To read the full report, please download PDF.

Huge USD sell-off as Europe acts

FX View:

The sell-off of the US dollar this week is of historic proportions. On a DXY basis, the drop is between 3.5%-4.0%. In the period back to the extreme volatility during the GFC there are only two occasions when the dollar fell by more – in November 2022 (easing inflation fears) and in March 2020 (covid). There are a number of factors that triggered this move with the surge in rates in Europe on the plan in Germany from a considerable easing of fiscal spending that alters one key drag that has held growth back in the euro-zone since the German debt brake was enshrined into the German constitution in 2009. It notably alters the growth outlook and is compelling reason for an adjustment in market pricing. Still, risks remain on the horizon and some US dollar recovery in Q2 remain plausible given aggressive tariff action doesn’t appear fully priced into the markets abroad. The extent of US slowdown over the near-term is also unclear following a solid jobs report today.

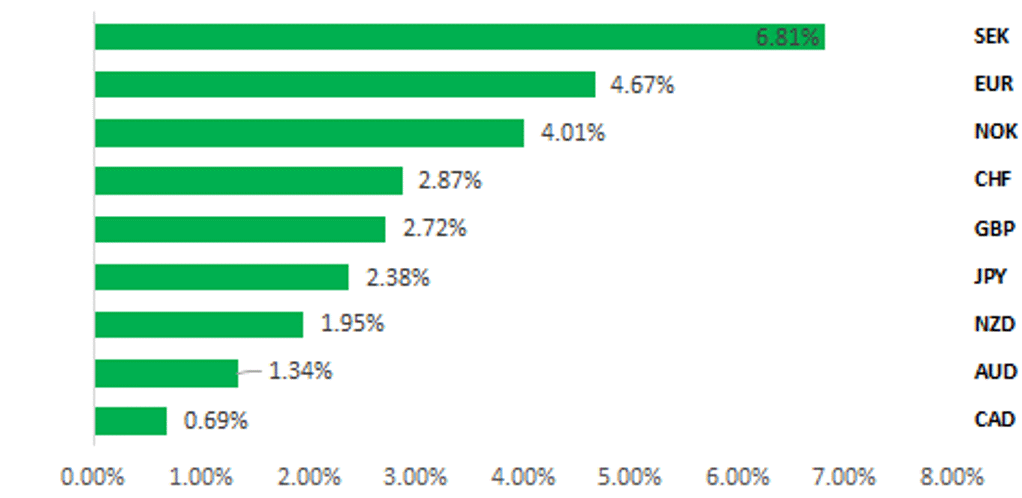

SHARP USD SELL-OFF AS EUROPE FX OUTPERFORMS REST OF G10

Source: Bloomberg, 14.15 GMT, 7th March 2025 (Weekly % Change vs. USD

Trade Ideas:

We are sticking with our short EUR/JPY trade idea. A lot of EUR good news is now priced and we still see scope for JPY to strengthen further.

JPY Flows:

The weekly flow data from the MoF this week covering last week revealed a notable pick-up in foreign bond and equity purchases. Strong demand for Japan fixed income by foreign investors was also evident although selling of Japan equities continued. Appetite for speculative selling of the yen remains far less than previously underlining we believe the changing market dynamics.

Price Action Analysis - The impact of Global Bond Yields on FX: :

Following the recent fallout in the Bund market, our analysis considers daily moves exceeding 3 Std Dev. Historical performance indicates that following such outsized moves, EUR/USD appreciation is most likely out to two months before starting to revert to a more normalised distribution of returns.

FX Views

USD/G10: Does this meaningful sell-off signal a change in trend?

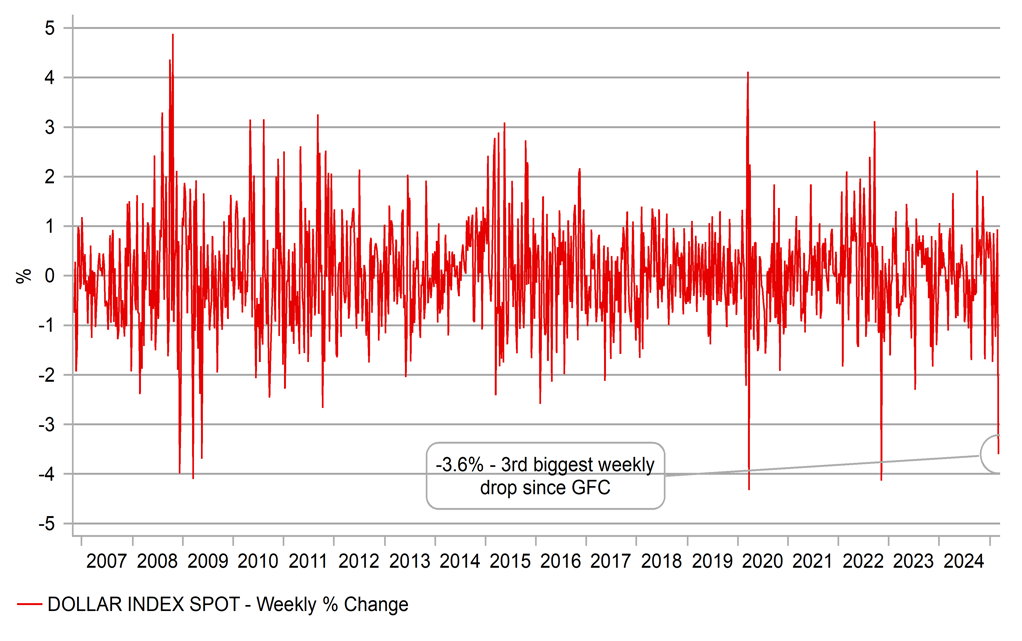

The US dollar this week has had a move that happens very rarely – a drop of between 3.5%-4.0% is the largest decline for the dollar since November 2022 when lower than expected inflation data triggered a 4.1% drop. Previous to that the dollar fell 4.3% during the covid turmoil in March 2020. In 2022 it was significant in signalling a further 5% drop over the following two months. In 2020 markets were more volatile but still also signalled a more sustained turn with the dollar extending 5% further lower but over a 4-month period and by 9% by the end of 2020. Looking back beyond those two more recent big weekly declines for the US dollar you have to go back to the Global Financial Crisis and the turmoil in 2009 to see the scale of declines we have had this week. So from a historic perspective this week’s move is now very significant.

As a reminder, our current forecasts highlight the fact that we had believed US dollar strength would prove unsustainable and we have forecast levels showing EUR/USD advancing 6% in H2 this year. Our year-end EUR/USD forecast of 1.0800 was above the Bloomberg consensus amongst 54 banks published in the month of January and in the top one-fifth of all forecasts. Many of the factors we cited for that dollar depreciation unfolding in H2 have basically started to unfold in the past few weeks. In assessing to what extent we should now adjust our forecasts we need to consider the following questions: 1) Did the announcements from Germany and Europe this week warrant the rates and FX reaction? 2) Is the US economic slowdown real and sustainable? 3) Does the impact of tariffs on the dollar not matter anymore?

We were not anticipating a 30bp jump in 10yr Bund yields on Wednesday but in hindsight the fiscal figures are certainly significant and do alter notably the projections for GDP growth over the coming years. Our European economist estimates potentially a 1.0ppt increase to GDP growth in 2026. The Bloomberg consensus for 2026 is 1.0% GDP growth in Germany meaning growth close to 2.0% is feasible. The EUR 500bn infrastructure fund over 10yrs; the cap of 1.0% on defence spending captured under the constitutional debt brake rules with a commitment to raise spending further (from 2.0% of GDP now) could equate to an additional EUR 400bn over 10yrs while Federal states can now increase deficit spending to the constitutional brake level of 0.35% of GDP. It’s feasibly a EUR 1trn package of measures. The EU has also announced a loan program of EUR 150bn with capacity under a new ReArm Europe program although incentives to partake remain unclear at this stage. But these plans are a “work in progress” as Lagarde stated this week and nothing is yet guaranteed. Germany’s new Bundestag is set to convene on 25th March so the window is tight. The first reading could be on Thursday with a target to complete by 18th March to allow ratification in the Bundesrat by 21st March. Die Linke has also threatened to take legal action given the rushed nature of getting this legislation through the current parliament and given it will curtail the scope for policy implementation under the new parliament. But the counter argument is that under German law, the current parliament remains capable of making decisions until the new parliament convenes within 30 days of the election. Nonetheless, on the balance of probability the measures will likely pass and hence the scale of yield increase in Germany does look justified.

SIGNIFICANT WEEKLY DROP FOR THE US DOLLAR

Source: Bloomberg, Macrobond & MUFG GMR

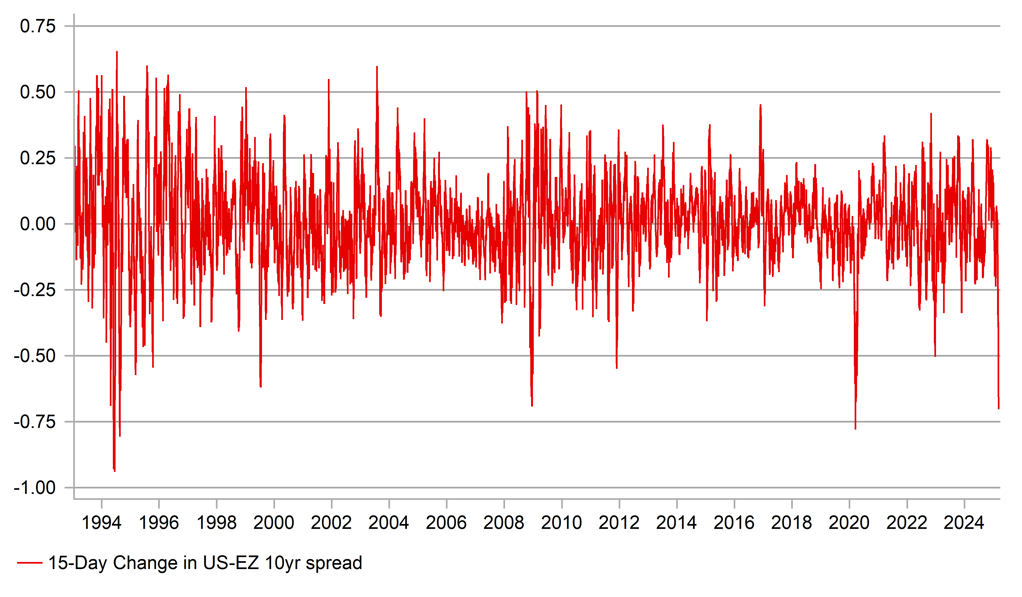

OF LARGEST DROP IN 10YR US-EZ SPREADS

Source: Bloomberg, Macrobond & MUFG GMR

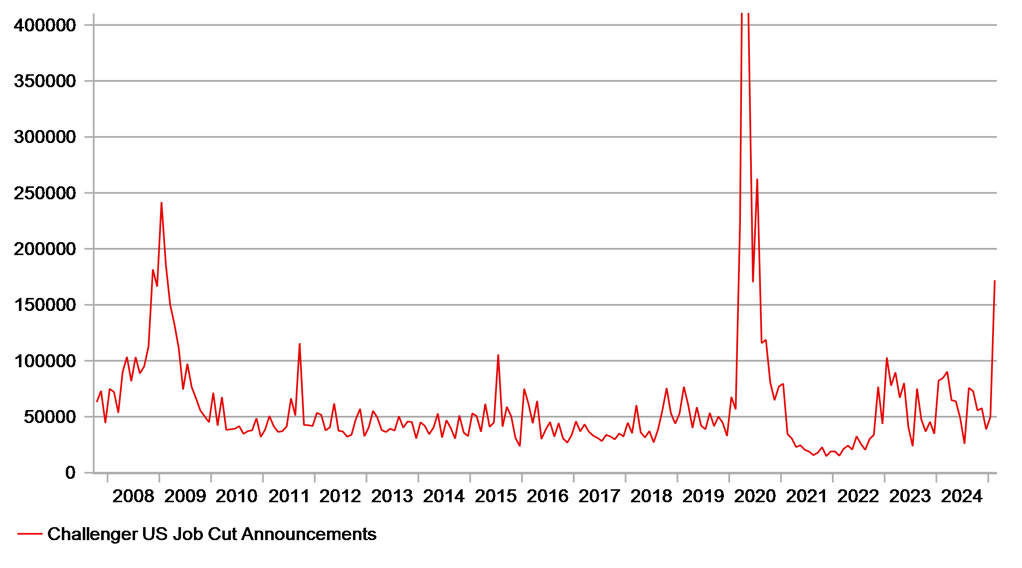

A key element of this FX move is also the ongoing evidence of a slowdown in the US economy. UST bond yields are down sharply with investors growing increasingly concerned over the damage of Trump trade policy uncertainties and the continued restrictiveness of monetary policy. Retail sales fell sharply in January and sets the economy up for a sharp slowdown in consumer spending after the 4.2% Q/Q SAAR gain in Q4. Real consumer spending dropped 0.5% in January. Consumer confidence readings have declined notably while both existing and new home sales fell sharply in the latest data readings. Net trade is now set to be a big drag on GDP growth as well. The deficit in January surged to a record USD 155.6bn (vs 10yr avg of USD -79bn). The nonfarm payrolls reading today of 151k, is not exactly consistent with the terrible Challenger Job Layoff announcement reading this week which revealed the largest jump since covid and before that since the GFC. So today’s payrolls suggest mixed economic signals and certainly it is too soon to conclude a notable slowdown is coming that will force the Fed to cut sooner. Two or possibly three rates cuts from the FOMC later this year (May possible, but we expect June) is where the market is now priced.

The financial market moves this week certainly point to far less concern over the impact of tariffs on imports into the US. There is some logic in investors believing Trump lacks the will to follow through with tariffs. This week for the second time, Trump delayed tariffs on Canada and Mexico imports to the US, at least covering goods included in the USMCA trade deal. The postponement is to the 2nd April, the same day as the planned implementation of Trump’s reciprocal tariff plan. The scale of that plan is difficult to predict as it can incorporate not just tariffs in other countries US imports but also sales tax rates, other barriers/subsidies and currency misalignments. Our sense at this stage is that markets are under-estimating the actions to be taken, especially on Europe and Asia.

Our Q1 and Q2 EUR/USD forecasts of 1.0200 look too low now and there have been some significant factors that have unfolded to suggest the dollar will be weaker going forward than expected. However, the scale of the move in yields in Europe and for EUR does suggest a lot of the good news to come was priced immediately. Tariff action from Trump is still coming and will likely be aggressive so while we see grounds for further USD depreciation (as before) there may be a spell of recovery first.

SOLID NFP TODAY BUT LAYOFFS SURGED IN FEB

Source: Bloomberg, Macrobond & MUFG GMR

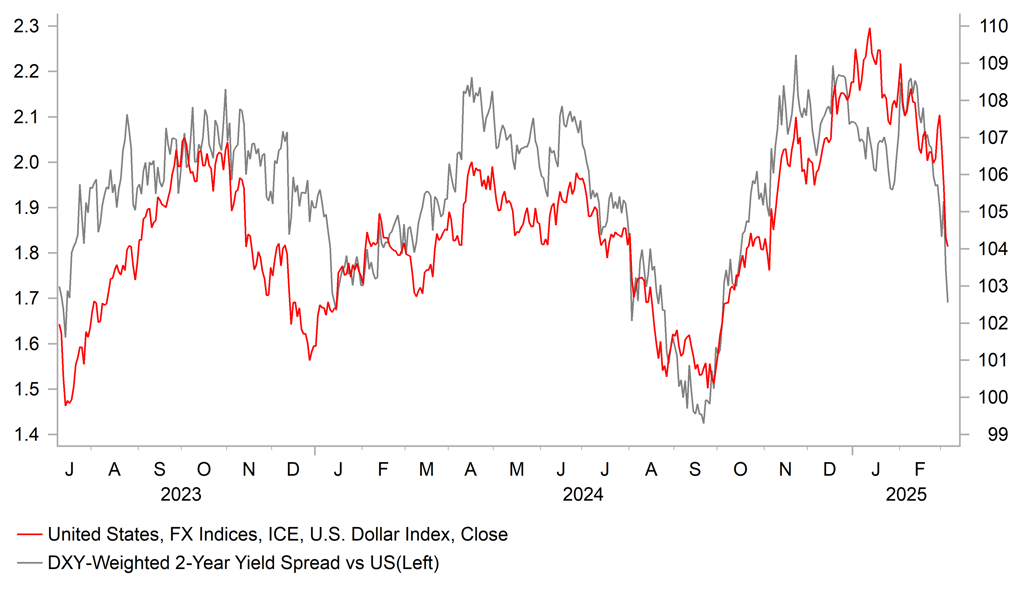

DXY OVER-EXTENDED VS WEIGHTED DXY SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

CAD: BoC to cut rates further contributing to CAD underperformance

It has been a volatile week for the CAD. At the start of the week USD/CAD hit of 1.4543 on Tuesday after President Trump’s tariff hikes (click here) on imports from Canada became effective from 4th March. The pair has since reversed the initial move higher and has fallen back towards last month’s lows at closer to the 1.4200-level. Despite gains in recent days the CAD has still underperformed this week alongside the USD when it has been the second worst performing G10 currency. It has significantly underperformed European G10 currencies weakening by -5.5% against the SEK, -3.4% against the EUR and -2.8% against the NOK.

President Trump’s subsequent decisions to scale back the tariff hikes imposed on Canada until at 2nd April has provided some relief for the CAD and will help to dampen the negative economic fallout for Canada. The White House provided an update yesterday indicating that President Trump has decided to pause tariff hikes on imports from Canada that comply with the USMCA trade agreement on top of the previous exclusion for autos and auto parts. The White House official stated that about 38% of Canadian imports are covered by the USMCA trade agreement. All other goods are subject to a 25% tariff apart from energy and potash which are subject to a 10% tariff. The Trump administration will decide whether to keep the tariffs in place on 2nd April when they will also outline plans for “reciprocal tariffs”.

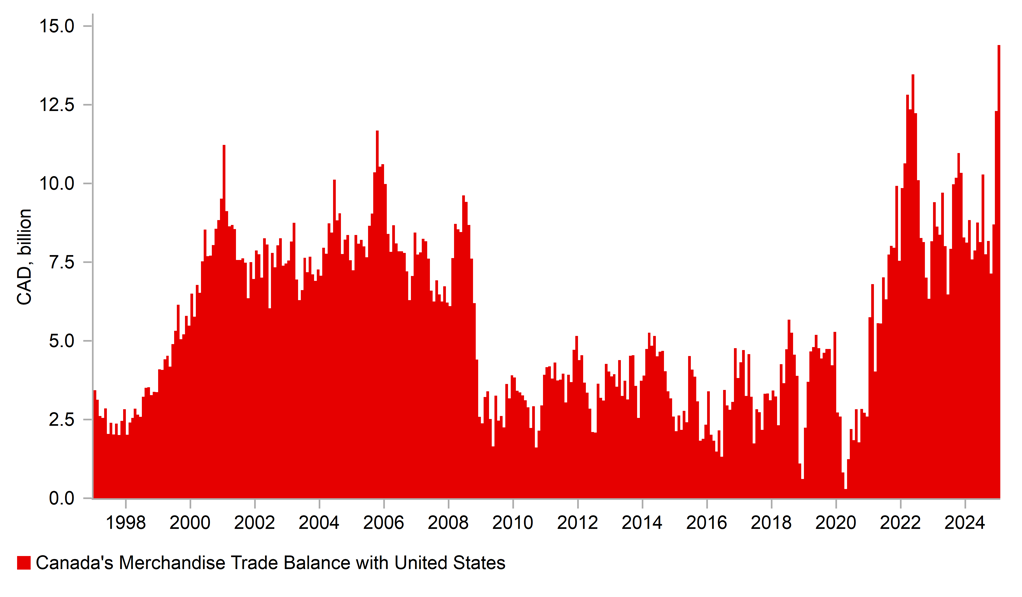

The negative economic fallout from heightened trade policy uncertainty and higher tariffs will increase pressure on the BoC to lower rates further next week. We expect the BoC to deliver another smaller 25bps cut although the return of larger 50bp cuts can’t be ruled out in the coming months if the trade war escalates further and Canada’s economy slows more sharply than expected. The BoC’s current estimate of the neutral policy rate is between 2.25% and 3.25%. Heightened downside risks to growth from trade disruption will offset recent positive Canadian data releases revealing economic growth was stronger than expected last year. Real GDP expanded more strongly than expected by 2.6% in Q4 and growth in Q3 was revised significantly higher by 1.2 percentage points to 2.2%. Growth at the start of this year was initially boosted as well by the front-running of Trump’s tariffs that lifted Canada’s exports. Total exports increased by 5.5%M/M in January and by 7.5% to the US. As a result, Canada’s trade surplus with the US hit a new record high of CAD14.4 billion. So far Canada has imposed only modest retaliatory tariffs of 25% on CAD30 billion of US imports from 4th March, and plans to step up to cover a further CAD125 billion of US imports within 21 days. We expect the BoC to put more weight on the disinflationary impact from weaker growth rather than the inflationary impact from retaliatory tariffs. In these circumstances, we expect the CAD to continue to underperform in the near-term.

HEIGHTENED TRADE DISRUPTION WEIGHS ON CAD

Source: Bloomberg, Macrobond & MUFG GMR

CANADA’S TRADE SURPLUS WITH US HITS NEW HIGH

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CNY |

03/09/2025 |

01:30 |

PPI YoY |

Feb |

-2.1% |

-2.3% |

!! |

|

CNY |

03/09/2025 |

01:30 |

CPI YoY |

Feb |

-0.4% |

0.5% |

!! |

|

JPY |

03/09/2025 |

23:30 |

Labor Cash Earnings YoY |

Jan |

3.0% |

4.8% |

!!! |

|

JPY |

03/09/2025 |

23:50 |

BoP Current Account Balance |

Jan |

-¥170.5b |

¥1077.3b |

!! |

|

NOK |

03/10/2025 |

07:00 |

CPI YoY |

Feb |

-- |

2.3% |

!! |

|

EUR |

03/10/2025 |

07:00 |

Germany Industrial Production SA MoM |

Jan |

-- |

-2.4% |

!! |

|

SEK |

03/10/2025 |

07:00 |

GDP Indicator SA MoM |

Jan |

-- |

0.7% |

!! |

|

EUR |

03/10/2025 |

09:30 |

Sentix Investor Confidence |

Mar |

-10.5 |

-12.7 |

!! |

|

JPY |

03/10/2025 |

23:50 |

GDP Annualized SA QoQ |

4Q F |

2.8% |

2.8% |

!! |

|

USD |

03/11/2025 |

10:00 |

NFIB Small Business Optimism |

Feb |

100.9 |

102.8 |

!! |

|

USD |

03/11/2025 |

14:00 |

JOLTS Job Openings |

Jan |

-- |

7600k |

!! |

|

EUR |

03/12/2025 |

08:45 |

ECB's Lagarde Speaks |

!!! |

|||

|

USD |

03/12/2025 |

12:30 |

CPI Ex Food and Energy MoM |

Feb |

0.3% |

0.4% |

!!! |

|

CAD |

03/12/2025 |

13:45 |

Bank of Canada Rate Decision |

2.8% |

3.0% |

!!! |

|

|

EUR |

03/12/2025 |

15:15 |

ECB's Lane Speaks |

!! |

|||

|

GBP |

03/13/2025 |

00:01 |

RICS House Price Balance |

Feb |

-- |

22.0% |

!! |

|

SEK |

03/13/2025 |

07:00 |

CPI YoY |

Feb F |

-- |

1.3% |

!! |

|

EUR |

03/13/2025 |

10:00 |

Industrial Production SA MoM |

Jan |

-- |

-1.1% |

!! |

|

USD |

03/13/2025 |

12:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

SEK |

03/14/2025 |

07:00 |

Unemployment Rate SA |

Feb |

-- |

9.7% |

!! |

|

GBP |

03/14/2025 |

07:00 |

Monthly GDP (MoM) |

Jan |

-- |

0.4% |

!! |

|

EUR |

03/14/2025 |

07:00 |

Germany CPI YoY |

Feb F |

2.3% |

2.3% |

!! |

|

EUR |

03/14/2025 |

07:45 |

France CPI YoY |

Feb F |

-- |

0.8% |

!! |

|

EUR |

03/14/2025 |

09:00 |

Italy Industrial Production MoM |

Jan |

-- |

-3.1% |

!! |

|

USD |

03/14/2025 |

14:00 |

U. of Mich. Sentiment |

Mar P |

65.0 |

64.7 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- The BoC is scheduled to hold their latest policy meeting in the week ahead. Pressure on the BoC to cut rates further has increased after President Trump put in place tariffs on imports from Canada this week. Even after the one month-exemption rolled out for auto and auto parts imports, disruption to Canada’s economy is expected to be significant. The longer the tariffs are in place the sharper the slowdown is likely to be for Canada’s economy and the deeper rate cuts the BoC is likely to deliver. We expect the BoC to continue cutting rates to provide more support for growth and to look through upside risks to inflation in the near-term from the Canadian government’s plans for retaliatory tariffs. Another larger 50bps cut can’t be ruled out but we judge unlikely as soon as next week. Downside risks from tariffs will offset stronger than expected economic growth last year in Canada.

- The main economic data release in the week ahead will be the latest US CPI report for February. Core inflation picked up strongly by +0.4%M/M in January although it did not feed through as much into the Fed’s preferred measure of inflation the core PCE deflator which increased by +0.3%M/M. A second consecutive month of stronger inflation at the start of this year would add to the Fed’s caution over cutting rates further, and cast some doubt on US rate market participants expectations for more active Fed easing in response to the recent run of softer US activity data.

- The latest labour cash earnings report from Japan will attract market attention in the week ahead with market participants continuing to weigh up the BoJ’s plans for further rate hikes. Scheduled full-time pay accounting using the same base for comparison has been running at around 3.0% which the BoJ’s judges as consistent with their 2.0% inflation target. The Japanese Trade Union Confederation known as Rengo announced this week that average wage demands amongst members in the 2025 Spring wage negotiations was 6.09% higher than last year’s average of 5.85%. A development that should provide reassurance to the BoJ that stronger wage growth will continue in the upcoming fiscal year.