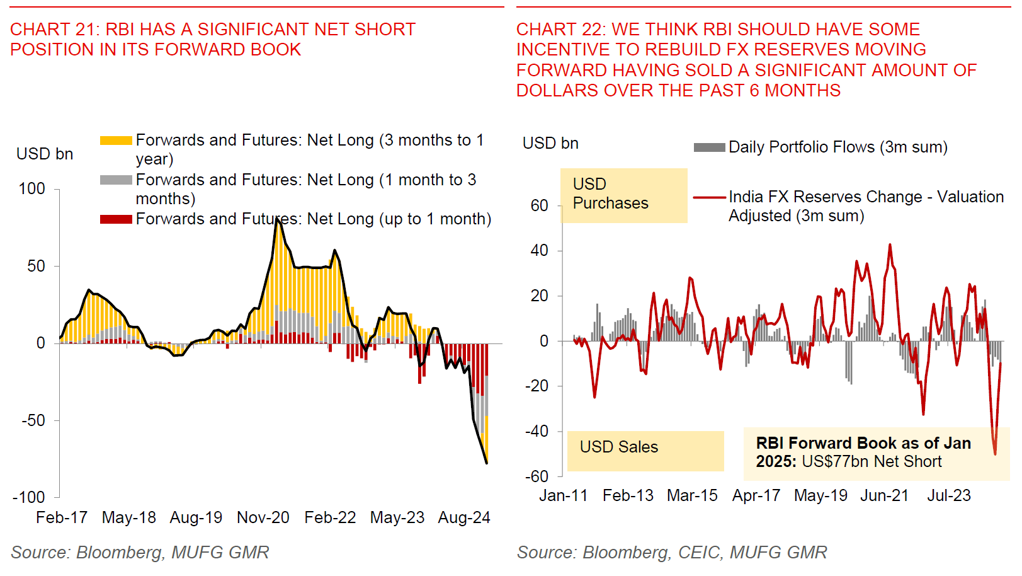

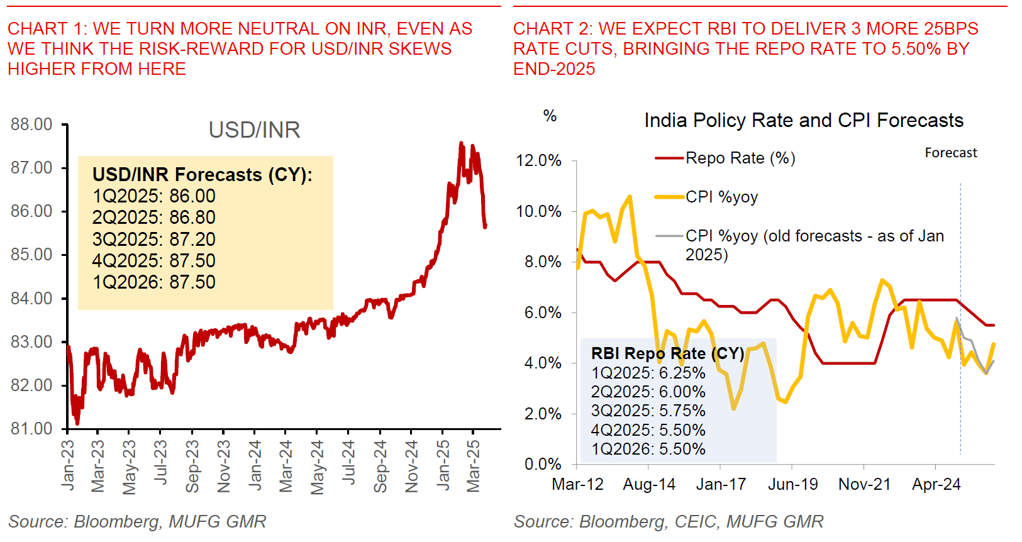

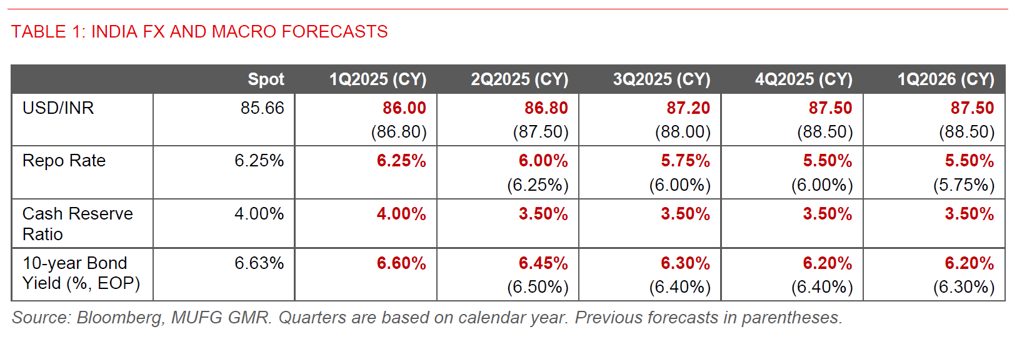

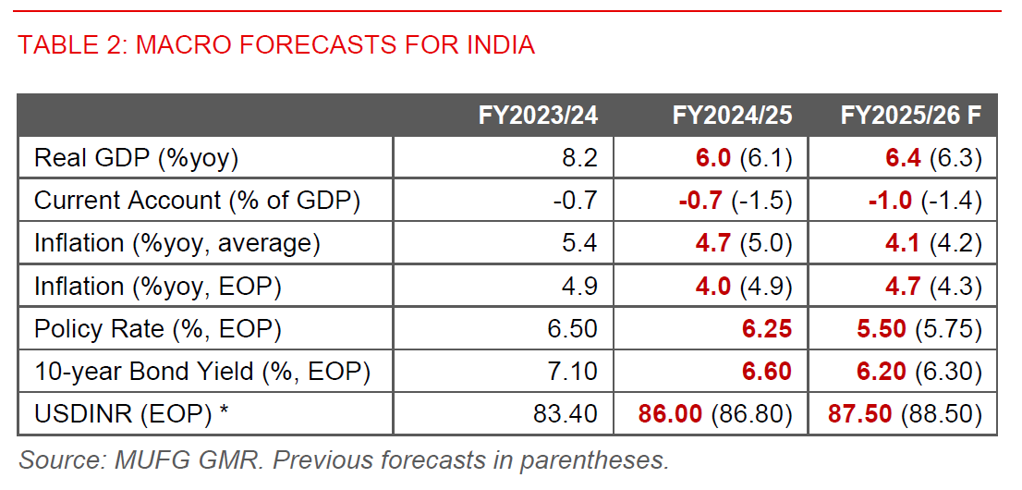

- We now forecast USD/INR at 87.50 by end-2025 (from 88.50 previously). We also expect RBI to deliver 3 more 25bps rate cuts for a terminal rate of 5.50% (from our previous forecast of 5.75%).

- We turn neutral on INR and no longer think INR will underperform Asian FX: This is driven by both global factors such as a weaker Dollar, but more importantly also local factors such as a smaller current account deficit and softer inflation.

- Nonetheless, we think the risk-reward for USD/INR skews higher from current levels with the big move in FX markets. First, we think markets are underpricing the risk of reciprocal tariffs on India. Second, India’s growth remains relatively soft and is likely to disappoint expectations in our view, with market valuations still quite high. Third, inflation while softer may rise in the coming months with forecasts of heatwaves. Fourth, our team continues to forecast Asian currencies to weaken into 2Q. Lastly, RBI should at some point come in to build FX reserves, even as it has been more hands-off than we anticipated so far.

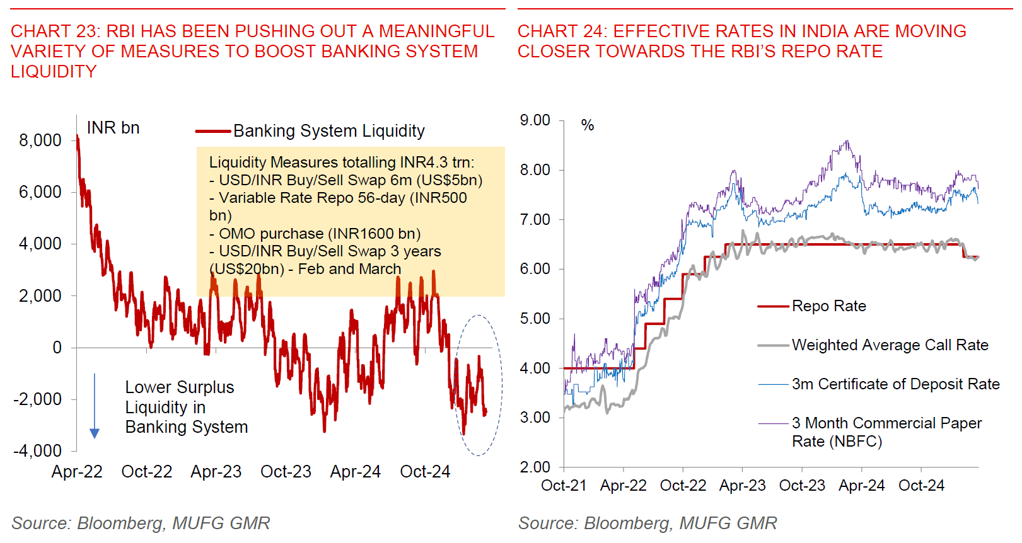

- The good news for India is two-fold, with more support to growth from monetary policy, and a possible push for structural reforms from the threat of tariffs: For one, we continue to expect RBI to pivot towards growth. We now forecast RBI to cut rates by 25bps in April, and again in August and December, bringing the repo rate to 5.50%. In addition, we think RBI will ease macroprudential restrictions further, while also pushing out more liquidity to lower effective rates. Second, we take it as a long-term positive that India is taking steps to diversify its trading relationships with partners such as the EU, UK and New Zealand, even as it is working towards a trade deal with the US.

Big moves in USD/INR over the past two weeks, driven by lower current account deficit and softer inflation outlook

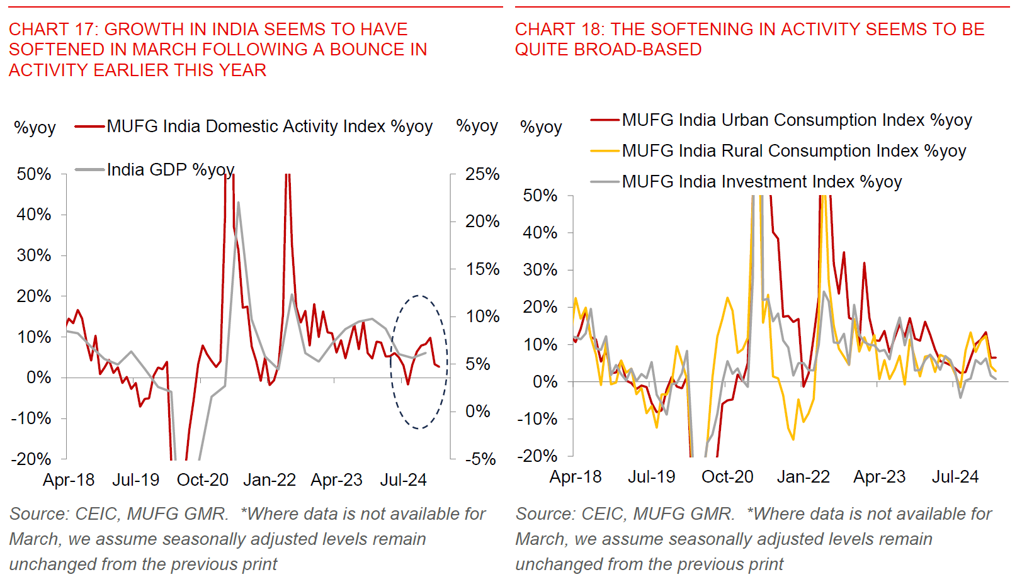

We have been holding onto a cautious view on INR for a few key reasons (see INR – Let it go? and INR – Softer growth). First, growth in India has been weighed down by several cyclical factors such as RBI’s tighter macroprudential measures to curb fast-growing personal loans, a modest deterioration in the credit cycle, elevated food inflation, slower disbursement of public infrastructure spending and continued fiscal consolidation. Second, the flow picture was also not supportive for India. The current account deficit was expected to be elevated at 1.4-1.5% of GDP due to spikes in gold imports and soft goods exports. On the capital account, higher FDI repatriation and continued foreign equity outflows more than offset an improvement in gross FDI inflows, especially given high asset valuations. Last but not least, we expected RBI to turn less interventionist in its FX policy and allow INR to adjust weaker, even as RBI was unlikely to let INR go completely (see INR – Let it go?).

While our view had worked out quite well especially since the start of the year, the past two weeks has seen a meaningful reversal with a huge downward move in USD/INR more so than we admittedly expected, from a local peak of 87.40 to 85.66 at the time of our writing (see Chart 1 above).

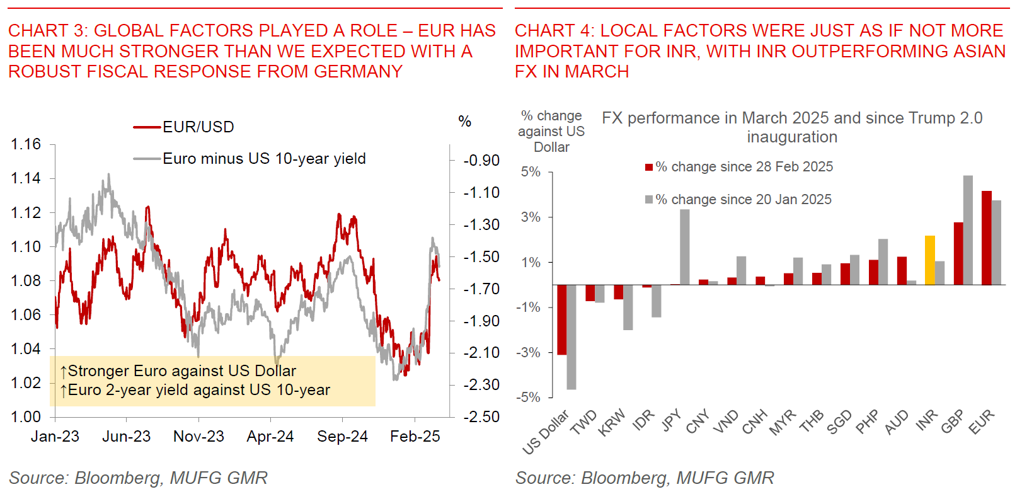

The key macro drivers were both global and more importantly also local factors as well. On the global front, EUR/USD has been much stronger than we pencilled in due to the much stronger than expected fiscal response from Germany, even as the forecasted path has been in line with what our global team has been expecting (see EUR/USD and G10 USD Forecasts Update – Three Questions). More importantly, INR has outperformed other Asian currencies in the month of March, indicating important local drivers underpinning India’s FX strength (see Chart 4 below).

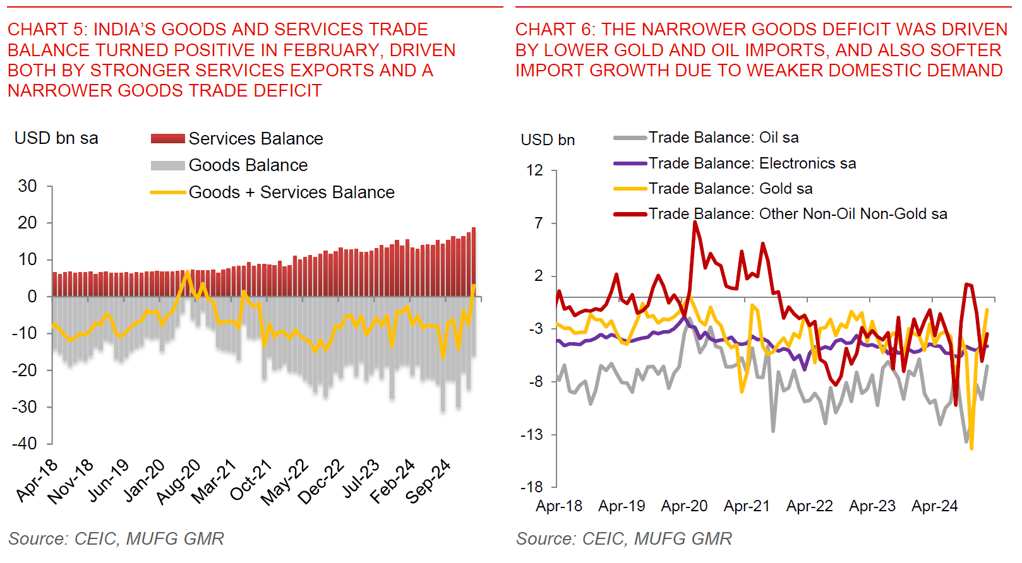

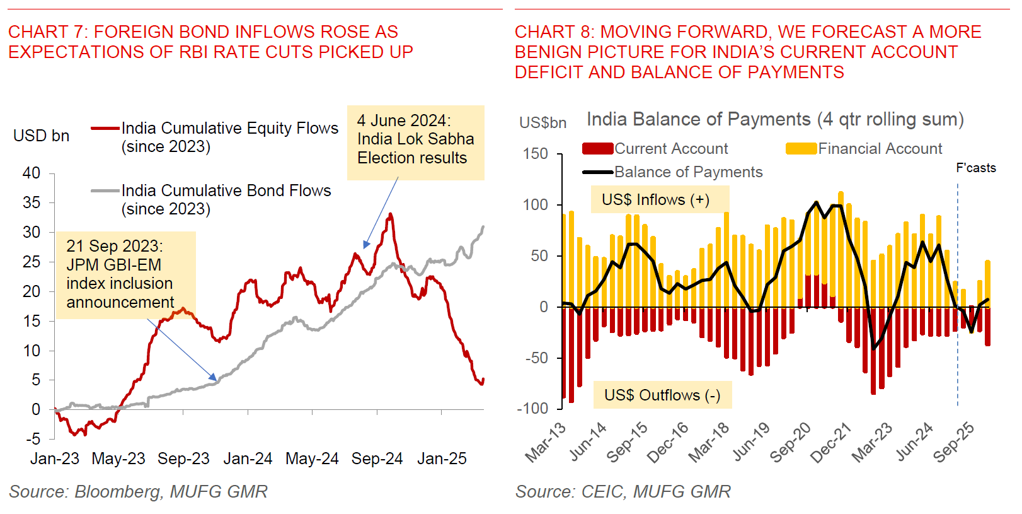

Among other things, this was likely driven by better macro data in India, with a narrower goods trade deficit, stronger services exports, lower than expected inflation print for February, and with that foreign bond inflows given rising expectations of RBI rate cuts (see Charts 5 and 6 below). There might also be some temporary factors such as rebalancing of key equity indices which were reported to bring around US$1.4-1.6bn towards the end of the month.

Moving forward, we are now forecasting a more benign picture for India’s current account deficit and inflation: We have lowered our forecasts for India’s current account deficit to a more manageable 1% of GDP for FY2025/26 (from 1.4% previously), to account for weaker than expected gold imports and also stronger than expected services exports. In addition, we have also lowered our inflation forecasts to 4.1% (from 4.2% previously), and we now expect headline inflation to end this fiscal year at 4%yoy.

Risk reward skews towards higher USD/INR from here. We forecast USD/INR at 87.50 by end-2025

Nonetheless, we think that the risk-reward skews towards higher USD/INR from here for a few key reasons:

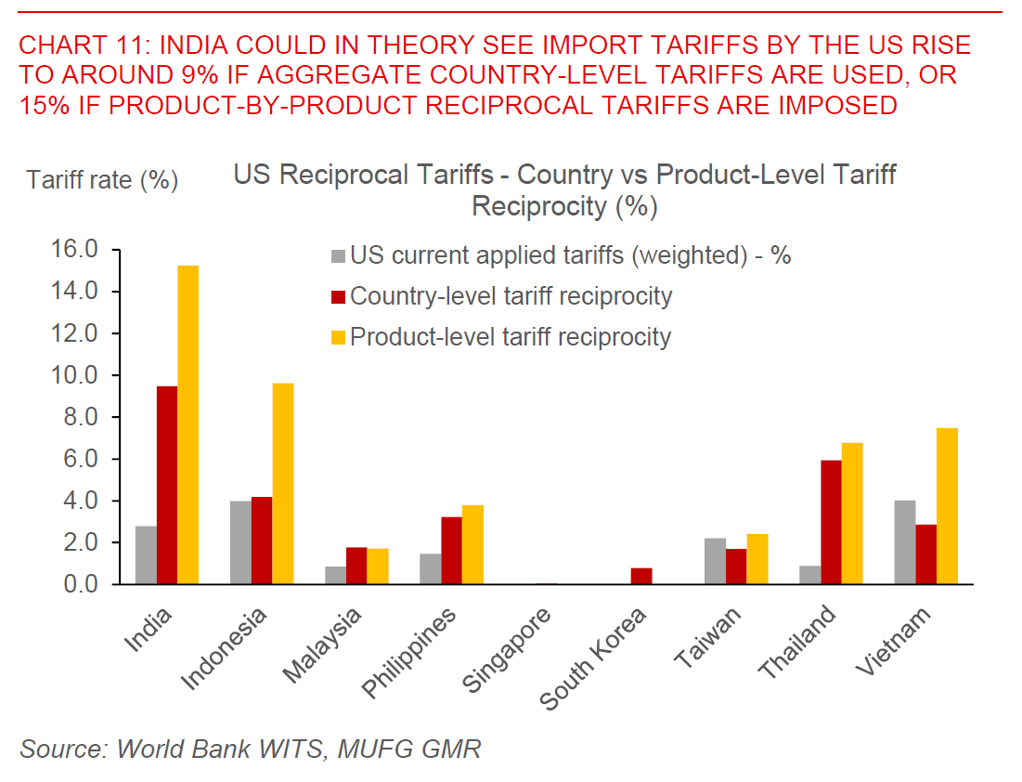

- First, we think that markets are under-pricing risks from Trump’s reciprocal tariffs specifically for India come 2 April. India should in theory see the sharpest rise in reciprocal import tariffs by the US in Asia. Assuming the Trump 2.0 administration uses aggregate differences in country-level tariff rates, the US could raise average tariffs on India by an additional 6.7%, bringing it to 9.5% from 2.8% currently (see Chart 11 below). In addition, if product-level reciprocity were followed, US could raise tariffs on India to 15%. Ultimately, we think product-line reciprocity is highly unlikely given the significant complexity both in determining the tariffs, and also in enforcement not just for India but across a whole host of trading partners for the US. Nonetheless, our broader point still stands that India should be more vulnerable looking at tariff differentials alone.

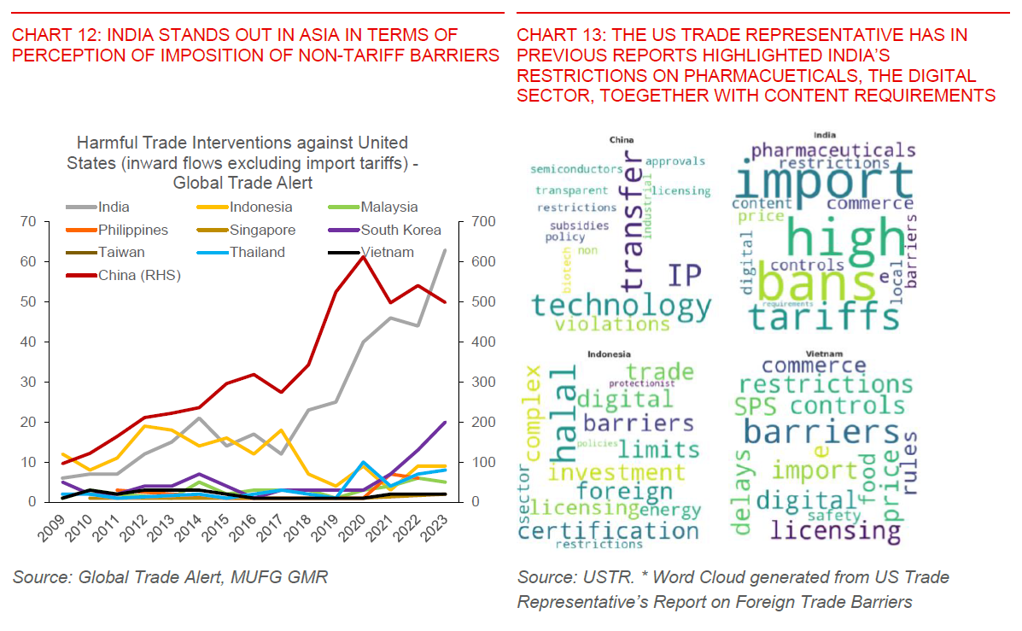

- In addition, India should in theory be quite vulnerable to reciprocal tariffs when looking beyond just tariff differentials. The Trump 2.0 administration has highlighted four other key criteria in determining reciprocal tariffs, namely: 1) taxes (such as value-added taxes and digital taxes), 2) non-tariff barriers (such as subsidies and regulation), 3) exchange rates and perceived deviation from market rates, and 4) any other criteria including unfair competition. Again, India stands out relative to other countries in the imposition of non-tariff barriers (see Charts 12 and 13 below), and also in terms of its implementation of digital taxes. There are signs that India is taking some steps to seek for exemption from reciprocal tariffs by lowering tariffs on certain goods and also removing its “digital tax” on some online advertisement services. Overall, it remains extremely unclear whether these moves will be successful.

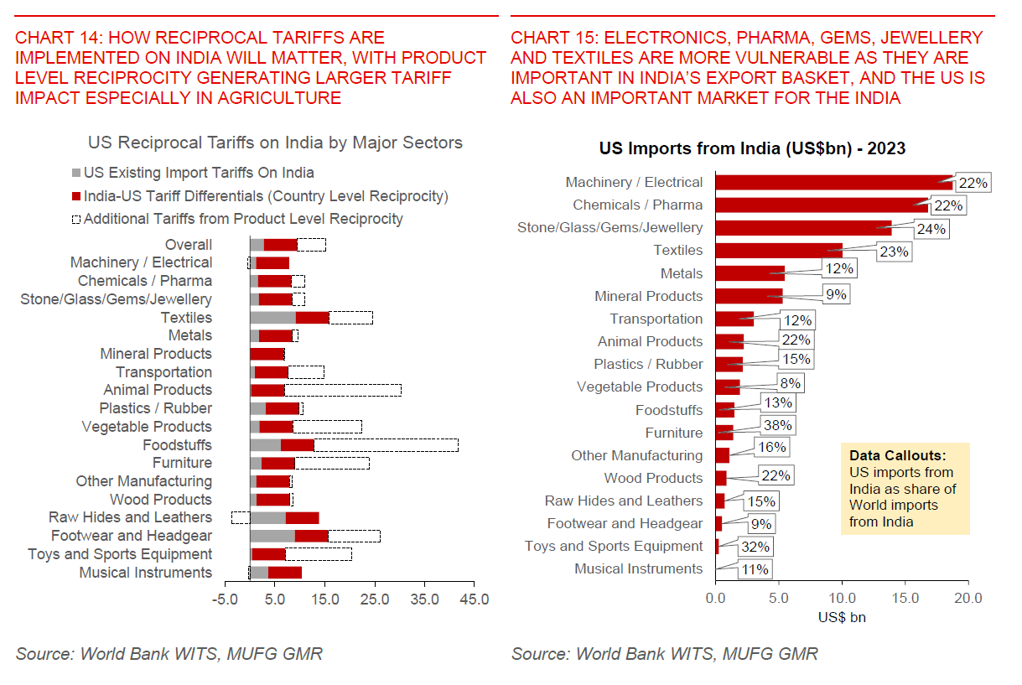

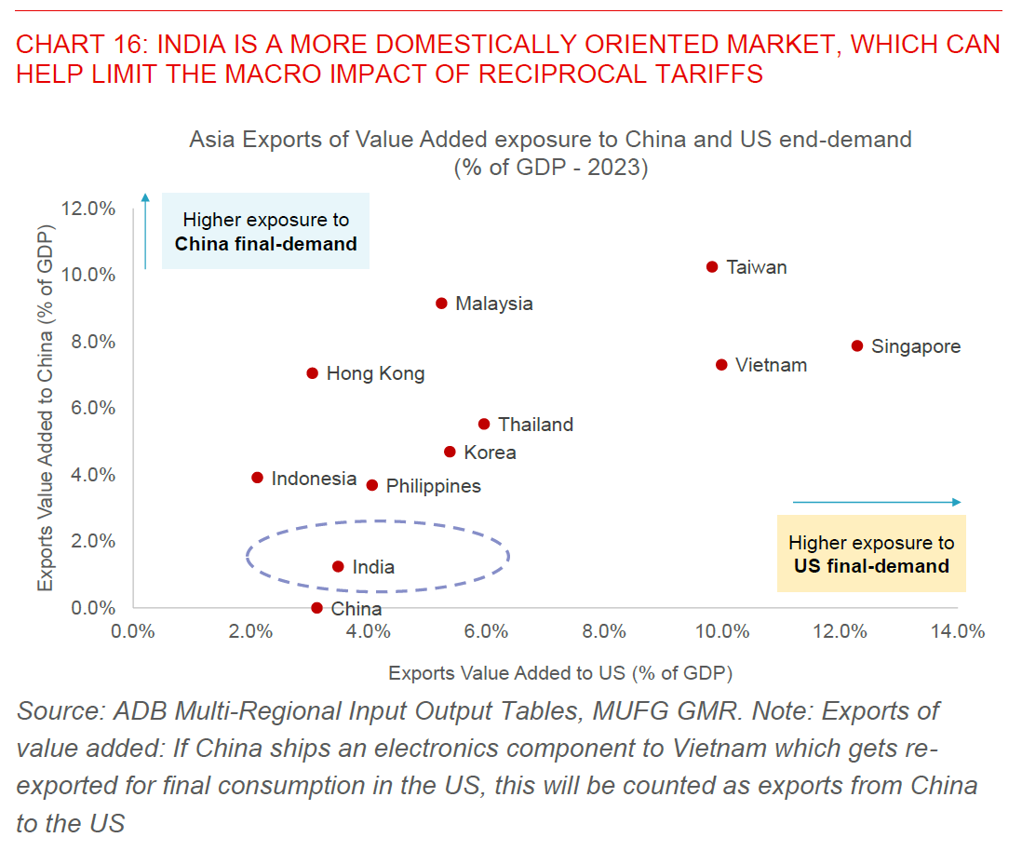

Overall, we think markets are underpricing the risks of reciprocal tariffs on India right now. While India is generally more domestically-oriented to begin with, reciprocal tariffs if raised to a meaningful level will still have a negative impact on India’s growth prospect in 2025. We note that India’s gross exports to the US makes up around 2% of its GDP, while India’s exports of value added to the US (which takes into account exports through third countries) makes up around 4% of its GDP, which overall is smaller than other Asian countries but could still weigh on India’s growth prospects in 2025. The impact could also be quite concentrated on sectors such as electronics, pharmaceuticals, gems and jewellery, and textiles given that the US is an important end-market for these products.

Our base case is that there will likely be a trade deal signed between the US and India by the end of the year, but that in the meantime, we assume higher import tariffs imposed by the US on India come April.

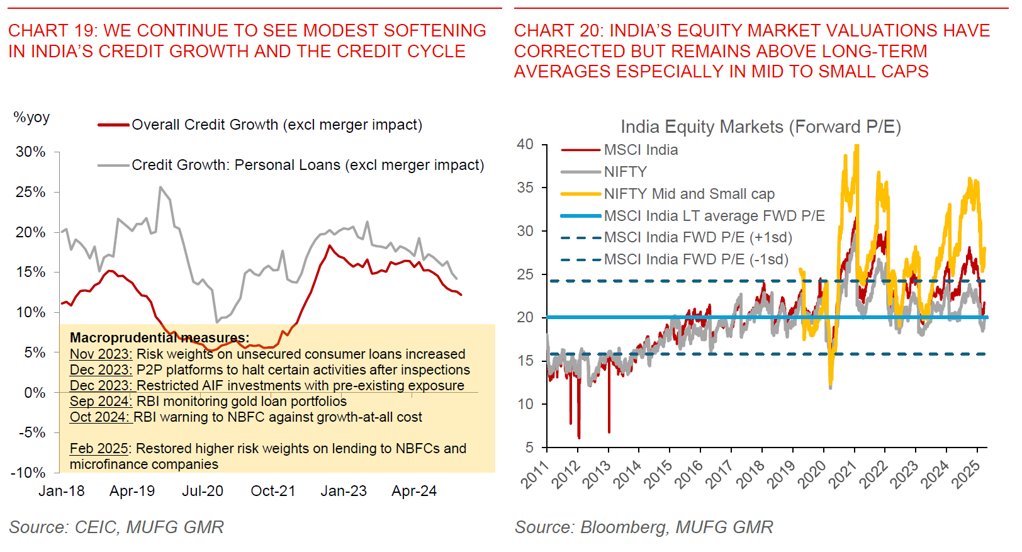

- The second key reason why we think INR should weaken from here is that growth could disappoint consensus expectations moving forward. Our tracking of high frequency indicators suggest that domestic economic activity seems to have softened in March, following a bounce heading into January which was possibly boosted by a key religious event held earlier this calendar year (the Kumbh Mela). Growth remains somewhat soft at around 6-6.5% (relative to the 7-8% rates seen previously), weighed down by the lagged impact of RBI’s macroprudential measures, slower credit growth, a modest deterioration in the credit cycle, coupled with slower disbursement of public infrastructure projects. Nonetheless, the government’s recent income tax cuts coupled with easier policy settings should help support growth moving forward. Overall, we forecast growth at 6% in FY2024/25 and picking up to 6.4% in FY2025/26, but importantly still below consensus expectations. Equity market valuations have corrected but nonetheless remain above long-term averages especially in mid-to-small caps and so the incremental foreign flow moving forward could still be somewhat challenging (see Chart 20).

- Lastly, we think RBI should have some incentive to rebuild FX reserves moving forward. Admittedly, RBI has been much more hands-off than we anticipated, and as such also raises the question of whether we should anticipate greater two-way swings in USD/INR moving forward. Nonetheless, with RBI’s meaningful net-short position in its forward book (US$77bn as of Jan 2025), we think the central bank should increasingly have an incentive to rebuild FX reserves moving forward (see Charts 21 and 22 below).