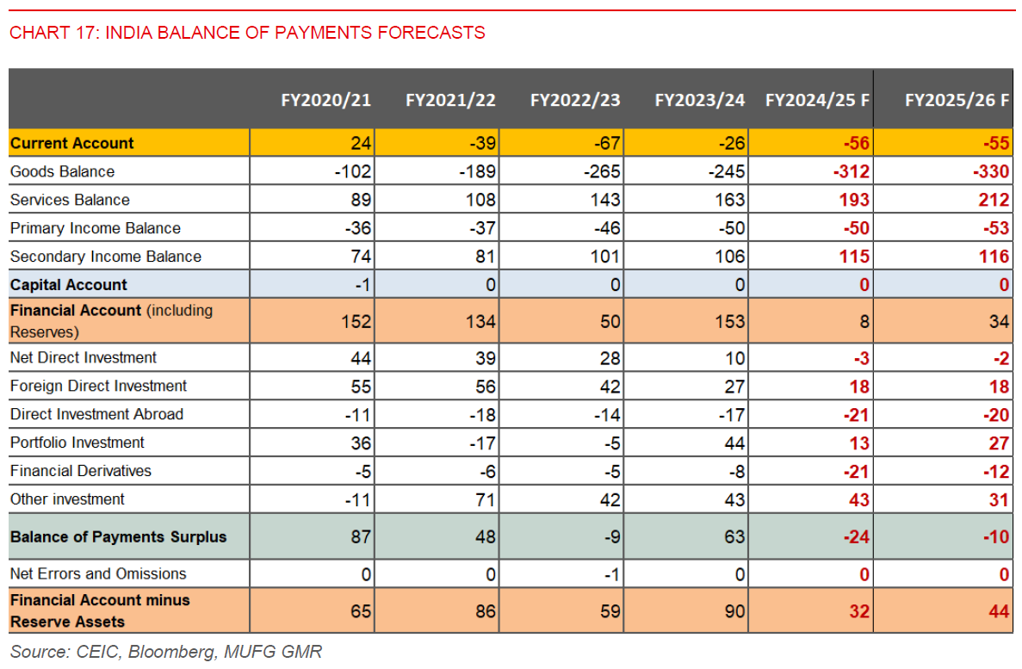

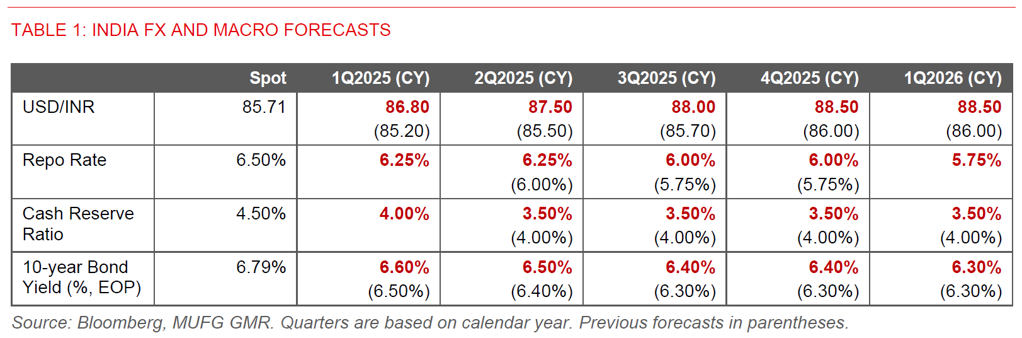

- We turn more cautious on INR and forecast USD/INR rising to 86.80 by 1Q2025 and 88.50 by 4Q2025 (calendar year). This compares with our previous expectation of 85.20 and 86.00. Our FX projections were in retrospect too conservative with INR weakening faster than we anticipated, even as we had already turned more circumspect (see IndiaPulse: Gradual rise in USD/INR).

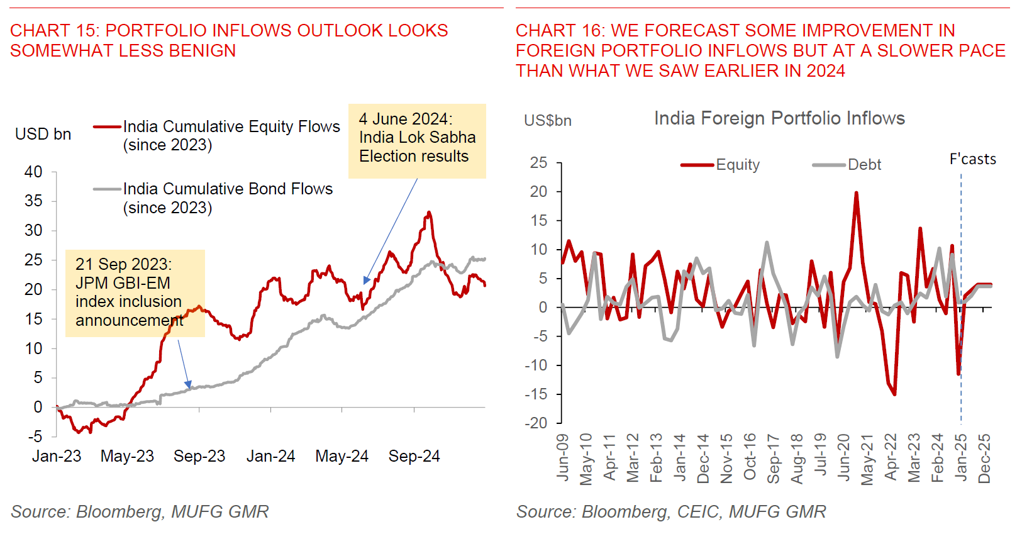

- INR weighed down by spike in gold imports, soft goods exports, higher FDI repatriation, weaker portfolio inflows and increased RHS hedging: We are now forecasting India’s current account deficit at 1.4% of GDP (from 1.2%). More importantly, direct investment inflows continue to disappoint with rising FDI repatriation and outward direct investment more than offsetting an improvement in gross FDI inflows. The outlook for portfolio inflows also looks less benign given high equity valuations and narrowing rate differentials, although a possible inclusion of India into the BBG Global Agg Index may help INR later in 2H2025.

- Ultimately, these flows are driven by a less benign growth-inflation outlook, a modest deterioration in the credit cycle, and INR overvaluation. Global factors from a more hawkish Fed and Trump 2.0 are certainly not helping as well.

- RBI’s FX policy could turn less interventionist and allow INR to adjust weaker, even as RBI will unlikely let INR go completely. We expect policies such as increasing gold import duties, FX swap windows for oil companies, coupled with export conversion rules to help manage INR weakness.

- We continue to forecast RBI to cut rates by 75bps but push out the timing of those cuts to account for the weaker INR outlook.

Meaningful step-up in INR weakness in December

We have seen a complex interplay of events for INR FX and rates markets especially over the past month in December, leading to a meaningful step-up in FX weakness and also tighter liquidity despite RBI’s Cash Reserve Ratio cut.

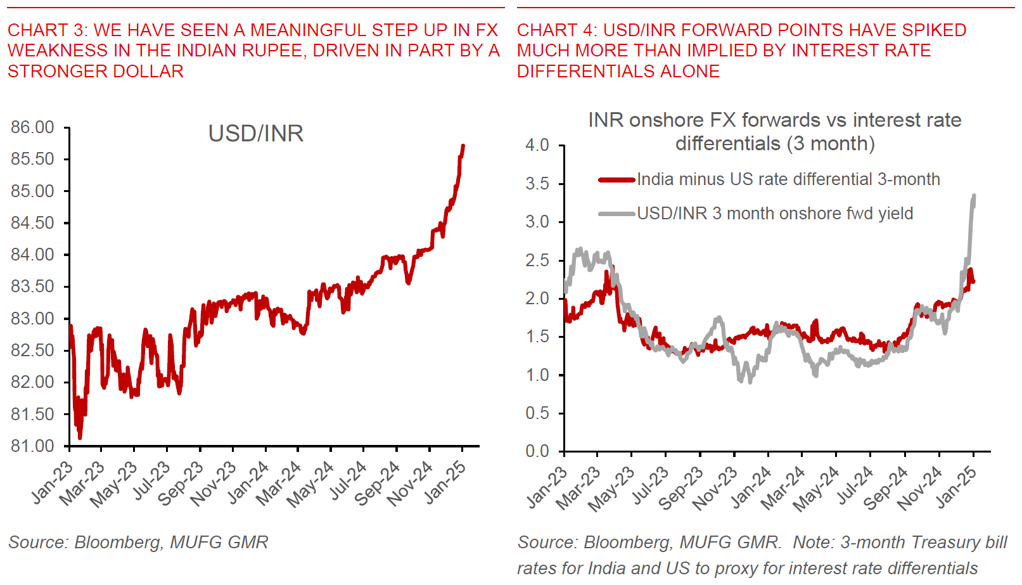

- USD/INR has moved up from 84.50 around early December to 85.72 at the time of writing (see Chart 3 below). This has been partly driven by a stronger Dollar and global factors but is not the complete story as we will discuss.

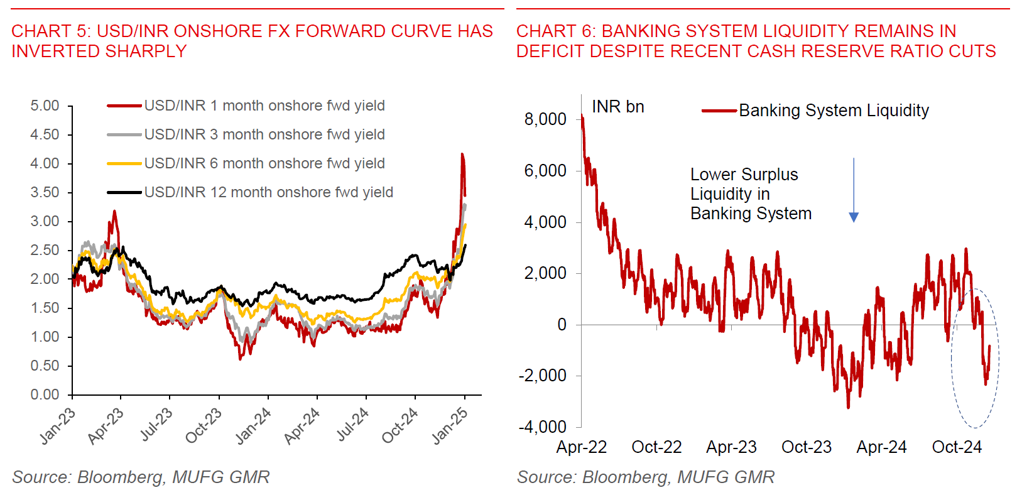

- The onshore FX forward curve also become rather dislocated in December 2024, certainly relative to the stability seen since 2023. For one, forward points have spiked much more than implied by interest rate differentials alone, reflecting some additional FX risk premia (see Chart 4). Second, the USD/INR FX forward curve inverted sharply with 1-week implied yields around 4.5% at the end of last month (from 1.5% in early December). This is in contrast to 12-month implied yields which have picked up to 2.6% from 2.1% in December (see Chart 5 below).

- Banking system liquidity deficit widened despite RBI’s decision to cut the Cash Reserve Ratio Requirement by 50bps in its December meeting: This has resulted in a gradual rise in the weighted average call rate closer to 6.70% although this has since come back down to 6.50% in early January (see Chart 6).

- Meanwhile we have seen a rise in FX implied vol for USD/INR across the curve, although we note that this still remains low relative to historical rates of above 4%, while realised FX volatility remains at decadal lows.

- The offshore Non-Deliverable Forward market’s premium has also increased relative to onshore especially in December, but it’s likely that RBI’s intervention has continued to keep a lid on NDF forward points at least so far.

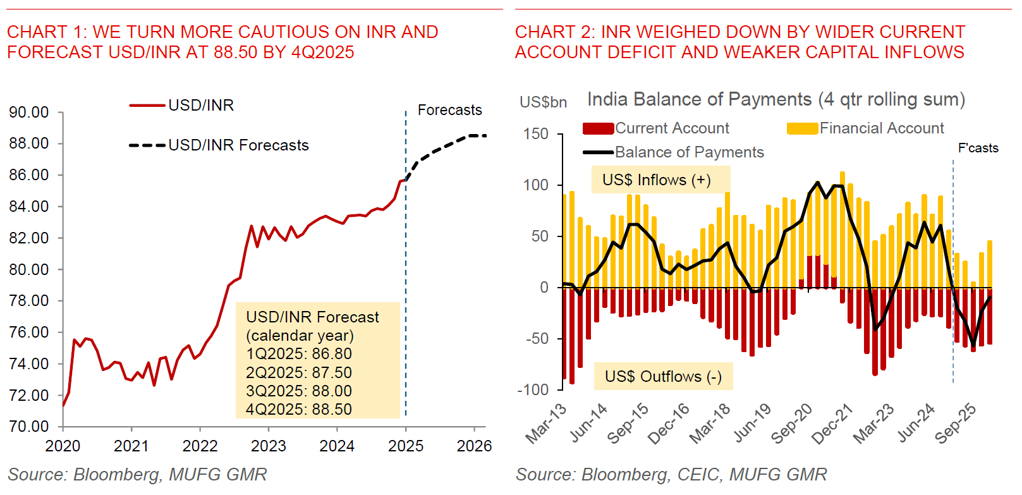

India likely to see continued balance of payments deficit pressures at least for 1H2025

To get a better gauge on the Indian Rupee, we re-assessed our forecasts for India’s balance of payments, including the current account deficit and financial account.

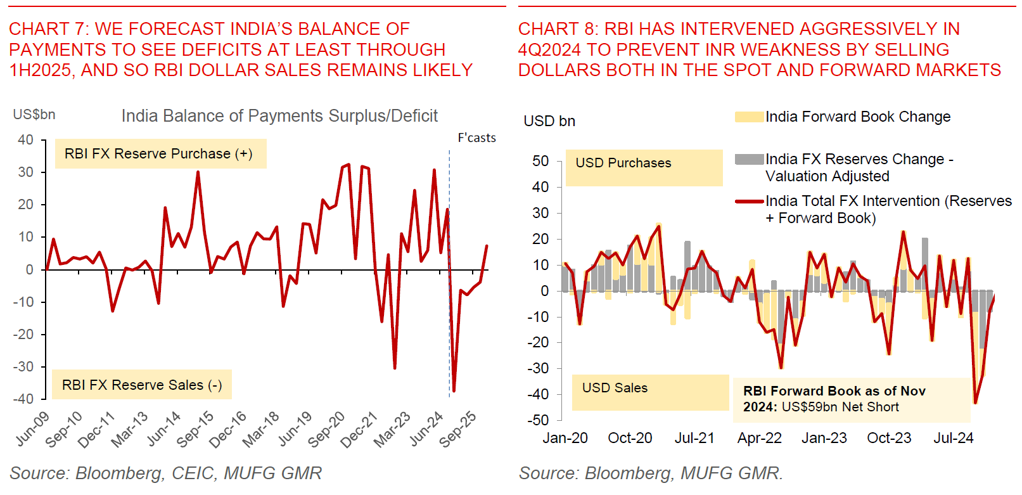

Our analysis and forecasts show that India’s balance of payments will likely see continued deficits in 1H2025, even if not at the same pace as in 4Q2024 (see Chart 7). This is driven by a few factors.

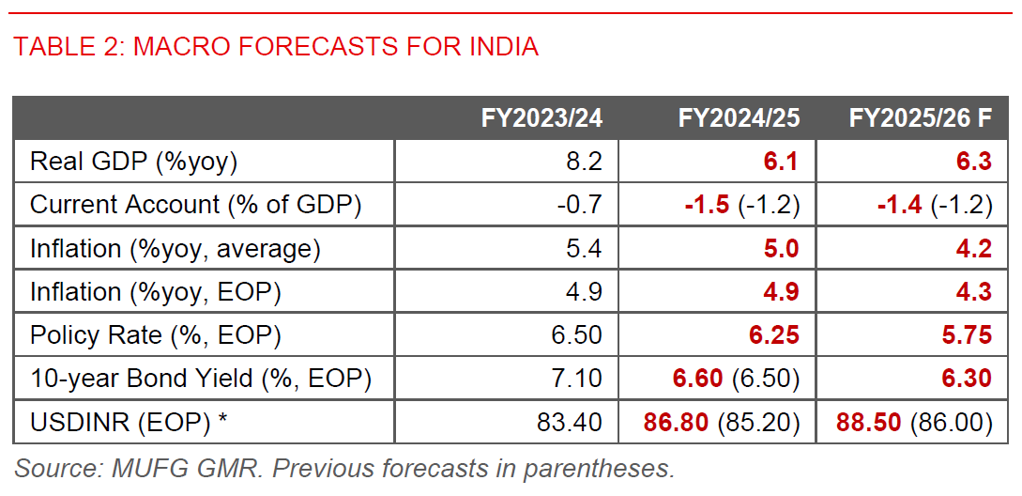

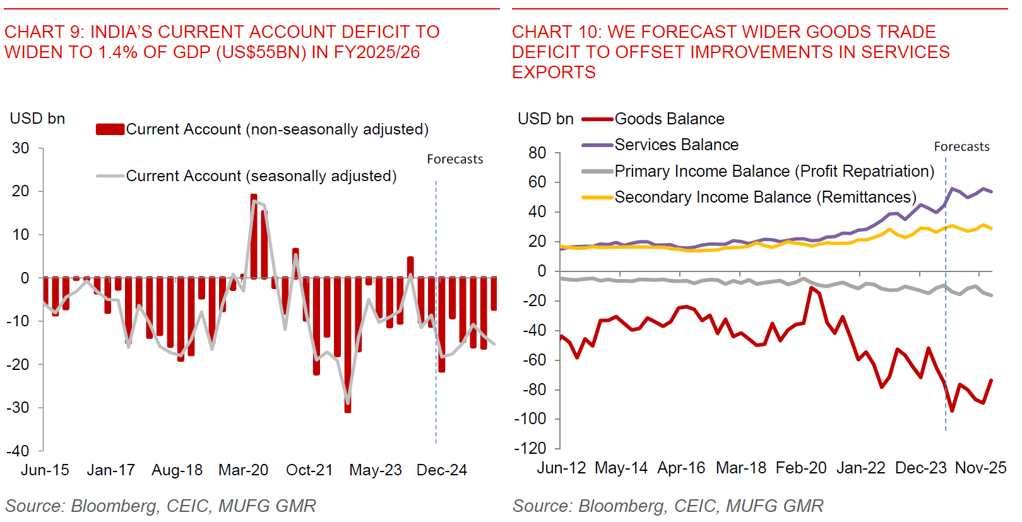

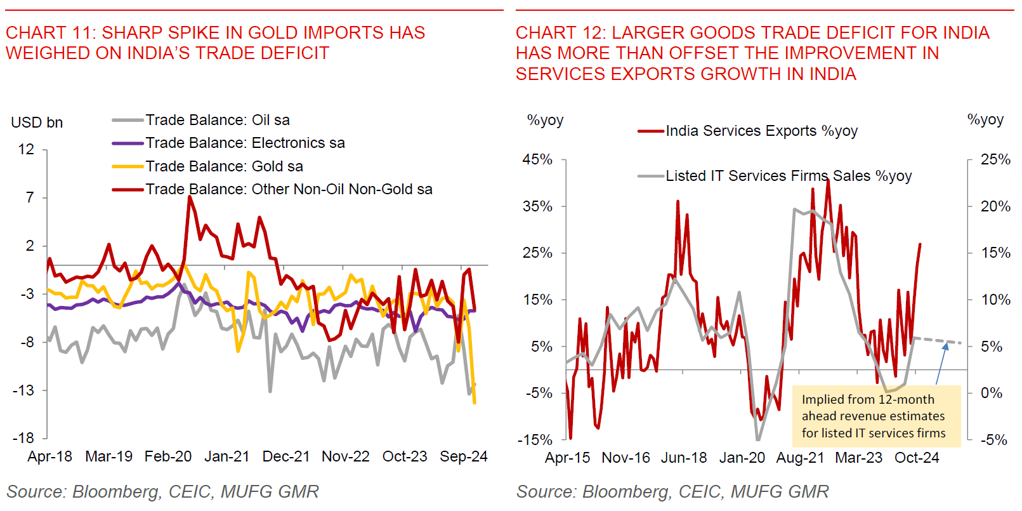

- For one, we now forecast India’s current account to record a deficit of 1.5% of GDP for FY2024/25 and 1.4% of GDP for FY2025/26. This is up from our previous forecasts of 1.2% of GDP for both. Driving this forecast is the fact the gold imports have been far stronger than we anticipated from the recent gold import duty cuts, and even after accounting for reported double-counting by official statistics. We doubt the strength in gold imports can continue at the same pace and are as such forecasting some narrowing in the goods deficit into FY2025/26. Nonetheless, the goods trade deficit should ultimately more than offset the positive improvement in services exports that we are seeing (see Chart 12).

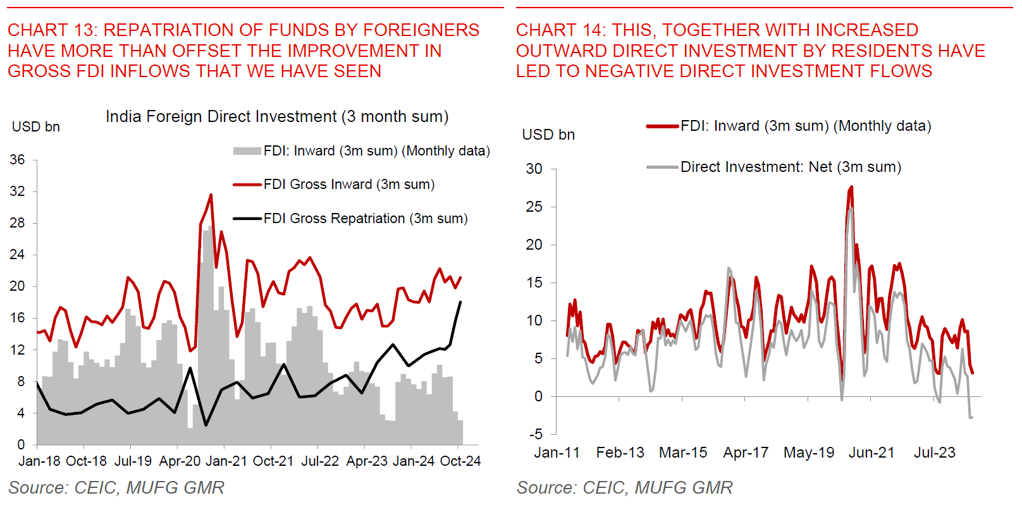

- Second, FDI flows continue to disappoint, driven by higher repatriation by foreigners. The capital account in India is actually where the action really is happening more so than the current account deficit, for a country which is reliant on growth capital to fund its deficit. While India has seen some improvement in gross inward FDI investments by foreigners, the key change at the margin has been a sharp spike in repatriation of direct investment by foreigners (see Chart 13). In addition, resident companies are also investing more in overseas assets and this has ultimately resulted in negative net direct investment flows (see Chart 14 below). It’s unclear what’s driving the sharp rise in gross FDI repatriation, and we hypothesise that it might have to do with some chunky private equity exits. From a forecasting perspective, we think FDI repatriation should not continue at the same pace moving forward and as such also see some improvement into 2025.

- Third, the outlook for portfolio inflows could look more challenging compared to what we saw in 2024. Global factors are not entirely supportive with the risk of tariffs from Trump 2.0 coupled with a more hawkish Fed. Local factors also point to a less benign growth-inflation trade-off for India (see IndiaPulse: Gradual rise in USD/INR). We do nonetheless see some respite in 2H2025 with the possible inclusion of Indian Government bonds in the BBG Global Agg Index, which may over time add US$10-15bn of incremental flows notwithstanding global risks and sticky US rates

- See Chart 17 in Appendix for summary of our balance of payments forecasts.

- All in we are now forecasting USD/INR to rise to 86.80 by 1Q2025 and 88.50 by 4Q2025 (calendar year).

- RBI’s FX policy could turn less interventionist and allow INR to adjust weaker, even as RBI will unlikely let INR go completely. We expect policies such as increasing gold import duties, FX swap windows for oil companies, coupled with export conversion rules to help manage INR weakness.

- We continue to forecast RBI to cut rates by 75bps but have pushed out the timing of those cuts to account for the weaker INR outlook.

Appendix