To read the full report, please download PDF.

JPY hits fresh year to date lows

FX View:

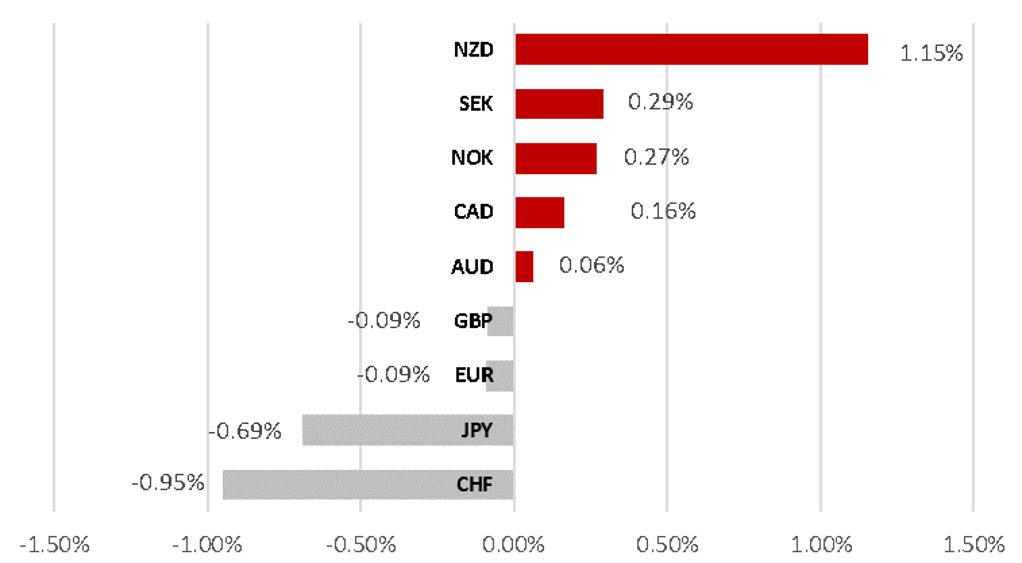

The bullish trend for the USD at the start of this year remains in place with the dollar index on course to close higher for the fourth consecutive week. The USD’s performance has been more mixed over the past week. The top performing G10 currency has been the NZD while the low yielding currencies of the CHF and JPY have both underperformed. The NZD has been boosted by building speculation that the RBNZ may raise rates further in the coming months in contrast to most other G10 central banks that are moving closer to cutting rates. Still rate cut expectations in the US and Europe continue to be scaled back as well which is providing a headwind for the low yielding currencies of the CHF and JPY. Fed and BoE rate cut expectations will be tested in the week ahead by the release of the latest US and UK CPI reports for January. After taking into consideration recent developments, we are sticking to our tactical bullish bias for the USD in the week ahead.

A MIXED PERFORMANCE FOR USD THIS WEEK

Source: Bloomberg, 14:30 GMT, 9th February 2024 (Weekly % Change vs. USD)

Trade Ideas:

We are maintaining our two open trade views - short EUR/GBP and long USD/CHF given our continued favourable outlook for USD and GBP.

JPY Flows:

The MoF portfolio flow data for the month of January revealed that there were record net purchases of foreign equities by Japanese Investment Trusts triggered by the change in NISA rules at the start of this year.

FX Momentum:

Our analysis suggests that upward momentum for USD & GBP has started to fade as the both majors struggle to make gains against respective G10 crosses in recent weeks.

FX Views

G10 FX: Limited follow through for USD after bullish break out

It has been a mixed week for the USD which has been gradually extending its advance after breaking higher in response to the stronger nonfarm payrolls report for January. The dollar index has held above the 104.00-level over the past week after climbing above the 200-day moving average at just above 103.50 earlier this month. The breakdown of G10 FX performance over the past week highlights that the USD’s performance has been more mixed. The USD has mainly extended its advance against the lower yielding G10 currencies of the CHF and JPY, and to a lesser extent against the European currencies of the EUR and GBP. In contrast, the USD has weakened over the past week against the NZD, SEK and NOK. Overall, recent price action still favours further USD upside in the near-term although the lack of follow through from upward momentum after the nonfarm payrolls report has been disappointing.

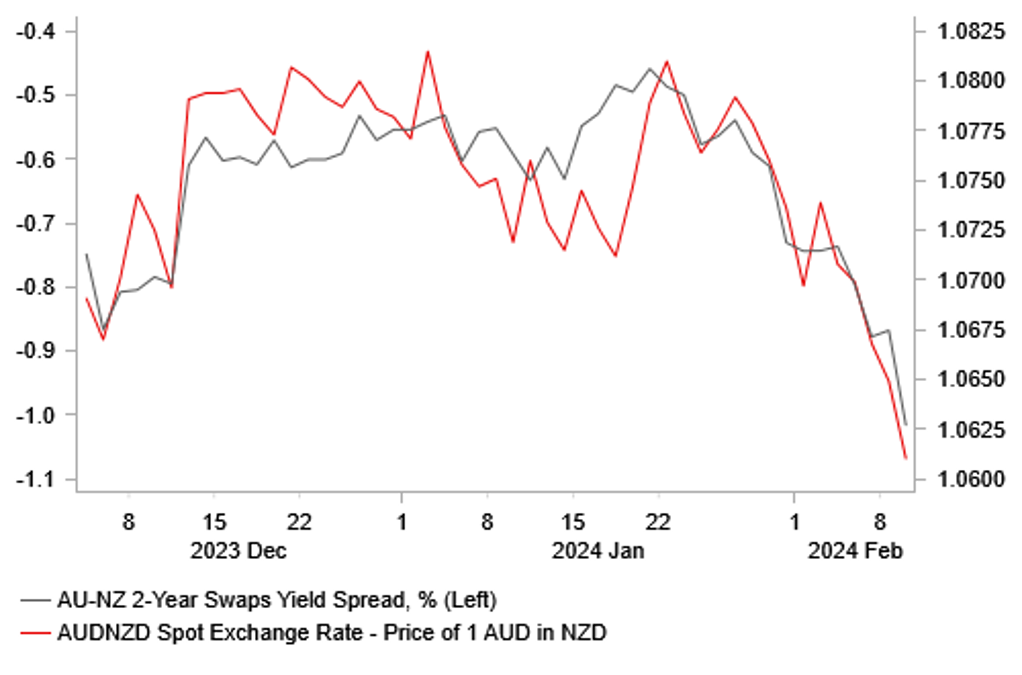

The best performing G10 currency over the past week and for this month as a whole has been the NZD. It has resulted in the AUD/NZD rate falling to its lowest level since May of last year with the pair breaking back below the 1.0600-level. The main catalyst has been a hawkish repricing of RBNZ rate hike expectations. There has been building speculation that the RBNZ will extend their rate hike cycle. The New Zealand rate market have moved to price in around 11bps of hikes by their next RBNZ policy meeting on 28th February and 22bps of hikes by the May RBNZ policy meeting. The implied yield from the three-month interest futures contract for the end of this year has risen by 60bps so far this month. Market participants are increasingly anticipating that the RBNZ’s monetary policy settings will divergence in the near-term from the RBA’s and other major G10 central banks as they move closer to cutting rates which is providing a bullish catalyst for the NZD. The RBNZ did signal at their last policy meeting in November that “if inflationary pressures were to be stronger than anticipated, the OCR would likely need to increase further”. The stronger labour market and CPI reports for Q4 have since increased the risk of another hike although we would question whether it is really necessary given the policy rate is already well into restrictive territory at 5.50%. It compares to the RBNZ’s own estimate of the neutral policy rate that was raised to 2.50% in November.

YIELD SPREADS MOVING IN FAVOUR OF NZD

Source: Bloomberg, Macrobond & MUFG GMR

FX RESERVES HAVE INCREASED IN RECENT MONTHS

Source: Bloomberg, Macrobond & MUFG GMR

At the other end of the spectrum, the low yielding G10 currencies of the CHF and JPY have underperformed over the past week. The price action supports our long USD/CHF trade recommendation which was established initially to take advantage of further USD upside in the near-term, and the SNB’s unease over CHF strength at the end of last year. The release of the latest FX reserve data from Switzerland revealed that the value of foreign currency reserves increased for the second consecutive month in January to CHF662 billion moving further above the low from November at CHF642 billion. It has been the biggest two month increase in the value of foreign currency reserves since January 2022. It suggests that the SNB could have already resumed direct intervention to weaken the CHF after indicating at their last policy meeting in December that they were no longer focusing on foreign currency sales after becoming more confident that inflation would remain within their target range over their forecast horizon. In the week ahead the release of the latest sight deposit data from Switzerland and CPI report for January will be important in assessing the SNB’s ongoing response to CHF strength. The Swiss interest rate market is currently pricing in around 8bps of rate cuts by the SNB’s next policy meeting on 21st March and 28bps by the following meeting in June. A softer than expected CPI reading in the week ahead could encourage speculation that the SNB will cut rates ahead of the ECB in March to help weaken the CHF further.

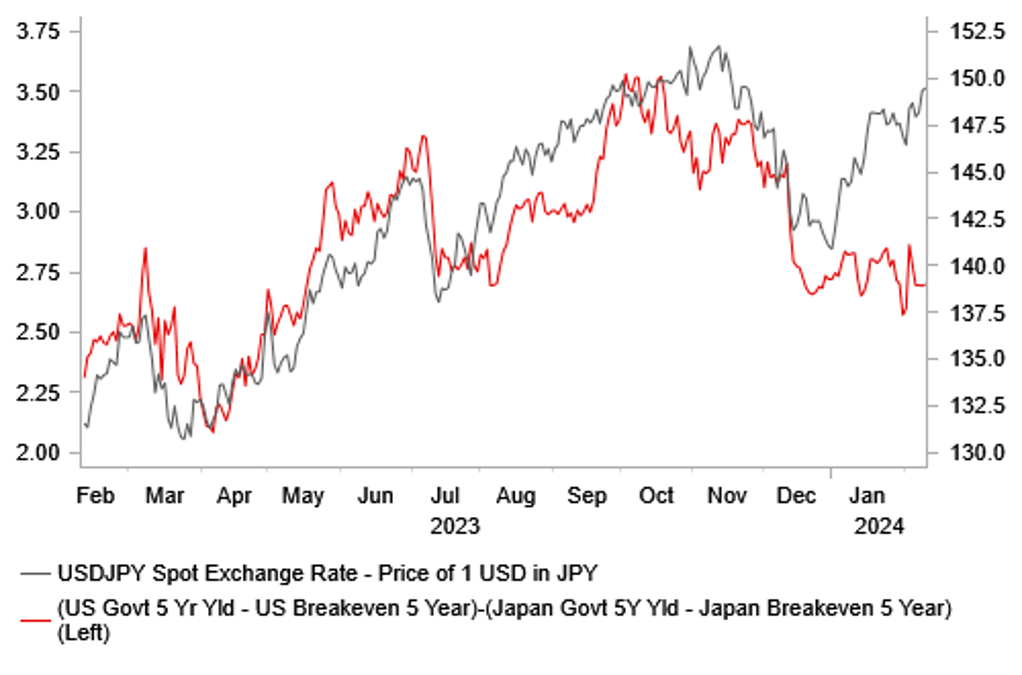

The low yielding G10 currencies of the CHF and JPY have also been undermined by the scaling back of rate cut expectations for the Fed and ECB. There recent run of economic data releases from the US and euro-zone have surprised to upside at the start of this year. The relative outperformance of the US economy remains striking triggering renewed interest in long USD positions to benefit from US exceptionalism. It has resulted in 2-year yields in the US and euro-zone rising by around 35bps and 30bps respectively from last month’s lows. The hawkish repricing of expectations for later start to and shallower Fed rate cut cycle on the back of a more resilient US economy has been important driver behind USD/JPY moving back towards last year’s peak at just above the 150.00-level. The JPY has weakened even as recent communication from the BoJ since their last policy meeting in January has been preparing markets for an exit from negative rates. The timing of the first rate hike from the BoJ is still judged as more likely in April but an earlier start in March can’t be ruled out. One additional domestic factor that could be contributing to renewed JPY weakness at the start of this year has the been changes to the NISA tax-free savings accounts for households in Japan. Data released by the MoF this week revealed that there was record demand for foreign equities by Japanese Investment Trusts in January totalling JPY1.29 trillion.

In light of recent developments, we remain comfortable sticking to our bullish bias for the USD in the near-term.

USD/JPY VS. REAL YIELD SPREADS

Source: Bloomberg, Macrobond & MUFG GMR

RECORD DEMAND FOR FOREIGN EQUITIES IN JANUARY

Source: Bloomberg, Macrobond & MUFG GMR

Weekly Calendar

|

Ccy |

Date |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CHF |

02/12/2024 |

09:00 |

Total Sight Deposits CHF |

-- |

481.2b |

!! |

|

|

EUR |

02/12/2024 |

09:45 |

ECB's Lane Speaks |

!!! |

|||

|

GBP |

02/12/2024 |

18:00 |

BoE Governor Bailey speaks |

!!! |

|||

|

GBP |

02/13/2024 |

07:00 |

Employment Change 3M/3M |

Dec |

-- |

-- |

!! |

|

GBP |

02/13/2024 |

07:00 |

Average Weekly Earnings 3M/YoY |

Dec |

-- |

6.5% |

!!! |

|

CHF |

02/13/2024 |

07:30 |

CPI YoY |

Jan |

-- |

1.7% |

!! |

|

EUR |

02/13/2024 |

10:00 |

Germany ZEW Survey Expectations |

Feb |

-- |

15.2 |

!! |

|

USD |

02/13/2024 |

13:30 |

CPI YoY |

Jan |

2.9% |

3.4% |

!!! |

|

NOK |

02/14/2024 |

07:00 |

GDP QoQ |

4Q |

-- |

-0.5% |

!! |

|

GBP |

02/14/2024 |

07:00 |

CPI YoY |

Jan |

-- |

4.0% |

!!! |

|

EUR |

02/14/2024 |

10:00 |

GDP SA QoQ |

4Q P |

-- |

0.0% |

!! |

|

EUR |

02/14/2024 |

10:00 |

Employment QoQ |

4Q P |

-- |

0.2% |

!! |

|

JPY |

02/14/2024 |

23:50 |

GDP SA QoQ |

4Q P |

0.3% |

-0.7% |

!!! |

|

AUD |

02/15/2024 |

00:30 |

Employment Change |

Jan |

32.5k |

-65.1k |

!!! |

|

JPY |

02/15/2024 |

04:30 |

Industrial Production MoM |

Dec F |

-- |

1.8% |

!! |

|

GBP |

02/15/2024 |

07:00 |

GDP QoQ |

4Q P |

-- |

-0.1% |

!!! |

|

GBP |

02/15/2024 |

07:00 |

Output Per Hour YoY |

4Q P |

-- |

-0.3% |

!! |

|

EUR |

02/15/2024 |

12:00 |

ECB's Lane Speaks |

!!! |

|||

|

USD |

02/15/2024 |

13:30 |

Retail Sales Advance MoM |

Jan |

0.1% |

0.6% |

!!! |

|

USD |

02/15/2024 |

13:30 |

Import Price Index YoY |

Jan |

-- |

-1.6% |

!! |

|

USD |

02/15/2024 |

13:30 |

Initial Jobless Claims |

-- |

-- |

!! |

|

|

USD |

02/15/2024 |

14:15 |

Industrial Production MoM |

Jan |

0.4% |

0.1% |

!! |

|

NOK |

02/15/2024 |

17:00 |

Norges Bank Governor's Annual Address |

!!! |

|||

|

NZD |

02/15/2024 |

18:40 |

RBNZ’s Orr to Speak |

!!! |

|||

|

SEK |

02/16/2024 |

07:00 |

Unemployment Rate SA |

Jan |

-- |

8.2% |

!! |

|

GBP |

02/16/2024 |

07:00 |

Retail Sales Inc Auto Fuel MoM |

Jan |

-- |

-3.2% |

!!! |

|

EUR |

02/16/2024 |

08:45 |

ECB's Schnabel Speaks |

!! |

|||

|

USD |

02/16/2024 |

13:30 |

Housing Starts |

Jan |

1468k |

1460k |

!! |

|

USD |

02/16/2024 |

13:30 |

PPI Final Demand YoY |

Jan |

-- |

1.0% |

!! |

|

USD |

02/16/2024 |

15:00 |

U. of Mich. Sentiment |

Feb P |

80.0 |

79.0 |

!! |

Source: Bloomberg, Macrobond & MUFG GMR

Key Events:

- Economic data releases will be the main highlights in the week ahead. The biggest market movers are likely to be the release of the latest US CPI and retail sales reports for January. A third consecutive month of stronger inflation in the CPI report for January could further push back market expectations for the Fed to begin cutting rates beyond April although the Fed places more weight on the PCE deflator which has been better behaved recently. US retail sales growth proved to be surprisingly strong at the end of last year contributing to a more modest slowdown for the US economy in Q4. If the US economy continues to prove resilient at the start of this year it will discourage the Fed from cutting rates sooner, and favour a more gradual pace of cuts when the easing cycle is underway.

- It will also be an important week for UK economic date releases. The latest UK labour market report is released on Tuesday, CPI report for January on Wednesday, and GDP report for Q4 on Thursday. Market participants will be watching closely for further evidence of slowing wage growth which has been moderating in the 2H of last year. The ONS announced at the start of this week that the unemployment rate had surprisingly dropped since last summer indicating tighter than expected labour market conditions. Recent stronger data releases have reduced the risk of the UK economy contracting for the second consecutive quarter in Q4 although a mild technical recession is not ruled out.

- A speech from BoE Governor Bailey on Monday could provide further guidance over the likely timing of rate cuts in the year ahead. Recent communication from BoE policymakers has cautioned against expecting imminent rate cuts signalling that the first rate cut is more likely in June or August than in May.