Key Points

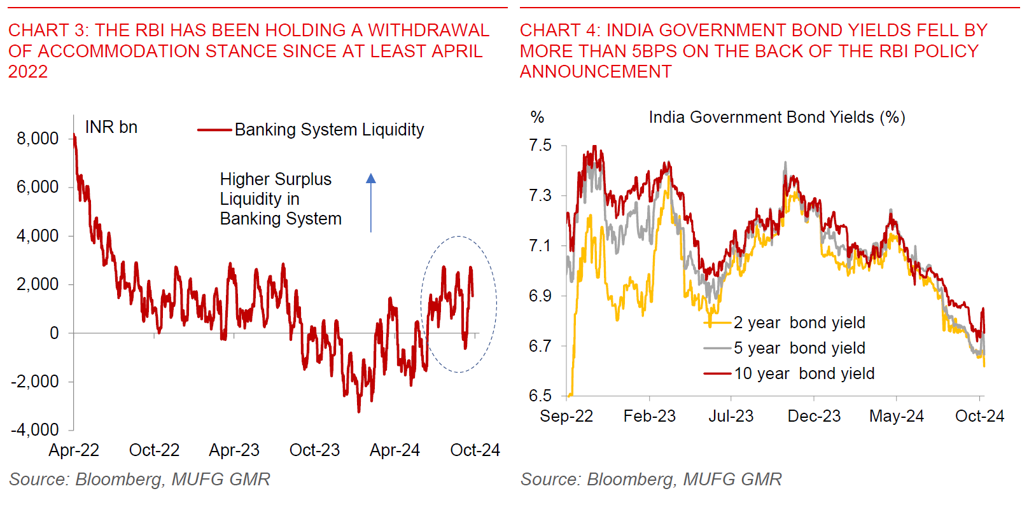

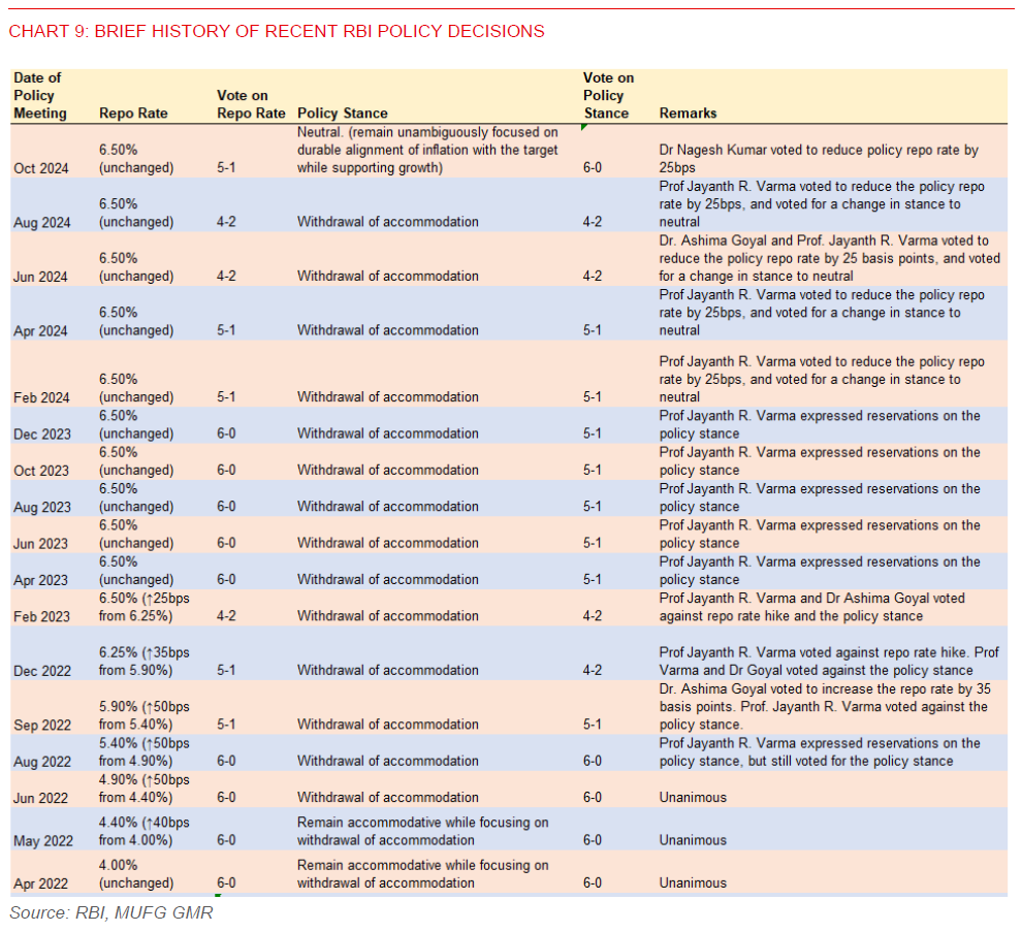

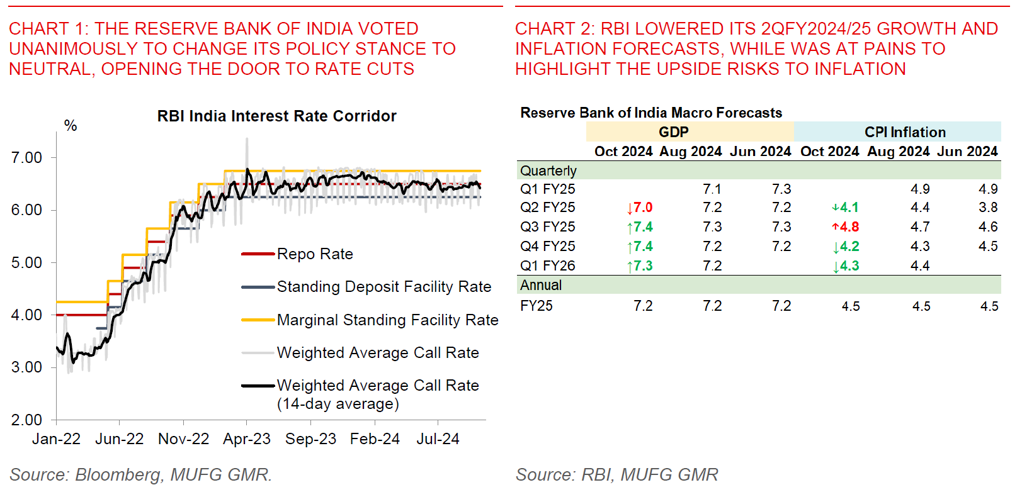

- The Reserve Bank of India turned less hawkish by voting unanimously to change its policy stance to “neutral” from “withdrawal of accommodation” in its October policy meeting. This was a hawkish position the central bank had been holding since at least April 2022.

- In addition, while the RBI repo rate was kept unchanged at 6.50%, 1 external member voted for a rate cut (Dr Nagesh Kumar) from the revamped Monetary Policy Committee with 3 new external members. India’s 10-year government bond yields fell by more than 5 bps on the back of the announcement.

- Today’s decision was in line with our view that the RBI will likely turn more dovish, with the door likely opening for a rate cut from the December policy meeting (see IndiaPulse: Bringing forward the 1st RBI rate cut).

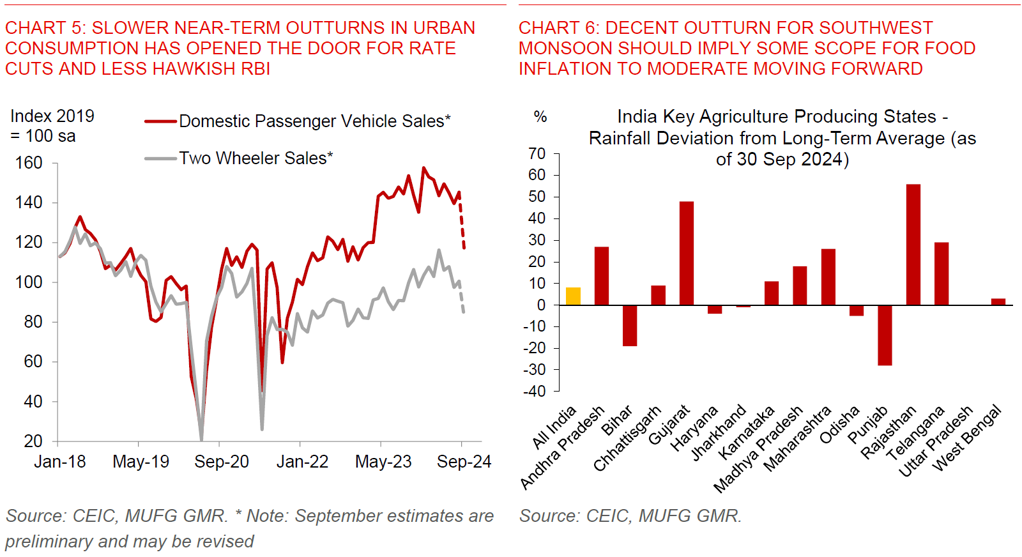

- We believe that somewhat slower growth and the better outlook for inflation including from a decent Southwest monsoon tilted the balance towards a change in policy stance towards neutral in this policy meeting.

- Nonetheless, the RBI Governor was at pains to highlight that the distribution of risks are tilted towards a resurgence in inflation given weather shocks and geopolitical risks. This is also reflected in the downgrade to RBI’s near-term growth and inflation forecasts for 2QFY2024/25 to 7% and 4.1% respectively (from 7.2% and 4.4%), but with an expectation for a tick-up thereafter.

- As such, our sense is that as long as the upside risks to inflation do not materialise (for instance through a spike in global oil prices through geopolitical risks), the path of least resistance should be for a rate cut, albeit a shallow one based on still decent even if moderating growth overall.

- We are forecasting the 1st rate cut in the December meeting, and for RBI to bring the repo rate to 6% by 1Q2025 (calendar year). We also see 10-year IGB bond yields moving towards 6.50% over the same time frame.

- The RBI’s continued focus towards closely monitoring unsecured loans and business practices of NBFCs mentioned in today’s policy statement also give us greater confidence that the central bank is using different tools for different objectives - macroprudential measures to maintain financial stability, while allowing changes in policy rates as inflation moderates.

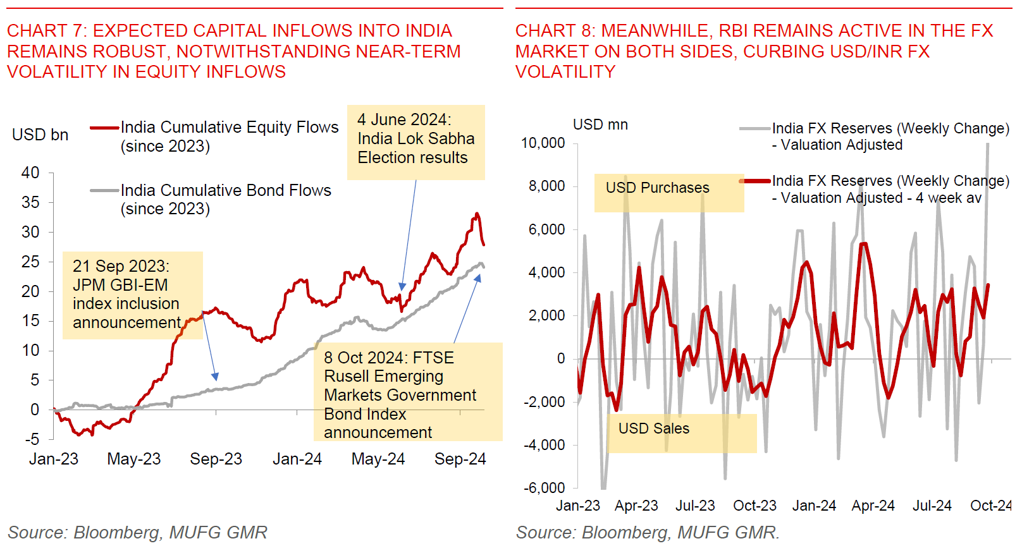

- On a separate but also related note, FTSE Russell also included Indian Government Bonds into its FTSE Emerging Markets Government Bond Index (EMGBI) in a statement overnight. This will commence from September 2025, with the inclusion phased in over a six-month period. IGBs will form a weight of 9.4% post the inclusion, with China dropping by 6% in the index weight.

- While estimates vary widely, we believe that the AUM tracking the FTSE EMGBI is far smaller than much more popular FTSE Rusell WGBI Index. As such, the actual flow impact to Indian bonds may only be around US$2-5bn over the time period by our estimates.

- The bigger impact for India’s bonds could come once Bloomberg Barclays includes Indian bonds into its key Global Aggregate Index, which may bring an additional US$10-15bn of inflows.

- The announcement by FTSE Russell should add some incremental bond inflows to India, and highlights how India still remains attractive and under-owned among global investors.

- More broadly, strong capital inflows together with RBI FX intervention are reasons why we believe that INR realised volatility can remain low and sharp USD/INR spikes are unlikely, even as INR should still underperform as the dollar weakens with a reasonably sticky current account deficit (see IndiaPulse: Bringing forward the 1st RBI rate cut). We forecast USD/INR to trade in a tight range between 83.50 and 84.00.