Key Points

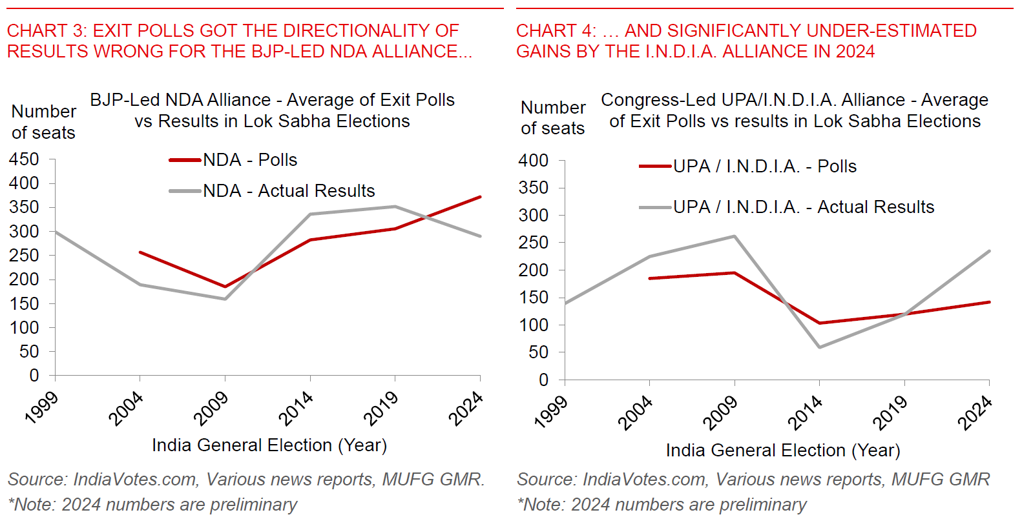

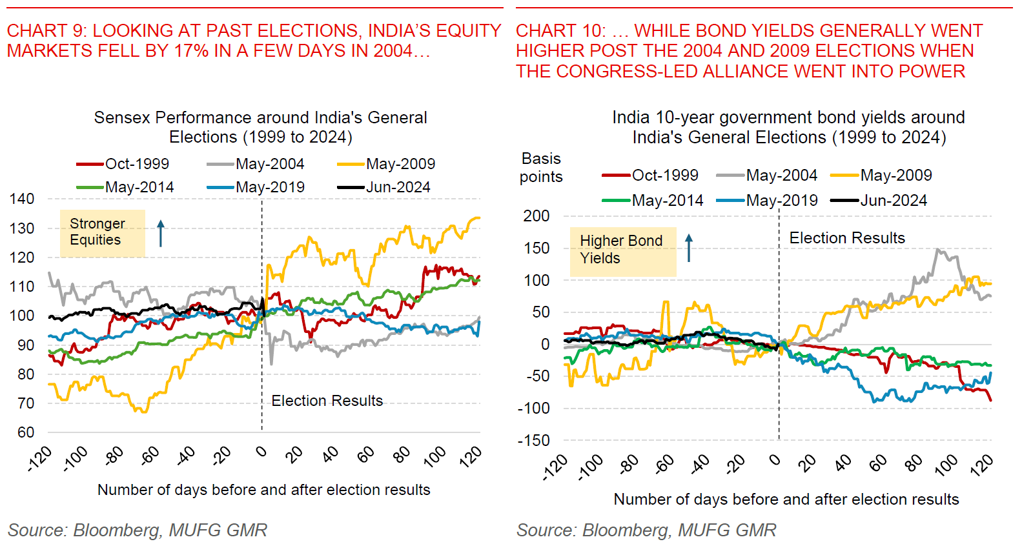

- In a massive surprise to markets and political observers, the incumbent BJP very likely lost its single-party majority in parliament, with leads in 239 seats at the time of writing, down significantly from 303 seats in the 2019 Elections. This number could still change with the latest data by the Election Commission showing the BJP leading in 15 seats with vote margins of 5% or less.

- Prime Minister Modi and his BJP party will now only be able to form the government and return to power in coalition with allies from the National Democratic Alliance (NDA), with the NDA leading in around 290 seats as of the latest count (majority mark: 272 seats). The opposition I.N.D.I.A. alliance is leading in 235 seats, far surpassing all polling expectations in this Elections.

- What’s crucial is that there are some regional parties in the NDA alliance which are known to switch sides historically, and as such not always loyal to the BJP nor the NDA. Some power sharing is likely needed, such as ceding key ministry positions together with compromise on structural reforms. We hesitate to make concrete predictions at this point, and the political implications will likely only become clearer in the days and weeks ahead.

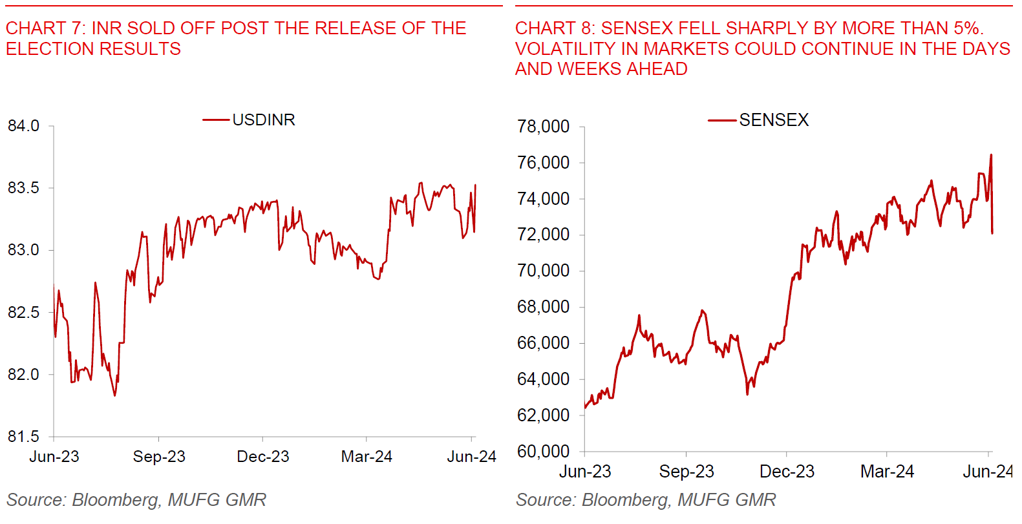

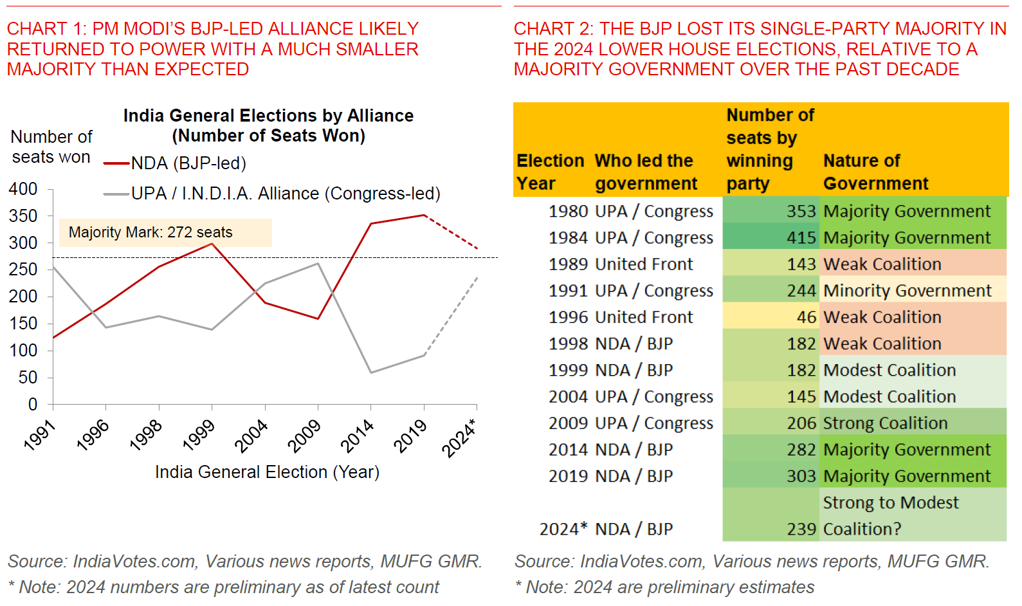

- With the increased political uncertainty, INR FX, rates, and equities sold off sharply in the aftermath of the surprise result, with Sensex declining by close to 6%, INR 10-year yields rising by 10bps, and INR weakening by 0.5% against the US dollar to breach 83.50. This moves are something we have highlighted in the scenarios in our Election preview reports (see in India 2024 General Elections – Can the strong reform momentum continue full report and chartpack).

- Our base case assumption is that the BJP and PM Modi will be able to come back to power by bringing their key NDA allies into their fold, and with Modi continuing once again as Prime Minister for a third term. Nonetheless, until we get clarity on that front, volatility in markets will likely continue.

- Assuming that is correct, we generally expect broad policy continuity in key planks that the Executive branch can implement without legislative changes, including infrastructure, digitalising land records, raising women’s labour participation rates, and attracting manufacturing investment, among others.

- Nonetheless, three things will likely be different.

- First, there is a much lower chance of passing the most contentious and difficult structural reforms in land, labour and the farm sector.

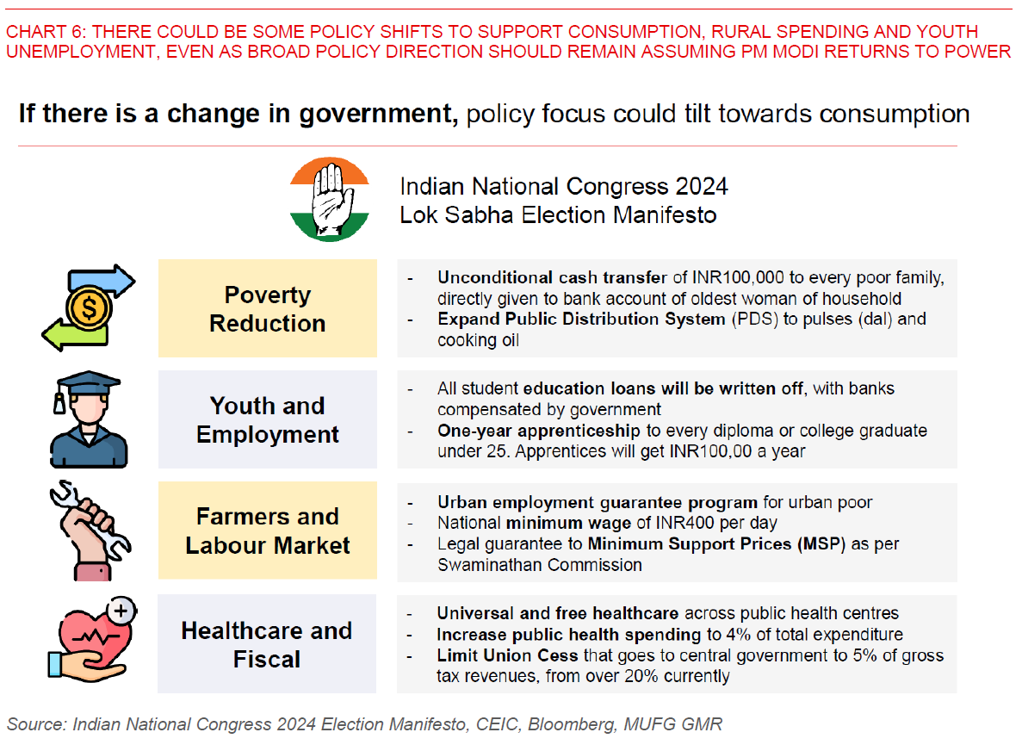

- Second, there will likely be some policy shifts to supporting consumption, including potentially more subsidy spending for the lower income and farmers, and also measures to address youth unemployment and inflation. The extent of these shifts will depend on the post-mortem analysis after the Elections, together with possible power sharing demands by the NDA partners. The composition of growth could change somewhat to favour consumption and the rural segment, and the pace of fiscal consolidation could slow modestly.

- Third, even if the BJP forms the government, the stability of the NDA coalition may still be somewhat unclear over the term of this government, depending on how some of the regional parties react.

- From a markets perspective, we would wait for the dust to settle first before attempting to fade some of the weakness in INR FX and risk assets that we are seeing right now. The important message is that India’s macro picture is still a positive one, with a manageable current account deficit, bond index inclusion inflows, lower core inflation, coupled with still robust growth, but what’s unclear is whether foreign investors will invest at the same pace moving forward.

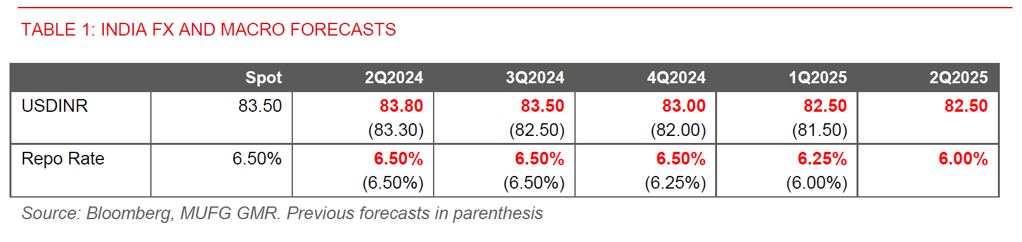

- We now forecast USDINR at 83.00 by calendar year end (from 82.00 previously). We provisionally revise our USDINR forecasts higher to account for an implicit slower pace of portfolio inflows but with the assumption that BJP and PM Modi return to power. The impact to other flows such as FDI is unclear, but we think it’s possible that some long-term investors who were sitting on the sidelines may wait it out a little longer to get better clarity on potential policy shifts.

- We push out the start of the 1st RBI rate cut to the Jan-Mar quarter, from our previous expectation of the Oct-Dec quarter. We think RBI will want to monitor possible policy shifts by the incoming government, while also keeping a close watch on the monsoon, impact of heatwaves, and also global factors such as the trajectory for Fed rate cuts.