Key Points

- The Reserve Bank of India kept its key repo rate on hold at 6.5% in a unanimous vote, in a move widely expected by the market.

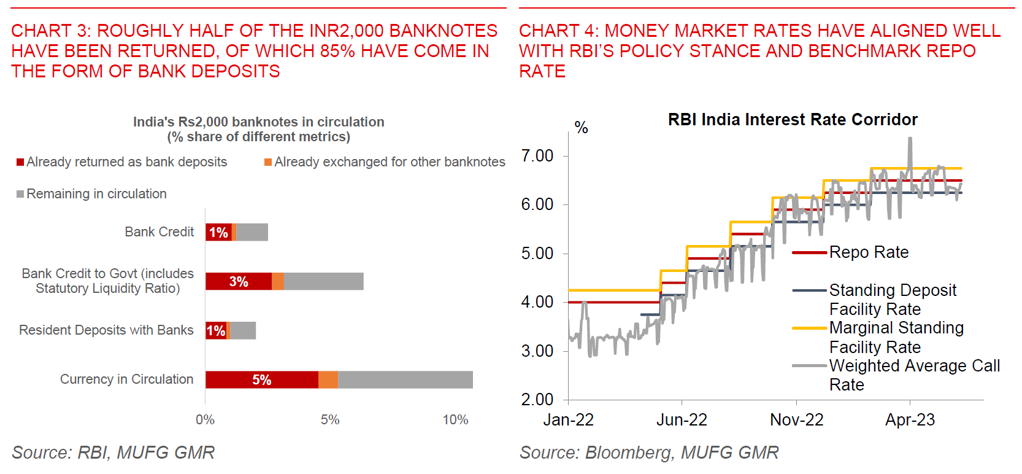

- More importantly, RBI kept its policy stance of “withdrawal of accommodation”, with 5 out of 6 in the monetary policy committee voting in favour, unchanged from the last meeting.

- The post-policy comments were somewhat more hawkish than market expectations, and gives us more confidence on our view that RBI will keep rates on hold for the rest of this calendar year 2023.

- Over the medium-term, we still see scope for RBI to cut rates by 50bps starting the March 2024 quarter as inflation trends closer to 5%. This will bring the nominal repo rate to 6%, and long-term real interest rates to ~1%.

Keeping the status quo, including on the policy stance: The RBI kept its key repo rate on hold at 6.5% in a unanimous vote by the monetary policy committee. More importantly, the central bank also kept its policy stance of “withdrawal of accommodation”, with 5 out of 6 in the monetary policy committee voting in favour, and unchanged from the last meeting. We were of the view that the central bank will keep its policy stance but had flagged it was a close call (see RBI preview).

The RBI was somewhat more hawkish than market expectations: There was a strong emphasis by the Governor on achieving the 4% mid-point of the inflation target. If the RBI is to be believed, this means that having inflation closer to 5% is not a sufficient bar for the central bank to turn more accommodative. We don’t think that this is necessarily a binding constraint to the RBI cutting rates (see below), but on balance, gives us more confidence that the RBI will keep rates on hold this year and skews the balance of risks towards a prolonged rate pause cycle.

We continue to see the RBI keeping rates on hold at 6.5% for the rest of this calendar year, before cutting rates by 50bps starting the March 2024 quarter: During the press conference, there were very relevant questions around whether the RBI is targeting a specific level of real interest rate, and whether the RBI will only cut rates when inflation is at 4%. Our reading of the answers is that the central bank is looking for inflation to move towards the 4% target on a sustainable basis, but not necessarily directly at 4%. As such, we still see space for the central bank to trim rates by 50bps starting next calendar year as inflation trends closer to 5% (as we and the RBI forecast). This would imply a 6% nominal repo rate and a 1% level of real interest rates, which we think is an appropriate medium-term level of real rates for India, given its growth trajectory.

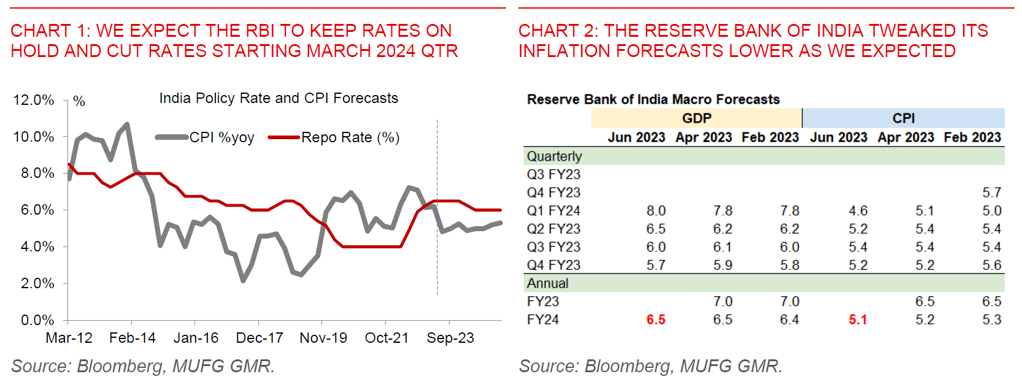

RBI gave a nod to uncertain situation on banking system liquidity, even as they reaffirmed the official policy stance of withdrawal of accommodation: The other area which received a lot of attention was on the liquidity situation, and on the back of the recent announcement of INR2,000 banknotes removal. The message from the RBI seems to be that there are teething issues banks are working through, but these are not too major given that market rates are currently well aligned with the policy stance and benchmark rates. It does sound like the central bank is still feeling the stones as it is crossing the river (so to speak) as it conducts fine-tuning liquidity operations (eg. recent 3-to-4 day variable rate reverse repo auctions). The RBI mentioned that so far INR1.8trillion out of INR3.6trillion of the INR2000 notes have been returned, with about 85% in the form of deposits. These numbers would suggest that deposits have risen by around INR1.5 trillion or around 1% of total banking system deposits. Moving forward, we think continued conversion of INR2,000 banknotes together with improvements in capital inflows should continue to help the liquidity situation.