To read the full report, please download PDF.

Scope for US dollar depreciation is limited

FX View:

The US dollar is today moderately recouping some of the losses recorded this week after the US employment report highlighted a still solid jobs market. The NFP increase was less than expected and as other jobs data has shown, the labour market is moderating. However, the unemployment rate dropped again, to 4.0% and average hourly earnings were stronger than expected. We believe the data is consistent with the current pricing in the rates market of an extended pause in the Fed easing cycle. In essence, the data allows the Fed to be patient in order to wait for Trump trade tariff policy announcements and assess the economic impact. Those trade policy uncertainties and the solid labour market conditions will help limit an extension of the dollar selling that emerged this week after President Trump suspended the implementation of tariffs on Canadian and Mexican imports to the US until 4th March.

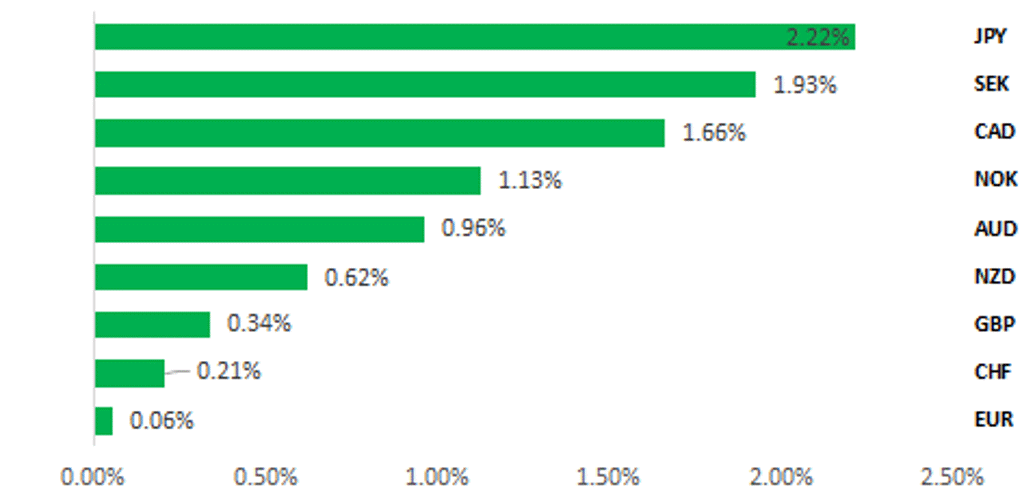

USD WEAKER ACROSS G10 WITH EUR LAGGING REST OF G10

Source: Bloomberg,1400 GMT, 7th February 2025 (Weekly % Change vs. USD)

Trade Ideas:

We are recommending a new short EUR/JPY trade idea. We have also closed our short cable trade idea after the stop-loss was hit this week.

JPY Flows: High Frequency:

This week we analyse the weekly MoF cross-border flow data released yesterday for last week with Japanese investors heavy sellers of foreign bonds.

Sentiment Analysis on BoE MPC Minutes:

Our sentiment analysis across the latest MPC minutes indicates a more pessimistic assessment of the UK's economic outlook by MPC members. This suggests that they may be inclined to lower interest rates further to less restrictive levels in order to support growth and employment if economic weakness persists.

FX Views

USD: Trump’s team mixed views on US dollar highlight uncertainties

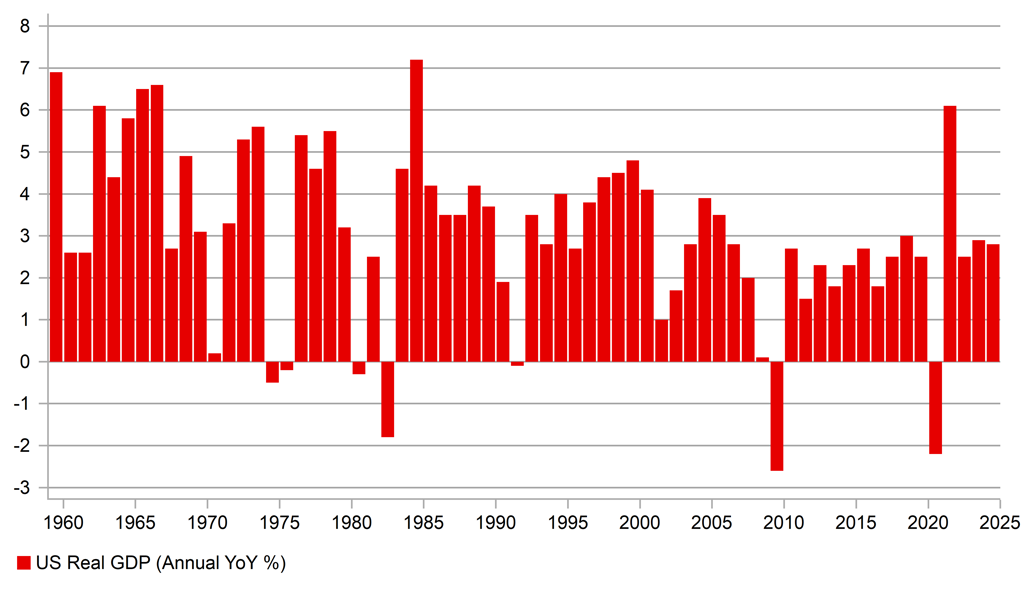

US Treasury Secretary Scott Bessent gave a detailed interview with Bloomberg yesterday and with Fox Business on Wednesday and in large part the updated details on economic policy going forward would generally be viewed as US dollar supportive. Bessent repeated his strong support for his previously stated 3-3-3 economic policy framework. By the end of Trump’s term in office to have achieved 3% real GDP growth; a reduced budget deficit to 3% of GDP and an increase in US oil-equivalent output by 3mn barrels p/day. The achievement of the 3-3-3 economic policy goal would certainly be a positive for US sentiment and the extension of the “US exceptionalism” dynamic that has helped fuel substantial outperformance for the US equity markets. Real GDP growth of that level has been nearly achieved in recent years (2.9% in 2023; 2.8% in 2024) but the last time it was actually achieved was in 2018 during Trump’s first term in office. That was the first time growth had a ‘3’ handle since 2005.

MUFG’s energy research team believe the 3mn increase in crude oil production is achievable, and could be achieved one year sooner than the final year of Trump’s term in office. US energy production has grown at a 1.8mboe/d average annual pace in 2018-23, which is basically more than double the pace required (0.75mboe/d) required to hit the 3mn target in four years. In that context, the potential is there for this particular objective being met. But we would be less convinced on the other two objectives. As we’ve highlighted here before, the economic cycle is at a different point than in Trump’s first term in office when growth picked up to 3.0% in 2018. The monetary stance is restrictive and growth is already running close to 3.0%. Inflation risks are notably higher in the post-covid economic backdrop, covid stimulus support is fully utilised by a wider portion of US households and equity valuations are considerably higher today underlining less supportive impact for consumption from rising equity markets. The forward p/e now is over 22 times. In 2016 is was around 16.5 times.

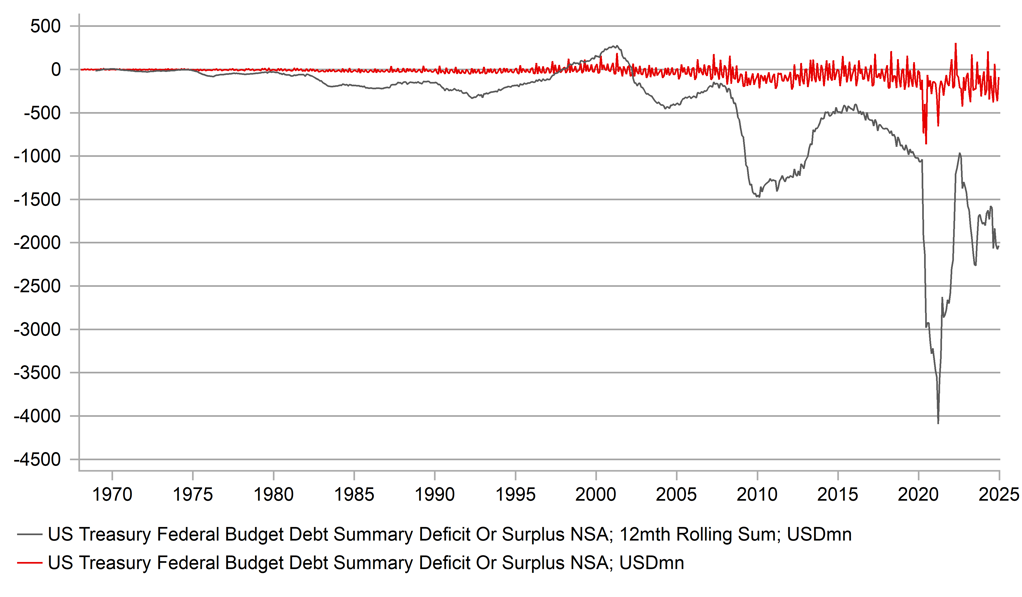

A reduction in the budget deficit to 3% of GDP will prove challenging. Total government spending amounted to USD 6.75trn in FY2024 financed through USD 4.92trn in tax revenues and a fiscal deficit of USD 1.83trn. Ignoring the decline in the deficit in 2021 and 2022 related to extraordinary spending related to covid, the US fiscal deficit has increased every year since 2016, the year of Trump’s first election victory. In GDP terms the deteriorating trend has been in place over that period too. The fiscal deficit in GDP terms was 2.5% in Q1 2016 and worsened steadily to 4.8% just prior to covid. The last time the deficit was at the 3% target Bessent is aiming for was in Q2 2016. The backdrop for the US deficit is one of a deteriorating trend that is nearly going on for a full ten years. For DOGE and what the likely focus will be on in relation to cutting government expenditure notably, 25% of total government spending is via the Department of Health and Human Services and another 22% is via the Social Security Administration. The deficit this current year is projected to reach USD 1.9trn so the scale of the task in getting the budget deficit to 3% is considerable. If you assume 5% nominal GDP growth each year of Trump’s term in office, a 3% deficit to GDP in the final year equates to a budget deficit of USD 1.08trn. That implies a 43% cut in US dollar terms of the current budget deficit. This scale of reduction was achieved of course post-covid and post-GFC but outside of crisis periods the last time the deficit fell in US dollar terms by this amount was between 2004-07. So there is precedent for the objective in reducing the deficit by this scale but of course with Trump looking to extend his Tax Cuts & Jobs Act from 2017 and reduce taxes further, whether tax revenues will rise to the same extent as in previous examples is questionable.

US CALENDAR YEAR REAL GDP GROWTH ALREADY AT ROBUST LEVEL

Source: Macrobond & Bloomberg

US FISCAL BALANCE – MONTHLY TOTAL AND 12MTH ROLLING TOTAL

Source: Bloomberg, Macrobond & MUFG Research

While the achievement of Bessent’s 3-3-3 economic policy mix is challenging in our view as we stated above, it would be US dollar supportive. However, one of the most common questions from clients evolves around the topic of Trump and his wish for a weaker US dollar and his possible interference in Fed independence to achieve both lower rates and a weaker dollar. In Bessent’s interview with Bloomberg he made clear that he supports a strong dollar. Bessent also stressed that Trump and the administration will not try and interfere in Fed policy deliberations and Trump’s desire is to see lower long-term yields rather than Fed policy.

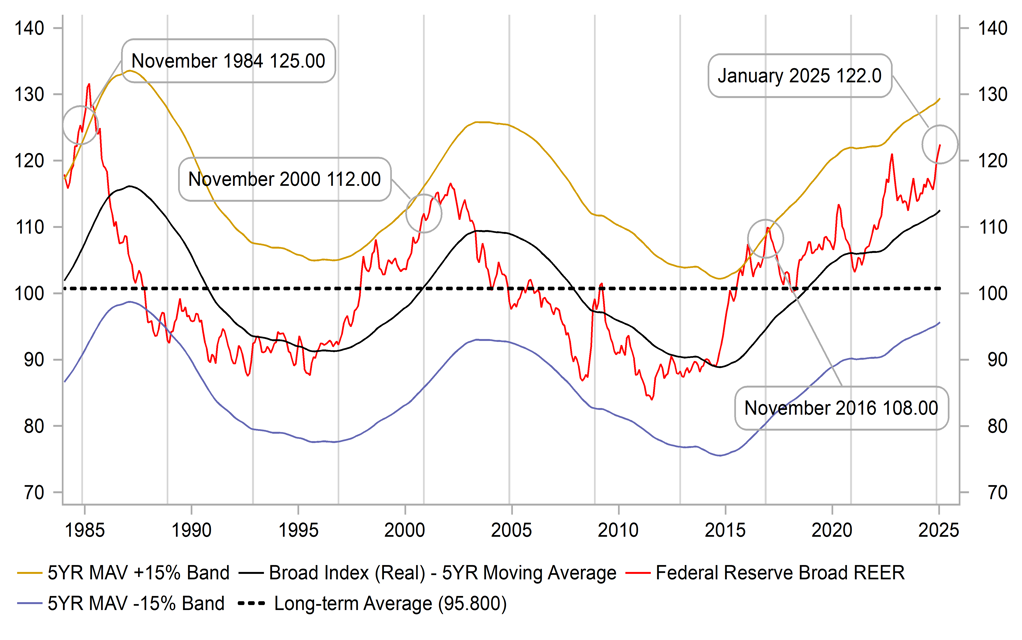

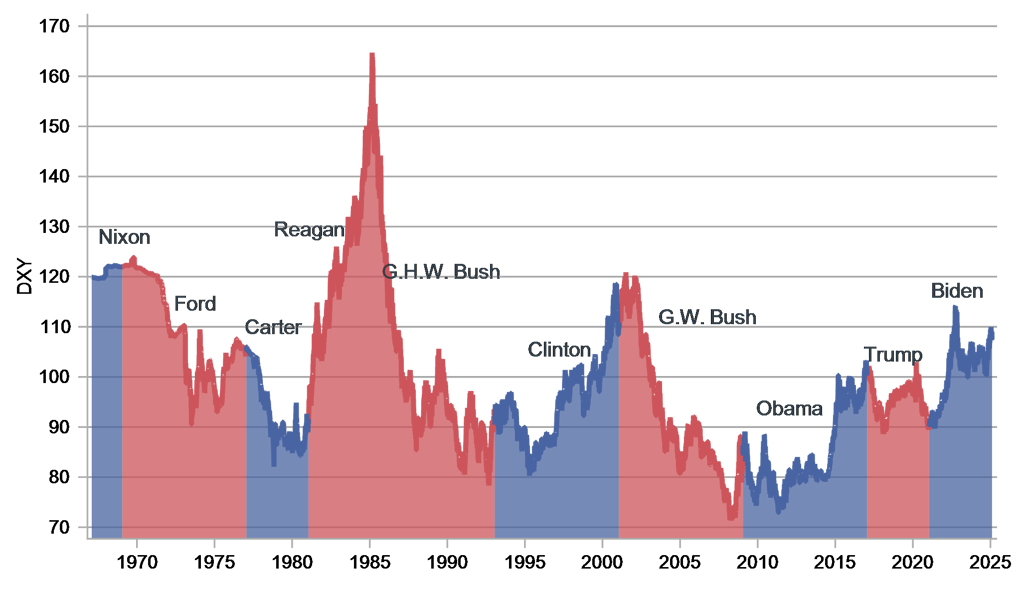

But how true Bessent’s comment that the US will continue to have a “strong dollar policy” under President Trump remains to be seen. It may be Bessent’s view but there are plenty within the administration who will likely push for something different. Stephen Miran, Trump’s nominee for Chair of the Council of Economic Advisers wrote a piece titled “A Users’ Guide to Restructuring the Global Trading System” and in the opening Executive Summary states that “The root of the economic imbalances lies in the persistent dollar overvaluation” and that we may now be on the cusp of a “generational change” in the international trade landscape. Miran stresses these are his own views but being nominated for one of the most senior influential roles must surely raise the risk of his views being realised to some degree. The US dollar in REER terms on election day was the strongest since the 1984 election. In that regard, even with more trade tariff announcements to come, we see limited scope for substantial dollar gains from here (we see 4-5% potentially) and with real GDP set to slow we continue to see scope for a weaker dollar emerging later in the year. More aggressive fiscal spending cuts could weigh on growth and help weaken the dollar.

USD REER LEVEL IS NOW STRONGEST SINCE PERIOD FOLLOWING PLAZA ACCORD PEAK

Source: Bloomberg, Macrobond & MUFG GMR

REPUBLICAN PRESIDENCIES HISTORICALLY END WITH US DOLLAR WEAKER THAN START OF TERMS

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Weighing up trade uncertainty & political risks amidst weak growth

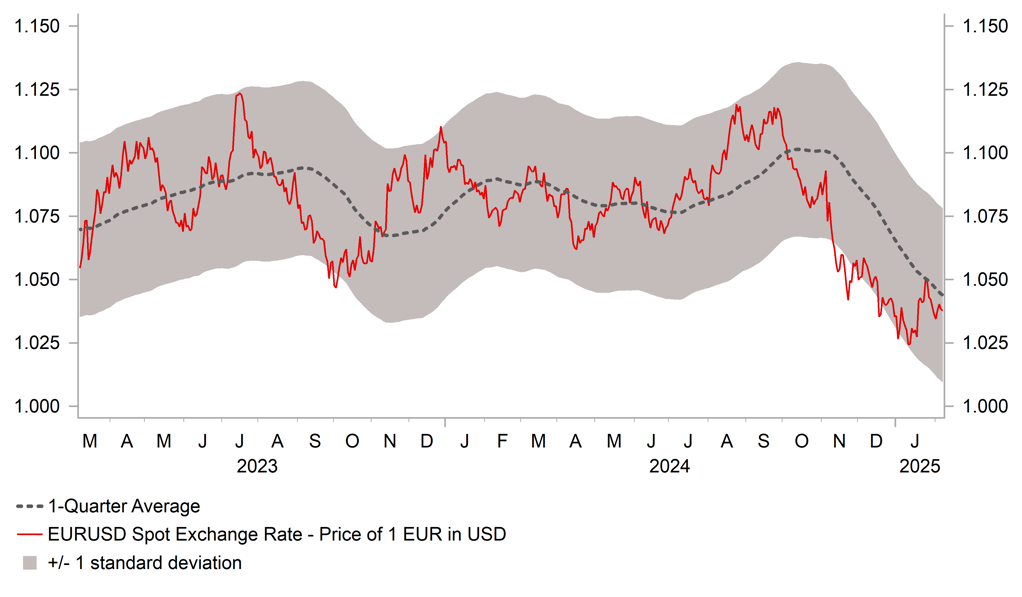

It has been a volatile week for the EUR. At the start of the week EUR/USD fell to a low of 1.0141 but has since climbed back up to the 1.0400-level. The pair has been consolidating in a lower range since the US election between 1.0200 and 1.0600. The sharp fluctuations in EUR/USD this week have been driven mainly by fast changing expectations for President Trump’s trade policy at the start of his second term. The EUR was hit hard initially after President Trump warned at the start of this week that tariffs with the EU “will definitely happen” and that they could come “pretty soon” in response to his ongoing complaints over the size of the EU’s trade surplus with the US.

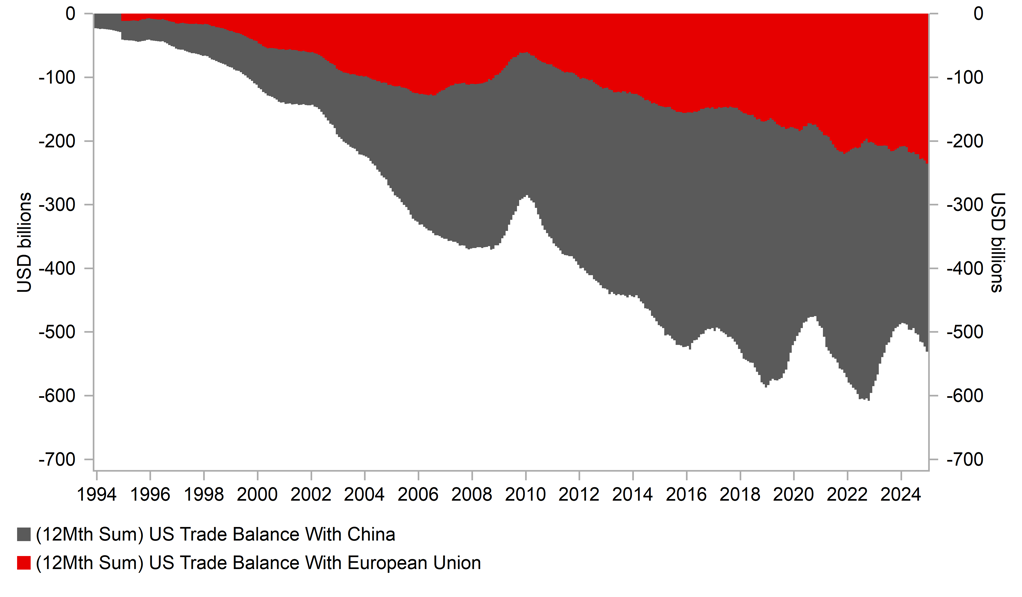

The release this week of the latest US trade report for December revealed that the US trade deficit in goods with the EU widened by a further 13% to USD235.6 billion in 2024. The bulk of the deficit was against Ireland (USD86.7 billion), Germany (USD84.8 billion) and Italy (USD44.0 billion). Imports from Germany, Ireland and Italy totalled USD160.4 billion, 103.3 billion and USD76.4 billion respectively in 2024. However, market concerns over trade disruption from Trump’s tariff threats have since eased for now after he delayed implementing 25% tariff hikes on Canada and Mexico. It has created cautious optimism that other trading partners such as the EU can reach similar “deals” with President Trump to avoid tariff hikes.

After President Trump’s election, many experts in Europe called for a unified EU response and warned of the danger of Member States acting independently. It appears that the EU’s Anti-Coercion Instrument (click here) could provide a vehicle for such general EU response to President Trump’s trade policies, whether they come in the form of sanctions or tariffs. The ACI provides a legal framework for a centralized and structured EU response to third country “coercion” through diplomatic means and, failing that, through any counter measures deemed necessary. The ACI offers the Commission a wide choice of response measures. Alongside retaliation plans, the EU is preparing conciliatory offers to the US such as increasing imports of US LNG and collaborating on China trade issues with the goal to avoid an escalating trade war.

President Trump could wait until trade reviews are completed by 1st April to outline plans for tariff hikes on the EU. Even if the EU is not targeted directly, it could still be impacted by sector specific tariffs similar to during Trump’s first presidency and/or by the implementation of a universal tariff hike on all trading partners. Sectors that could be hit with tariff hikes include semiconductors and electronics, metals and minerals, pharmaceuticals, automotives, energy including oil and gas, and agriculture and food products. During Trump’s first term, EU countries were impacted by tariff hikes of 25% on steel and 10% on aluminium. The EU imposed retaliatory tariffs which have been suspended since 2021 but the suspension is due to expire on 31st March. In light of the lingering trade policy uncertainty, we remain sceptical that EUR/USD can extend its advance much further beyond the 1.0500-level and still judge that a retest of parity is likely although our forecast (click here) for as early as Q1 set prior to Trump’s decision to delay tariffs hikes in Canada and Mexico could now be premature.

EUR/USD CONSOLIDATING AT LOWER LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

WIDENING US TRADE DEFICIT WITH EU

Source: Bloomberg, Macrobond & MUFG GMR

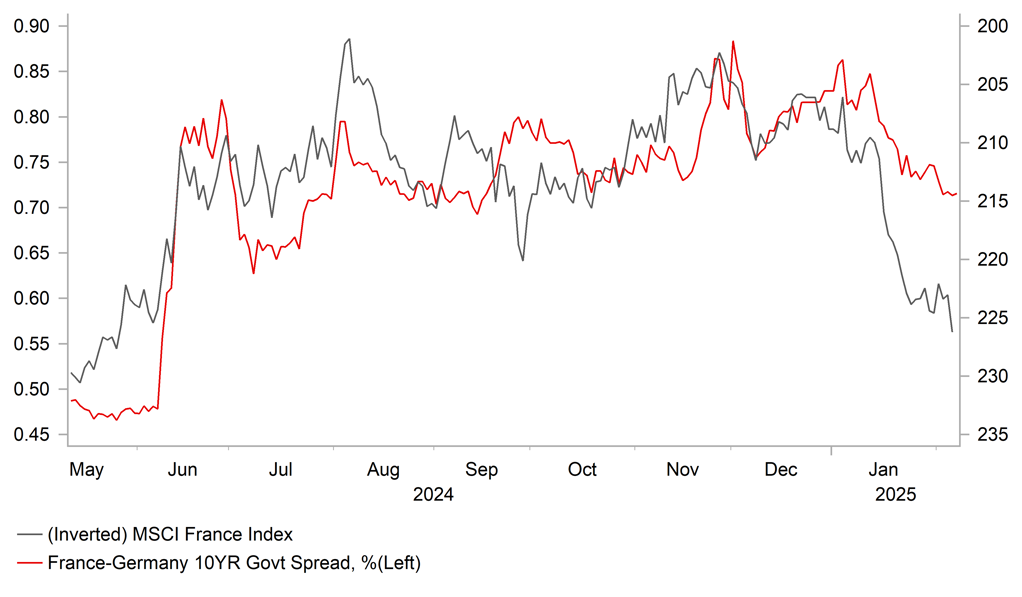

One positive factor for the euro this week that has been overshadowed understandably by trade policy risks has been the latest political developments in France. New Prime Minister Francois Bayrou’s government survived two no-confidence motions on Wednesday ensuring the adoption of a 2025 budget after months of political uncertainty. The motions of no confidence were raised after Prime Minister Bayrou used a special constitutional provision to force through the budget. The motions of no-confidence failed after the Socialists broke from their left-wing alliance by refusing to support it. The emergency budget has been welcomed by financial markets even though Prime Minister Bayrou acknowledged it is “imperfect”. The yield spread between 10-year French and German government bonds has narrowed by around 15ps from the highs at the start of this year and is currently retesting support at around 0.70%. Bayrou’s budget plans for a smaller tightening of fiscal policy of around EUR52 billion compared to the plans rejected by former Prime Minister Barnier whose plans included EUR60 billion of tax increases and spending cuts. It will target a budget deficit of 5.4% of GDP for this year down from around 6.0% last year. The next steps for France’s economic policy are potential amendments to the 2023 pension reforms.

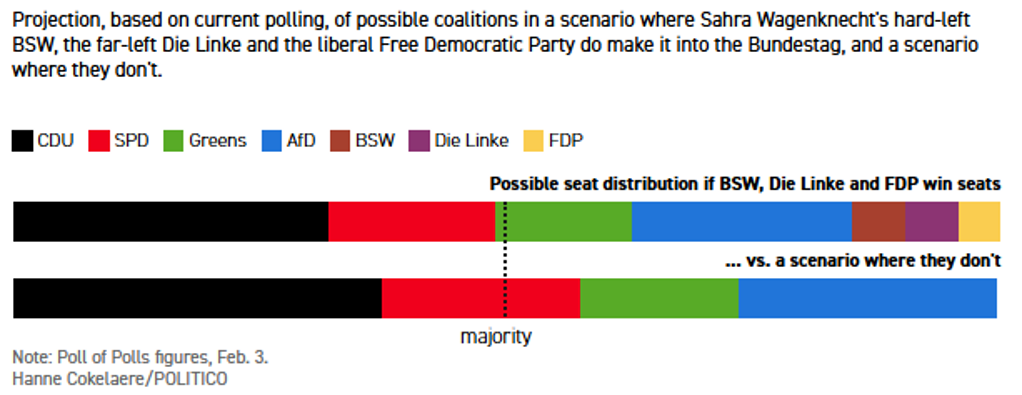

The next important political event in Europe will be the upcoming German elections on 23rd February. The latest opinion polls continue to point strongly towards Friedrich Merz becoming the next Chancellor whose centre-right alliance of the CDU and CSU parties is currently polling at around 30% well ahead of other parties. The far-right AfD party is in second place currently polling at just over 20% followed by the centre-left Social Democratic party and Greens who are polling at around 16% and 13% respectively. According to politicians from Merz’s party, their least favoured outcome would be a three-way coalition because of the infighting that would inevitably follow. The main options for a coalition government include: i) a grand coalition between the CDU/CSU and the SPD, ii) a kiwi coalition between the CDU/CSU and Greens, iii) a Germany coalition between CDU/CSU, SPD and FDP, and iv) a Kenya coalition between CDU/CSU, SPD and Greens. Market participants will be watching the election outcome closely to assess the likelihood of the next government putting in place policies to try to kick start growth in Germany including loosening regulations, lowering corporate and income taxes, and reforming the debt brake to allow more government investment in the coming years. It follows two years of stagnation for the German economy.

POLITICAL & FISCAL RISKS IN FRANCE HAVE EASED

Source: Bloomberg, Macrobond & MUFG GMR

GERMAN COALITION HYPOTHETICALS

Source: Politico

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

02/09/2025 |

01:30 |

PPI YoY |

Jan |

-2.2% |

-2.3% |

! |

|

CNY |

02/09/2025 |

01:30 |

CPI YoY |

Jan |

0.4% |

0.1% |

!! |

|

JPY |

02/09/2025 |

23:50 |

BoP Current Account Balance |

Dec |

¥1384.6b |

¥3352.5b |

!! |

|

GBP |

02/10/2025 |

00:01 |

S&P, KPMG and REC UK Jobs Report |

!! |

|||

|

NOK |

02/10/2025 |

07:00 |

CPI YoY |

Jan |

-- |

2.2% |

!! |

|

EUR |

02/10/2025 |

09:30 |

Sentix Investor Confidence |

Feb |

-- |

- 17.7 |

!! |

|

NOK |

02/11/2025 |

07:00 |

GDP Mainland QoQ |

4Q |

-- |

0.5% |

!! |

|

USD |

02/11/2025 |

11:00 |

NFIB Small Business Optimism |

Jan |

104.0 |

105.1 |

!! |

|

GBP |

02/11/2025 |

12:15 |

BoE's Bailey speaks |

!!! |

|||

|

USD |

02/11/2025 |

20:30 |

Fed's Williams speaks |

!!! |

|||

|

USD |

02/12/2025 |

13:30 |

Annual Revisions: CPI |

!!! |

|||

|

USD |

02/12/2025 |

13:30 |

CPI Ex Food and Energy MoM |

Jan |

0.3% |

0.2% |

!!! |

|

USD |

02/12/2025 |

15:00 |

Fed's Powell testifies |

!!! |

|||

|

EUR |

02/12/2025 |

17:00 |

ECB's Nagel Speaks |

!! |

|||

|

CAD |

02/12/2025 |

18:30 |

BoC Summary of Deliberations |

!! |

|||

|

GBP |

02/13/2025 |

00:01 |

RICS House Price Balance |

Jan |

-- |

28.0% |

!! |

|

GBP |

02/13/2025 |

07:00 |

Monthly GDP (MoM) |

Dec |

-- |

0.1% |

!!! |

|

EUR |

02/13/2025 |

07:00 |

Germany CPI YoY |

Jan F |

-- |

2.3% |

!! |

|

GBP |

02/13/2025 |

07:00 |

GDP QoQ |

4Q P |

-- |

0.0% |

!!! |

|

CHF |

02/13/2025 |

07:30 |

CPI YoY |

Jan |

-- |

0.6% |

!! |

|

EUR |

02/13/2025 |

09:00 |

ECB Publishes Economic Bulletin |

!! |

|||

|

EUR |

02/13/2025 |

10:00 |

Industrial Production SA MoM |

Dec |

-- |

0.2% |

!! |

|

USD |

02/13/2025 |

13:30 |

PPI Final Demand MoM |

Jan |

0.3% |

0.2% |

!! |

|

USD |

02/13/2025 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

EUR |

02/14/2025 |

10:00 |

GDP SA QoQ |

4Q P |

-- |

0.0% |

!!! |

|

EUR |

02/14/2025 |

10:00 |

Employment QoQ |

4Q P |

-- |

0.2% |

!! |

|

USD |

02/14/2025 |

13:30 |

Retail Sales Control Group |

Jan |

-- |

0.7% |

!!! |

|

USD |

02/14/2025 |

13:30 |

Import Price Index MoM |

Jan |

0.4% |

0.1% |

!! |

|

USD |

02/14/2025 |

14:15 |

Industrial Production MoM |

Jan |

0.3% |

0.9% |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The latest US CPI and PPI reports for January will be two of the most important data releases in the week ahead for financial markets to provide further insight into the likely timing of the next Fed rate cut. Inflation pressures slowed again at the end of last year providing some reassurance to the Fed that the US economy remains on a disinflationary path supporting their plans for two further rate cuts this year. However, core inflation is expected to pick-up temporarily at the start of this year driven by the effect of the wildfires in LA and a residual seasonality issue that add an upward bias to January inflation. Adding to the uncertainty will be the release of annual revisions to the CPI and PPI data. Further clarity on the Fed’s policy thinking will be provided by Fed Chair Powell’s semi-annual testimony on monetary policy, and New York Fed Chair Williams in the week ahead. The release of the latest retail sales report for January will also provide an update on how the US economy is performing at the start of this year.

- The main focus in Europe will be the release of the GDP reports from the euro-zone and UK for Q4. The reports are expected to confirm that the euro-zone and UK economies had stalled at the end of last year. It has provided justification for the ECB and BoE to continue cutting rates at the start of this year. BoE Governor Bailey is scheduled to speak again in the week ahead although his views are likely to be similar to after this week’s MPC meeting. We expect the BoE to cut rates again in May.