Key Points

- India announced the withdrawals of Rs2,000 notes, in a move reminiscent of the Nov 2016 demonetisation policy. We think this time is different, given the transitional period (4 months) and the smaller scale (11% of currency held).

- We expect front-end yields to decline as bank deposits rise, while economic activity to remain robust.

- The impact to USDINR is harder to ascertain, with some possible buying of gold and Dollars in the near-term. We remain positive on INR’s fundamentals, given softer inflation, narrowing current account deficit, and cheap INR valuations.

India announced withdrawals of Rs2,000 banknotes, in a move reminiscent of the Nov 2016 demonetisation policy: India announced on Friday evening (19 May 2023) that the Rs2,000 banknotes will be removed from circulation. Members of the public can exchange their notes into different denominations (up to a limit), or deposit them into bank accounts until 30 Sep 2023.

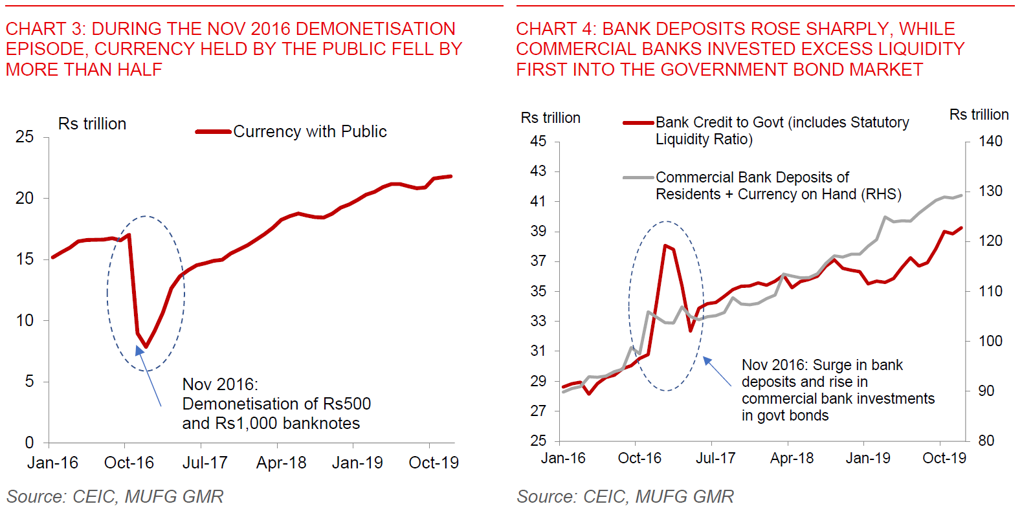

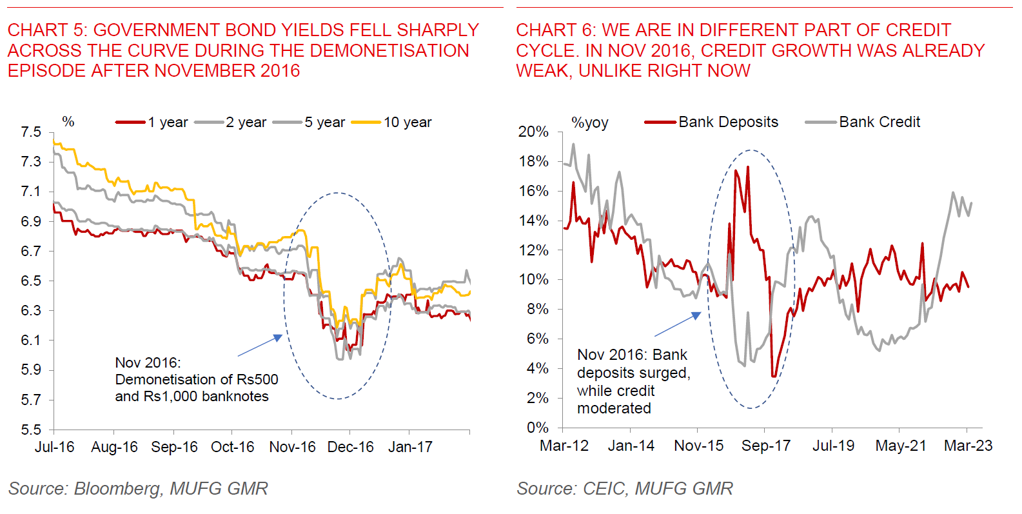

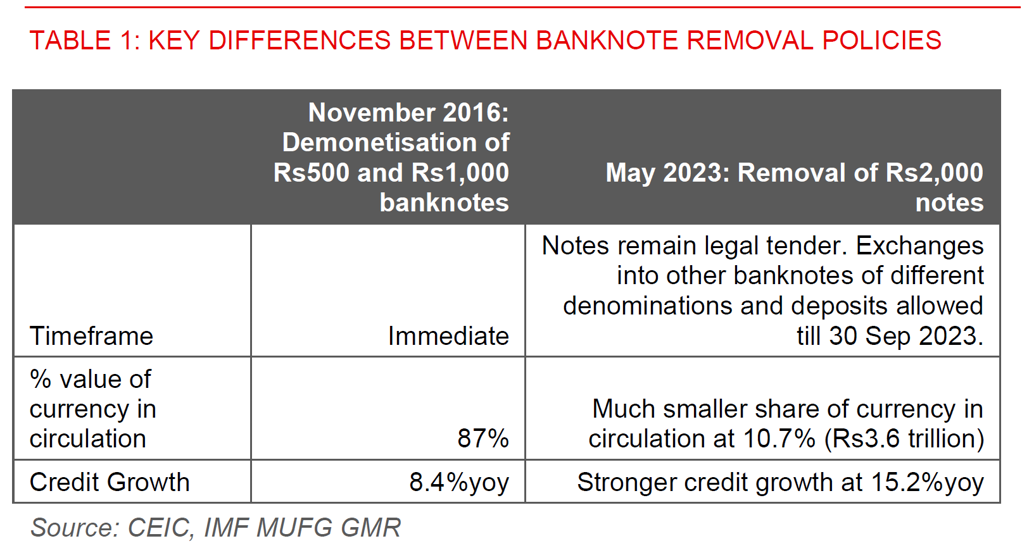

This time is different in 1)timeframe, 2)scale, and 3)the credit cycle: While observers may note similarities between the Nov 2016 demonetisation policy and the recent announcement, we note at least 3 ways where it is different (see Table 1 and Chart 1 below). First, there is a four-month transitional period with the Rs2,000 notes remaining legal tender. This is vastly different from the 2016 episode where the banknotes were immediately not usable. Second, the scale is much smaller, with Rs2,000 notes forming only 10.7% of currency in circulation. In sharp contrast, the Rs500 and Rs1,000 banknotes made up a far larger 87% of currency in circulation in November 2016. Third, India is in a different part of the business cycle now, with credit growth stable and quite robust at 15%yoy. This has implications on how banks allocate between different assets (see economic and market implications below). In 2016, credit growth was much slower at 8%yoy.

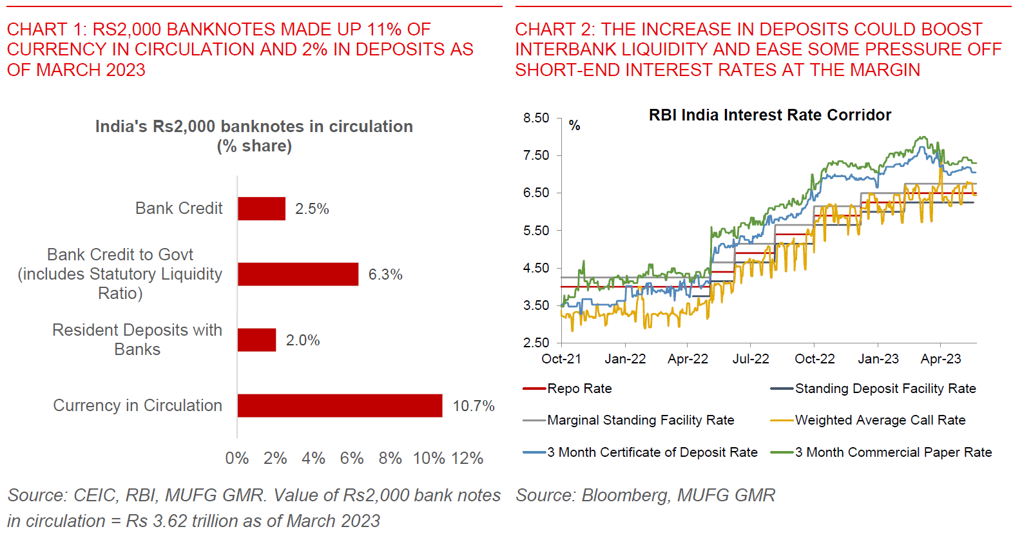

Bank deposits to rise, front-end yields could fall at the margin as banks allocate some extra liquidity to bonds: While the magnitude is far different from the 2016 demonetisation, the direction of travel is likely to be similar (see Charts 3-5 below). The clearest market impact should be felt in the rates market and banking liquidity. Bank deposits are likely to rise over time by around 1%-2% as some (but not all) choose to deposit their old notes. Banks will likely allocate some of this additional liquidity to short-end government bonds. However, given that credit growth is still quite robust at 15%yoy, we doubt that commercial banks will allocate all of the deposit increase to government bonds given alternatives on the asset side.

The net impact to USDINR is more difficult to ascertain. Some pull forward of economic activity, perhaps with some short-term buying of gold and US Dollars: We find the net impact to INR from this policy much more difficult to ascertain. The expected declines in front-end yields, together a possible further compression in the forward premia could make it less expensive for RHS hedging, providing less support for INR all things equal. There may even be short-term purchases of gold and perhaps even conversions into US Dollar (notwithstanding capital account restrictions for residents). Nonetheless, we stress that these are still conjectures at this point. What’s clearer to us is that the policy will unlikely have a negative impact on economic activity, unlike what we saw in Nov 2016 when demonetisation hit the informal sector the hardest.

We remain positive on INR – the flow picture continues to look very supportive, while INR REER valuations are relatively cheap: USDINR seems to have hit an airpocket recently rising closer to 82.8, but with RBI likely selling US Dollars aggressively to cap USDINR volatility at the same time. We continue to like the INR given the fundamental flow picture (see IndiaPulse: Positives are lining up). Growth remains resilient, while macro stability continues to improve with softer inflation, a narrower current account deficit, and stable credit growth. The stability in global oil prices is also very helpful for India’s FX, while services exports also bounced up allying our earlier fears of a sharper slowdown. Equity markets have also more than reversed their year-to-date foreign outflows. INR REER valuations are also relatively cheap. We are forecasting USDINR at 81.5 in 3m and 79.0 in 12m, but with risks coming from a stronger USD.