Key Points

- Summary: Prime Minister Modi’s party will in all likelihood return to power with a higher number of seats and obtain a stronger mandate after the 2024 Lok Sabha Elections, if exit polls are anything to go by.

- Assuming the official results on 4 June validate these estimates, PM Modi will have greater space to push through more difficult structural reforms, and to also execute on key supply-side policies such as infrastructure, investment attraction, fiscal consolidation and inflation management (see India 2024 General Elections full report and chartpack).

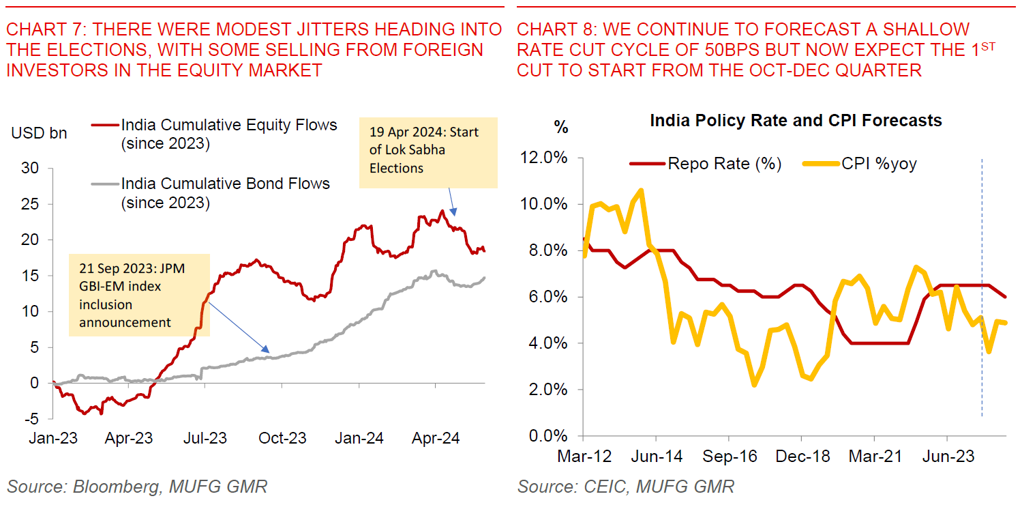

- We expect risk assets to rally, India govt bond yields to grind lower, and INR to strengthen in the immediate aftermath, notwithstanding RBI’s likely hand in intervening to cap INR strength.

- We remain reasonably constructive on INR and forecast USDINR at 82.0 by calendar year-end. A stronger mandate for the incumbent would give us more confidence on our constructive view. We continue to expect a shallow RBI rate cut cycle of 50bps but now see the 1st rate cut starting in the Oct-Dec quarter, with RBI likely to wait for clarity on the monsoon and the start of the Fed rate cut cycle before making the 1st move.

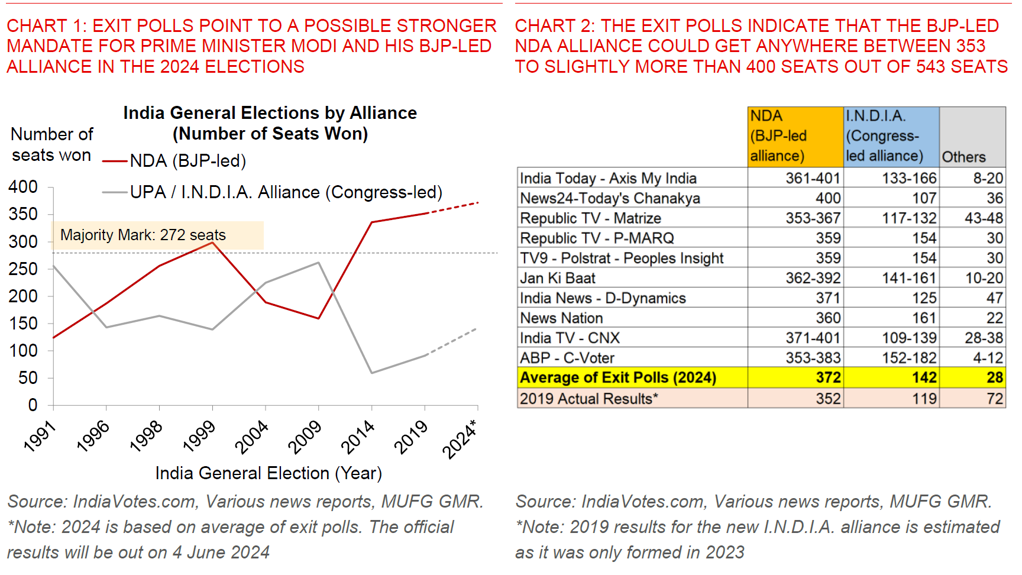

- The world’s largest elections has just concluded on 1 June, and the exit polls out indicate that the incumbent BJP together with the National Democratic Alliance (NDA) could get anywhere between 353 to slightly more than 400 seats, out of 543 seats in the Lower House of Parliament (see Charts 1 and 2 above).

- If this is right, this would mean Prime Minister Modi has obtained a stronger mandate to govern post the 2024 General Elections.

- Nonetheless, it’s true that opinion and exit polls have a somewhat checkered history of predicting elections in India, and we should most certainly wait for the official results on 4 June. However, there are three factors which make us sanguine about the eventual outcome and implications for markets.

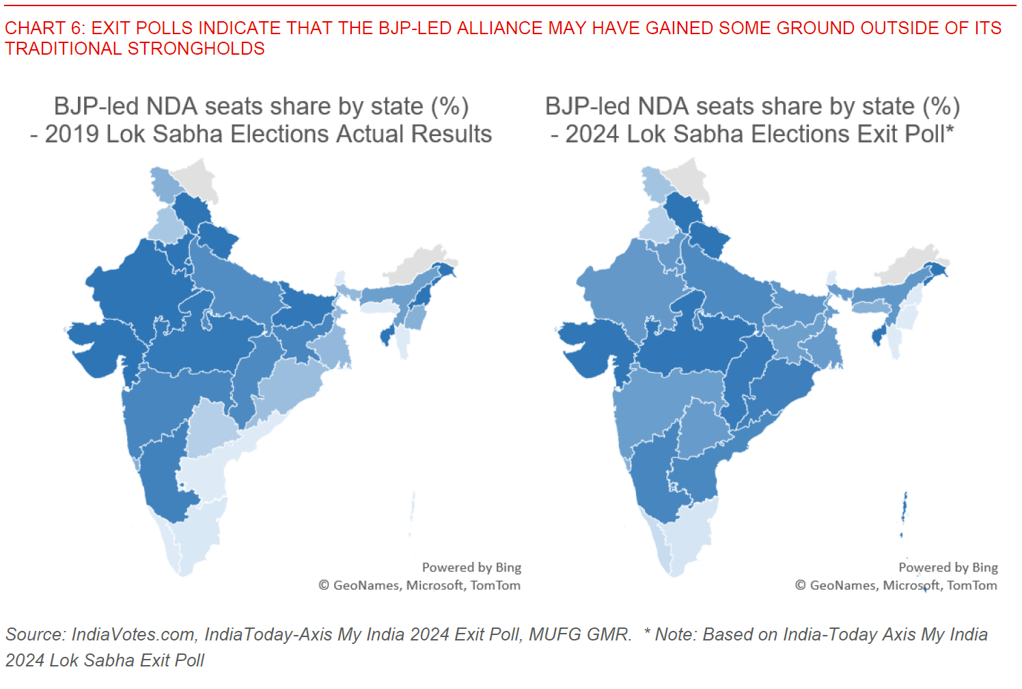

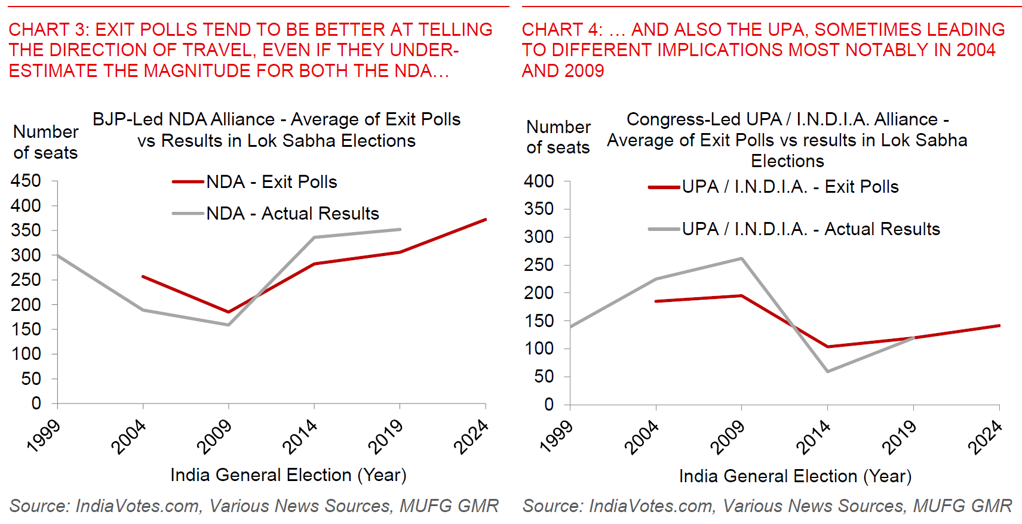

- First, exit polls have actually been quite decent at telling the direction of travel historically, even if they have often under-estimated the magnitude of the shifts, most notably in 2004 and 2009, but also in 2014 and 2019 (see Charts 4 and 5 below). The fact that virtually all exit polls point in the same direction in 2024 – ie. a larger majority from 2019 – therefore gives us some comfort in that regard.

- Second, the most accurate polling agencies in recent General Elections (Axis My India and Today’s Chanakya) are estimating a decent chance of the NDA getting around 400 seats, and not just a larger majority.

- Last but not least, the fact that all exit polls estimate such a wide buffer in seats between the incumbent and the opposition indicate that it would probably take a monumental and universal statistical bias across all polling agencies for PM Modi not to return to power. This seems extremely unlikely to our minds.

- Assuming these exit poll results hold, we expect risk assets to rally, India government bond yields to grind lower, and INR to strengthen in the immediate aftermath, although RBI will likely be in the market to cap INR strength.

- The fundamental reason is that markets will likely price for a higher chance of more contentious structural reforms coming to pass such as in land ownership and acquisition, less restrictive labour codes at the state level, together with reforming India’s farm and agriculture sector, if the BJP/NDA gets a larger seat share (India 2024 General Elections: Can the strong reform momentum continue - full report and chartpack).

- In addition, a stronger mandate for the incumbent would also imply a freer hand in executing key policies important for markets, including those on the supply-side such as fiscal consolidation, inflation management, infrastructure, and investment attraction including in the manufacturing space.

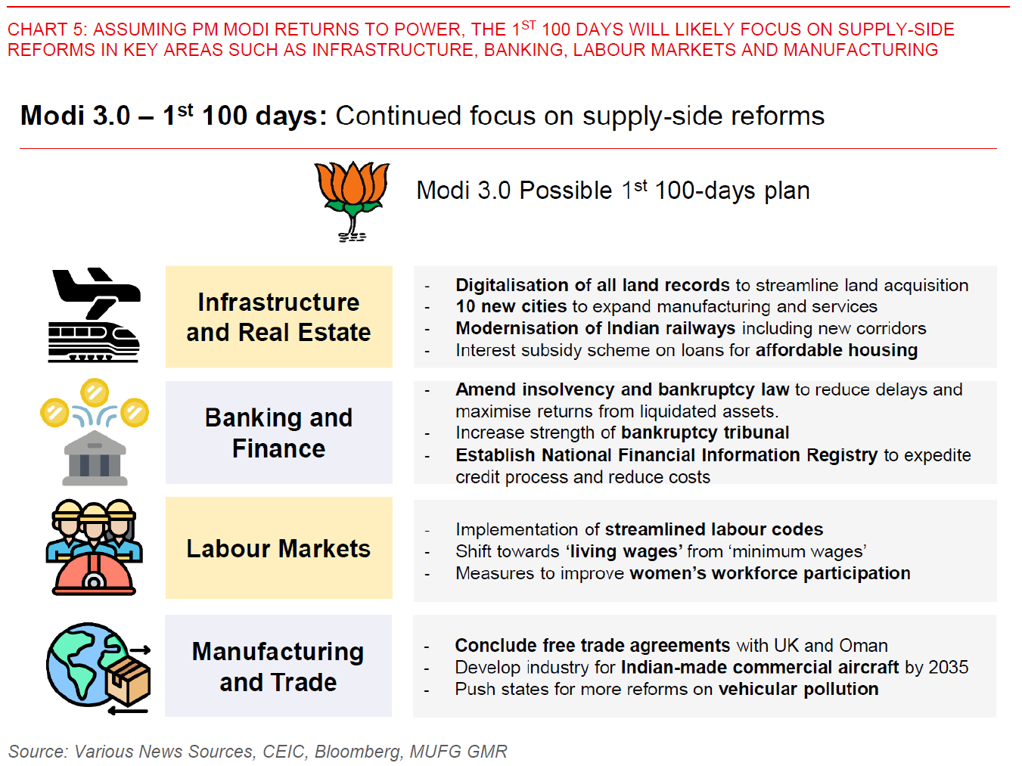

- While we do not know the exact plans and policies that Prime Minister Modi has right now for a possible 3rd term, we can gleam some insights from some of the news articles and interviews out thus far.

- In general, some of the key policies that could be pushed out in the 1st 100 days include digitalisation of land records to facilitate land acquisition, modernising the Indian railways, amending the insolvency and bankruptcy law, raising women’s workforce participation, together with moves to implement streamlined labour codes (see Chart 5 below).

- The full Union Budget out in July will be key to watch, while announcements over the few months could help set the tone for the next term of government.