Key Points

- We have received increasing client questions on whether INR could turn sharply weaker, or continue to weaken for that matter.

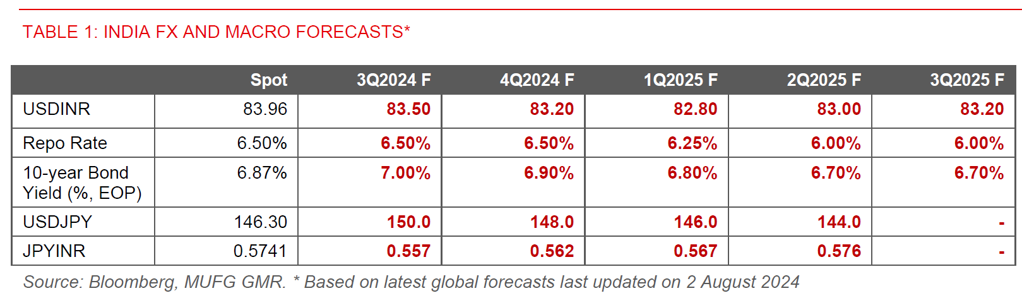

- Our short answer is that sharp INR weakness is highly unlikely, in our base case expectation of a “soft-ish” landing for the global economy, a more modest pace of JPY carry trade unwinds, strong domestic macro stability and expected fund flows into India. In addition, we expect RBI to remain in the FX market to strongly intervene against excessive INR weakness. Nonetheless, the near-term bias over the next 1-3 months is likely still for INR to weaken in a modest fashion due to the uncertainty around the extent of carry trade unwinds left, the strength of the global economy, and also larger than seasonal import pressures in India.

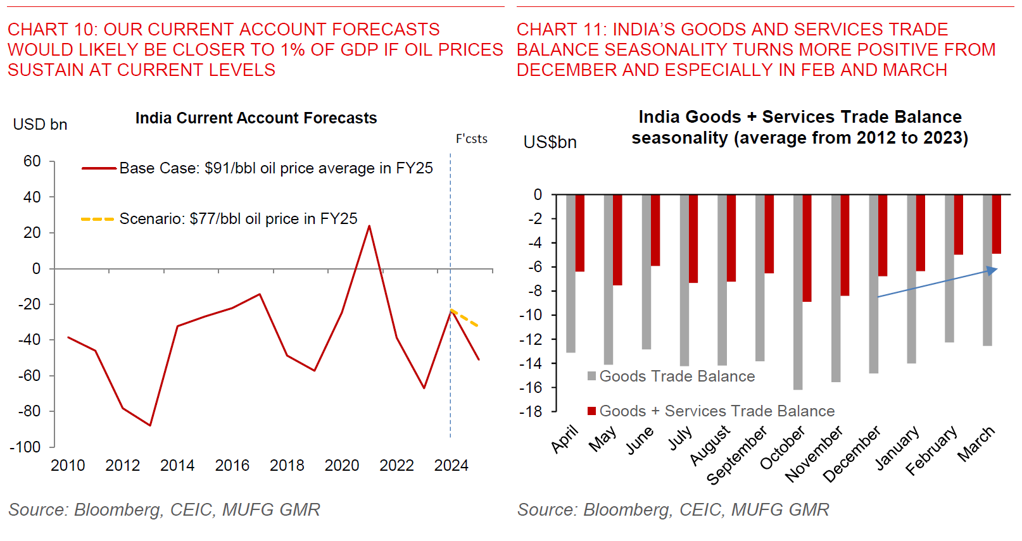

- While USD/INR has admittedly moved against our existing forecast set, we are not bearish on the Indian Rupee for a few reasons. The positive factors we highlighted in our previous report are still applicable, with bond index inclusion inflows coming in nicely, expected improvement in FDI, coupled with a strong pipeline of equity IPOs (see IndiaPulse – Towards more inclusive growth). In addition, the decline in oil prices if sustained should also imply a lower current account deficit than we currently forecast, probably closer to 1% of GDP.

- If we are right about the fundamentals above, near-dated USD/INR call spreads or risk reversal longs make sense to our minds. Beyond the next 1-3 months, we continue to be biased to see USD/INR lower over the next 6-12 months. In particular, seasonality for India’s combined goods and services trade balance turns much more helpful from December, and especially in February and March.

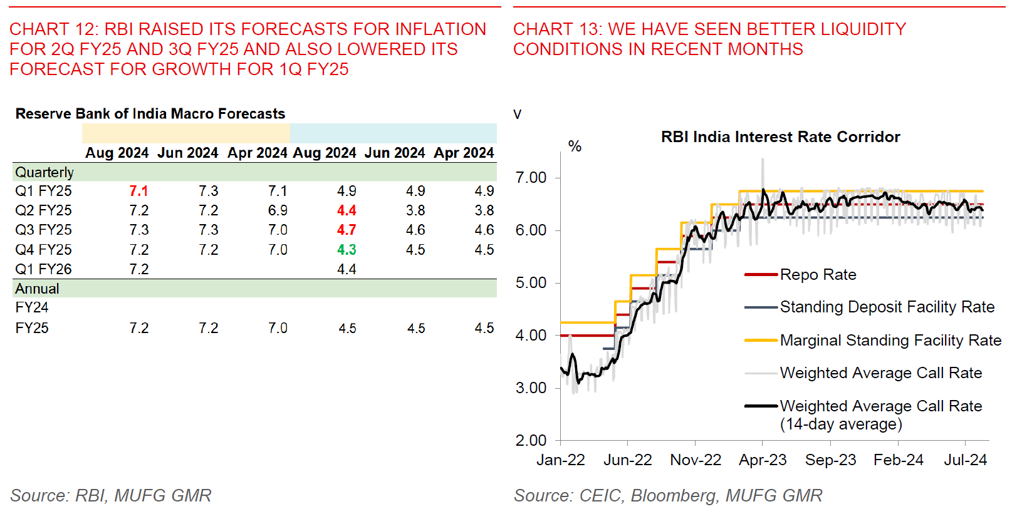

- INR has been hit by the global carry trade unwind over the past one month: USD/INR has weakened closer to the 84 handle, and probably would have weakened more were it not for aggressive RBI action to intervene in the market to cap FX weakness. More importantly, USD/INR has moved against the broader weaker Dollar trend during that period, and has also underperformed against low-yielding Asian currencies such as JPY, MYR and THB (see Chart 3 below). We think one major global driver is the global carry trade unwind, with the epicenter being JPY, and also catalysed by the much more hawkish Bank of Japan policy meeting and weakening US data over the past few months (see Asia FX Talk – Will the great unwind continue?). While INR has not weakened as much compared with the likes of MXN, BRL and AUD, its move has been quite meaningful relative to its low volatility in recent years.

- Our base case is that the pace of carry trade unwinds should slow moving forward: While it’s hard to know the full extent of JPY and perhaps also CNH carry trades, latest data from the CFTC shows that net Japanese Yen short positions among non-commercial participants have more than halved as of 30 July (see Chart 4 below). These positions may have reduced further based on USDJPY price action. Some relative calm has also returned to markets in part following more dovish signals by Bank of Japan Deputy Governor Uchida on the impact of financial and FX volatility on the possible pace of BOJ’s rate hike path.

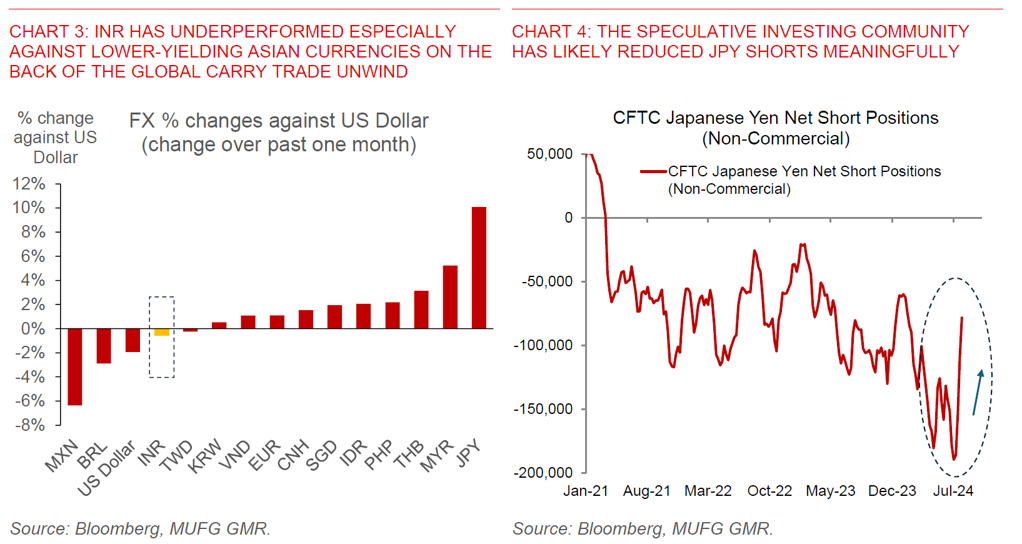

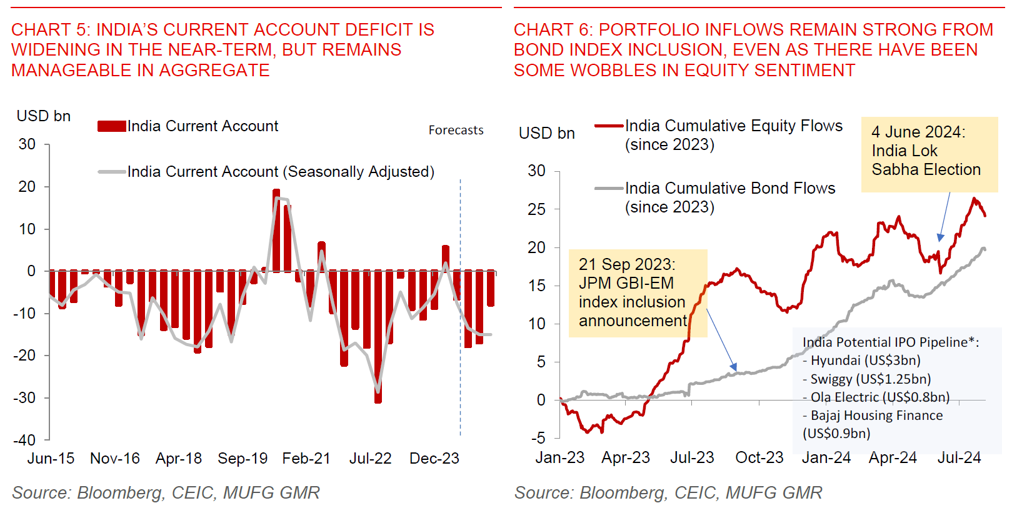

- Larger than seasonal import pressures in India, coupled some near-term foreign equity selling has also contributed to INR weakness: Looking at India specifically, we are likely also seeing some larger than seasonal import pressures, perhaps driven by some front-loading of imports post the Lok Sabha Elections in June 2024 (see Chart 5). In our previous report, we have highlighted higher container freight rates as a key driver of import pressures. In addition, the recent gold import duty cuts could also have led to some higher import pressures on gold, although the net impact of the policy itself on the trade deficit is unclear to our minds. Nonetheless, we note that some components such as the oil trade deficit has been running at a much larger pace of US$11-13bn than implied by the historical relationship with global oil prices (see Chart 2), and our expectation is that this divergence should close eventually.

- Portfolio inflows trends have been quite robust helped by bond index inclusion, even as there have been some near-term wobbles in equity sentiment: The good news is that India has continued to receive steady inflows from the JPM GBI-EM bond index inclusion of around US$2bn per month (see Chart 6). There have been some near-term wobbles in equity sentiment given the global risk-off environment, and our base case is that equity inflows should continue over the medium-term given the strong pipeline of equity market IPOs.

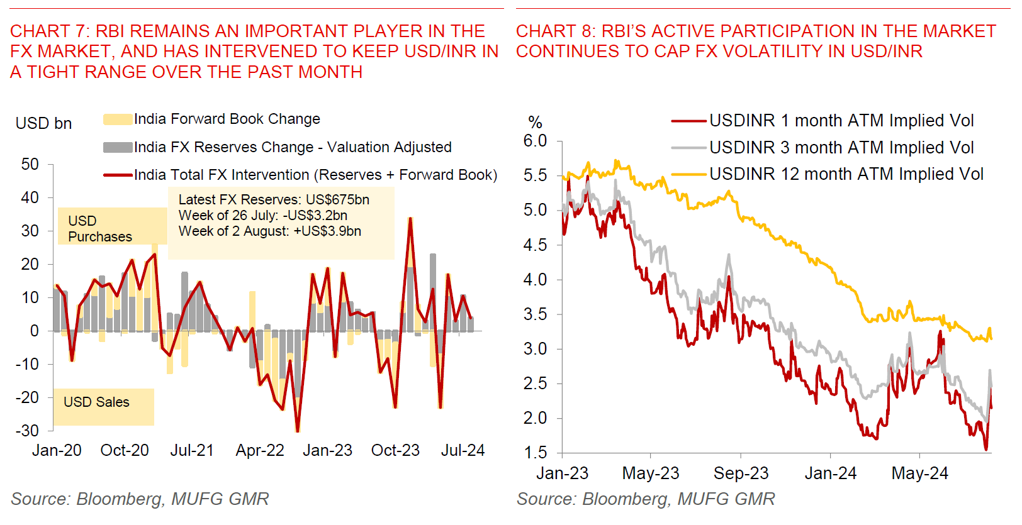

- RBI remains an important player in the FX market by intervening on both sides, and keeping USD/INR in a reasonably tight range: As always RBI remains an important player in the FX market. RBI Governor Das revealed that latest FX reserves is at US$675 billion as of 2 August. We estimate that this implies that RBI has bought Dollars to the tune of US$3.9bn in the week of 2 August, even as it has likely sold Dollars quite aggressively both this week and the preceeding week of 26 July, as such keeping USD/INR in a reasonably tight range. (see Chart 7). Implied FX volatility in USD/INR has also remained around decadal lows, even as it has picked up somewhat in the very near-term (see Chart 8).

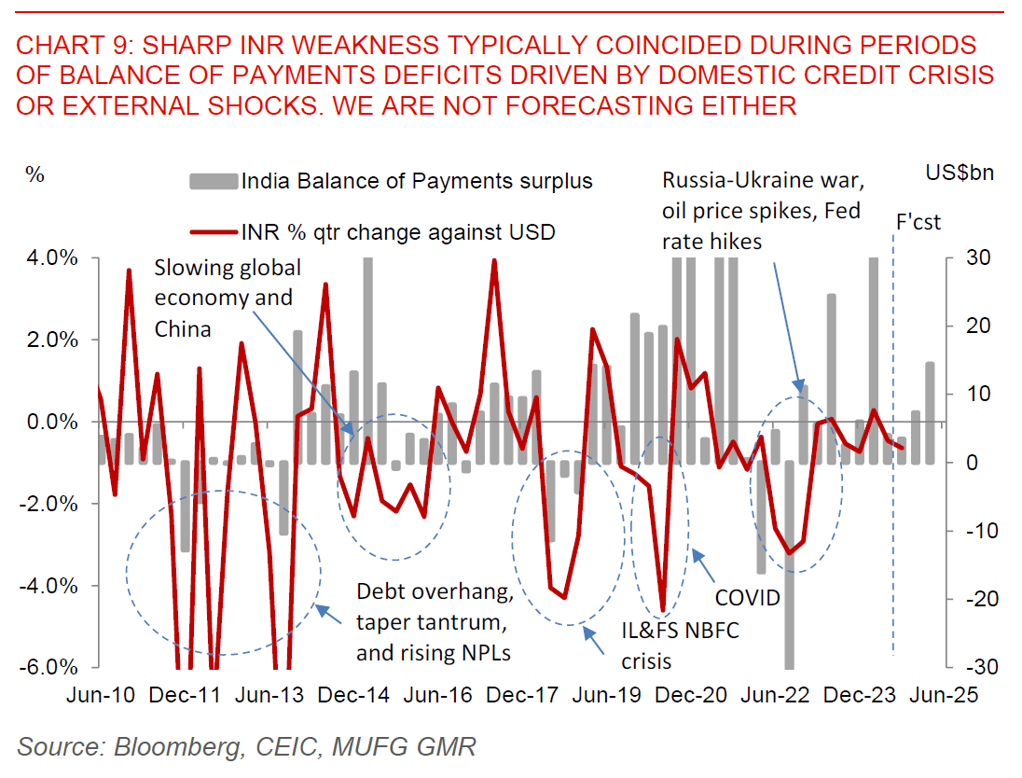

- More importantly, India’s fundamentals do not point to sharp INR spikes in our view with still positive balance of payments surplus through FY2024/25: Historically, sharp INR weakness tends to come during periods of either domestic credit crisis for instance during the debt overhang and rising NPLs from 2011, or the IL&FS non-bank financial corporation crisis in 2018 (see Chart 9 below). Other key episodes include the Russia-Ukraine war, oil price spikes and Fed rate hikes. It’s important to stress that we are not forecasting these possible global shocks moving forward, nor are we forecasting a domestic credit crisis, with domestic macro stability still strong.

- While the near-term bias for USD/INR is to move higher in the near-term given global carry trade unwinds, higher than seasonal import pressures and uncertainty on global growth, we still look for USD/INR to be lower over the next 6-12 months. For one, oil prices at current levels of US$77/bbl should imply the current account deficit closer to 1% of GDP relative to our expectation of 1.4% of GDP (see Chart 10). In addition, both our forecasted path of the current account deficit, coupled with more helpful seasonality from December should imply less downside pressures on INR beyond 3 months

RBI Policy Meeting (August 2024)

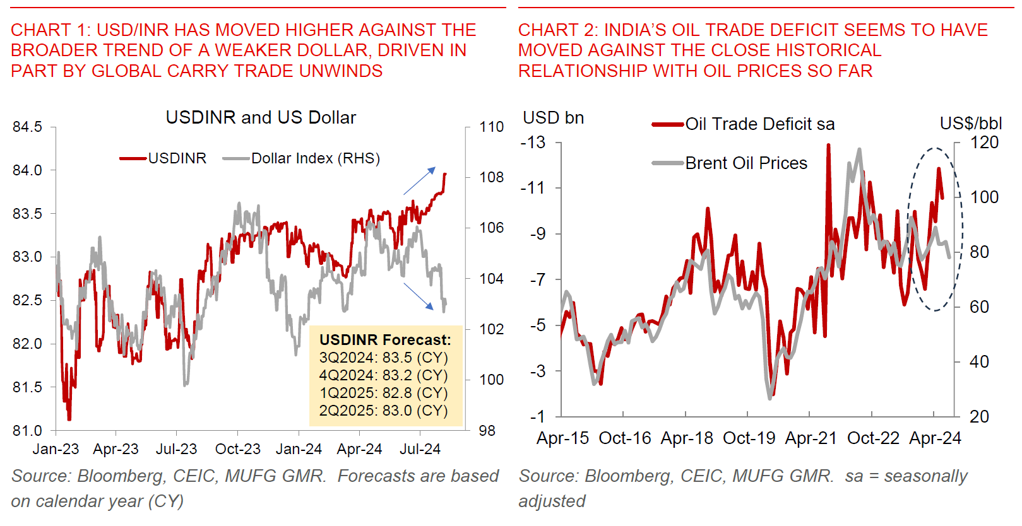

- RBI’s policy decision for August 2024 was as expected, with the repo rate unchanged at 6.50% and policy stance unchanged. The vote pattern was also unchanged with two external members of the monetary policy committee voting against the decision.

- The central bank lowered its growth forecast slightly but also raised its inflation estimates slightly (see Chart 12). In addition, Governor Das also highlighted that global financial market volatility has affected INR, but the currency’s performance remains well managed relative to other currencies