |

Mar |

0.2% |

0.0% |

!!! |

|

USD |

11/04/2025 |

15:00 |

U. of Mich. Sentiment |

Apr P |

55.0 |

57.0 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- Market participants will be watching close to see if there are any changes to President Trump’s “reciprocal tariff” plans in the week ahead. The higher tariffs on worst offenders are schedule to become effective on 9th April leaving room for some countries to reach a last minute deal to water down the impact by potentially lowering their own tariff rates on US imports and lowering non-tariff barriers Alternatively, other stronger trading partners such as China and EU may choose to retaliate increasing the risk of a worsening trade war with the US.

- The main economic data releases in the week ahead will be: i) the latest US CPI and PPI reports for March and ii) FOMC minutes from 19th The economic data and FOMC minutes will be viewed as more dated than normal following this week’s “reciprocal tariff” plans for President Trump. The higher and broad-based tariff hikes if implemented as currently planned will increase the likelihood of a bigger pick-up in inflation pressures in the coming months. It will create more challenging backdrop for the Fed. The US labour market will need to loosen further (higher unemployment rate) to create room for the Fed to cut rates by June as the US rate market is currently pricing in. We expect the minutes to confirm that the Fed was comfortably on hold and waiting to see details of President Trump’s tariff plans at the March FOMC meeting.

- The RBNZ will be the first G10 central bank to hold a policy meeting in the week ahead since President Trump announced his plans for “reciprocal tariffs”. The RBNZ was expected to deliver a smaller 25bps rate cut but there is now a higher probability that they deliver a fourth consecutive larger 50bps cut in response to heightened downside risks to the global growth outlook in response to tariffs disruption.