Key Points

- The Reserve Bank of India cut its key repo rate by 25bps, bringing it to 6.25% from 6.50% previously. While this was in line with our forecasts (see IndiaPulse – Let it go), we note that heading into the policy meeting there was speculation of a larger rate cut, perhaps leading to USD/INR rising quickly above 87.50 this week before settling down today at 87.42. We were of the view that a jumbo rate cut at this juncture would be a policy mistake given significant global uncertainties, and as such take it as a positive for FX that they did not do so.

- Nonetheless, this was also new RBI Governor Sanjay Malhotra’s first monetary policy meeting, and most certainly the market (and the media alike) were always going to be curious to decipher his leanings.

- We sense from the press conference that the new RBI Governor leans dovish, even as he is cognisant that there are “no free lunches” with policy trade-offs between achieving financial stability and promoting growth.

- In addition, his comments suggest to us he is willing to allow more flexibility in the Indian Rupee, saying that INR is “market-determined” and RBI’s key policy is not to target any specific INR level or band.

- We maintain our forecasts for RBI to cut the repo rate by another 50bps, bringing it to 5.75% by the end of FY2025/26.

- For now, we maintain our USD/INR forecast of 88.50 by the end of calendar year 2025, even as we acknowledge that the current spot rate has already exceeded our 1Q forecast.

- Our key message to clients remains the same - the path of least resistance is for further INR weakness, with some underperformance against other Asian currencies, and with depreciation being more front-loaded before tapering off later in the year.

- Today’s policy meeting has reinforced our views.

Key details:

- We thought that the new RBI Governor leaned dovish in his press conference in a couple of ways.

- First, when he was asked about the Liquidity Coverage Ratio (LCR) that were supposed to take effect from 1 April 2025, he was explicit in saying that RBI will give sufficient time for banks to adjust up to an additional one year.

- Second, when he was asked whether RBI’s various macroprudential measures including on consumer loans and NBFCs have already achieved the desired policy objective of slowing loan growth, he was also straight up in saying that they had, perhaps indicating a preference to change the pace of implementation moving forward.

- All this is not to say that RBI Governor Malhotra is a growth at all cost policymaker, and think it’s a positive that the policy statement clearly acknowledges important trade-offs to be made when it comes to promoting financial stability and consumer protection, while also supporting growth.

- Nonetheless, we think that the new RBI Governor should over time support making more rate cuts, and as such continue to see the central bank reducing the repo rate to 5.75% over the course of this financial year.

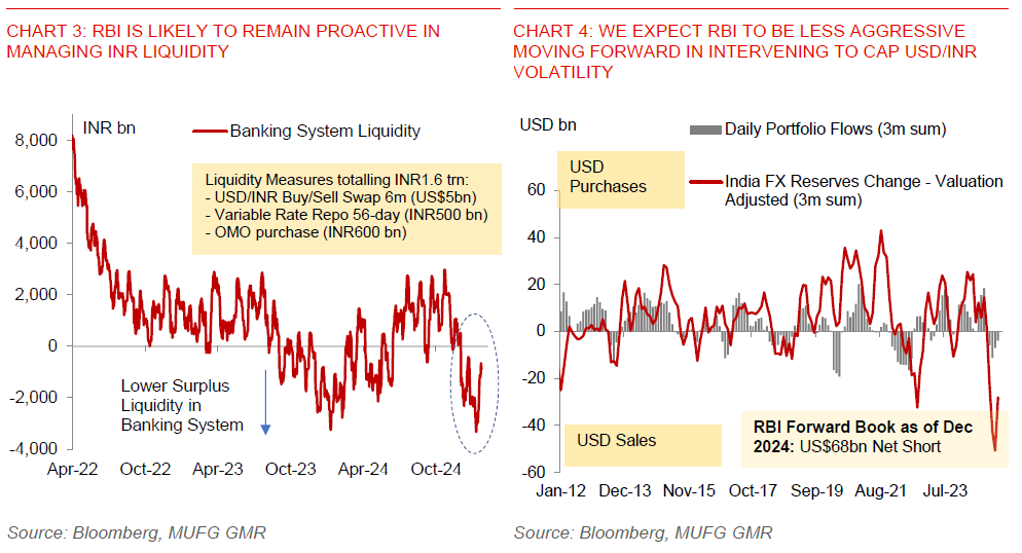

- Perhaps in a slight disappointment to markets, RBI did not officially announce any additional liquidity injection measures on top of the INR1.6 trillion they mentioned last month through buy/sell swaps, OMO purchases among others.

- Nonetheless, the delay in LCR norms may partially reduce some of the liquidity tightness, while RBI is likely to remain proactive in pushing out more measures moving forward.