Key Points

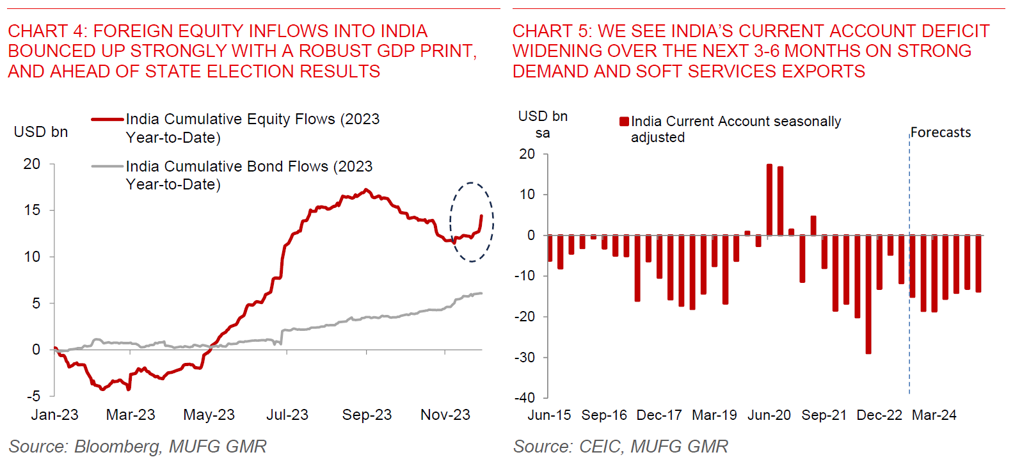

- India announced the results of several State Assembly Elections over the weekend. The latest results showed that BJP – the party led by Prime Minister Modi – performed well, winning in 3 states with generally good seat margins (Madhya Pradesh, Rajasthan, and Chhattisgarh). The main opposition party, the Indian National Congress, won in one state (Telangana) from a regional party.

- More than the number of states BJP won, we think the bigger surprise for markets is also BJP’s win in Chhattisgarh, which Congress was expected to retain given all exit polls had given Congress an edge over BJP (see Chart 1).

- We believe markets would view these results as a positive for policy continuity in 2024’s General Elections, and as such, also for risk assets.

- First, the incumbent BJP achieved a strong margin of victory in larger states with more seats in the Lok Sabha (India’s Parliament). For instance, Madhya Pradesh and Rajasthan have 29 and 25 seats up for grabs in the General Elections, compared with 17 and 11 seats for Telangana and Chhattisgarh. To the extent that the state elections translate into political momentum on the national stage, this could be a tailwind for the BJP in the General Elections.

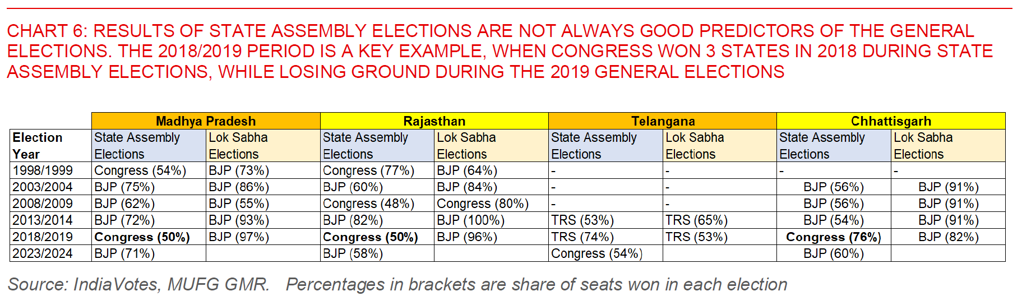

- Second, and more importantly, Congress’ weaker than expected showing may reduce the chance of a cohesive and sustainable seat-sharing strategy among the I.N.D.I.A. opposition alliance to contest the General Elections. The significance of the I.N.D.I.A. alliance partly rested on its ability to reduce multi-cornered contests with the BJP in the General Elections (see Charts 2 and 3).

- Moving forward, we will be watching closely to see if the I.N.D.I.A. opposition alliance is able to develop concrete seat-sharing plans for the upcoming General Elections. There is an alliance meeting called for 6 December, and our base case is for various parties to drive difficult negotiations with Congress.

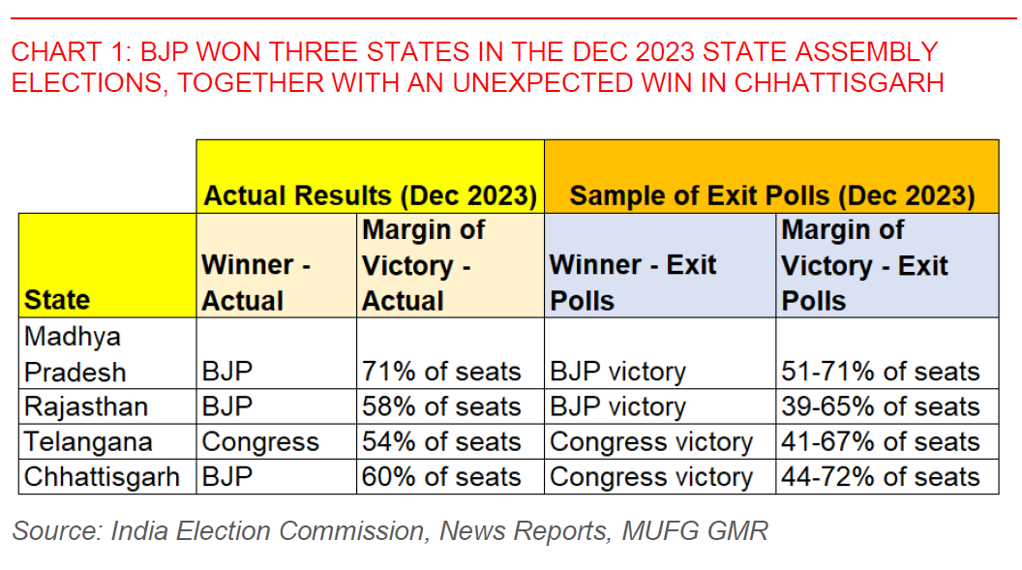

- In terms of market implications, these developments are likely positive for equity inflows, and as such reduces some pressure for INR depreciation in the near-term. This comes even as INR faces some headwinds from India’s widening current account deficit (due to strong domestic demand and soft IT services exports), coupled with slowing FDI inflows (see Turning Cautious INR).

- We continue to forecast USDINR at 83.5 in 3 months and 82.0 in 12 months, implying some INR underperformance near-term, before strengthening through 2024 on the back of bond index inclusion flows and a weaker US Dollar.

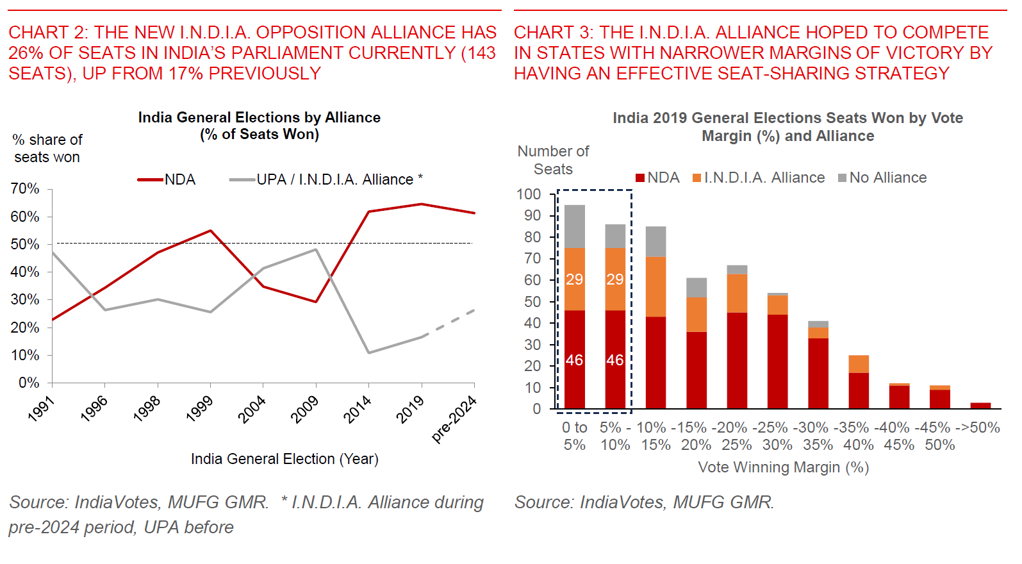

- We make no judgement on the election outcomes, and are implicitly assuming policy and reform continuity in our forecasts, as we believe is the case for the vast majority of market participants right now. One caveat is that state elections results are not always good predictors of National Elections, and many factors could also change ahead of the elections next year (see Chart 6).