Key Points

- After several years of false dawns and dashed hopes, India is finally added to the JPM GBI-EM Global Diversified Index.

- The Index provider said that India Government Bonds will be included in the index starting 28 June 2024, at a maximum weight of 10%. In addition, inclusion will be staggered through 10 months (ie. 1% weight per month) from June 2024 through March 2025.

- This inclusion is partial as it only includes 23 Indian Government Bonds (IGBs) under the Fully-Accessible Route, which doesn’t have foreign restrictions.

- There was certainly loads of skepticism leading up to the review, given that India hadn’t really done much at all to ease foreign investors’ perennial bugbears on capital gains taxation and other operational issues.

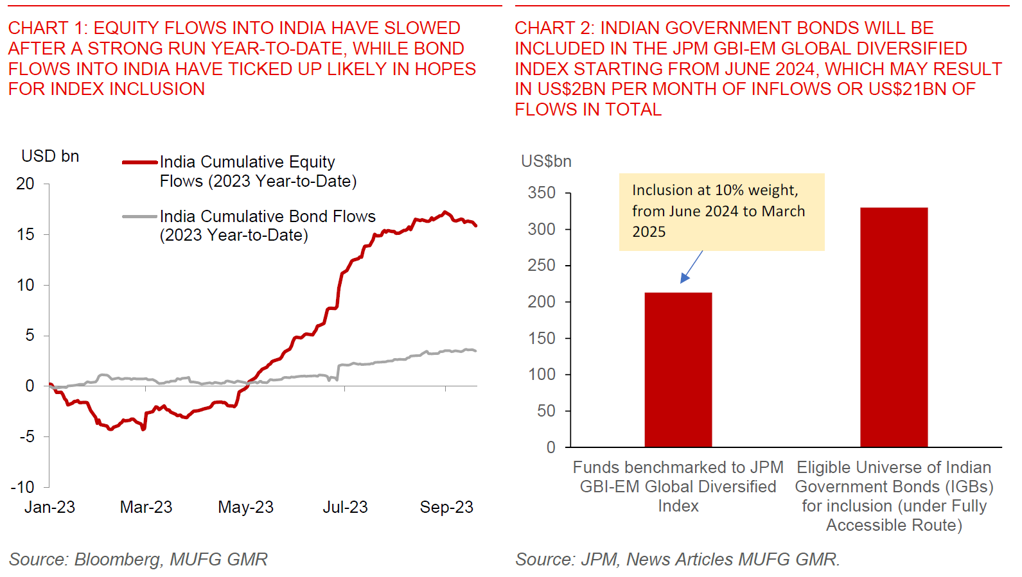

- In terms of potential macro and FX impact, we estimate that India could see one-off inflows of around US$21bn with index inclusion, which would equate to around US$2bn per month with the 10-month phase in period.

- The key question is also whether foreign investors will front-run the index inclusion. If the experience of China is anything to go by, foreigners may pre-position for the inflows ahead of the actual inclusion date, notwithstanding continued operational frictions surrounding investing in IGBs.

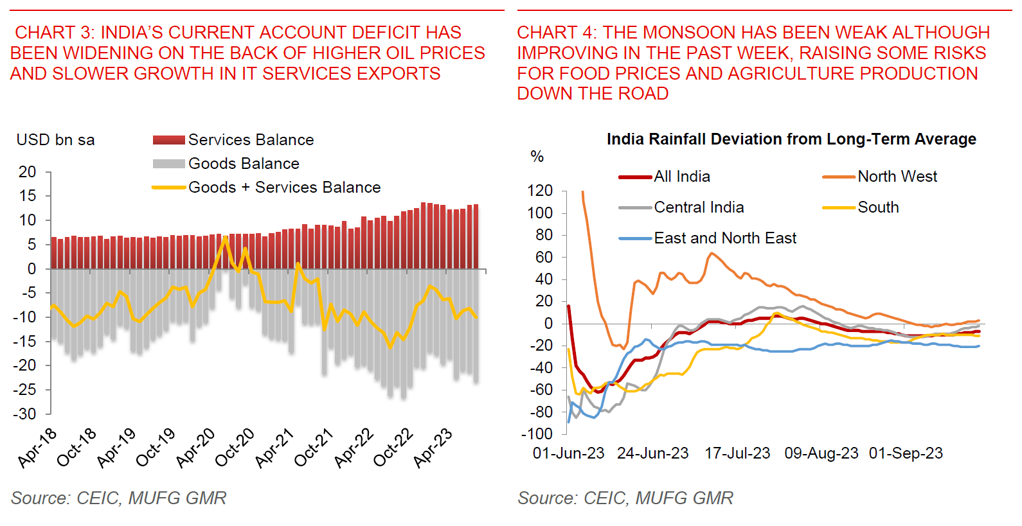

- The inflows can be quite sizeable for INR. To put them in context, India’s current account deficit is running around US$5bn per month (~US$60bn annualised), and an incremental US$2bn per month could go some way to funding that deficit, all things being equal.

- Of course, not all things not equal, and INR has certainly been buffeted by several macro headwinds in the near-term. For one, Brent oil prices have risen closer to US$95/bbl, which may add around US$1-1.5bn per month to the deficit. Second, foreign equity portfolio flows have slowed to a trickle after a strong year-to-date run of close to US$17bn of inflows. Third, the monsoon has been weak, which raises risk for food prices and agriculture production. And lastly, the current account deficit has been widening, partly on the back of subdued IT services export growth, strong domestic demand, and infrastructure spend.

- We nonetheless remain constructive on INR’s medium-term prospects, and the bond index inclusion provides some additional support to that view. We assume that India’s current account deficit will narrow in 2024 once IT services exports improve more meaningfully, and domestic demand normalises. We are also assuming that oil prices come off next year as Saudi Arabia tapers its oil production cuts, but suffice to say there is significant uncertainty on this front. India’s FDI flows should also pickup over the medium-term as it remains a key beneficiary of increasing investment commitments by manufacturers. Lastly, we also expect RBI to remain in the FX market to supply Dollars and prevent sharp spikes in USDINR, hence capping upside to FX volatility.

- We are forecasting USDINR at 82.7 in 3 months and 81.0 in 12 months, with risks to our forecasts from rising oil prices and the strong Dollar environment.